609 Template Letter

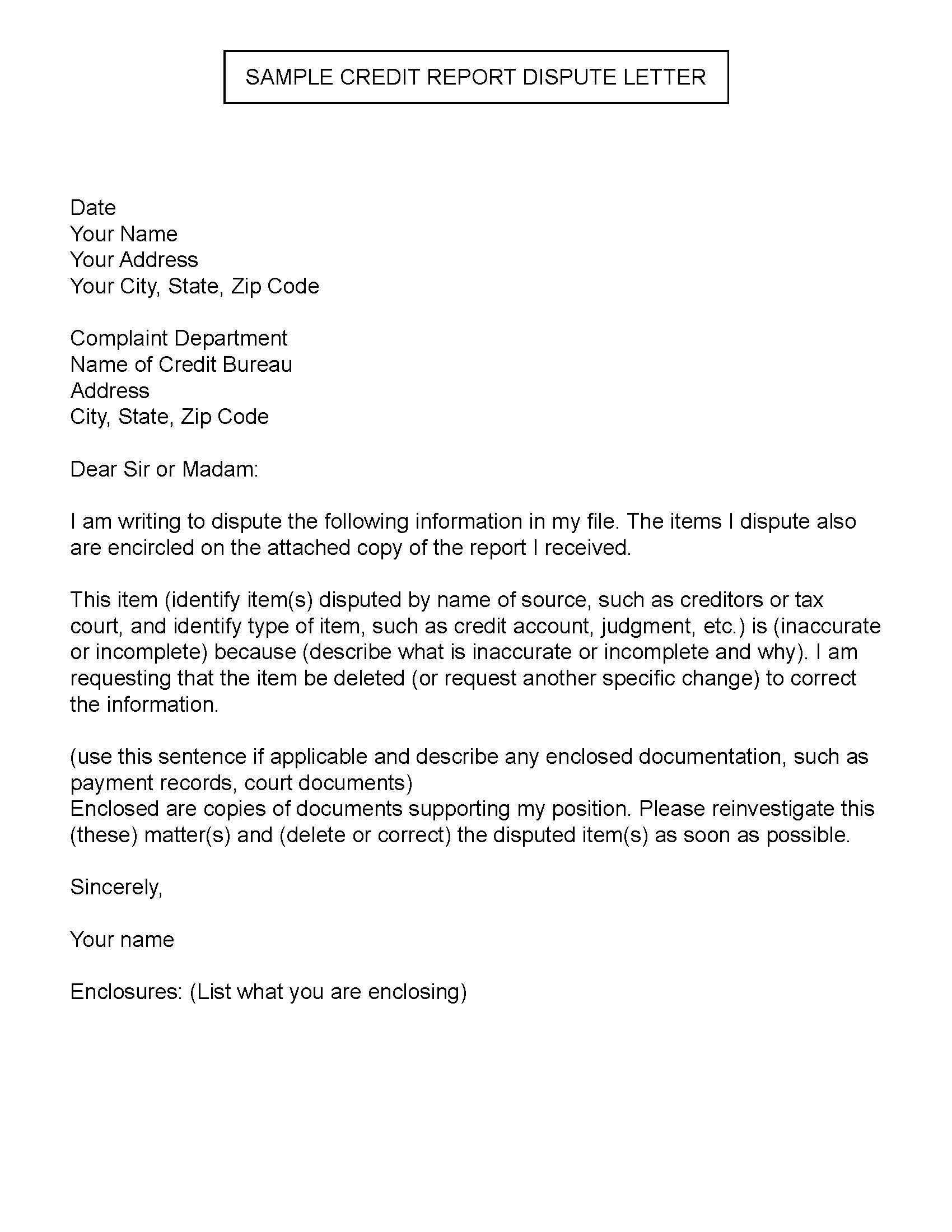

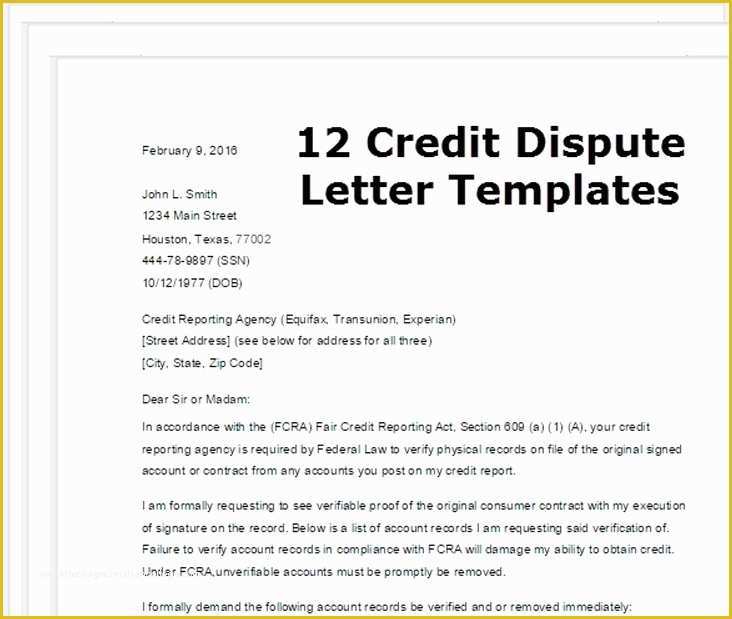

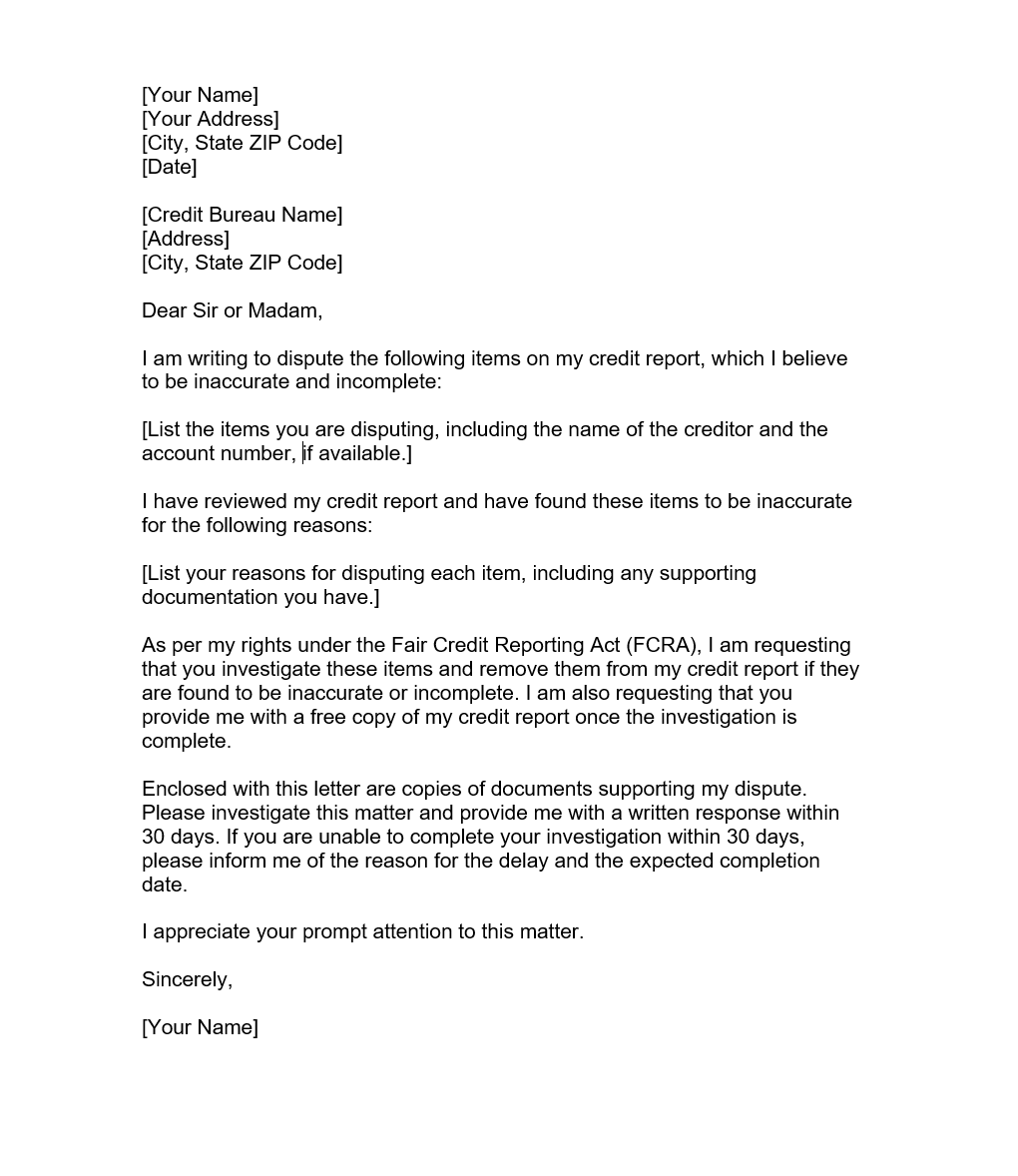

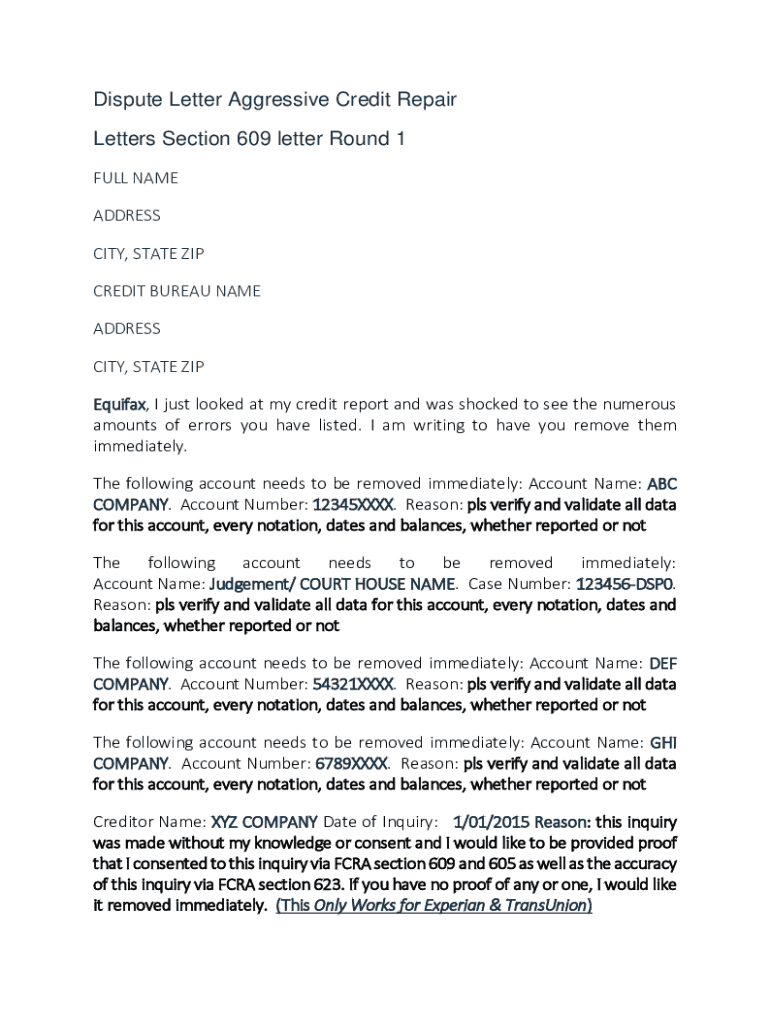

609 Template Letter - A 609 letter is a method of requesting the removal of negative information (even if it’s accurate) from your credit report, thanks to the legal specifications of section 609 of the. You’ll get a template to follow and we’ll also address some of the most commonly asked questions and. In this guide, we will show you how to use a 609 letter. Section 609 of fcra directs or allows the consumer to. Section 609 of the fair credit reporting act outlines consumers’ protections regarding disclosures. A 609 letter is a formal written request sent to credit bureaus, invoking rights under section 609 of the fcra. In short, a 609 letter is a method of requesting credit bureaus to remove false or negative information from your credit report. This article gives you all the details you need. 609 dispute letter templates, according to some, offer you a secret way to remove negative items from your credit reports. Two sections of the fair credit reporting act build up the. After that, use the following sample letter as a guide: Section 609 refers to a section of the fair credit reporting act (fcra) that addresses your rights to request copies of your own credit reports and associated information. The fair credit reporting act (fcra) makes this. Section 609 of the fcra does not require that consumers submit requests using a specific template or. Some companies offer 609 letter templates for sale, but you don’t need to buy a template. You’ll get a template to follow and we’ll also address some of the most commonly asked questions and. Section 609 of the fcra gives consumers the right to request all information in their credit files and the source of that information. It allows consumers to obtain information about the sources of data on their. If you’ve never heard of a 609 letter, the following article will help you understand its purpose, your legal rights in obtaining a free copy of your credit report, when you should. A 609 letter, also known as a 609 dispute letter, can help you remove “unverifiable” bad marks, boost your credit score, and help you qualify for loans that you otherwise wouldn’t. Here's how to prepare an effective 609 letter that really works. Below is a sample of a typical 609 letter, as well as a downloadable. In this guide, we will show you how to use a 609 letter. There are a few 609 letter templates you can follow to ensure you are including the correct information. Some companies offer 609. Individuals who have identified inaccurate or questionable information on their credit reports may need a 609 letter template to initiate the dispute process. In this guide, we will show you how to use a 609 letter. The fair credit reporting act (fcra) makes this. A 609 letter is a formal written request sent to credit bureaus, invoking rights under section. In short, a 609 letter is a method of requesting credit bureaus to remove false or negative information from your credit report. There are a few 609 letter templates you can follow to ensure you are including the correct information. You’ll get a template to follow and we’ll also address some of the most commonly asked questions and. A 609. Section 609 of the fair credit reporting act outlines consumers’ protections regarding disclosures. Here's how to prepare an effective 609 letter that really works. If you’ve never heard of a 609 letter, the following article will help you understand its purpose, your legal rights in obtaining a free copy of your credit report, when you should. Two sections of the. Learn how to structure your arguments, include supporting evidence, and craft a compelling request for correction. Some companies offer 609 letter templates for sale, but you don’t need to buy a template. A 609 letter is a formal written request sent to credit bureaus, invoking rights under section 609 of the fcra. Section 609 of the fair credit reporting act. Section 609 of fcra directs or allows the consumer to. Writing an effective dispute letter (or 609 letter) is the key to getting results. It is section 609, and the letter is 611 dispute letter which helps the consumer file a dispute with bureaus and get rid of negative items. This article gives you all the details you need. It. It is section 609, and the letter is 611 dispute letter which helps the consumer file a dispute with bureaus and get rid of negative items. It requires credit reporting agencies to provide consumers, upon. Below is a sample of a typical 609 letter, as well as a downloadable. Section 609 of the fcra does not require that consumers submit. Section 609 of the fcra does not require that consumers submit requests using a specific template or. This article gives you all the details you need. Consumers also have the right to know any. A 609 letter is a formal written request sent to credit bureaus, invoking rights under section 609 of the fcra. Use solosuit to respond to debt. It is section 609, and the letter is 611 dispute letter which helps the consumer file a dispute with bureaus and get rid of negative items. Done correctly, this letter forces a thorough reinvestigation and can finally provide the breakthrough to repairing. Two sections of the fair credit reporting act build up the. Consumers also have the right to know. Section 609 of the fcra gives consumers the right to request all information in their credit files and the source of that information. Two sections of the fair credit reporting act build up the. A 609 letter is a method of requesting the removal of negative information (even if it’s accurate) from your credit report, thanks to the legal specifications. People who want to exercise their. Learn how to structure your arguments, include supporting evidence, and craft a compelling request for correction. A 609 letter is a method of requesting the removal of negative information (even if it’s accurate) from your credit report, thanks to the legal specifications of section 609 of the. It requires credit reporting agencies to provide consumers, upon. Writing an effective dispute letter (or 609 letter) is the key to getting results. These templates provide you with a framework to. Section 609 of the fair credit reporting act outlines consumers’ protections regarding disclosures. You’ll get a template to follow and we’ll also address some of the most commonly asked questions and. In short, a 609 letter is a method of requesting credit bureaus to remove false or negative information from your credit report. The fair credit reporting act (fcra) makes this. Two sections of the fair credit reporting act build up the. This article gives you all the details you need. Done correctly, this letter forces a thorough reinvestigation and can finally provide the breakthrough to repairing. Some companies offer 609 letter templates for sale, but you don’t need to buy a template. If you’ve identified inaccurate credit information, or if you want to know more about your current credit info, you need to know how to draft and send a 609 dispute letter. Section 609 of the fcra gives consumers the right to request all information in their credit files and the source of that information.Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]

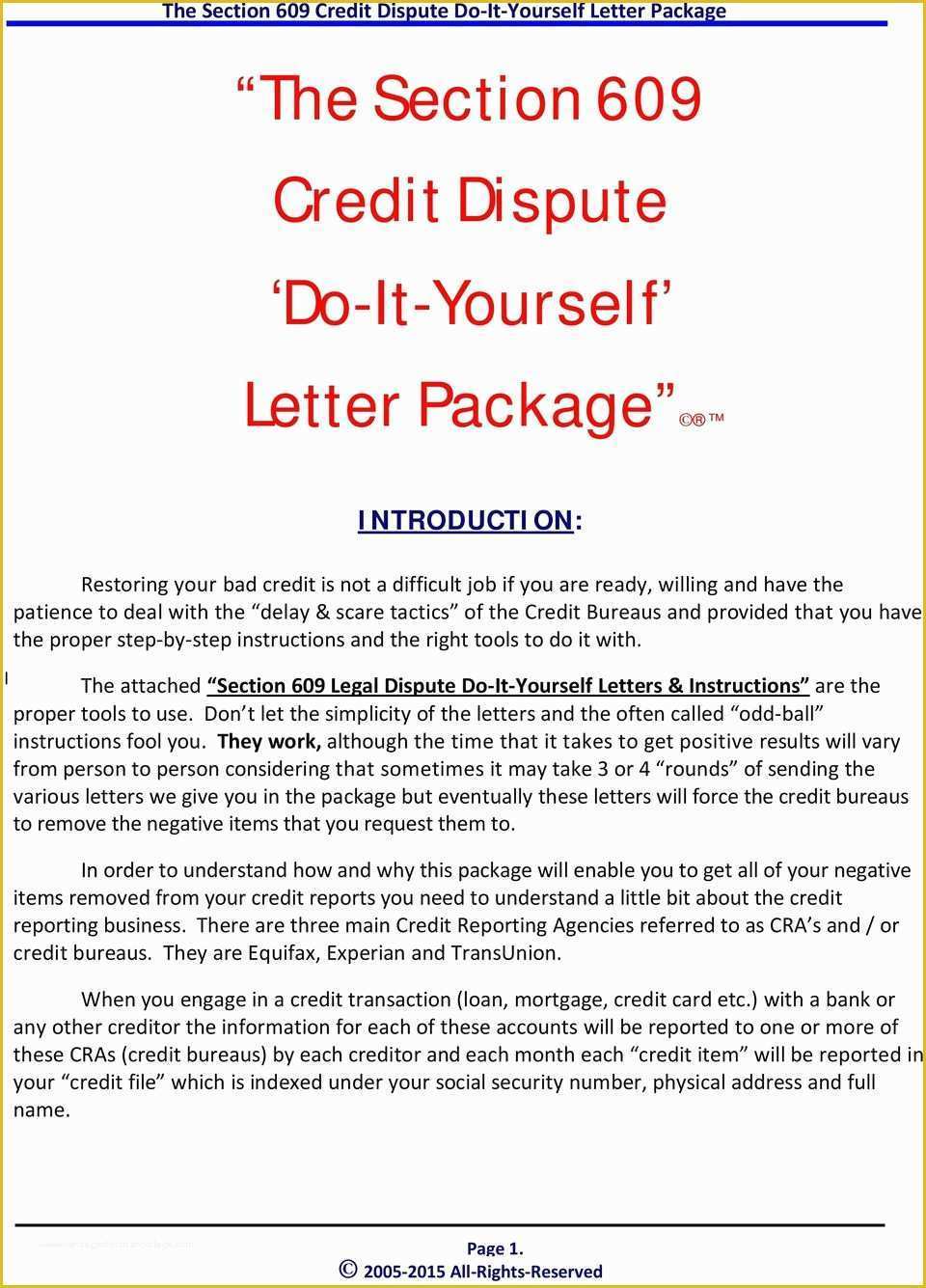

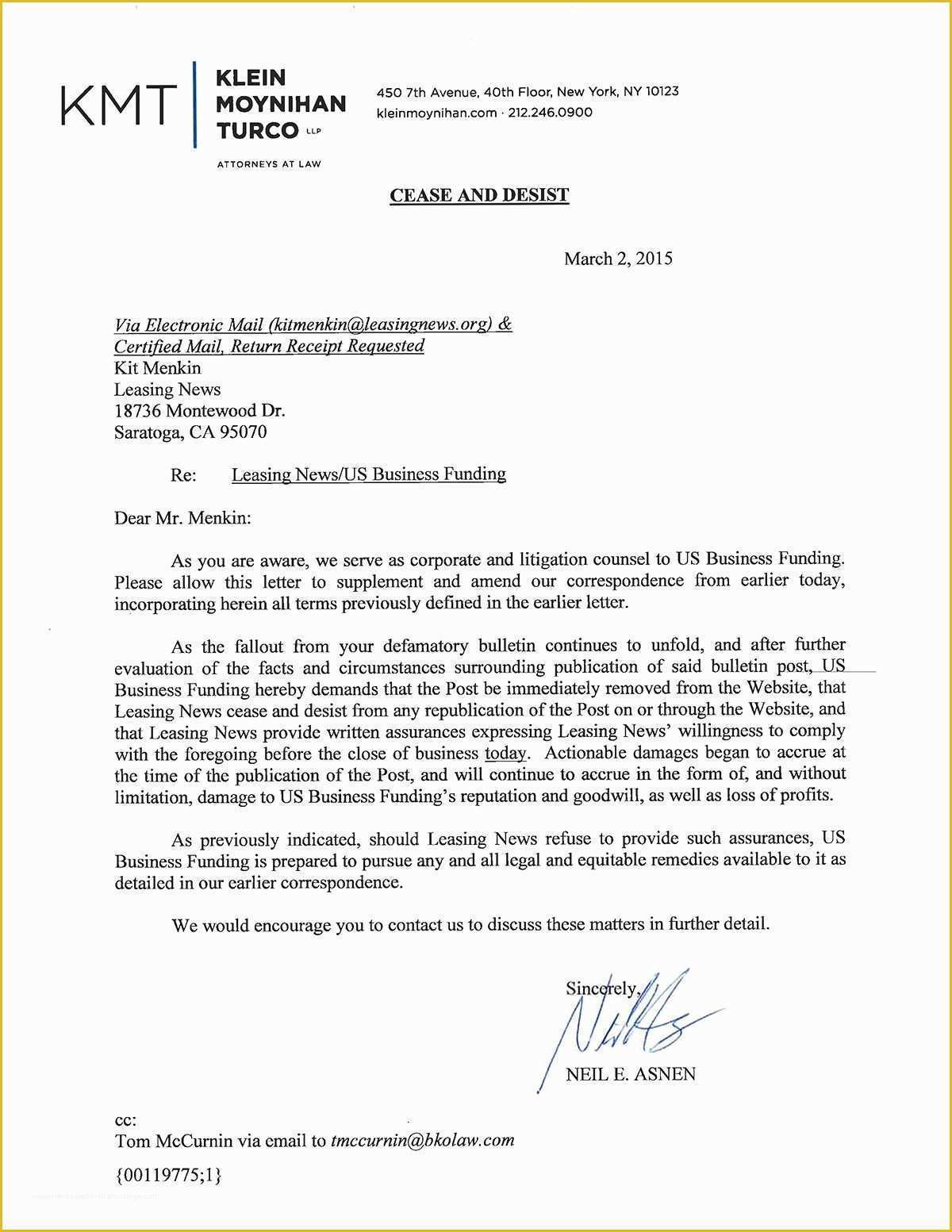

Section 609 Credit Dispute Letter Template Samples Letter Template

Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]

Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]

Free Section 609 Credit Dispute Letter Template Of Section 609 Credit

609 Credit Dispute Letter Forms Docs 2023

Free Section 609 Credit Dispute Letter Template

Free 609 Letter Template Printable Templates Your GoTo Resource for

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Free 609 Letter Template

It Allows Consumers To Obtain Information About The Sources Of Data On Their.

Individuals Who Have Identified Inaccurate Or Questionable Information On Their Credit Reports May Need A 609 Letter Template To Initiate The Dispute Process.

Section 609 Refers To A Section Of The Fair Credit Reporting Act (Fcra) That Addresses Your Rights To Request Copies Of Your Own Credit Reports And Associated Information.

A 609 Letter Is A Formal Written Request Sent To Credit Bureaus, Invoking Rights Under Section 609 Of The Fcra.

Related Post:

![Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/05/609-credit-dispute-letter.jpg)

![Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/05/Credit-Dispute-Letter-1-768x1086.jpg)

![Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/05/letter-to-dispute-credit-report.jpg?gid=126)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-11.jpg)