Commercial Lease Templates

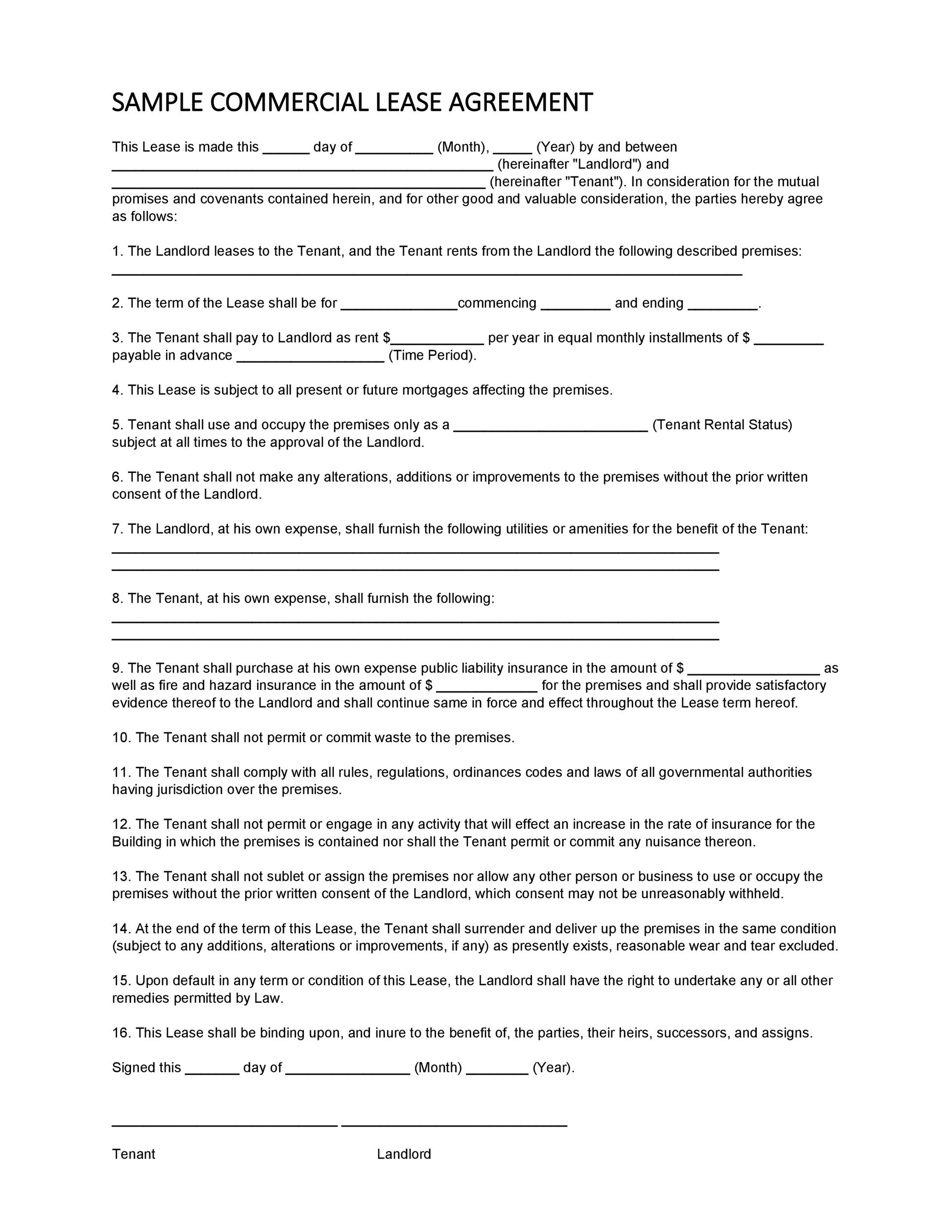

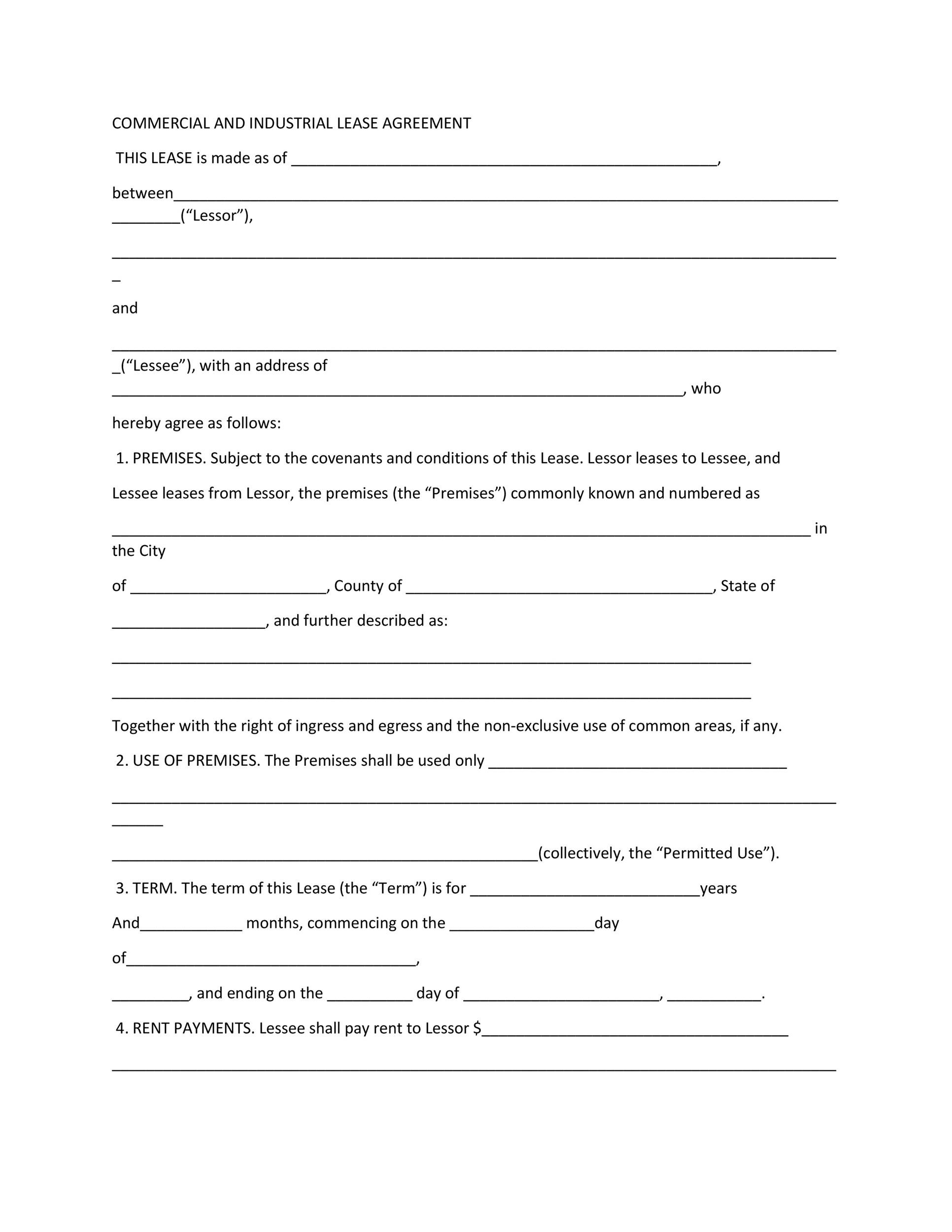

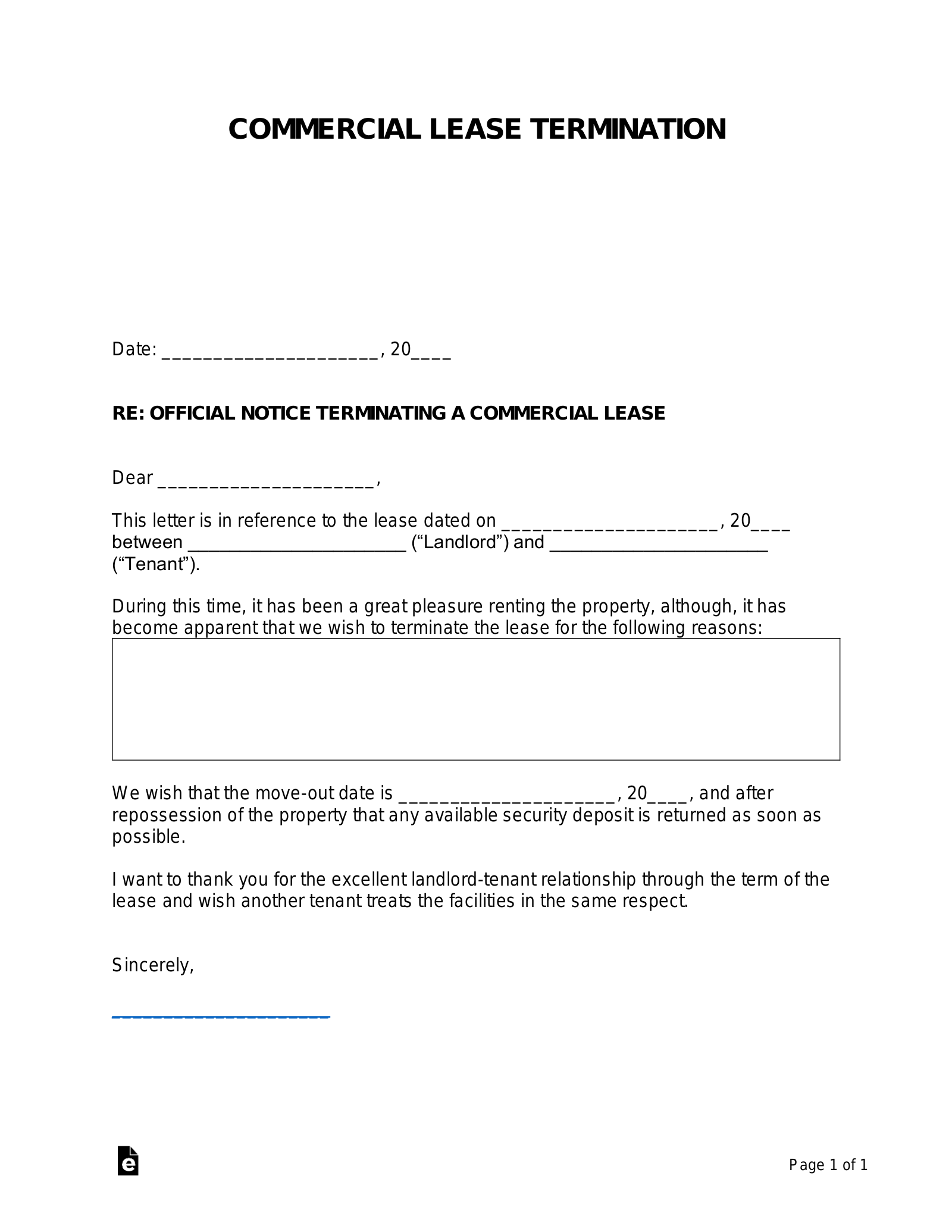

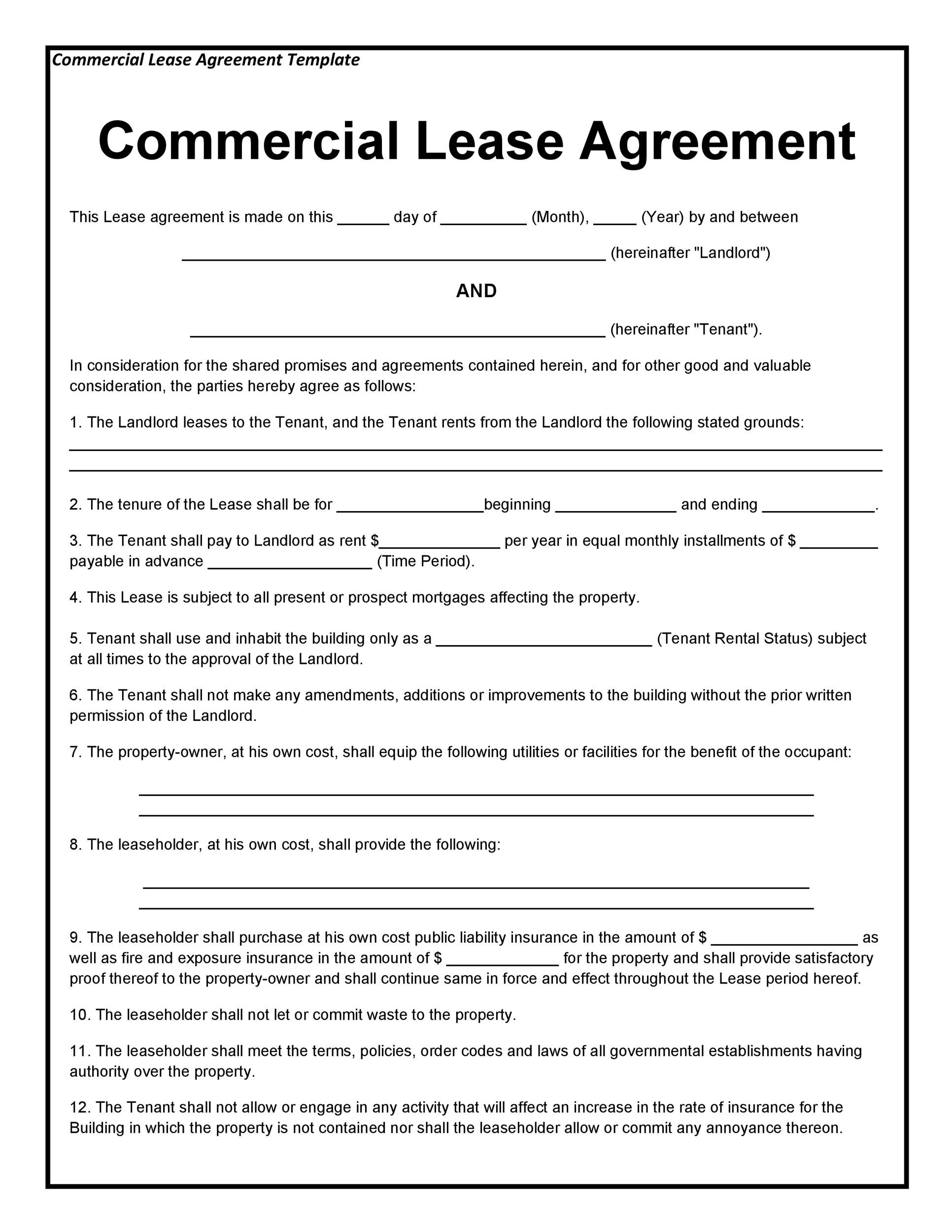

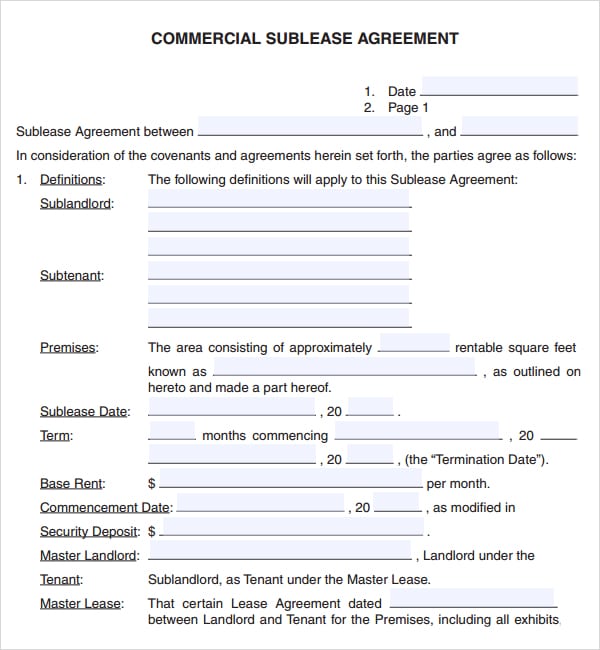

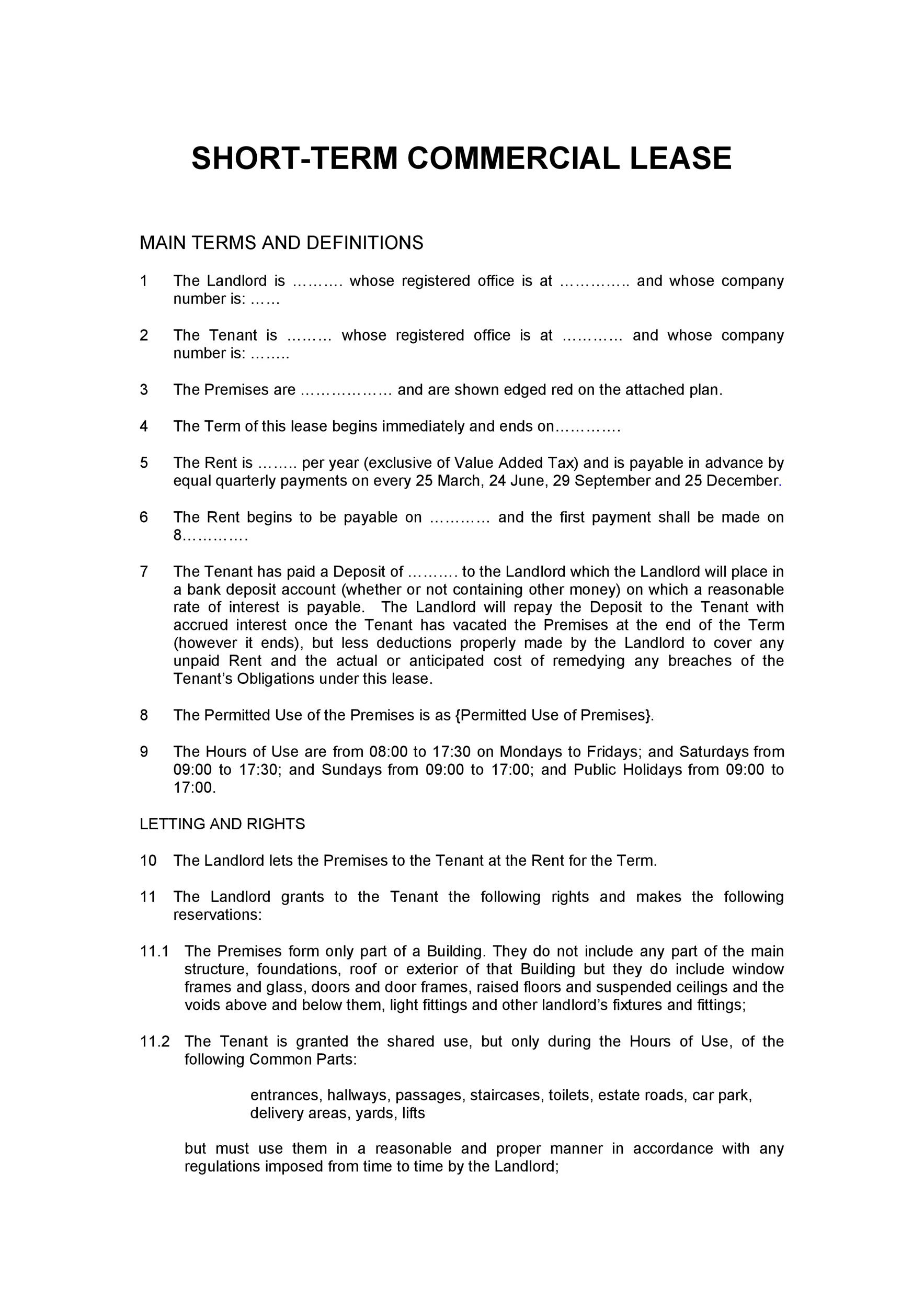

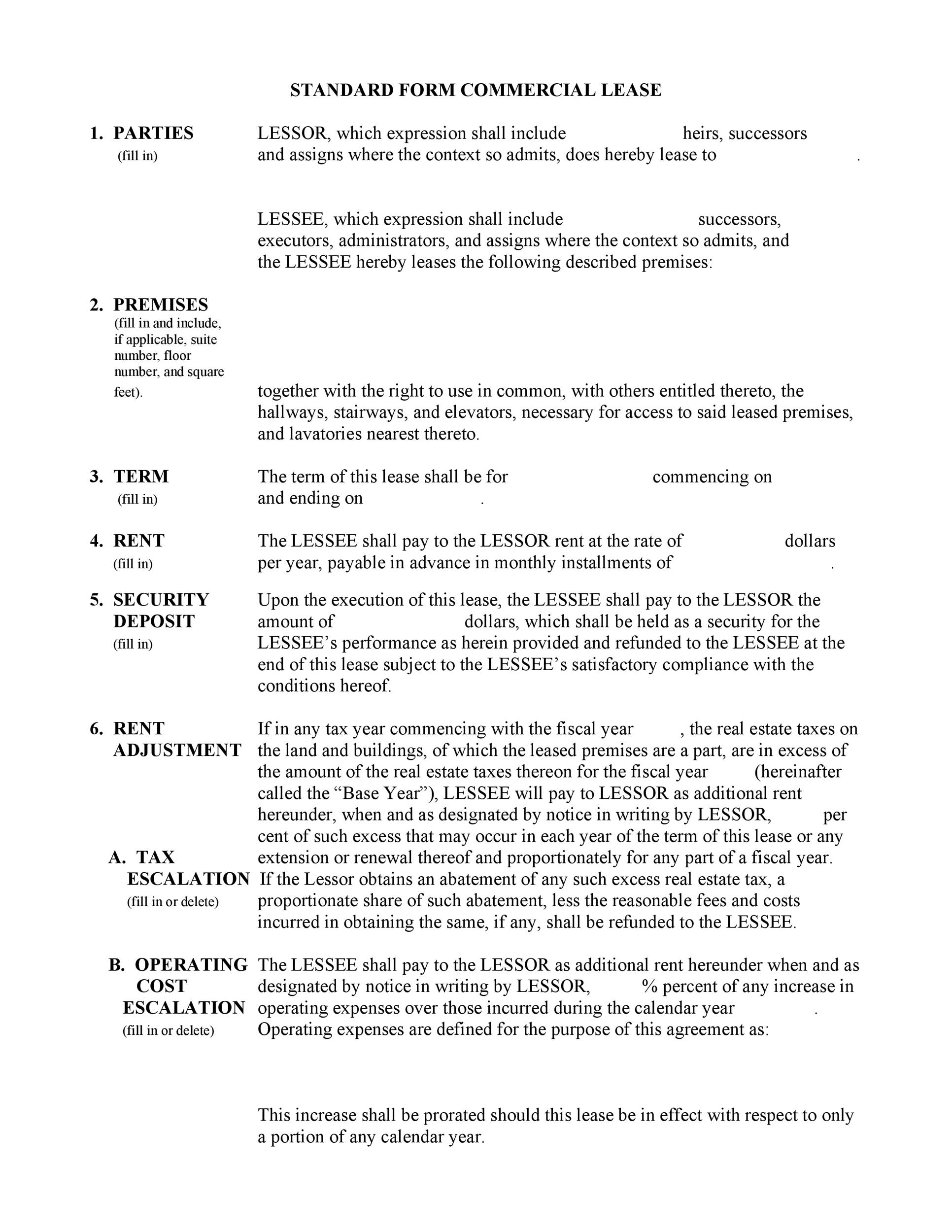

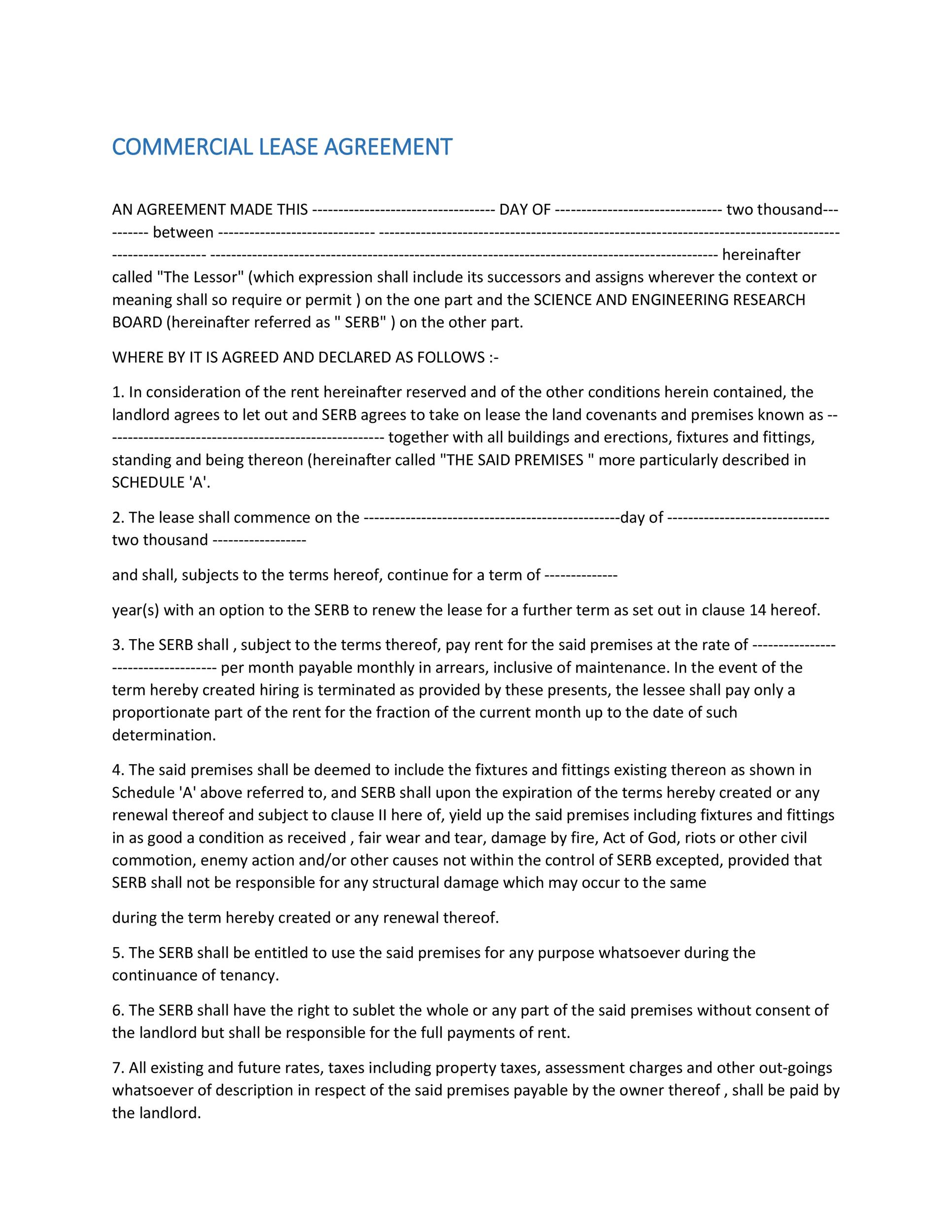

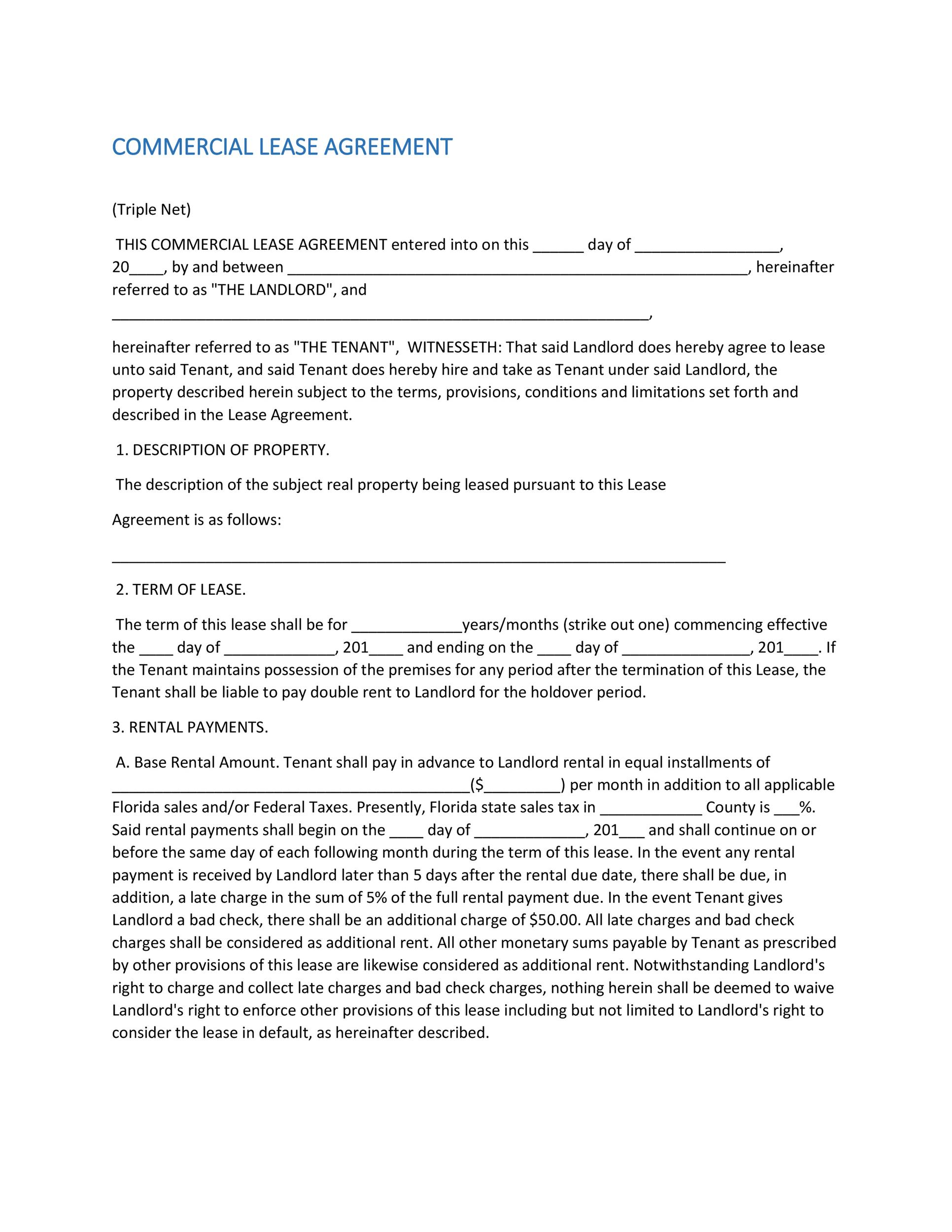

Commercial Lease Templates - This commercial lease agreement (“agreement”) is made on _____, by and between: Rent is usually figured on a price per square foot, with the obligations of the landlord and tenant to be negotiated. Often used for retail, office, or industrial spaces, the agreement contains sections on rent, lease duration, and security deposit, as well as provisions on renewal and penalties for breach of. This commercial lease agreement (“agreement”) made on _____, 20____, by and between: _____, with a mailing address of _____ (landlord), who agrees to lease the premises to: A commercial gross lease agreement is a lease agreement under which all expenses related to the property are the landlord's responsibility. The document outlines provisions regarding the rent, security deposit, lease. These expenses commonly include real estate taxes, property insurance, and common area maintenance. It contains provisions on the rent, subleasing, penalties for late payments, as well as the rights and responsibilities of both parties. A texas commercial lease agreement is a contract between a landlord and a tenant for the rental of commercial property for business use. It contains provisions on the rent, subleasing, penalties for late payments, as well as the rights and responsibilities of both parties. _____, with a mailing address of _____ (“landlord”), and tenant: A new jersey commercial lease agreement is a legal document allowing a landlord to lease a property to an individual or entity for a business purpose. The tenant pays monthly rent (and any other expenses) to use the space for retail, office, or industrial purposes. The document outlines provisions regarding the rent, security deposit, lease. Often used for retail, office, or industrial spaces, the agreement contains sections on rent, lease duration, and security deposit, as well as provisions on renewal and penalties for breach of. A commercial gross lease agreement is a lease agreement under which all expenses related to the property are the landlord's responsibility. This commercial lease agreement (“agreement”) made on _____, 20____, by and between: Rent is usually figured on a price per square foot, with the obligations of the landlord and tenant to be negotiated. A texas commercial lease agreement is a contract between a landlord and a tenant for the rental of commercial property for business use. A commercial gross lease agreement is a lease agreement under which all expenses related to the property are the landlord's responsibility. A new jersey commercial lease agreement is a legal document allowing a landlord to lease a property to an individual or entity for a business purpose. A texas commercial lease agreement is a contract between a landlord and a. Often used for retail, office, or industrial spaces, the agreement contains sections on rent, lease duration, and security deposit, as well as provisions on renewal and penalties for breach of. _____, with a mailing address of _____ (landlord), who agrees to lease the premises to: The tenant pays monthly rent (and any other expenses) to use the space for retail,. Rent is usually figured on a price per square foot, with the obligations of the landlord and tenant to be negotiated. _____, with a mailing address of _____ (landlord), who agrees to lease the premises to: The tenant pays monthly rent (and any other expenses) to use the space for retail, office, or industrial purposes. A pennsylvania commercial lease agreement. _____, with a mailing address of It contains provisions on the rent, subleasing, penalties for late payments, as well as the rights and responsibilities of both parties. A pennsylvania commercial lease agreement is a contract between a property owner and an individual or business entity for the rental of a commercial space. _____, with a mailing address of _____ (“landlord”),. The tenant pays monthly rent (and any other expenses) to use the space for retail, office, or industrial purposes. _____, with a mailing address of _____ (“landlord”), and tenant: It contains provisions on the rent, subleasing, penalties for late payments, as well as the rights and responsibilities of both parties. This commercial lease agreement (“agreement”) made on _____, 20____, by. These expenses commonly include real estate taxes, property insurance, and common area maintenance. _____, with a mailing address of _____, with a mailing address of _____ (“landlord”), and tenant: This commercial lease agreement (“agreement”) made on _____, 20____, by and between: This commercial lease agreement (“agreement”) is made on _____, by and between: _____, with a mailing address of _____ (“landlord”), and tenant: This commercial lease agreement (“agreement”) made on _____, 20____, by and between: The document outlines provisions regarding the rent, security deposit, lease. A pennsylvania commercial lease agreement is a contract between a property owner and an individual or business entity for the rental of a commercial space. _____, with a. This commercial lease agreement (“agreement”) made on _____, 20____, by and between: A texas commercial lease agreement is a contract between a landlord and a tenant for the rental of commercial property for business use. _____, with a mailing address of _____ (“landlord”), and tenant: A new jersey commercial lease agreement is a legal document allowing a landlord to lease. Often used for retail, office, or industrial spaces, the agreement contains sections on rent, lease duration, and security deposit, as well as provisions on renewal and penalties for breach of. _____, with a mailing address of A pennsylvania commercial lease agreement is a contract between a property owner and an individual or business entity for the rental of a commercial. It contains provisions on the rent, subleasing, penalties for late payments, as well as the rights and responsibilities of both parties. These expenses commonly include real estate taxes, property insurance, and common area maintenance. A pennsylvania commercial lease agreement is a contract between a property owner and an individual or business entity for the rental of a commercial space. _____,. _____, with a mailing address of A texas commercial lease agreement is a contract between a landlord and a tenant for the rental of commercial property for business use. A commercial gross lease agreement is a lease agreement under which all expenses related to the property are the landlord's responsibility. A pennsylvania commercial lease agreement is a contract between a property owner and an individual or business entity for the rental of a commercial space. _____, with a mailing address of _____ (“landlord”), and tenant: The document outlines provisions regarding the rent, security deposit, lease. These expenses commonly include real estate taxes, property insurance, and common area maintenance. It contains provisions on the rent, subleasing, penalties for late payments, as well as the rights and responsibilities of both parties. Rent is usually figured on a price per square foot, with the obligations of the landlord and tenant to be negotiated. _____, with a mailing address of _____ (landlord), who agrees to lease the premises to: This commercial lease agreement (“agreement”) is made on _____, by and between: Often used for retail, office, or industrial spaces, the agreement contains sections on rent, lease duration, and security deposit, as well as provisions on renewal and penalties for breach of.26 Free Commercial Lease Agreement Templates Template Lab

26 Free Commercial Lease Agreement Templates ᐅ TemplateLab

Free Commercial Lease Agreement Template Word PDF eForms

27 Free Commercial Lease Agreement Templates ᐅ TemplateLab

6 Free Commercial Lease Agreement Templates Excel PDF Formats

27 Free Commercial Lease Agreement Templates ᐅ TemplateLab

26 Free Commercial Lease Agreement Templates ᐅ TemplateLab

26 Free Commercial Lease Agreement Templates Template Lab

26 Free Commercial Lease Agreement Templates ᐅ TemplateLab

26 Free Commercial Lease Agreement Templates ᐅ TemplateLab

A New Jersey Commercial Lease Agreement Is A Legal Document Allowing A Landlord To Lease A Property To An Individual Or Entity For A Business Purpose.

The Tenant Pays Monthly Rent (And Any Other Expenses) To Use The Space For Retail, Office, Or Industrial Purposes.

This Commercial Lease Agreement (“Agreement”) Made On _____, 20____, By And Between:

Related Post: