Debt Payment Plan Template

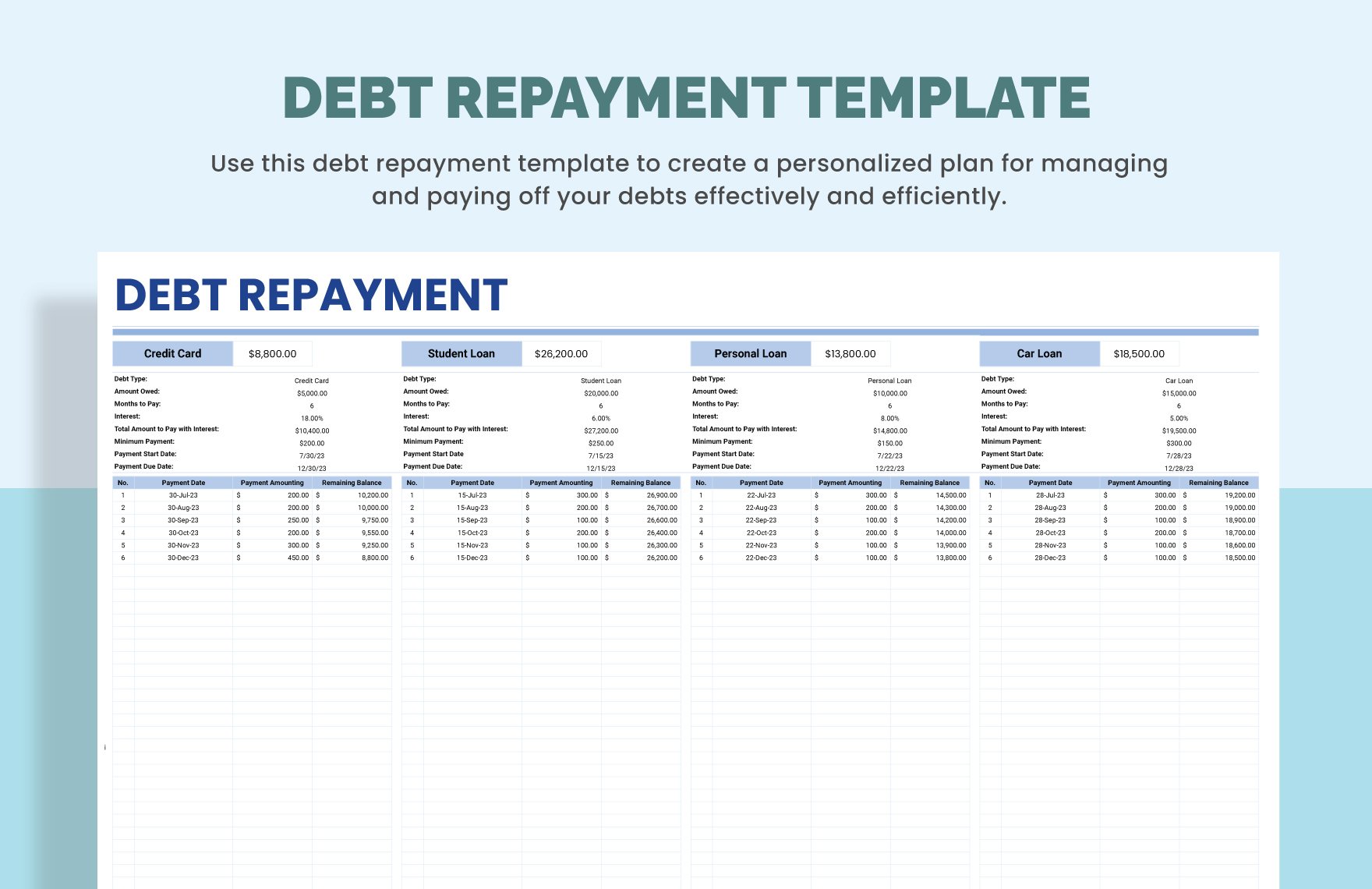

Debt Payment Plan Template - Debt repayment plans templates are useful and practical when you need to deal with data and tables in daily work. A payment plan agreement is a legal document outlining how a borrower agrees to pay back a lender over time. Explore professionally designed free payment plan templates to edit online. The plan can help debtors track their debts and ultimately speed up the debt. Whether you’re dealing with student loans, credit card. This can involve budgeting, setting clear goals around paying down the debt and committing to making steady payments that are affordable and separate from. Customizable and printable for professional quality. It contains tables for each date, including the. Download a free payment plan template to create a structured agreement with your creditor. Specify the information about all parties involved, including legal names and contact. Get the necessary forms and instructions to implement a chapter 13 plan and manage your debt. Payments are commonly made on a weekly or monthly basis until. Debt repayment plans templates are useful and practical when you need to deal with data and tables in daily work. A creditor can set up a payment plan agreement to make the debtor’s. A debt payment schedule or plan is a strategy individuals or businesses use to make consistent payments toward their debt to pay it off as soon as possible. A payment plan agreement is a legal document outlining how a borrower agrees to pay back a lender over time. Here's how to draft a payment contract template, whether you are the debtor or the creditor: A payment plan agreement is a legal contract that outlines how a debtor will pay back the creditor. Customize the template with your debt amount, payment method, interest rate, repayment. It contains tables for each date, including the. Get the necessary forms and instructions to implement a chapter 13 plan and manage your debt. Download a free payment plan template to create a structured agreement with your creditor. A payment plan agreement is a legal contract that outlines how a debtor will pay back the creditor. A creditor can set up a payment plan agreement to make the. Here's how to draft a payment contract template, whether you are the debtor or the creditor: This can involve budgeting, setting clear goals around paying down the debt and committing to making steady payments that are affordable and separate from. It contains tables for each date, including the. The plan can help debtors track their debts and ultimately speed up. Specify the information about all parties involved, including legal names and contact. The plan can help debtors track their debts and ultimately speed up the debt. It contains tables for each date, including the. A payment plan agreement is a legal contract that outlines how a debtor will pay back the creditor. Payments are commonly made on a weekly or. A payment plan agreement is a legal document outlining how a borrower agrees to pay back a lender over time. It contains tables for each date, including the. Download a free payment plan template to create a structured agreement with your creditor. Columns and rows have been professionally designed so that you only. Payments are commonly made on a weekly. Whether you’re dealing with student loans, credit card. Customizable and printable for professional quality. A debt payment schedule or plan is a strategy individuals or businesses use to make consistent payments toward their debt to pay it off as soon as possible. A payment plan agreement is a legal contract that outlines how a debtor will pay back the creditor. Customize. Payments are commonly made on a weekly or monthly basis until. A debt payment schedule or plan is a strategy individuals or businesses use to make consistent payments toward their debt to pay it off as soon as possible. In this article, we’ll share 8 free google sheets debt payoff templates for 2023 to help you take control of your finances.. In this article, we’ll share 8 free google sheets debt payoff templates for 2023 to help you take control of your finances. Explore professionally designed free payment plan templates to edit online. Here's how to draft a payment contract template, whether you are the debtor or the creditor: It contains tables for each date, including the. Customizable and printable for. This can involve budgeting, setting clear goals around paying down the debt and committing to making steady payments that are affordable and separate from. A debt payment schedule or plan is a strategy individuals or businesses use to make consistent payments toward their debt to pay it off as soon as possible. Debt repayment plans templates are useful and practical when. A payment plan agreement is a legal contract that outlines how a debtor will pay back the creditor. Payments are commonly made on a weekly or monthly basis until. Discover effective debt repayment plans and strategies with our collection of legal documents. Columns and rows have been professionally designed so that you only. Download a free payment plan template to. Specify the information about all parties involved, including legal names and contact. Get the necessary forms and instructions to implement a chapter 13 plan and manage your debt. A creditor can set up a payment plan agreement to make the debtor’s. In this article, we’ll share 8 free google sheets debt payoff templates for 2023 to help you take control. Debt repayment plans templates are useful and practical when you need to deal with data and tables in daily work. Whether you’re dealing with student loans, credit card. A payment plan agreement is a legal contract that outlines how a debtor will pay back the creditor. It contains tables for each date, including the. Payments are commonly made on a weekly or monthly basis until. Specify the information about all parties involved, including legal names and contact. Download a free payment plan template to create a structured agreement with your creditor. The plan can help debtors track their debts and ultimately speed up the debt. The set includes a debt overview sheet, a debt payoff tracking. Explore professionally designed debt spreadsheet templates that are free, customizable, and printable. Customize the template with your debt amount, payment method, interest rate, repayment. Get the necessary forms and instructions to implement a chapter 13 plan and manage your debt. A payment plan agreement is a legal document outlining how a borrower agrees to pay back a lender over time. A debt payment schedule or plan is a strategy individuals or businesses use to make consistent payments toward their debt to pay it off as soon as possible. Customizable and printable for professional quality. This can involve budgeting, setting clear goals around paying down the debt and committing to making steady payments that are affordable and separate from.Debt Repayment Plan Printable

Debt Tracker Excel Template, Debt Payoff Planner, Debt Repayment

Debt Payment Plan Printable Bill Payment Schedule Pinterest Etsy

Template Of Payment Agreement

Debt Templates in Excel FREE Download

Free Debt Spreadsheet Templates, Editable and Printable

Debt Payoff Worksheet Excel Debt Spreadsheet Payoff Template

FREE Payment Plan Templates & Examples Edit Online & Download

Debt Payment Plan Template Edit Online & Download Example

Debt Tracker Payment Plan Template Edit Online & Download Example

Discover Effective Debt Repayment Plans And Strategies With Our Collection Of Legal Documents.

Columns And Rows Have Been Professionally Designed So That You Only.

A Creditor Can Set Up A Payment Plan Agreement To Make The Debtor’s.

In This Article, We’ll Share 8 Free Google Sheets Debt Payoff Templates For 2023 To Help You Take Control Of Your Finances.

Related Post: