Donation Receipt Letter Template

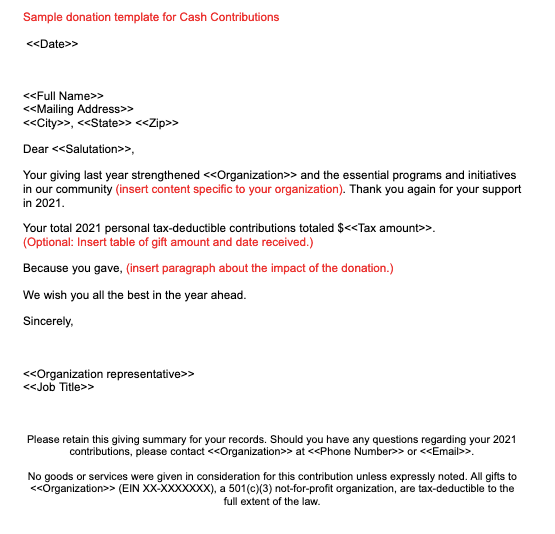

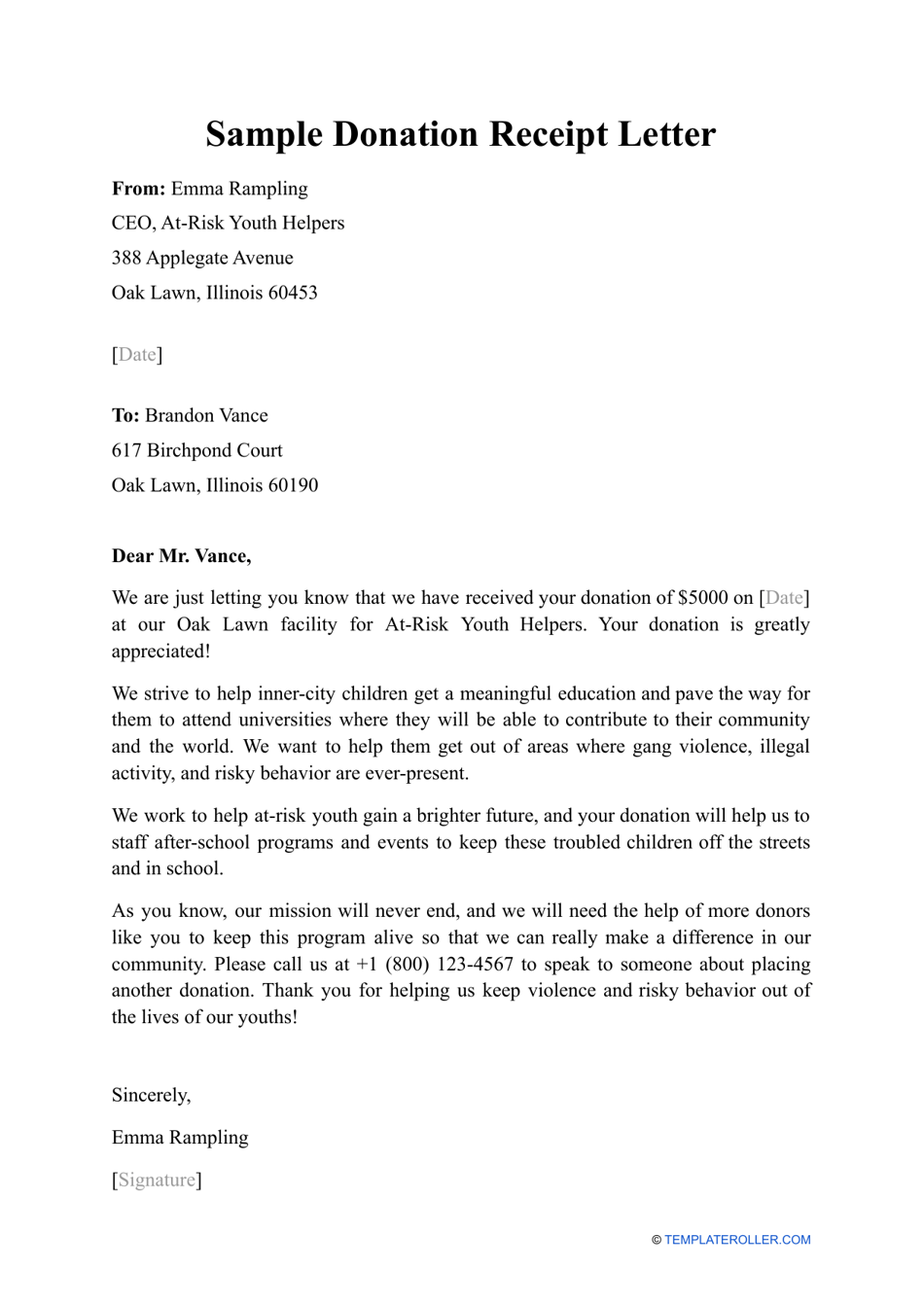

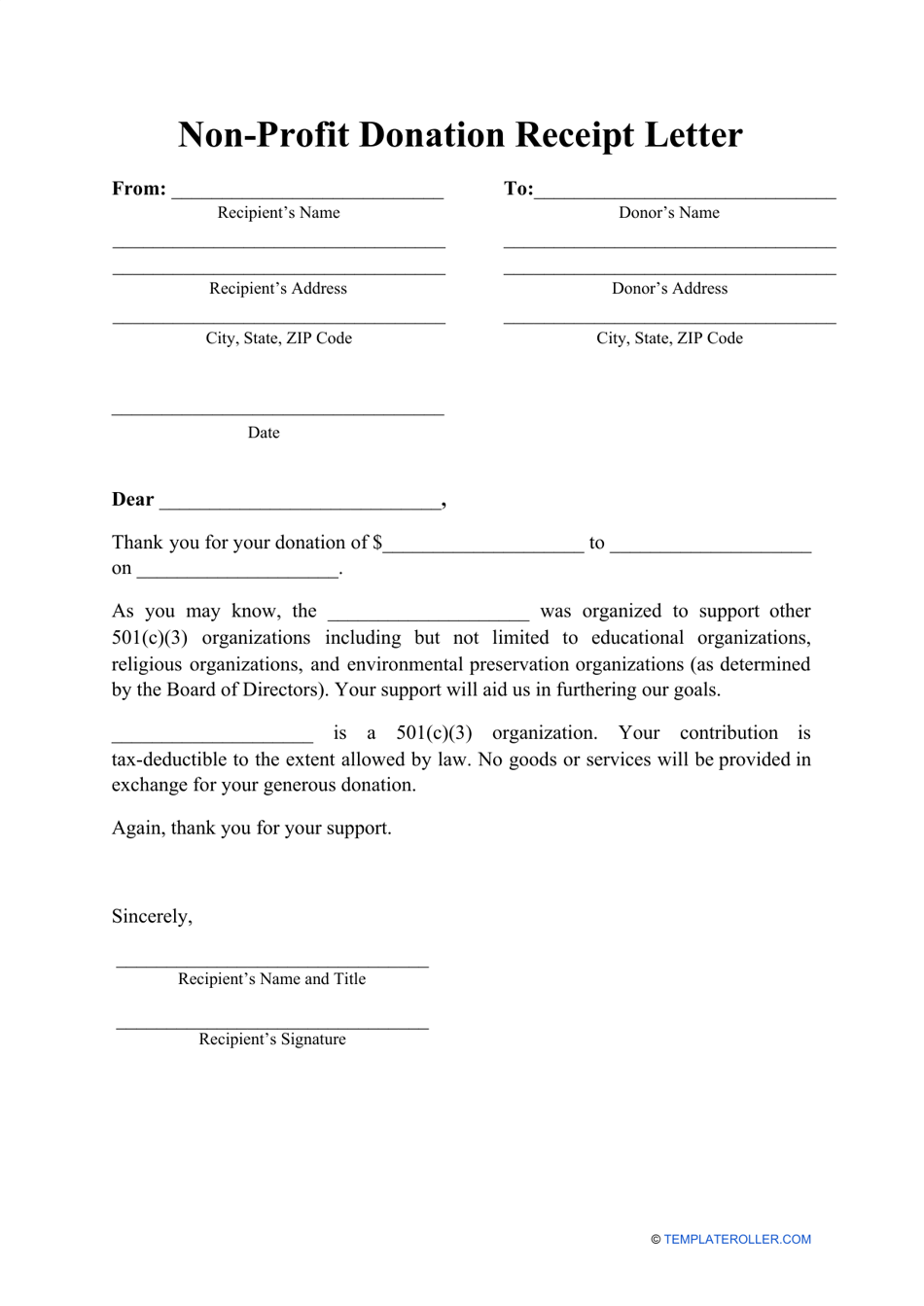

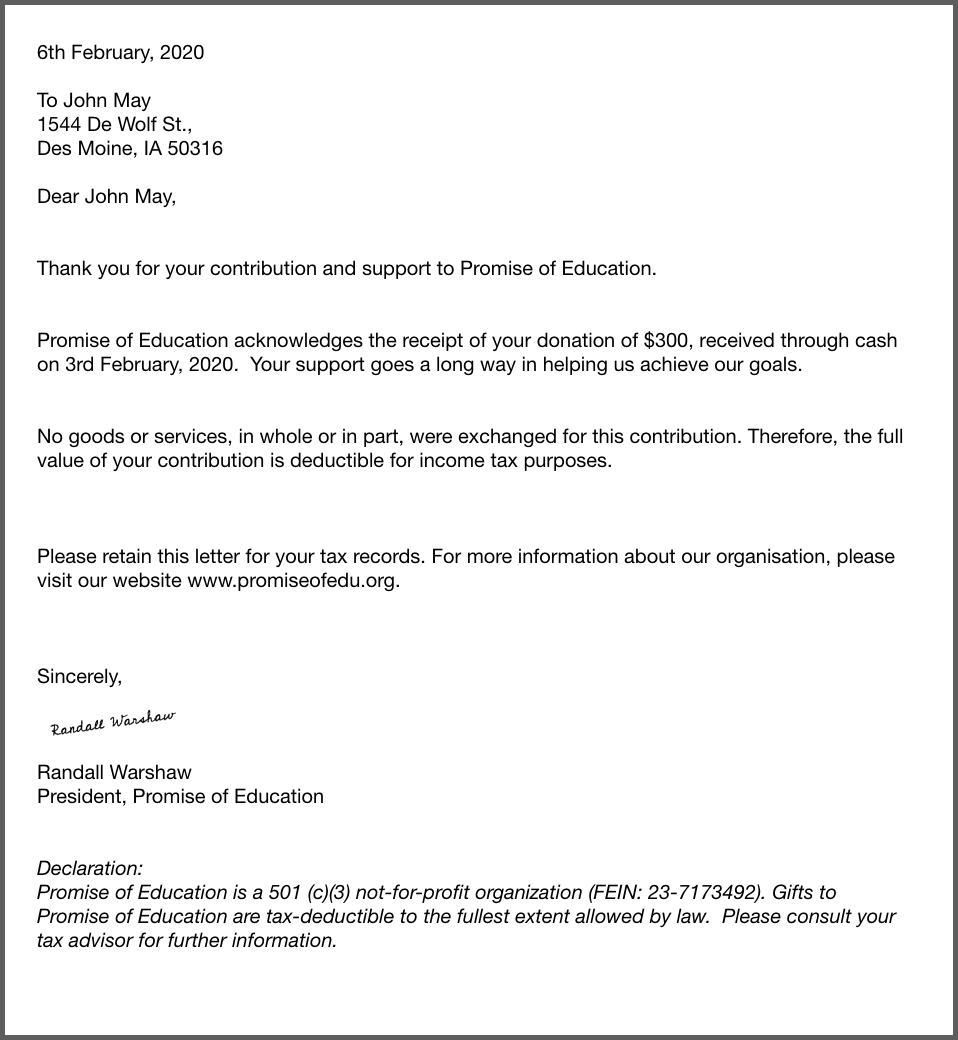

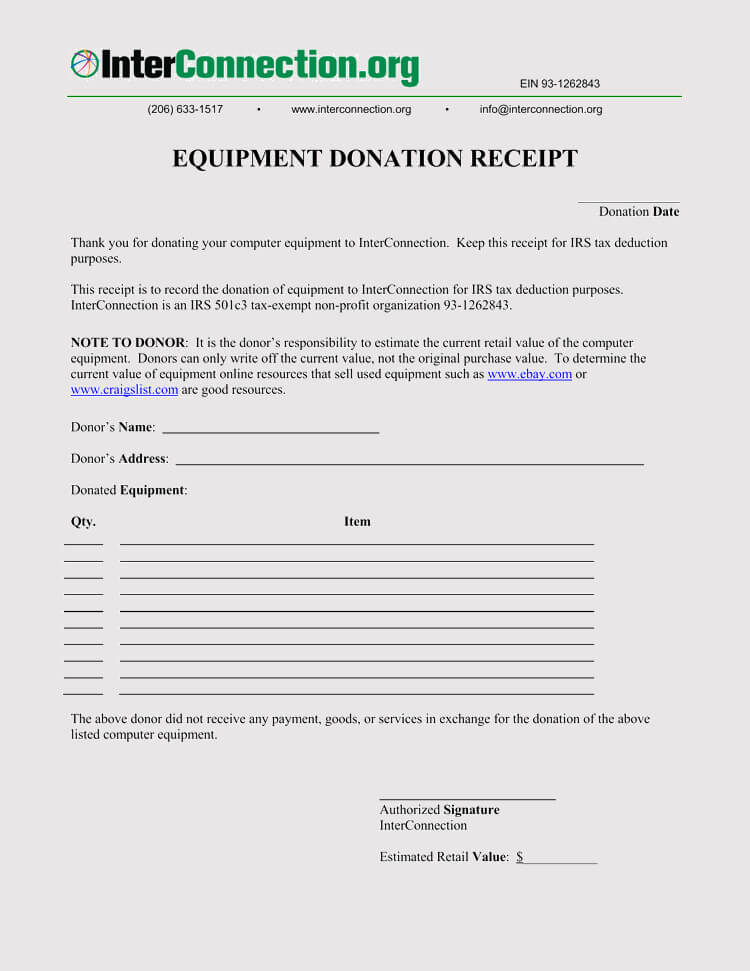

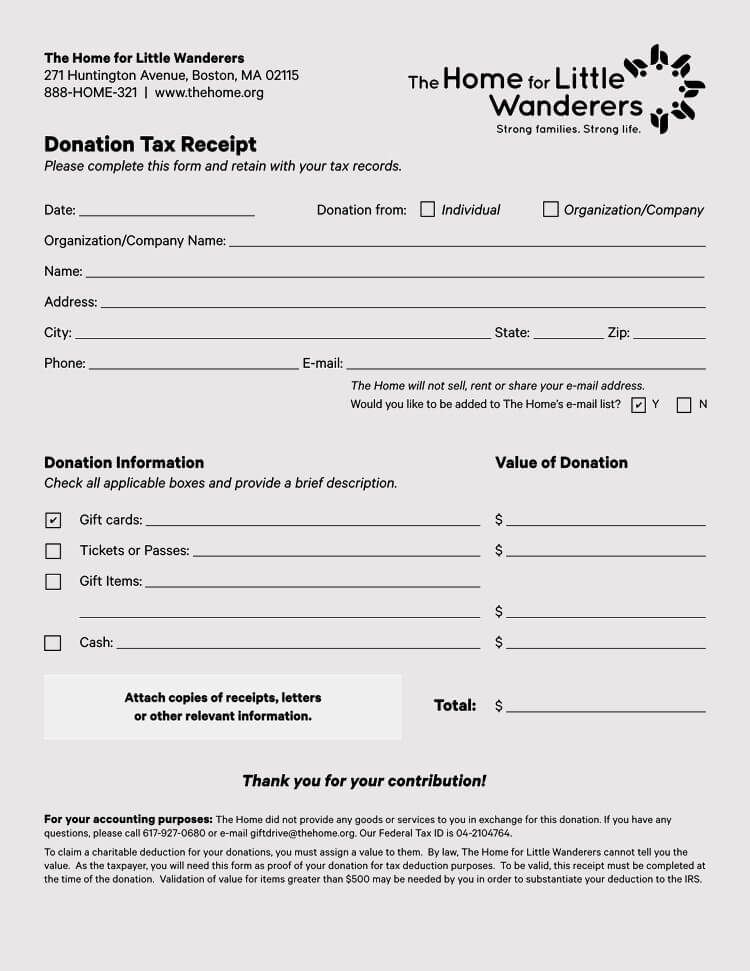

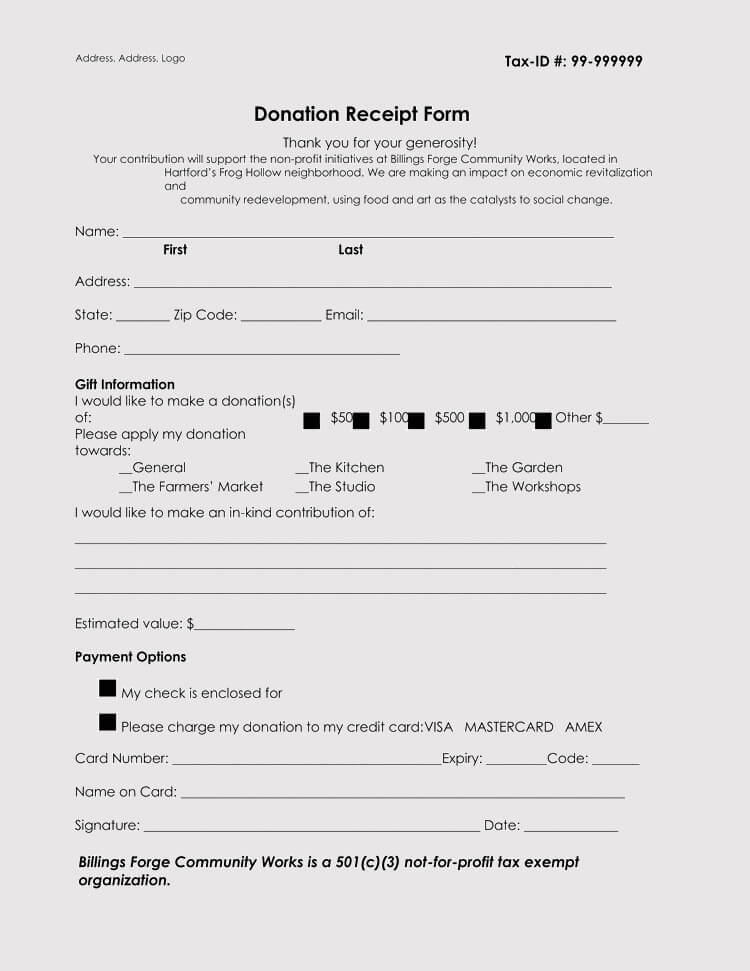

Donation Receipt Letter Template - Get simple, free templates that can be used for any donation or gift here. You can make your own template for your organization to be prepared in the event that a donation is given to your group. Creating your donation receipt template. Donation receipt templates are a necessity when it comes to charitable donations. This receipt typically includes essential information such as the donor's name, donation amount (including any significant figures, like $100 or $1,000), date of donation (often including the month, day, year. Plus, well share a handy template you can use to streamline your process. Nonprofits and charitable organizations use these to acknowledge and record contributions from donors. In this article, well explore the key elements that should be included in a charity donation receipt, ensuring transparency and gratitude in every charitable transaction. Use these donation receipt email & letter templates to help you stay compliant, save time, and maintain good relationships with your donors. Use this template or letter sample to write your donation receipt letter. You can make your own template for your organization to be prepared in the event that a donation is given to your group. This receipt is issued to individuals who have donated cash or payment, personal property, or a vehicle and seek to claim the donation as a tax deduction. Donation receipt templates are a necessity when it comes to charitable donations. Creating your donation receipt template. Charitable organization s must complete a 501(c)(3) donation receipt when receiving gifts of $250 or more. Plus, well share a handy template you can use to streamline your process. There are no specific formats for donation receipt templates. Here are some free 501(c)(3) donation receipt templates for you to download and use; The donation receipt may be issued by your charity, organization, or group to document the receipt of a donation. Nonprofits and charitable organizations use these to acknowledge and record contributions from donors. The donation receipt may be issued by your charity, organization, or group to document the receipt of a donation. Using a (501)(c)(3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. In this article, well explore the key elements that should be included in a charity donation receipt, ensuring transparency and gratitude in. Use this template or letter sample to write your donation receipt letter. Creating your donation receipt template. You can make your own template for your organization to be prepared in the event that a donation is given to your group. Use these donation receipt email & letter templates to help you stay compliant, save time, and maintain good relationships with. Charitable organization s must complete a 501(c)(3) donation receipt when receiving gifts of $250 or more. Creating your donation receipt template. The donation receipt may be issued by your charity, organization, or group to document the receipt of a donation. Get simple, free templates that can be used for any donation or gift here. Donation receipt templates are a necessity. Creating your donation receipt template. Use this template or letter sample to write your donation receipt letter. Donation receipt templates are a necessity when it comes to charitable donations. An official donation receipt is a document that provides the donor with an itemized list of how their donation was spent. This receipt typically includes essential information such as the donor's. The donation receipt may be issued by your charity, organization, or group to document the receipt of a donation. Creating your donation receipt template. In this article, well explore the key elements that should be included in a charity donation receipt, ensuring transparency and gratitude in every charitable transaction. Get simple, free templates that can be used for any donation. In this article, well explore the key elements that should be included in a charity donation receipt, ensuring transparency and gratitude in every charitable transaction. Charitable organization s must complete a 501(c)(3) donation receipt when receiving gifts of $250 or more. There are no specific formats for donation receipt templates. The donation receipt may be issued by your charity, organization,. Nonprofits and charitable organizations use these to acknowledge and record contributions from donors. The donation receipt may be issued by your charity, organization, or group to document the receipt of a donation. This receipt typically includes essential information such as the donor's name, donation amount (including any significant figures, like $100 or $1,000), date of donation (often including the month,. Plus, well share a handy template you can use to streamline your process. This receipt typically includes essential information such as the donor's name, donation amount (including any significant figures, like $100 or $1,000), date of donation (often including the month, day, year. This receipt is issued to individuals who have donated cash or payment, personal property, or a vehicle. This receipt is issued to individuals who have donated cash or payment, personal property, or a vehicle and seek to claim the donation as a tax deduction. You can make your own template for your organization to be prepared in the event that a donation is given to your group. Charitable organization s must complete a 501(c)(3) donation receipt when. Creating your donation receipt template. The donation receipt may be issued by your charity, organization, or group to document the receipt of a donation. Here are some free 501(c)(3) donation receipt templates for you to download and use; Use this template or letter sample to write your donation receipt letter. Charitable organization s must complete a 501(c)(3) donation receipt when. This receipt typically includes essential information such as the donor's name, donation amount (including any significant figures, like $100 or $1,000), date of donation (often including the month, day, year. The purpose of writing a donation receipt letter is to acknowledge that the donated amount has been received by you or your organization. You can make your own template for your organization to be prepared in the event that a donation is given to your group. Plus, well share a handy template you can use to streamline your process. Use these donation receipt email & letter templates to help you stay compliant, save time, and maintain good relationships with your donors. Nonprofits and charitable organizations use these to acknowledge and record contributions from donors. In this article, well explore the key elements that should be included in a charity donation receipt, ensuring transparency and gratitude in every charitable transaction. Here are some free 501(c)(3) donation receipt templates for you to download and use; Using a (501)(c)(3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. This receipt is issued to individuals who have donated cash or payment, personal property, or a vehicle and seek to claim the donation as a tax deduction. An official donation receipt is a document that provides the donor with an itemized list of how their donation was spent. There are no specific formats for donation receipt templates. Get simple, free templates that can be used for any donation or gift here. Use this template or letter sample to write your donation receipt letter.Sample Donation Receipt Letter Download Printable PDF Templateroller

Nonprofit Donation Receipt Letter Template Download Printable PDF

Letter Of Acknowledgment Sample

Donation Receipt Letter Templates at

46 Free Donation Receipt Templates (501c3, NonProfit)

45+ Free Donation Receipt Templates (501c3, NonProfit, Charity)

45+ Free Donation Receipt Templates (501c3, NonProfit, Charity)

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

How to Create a 501(c)(3) Donation Receipt Donorbox

Charitable Organization S Must Complete A 501(C)(3) Donation Receipt When Receiving Gifts Of $250 Or More.

The Donation Receipt May Be Issued By Your Charity, Organization, Or Group To Document The Receipt Of A Donation.

Donation Receipt Templates Are A Necessity When It Comes To Charitable Donations.

Creating Your Donation Receipt Template.

Related Post:

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-27.jpg)

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-02.jpg)