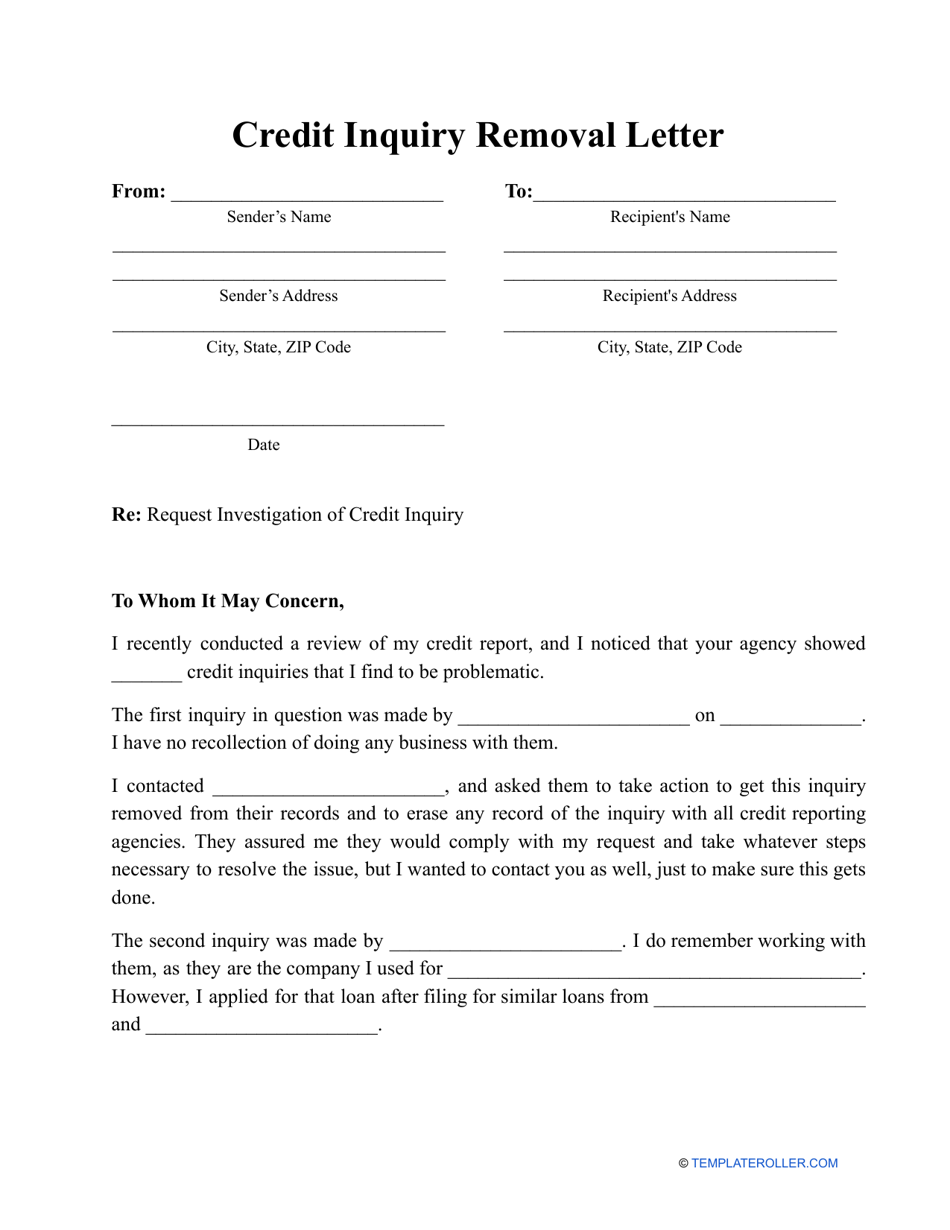

Credit Inquiry Removal Letter Template

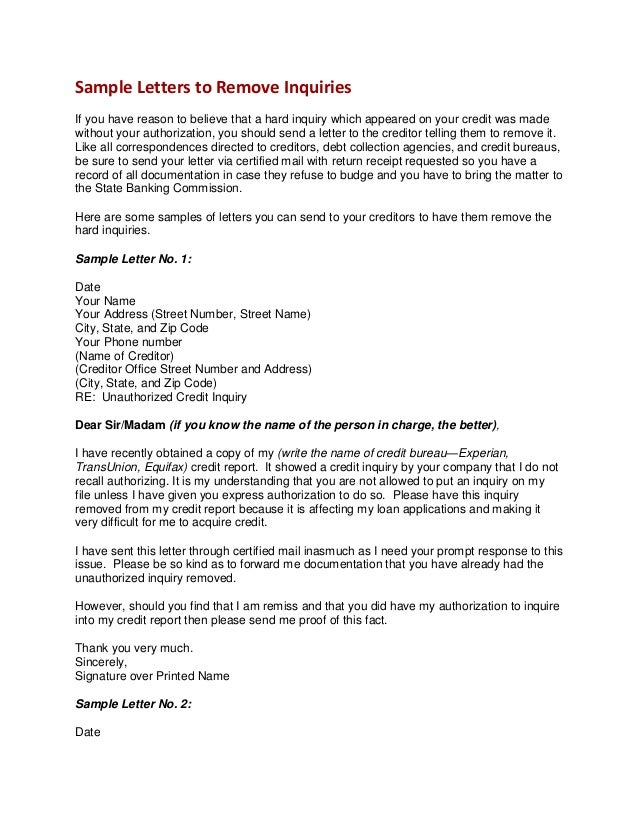

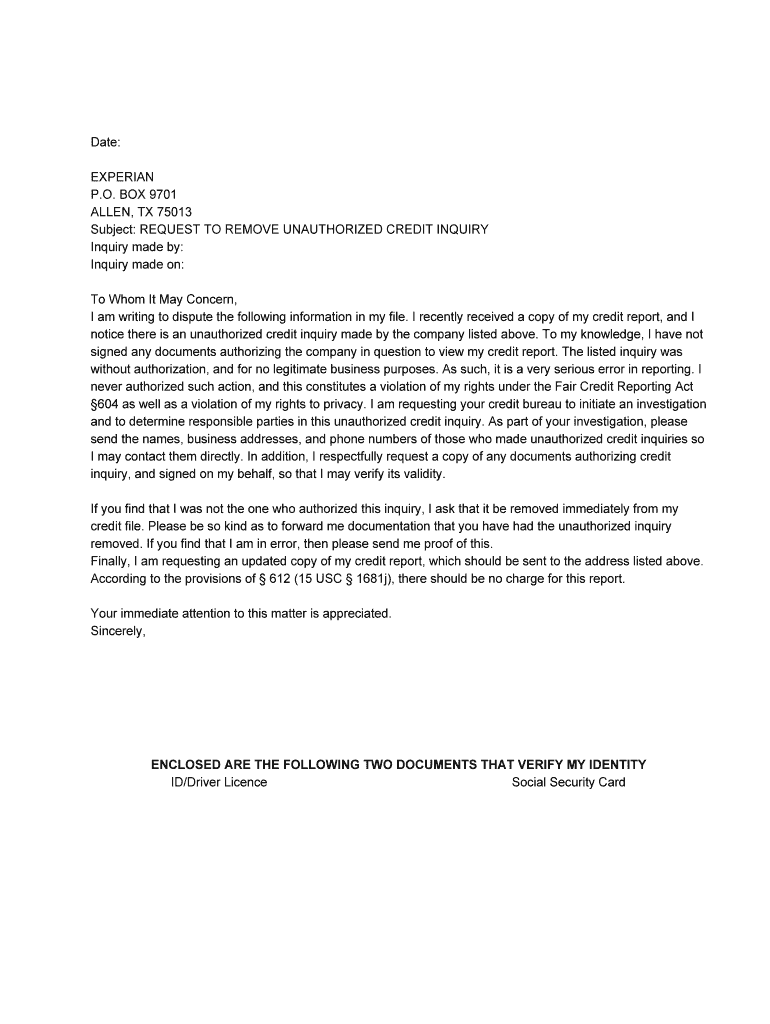

Credit Inquiry Removal Letter Template - You can send this sample letter to a credit bureau requesting to remove inquiries from your credit report. What is a 609 dispute letter? A simple, yet effective letter to. Why removing inquiries matters and how it can improve your credit score. Please ensure that this information is updated within the. A credit inquiry dispute involves a consumer challenging an inaccurate or unauthorized credit check reported by credit bureaus such as experian, equifax, or transunion. If you are unable to provide valid authorization for these inquiries, i request their immediate removal from my credit report. Accurately locate them in your credit report. Ensure the error has been removed by requesting confirmation from the consumer reporting company. Upon receipt, it is the credit bureaus duty to investigate. By following these steps and leveraging the provided template, you can effectively dispute and remove unauthorized inquiries from your credit report. What is a 609 dispute letter? Ensure the error has been removed by requesting confirmation from the consumer reporting company. A credit inquiry dispute involves a consumer challenging an inaccurate or unauthorized credit check reported by credit bureaus such as experian, equifax, or transunion. Upon receipt, it is the credit bureaus duty to investigate. A credit inquiry removal letter is used to dispute an unauthorized inquiry. Please ensure that this information is updated within the. Why removing inquiries matters and how it can improve your credit score. A credit inquiry removal letter is used to alert the credit bureaus of an unauthorized inquiry and request that it be removed. Make sure that you use fax or certified mail in order to ensure your. A simple, yet effective letter to. By following these steps and leveraging the provided template, you can effectively dispute and remove unauthorized inquiries from your credit report. Why removing inquiries matters and how it can improve your credit score. This letter requests the removal of unauthorized credit inquiries. Accurately locate them in your credit report. After receiving your letter, the credit bureaus are obligated to investigate your claim with the creditor who placed the hard inquiry on your credit report. For this task, the best thing you can do is write a credit dispute letter requesting the removal of such inaccuracies or errors in your credit file. It is sent to the credit bureaus to. A simple, yet effective letter to. Upon receipt, it is the credit bureaus duty to investigate. By following these steps and leveraging the provided template, you can effectively dispute and remove unauthorized inquiries from your credit report. In this comprehensive guide, we will delve into the intricacies of credit inquiries, explore the reasons for requesting the removal of a credit. In this comprehensive guide, we will delve into the intricacies of credit inquiries, explore the reasons for requesting the removal of a credit inquiry, and provide a detailed step. Make sure that you use fax or certified mail in order to ensure your. You can send this sample letter to a credit bureau requesting to remove inquiries from your credit. A simple, yet effective letter to. After receiving your letter, the credit bureaus are obligated to investigate your claim with the creditor who placed the hard inquiry on your credit report. Submit a formal removal letter to the major credit bureaus. It is sent to the credit bureaus to request that a credit inquiry be removed. Make sure that you. After receiving your letter, the credit bureaus are obligated to investigate your claim with the creditor who placed the hard inquiry on your credit report. Below we’ve provided some tips for removing unauthorized hard inquiries from your credit report, as well as a credit inquiry removal letter template for your professional use. What is a 609 dispute letter? This letter. A credit inquiry removal letter is used to dispute an unauthorized inquiry. It is sent to the credit bureaus to request that a credit inquiry be removed. Removing false inquiries from your report requires you to: A simple, yet effective letter to. Submit a formal removal letter to the major credit bureaus. It is sent to the credit bureaus to request that a credit inquiry be removed. This letter requests the removal of unauthorized credit inquiries. Accurately locate them in your credit report. A credit inquiry removal letter is used to dispute an unauthorized inquiry. What is a 609 dispute letter? A simple, yet effective letter to. Upon receipt, it is the credit bureaus duty to investigate. Credit inquiry removal letter if you want to remove a credit inquiry from your credit report, you can follow these steps and use the following template as a guide for writing a credit inquiry. A simple, yet effective letter to. Why removing inquiries matters. A simple, yet effective letter to. Submit a formal removal letter to the major credit bureaus. Why removing inquiries matters and how it can improve your credit score. After receiving your letter, the credit bureaus are obligated to investigate your claim with the creditor who placed the hard inquiry on your credit report. Below we’ve provided some tips for removing. Please ensure that this information is updated within the. Submit a formal removal letter to the major credit bureaus. Make sure that you use fax or certified mail in order to ensure your. Removing false inquiries from your report requires you to: By following these steps and leveraging the provided template, you can effectively dispute and remove unauthorized inquiries from your credit report. After receiving your letter, the credit bureaus are obligated to investigate your claim with the creditor who placed the hard inquiry on your credit report. Below we’ve provided some tips for removing unauthorized hard inquiries from your credit report, as well as a credit inquiry removal letter template for your professional use. For this task, the best thing you can do is write a credit dispute letter requesting the removal of such inaccuracies or errors in your credit file. A credit inquiry removal letter is used to dispute an unauthorized inquiry. A credit inquiry dispute involves a consumer challenging an inaccurate or unauthorized credit check reported by credit bureaus such as experian, equifax, or transunion. A credit inquiry removal letter is used to alert the credit bureaus of an unauthorized inquiry and request that it be removed. In this comprehensive guide, we will delve into the intricacies of credit inquiries, explore the reasons for requesting the removal of a credit inquiry, and provide a detailed step. Accurately locate them in your credit report. This letter requests the removal of unauthorized credit inquiries. You can send this sample letter to a credit bureau requesting to remove inquiries from your credit report. What is a 609 dispute letter?Sample letters to remove inquiries

Credit Inquiry Removal Letter Fill and Sign Printable Template Online

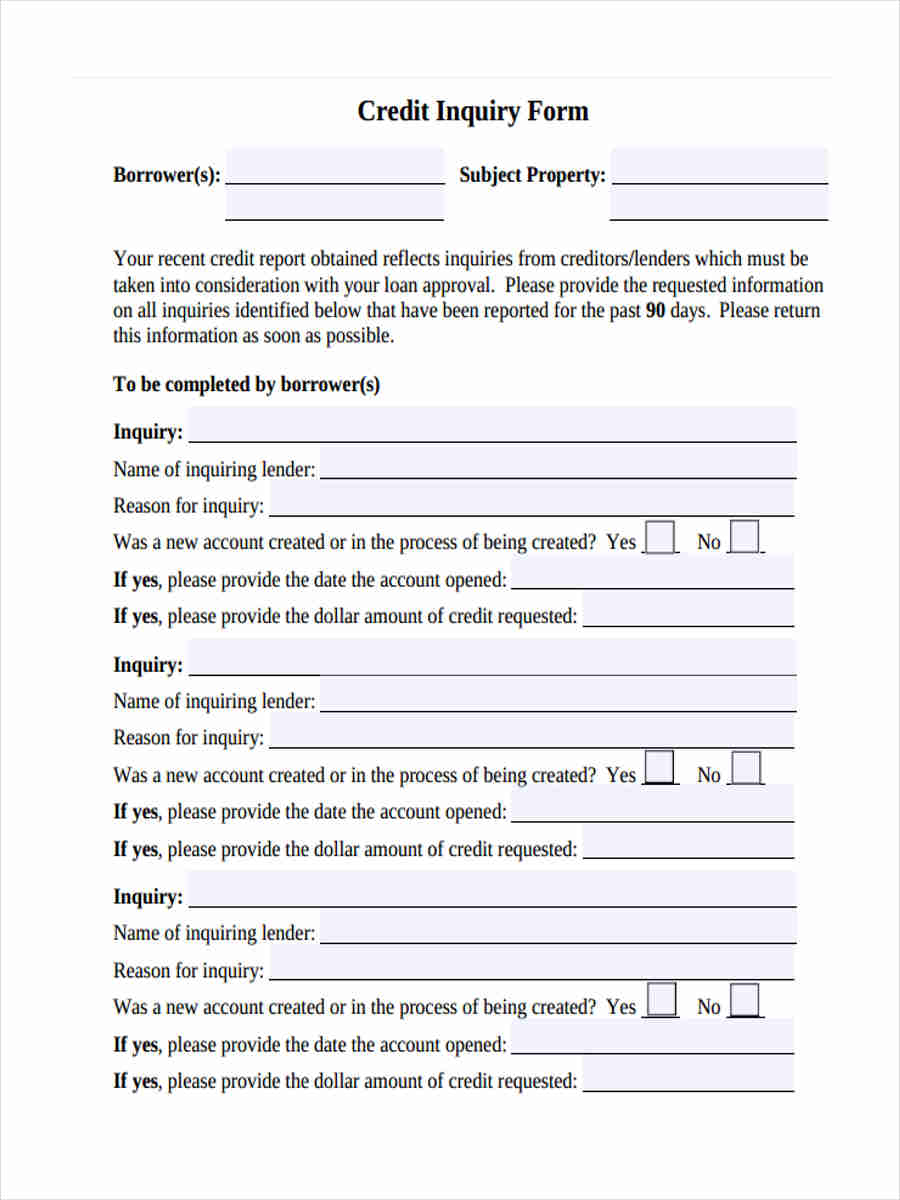

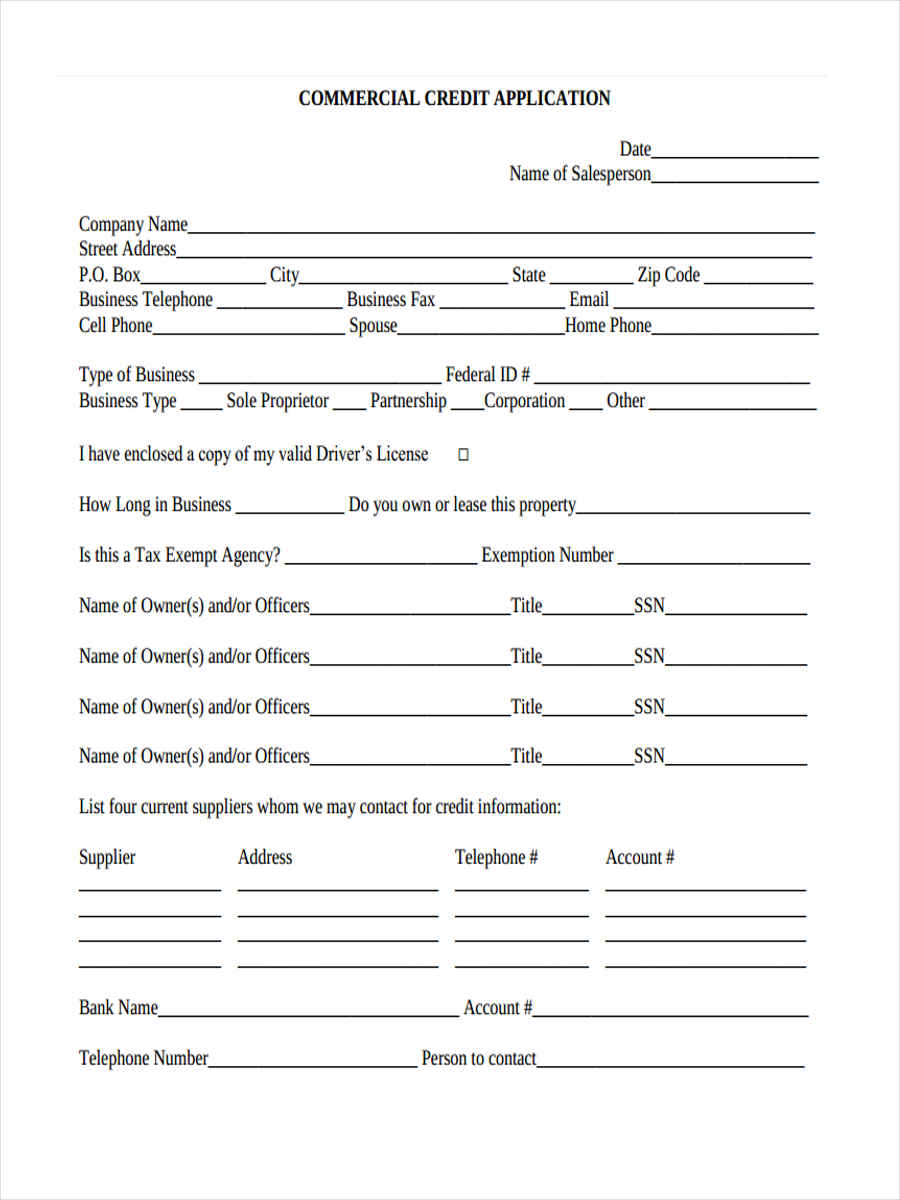

FREE 6+ Sample Credit Inquiry Forms in MS Word PDF

Credit Inquiry Letter Of Explanation And Removal

How I Raised My Credit Scores Over 200 Pointsremoving inside Credit

Hard Inquiry Removal Credit Dispute Letter Template DIY Credit Repair

Hard Inquiry Removal Credit Dispute Letter Template DIY Credit Repair

FREE 11+ Credit Inquiry Forms in PDF Ms Word

14 Sample Letter of Credit Templates Samples, Examples & Format

Credit Inquiry Removal Letter Template Download Printable PDF

Why Removing Inquiries Matters And How It Can Improve Your Credit Score.

If You Are Unable To Provide Valid Authorization For These Inquiries, I Request Their Immediate Removal From My Credit Report.

Ensure The Error Has Been Removed By Requesting Confirmation From The Consumer Reporting Company.

A Simple, Yet Effective Letter To.

Related Post: