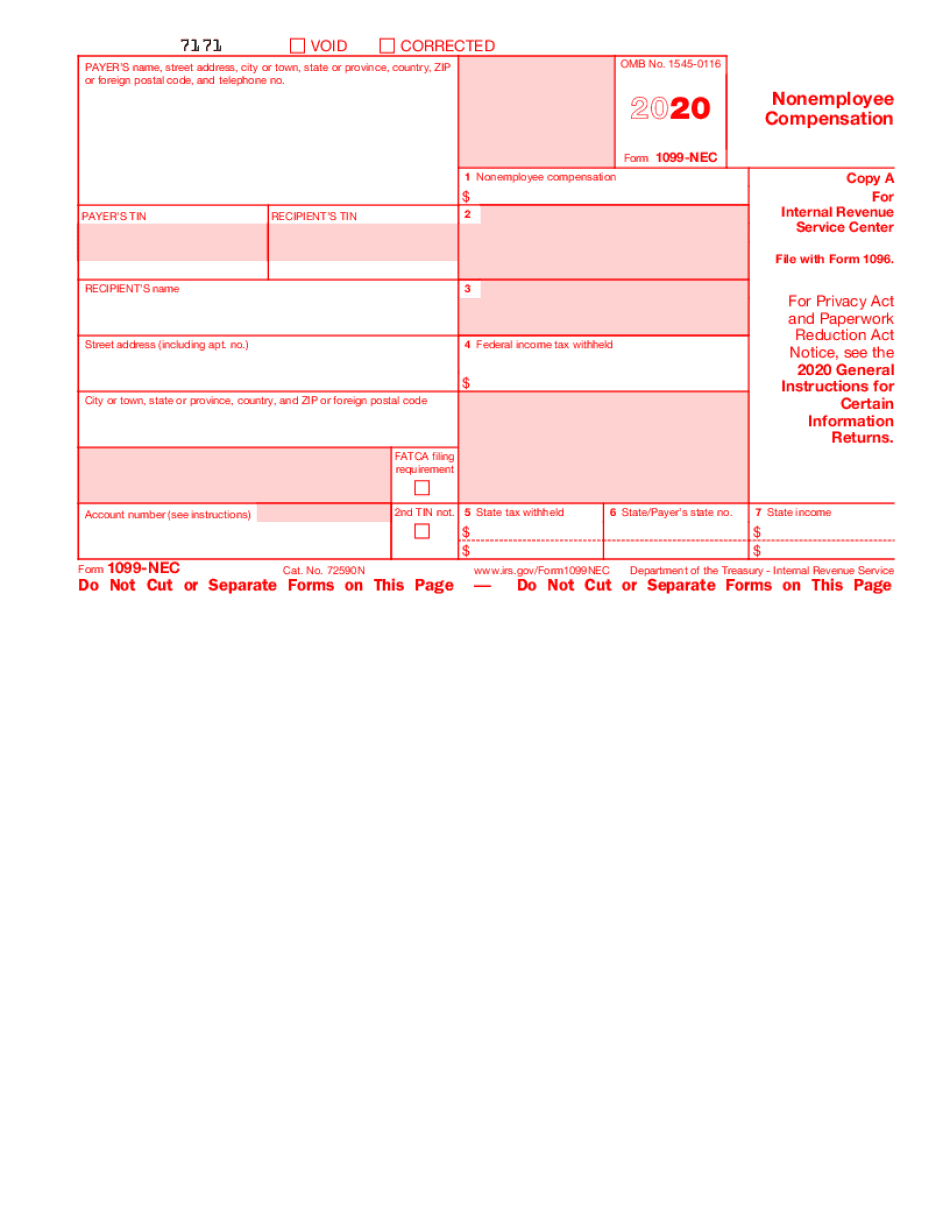

1099Nec Template For Preprinted Forms

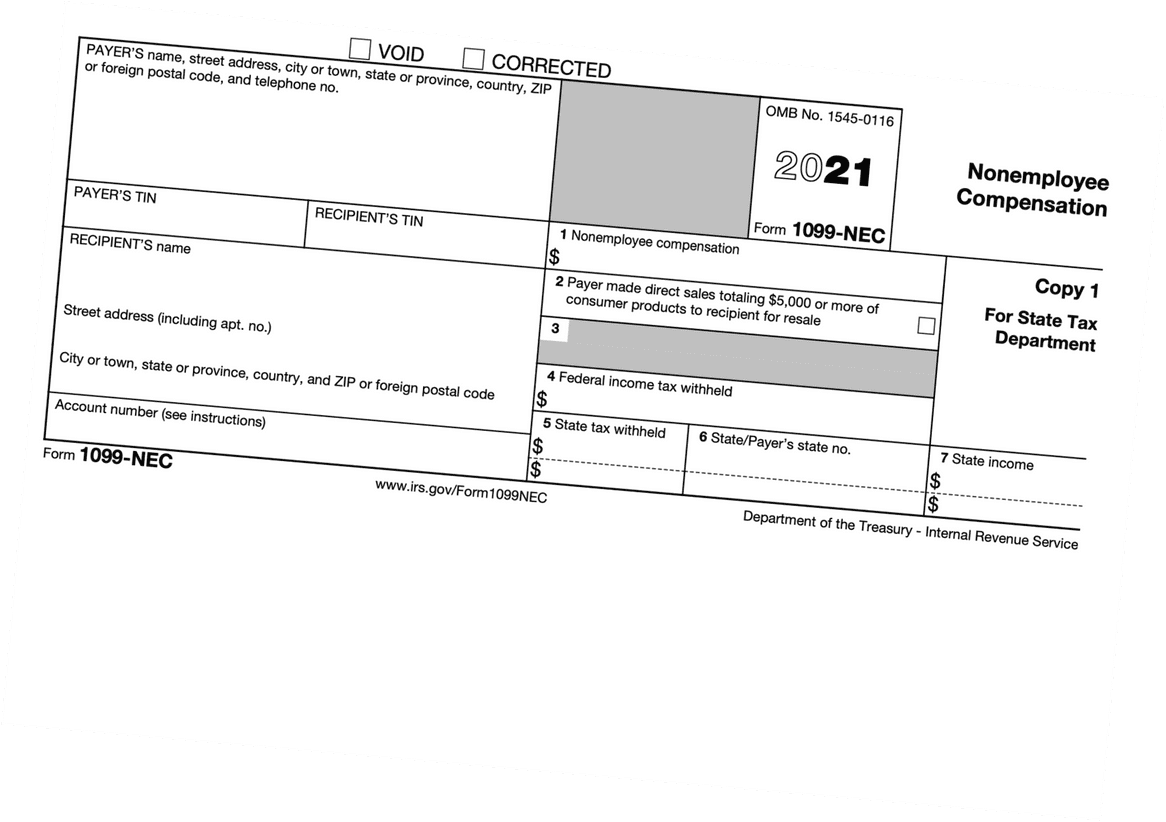

1099Nec Template For Preprinted Forms - Preprinted forms are not necessary for recipient copies! Instructions for the recipient (copy b) are printed on the back of. You also have the option to print 1099s on blank paper, and can also choose to have patriot e. I used to go to the library. This form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or. April 2025) nonemployee compensation copy 1 for state tax department Click select under form type. You can hand copy or type the info from the turbo tax printout onto the red forms. If your organization paid over $600 for services this year or withheld. Irs does not certify the substitute forms right now. Irs does not certify the substitute forms right now. If your organization paid over $600 for services this year or withheld. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Click select under form type. It helps businesses accurately disclose payments made to freelancers or. You also have the option to print 1099s on blank paper, and can also choose to have patriot e. Choose 1099 & 1098 forms in shortcuts. This form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or. I used to go to the library. Instructions for the recipient (copy b) are printed on the back of. Preprinted forms are not necessary for recipient copies! Irs does not certify the substitute forms right now. Instructions for the recipient (copy b) are printed on the back of. If your organization paid over $600 for services this year or withheld. April 2025) nonemployee compensation copy 1 for state tax department Irs does not certify the substitute forms right now. If your organization paid over $600 for services this year or withheld. April 2025) nonemployee compensation copy 1 for state tax department I used to go to the library. Preprinted forms are not necessary for recipient copies! It helps businesses accurately disclose payments made to freelancers or. April 2025) nonemployee compensation copy 1 for state tax department Instructions for the recipient (copy b) are printed on the back of. This form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or. Irs. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. It helps businesses accurately disclose payments made to freelancers or. If your organization paid over $600 for services this year or withheld. Irs does not certify the substitute forms right now. You also have the option. Choose 1099 & 1098 forms in shortcuts. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. This form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or. April 2025). This form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or. If your organization paid over $600 for services this year or withheld. Click select under form type. It helps businesses accurately disclose payments made to freelancers or. I used to go to the. Click select under form type. Choose 1099 & 1098 forms in shortcuts. Irs does not certify the substitute forms right now. If your organization paid over $600 for services this year or withheld. Preprinted forms are not necessary for recipient copies! This form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or. To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. You also have the option to print 1099s on. If your organization paid over $600 for services this year or withheld. Irs does not certify the substitute forms right now. Instructions for the recipient (copy b) are printed on the back of. This form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or.. It helps businesses accurately disclose payments made to freelancers or. I used to go to the library. Instructions for the recipient (copy b) are printed on the back of. Irs does not certify the substitute forms right now. If your organization paid over $600 for services this year or withheld. If your organization paid over $600 for services this year or withheld. I used to go to the library. You can hand copy or type the info from the turbo tax printout onto the red forms. This form may show only the last four digits of your tin (social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or. Preprinted forms are not necessary for recipient copies! To ease statement furnishing requirements, copies b, 1, and 2 have been made fillable online in a pdf format available at irs.gov/form1099misc and irs.gov/form1099nec. Irs does not certify the substitute forms right now. It helps businesses accurately disclose payments made to freelancers or. You also have the option to print 1099s on blank paper, and can also choose to have patriot e. April 2025) nonemployee compensation copy 1 for state tax departmentForm 1099 Nec Printable Blank PDF Online

2020 1099NEC Form Print Template for Word or PDF 1096 Transmittal

Printable Fillable 1099 Nec

1099Nec Template For Preprinted Forms

1099Nec Template For Preprinted Forms

1099NEC Excel Template for Printing Onto IRS Form 2022 Etsy

1099NEC Pressure Seal Form (TXE 1099NEC)

1099 NEC Editable PDF Fillable Template 2024 With Print and Clear

Free Printable 1099NEC File Online 1099FormTemplate

1099NEC Form Print Template for Word or PDF, 2021 Tax Year 1096

Choose 1099 & 1098 Forms In Shortcuts.

Click Select Under Form Type.

Instructions For The Recipient (Copy B) Are Printed On The Back Of.

Related Post: