Cost Segregation Study Template

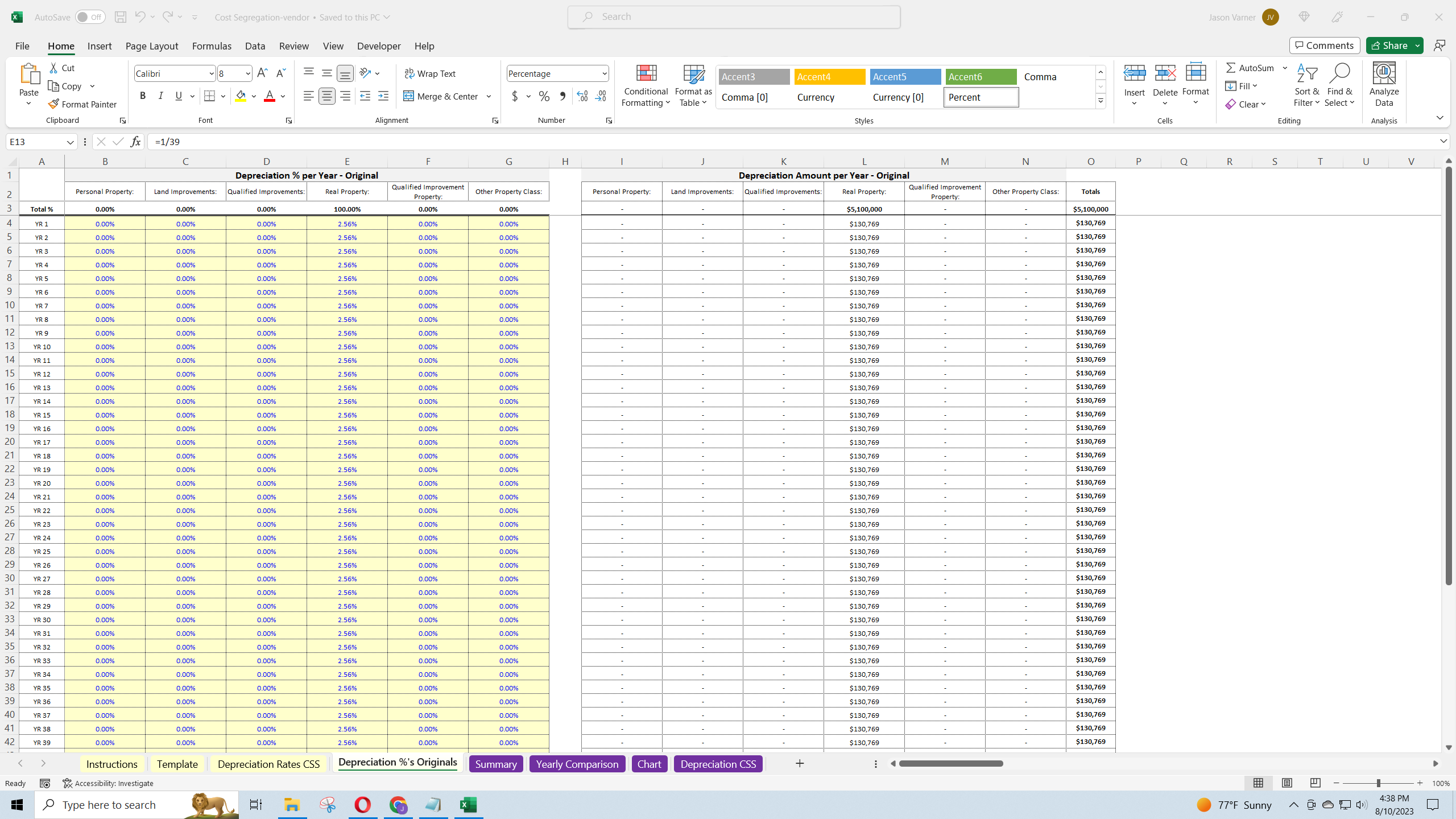

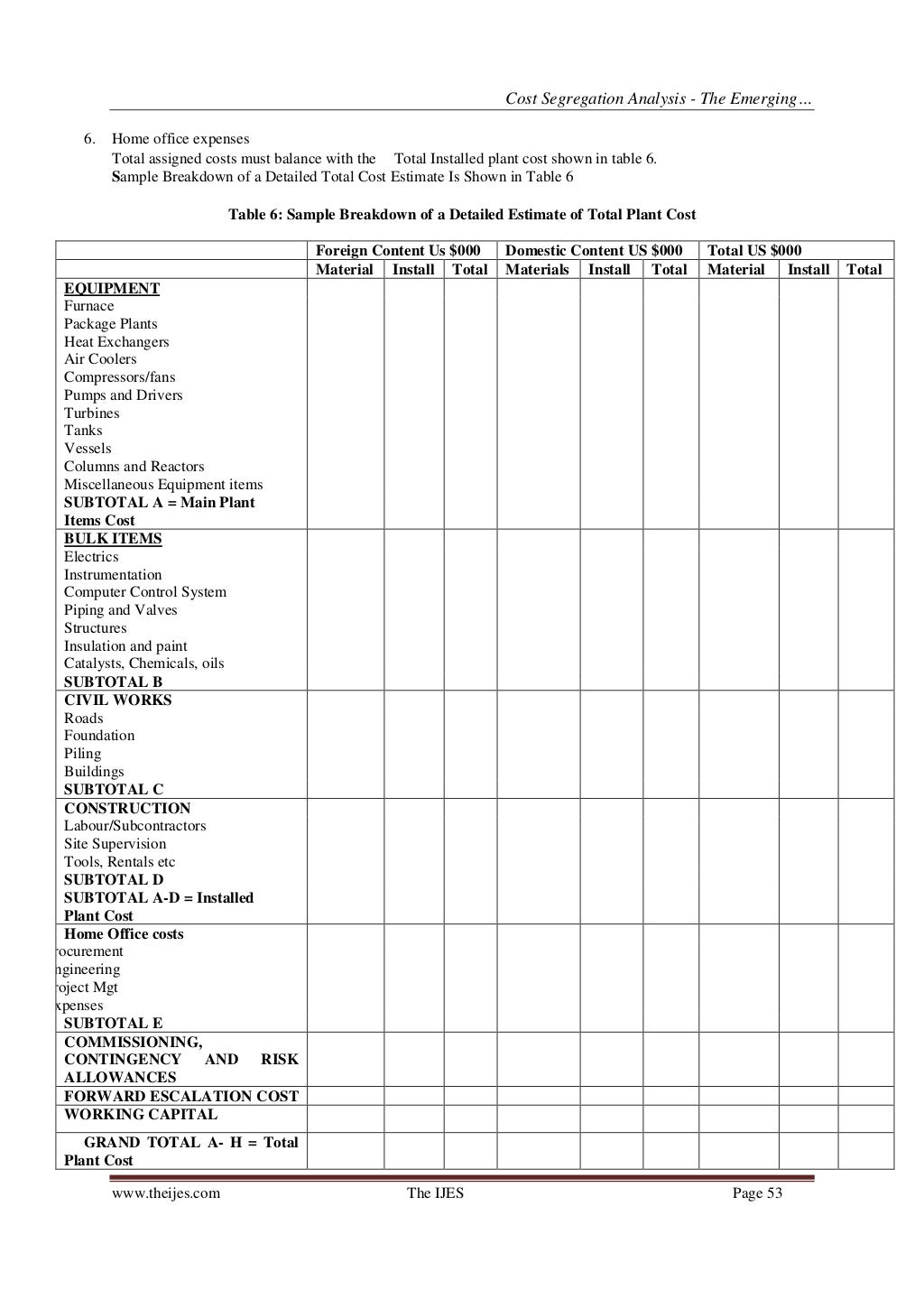

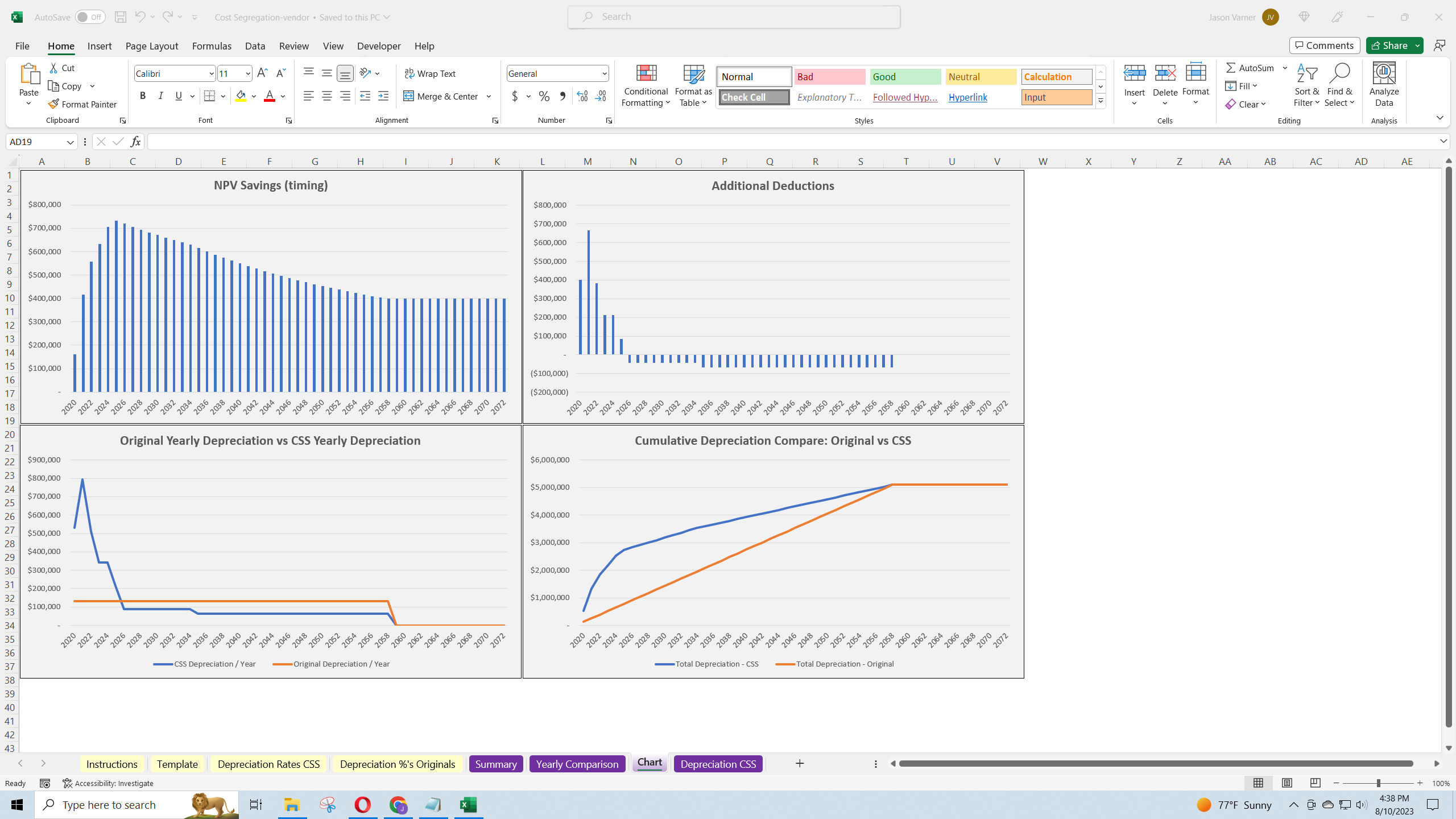

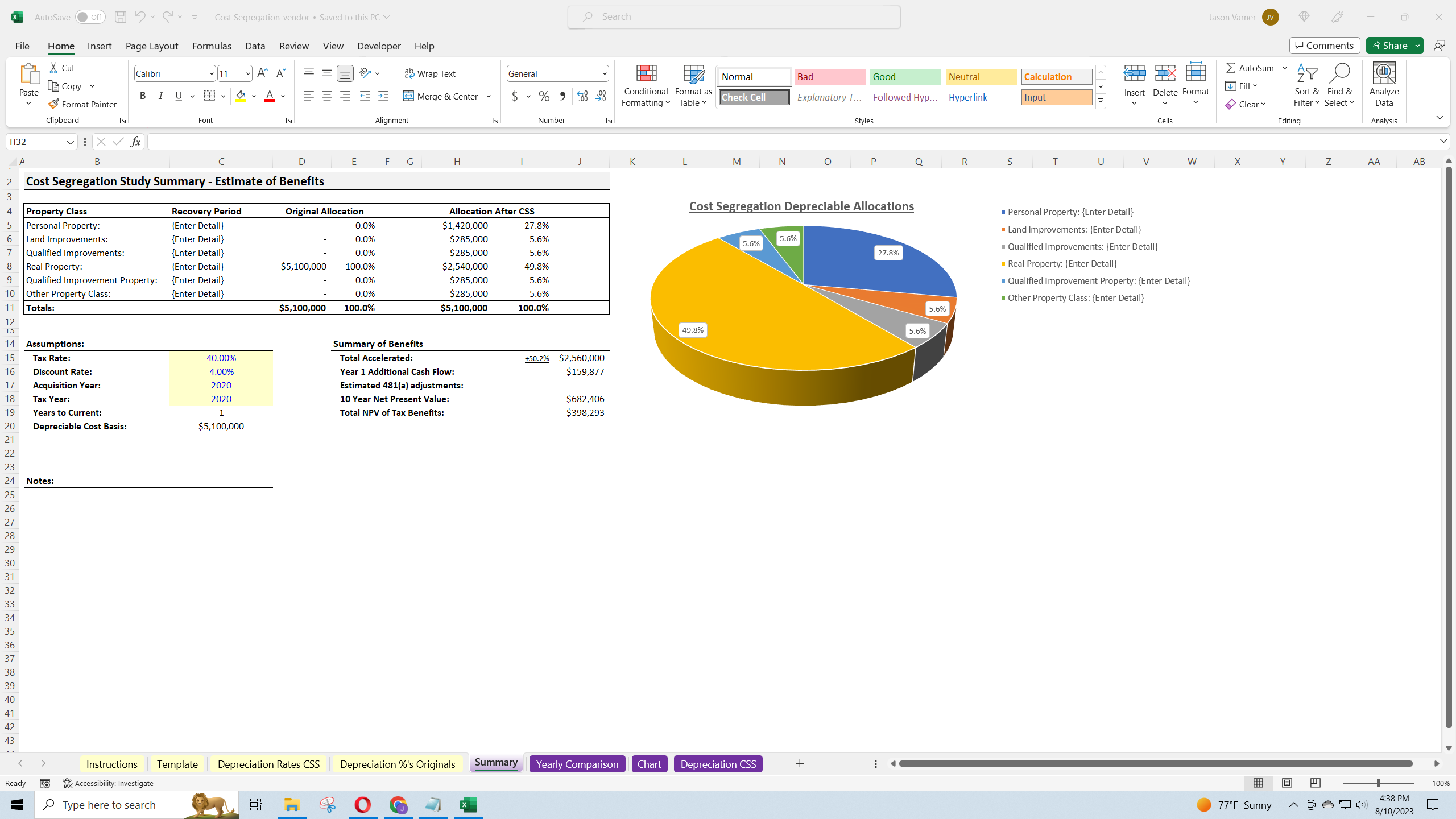

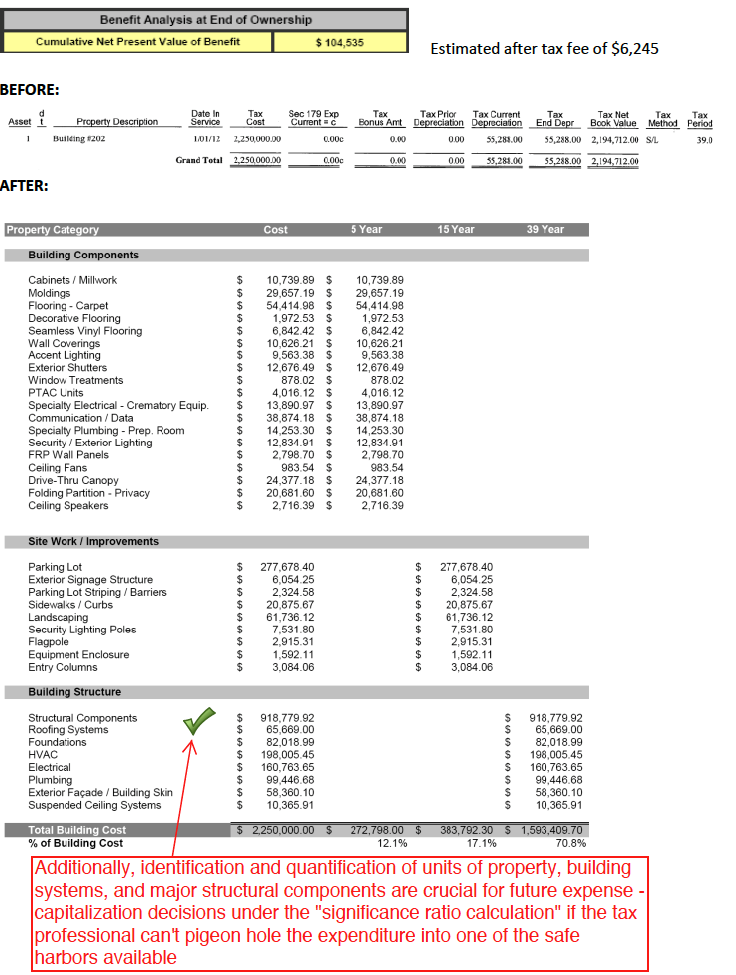

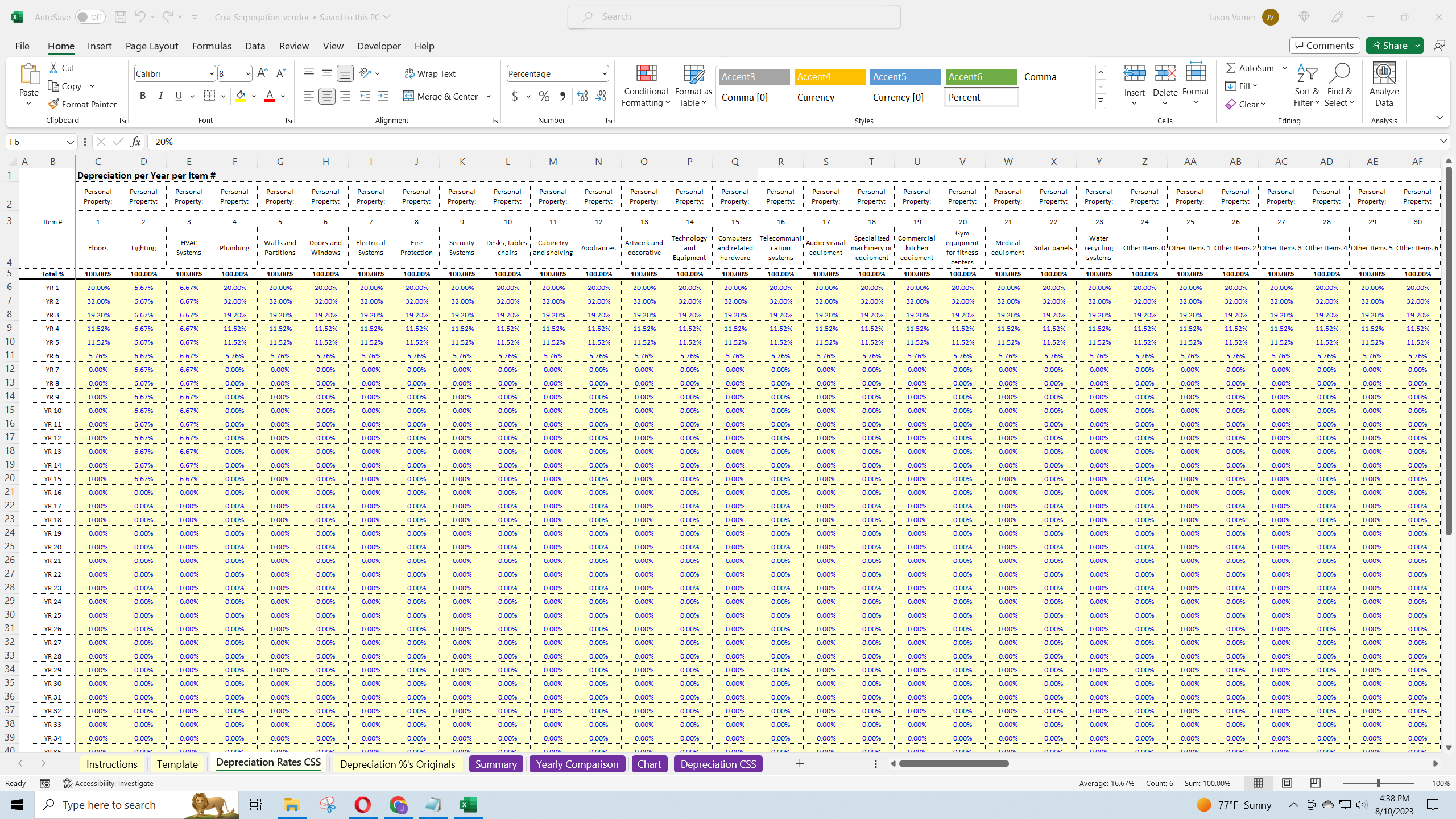

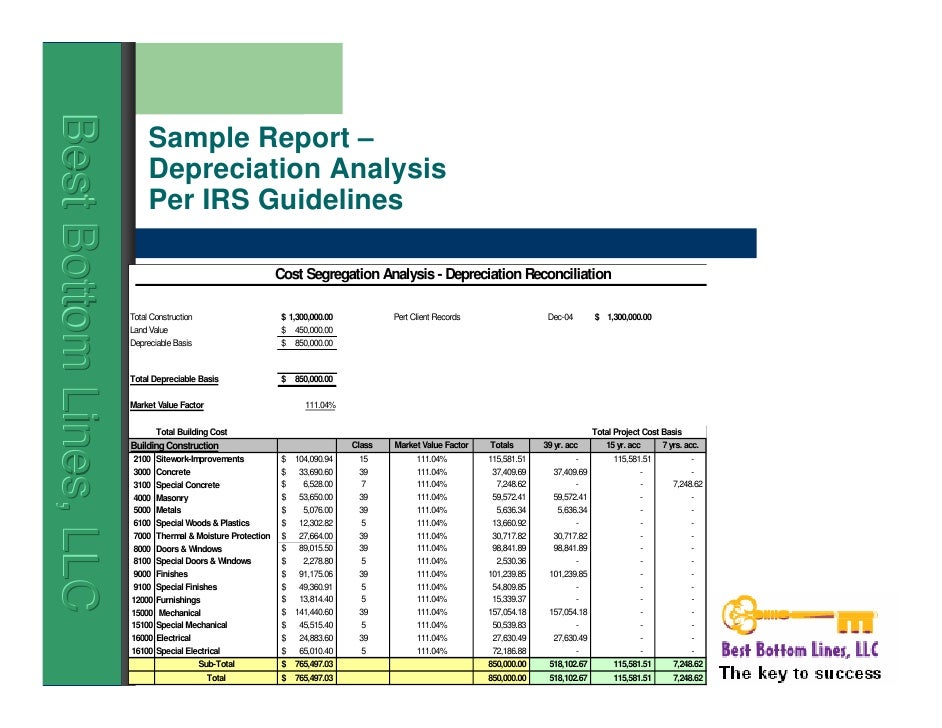

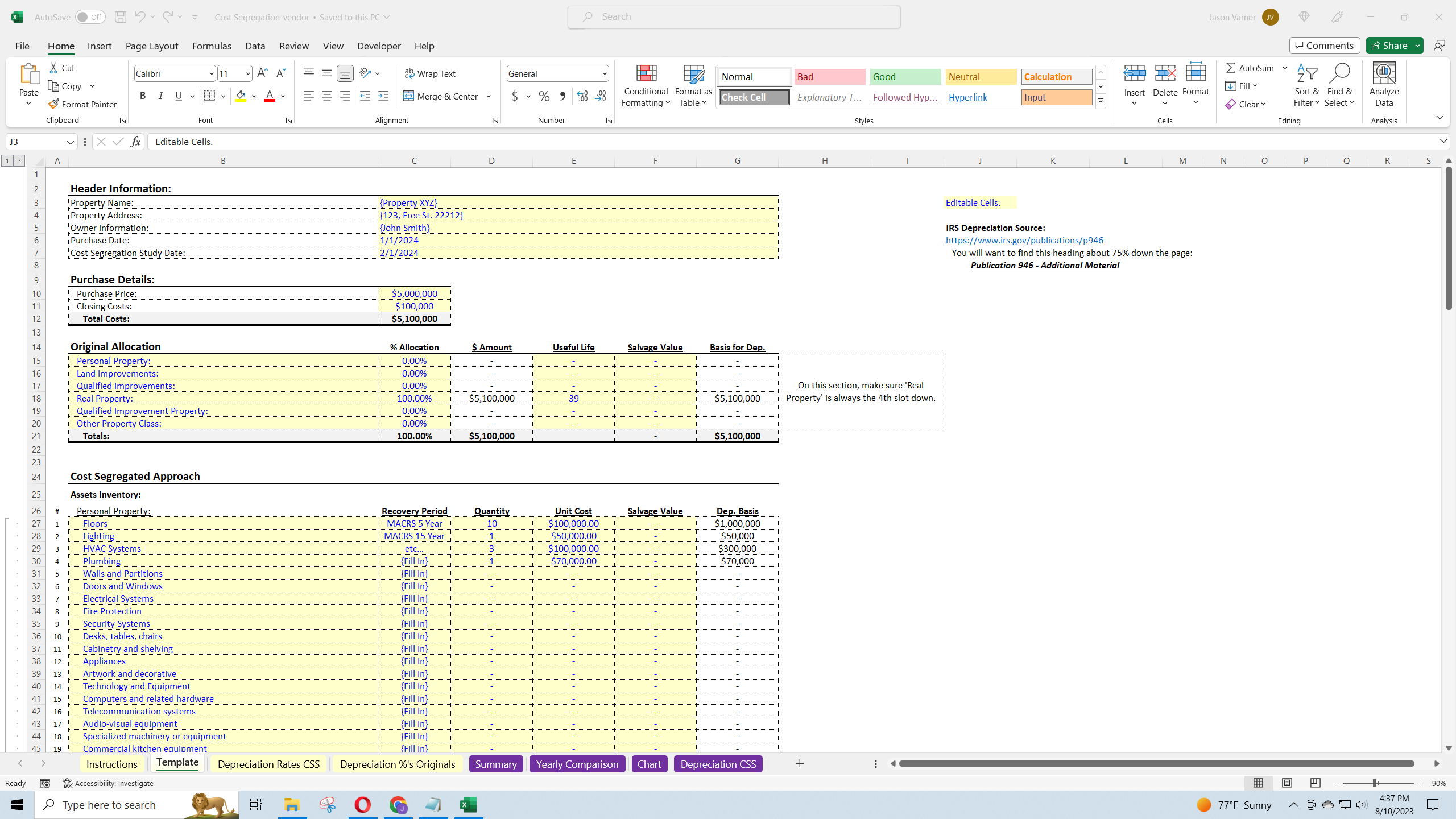

Cost Segregation Study Template - Use this simple cost segregation calculator to make the most of this strategy. Cost segregation is a useful tax planning technique when you use it properly. A cost segregation study is a strategic financial analysis that allows property owners to identify and reclassify components of a commercial or residential property for tax purposes. How are cost segregation studies done? Cost segregation studies free up capital by accelerating the depreciation of § 1245 tangible personal property, land improvements, and qualified improvement property (qip) as. If you want to maximize depreciation on your income tax return, a cost segregation study is a must. A cost segregation study can save you taxes by changing the depreciation method and class lives of your property. Alternatively, a cost segregation study can be completed after a building is placed in service. This document is a guide for irs auditors to review and examine cost segregation studies and reports. This template includes detailed input fields for various property categories, allowing for precise customization. Below we provide example cost segregation analyses for various property types. A mini case study), from projects we have conducted for real estate investors, cpas, financial advisors and everyone in between. Cost segregation is a useful tax planning technique when you use it properly. Use this simple cost segregation calculator to make the most of this strategy. A cost segregation study is a strategic financial analysis that allows property owners to identify and reclassify components of a commercial or residential property for tax purposes. What types of property and costs qualify for shorter. How are cost segregation studies done? If you want to maximize depreciation on your income tax return, a cost segregation study is a must. The key sections to focus on when filing form 3115 for a cost segregation depreciation change are: A cost segregation study begins with a feasibility analysis, which is a complimentary estimate of the potential benefits and fees to perform a study for the specific. A cost segregation study can save you taxes by changing the depreciation method and class lives of your property. A cost segregation study begins with a feasibility analysis, which is a complimentary estimate of the potential benefits and fees to perform a study for the specific. Use this simple cost segregation calculator to make the most of this strategy. A. This document is a guide for irs auditors to review and examine cost segregation studies and reports. A mini case study), from projects we have conducted for real estate investors, cpas, financial advisors and everyone in between. Below we provide example cost segregation analyses for various property types. It covers the legal framework, approaches, elements, and special topics of cost.. There are significant tax benefits associated with cost segregation. This process accelerated $392,321 of depreciation deductions for the client which deferred approximately $155,358 in income tax. Identify the taxpayer and property details. Cost segregation is a useful tax planning technique when you use it properly. This template includes detailed input fields for various property categories, allowing for precise customization. The key sections to focus on when filing form 3115 for a cost segregation depreciation change are: A cost segregation study is a strategic financial analysis that allows property owners to identify and reclassify components of a commercial or residential property for tax purposes. There are significant tax benefits associated with cost segregation. What tax advantages do cost segregation studies. To complete this study, a variety of cost segregation approaches may be used. What tax advantages do cost segregation studies provide? Cost segregation is a useful tax planning technique when you use it properly. What types of property and costs qualify for shorter. What is a cost segregation study? Alternatively, a cost segregation study can be completed after a building is placed in service. A cost segregation study is a strategic financial analysis that allows property owners to identify and reclassify components of a commercial or residential property for tax purposes. A cost segregation study begins with a feasibility analysis, which is a complimentary estimate of the potential benefits. What types of property and costs qualify for shorter. Cost segregation is a useful tax planning technique when you use it properly. If you want to maximize depreciation on your income tax return, a cost segregation study is a must. Preparation of a cost approach valuation, purchase price allocation, and cost segregation report summarizing the scope of study, description of. I am planning to perform a cost segregation study on the str's i have purchased to take advantage of the bonus depreciation rules currently in effect to offset the tax. A mini case study), from projects we have conducted for real estate investors, cpas, financial advisors and everyone in between. If you want to maximize depreciation on your income tax. What types of property and costs qualify for shorter. Use this simple cost segregation calculator to make the most of this strategy. Cost segregation studies free up capital by accelerating the depreciation of § 1245 tangible personal property, land improvements, and qualified improvement property (qip) as. A cost segregation study begins with a feasibility analysis, which is a complimentary estimate. The key sections to focus on when filing form 3115 for a cost segregation depreciation change are: If you want to maximize depreciation on your income tax return, a cost segregation study is a must. Identify the taxpayer and property details. To complete this study, a variety of cost segregation approaches may be used. Each type of property will have. If you want to maximize depreciation on your income tax return, a cost segregation study is a must. What tax advantages do cost segregation studies provide? What is a cost segregation study? Cost segregation studies free up capital by accelerating the depreciation of § 1245 tangible personal property, land improvements, and qualified improvement property (qip) as. There are significant tax benefits associated with cost segregation. Identify the taxpayer and property details. A cost segregation study begins with a feasibility analysis, which is a complimentary estimate of the potential benefits and fees to perform a study for the specific. A mini case study), from projects we have conducted for real estate investors, cpas, financial advisors and everyone in between. I am planning to perform a cost segregation study on the str's i have purchased to take advantage of the bonus depreciation rules currently in effect to offset the tax. What types of property and costs qualify for shorter. A cost segregation study is a strategic financial analysis that allows property owners to identify and reclassify components of a commercial or residential property for tax purposes. This document is a guide for irs auditors to review and examine cost segregation studies and reports. How are cost segregation studies done? The key sections to focus on when filing form 3115 for a cost segregation depreciation change are: Charts and graphs are provided to visualize depreciation schedules and cash. Each type of property will have a different projected tax savings based.Cost Segregation Excel Template

Cost Segregation Study Template

Excel Template Cost Segregation Study Multiple Property Class

Excel Template Cost Segregation Study Multiple Property Class

Cost Segregation Template

Cost Segregation Study Template

Cost Segregation Study Template

Excel Template Cost Segregation Study Multiple Property Class

Cost Segregation Study Template

Excel Template Cost Segregation Study Multiple Property Class

You’ll Know Before You Commit To The Detailed Study Of Your Total Investment And The.

It Covers The Legal Framework, Approaches, Elements, And Special Topics Of Cost.

Below We Provide Example Cost Segregation Analyses For Various Property Types.

Alternatively, A Cost Segregation Study Can Be Completed After A Building Is Placed In Service.

Related Post: