Debt Snowball Excel Template

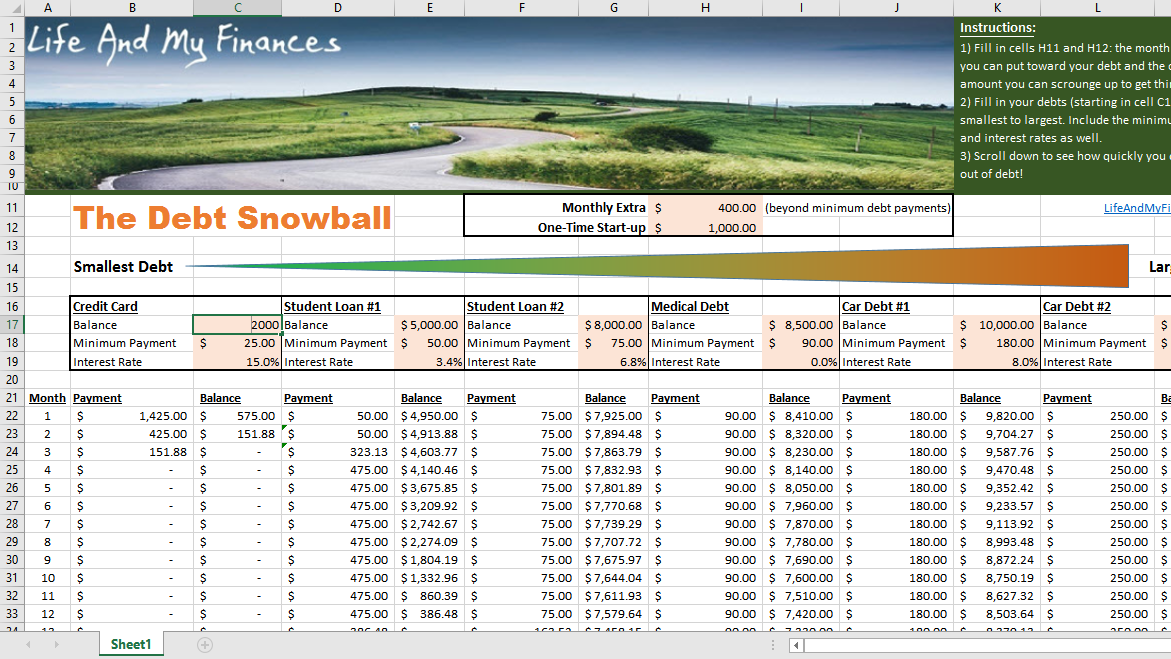

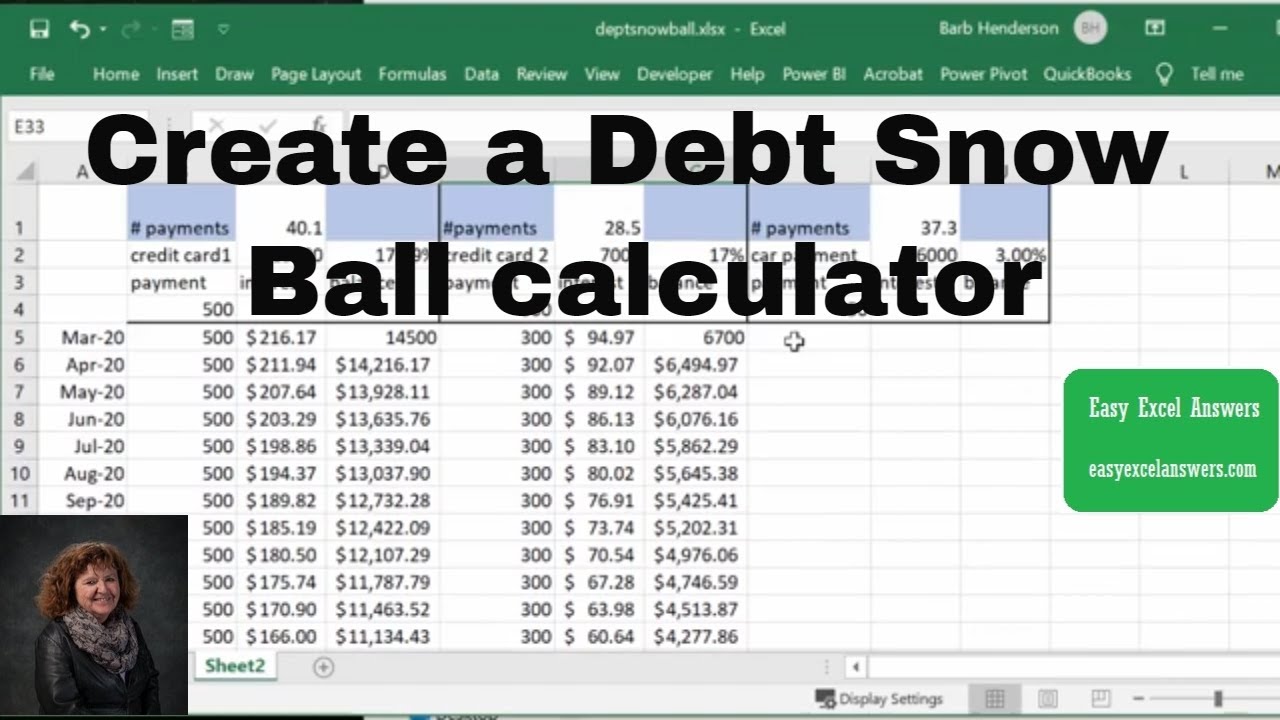

Debt Snowball Excel Template - You will also learn the steps needed to create. Accelerate your journey to financial freedom with our editable debt snowball spreadsheet template. The debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. Your debt snowball spreadsheet will help you organize your debt, use simple formulas to calculate your debt payoff dates, order your debts from smallest to largest, and. With this snowball debt calculator spreadsheet, you can enter the rates (including teaser rates) and balances of all your debts, as well as change the order of your debt snowball plan to. In this guide, you will learn what the debt snowball method and the debt snowball spreadsheet are and how they can help you pay off your debt. Use our spreadsheets for debt tracking and payoff to simplify your financial planning. Snowball debt payoff spreadsheet excel will allow you to easily calculate. This powerful tool empowers you to. Find 14+ best templates to track and pay off your debts using the debt snowball method. Accelerate your journey to financial freedom with our editable debt snowball spreadsheet template. Get free google sheets debt payoff templates and debt snowball calculators! With this snowball debt calculator spreadsheet, you can enter the rates (including teaser rates) and balances of all your debts, as well as change the order of your debt snowball plan to. In this guide, you will learn what the debt snowball method and the debt snowball spreadsheet are and how they can help you pay off your debt. This is the exact amount you have leftover at the end of the month. The debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. Use our spreadsheets for debt tracking and payoff to simplify your financial planning. Your debt snowball spreadsheet will help you organize your debt, use simple formulas to calculate your debt payoff dates, order your debts from smallest to largest, and. Find 14+ best templates to track and pay off your debts using the debt snowball method. Here’s how to use the debt snowball spreadsheet to start paying down your debt today: Your debt snowball spreadsheet will help you organize your debt, use simple formulas to calculate your debt payoff dates, order your debts from smallest to largest, and. You will have to use a debt snowball spreadsheet or a debt snowball form in this method. You will also learn the steps needed to create. Find 14+ best templates to track and. With this snowball debt calculator spreadsheet, you can enter the rates (including teaser rates) and balances of all your debts, as well as change the order of your debt snowball plan to. You will have to use a debt snowball spreadsheet or a debt snowball form in this method. You will also learn the steps needed to create. The debt. Here’s how to use the debt snowball spreadsheet to start paying down your debt today: The debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. Get free google sheets debt payoff templates and debt snowball calculators! Compare different spreadsheets for excel and google sheets with feature… Find. In this guide, you will learn what the debt snowball method and the debt snowball spreadsheet are and how they can help you pay off your debt. Here’s how to use the debt snowball spreadsheet to start paying down your debt today: Get free google sheets debt payoff templates and debt snowball calculators! Compare different spreadsheets for excel and google. The debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. Accelerate your journey to financial freedom with our editable debt snowball spreadsheet template. This is the exact amount you have leftover at the end of the month. Coming up with a plan for paying off debt may. Luckily we have developed a tool that will allow you to use one of the most proven methods to pay off debt for good. Find 14+ best templates to track and pay off your debts using the debt snowball method. Coming up with a plan for paying off debt may sound difficult, especially if you don’t have a financial background.. Get free google sheets debt payoff templates and debt snowball calculators! Your debt snowball spreadsheet will help you organize your debt, use simple formulas to calculate your debt payoff dates, order your debts from smallest to largest, and. With this snowball debt calculator spreadsheet, you can enter the rates (including teaser rates) and balances of all your debts, as well. You will have to use a debt snowball spreadsheet or a debt snowball form in this method. Use our spreadsheets for debt tracking and payoff to simplify your financial planning. The debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. The debt snowball calculator is a simple. Use our spreadsheets for debt tracking and payoff to simplify your financial planning. The debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. Compare different spreadsheets for excel and google sheets with feature… In this guide, you will learn what the debt snowball method and the debt. The debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. Find 14+ best templates to track and pay off your debts using the debt snowball method. You will also learn the steps needed to create. This powerful tool empowers you to. Use our spreadsheets for debt tracking. Compare different spreadsheets for excel and google sheets with feature… You will have to use a debt snowball spreadsheet or a debt snowball form in this method. Get free google sheets debt payoff templates and debt snowball calculators! Your debt snowball spreadsheet will help you organize your debt, use simple formulas to calculate your debt payoff dates, order your debts from smallest to largest, and. The debt snowball calculator is a simple spreadsheet available for microsoft excel® and google sheets that helps you come up with a plan. Here’s how to use the debt snowball spreadsheet to start paying down your debt today: Coming up with a plan for paying off debt may sound difficult, especially if you don’t have a financial background. You will also learn the steps needed to create. Find 14+ best templates to track and pay off your debts using the debt snowball method. Use our spreadsheets for debt tracking and payoff to simplify your financial planning. With this snowball debt calculator spreadsheet, you can enter the rates (including teaser rates) and balances of all your debts, as well as change the order of your debt snowball plan to. This is the exact amount you have leftover at the end of the month. Snowball debt payoff spreadsheet excel will allow you to easily calculate. This powerful tool empowers you to.Debt Snowball Excel Spreadsheet Google Sheets Debt Payoff Etsy Canada

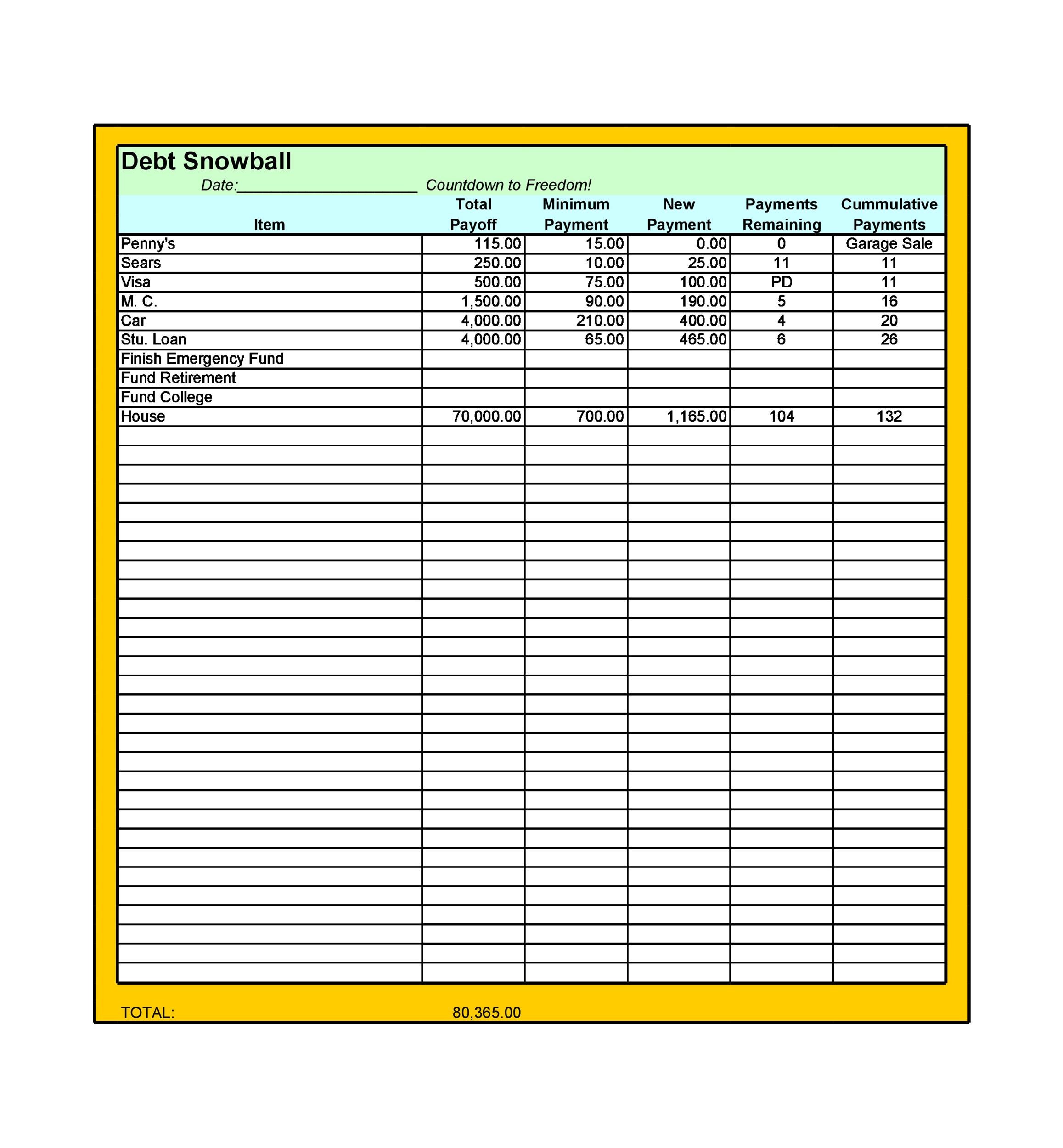

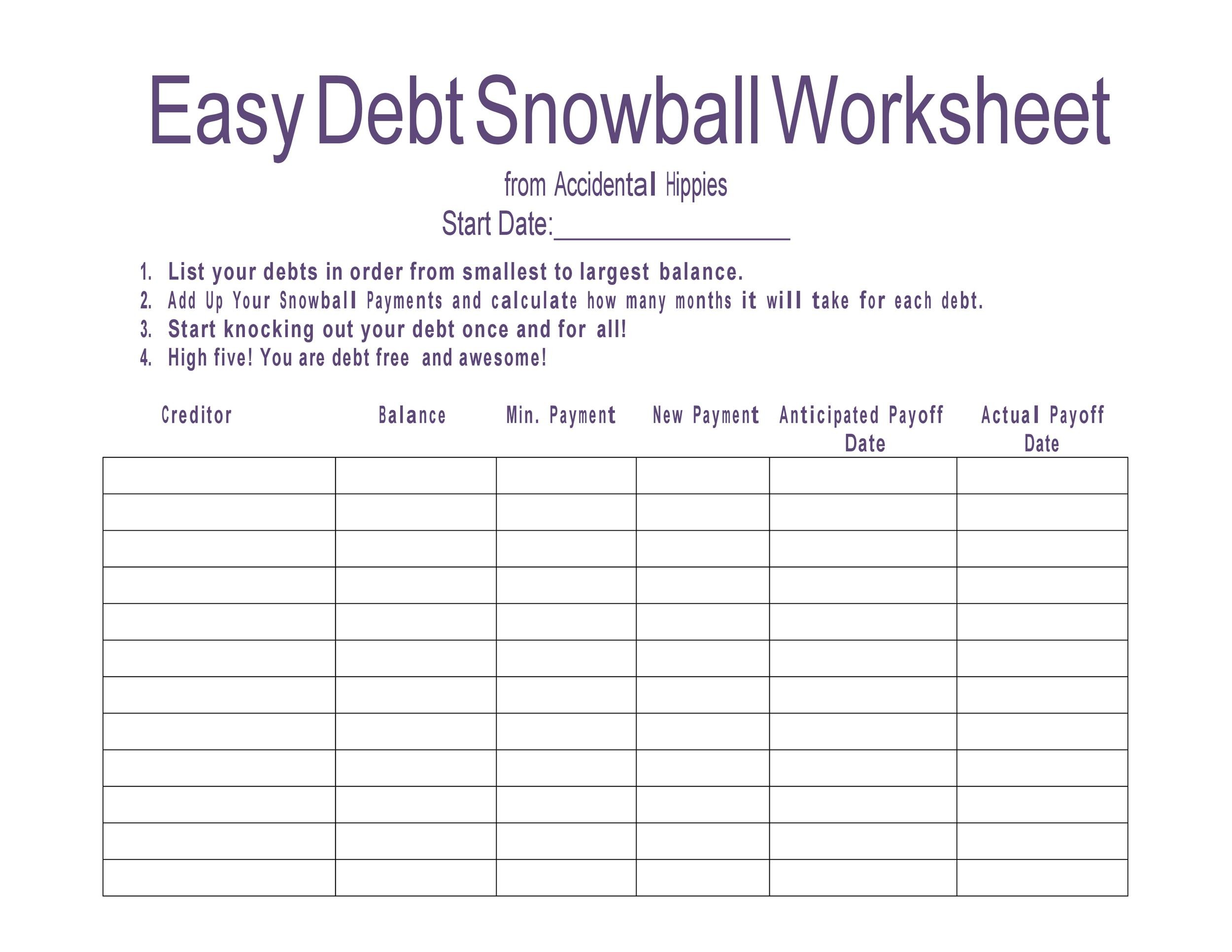

Free Printable Debt Snowball Templates [PDF, Excel] Worksheet

Free Printable Debt Snowball Spreadsheet

38 Debt Snowball Spreadsheets, Forms & Calculators

Free Printable Debt Snowball Templates [PDF, Excel] Worksheet

This Spreadsheet Calculates When You'll Pay Off Debt With The Snowball

Easy to use Digital Debt Snowball Excel Template Etsy

38 Debt Snowball Spreadsheets, Forms & Calculators

Debt Snowball Spreadsheet, Debt Snowball Calculator, Debt Snowball

How to Create a Debt Snow Ball Calculator in Excel YouTube

The Debt Snowball Calculator Is A Simple Spreadsheet Available For Microsoft Excel® And Google Sheets That Helps You Come Up With A Plan.

In This Guide, You Will Learn What The Debt Snowball Method And The Debt Snowball Spreadsheet Are And How They Can Help You Pay Off Your Debt.

Accelerate Your Journey To Financial Freedom With Our Editable Debt Snowball Spreadsheet Template.

Luckily We Have Developed A Tool That Will Allow You To Use One Of The Most Proven Methods To Pay Off Debt For Good.

Related Post:

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/05/excel-debt-snowball-template.jpg?gid=443)

![Free Printable Debt Snowball Templates [PDF, Excel] Worksheet](https://www.typecalendar.com/wp-content/uploads/2023/02/Debt-Snowball-724x1024.jpg)