Business Credit Application Templates

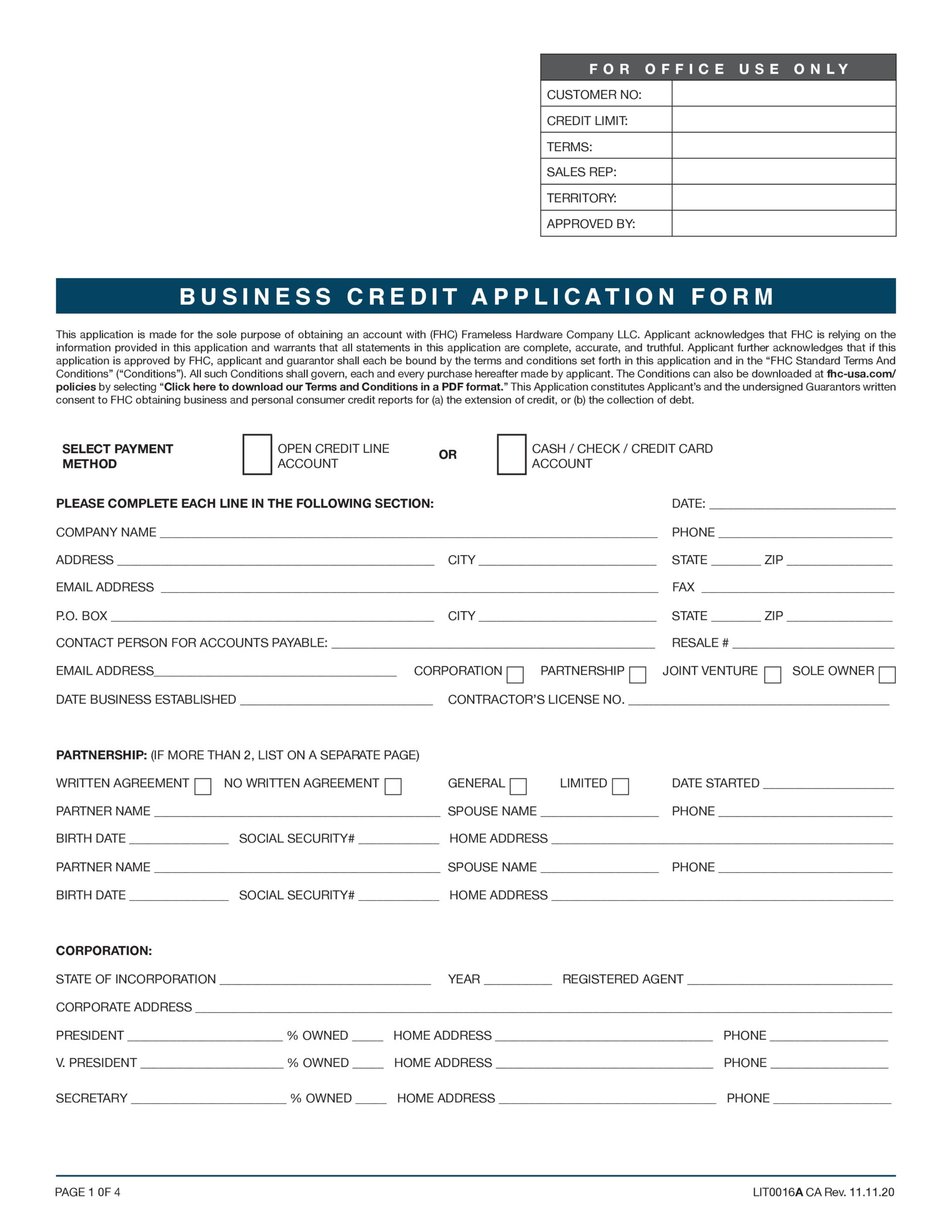

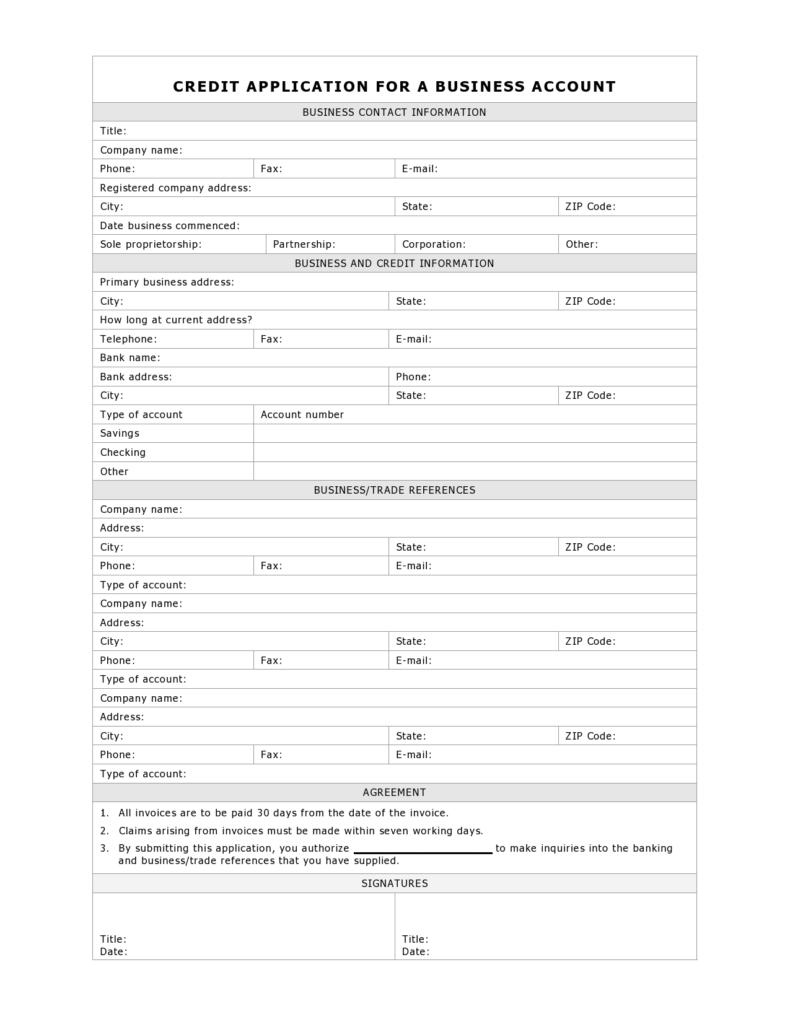

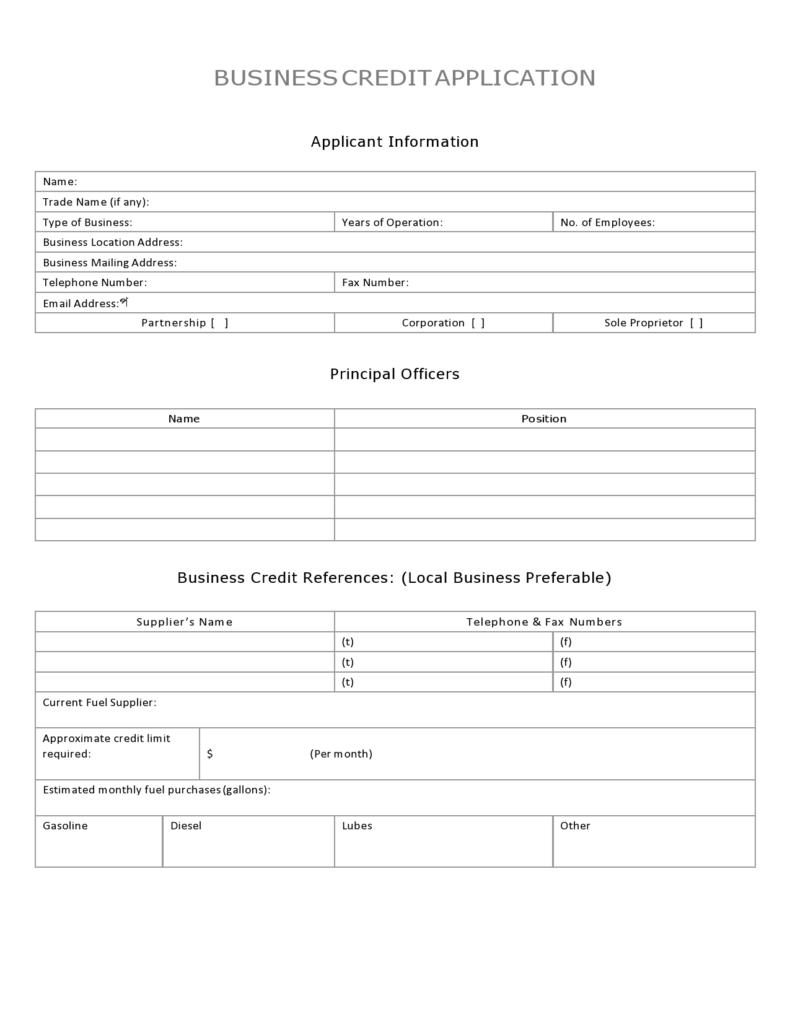

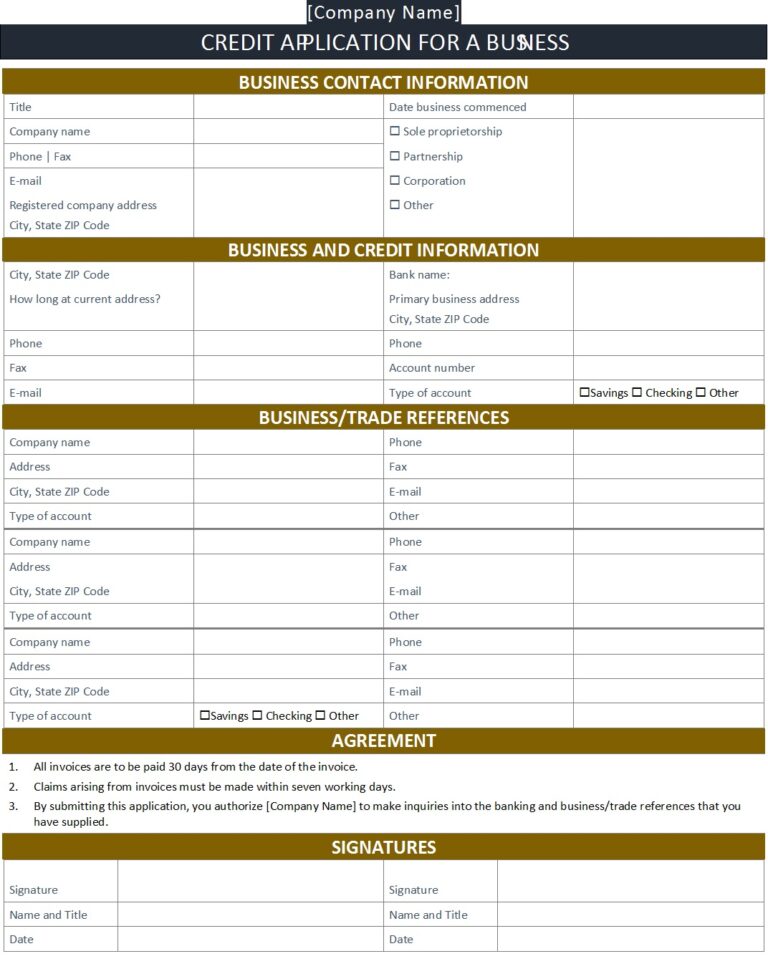

Business Credit Application Templates - For what reason is a business credit application form? Presenting a business credit application is crucial in helping lenders manage and evaluate credit risks. A business credit application form is a document that businesses complete to apply for credit or financing from lenders or suppliers. Instantly download business credit application template, sample & example in microsoft word (doc), google docs, apple pages format. In canada, “business credit card” and “corporate credit card” are often used interchangeably, but they serve different purposes. Completing a business credit application form would be important for businesses that seek to build or expand their credit lines. In this article, we will explore the ins and outs of a business credit application form and discuss why it is an essential tool for any business owner. This essential document helps businesses evaluate the creditworthiness of potential clients by collecting critical financial and personal. What is a credit application form? These free business credit application forms will help you collect and organize the appropriate information so both the lender and borrower can stay on the same page and make informed. This form collects key financial and personal information, enabling informed. What is a business credit. These free business credit application forms will help you collect and organize the appropriate information so both the lender and borrower can stay on the same page and make informed. This essential document helps businesses evaluate the creditworthiness of potential clients by collecting critical financial and personal. The credit application form is the initial step in collecting information regarding a prospective. Presenting a business credit application is crucial in helping lenders manage and evaluate credit risks. In the application, provide your. Available in a4 & us letter sizes. A business credit application form is used to request credit from. An effective credit application template helps you get to the point you want to be at. In this blog post, we’ll guide you. Earn unlimited 1.5% cash back on every purchase made for. What is a credit application form? Presenting a business credit application is crucial in helping lenders manage and evaluate credit risks. Instant access to the credit your business needs. While offering credit terms has benefits, managing delayed payments is crucial and it all starts with your business credit application template. Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening; Instantly download business credit application template, sample & example in microsoft word (doc), google docs, apple pages format. This form. In canada, “business credit card” and “corporate credit card” are often used interchangeably, but they serve different purposes. What is a credit application form? While offering credit terms has benefits, managing delayed payments is crucial and it all starts with your business credit application template. Instantly download business credit application template, sample & example in microsoft word (doc), google docs,. Are you in need of a credit application form template? Completing a business credit application form would be important for businesses that seek to build or expand their credit lines. If used correctly, lenders can identify companies to watch out for when extending credit. What is a credit application form? An effective credit application template helps you get to the. In the application, provide your. A business credit application form is used to request credit from. Earn $750 bonus cash back after you spend $6,000 on purchases in the first 3 months from account opening; An effective credit application template helps you get to the point you want to be at. These free business credit application forms will help you. Presenting a business credit application is crucial in helping lenders manage and evaluate credit risks. In this article, we will explore the ins and outs of a business credit application form and discuss why it is an essential tool for any business owner. For what reason is a business credit application form? Earn unlimited 1.5% cash back on every purchase. In canada, “business credit card” and “corporate credit card” are often used interchangeably, but they serve different purposes. In this article, we will explore the ins and outs of a business credit application form and discuss why it is an essential tool for any business owner. These free business credit application forms will help you collect and organize the appropriate. In this blog post, we’ll guide you. Do you want a form template for a business credit application? In conclusion, the main goal of filling up a business credit application template is to identify whether you’re financially responsible and stable. The credit application form is the initial step in collecting information regarding a prospective. Creating a business credit application form. Creating a business credit application form is essential for evaluating the creditworthiness of potential clients. This written report helps the business secure. An effective credit application template helps you get to the point you want to be at. What is a business credit. If used correctly, lenders can identify companies to watch out for when extending credit. This written report helps the business secure. This essential document helps businesses evaluate the creditworthiness of potential clients by collecting critical financial and personal. Do you want a form template for a business credit application? Presenting a business credit application is crucial in helping lenders manage and evaluate credit risks. In conclusion, the main goal of filling up a business. Available in a4 & us letter sizes. In conclusion, the main goal of filling up a business credit application template is to identify whether you’re financially responsible and stable. In canada, “business credit card” and “corporate credit card” are often used interchangeably, but they serve different purposes. A credit application form is a document drafted by an individual/business establishment to be used by potential customers aiming to get approval for. The credit application form is the initial step in collecting information regarding a prospective. Creating a business credit application form is essential for evaluating the creditworthiness of potential clients. This written report helps the business secure. What is a credit application form? An effective credit application template helps you get to the point you want to be at. For what reason is a business credit application form? This form collects key financial and personal information, enabling informed. In this article, we will explore the ins and outs of a business credit application form and discuss why it is an essential tool for any business owner. A business credit application form is a document that businesses complete to apply for credit or financing from lenders or suppliers. Are you in need of a credit application form template? While offering credit terms has benefits, managing delayed payments is crucial and it all starts with your business credit application template. In the application, provide your.Free, Printable Business Credit Application Template (Plus, How to Use

Business Credit Application Samples Excel Word Template

Free Printable Business Credit Application Templates [Word, PDF, Excel]

Free Printable Business Credit Application Templates [Word, PDF, Excel]

MustHave Business Credit Application Templates with Samples and Examples

Free Printable Business Credit Application Templates [Word, PDF, Excel]

48 Blank Business Credit Application Templates (100 FREE)

48 Blank Business Credit Application Templates (100 FREE)

40 Free Credit Application Form Templates & Samples

48 Blank Business Credit Application Templates (100 FREE)

Earn Unlimited 1.5% Cash Back On Every Purchase Made For.

Do You Want A Form Template For A Business Credit Application?

Completing A Business Credit Application Form Would Be Important For Businesses That Seek To Build Or Expand Their Credit Lines.

If Used Correctly, Lenders Can Identify Companies To Watch Out For When Extending Credit.

Related Post:

![Free Printable Business Credit Application Templates [Word, PDF, Excel]](https://www.typecalendar.com/wp-content/uploads/2023/05/business-credit-application-form-template-1.jpg)

![Free Printable Business Credit Application Templates [Word, PDF, Excel]](https://www.typecalendar.com/wp-content/uploads/2023/05/business-credit-application-template-excel.jpg?gid=433)

![Free Printable Business Credit Application Templates [Word, PDF, Excel]](https://www.typecalendar.com/wp-content/uploads/2023/05/business-credit-application-templates.jpg?gid=433)