15Usc1692C Letter Template

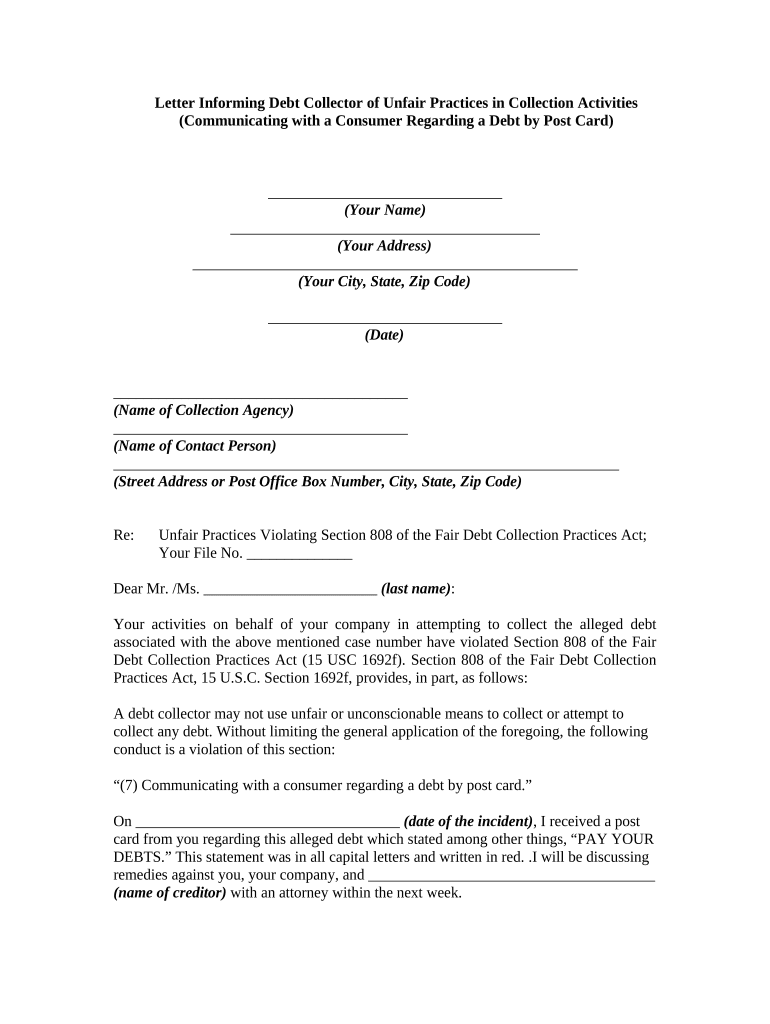

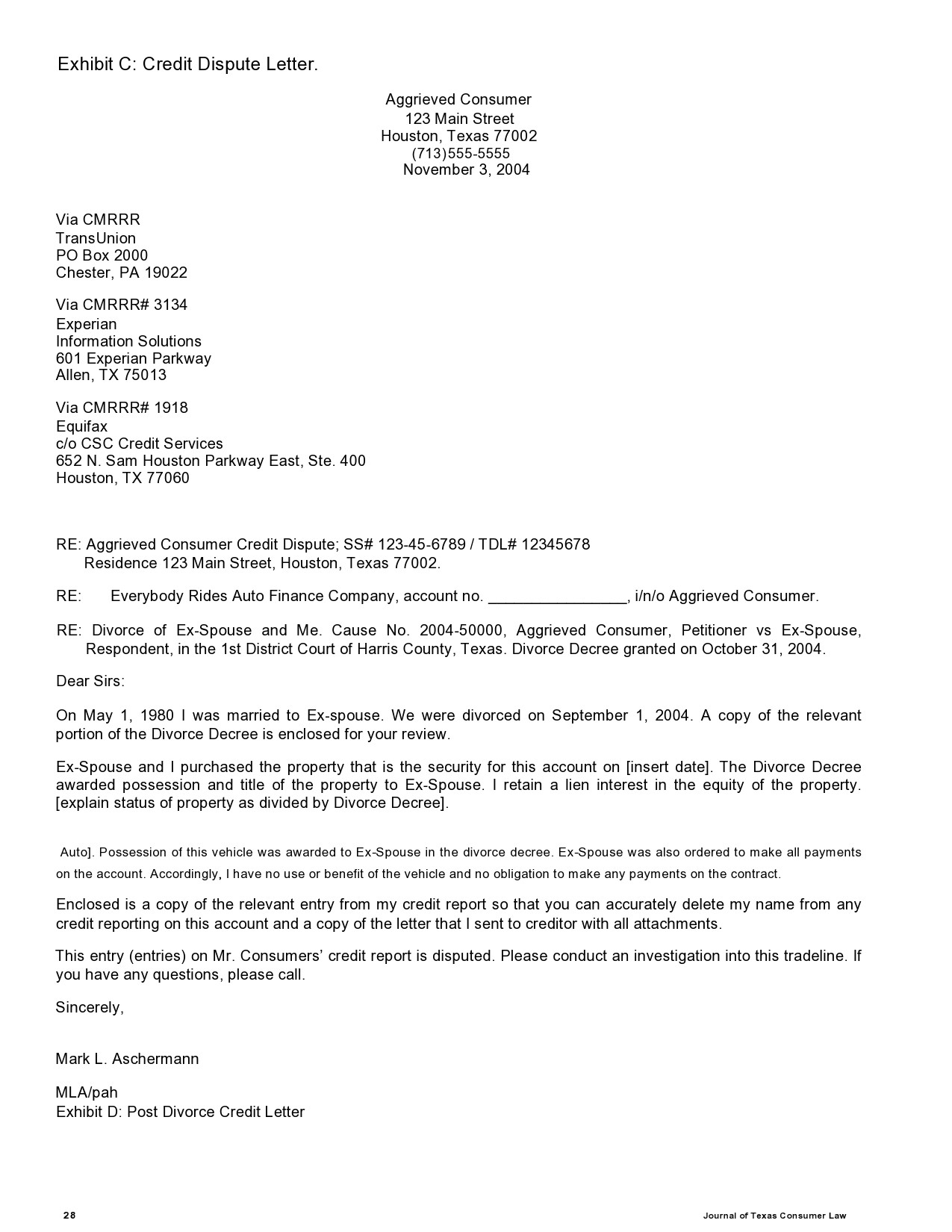

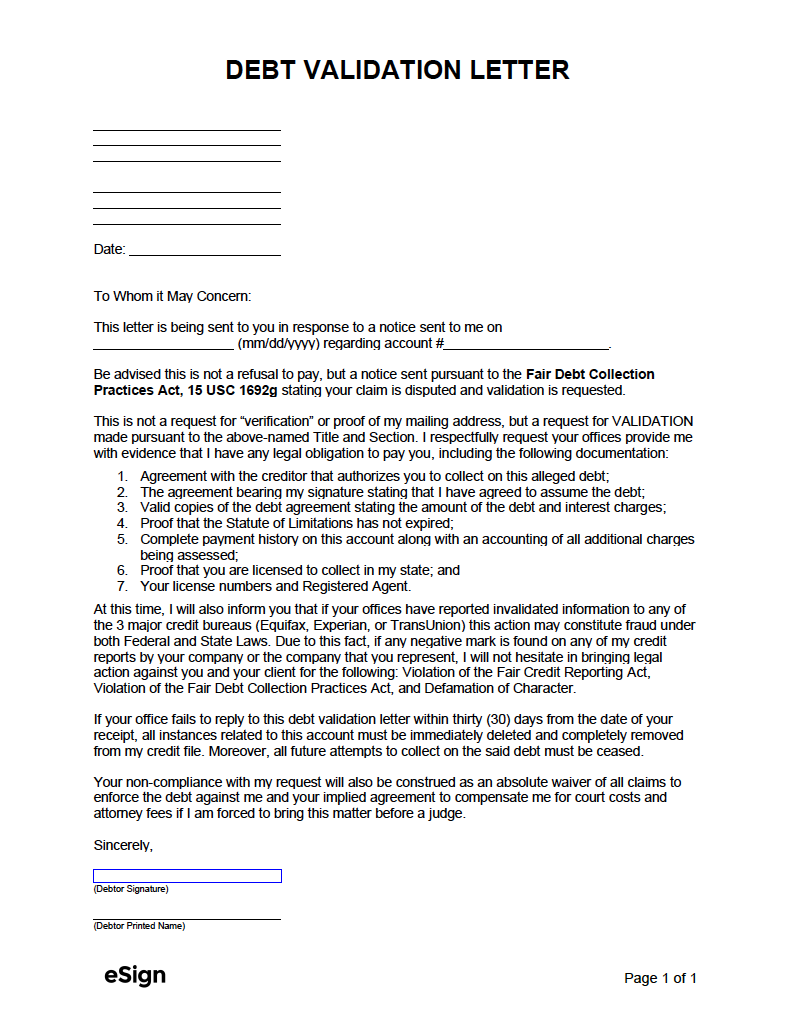

15Usc1692C Letter Template - Use this letter to dispute a debt and to tell a collector to stop contacting you. A cease and desist letter can stop a debt collector in their tracks. According to the fair debt collection practices act, specifically 15 u.s. Be sure to keep a copy of your letter and. You can send this letter at any time. Letter to creditors or collection agencies to stop contact instructions under the pennsylvania fair credit extension uniformity act, 73 p.s.§2270.4, and the federal. I am writing pursuant to the fair debt collection practices act, 15 usc 1692c (c), to request to request that you cease all communication to me about my account# [number] with [creditor]. Below is an electronic form of the cease letter, which you may fill out and print. I am writing in response to your constant phone calls! The best case for sending a cease communications letter is when the sol has expired, and the credit report exclusion period has also expired, or is about to. The best case for sending a cease communications letter is when the sol has expired, and the credit report exclusion period has also expired, or is about to. Code § 1692c, this is my formal declaration to terminate and cease all communication from you in. Use this letter to tell a debt collector to stop contacting you. According to the fair debt collection practices act, [15 usc 1692c] section 805(c): Be advised this is not a refusal to pay, but a notice sent pursuant to the fair debt collection practices act, 15 usc 1692g stating your claim is disputed and validation is requested. According to the fair debt collection practices act, specifically 15 u.s. See below for the full template. In the absence of knowledge of circumstances to the contrary, a debt collector shall assume that the convenient time for communicating with a consumer is after 8 o’clock antemeridian and. If you get sued for a debt use solosuit to respond in 15 minutes and win your. You can send this letter at any time. I am writing pursuant to the fair debt collection practices act, 15 usc 1692c (c), to request to request that you cease all communication to me about my account# [number] with [creditor]. See below for the full template. Please complete the letter according to the above instructions. A cease and desist letter can stop a debt collector in their tracks.. I am writing in response to your constant phone calls! (1) to advise the consumer that the debt collector's further efforts are being terminated; A cease and desist letter can stop a debt collector in their tracks. Code § 1692c, this is my formal declaration to terminate and cease all communication from you in. Letter to creditors or collection agencies. Sending this letter does not cancel your debt. Please consider this letter a formal dispute of the alleged debt pursuant to the fdcpa, 15 u.s.c. Below is an electronic form of the cease letter, which you may fill out and print. Be advised this is not a refusal to pay, but a notice sent pursuant to the fair debt collection. Here is a sample form: Sending this letter does not cancel your debt. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must. See below for the full template. If you get sued for a debt use solosuit to respond in 15 minutes and win your. (1) to advise the consumer that the debt collector's further efforts are being terminated; Code § 1692c, this is my formal declaration to terminate and cease all communication from you in. I am writing pursuant to the fair debt collection practices act, 15 usc 1692c (c), to request to request that you cease all communication to me about my account#. I also request verification, validation, and the name and address of the original. Here is a sample form: Use this letter to tell a debt collector to stop contacting you. (2) to notify the consumer that the debt collector or creditor may invoke specified remedies which are. The following page is a sample of a letter that you can send. I am writing to request that you stop contacting me about my account number _____ with [creditor’s name] as required by the fair debt collection. Use this letter to dispute a debt and to tell a collector to stop contacting you. Please consider this letter a formal dispute of the alleged debt pursuant to the fdcpa, 15 u.s.c. (2) to. I am writing to request that you stop contacting me about my account number _____ with [creditor’s name] as required by the fair debt collection. The best case for sending a cease communications letter is when the sol has expired, and the credit report exclusion period has also expired, or is about to. (2) to notify the consumer that the. Please consider this letter a formal dispute of the alleged debt pursuant to the fdcpa, 15 u.s.c. See below for the full template. (1) to advise the consumer that the debt collector's further efforts are being terminated; I am writing in response to your constant phone calls! According to the fair debt collection practices act, [15 usc 1692c] section 805(c): Be advised this is not a refusal to pay, but a notice sent pursuant to the fair debt collection practices act, 15 usc 1692g stating your claim is disputed and validation is requested. Please consider this letter a formal dispute of the alleged debt pursuant to the fdcpa, 15 u.s.c. You can send this letter at any time. If you. According to the fair debt collection practices act, [15 usc 1692c] section 805(c): Here is a sample form: See below for the full template. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. Use this letter to dispute a debt and to tell a collector to stop contacting you. Please consider this letter a formal dispute of the alleged debt pursuant to the fdcpa, 15 u.s.c. (1) to advise the consumer that the debt collector's further efforts are being terminated; (2) to notify the consumer that the debt collector or creditor may invoke specified remedies which are. You can send this letter at any time. Sending this letter does not cancel your debt. Please complete the letter according to the above instructions. If you get sued for a debt use solosuit to respond in 15 minutes and win your. Code § 1692c, this is my formal declaration to terminate and cease all communication from you in. In the absence of knowledge of circumstances to the contrary, a debt collector shall assume that the convenient time for communicating with a consumer is after 8 o’clock antemeridian and. Be advised this is not a refusal to pay, but a notice sent pursuant to the fair debt collection practices act, 15 usc 1692g stating your claim is disputed and validation is requested. I am writing to request that you stop contacting me about my account number _____ with [creditor’s name] as required by the fair debt collection.15 usc 1692c Fill out & sign online DocHub

Cease And Desist Letter Template Free

Part One FDCPA (Fair Debt Collection Practices Act) Text 15 USC

15 USC 1607 PART 2 YouTube

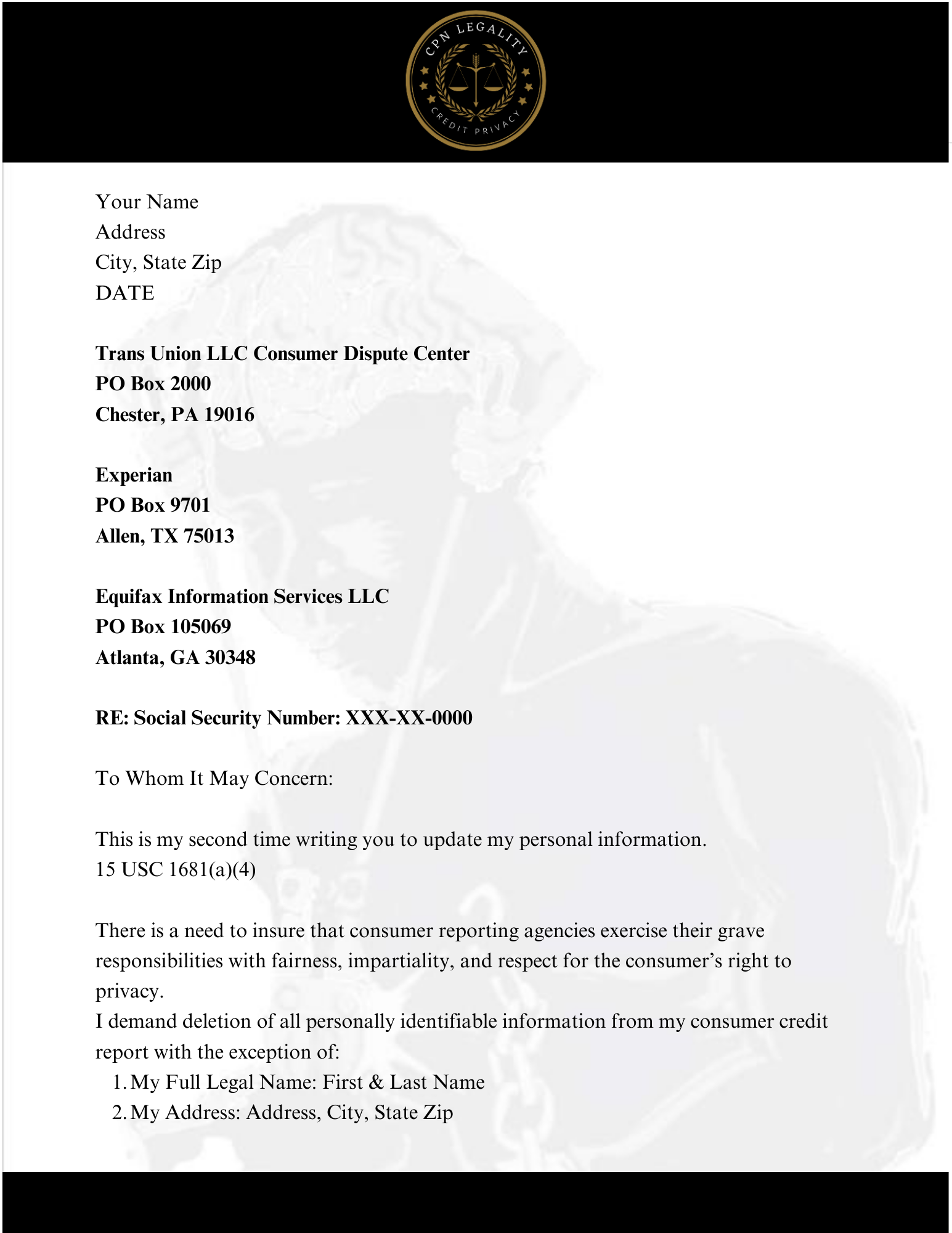

Shop page cpnlegality

Letter Of Credit Sample Format

15usc1692c letter template Fill out & sign online DocHub

CMAP Cease & Desist Letter PDF Foreclosure Practice Of Law

Debt Validation Sample Letter

CLARO Buffalo Debt Validation Letter Fill and Sign Printable Template

I Am Writing Pursuant To The Fair Debt Collection Practices Act, 15 Usc 1692C (C), To Request To Request That You Cease All Communication To Me About My Account# [Number] With [Creditor].

If You Send This Letter Within 30 Days From The Date You First Receive A Debt Collection Letter, The Debt Collector Must.

The Best Case For Sending A Cease Communications Letter Is When The Sol Has Expired, And The Credit Report Exclusion Period Has Also Expired, Or Is About To.

Use This Letter To Tell A Debt Collector To Stop Contacting You.

Related Post: