Charge Off Dispute Letter Template

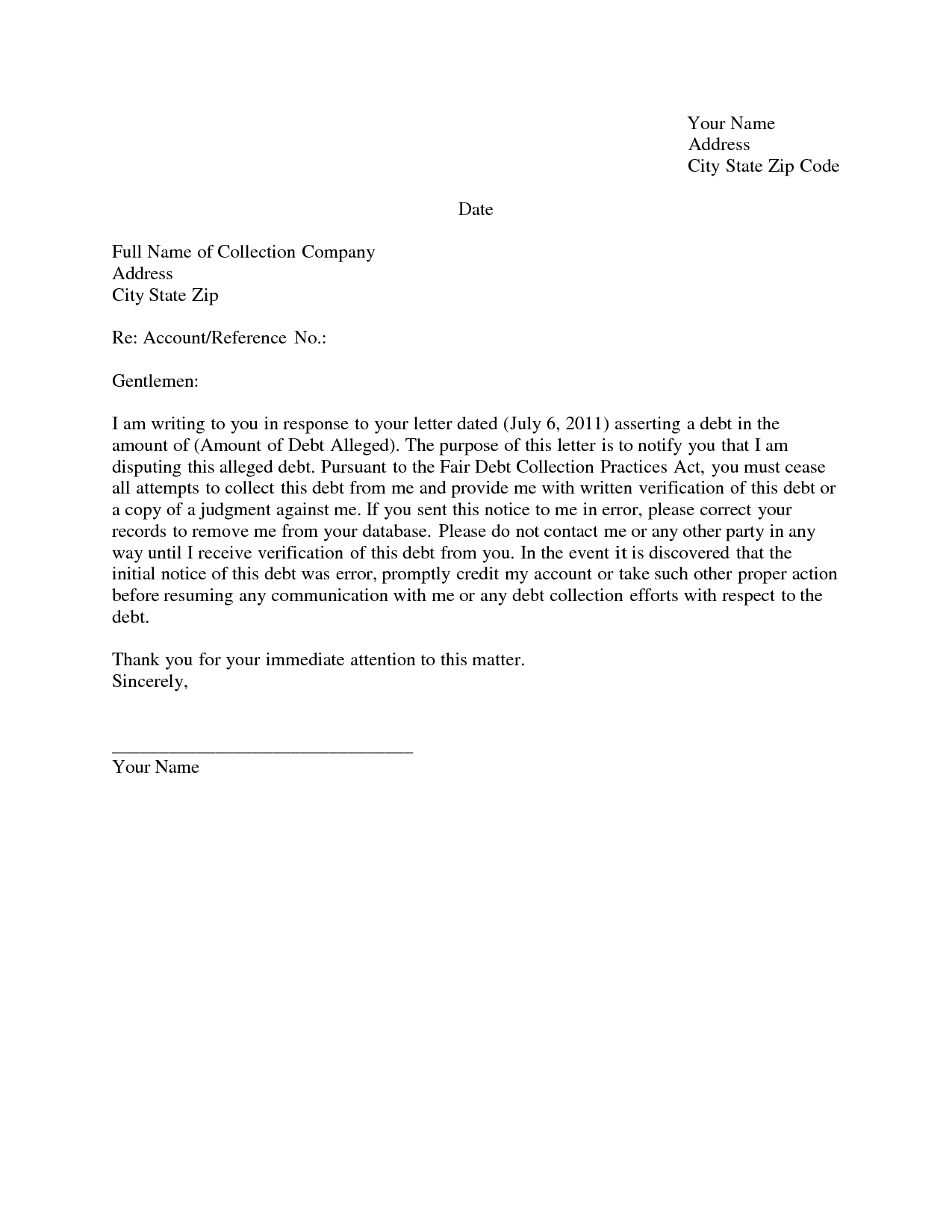

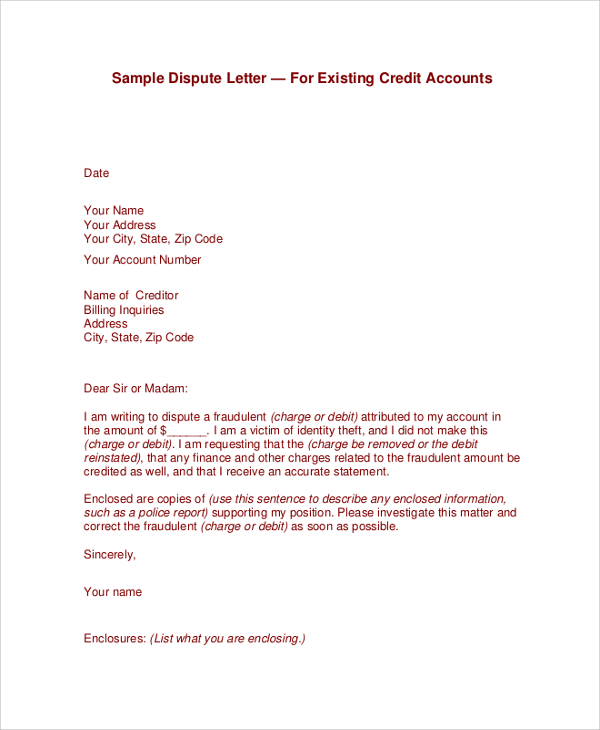

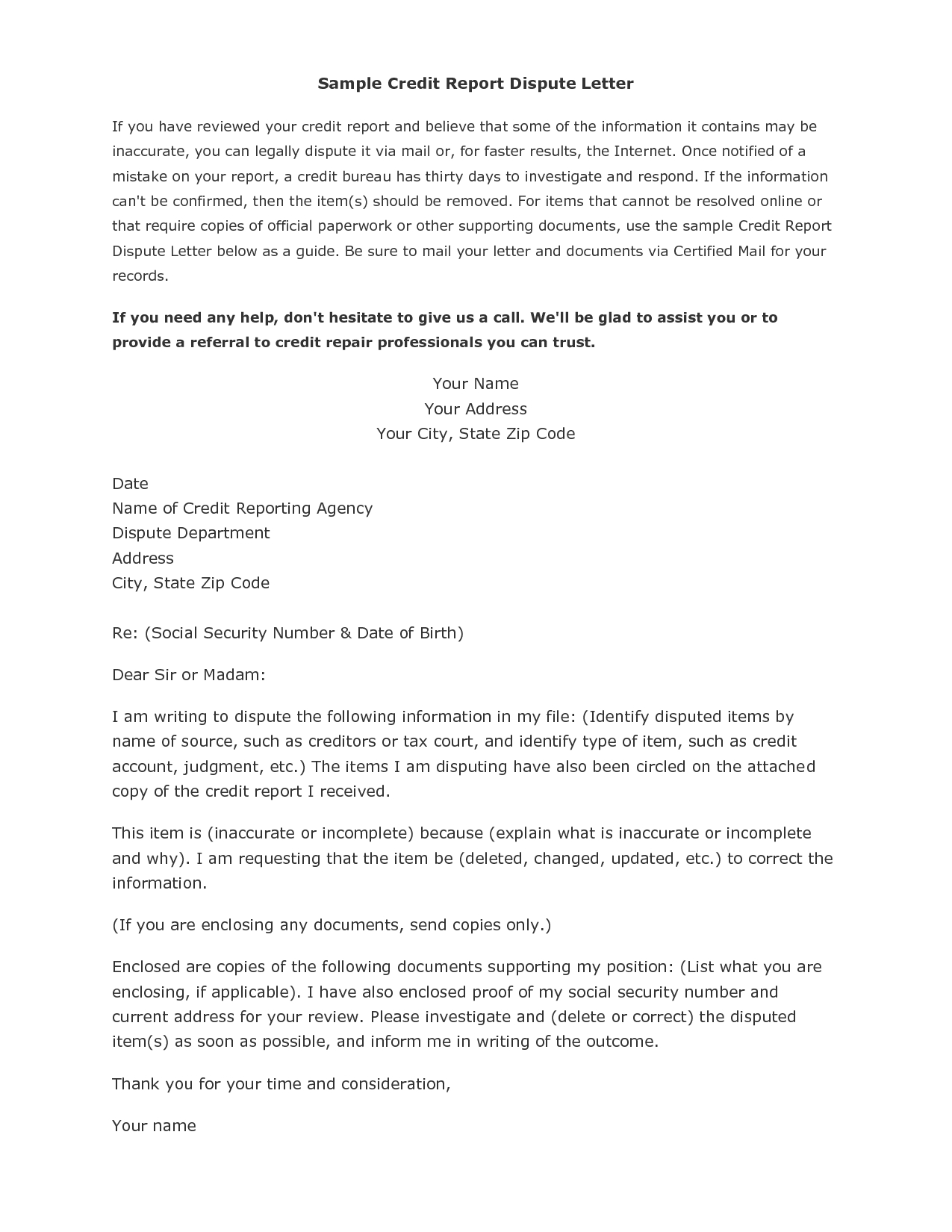

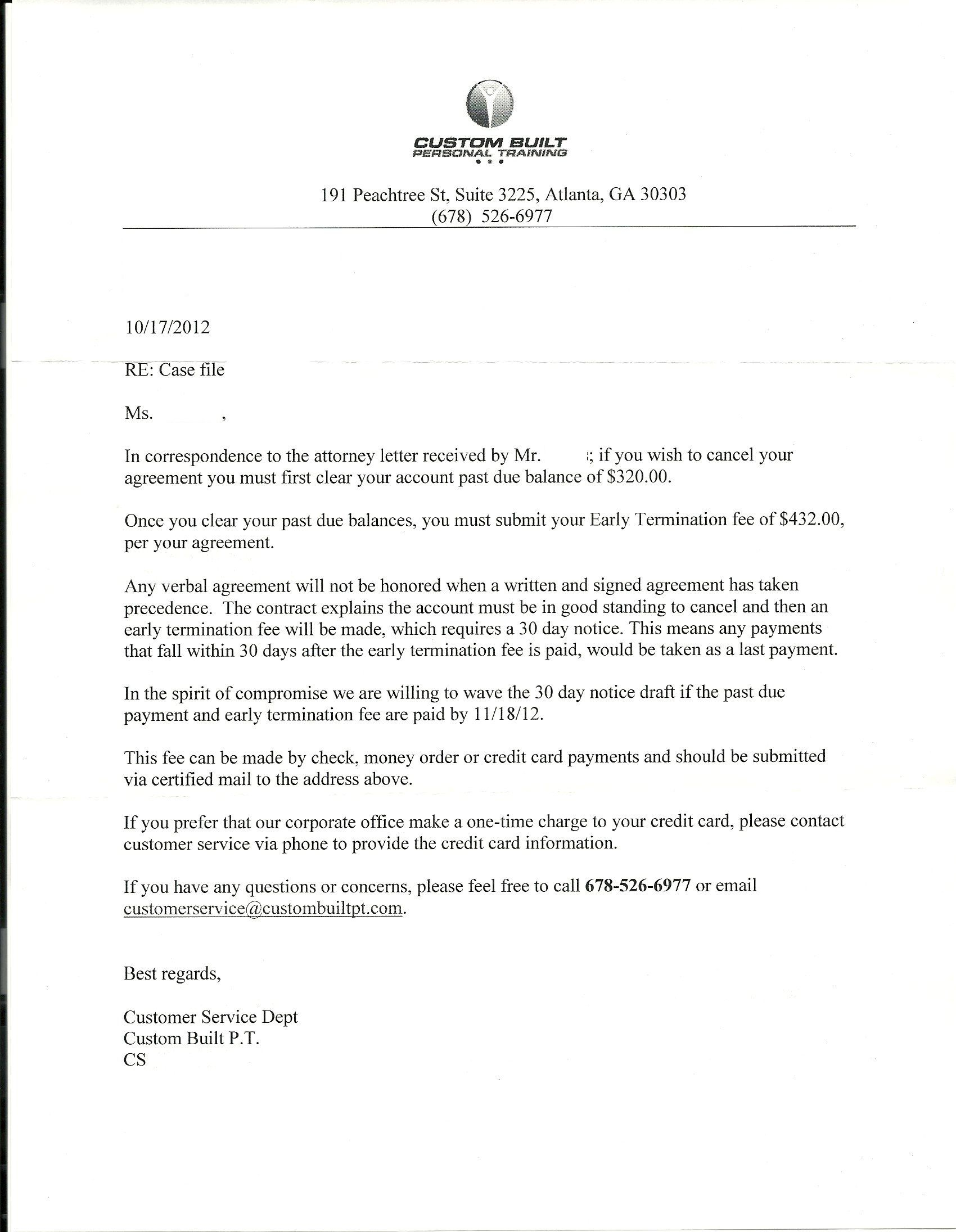

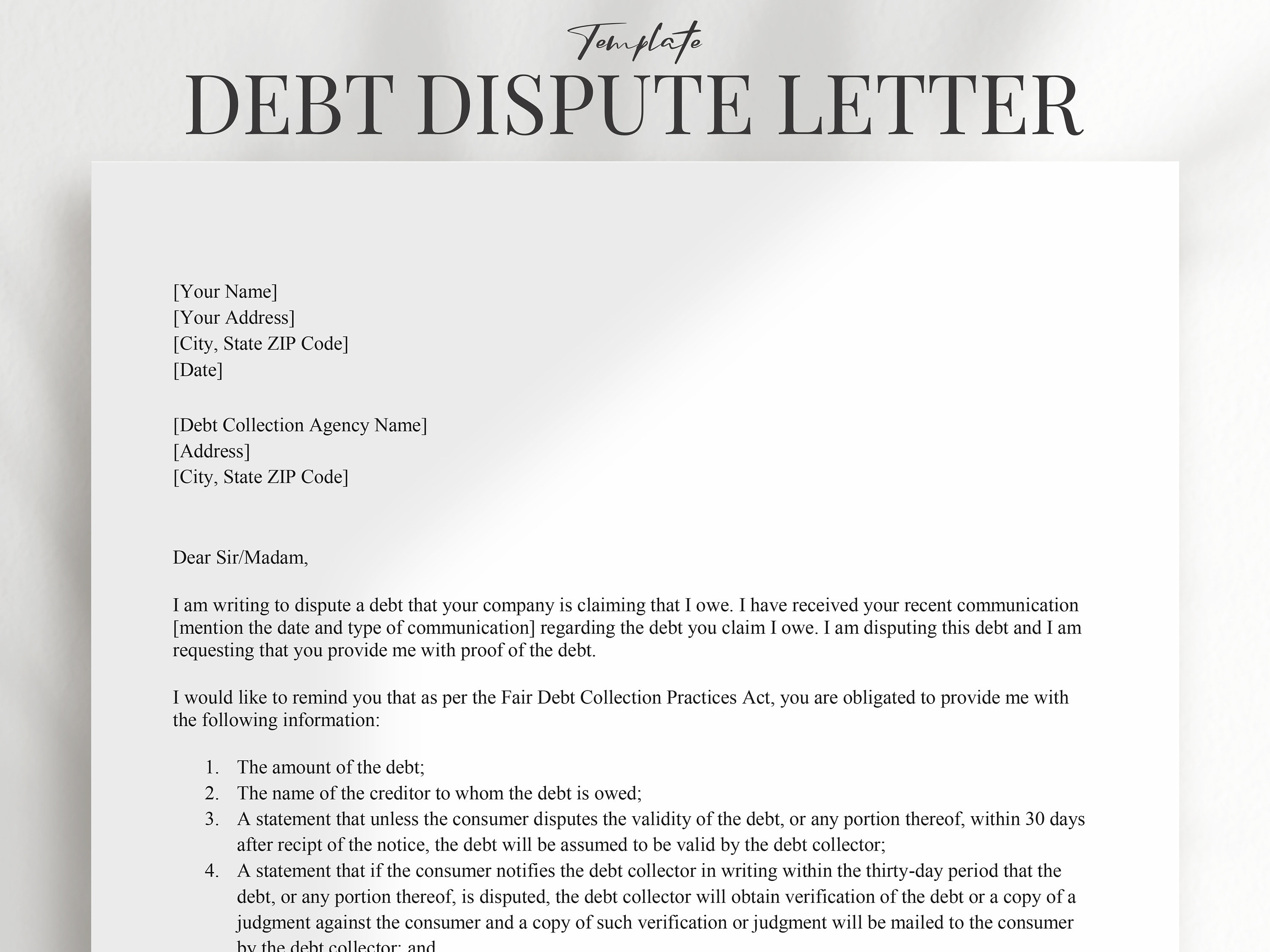

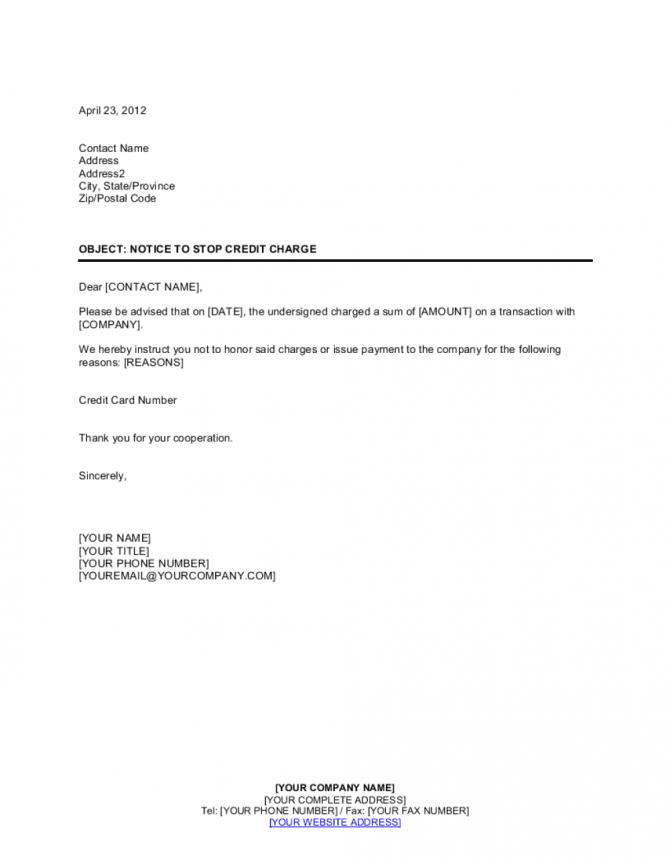

Charge Off Dispute Letter Template - All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone. Banks require you to try sorting things out with the seller first. Were you charged for something you returned, ordered but never got, or don’t recognize? Use this sample letter to help you write your dispute letter. Ensure the error has been removed by requesting confirmation from the consumer reporting company. When an account is so far in arrears — usually after 180 consecutive days of no payments — a collection agency may get involved. There is no charge for submitting a dispute. To begin the process, obtain copies. See sample letter templates and tips to negotiate with creditors or pay off the. The sample letter below can be used for contacting a credit bureau. See sample letter templates and tips to negotiate with creditors or pay off the. Were you charged without your permission for more than you agreed to pay, or for. Banks require you to try sorting things out with the seller first. Ensure the error has been removed by requesting confirmation from the consumer reporting company. These letters are designed to. There is no charge for submitting a dispute. A charge off dispute letter is when a creditor writes off a debt as uncollectible and reports it to credit bureaus as a loss. [your account number] [date of the charge]. When disputing an error through the mail, never mail in any original paperwork and keep copies of any documents you share. The sample letter below can be used for contacting a credit bureau. When an account is so far in arrears — usually after 180 consecutive days of no payments — a collection agency may get involved. Charge off dispute letter template provides a clear and effective format to challenge inaccurate charge off entries on your credit report. See sample letter templates and tips to negotiate with creditors or pay off the. These. A charge off dispute letter is when a creditor writes off a debt as uncollectible and reports it to credit bureaus as a loss. A credit report dispute letter allows consumers to challenge inaccurate,. Were you charged for something you returned, ordered but never got, or don’t recognize? Up to $40 cash back dispute letters aim to rectify the situation. When disputing an error through the mail, never mail in any original paperwork and keep copies of any documents you share. Charge off dispute letter template provides a clear and effective format to challenge inaccurate charge off entries on your credit report. Banks require you to try sorting things out with the seller first. If you spot an incorrect or. Were you charged without your permission for more than you agreed to pay, or for. Charge off dispute letter template provides a clear and effective format to challenge inaccurate charge off entries on your credit report. Notice of disputed charge to account no. Use our credit report dispute letter template to contest inaccurate items on your credit report. Credit dispute. When disputing an error through the mail, never mail in any original paperwork and keep copies of any documents you share. Notice of disputed charge to account no. Banks require you to try sorting things out with the seller first. A charge off dispute letter is when a creditor writes off a debt as uncollectible and reports it to credit. Were you charged for something you returned, ordered but never got, or don’t recognize? A charge off dispute letter is when a creditor writes off a debt as uncollectible and reports it to credit bureaus as a loss. If you spot an incorrect or invalid charge, your first move should be to reach out to the merchant. These letters are. Were you charged for something you returned, ordered but never got, or don’t recognize? When disputing an error through the mail, never mail in any original paperwork and keep copies of any documents you share. I am the victim of identity theft, and i did not open this account; To begin the process, obtain copies. Banks require you to try. All three credit reporting bureaus (equifax, experian, and transunion) accept dispute requests online, standard mail, and by phone. The charge is in error because. Notice of disputed charge to account no. Banks require you to try sorting things out with the seller first. Use this sample letter to help you write your dispute letter. Use our credit report dispute letter template to contest inaccurate items on your credit report. Charge off dispute letter template provides a clear and effective format to challenge inaccurate charge off entries on your credit report. Were you charged without your permission for more than you agreed to pay, or for. When disputing an error through the mail, never mail. A credit report dispute letter allows consumers to challenge inaccurate,. Notice of disputed charge to account no. To begin the process, obtain copies. Banks require you to try sorting things out with the seller first. See sample letter templates and tips to negotiate with creditors or pay off the. The sample letter below can be used for contacting a credit bureau. Notice of disputed charge to account no. See sample letter templates and tips to negotiate with creditors or pay off the. A charge off dispute letter is when a creditor writes off a debt as uncollectible and reports it to credit bureaus as a loss. Were you charged for something you returned, ordered but never got, or don’t recognize? Ensure the error has been removed by requesting confirmation from the consumer reporting company. When an account is so far in arrears — usually after 180 consecutive days of no payments — a collection agency may get involved. [your account number] [date of the charge]. To begin the process, obtain copies. When disputing an error through the mail, never mail in any original paperwork and keep copies of any documents you share. Use our credit report dispute letter template to contest inaccurate items on your credit report. Banks require you to try sorting things out with the seller first. A credit report dispute letter allows consumers to challenge inaccurate,. There is no charge for submitting a dispute. If you spot an incorrect or invalid charge, your first move should be to reach out to the merchant. Were you charged without your permission for more than you agreed to pay, or for.Charge Off Dispute Letter Template Resume Letter

Sample Letter Of Dropping Charges

Charge Off Dispute Letter Template Collection Letter Template Collection

18+ Letter To Dispute Debt LeoThurston

Sample Collection Dispute Letter

Charge Off Letter Template

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Charge Off Dispute Letter Template Collection Letter Template Collection

Charge Off Dispute Letter Template

Charge Off Dispute Letter Template Collection Letter Template Collection

Up To $40 Cash Back Dispute Letters Aim To Rectify The Situation By Asserting The Individual's Rights And Requesting The Removal Or Correction Of The Charge Off.

I Am The Victim Of Identity Theft, And I Did Not Open This Account;

Use This Sample Letter To Help You Write Your Dispute Letter.

All Three Credit Reporting Bureaus (Equifax, Experian, And Transunion) Accept Dispute Requests Online, Standard Mail, And By Phone.

Related Post:

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-05.jpg)