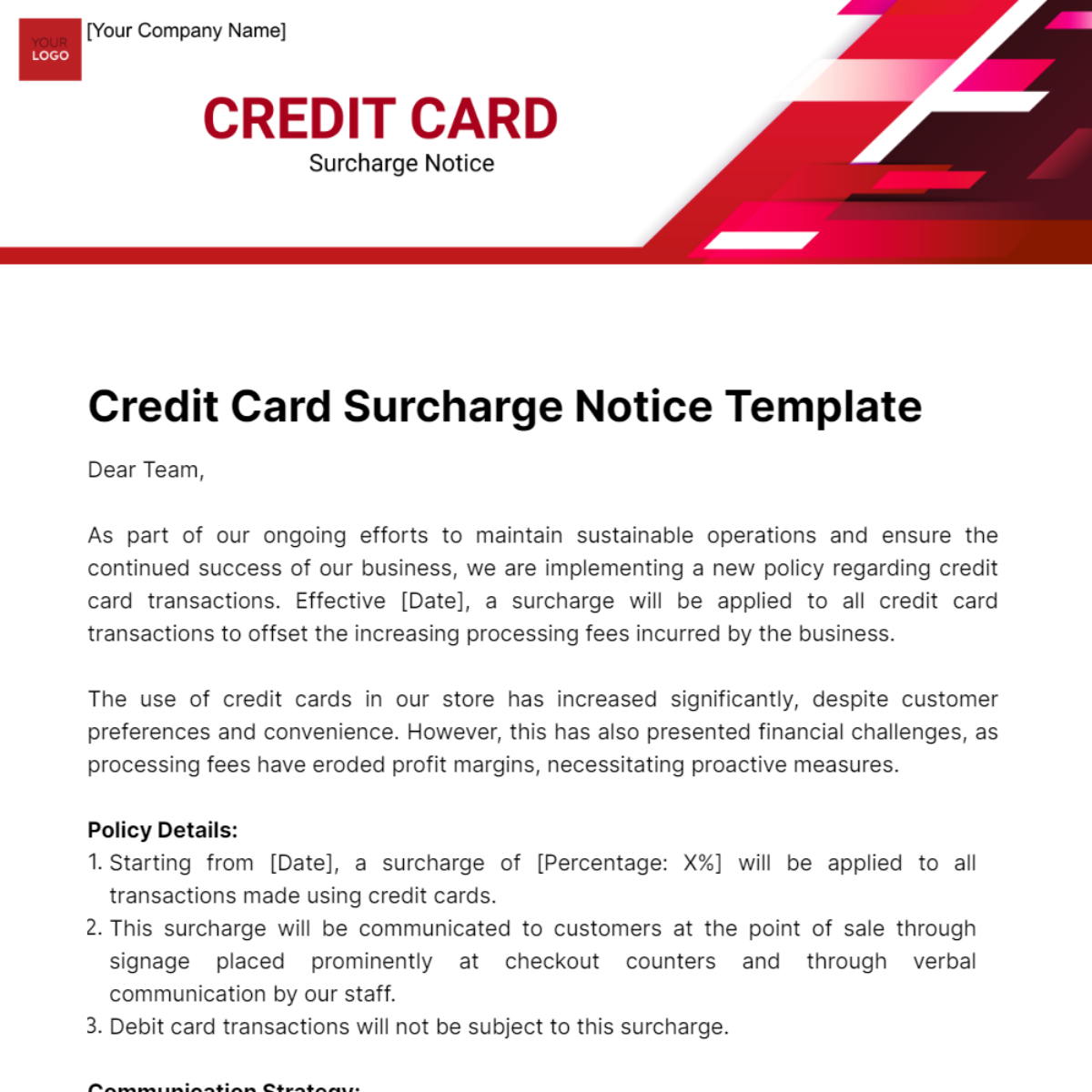

Credit Card Surcharge Notice Template

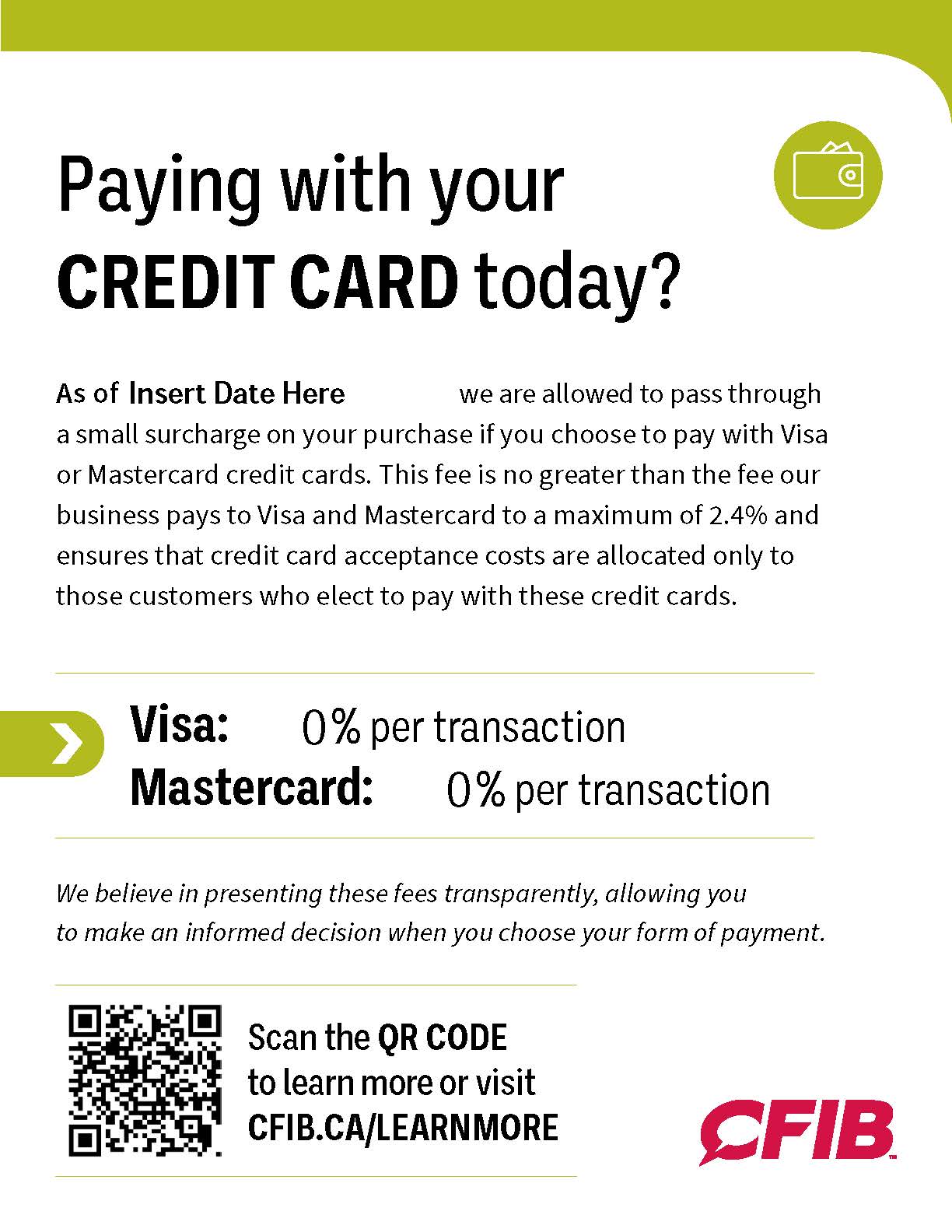

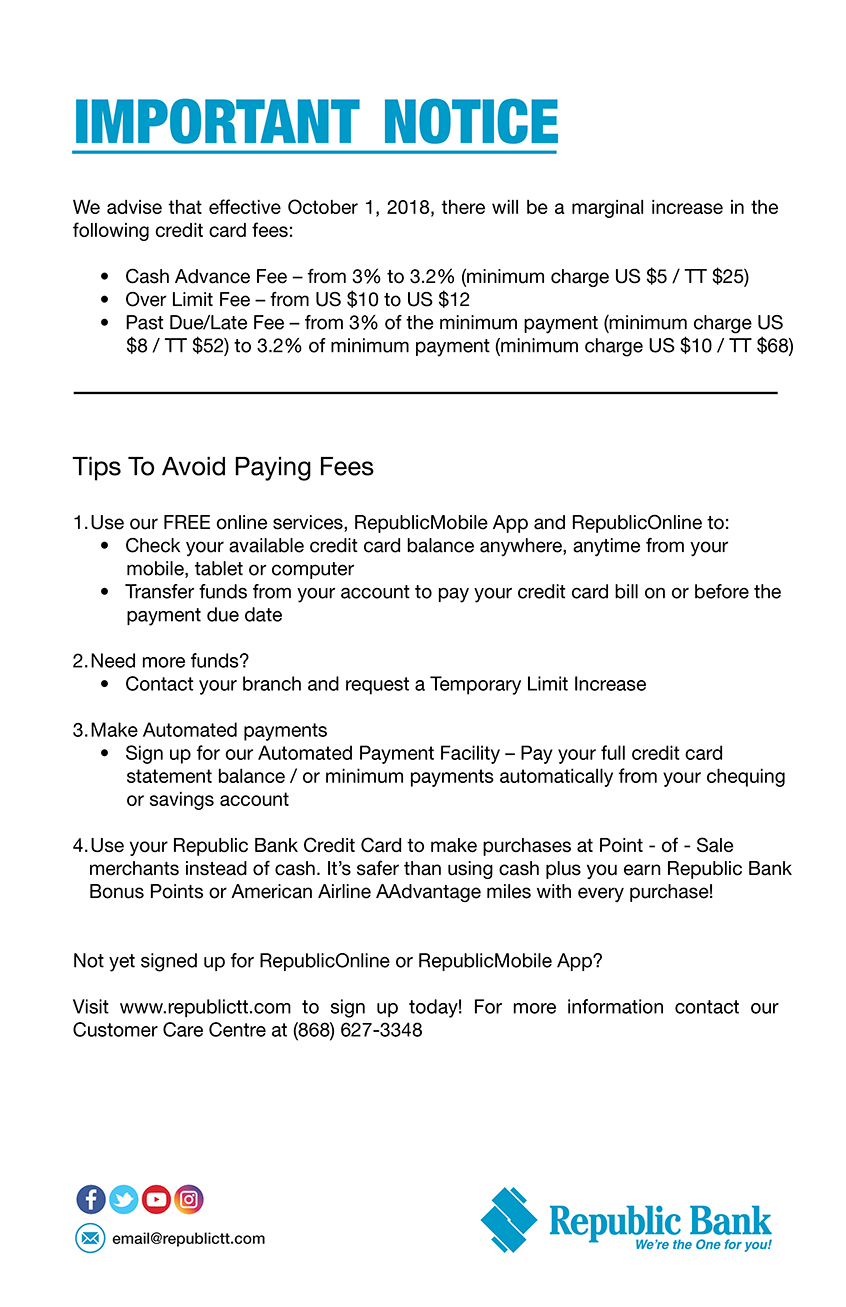

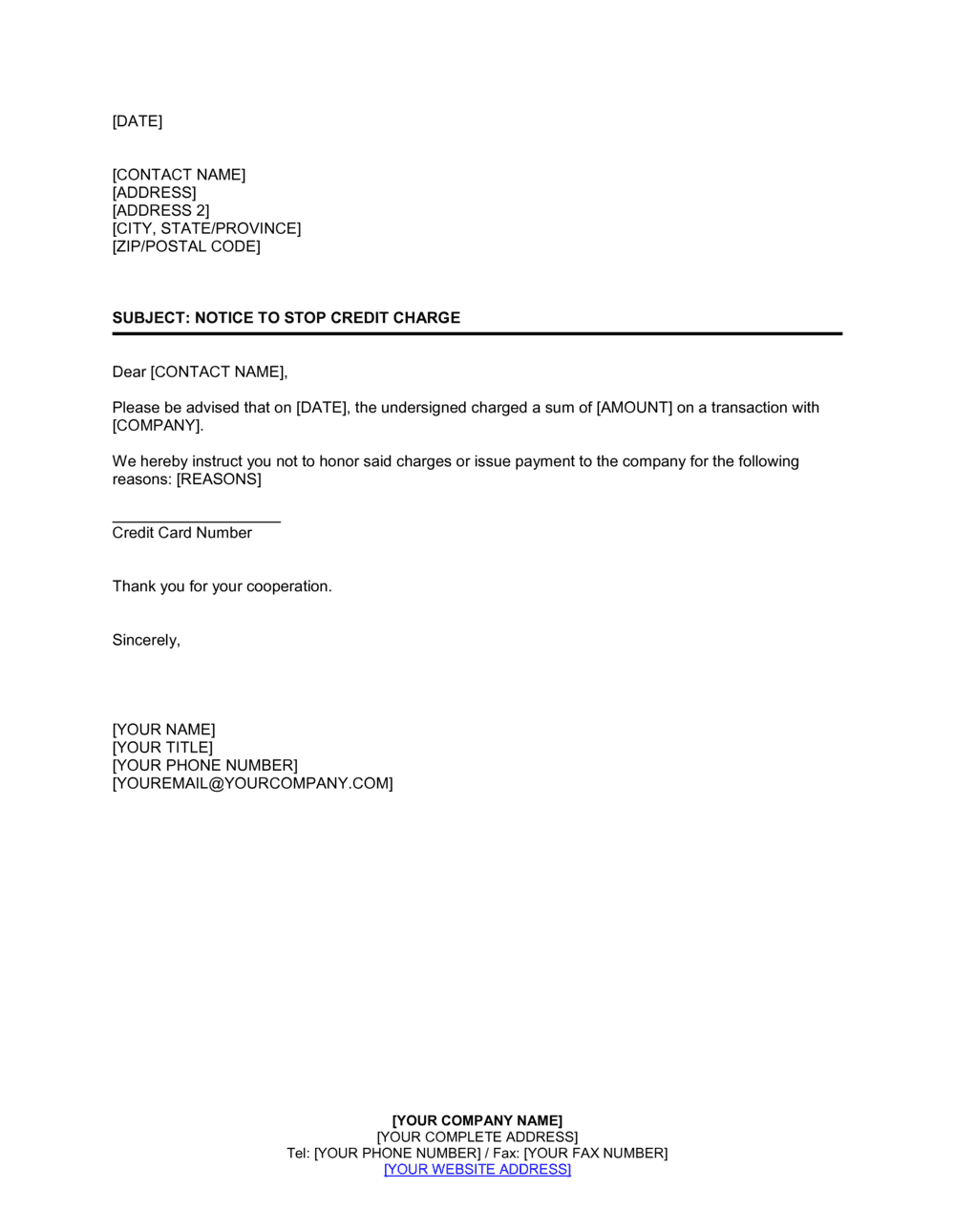

Credit Card Surcharge Notice Template - Displaying credit card surcharge signs is legally required for merchants who add fees to credit card transactions, informing customers of the additional charges. For 2025, generally, yes, you can impose a surcharge on credit card transactions. Debit card surcharges, however, are. At the federal level, there is a limit of 4% on credit card surcharges. Get more information about merchant surcharge disclosure from mastercard by filling in a webform. Credit card surcharge notice is in editable, printable format. Find out the legal and card association requirements, the disclosure template, and the better. Get in touch with us for more details. Notify visa, mastercard, discover and your credit card processor at least 30 days in advance of beginning to surcharge. Offer payment options that include debit and credit card acceptance to meet customer. Displaying credit card surcharge signs is legally required for merchants who add fees to credit card transactions, informing customers of the additional charges. Enhance this design & content with free ai. Offer payment options that include debit and credit card acceptance to meet customer. For 2025, generally, yes, you can impose a surcharge on credit card transactions. Credit card convenience fee wording is crucial in safeguarding profits. These examples will help you present fees clearly and fairly,. Debit card surcharges, however, are. Find out the legal and card association requirements, the disclosure template, and the better. Typically, business owners bear the majority of credit card processing expenses. Below are some of the examples and templates of credit card surcharge signs that merchants can use in different situations, according to their business needs. Merchants are free to develop their own signage that meets surcharging requirements and are permitted. For 2025, generally, yes, you can impose a surcharge on credit card transactions. Card surcharges may apply a card processing fee will be added at the time of payment visa unior% credit unior% visa diners club international debit eftpos. Transparently communicate credit card surcharges to. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. At the federal level, there is a limit of 4% on credit card surcharges. Get in touch with us for more details. The enclosed signage is provided as an example of compliant surcharge disclosure. Below are some of the examples and. Find out the legal and card association requirements, the disclosure template, and the better. In this article, you'll explore various examples of credit card convenience fee wording and surcharge sign templates. For 2025, generally, yes, you can impose a surcharge on credit card transactions. Transparently communicate credit card surcharges to maintain customer trust and satisfaction. Enhance this design & content. Customize and download this credit card surcharge notice. Get everything done in minutes. Below are some of the examples and templates of credit card surcharge signs that merchants can use in different situations, according to their business needs. Get more information about merchant surcharge disclosure from mastercard by filling in a webform. Unless otherwise prohibited by law, i understand, agree. Card surcharges may apply a card processing fee will be added at the time of payment visa unior% credit unior% visa diners club international debit eftpos. Below are some of the examples and templates of credit card surcharge signs that merchants can use in different situations, according to their business needs. Find out the legal and card association requirements, the. Find out the legal and card association requirements, the disclosure template, and the better. Unless otherwise prohibited by law, i understand, agree and acknowledge that ffc may impose and collect a surcharge each time my credit card is charged, whether in. In this article, you'll explore various examples of credit card convenience fee wording and surcharge sign templates. Card surcharges. At the federal level, there is a limit of 4% on credit card surcharges. The enclosed signage is provided as an example of compliant surcharge disclosure. Get more information about merchant surcharge disclosure from mastercard by filling in a webform. Get in touch with us for more details. These examples will help you present fees clearly and fairly,. Debit card surcharges, however, are. For 2025, generally, yes, you can impose a surcharge on credit card transactions. These examples will help you present fees clearly and fairly,. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. The enclosed signage is provided as an example of compliant surcharge disclosure. Card surcharges may apply a card processing fee will be added at the time of payment visa unior% credit unior% visa diners club international debit eftpos. Customize and download this credit card surcharge notice. Get in touch with us for more details. Enhance this design & content with free ai. While large retailers may have the. Notify visa, mastercard, discover and your credit card processor at least 30 days in advance of beginning to surcharge. Get in touch with us for more details. Get more information about merchant surcharge disclosure from mastercard by filling in a webform. Enhance this design & content with free ai. These examples will help you present fees clearly and fairly,. Learn what credit card surcharging is, how it works, and why you should avoid it. At the federal level, there is a limit of 4% on credit card surcharges. Below are some of the examples and templates of credit card surcharge signs that merchants can use in different situations, according to their business needs. Printable credit card fee sign. Unless otherwise prohibited by law, i understand, agree and acknowledge that ffc may impose and collect a surcharge each time my credit card is charged, whether in. Get in touch with us for more details. Customize and download this credit card surcharge notice. Notify visa, mastercard, discover and your credit card processor at least 30 days in advance of beginning to surcharge. Save the credit card surcharge notice to customers template, print, or email it. Merchants are free to develop their own signage that meets surcharging requirements and are permitted. Credit card convenience fee wording is crucial in safeguarding profits. Typically, business owners bear the majority of credit card processing expenses. For 2025, generally, yes, you can impose a surcharge on credit card transactions. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Find out the legal and card association requirements, the disclosure template, and the better. Debit card surcharges, however, are.Free Credit Card Surcharge Notice Template Edit Online & Download

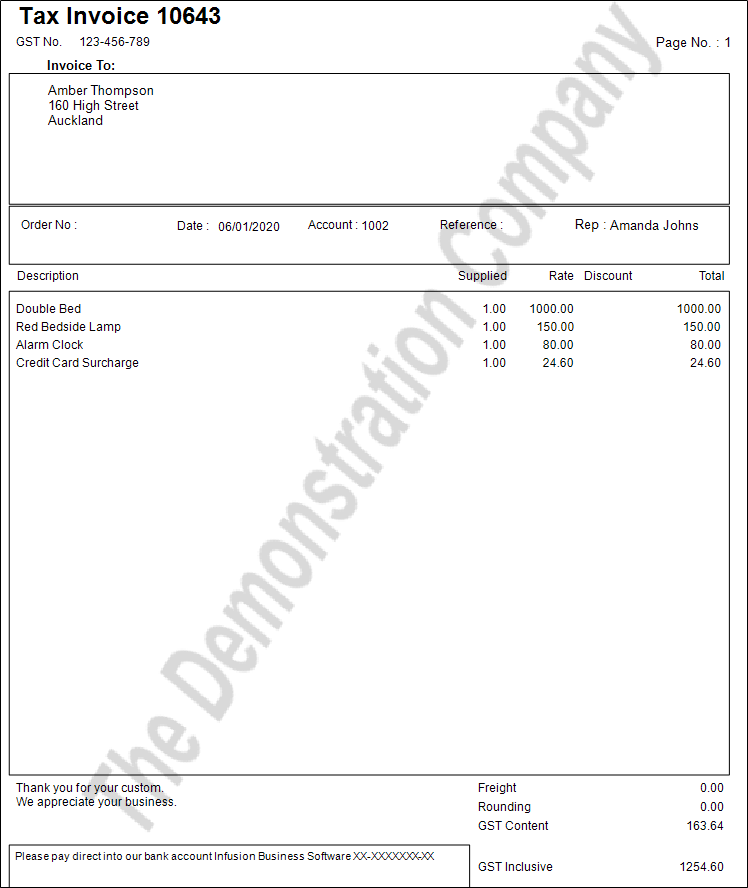

Credit Card Surcharges

Credit Card Surcharge Notice Template

Credit Card Surcharge Notice Template prntbl.concejomunicipaldechinu

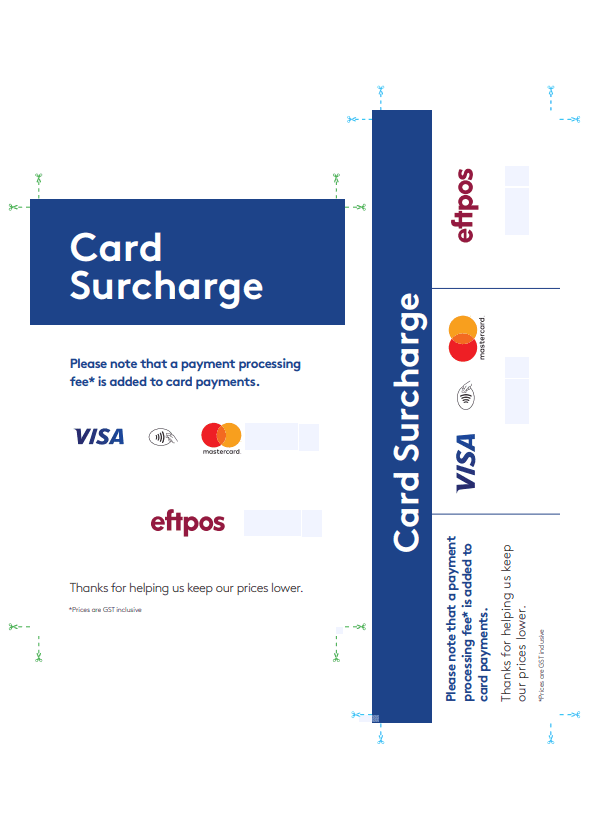

Surcharge Signage Templates by Zeller Free Download

Credit Card Surcharge Notice Template prntbl.concejomunicipaldechinu

Credit Card Surcharge Sign Template

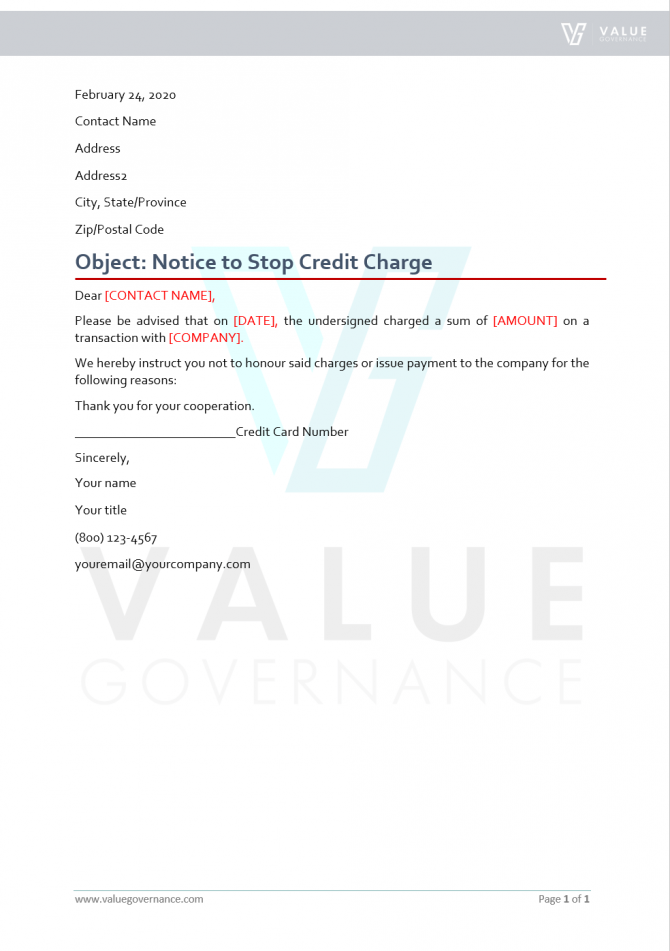

Surcharge Letter Template prntbl.concejomunicipaldechinu.gov.co

Credit Card Surcharge Notice Template

Credit Card Surcharge Notice Template

Displaying Credit Card Surcharge Signs Is Legally Required For Merchants Who Add Fees To Credit Card Transactions, Informing Customers Of The Additional Charges.

Get More Information About Merchant Surcharge Disclosure From Mastercard By Filling In A Webform.

Get Everything Done In Minutes.

The Enclosed Signage Is Provided As An Example Of Compliant Surcharge Disclosure.

Related Post: