Debt Dispute Letter Template

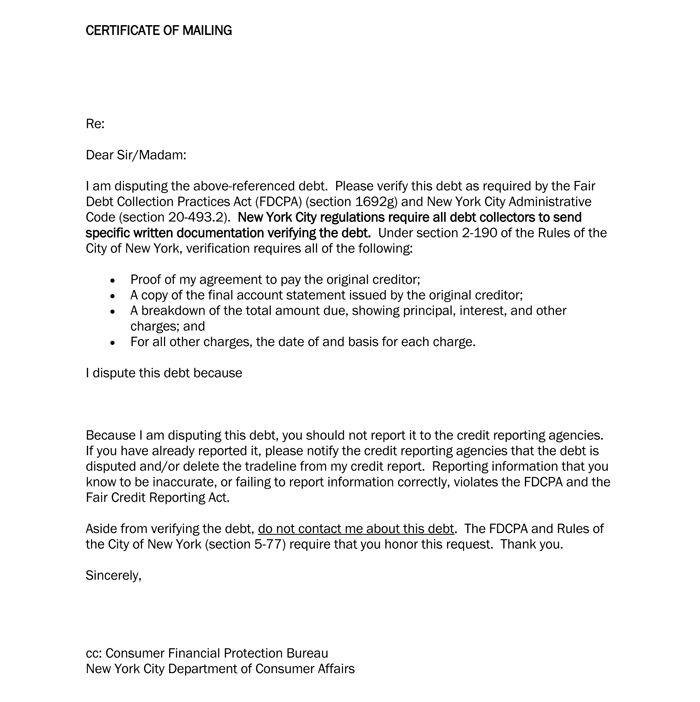

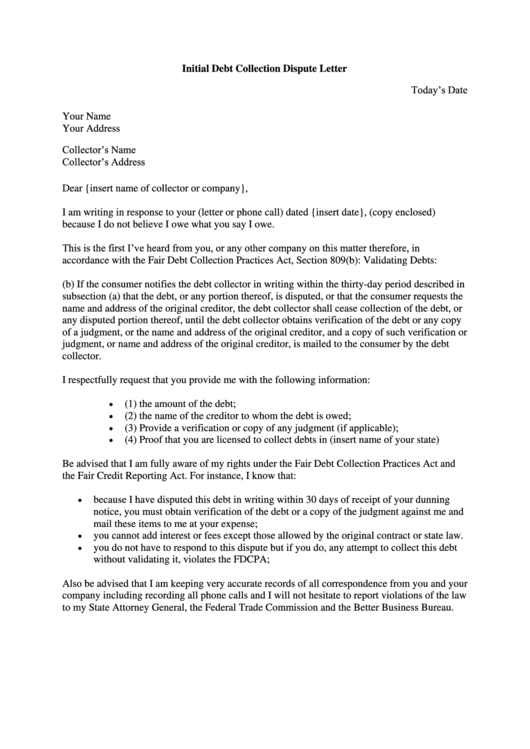

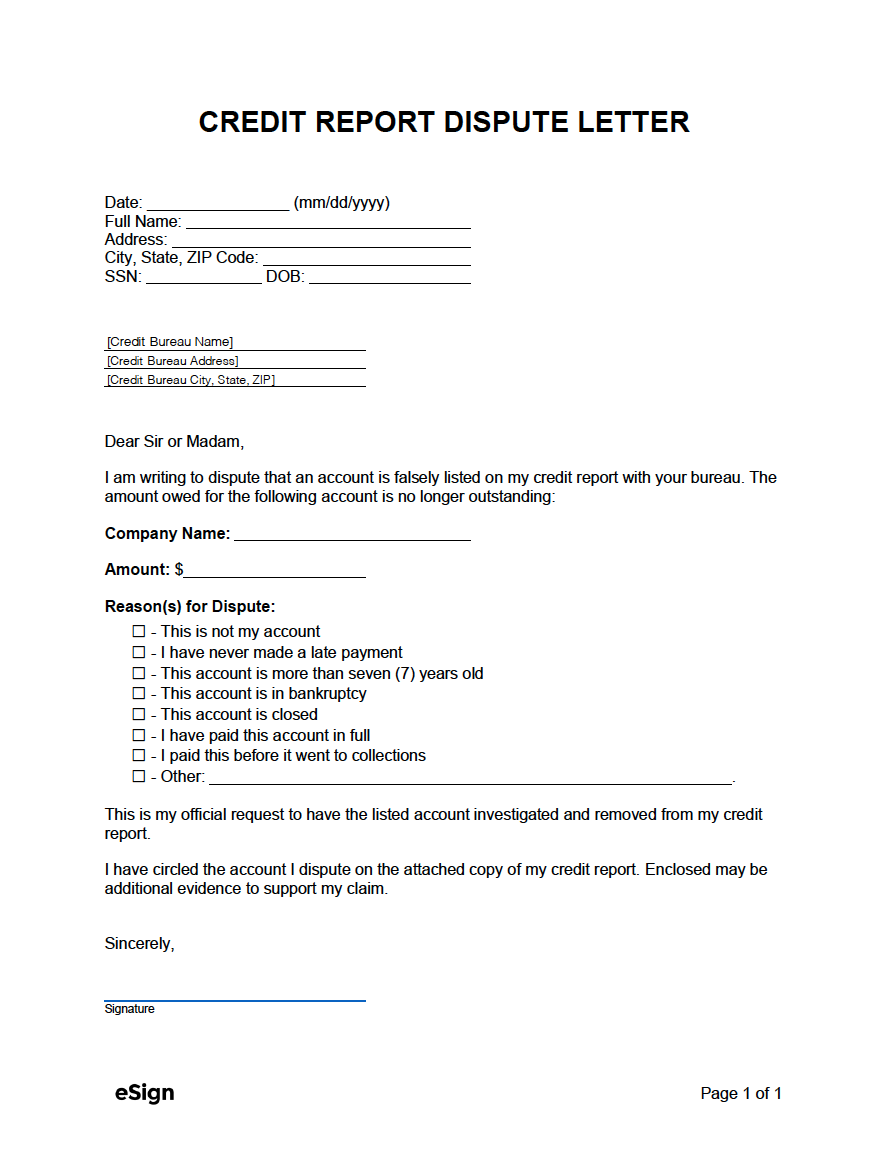

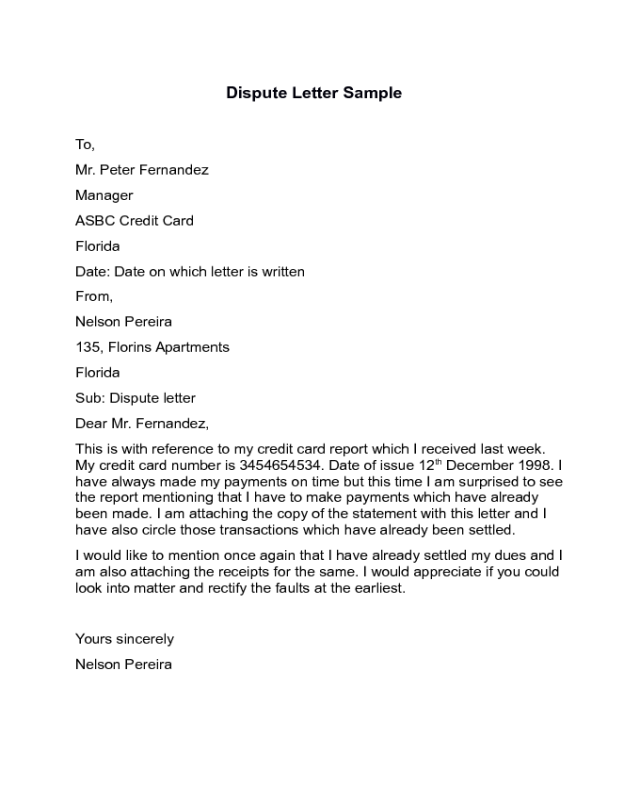

Debt Dispute Letter Template - Writing a dispute letter to a collection agency can be an effective way to address issues with your credit report or to contest a debt. Simplify the process of disputing debt collection efforts. Use this free debt dispute letter template to formally dispute a debt and protect your rights in dealing with creditors. Therefore, until validated you know your information concerning this debt is inaccurate. If you need help with the mailing, just ask at any post ofice. Discover our free debt collection dispute letter template, available in ms word and google docs formats. It is a necessary step you will need to make if someone is trying to make you pay back money that you don't actually owe, or perhaps, would owe a much smaller amount. Be sure to keep a copy of your letter and always send a letter like this “certified with a return receipt”. By following the steps outlined in this guide and utilizing the provided template, you can confidently navigate the process of disputing a debt. Use this letter to dispute a debt and to tell a collector to stop contacting you. Simplify the process of disputing debt collection efforts. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. Writing a dispute letter to a collection agency can be an effective way to address issues with your credit report or to contest a debt. Use this free debt dispute letter template to formally dispute a debt and protect your rights in dealing with creditors. A debt dispute letter is a written refusal to accept debt in response to a collector's notice. It is a necessary step you will need to make if someone is trying to make you pay back money that you don't actually owe, or perhaps, would owe a much smaller amount. Use the free sample debt dispute letter below to write your own personal debt dispute letter when you don’t owe the money or at least you don’t think you do. If you need help with the mailing, just ask at any post ofice. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must stop all collec tion activities until it verifies the debt. Be sure to keep a copy of your letter and always send a letter like this “certified with a return receipt”. Simplify the process of disputing debt collection efforts. Use this letter to dispute a debt and to tell a collector to stop contacting you. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must stop all collec tion activities until it verifies the debt. I have disputed this. Use this letter to dispute a debt and to tell a collector to stop contacting you. Writing a dispute letter to a collection agency can be an effective way to address issues with your credit report or to contest a debt. If you send this letter within 30 days from the date you first receive a debt collection letter, the. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must stop all collec tion activities until it verifies the debt. Be sure to keep a copy of your letter and always send a letter like this “certified with a return receipt”. Use this free debt dispute letter template. Use the free sample debt dispute letter below to write your own personal debt dispute letter when you don’t owe the money or at least you don’t think you do. Therefore, until validated you know your information concerning this debt is inaccurate. Be sure to keep a copy of your letter and always send a letter like this “certified with. By following the steps outlined in this guide and utilizing the provided template, you can confidently navigate the process of disputing a debt. Craft an effective letter to challenge the legitimacy of the debt and seek resolution. Be sure to keep a copy of your letter and always send a letter like this “certified with a return receipt”. A debt. If you've received a notice from a debt collector, but have reason to believe you don't actually owe that debt (or owe a lot less than they say you owe), federal law gives you a brief. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must stop all. Therefore, until validated you know your information concerning this debt is inaccurate. Craft an effective letter to challenge the legitimacy of the debt and seek resolution. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. Use this free. I have disputed this debt; Use the free sample debt dispute letter below to write your own personal debt dispute letter when you don’t owe the money or at least you don’t think you do. Craft an effective letter to challenge the legitimacy of the debt and seek resolution. Feel free to copy and paste the letter below into your. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. Feel free to copy and paste the letter below into your word processor. By following the steps outlined in this guide and utilizing the provided template, you can confidently. Discover our free debt collection dispute letter template, available in ms word and google docs formats. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. If you need help with the mailing, just ask at any post ofice.. If you need help with the mailing, just ask at any post ofice. Feel free to copy and paste the letter below into your word processor. Therefore, until validated you know your information concerning this debt is inaccurate. By following the steps outlined in this guide and utilizing the provided template, you can confidently navigate the process of disputing a debt. Discover our free debt collection dispute letter template, available in ms word and google docs formats. It is a necessary step you will need to make if someone is trying to make you pay back money that you don't actually owe, or perhaps, would owe a much smaller amount. If you send this letter within 30 days from the date you first receive a debt collection letter, the debt collector must stop all collec tion activities until it verifies the debt. Use this free debt dispute letter template to formally dispute a debt and protect your rights in dealing with creditors. Writing a dispute letter to a collection agency can be an effective way to address issues with your credit report or to contest a debt. A debt dispute letter is a written refusal to accept debt in response to a collector's notice. I have disputed this debt; A debt dispute letter is a written statement composed by an individual who believes a creditor or debt collection agency has made a mistake and attributed a wrong amount of debt to them or mistook them for another borrower. Be sure to keep a copy of your letter and always send a letter like this “certified with a return receipt”. The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they are trying to collect. Use the free sample debt dispute letter below to write your own personal debt dispute letter when you don’t owe the money or at least you don’t think you do.Professional Debt Collection Dispute Letter Template Etsy Credit

What Is A 604 Dispute Letter

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Sample Debt Validation Letters & Templates

Collections Dispute Letter Template

Professional Debt Collection Dispute Letter Template Etsy in 2024

Credit Dispute Letter Templates Credit Report Dispute Letter

2025 Dispute Letter Templates Fillable, Printable PDF & Forms Handypdf

Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

If You've Received A Notice From A Debt Collector, But Have Reason To Believe You Don't Actually Owe That Debt (Or Owe A Lot Less Than They Say You Owe), Federal Law Gives You A Brief.

Simplify The Process Of Disputing Debt Collection Efforts.

Craft An Effective Letter To Challenge The Legitimacy Of The Debt And Seek Resolution.

Use This Letter To Dispute A Debt And To Tell A Collector To Stop Contacting You.

Related Post:

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-05.jpg)

![Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/05/Credit-Dispute-Letter-1-768x1086.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-17.jpg)