Credit Repair Secrets And 609 Letter Templates

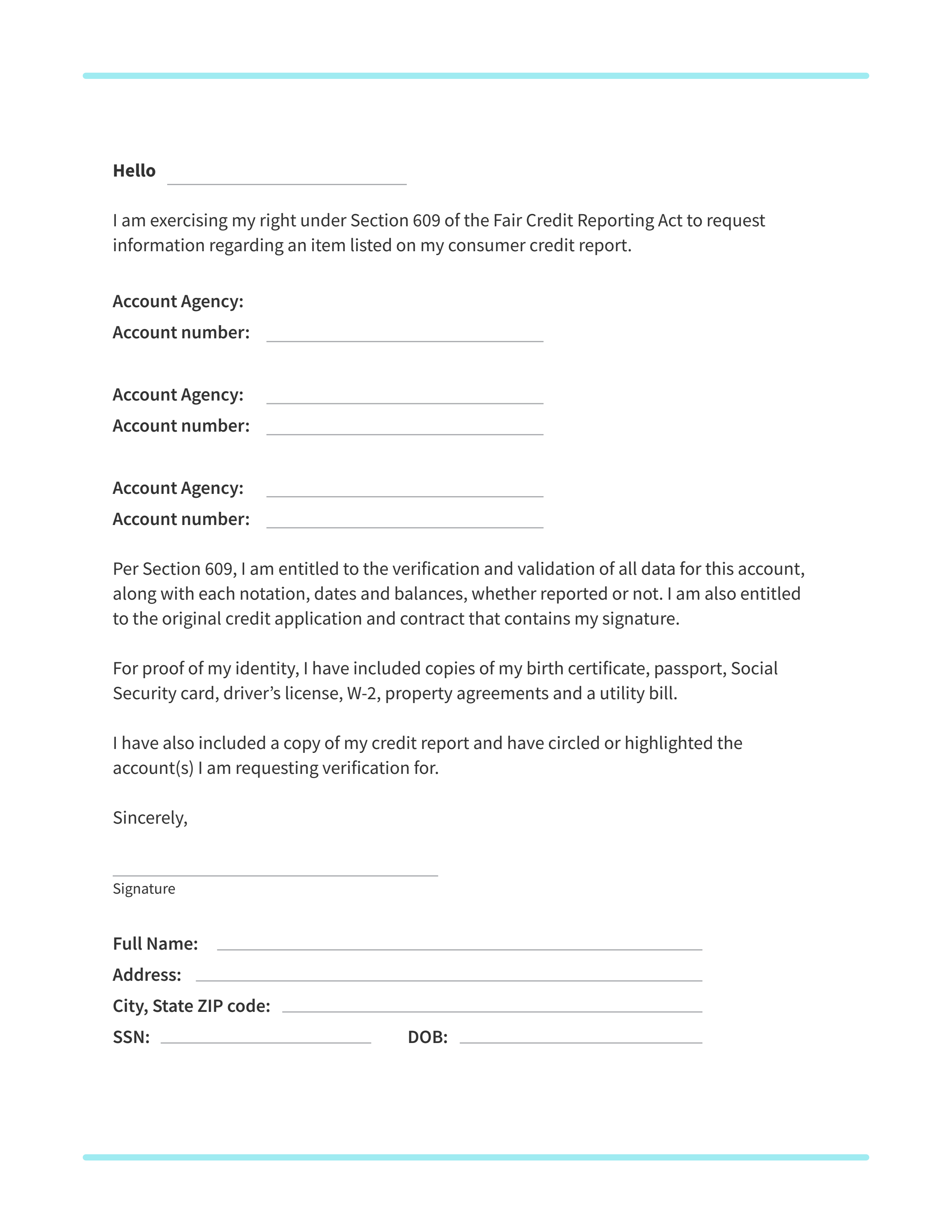

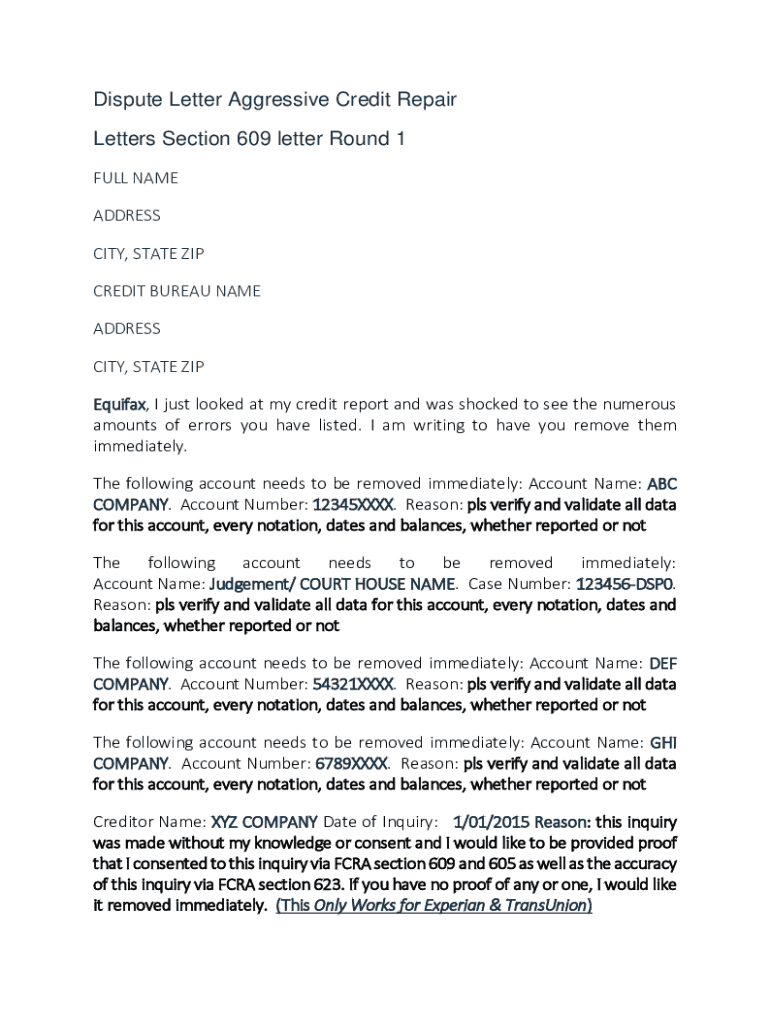

Credit Repair Secrets And 609 Letter Templates - Apart from correcting your credit report,. The 609 dispute letter is often referred to as the “legal loophole”, or the “credit repair secret' and can be useful in different situations. The fair credit reporting act (fcra) makes this. The easy section 609 credit repair secret: You should send this letter to the credit bureau that reported the inaccurate information. Credit repair secrets and 609 letter templates is the ultimate guide to transforming your financial future. Are you tired of being rejected by the banks and other financial institutions because you have bad. Remove all negative accounts in 30 days using a federal law loophole that works every time If yes, then keep reading. A 609 credit repair letter is a way to dispute negative information on your credit report. Do you want to learn how to file a credit dispute and increase your score? Credit repair secrets and 609 letter templates is the ultimate guide to transforming your financial future. Apart from correcting your credit report,. If yes, then keep reading. Rooted in section 609 of the fair credit reporting act (fcra),. The easy section 609 credit repair secret: An essential guide to navigate your way to great credit that will open doors to your future, learn how to fix debt and. You should send this letter to the credit bureau that reported the inaccurate information. Are you tired of being rejected by the banks and other financial institutions because you have bad. A 609 letter, also known as a 609 dispute letter, can help you remove “unverifiable” bad marks, boost your credit score, and help you qualify for loans that you otherwise wouldn’t. Rooted in section 609 of the fair credit reporting act (fcra),. Apart from correcting your credit report,. The 609 dispute letter is often referred to as the “legal loophole”, or the “credit repair secret' and can be useful in different situations. If yes, then keep reading. In short, a 609 letter is a method of requesting credit bureaus to remove. You can purchase these templates with varying. 609 dispute letter templates, according to some, offer you a secret way to remove negative items from your credit reports. You can get negative things expelled from your credit report based on. Credit repair secrets and 609 letter templates: A 609 credit repair letter is a way to dispute negative information on your. The easy section 609 credit repair secret: Remove all negative accounts in 30 days using a federal law loophole that works every time You can get negative things expelled from your credit report based on. Do you want to learn how to file a credit dispute and increase your score? You can purchase these templates with varying. Credit repair secrets and 609 letter templates: You can purchase these templates with varying. The easy section 609 credit repair secret: Fix your credit in a 609 legal and fast way and bring financial freedom. Apart from correcting your credit report,. You can purchase these templates with varying. Apart from correcting your credit report,. Credit repair secrets and 609 letter templates is the ultimate guide to transforming your financial future. The easy section 609 credit repair secret: An essential guide to navigate your way to great credit that will open doors to your future, learn how to fix debt and. You can get negative things expelled from your credit report based on. Remove all negative accounts in 30 days using a federal law loophole that works every time Sending a 609 dispute letter may help you remove errors from your credit report. Fix your credit in a 609 legal and fast way and bring financial freedom. The fair credit reporting. Credit repair secrets and 609 letter templates: A 609 credit repair letter is a way to dispute negative information on your credit report. Rooted in section 609 of the fair credit reporting act (fcra),. Sending a 609 dispute letter may help you remove errors from your credit report. What if you could write a few letters and attach a few. 609 dispute letter templates, according to some, offer you a secret way to remove negative items from your credit reports. That is exactly what this guidebook is. You can purchase these templates with varying. A 609 credit repair letter is a way to dispute negative information on your credit report. In short, a 609 letter is a method of requesting. The 609 dispute letter is often referred to as the “legal loophole”, or the “credit repair secret' and can be useful in different situations. A 609 credit repair letter is a way to dispute negative information on your credit report. You can purchase these templates with varying. A 609 dispute letter is a formal way to request more information about. You can purchase these templates with varying. You should send this letter to the credit bureau that reported the inaccurate information. What if you could write a few letters and attach a few supporting documents and get a lot of your credit score cleared up and ready to go? Fix your credit in a 609 legal and fast way and. A 609 dispute letter is a formal way to request more information about the accounts on your credit report. What if you could write a few letters and attach a few supporting documents and get a lot of your credit score cleared up and ready to go? You can get negative things expelled from your credit report based on. A 609 letter, also known as a 609 dispute letter, can help you remove “unverifiable” bad marks, boost your credit score, and help you qualify for loans that you otherwise wouldn’t. 609 dispute letter templates, according to some, offer you a secret way to remove negative items from your credit reports. The 609 dispute letter is often referred to as the “legal loophole”, or the “credit repair secret' and can be useful in different situations. Credit repair secrets and 609 letter templates: In the realm of credit repair, the “609 letter” is often touted as a powerful tool for disputing inaccuracies on credit reports. Are you tired of being rejected by the banks and other financial institutions because you have bad. The easy section 609 credit repair secret: Rooted in section 609 of the fair credit reporting act (fcra),. An essential guide to navigate your way to great credit that will open doors to your future, learn how to fix debt and. Remove all negative accounts in 30 days using a federal law loophole that works every time That is exactly what this guidebook is. A 609 credit repair letter is a way to dispute negative information on your credit report. Sending a 609 dispute letter may help you remove errors from your credit report.What Is a 609 Letter?

Credit Repair Secrets and 609 Letter Templates YouTube

609 Letter Template And Credit Repair 609 Letter Template And Credit

150 DIY Credit Repair Letter Templates Etsy

609 Letter Template Pdf Fill and Sign Printable Template Online US

609 Letter Templates & Credit Repair Secrets How to Fix

Buy 609 Letter Template And Credit Repair Secrets How To File A Credit

Free Sample Credit Repair Letters and Templates Of 609 Dispute Letter

609 Letter Templates & Credit Repair Secrets The Best Way to Fix Your

Credit Repair Secrets Increase Your Credits Score in 30 Days Legally

Fix Your Credit In A 609 Legal And Fast Way And Bring Financial Freedom.

If Yes, Then Keep Reading.

You Can Purchase These Templates With Varying.

The Fair Credit Reporting Act (Fcra) Makes This.

Related Post: