Accountability Plan Template

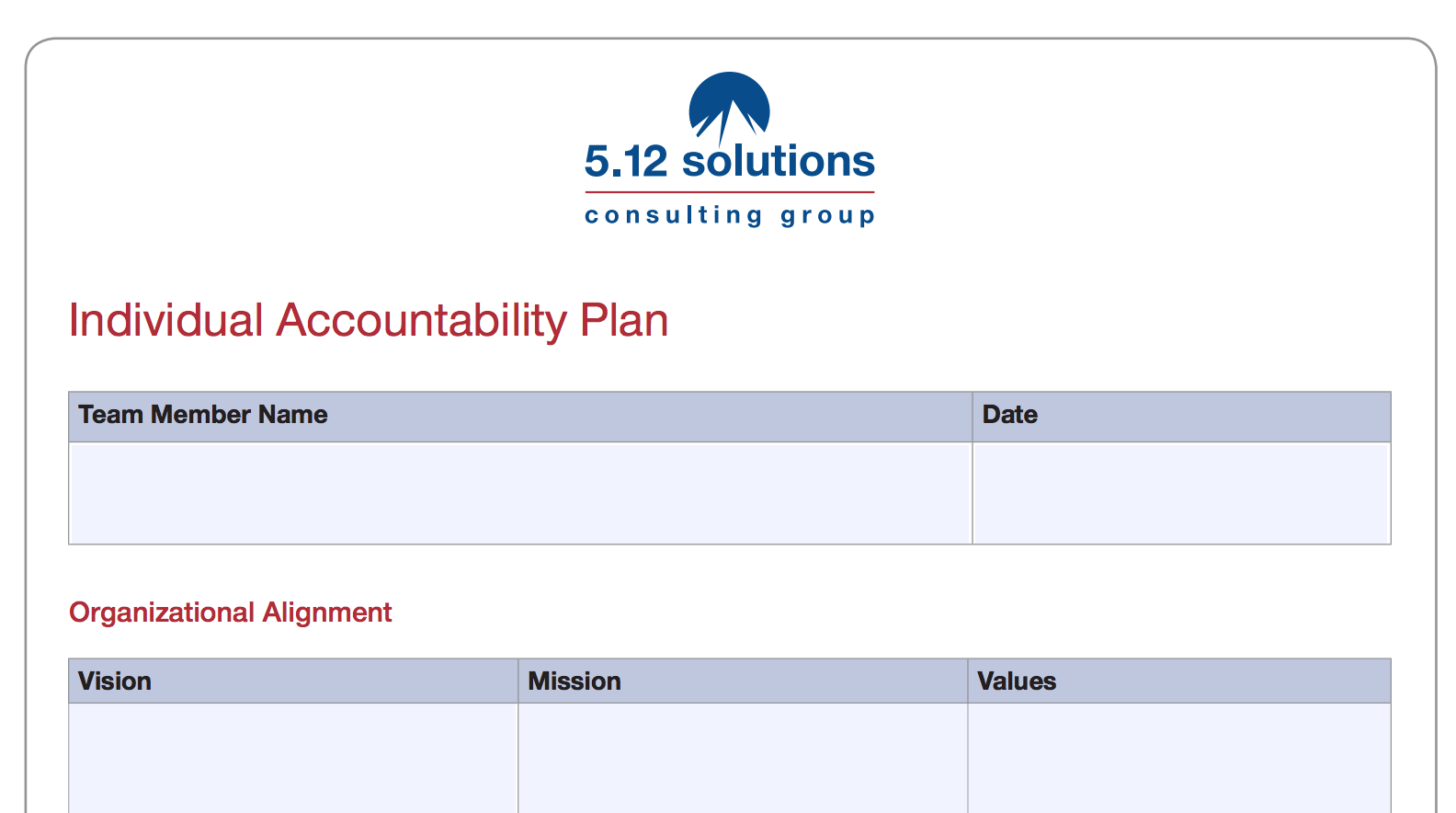

Accountability Plan Template - This guide also serves as a means of highlighting the accountability requirements associated with federal awards. Employee shall submit and keep copies of all related invoices and receipts associated with the expense reimbursement. Use our free sample accountable plan template to easily draft an expense review and make calculated decisions. Understand what a data retention policy is and get templates, examples, and best practices for creating your own so you can minimize data exposure. Agreement to adopt an accountable plan part i: Instantly download free blank accountable plan template sample & example in pdf format. Timely submission of documentation is required by federal tax law. What is an irs accountable plan? Tax preparation gross revenue/sales on 1099s 0 purchase price of home 425,000 ending biz checking balance on 12/31 0 gross revenue/sales not on 1099s 0 business use start date. Following a template/plan can help you maintain your sobriety. Accountability at work is the repeated pattern of verifying that expectations are turning into results. Employee shall submit and keep copies of all related invoices and receipts associated with the expense reimbursement. Timely submission of documentation is required by federal tax law. Templates and plans create predictability and accountability for preventing relapses in the future. Use our free sample accountable plan template to easily draft an expense review and make calculated decisions. Accountable plan (“company name”) desires to establish an expense reimbursement policy pursuant to reg. Following a template/plan can help you maintain your sobriety. This allows your company to deduct reimbursements (with some restrictions on meal. What is an irs accountable plan? This document can be used as a guide to draft an accountable plan for expense reimbursements. Accountable plan (“company name”) desires to establish an expense reimbursement policy pursuant to reg. Agreement to adopt an accountable plan part i: Accountable reimbursement plan of [company] it is the policy of [company] (hereinafter referred to as the “company”) to reimburse employees, partners, members, and/or. This document can be used as a guide to draft an accountable plan for expense. What is an irs accountable plan? Following a template/plan can help you maintain your sobriety. Employee shall submit and keep copies of all related invoices and receipts associated with the expense reimbursement. Accountability at work is the repeated pattern of verifying that expectations are turning into results. Up to $50 cash back accountable plan templates are standardized forms used by. This allows your company to deduct reimbursements (with some restrictions on meal. Agreement to adopt an accountable plan part i: However, it is merely an example, and it is not meant to be adopted or. A corrective action plan (cap) is a structured approach to identifying, addressing, and preventing recurring issues in an organization. Discover the requirements, benefits, and steps. Discover the requirements, benefits, and steps to create an. Agreement to adopt an accountable plan part i: Accountable plan (“company name”) desires to establish an expense reimbursement policy pursuant to reg. Tax preparation gross revenue/sales on 1099s 0 purchase price of home 425,000 ending biz checking balance on 12/31 0 gross revenue/sales not on 1099s 0 business use start date.. Use the template to create your own policy for the. Use our free sample accountable plan template to easily draft an expense review and make calculated decisions. This guide also serves as a means of highlighting the accountability requirements associated with federal awards. Instantly download accountable plan template sample & example in word, google docs, pdf format. This allows your. However, it is merely an example, and it is not meant to be adopted or. Accountability at work is the repeated pattern of verifying that expectations are turning into results. Use our free sample accountable plan template to easily draft an expense review and make calculated decisions. Tax preparation gross revenue/sales on 1099s 0 purchase price of home 425,000 ending. To mitigate the impact on employees, implementing an accountable expense reimbursement plan is crucial. Use the template to create your own policy for the. Discover the requirements, benefits, and steps to create an. Easily edit this template for free using our online document editor tool. This sample accountable plan is for you to include in your business records or corporate. Accountable plan desires to establish an expense reimbursement policy pursuant to reg. However, it is merely an example, and it is not meant to be adopted or. This sample accountable plan is for you to include in your business records or corporate minutes as proof that your business knows and follows the law with regard to expense reimbursements. Tax preparation. This guide also serves as a means of highlighting the accountability requirements associated with federal awards. Timely submission of documentation is required by federal tax law. Templates and plans create predictability and accountability for preventing relapses in the future. This sample accountable plan is for you to include in your business records or corporate minutes as proof that your business. Accountable plan desires to establish an expense reimbursement policy pursuant to reg. To mitigate the impact on employees, implementing an accountable expense reimbursement plan is crucial. This document can be used as a guide to draft an accountable plan for expense reimbursements. Discover the requirements, benefits, and steps to create an. This guide also serves as a means of highlighting. Agreement to adopt an accountable plan part i: Instantly download accountable plan template sample & example in word, google docs, pdf format. Easily edit this template for free using our online document editor tool. This sample accountable plan is for you to include in your business records or corporate minutes as proof that your business knows and follows the law with regard to expense reimbursements. Accountability helps you create a life you’re proud of by turning your goals into reality. This guide also serves as a means of highlighting the accountability requirements associated with federal awards. Tax preparation gross revenue/sales on 1099s 0 purchase price of home 425,000 ending biz checking balance on 12/31 0 gross revenue/sales not on 1099s 0 business use start date. Use the template to create your own policy for the. Are you a corporation that cannot claim home. Accountability at work is the repeated pattern of verifying that expectations are turning into results. Accountable plan desires to establish an expense reimbursement policy pursuant to reg. Following a template/plan can help you maintain your sobriety. Timely submission of documentation is required by federal tax law. To mitigate the impact on employees, implementing an accountable expense reimbursement plan is crucial. Discover the requirements, benefits, and steps to create an. Employee shall submit and keep copies of all related invoices and receipts associated with the expense reimbursement.Individual Accountability Plan Worksheet 5.12 Solutions Consulting Group

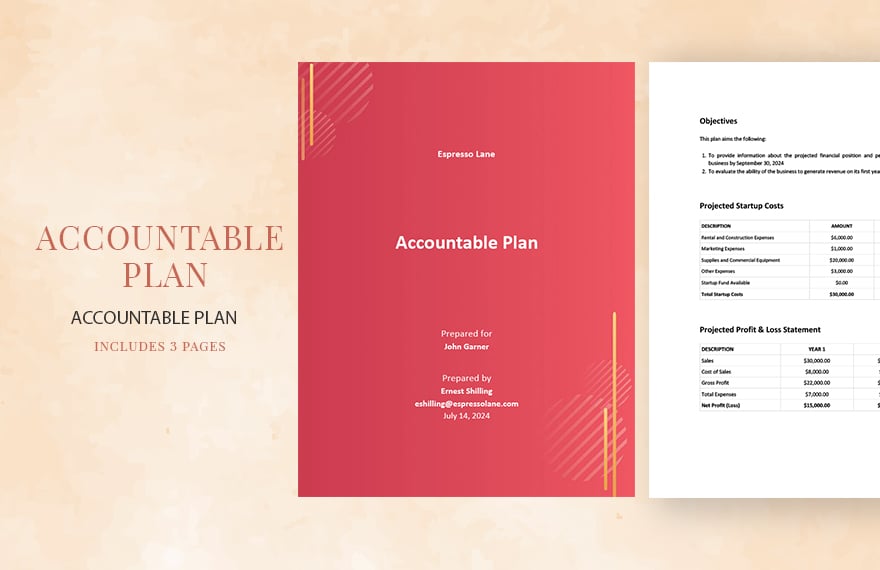

Sample Accountable Plan Template in Word, PDF, Google Docs, Pages

Accountable Reimbursement Plan Template [Free PDF] Google Docs, Word

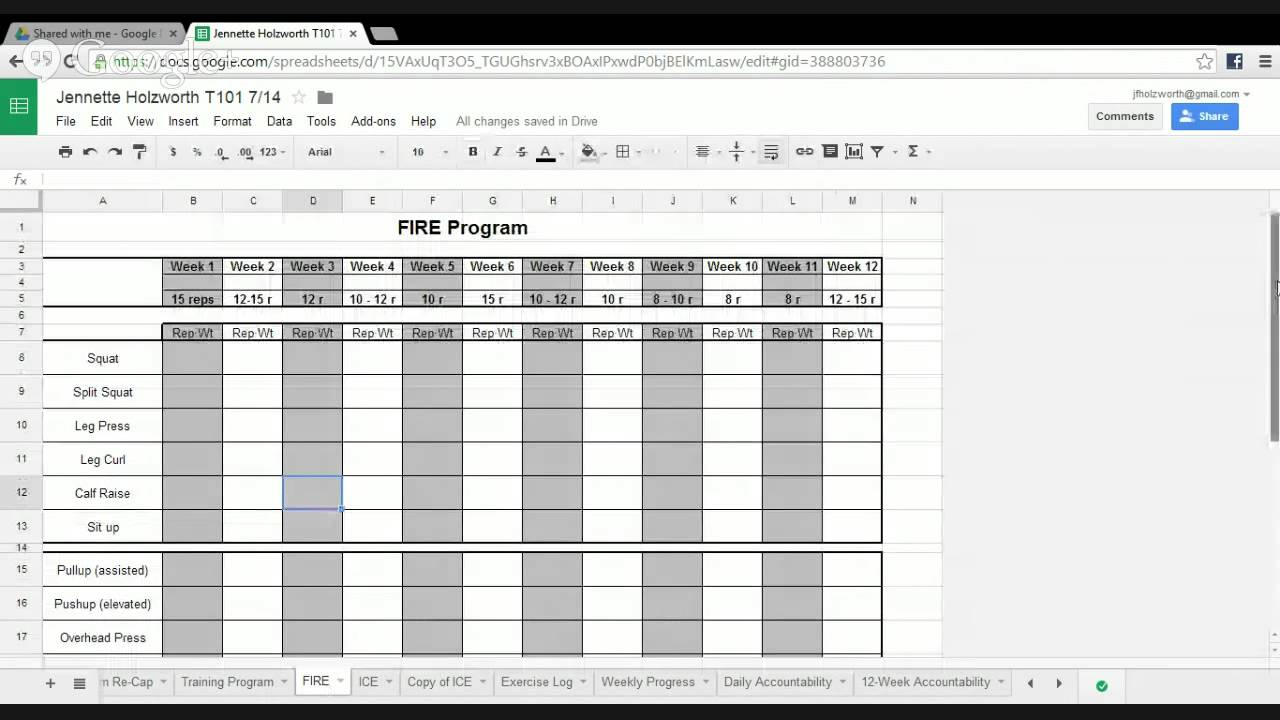

Accountable Plan Template Excel, Web provide them with templates for

Accountable Plan Templates in Word FREE Download

Accountable Expense Plan Template in Word, PDF, Google Docs, Pages

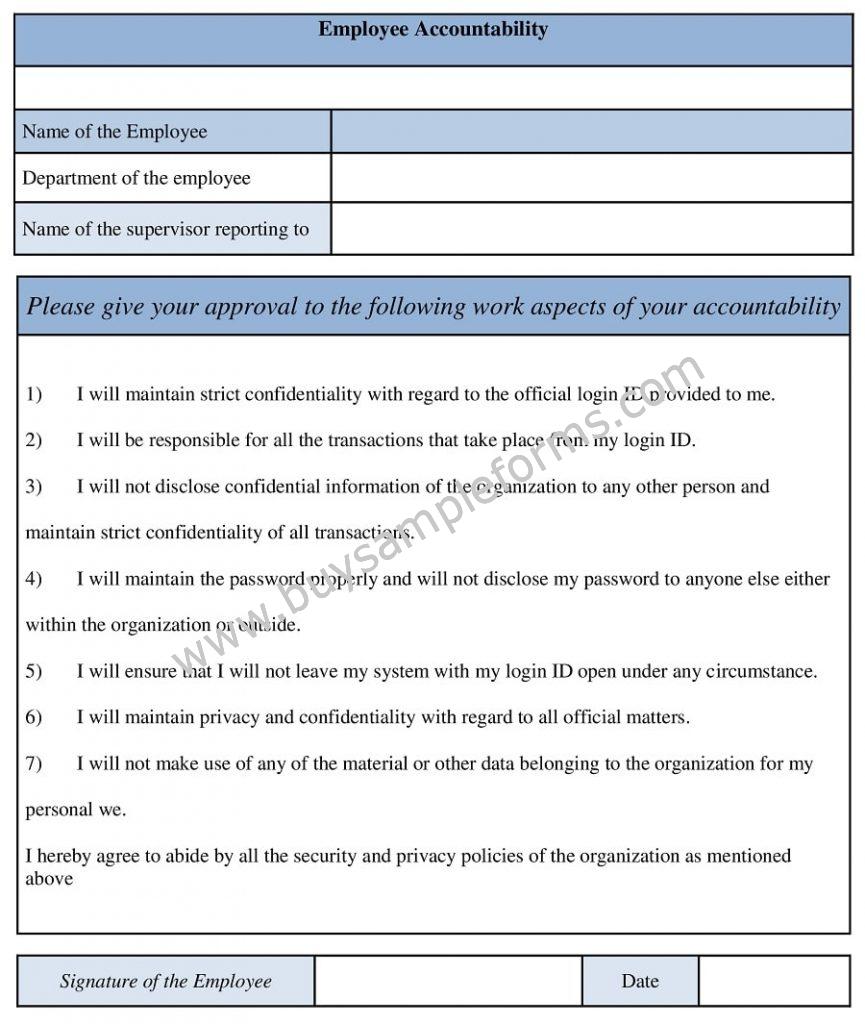

Printable Accountability Form Template Printable Forms Free Online

Accountable Reimbursement Plan Template Google Docs, Word, Apple

Simple Accountable Plan Template in Word, PDF, Google Docs, Pages

Accountable Reimbursement Plan Template Google Docs, Word, Apple

Templates And Plans Create Predictability And Accountability For Preventing Relapses In The Future.

Up To $50 Cash Back Accountable Plan Templates Are Standardized Forms Used By Businesses To Outline Reimbursable Expenses Incurred By Employees.

However, It Is Merely An Example, And It Is Not Meant To Be Adopted Or.

Use Our Free Sample Accountable Plan Template To Easily Draft An Expense Review And Make Calculated Decisions.

Related Post:

![Accountable Reimbursement Plan Template [Free PDF] Google Docs, Word](https://images.template.net/62891/Accountable-Reimbursement-Plan-Template-1.jpeg)