Debt Collection Dispute Letter Template

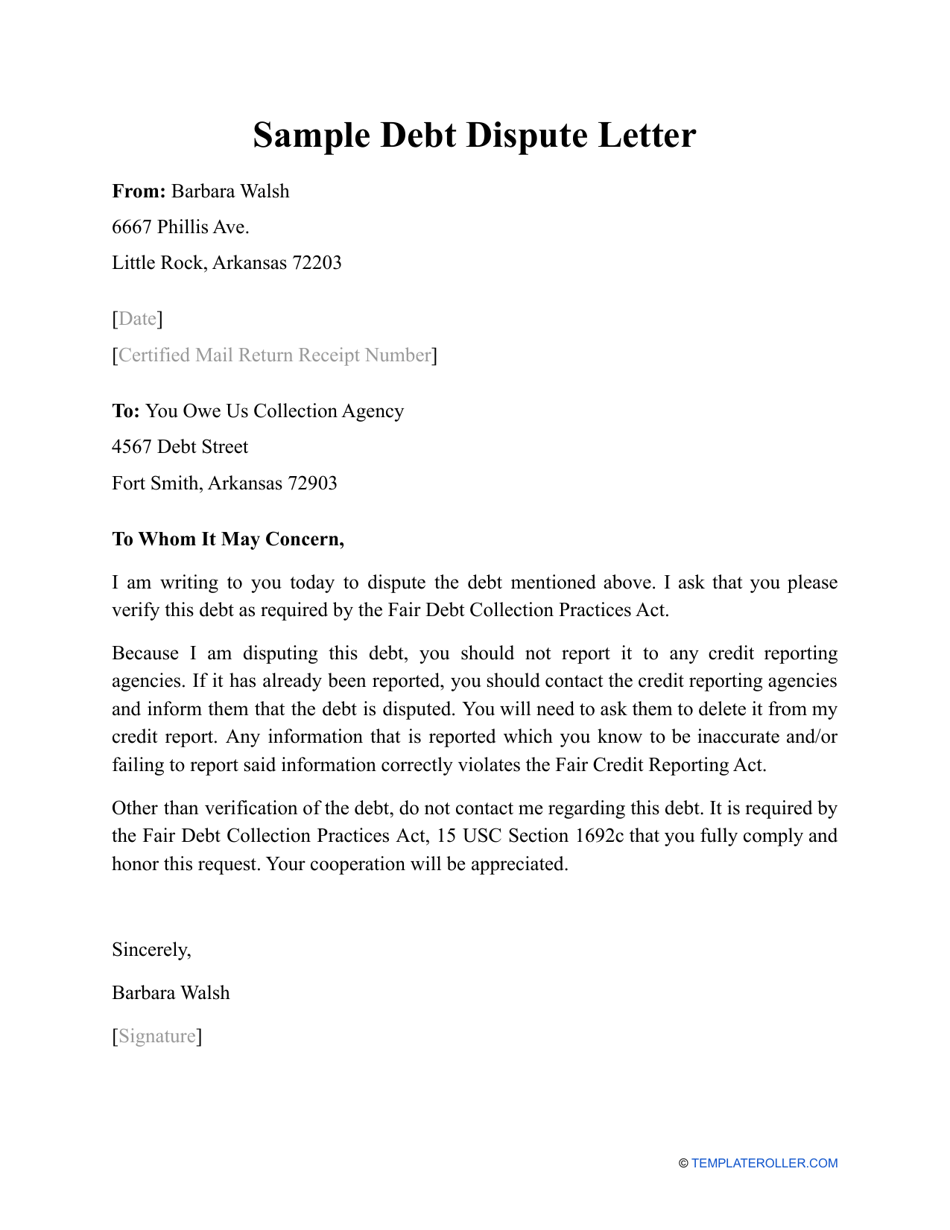

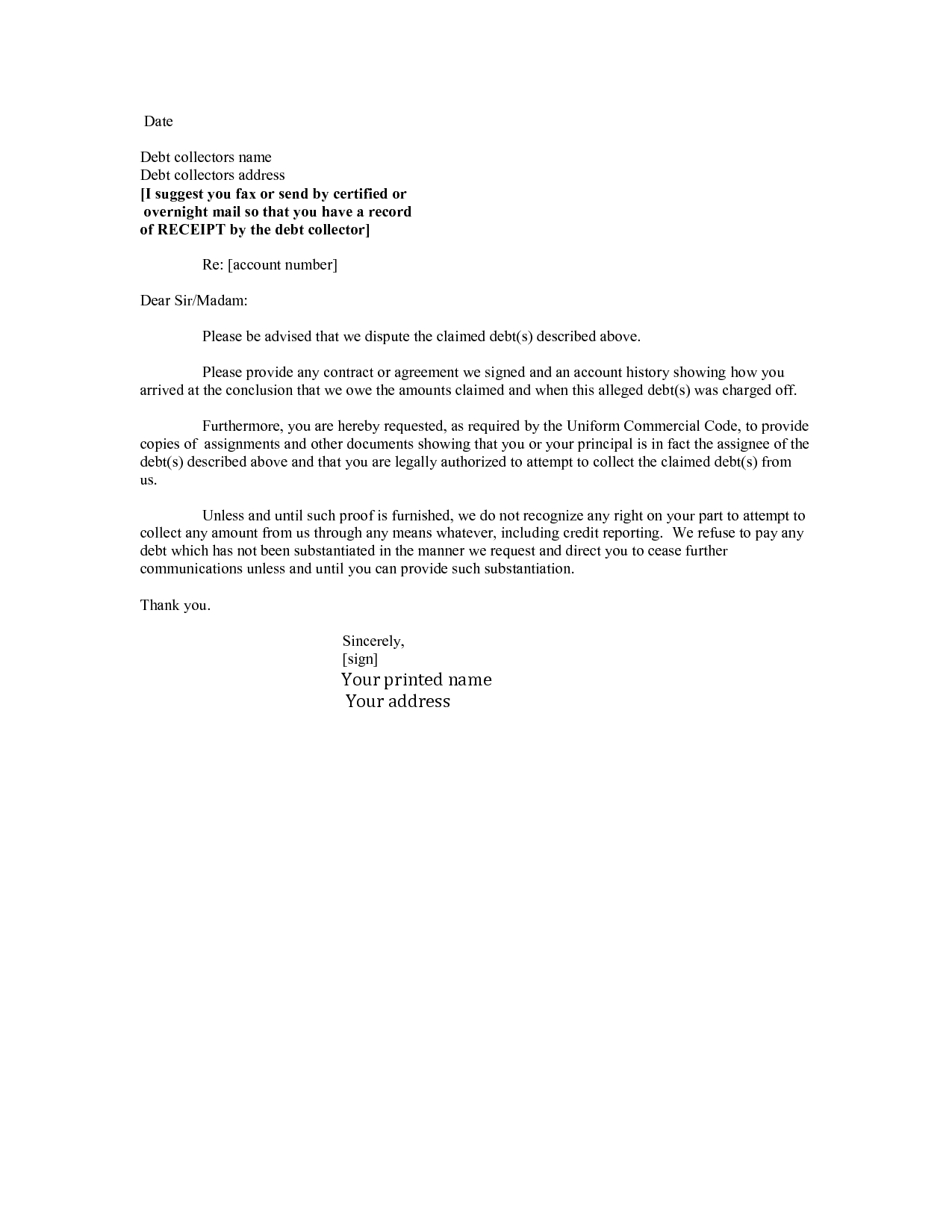

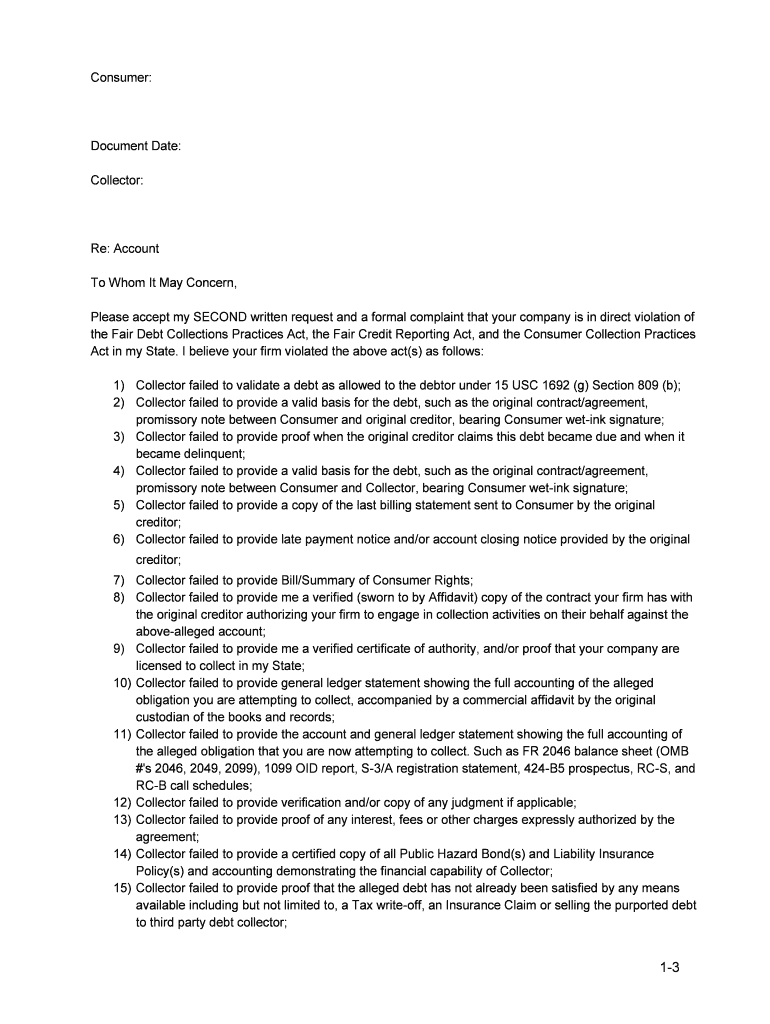

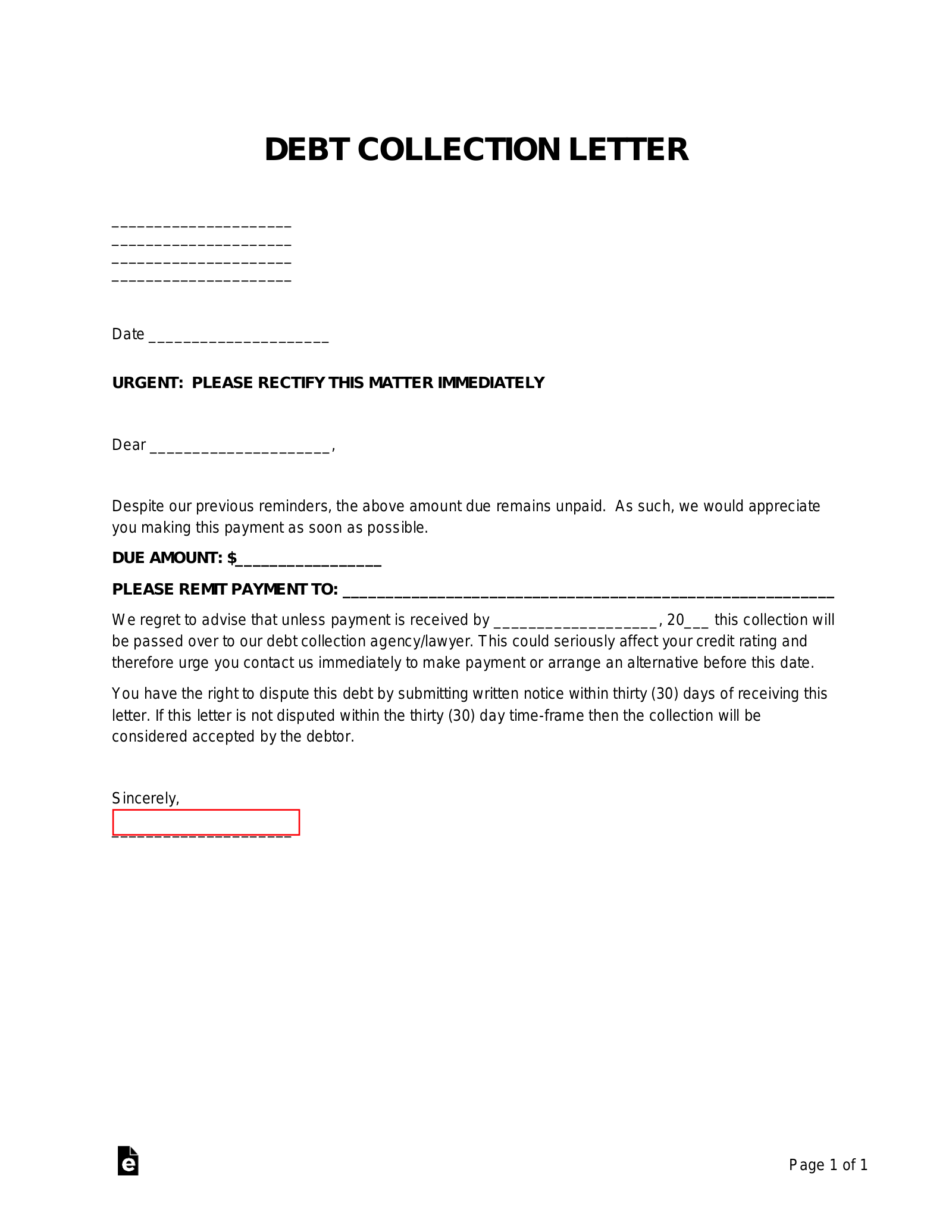

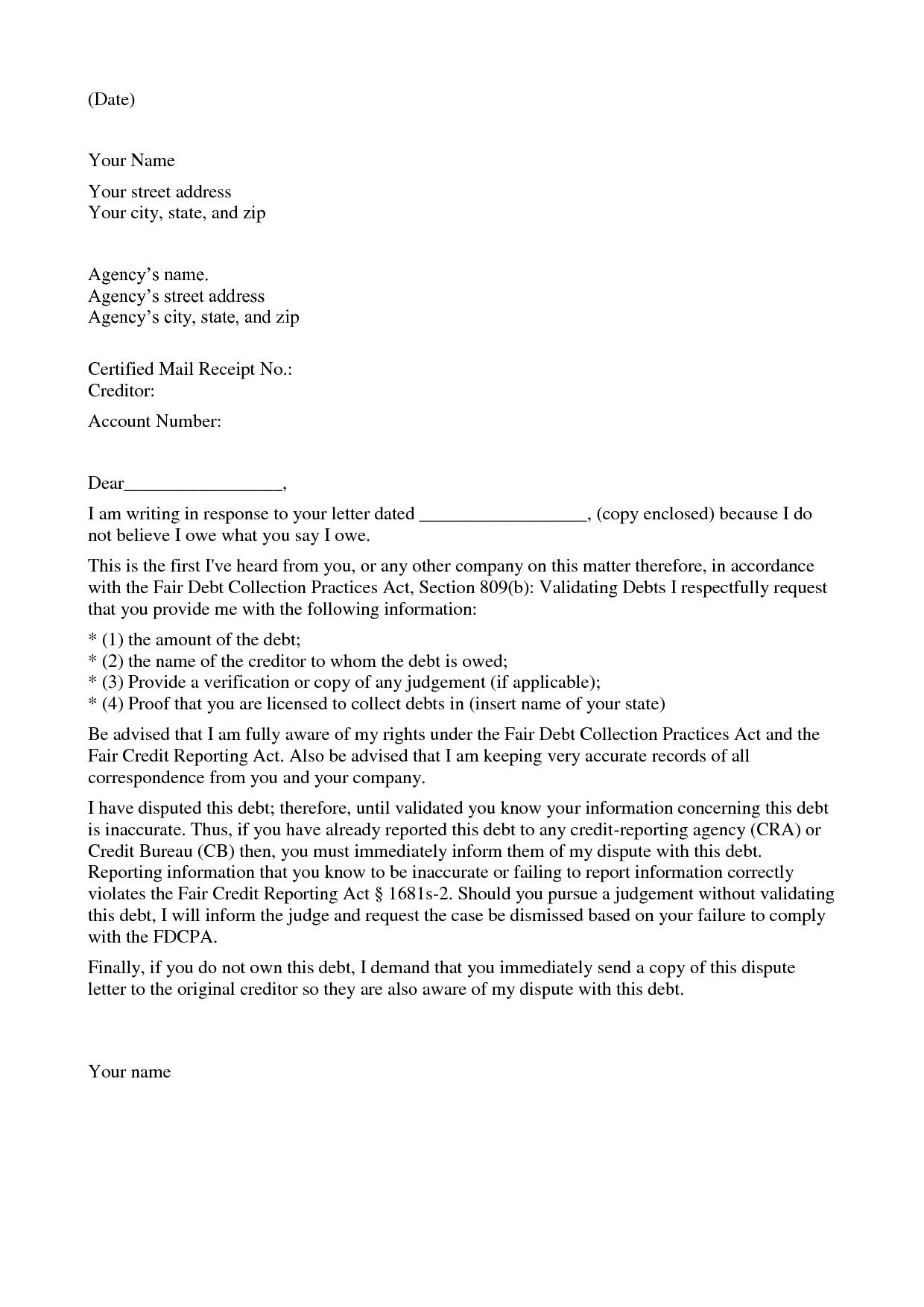

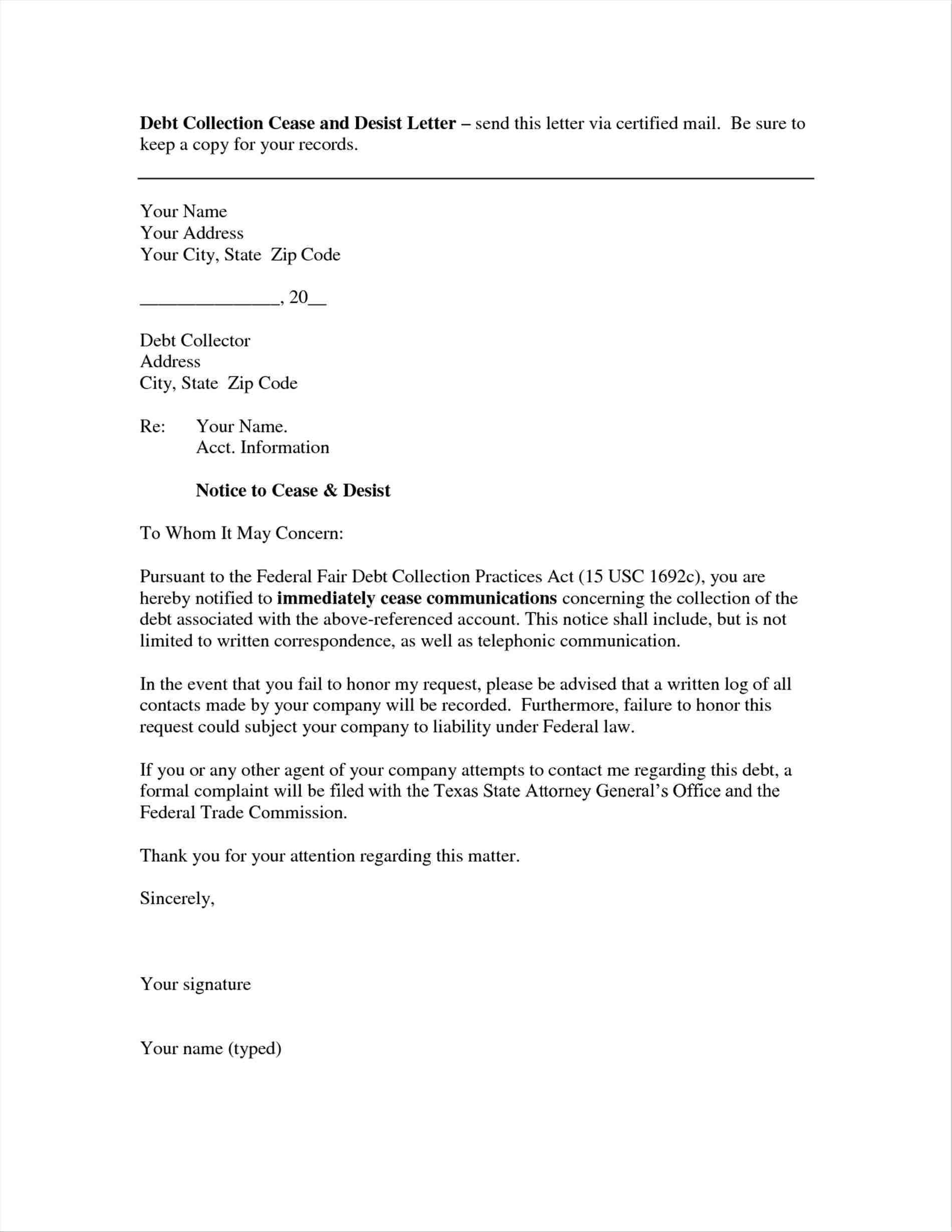

Debt Collection Dispute Letter Template - If you've received a notice from a debt collector, but have reason to believe you don't actually owe that debt (or owe a lot less than they say you owe), federal law gives you a. Below are three unique and detailed templates for disputing a debt with a collection agency. Use this letter to dispute a debt and to tell a collector to stop contacting you. Please consider this letter a formal dispute of the alleged debt pursuant to the fdcpa, 15 u.s.c. I also request verification, validation, and the name and address of the original. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must. Don’t just accept the conversation quickly deteriorating into verbal harassment and abuse, do something about it. Be sure to keep a copy of your letter and. I have disputed this debt; With the collection of any debt, a debt collector shall, unless the following information is contained in the initial communication or the consumer has paid the debt, send the consumer a written. Sample initial debt dispute letter: I have disputed this debt; Be sure to keep a copy of your letter and. I also request verification, validation, and the name and address of the original. Therefore, until validated you know your information concerning this debt is inaccurate. With the collection of any debt, a debt collector shall, unless the following information is contained in the initial communication or the consumer has paid the debt, send the consumer a written. If a consumer does not think the debt is theirs, thinks that the amount is incorrect, or believes that there is some other type of error, the consumer can send the collector a dispute letter. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must. Don’t just accept the conversation quickly deteriorating into verbal harassment and abuse, do something about it. Writing a dispute letter to a collection agency can be an effective way to address issues with your credit report or to contest a debt. Sample initial debt dispute letter: If a consumer does not think the debt is theirs, thinks that the amount is incorrect, or believes that there is some other type of error, the consumer can send the collector a dispute letter. Each template includes a short introductory paragraph and is structured to. If you've received a notice from a debt collector,. Don’t just accept the conversation quickly deteriorating into verbal harassment and abuse, do something about it. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. Sample initial debt dispute letter: By following the steps outlined in this guide.. If you've received a notice from a debt collector, but have reason to believe you don't actually owe that debt (or owe a lot less than they say you owe), federal law gives you a. With the collection of any debt, a debt collector shall, unless the following information is contained in the initial communication or the consumer has paid. If a consumer does not think the debt is theirs, thinks that the amount is incorrect, or believes that there is some other type of error, the consumer can send the collector a dispute letter. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must. Each template includes. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must. With the collection of any debt, a debt collector shall, unless the following information is contained in the initial communication or the consumer has paid the debt, send the consumer a written. Therefore, until validated you know your. With the collection of any debt, a debt collector shall, unless the following information is contained in the initial communication or the consumer has paid the debt, send the consumer a written. I also request verification, validation, and the name and address of the original. If you send this letter within 30 days from the date you first receive a. By following the steps outlined in this guide. I also request verification, validation, and the name and address of the original. Each template includes a short introductory paragraph and is structured to. Below are three unique and detailed templates for disputing a debt with a collection agency. Don’t just accept the conversation quickly deteriorating into verbal harassment and abuse, do. With the collection of any debt, a debt collector shall, unless the following information is contained in the initial communication or the consumer has paid the debt, send the consumer a written. Use this letter to dispute a debt and to tell a collector to stop contacting you. Please consider this letter a formal dispute of the alleged debt pursuant. If a consumer does not think the debt is theirs, thinks that the amount is incorrect, or believes that there is some other type of error, the consumer can send the collector a dispute letter. Below are three unique and detailed templates for disputing a debt with a collection agency. Please consider this letter a formal dispute of the alleged. If you've received a notice from a debt collector, but have reason to believe you don't actually owe that debt (or owe a lot less than they say you owe), federal law gives you a. Don’t just accept the conversation quickly deteriorating into verbal harassment and abuse, do something about it. Use this letter to dispute a debt and to. Each template includes a short introductory paragraph and is structured to. By following the steps outlined in this guide. If a consumer does not think the debt is theirs, thinks that the amount is incorrect, or believes that there is some other type of error, the consumer can send the collector a dispute letter. Sample initial debt dispute letter: Below are three unique and detailed templates for disputing a debt with a collection agency. Be sure to keep a copy of your letter and. I also request verification, validation, and the name and address of the original. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must. With the collection of any debt, a debt collector shall, unless the following information is contained in the initial communication or the consumer has paid the debt, send the consumer a written. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. Please consider this letter a formal dispute of the alleged debt pursuant to the fdcpa, 15 u.s.c. Don’t just accept the conversation quickly deteriorating into verbal harassment and abuse, do something about it. I have disputed this debt;Sample Letter For Disputing A Debt Collection Notice For for Debt

Professional Debt Collection Dispute Letter Template, Notice Letter

Sample Debt Dispute Letter Fill Out, Sign Online and Download PDF

Debt Dispute Letter Template Collection Letter Template Collection

Collection Dispute Letter Template

Debt Collection Letter Templates Letter Debt Collection Temp

Debt Dispute Letter Template Collection Letter Template Collection

Debt Dispute Letter Template Collection Letter Template Collection

免费 Collection Dispute Letter 样本文件在

Free Credit Report Dispute Letter Template PDF & Word

Therefore, Until Validated You Know Your Information Concerning This Debt Is Inaccurate.

Writing A Dispute Letter To A Collection Agency Can Be An Effective Way To Address Issues With Your Credit Report Or To Contest A Debt.

Use This Letter To Dispute A Debt And To Tell A Collector To Stop Contacting You.

If You've Received A Notice From A Debt Collector, But Have Reason To Believe You Don't Actually Owe That Debt (Or Owe A Lot Less Than They Say You Owe), Federal Law Gives You A.

Related Post: