Asc 842 Template

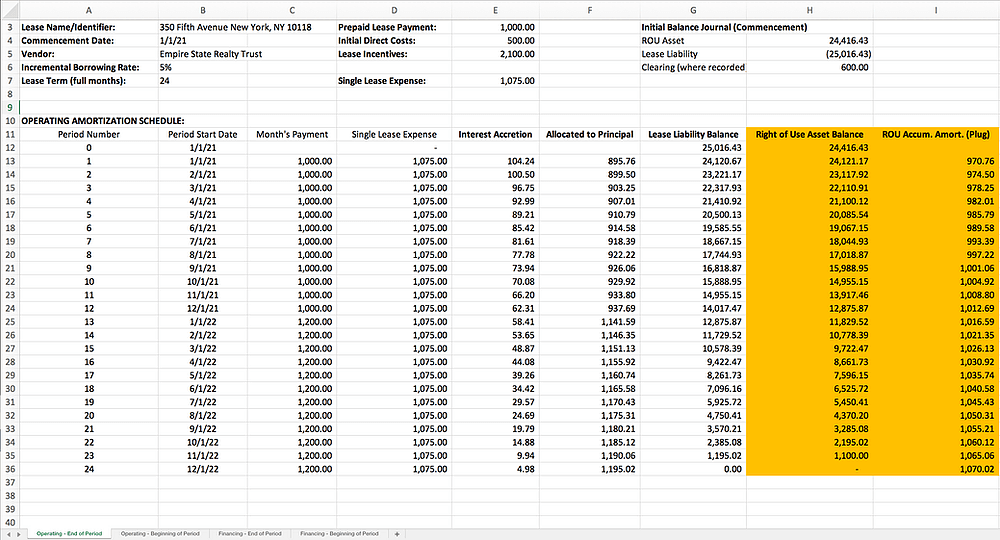

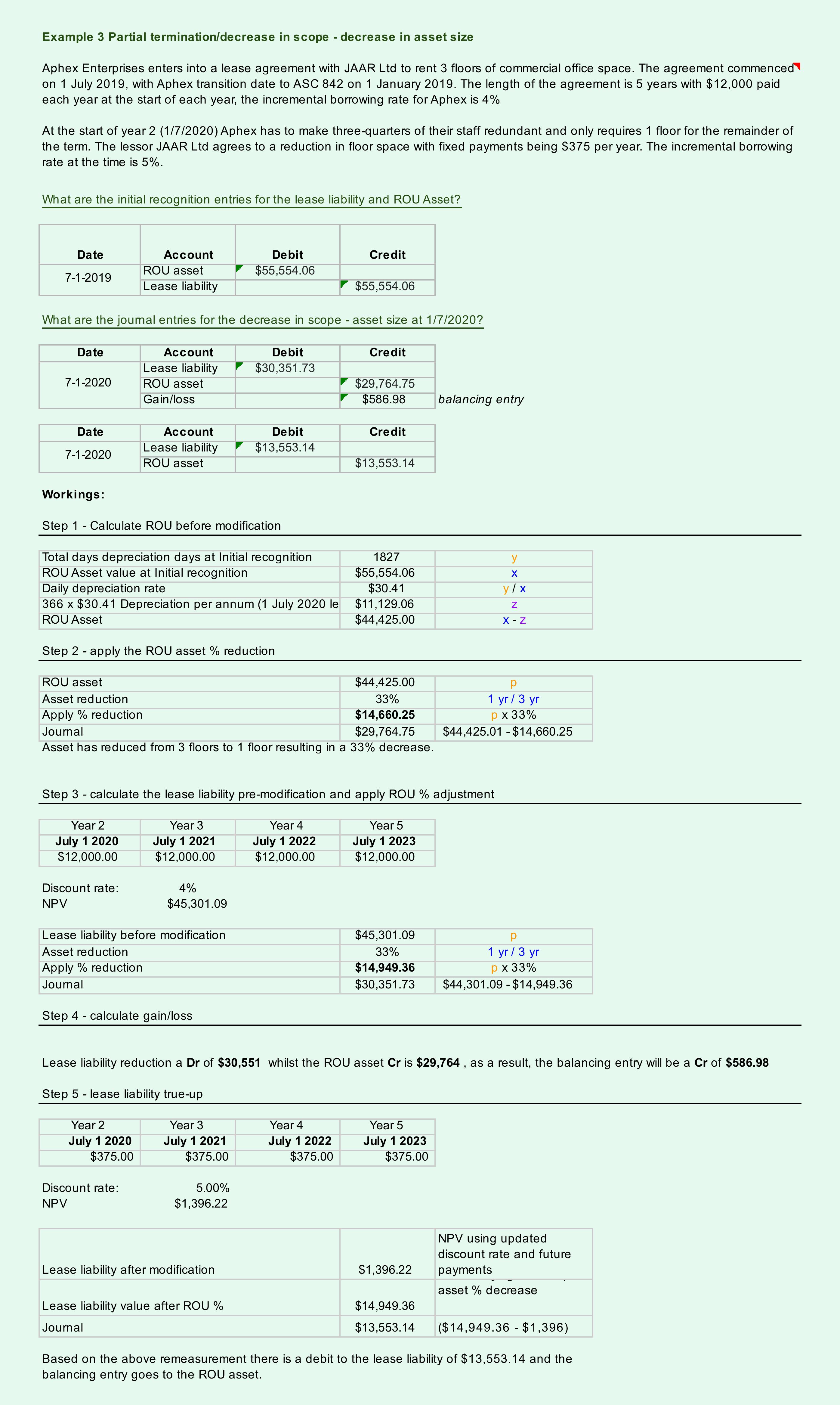

Asc 842 Template - With the adoption of asc 842 and ifrs 16, organizations must ensure compliance while managing. We've created a straightforward but comprehensive template that provides your accounting team with a clear and concise view of. Download our finance lease amortization schedule template to simplify lease accounting under asc 842 or ifrs 16. Download our free asc 842 lease accounting calculator and calculate the accounting impact of leases under new lease accounting standard us gaap (topic 842). Download our asc 842 lease accounting spreadsheet template & easily create an operating lease schedule that complies with asc 842 requirements. It helps you accurately track lease liabilities and expenses over time,. Lease accounting can be intricate, requiring precision and accuracy. With our excel template, you will be guided on how to calculate your lease. Under asc 842, operating leases and financial leases have different amortization calculations. In this blog post, we will explore both excel templates and technology options for asc 842 compliance. In this blog post, we will explore both excel templates and technology options for asc 842 compliance. Download our finance lease amortization schedule template to simplify lease accounting under asc 842 or ifrs 16. We've created a straightforward but comprehensive template that provides your accounting team with a clear and concise view of. Lease accounting can be intricate, requiring precision and accuracy. Asc 842 lease classification template for lessees. Download our asc 842 lease accounting spreadsheet template & easily create an operating lease schedule that complies with asc 842 requirements. Under asc 842, operating leases and financial leases have different amortization calculations. Discover the key to accurate financial reporting with our free guide on excel templates for lease amortization schedules under asc 842. The asc 842 lease accounting standard is mandatory for all private companies and nonprofit organizations that follow gaap and have leases longer than 12 months. With our excel template, you will be guided on how to calculate your lease. In this blog post, we will explore both excel templates and technology options for asc 842 compliance. Under asc 842, operating leases and financial leases have different amortization calculations. The asc 842 lease accounting standard is mandatory for all private companies and nonprofit organizations that follow gaap and have leases longer than 12 months. Discover the key to accurate financial. Download our free asc 842 lease accounting calculator and calculate the accounting impact of leases under new lease accounting standard us gaap (topic 842). Under asc 842, operating leases and financial leases have different amortization calculations. With our excel template, you will be guided on how to calculate your lease. The asc 842 lease accounting standard is mandatory for all. Lease accounting can be intricate, requiring precision and accuracy. With our excel template, you will be guided on how to calculate your lease. Discover the key to accurate financial reporting with our free guide on excel templates for lease amortization schedules under asc 842. A lease amortization schedule is crucial for ensuring compliance with accounting standards like asc 842 and. In this blog post, we will explore both excel templates and technology options for asc 842 compliance. The asc 842 lease accounting standard is mandatory for all private companies and nonprofit organizations that follow gaap and have leases longer than 12 months. Asc 842 lease classification template for lessees. Download our asc 842 lease accounting spreadsheet template & easily create. Under asc 842, operating leases and financial leases have different amortization calculations. Asc 842 lease classification template for lessees. With our excel template, you will be guided on how to calculate your lease. A lease amortization schedule is crucial for ensuring compliance with accounting standards like asc 842 and ifrs 16. In this blog post, we will explore both excel. With our excel template, you will be guided on how to calculate your lease. Download our free asc 842 lease accounting calculator and calculate the accounting impact of leases under new lease accounting standard us gaap (topic 842). Asc 842 lease classification template for lessees. Lease accounting can be intricate, requiring precision and accuracy. Discover the key to accurate financial. Lease accounting can be intricate, requiring precision and accuracy. Download our finance lease amortization schedule template to simplify lease accounting under asc 842 or ifrs 16. Asc 842 lease classification template for lessees. Download our free asc 842 lease accounting calculator and calculate the accounting impact of leases under new lease accounting standard us gaap (topic 842). Discover the key. The asc 842 lease accounting standard is mandatory for all private companies and nonprofit organizations that follow gaap and have leases longer than 12 months. Under asc 842, operating leases and financial leases have different amortization calculations. A lease amortization schedule is crucial for ensuring compliance with accounting standards like asc 842 and ifrs 16. We've created a straightforward but. Discover the key to accurate financial reporting with our free guide on excel templates for lease amortization schedules under asc 842. Download our asc 842 lease accounting spreadsheet template & easily create an operating lease schedule that complies with asc 842 requirements. Download our free asc 842 lease accounting calculator and calculate the accounting impact of leases under new lease. With the adoption of asc 842 and ifrs 16, organizations must ensure compliance while managing. Asc 842 lease classification template for lessees. We've created a straightforward but comprehensive template that provides your accounting team with a clear and concise view of. A lease amortization schedule is crucial for ensuring compliance with accounting standards like asc 842 and ifrs 16. With. It helps you accurately track lease liabilities and expenses over time,. Download our free asc 842 lease accounting calculator and calculate the accounting impact of leases under new lease accounting standard us gaap (topic 842). In this blog post, we will explore both excel templates and technology options for asc 842 compliance. The asc 842 lease accounting standard is mandatory for all private companies and nonprofit organizations that follow gaap and have leases longer than 12 months. We've created a straightforward but comprehensive template that provides your accounting team with a clear and concise view of. Discover the key to accurate financial reporting with our free guide on excel templates for lease amortization schedules under asc 842. A lease amortization schedule is crucial for ensuring compliance with accounting standards like asc 842 and ifrs 16. Download our asc 842 lease accounting spreadsheet template & easily create an operating lease schedule that complies with asc 842 requirements. Under asc 842, operating leases and financial leases have different amortization calculations. With our excel template, you will be guided on how to calculate your lease. Lease accounting can be intricate, requiring precision and accuracy.Asc 842 Calculation Template

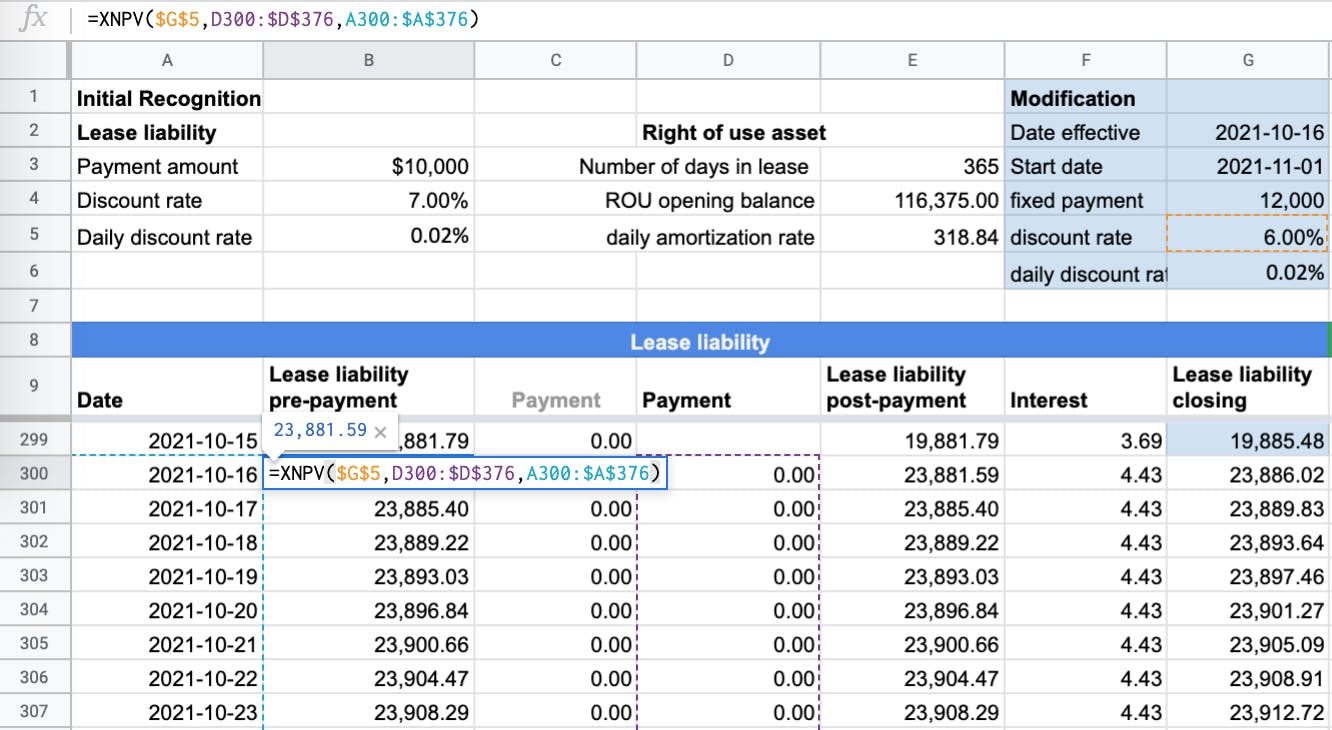

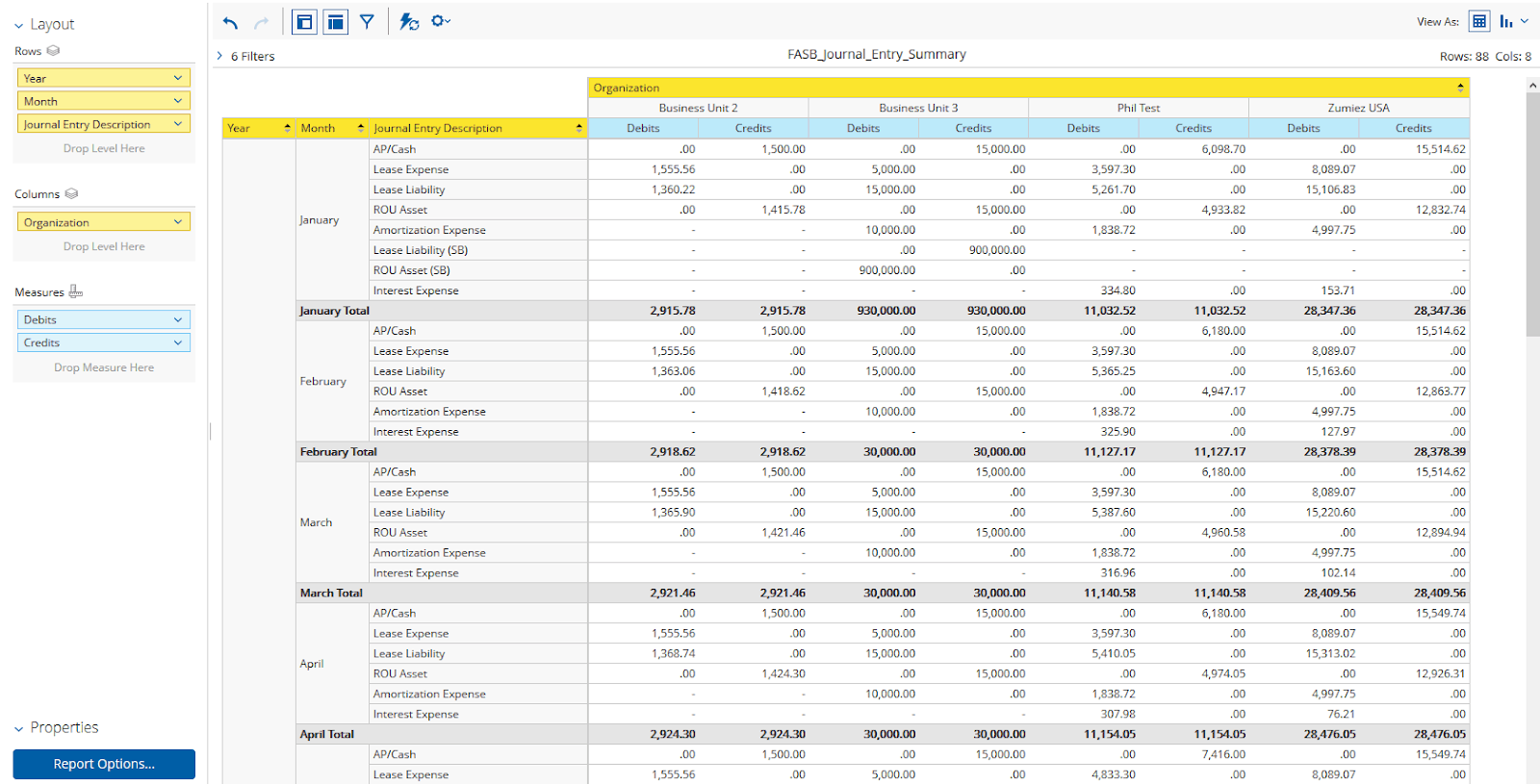

Asc 842 Lease Accounting Excel Template

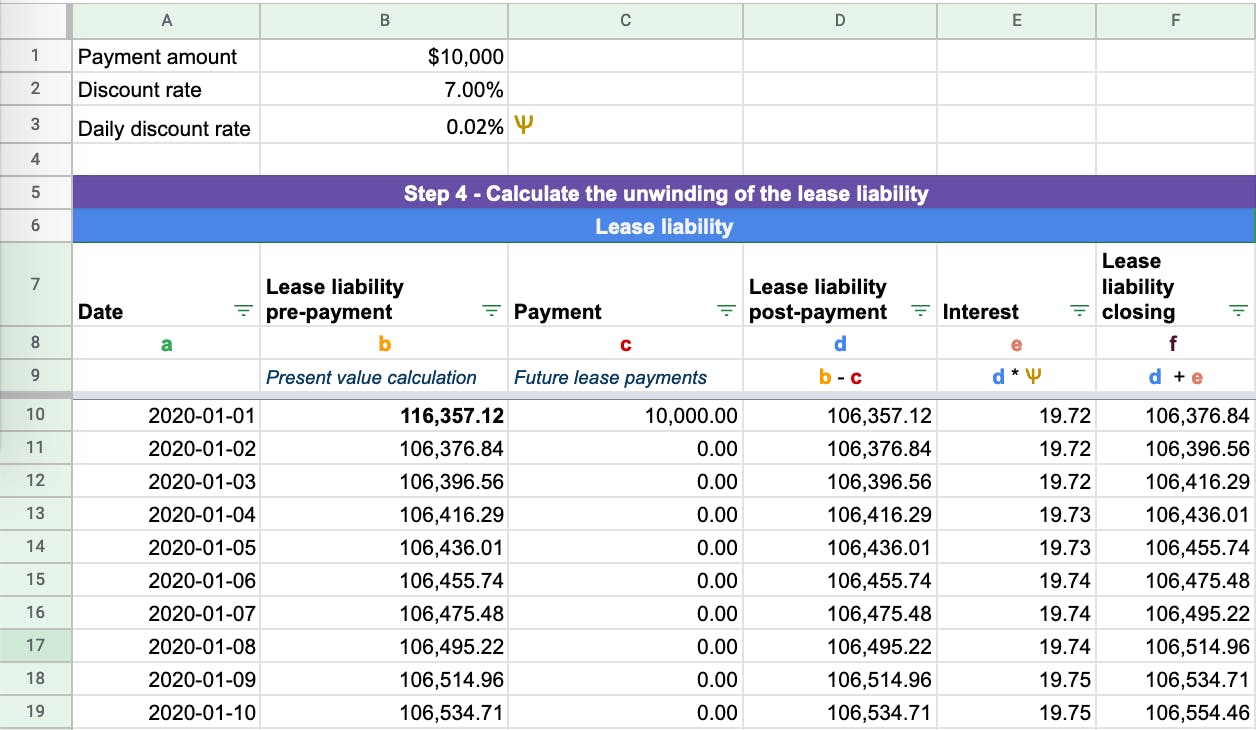

ASC 842 Lease Amortization Schedule Templates in Excel Free Download

Asc 842 Memo Template

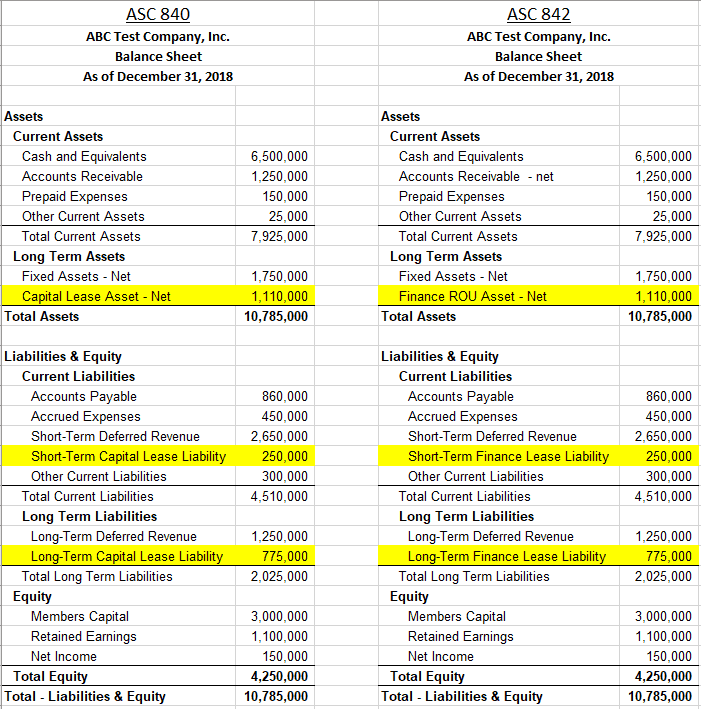

ASC 842 Lease Accounting Balance Sheet Examples Visual Lease

Asc 842 Lease Accounting Excel Template

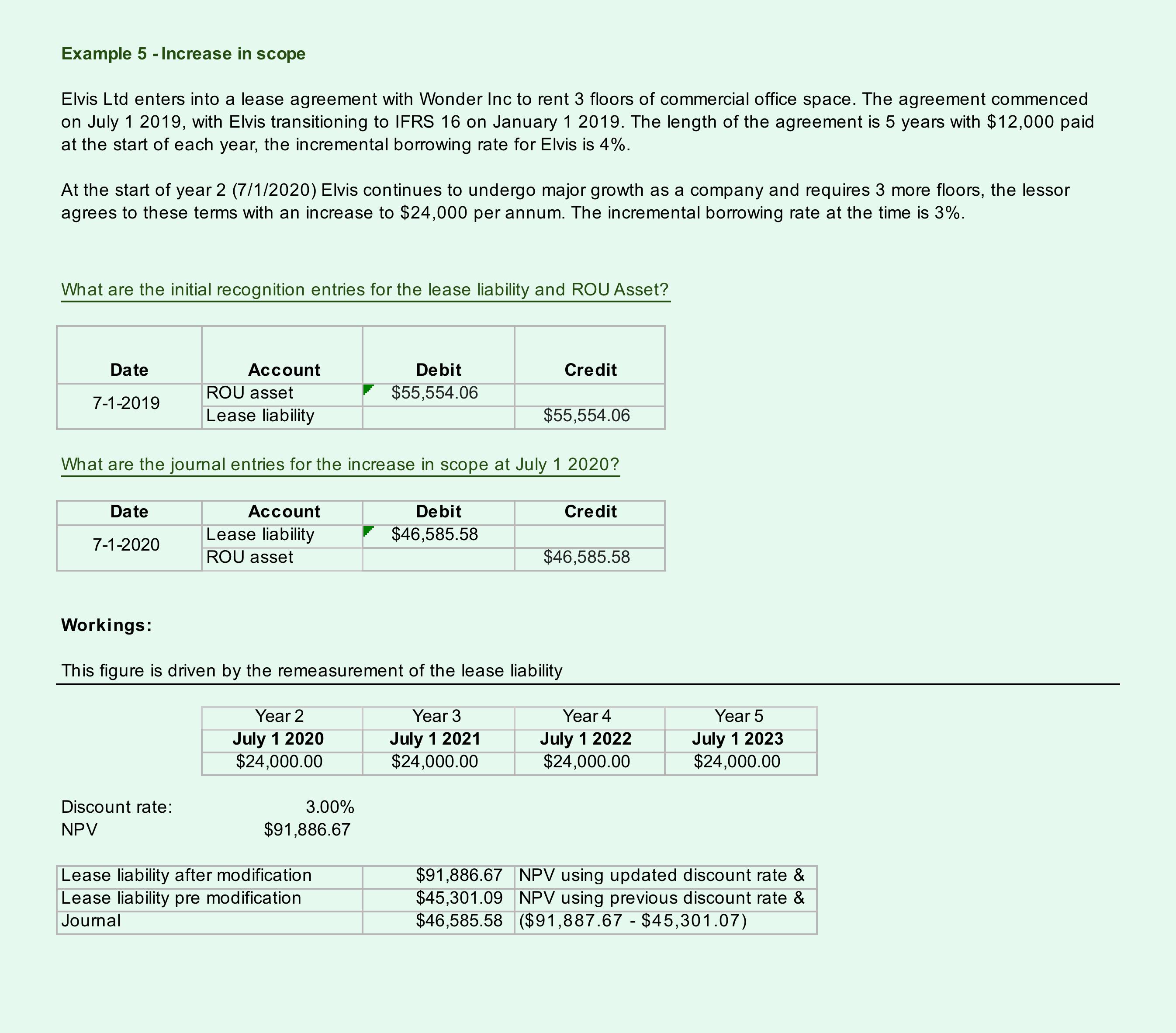

Asc 842 Lease Accounting Template

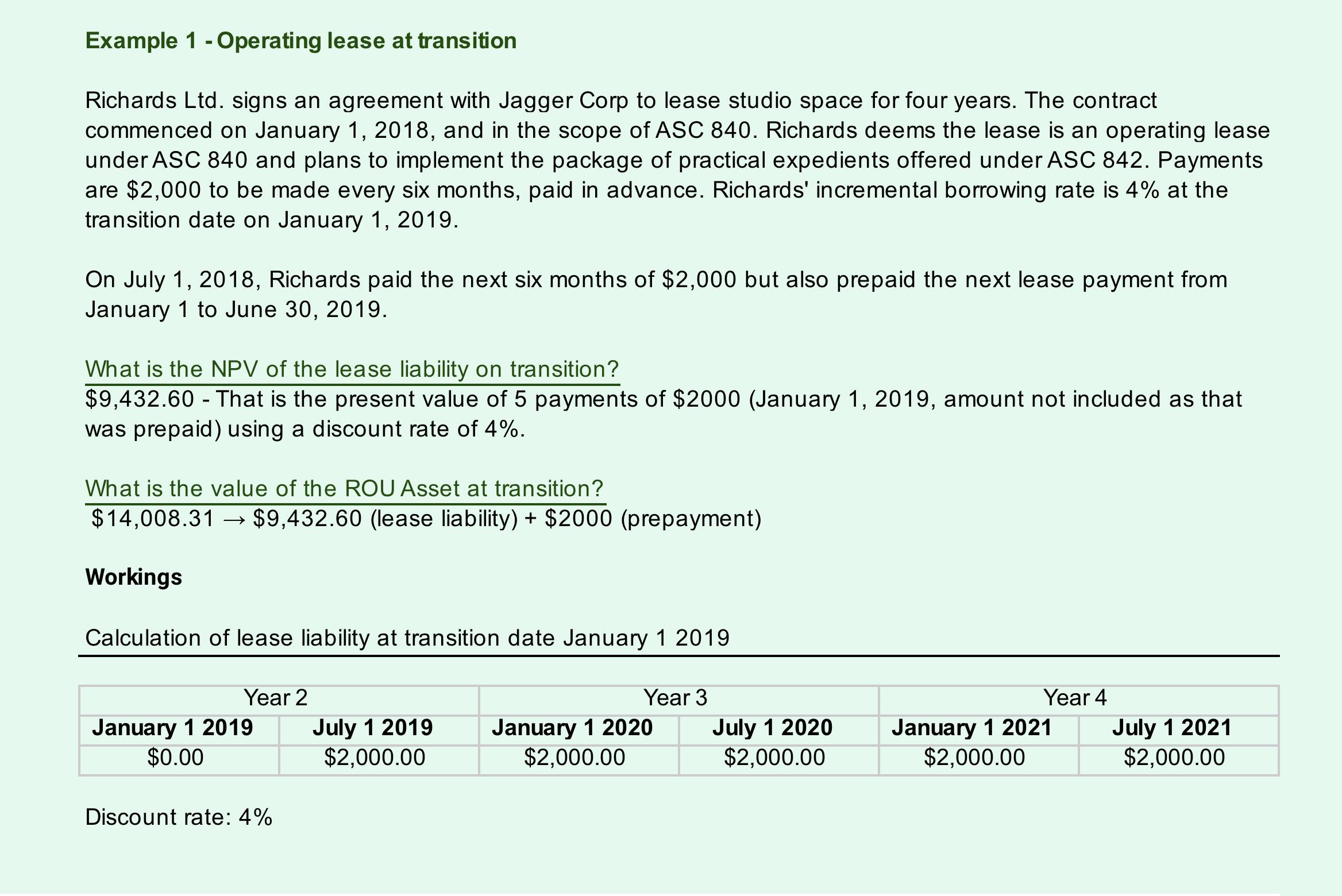

Asc 842 Lease Accounting Template

Asc 842 Lease Accounting Excel Template

Asc 842 Calculation Template

With The Adoption Of Asc 842 And Ifrs 16, Organizations Must Ensure Compliance While Managing.

Download Our Finance Lease Amortization Schedule Template To Simplify Lease Accounting Under Asc 842 Or Ifrs 16.

Asc 842 Lease Classification Template For Lessees.

Related Post: