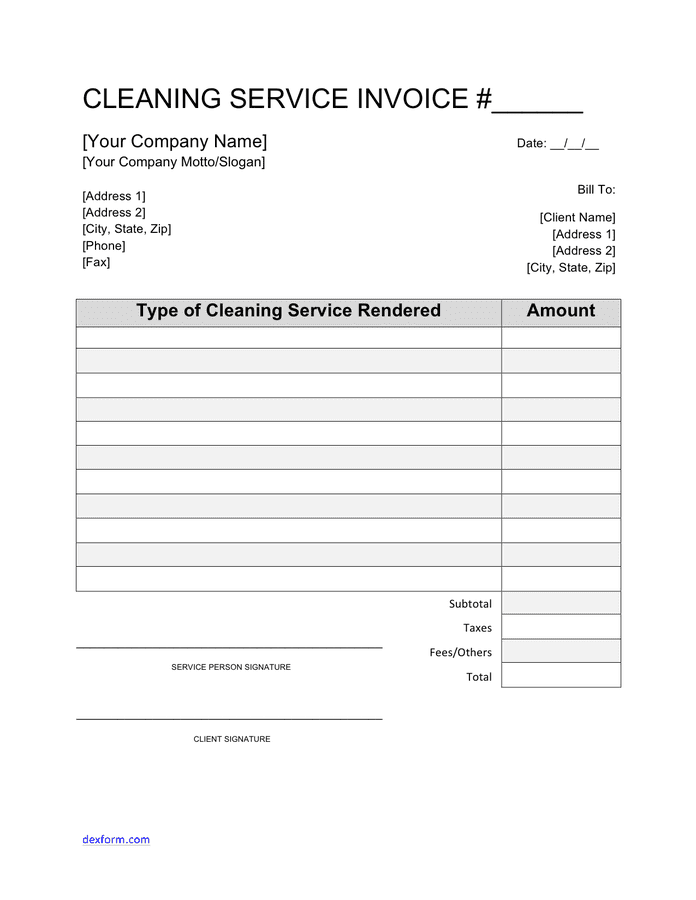

Cleaning Receipt Template

Cleaning Receipt Template - A cleaning receipt template is submitted to a client after receiving payment for residential or commercial cleaning services. A carpet cleaning receipt acknowledges the payment made by a client in exchange for the cleaning services rendered by a company. A cleaning (housekeeping) invoice is used to charge a client after an individual or a housekeeping business has performed housekeeping services. A dry cleaning receipt proves that a company received payment in exchange for dry cleaning services. Cleaning services are usually billed by the hour or a preset price depending on the size of the home. House cleaning receipt template author: _____ description of cleaning services The receipt details the specifics of the transaction, including the payment date, tax rate, amount due, and payment method. A receipt is made after a transaction has occurred, detailing the price of the goods or services along with any taxes, discounts, shipping fees, or other line items. The template indicates both the date(s) that carpet cleaning services were performed and the costs corresponding with the completed work. Both the client and the company should retain copies. The receipt details the specifics of the transaction, including the payment date, tax rate, amount due, and payment method. Clients will require the receipt should they wish to deduct the transaction cost when issuing their personal or business income tax reports. A house cleaning receipt is used to prove that a company or individual received payment after fulfilling a cleaning duty for a client. The template indicates both the date(s) that carpet cleaning services were performed and the costs corresponding with the completed work. A cleaning receipt template is submitted to a client after receiving payment for residential or commercial cleaning services. Cleaning services are usually billed by the hour or a preset price depending on the size of the home. Pdf , ms word, opendocument A window cleaning receipt documents a payment received by a company or individual for window cleaning services. A receipt is made after a transaction has occurred, detailing the price of the goods or services along with any taxes, discounts, shipping fees, or other line items. A cleaning receipt template is submitted to a client after receiving payment for residential or commercial cleaning services. A dry cleaning receipt proves that a company received payment in exchange for dry cleaning services. The receipt details the specifics of the transaction, including the payment date, tax rate, amount due, and payment method. The template indicates both the date(s) that. It indicates the date when the services were rendered and the payment details. The receipt details the specifics of the transaction, including the payment date, tax rate, amount due, and payment method. House cleaning receipt template author: _____ description of cleaning services A dry cleaning receipt proves that a company received payment in exchange for dry cleaning services. A house cleaning receipt is used to prove that a company or individual received payment after fulfilling a cleaning duty for a client. Clients will require the receipt should they wish to deduct the transaction cost when issuing their personal or business income tax reports. A receipt is made after a transaction has occurred, detailing the price of the goods. Both the client and the company should retain copies. A cleaning (housekeeping) invoice is used to charge a client after an individual or a housekeeping business has performed housekeeping services. _____ description of cleaning services The template indicates both the date(s) that carpet cleaning services were performed and the costs corresponding with the completed work. A house cleaning receipt is. Pdf , ms word, opendocument The receipt details the specifics of the transaction, including the payment date, tax rate, amount due, and payment method. A dry cleaning receipt proves that a company received payment in exchange for dry cleaning services. It indicates the date when the services were rendered and the payment details. A receipt is made after a transaction. The receipt details the specifics of the transaction, including the payment date, tax rate, amount due, and payment method. Clients will require the receipt should they wish to deduct the transaction cost when issuing their personal or business income tax reports. A carpet cleaning receipt acknowledges the payment made by a client in exchange for the cleaning services rendered by. House cleaning receipt template author: A cleaning (housekeeping) invoice is used to charge a client after an individual or a housekeeping business has performed housekeeping services. Clients will require the receipt should they wish to deduct the transaction cost when issuing their personal or business income tax reports. A window cleaning receipt documents a payment received by a company or. The template indicates both the date(s) that carpet cleaning services were performed and the costs corresponding with the completed work. Clients will require the receipt should they wish to deduct the transaction cost when issuing their personal or business income tax reports. A house cleaning receipt is used to prove that a company or individual received payment after fulfilling a. _____ description of cleaning services The template indicates both the date(s) that carpet cleaning services were performed and the costs corresponding with the completed work. A cleaning receipt template is submitted to a client after receiving payment for residential or commercial cleaning services. It indicates the date when the services were rendered and the payment details. The receipt details the. The receipt details the specifics of the transaction, including the payment date, tax rate, amount due, and payment method. It indicates the date when the services were rendered and the payment details. Cleaning services are usually billed by the hour or a preset price depending on the size of the home. A house cleaning receipt is used to prove that. Cleaning services are usually billed by the hour or a preset price depending on the size of the home. A window cleaning receipt documents a payment received by a company or individual for window cleaning services. _____ description of cleaning services Pdf , ms word, opendocument The template indicates both the date(s) that carpet cleaning services were performed and the costs corresponding with the completed work. A dry cleaning receipt proves that a company received payment in exchange for dry cleaning services. The receipt details the specifics of the transaction, including the payment date, tax rate, amount due, and payment method. It indicates the date when the services were rendered and the payment details. A receipt is made after a transaction has occurred, detailing the price of the goods or services along with any taxes, discounts, shipping fees, or other line items. A house cleaning receipt is used to prove that a company or individual received payment after fulfilling a cleaning duty for a client. Both the client and the company should retain copies. A cleaning receipt template is submitted to a client after receiving payment for residential or commercial cleaning services.Free Cleaning Service Receipt Template PDF Word eForms

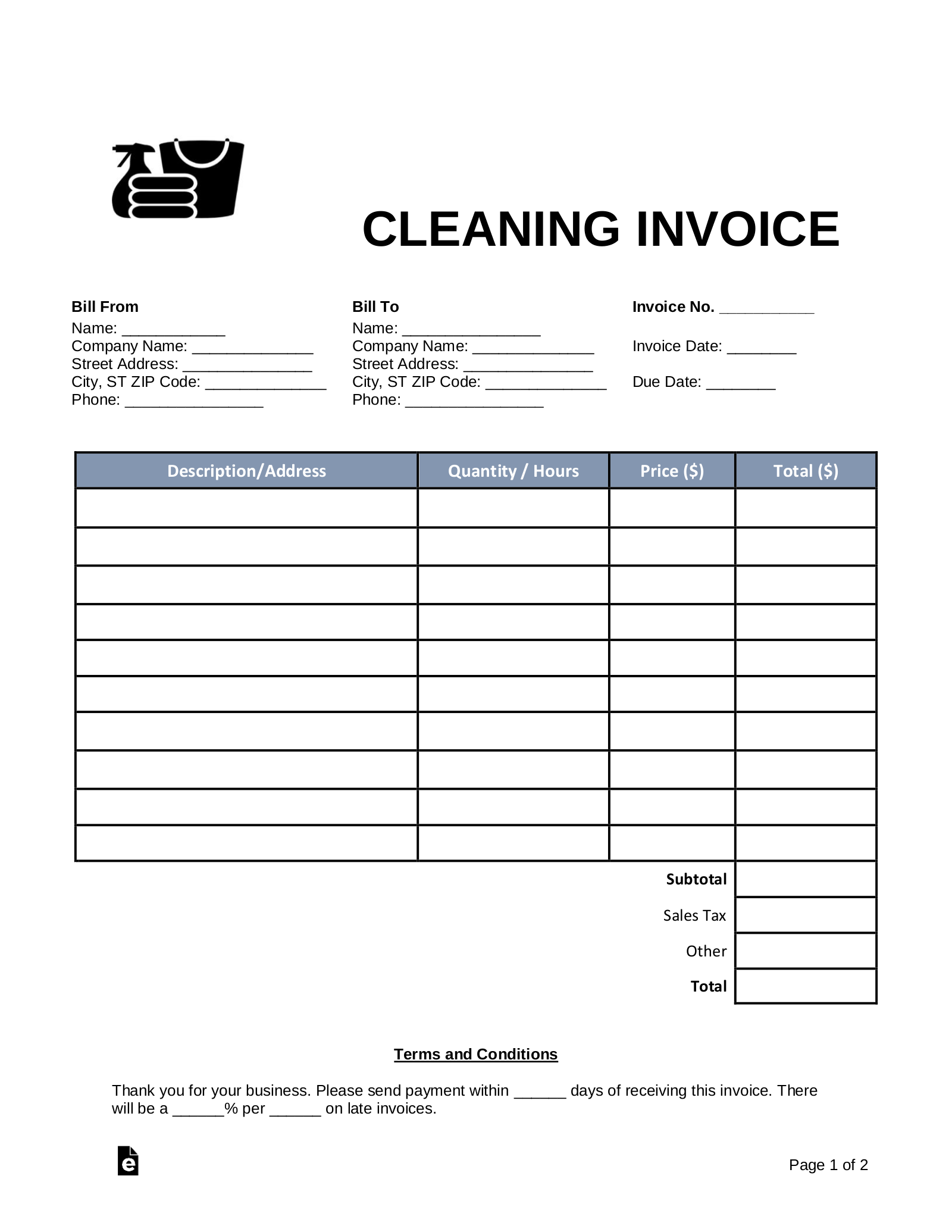

Cleaning Invoice Template Blank Printable in PDF, Excel, Word

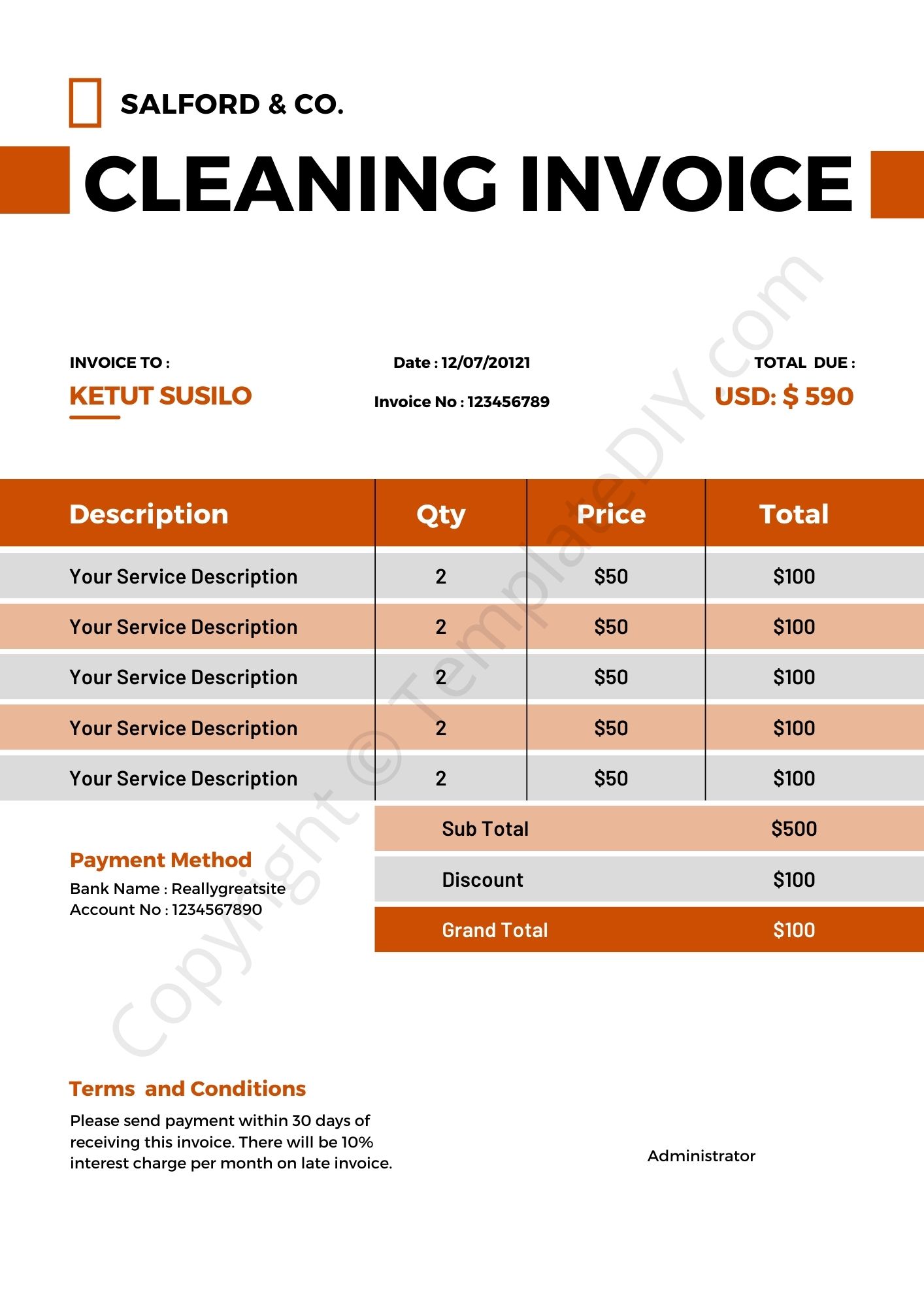

Cleaning Service INVOICE Template Printable PDF Etsy

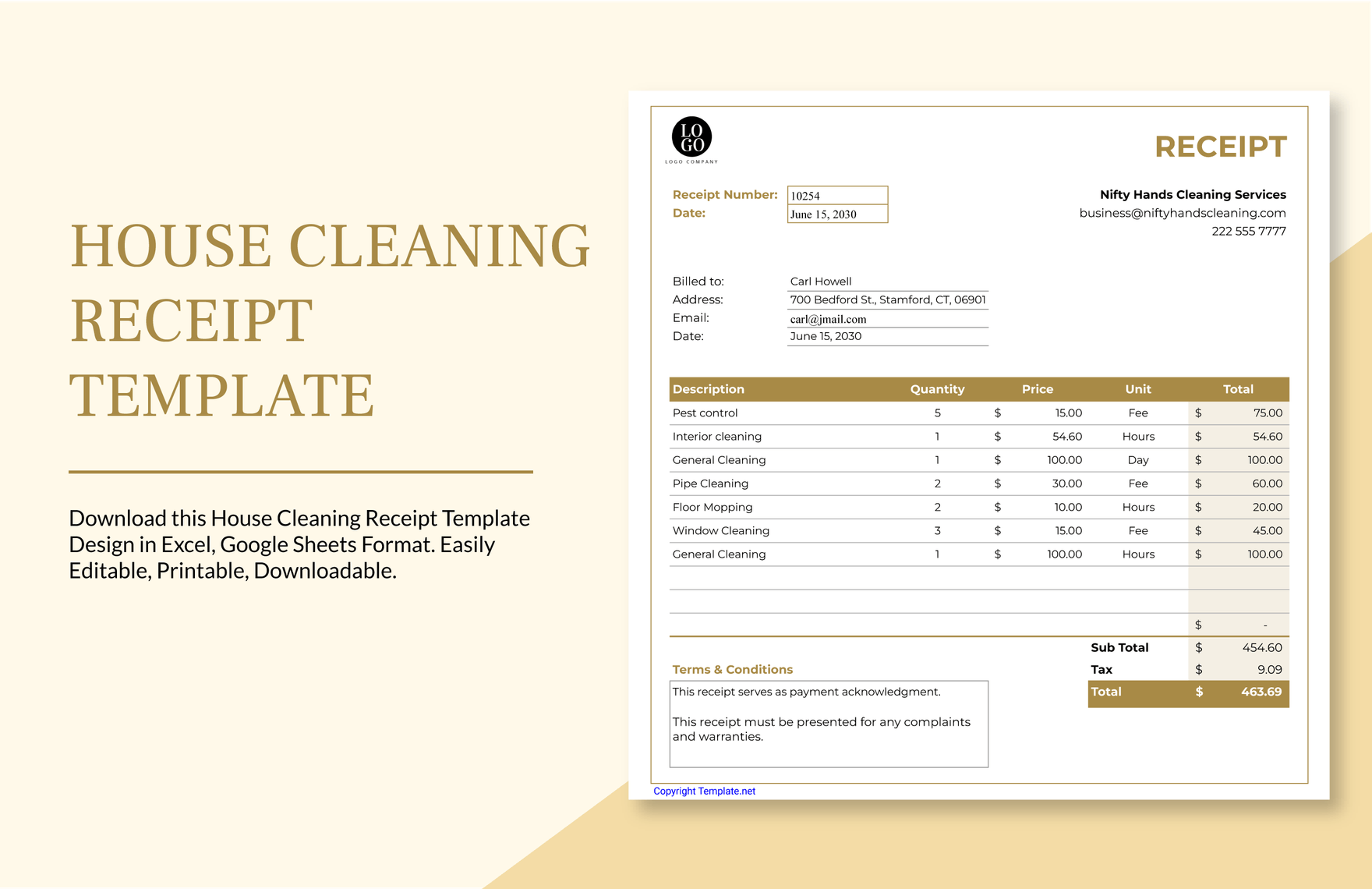

Cleaning Payment Receipt Template in Excel, Word, Google Sheets, Google

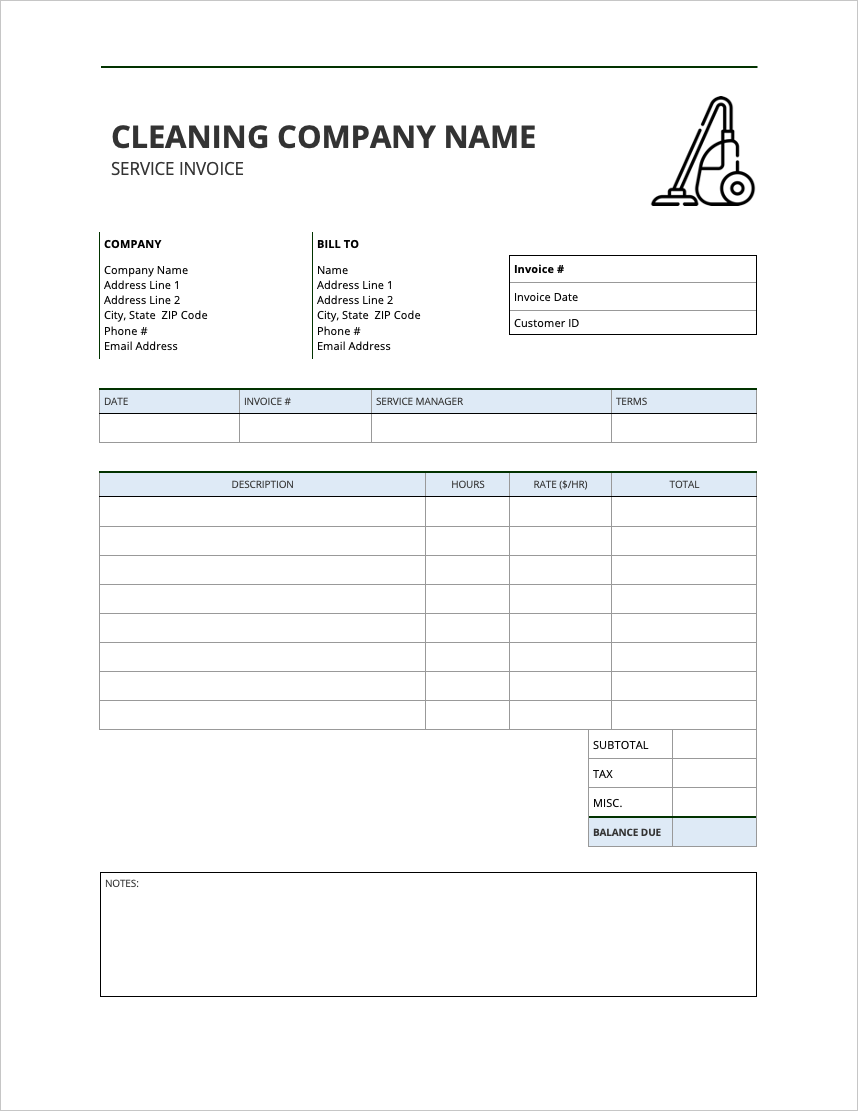

Free Office Cleaning Invoice Template PDF WORD EXCEL

Free Printable Cleaning Service Invoice Templates 10 Different Formats

Invoice Template For Cleaning Services

FREE 13+ Cleaning Service Invoice Templates in PDF MS Word

Free Professional Cleaning Invoice Templates in PDF Billdu

5+ FREE Cleaning Invoice Templates [Edit & Download]

House Cleaning Receipt Template Author:

A Cleaning (Housekeeping) Invoice Is Used To Charge A Client After An Individual Or A Housekeeping Business Has Performed Housekeeping Services.

A Carpet Cleaning Receipt Acknowledges The Payment Made By A Client In Exchange For The Cleaning Services Rendered By A Company.

Clients Will Require The Receipt Should They Wish To Deduct The Transaction Cost When Issuing Their Personal Or Business Income Tax Reports.

Related Post:

![5+ FREE Cleaning Invoice Templates [Edit & Download]](https://images.template.net/2141/Free-Cleaning-Service-Invoice-Template.jpeg)