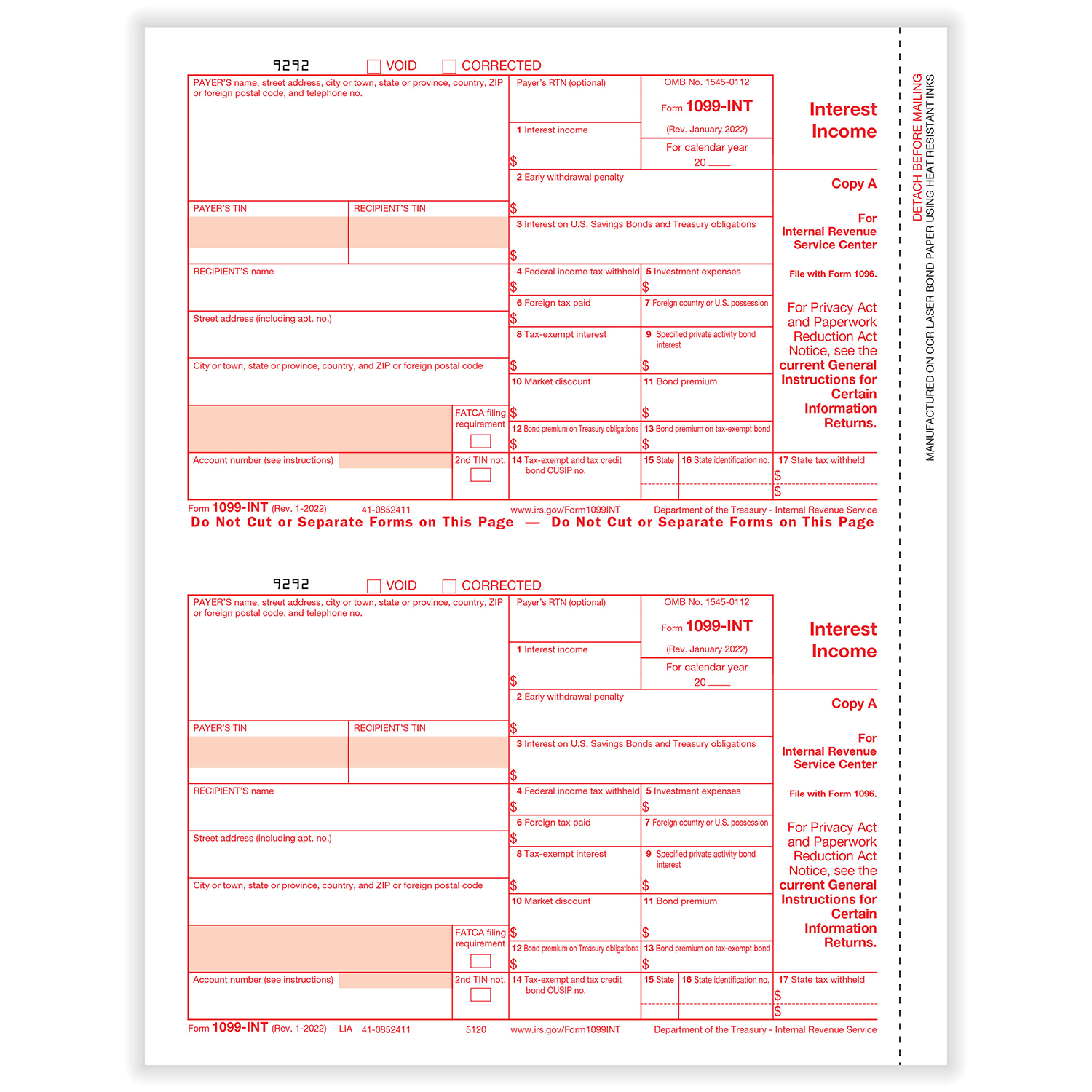

1099 Int Template

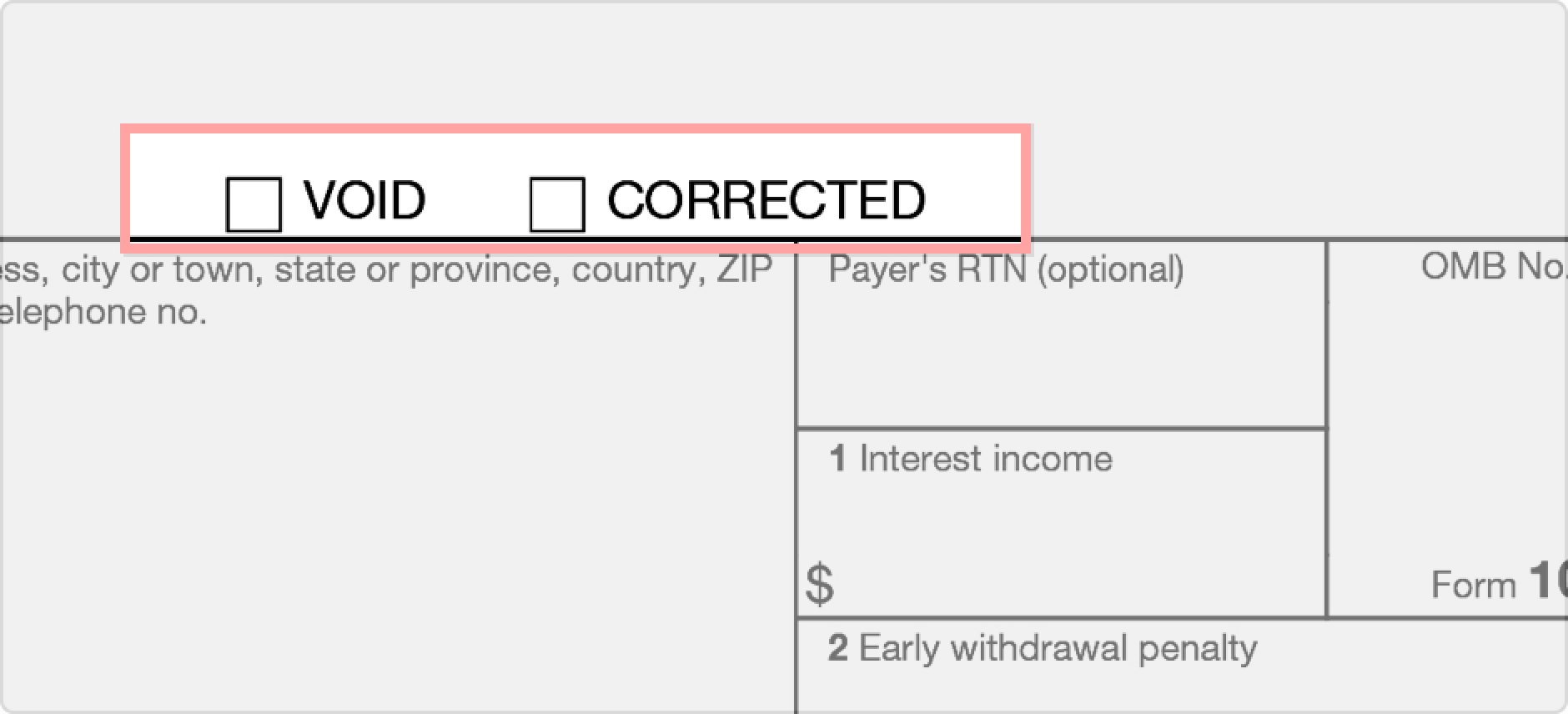

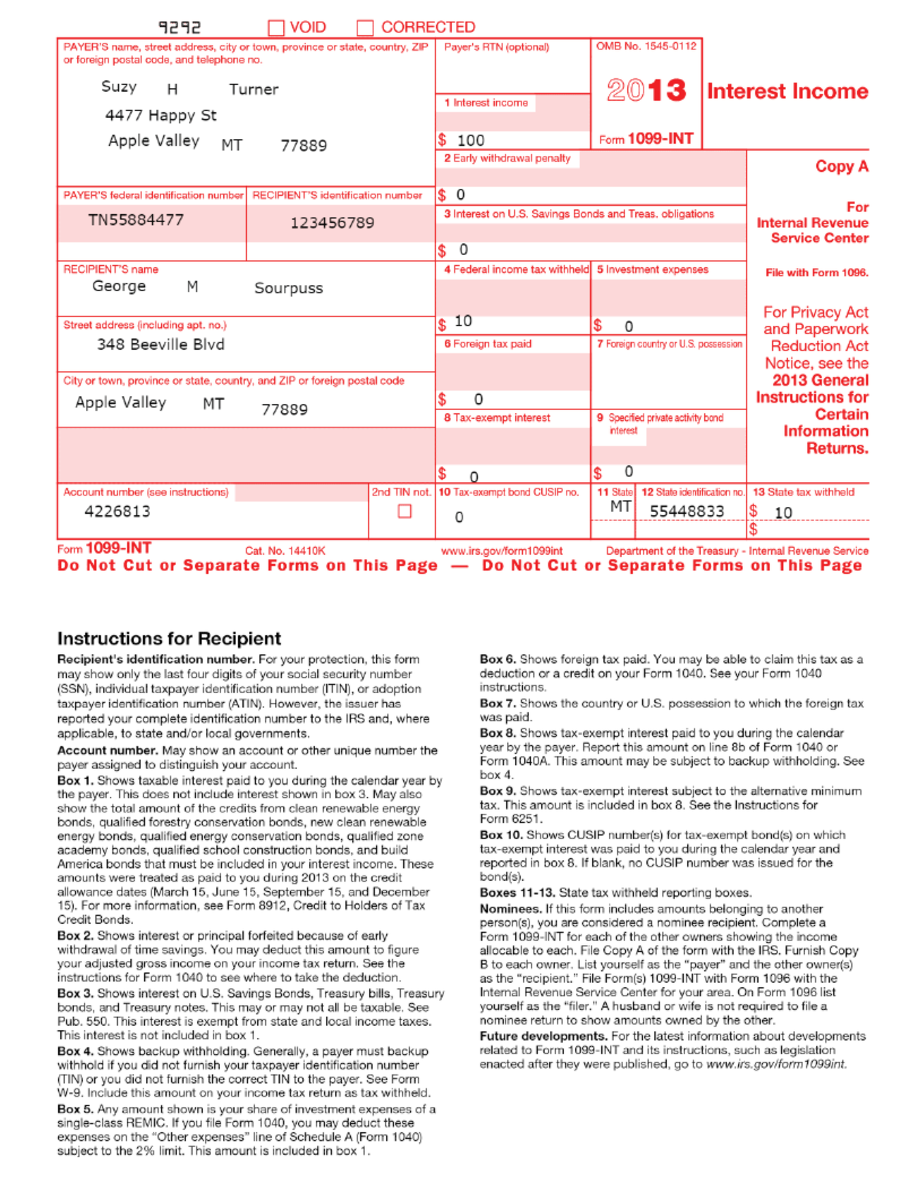

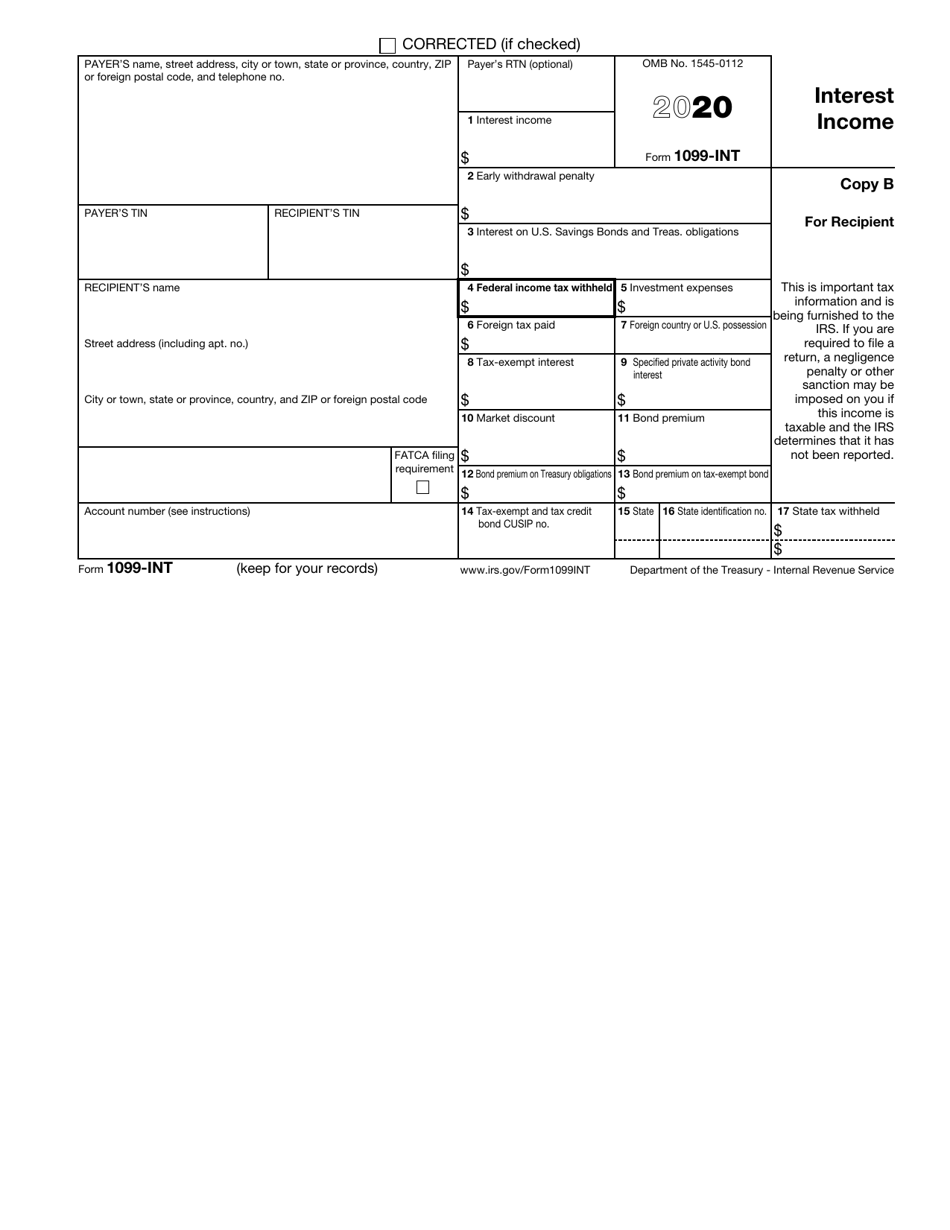

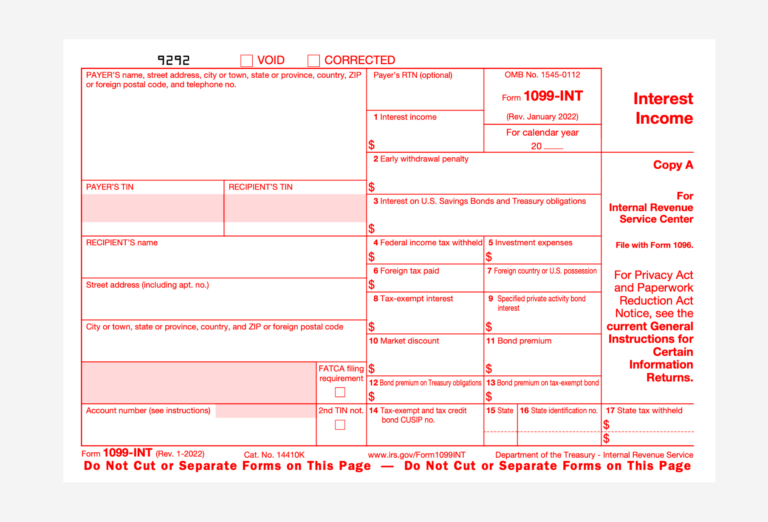

1099 Int Template - This interest is usually from a bank or government agency. Interest earned needs to be included as part of. The form must be filed for any customer who earned at least. Enter information into the portal or upload a file with a downloadable template in iris. Aimed at taxpayers who have earned $10 or more in interest, this form is a crucial. To whom you paid amounts reportable in boxes 1, 3, or 8 of at least $10 (or at least $600 of interest paid in the course of your trade or. Form 1099 int meaning is a tax form the irs provides that allows payers to report interest income of $10 or greater to individuals or organizations. You’ll receive this form if you earn at least $10 in interest during the tax year. Ensure your interest income is reported accurately with our guidance. Recipient’s taxpayer identification number (tin). Aimed at taxpayers who have earned $10 or more in interest, this form is a crucial. The irs does have a printable. Most interest is taxable and should be. The form must be filed for any customer who earned at least. Interest earned needs to be included as part of. Enter information into the portal or upload a file with a downloadable template in iris. Ensure your interest income is reported accurately with our guidance. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification. Download completed copies of form 1099 series information returns. This interest is usually from a bank or government agency. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification. Ensure your interest income is reported accurately with our guidance. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance.. Aimed at taxpayers who have earned $10 or more in interest, this form is a crucial. Recipient’s taxpayer identification number (tin). Download completed copies of form 1099 series information returns. Interest earned needs to be included as part of. This interest is usually from a bank or government agency. Most interest is taxable and should be. Recipient’s taxpayer identification number (tin). Interest earned needs to be included as part of. Form 1099 int meaning is a tax form the irs provides that allows payers to report interest income of $10 or greater to individuals or organizations. To whom you paid amounts reportable in boxes 1, 3, or 8 of. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. The irs does have a printable. Interest earned needs to be included as part of. The form must be filed for any customer who earned at least. Download completed copies of form. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. This interest is usually from a bank or government agency. Ensure your interest income is reported accurately with our guidance. Form 1099 int meaning is a tax form the irs provides that. Interest earned needs to be included as part of. The form must be filed for any customer who earned at least. This interest is usually from a bank or government agency. Interest earned needs to be included as part of. For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual. Download completed copies of form 1099 series information returns. Interest earned needs to be included as part of. Ensure your interest income is reported accurately with our guidance. You’ll receive this form if you earn at least $10 in interest during the tax year. Recipient’s taxpayer identification number (tin). For your protection, this form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification. Download completed copies of form 1099 series information returns. Ensure your interest income is reported accurately with our guidance. Interest earned needs to be included as part of. The form must be filed for any customer who earned. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. Form 1099 int meaning is a tax form the irs provides that allows payers to report interest income of $10 or greater to individuals or organizations. This interest is usually from a. Recipient’s taxpayer identification number (tin). This interest is usually from a bank or government agency. This interest is usually from a bank or government agency. Aimed at taxpayers who have earned $10 or more in interest, this form is a crucial. Form 1099 int meaning is a tax form the irs provides that allows payers to report interest income of. You’ll receive this form if you earn at least $10 in interest during the tax year. This interest is usually from a bank or government agency. Download completed copies of form 1099 series information returns. Interest earned needs to be included as part of. To whom you paid amounts reportable in boxes 1, 3, or 8 of at least $10 (or at least $600 of interest paid in the course of your trade or. The form must be filed for any customer who earned at least. Most interest is taxable and should be. Ensure your interest income is reported accurately with our guidance. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance. The irs does have a printable. Aimed at taxpayers who have earned $10 or more in interest, this form is a crucial. Form 1099 int meaning is a tax form the irs provides that allows payers to report interest income of $10 or greater to individuals or organizations. Interest earned needs to be included as part of.1099 Int Federal Form 1099INT Formstax

Form 1099 Int Printable Printable Forms Free Online

1099INT Form Print Template for Word or PDF 1096 Transmittal Summary

1099INT Form Fillable, Printable, Downloadable. 2024 Instructions

1099Int Template. Create A Free 1099Int Form.

IRS Form 1099INT 2020 Fill Out, Sign Online and Download Fillable

1099INT Form Everything You Need to Know About Reporting Interest

1099 INT Form PDF Template 2024 2023 With Print and Clear Buttons Etsy

1099 Int Template

1099INT Interest Excel Template for Printing Onto IRS Form 2022 Taxes

Enter Information Into The Portal Or Upload A File With A Downloadable Template In Iris.

For Your Protection, This Form May Show Only The Last Four Digits Of Your Tin (Social Security Number (Ssn), Individual Taxpayer Identification.

Recipient’s Taxpayer Identification Number (Tin).

This Interest Is Usually From A Bank Or Government Agency.

Related Post:

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.47.45AM-80a4044783b44a7b85412e8cd21bcbbc.png)