Excel Template Credit Card

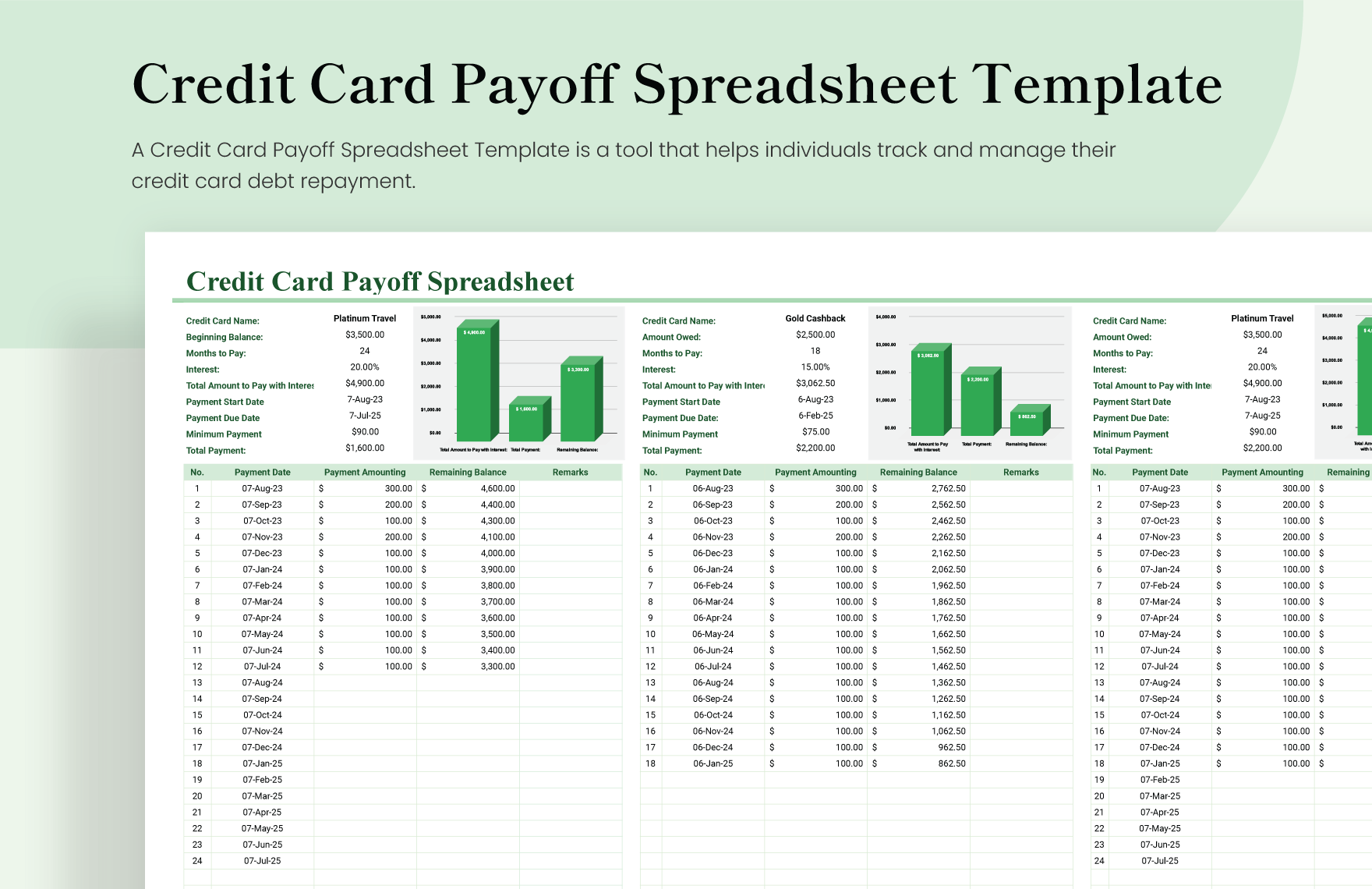

Excel Template Credit Card - This credit card payoff spreadsheet template helps you easily plan and track payments for all your credit cards in one place. This excel template helps you pay off your credit card debt faster. Mathematically speaking, the avalanche method is the most efficient way to get rid of your credit card debt. Manage credit card details, transactions, payments, and rewards seamlessly with the credit card management excel template from besttemplates.com. This excel template is the perfect tool to help you manage and pay off your credit card debt. The method requires the payment of the minimum amount on each, then dedicating as. Use this excel template to keep track of your. This excel template makes it easy to calculate how long it will take to pay off your credit cards. A credit card excel template provides essential tools for tracking expenses, monitoring payment deadlines, and analyzing spending patterns. This involves listing your obligations from the highest to lowest, based on interest rates in a debt reduction spreadsheet. Up to 50% cash back credit card excel templates manage your finances professionally. The method requires the payment of the minimum amount on each, then dedicating as. Mathematically speaking, the avalanche method is the most efficient way to get rid of your credit card debt. These templates offer customizable columns for. View our free and editable credit card templates for excel or google sheets. Manage credit card details, transactions, payments, and rewards seamlessly with the credit card management excel template from besttemplates.com. Struggling with credit card debt and looking for a way to get a handle on it? This excel template is the perfect tool to help you manage and pay off your credit card debt. This involves listing your obligations from the highest to lowest, based on interest rates in a debt reduction spreadsheet. With a few simple steps, you can. Track your monthly payments, interest rate, and total balance. A credit card excel template provides essential tools for tracking expenses, monitoring payment deadlines, and analyzing spending patterns. Up to 50% cash back credit card excel templates manage your finances professionally. You’re not alone, and there’s a handy tool at your disposal—excel! Struggling with credit card debt and looking for a. Manage credit card details, transactions, payments, and rewards seamlessly with the credit card management excel template from besttemplates.com. Get started today with the credit card payoff spreadsheet 18 excel template. The credit card payoff calculator is an excel template designed to assist individuals in calculating the number of installments required to pay off their outstanding credit card balances. View our. This credit card payoff spreadsheet template helps you easily plan and track payments for all your credit cards in one place. The method requires the payment of the minimum amount on each, then dedicating as. This excel template makes it easy to calculate how long it will take to pay off your credit cards. Struggling with credit card debt and. These credit card spreadsheet templates are easy to modify and you can customize the design, the header,. Manage credit card details, transactions, payments, and rewards seamlessly with the credit card management excel template from besttemplates.com. This excel template helps you pay off your credit card debt faster. Wps has many fully customizable credit cards excel templates that many. The method. You’re not alone, and there’s a handy tool at your disposal—excel! Up to 50% cash back credit card excel templates manage your finances professionally. This excel template helps you pay off your credit card debt faster. This excel template makes it easy to calculate how long it will take to pay off your credit cards. A credit card excel template. Wps has many fully customizable credit cards excel templates that many. This credit card payoff spreadsheet template helps you easily plan and track payments for all your credit cards in one place. These credit card spreadsheet templates are easy to modify and you can customize the design, the header,. Mathematically speaking, the avalanche method is the most efficient way to. This excel template makes it easy to calculate how long it will take to pay off your credit cards. The method requires the payment of the minimum amount on each, then dedicating as. Up to 50% cash back credit card excel templates manage your finances professionally. Get started today with the credit card payoff spreadsheet 18 excel template. With a. Struggling with credit card debt and looking for a way to get a handle on it? The method requires the payment of the minimum amount on each, then dedicating as. These credit card spreadsheet templates are easy to modify and you can customize the design, the header,. These templates offer customizable columns for. This excel template makes it easy to. Struggling with credit card debt and looking for a way to get a handle on it? This excel template helps you pay off your credit card debt faster. This credit card payoff spreadsheet template helps you easily plan and track payments for all your credit cards in one place. Wps has many fully customizable credit cards excel templates that many.. Wps has many fully customizable credit cards excel templates that many. Track your monthly payments, interest rate, and total balance. Up to 50% cash back credit card excel templates manage your finances professionally. This credit card payoff spreadsheet template helps you easily plan and track payments for all your credit cards in one place. Get started today with the credit. Struggling with credit card debt and looking for a way to get a handle on it? Manage credit card details, transactions, payments, and rewards seamlessly with the credit card management excel template from besttemplates.com. Up to 50% cash back credit card excel templates manage your finances professionally. These credit card spreadsheet templates are easy to modify and you can customize the design, the header,. You’re not alone, and there’s a handy tool at your disposal—excel! A credit card excel template provides essential tools for tracking expenses, monitoring payment deadlines, and analyzing spending patterns. Use this excel template to keep track of your. These templates offer customizable columns for. This excel template makes it easy to calculate how long it will take to pay off your credit cards. Get started today with the credit card payoff spreadsheet 18 excel template. This excel template is the perfect tool to help you manage and pay off your credit card debt. The credit card payoff calculator is an excel template designed to assist individuals in calculating the number of installments required to pay off their outstanding credit card balances. This excel template helps you pay off your credit card debt faster. This involves listing your obligations from the highest to lowest, based on interest rates in a debt reduction spreadsheet. The method requires the payment of the minimum amount on each, then dedicating as. Track your monthly payments, interest rate, and total balance.Excel Credit Card Payment Tracker Template

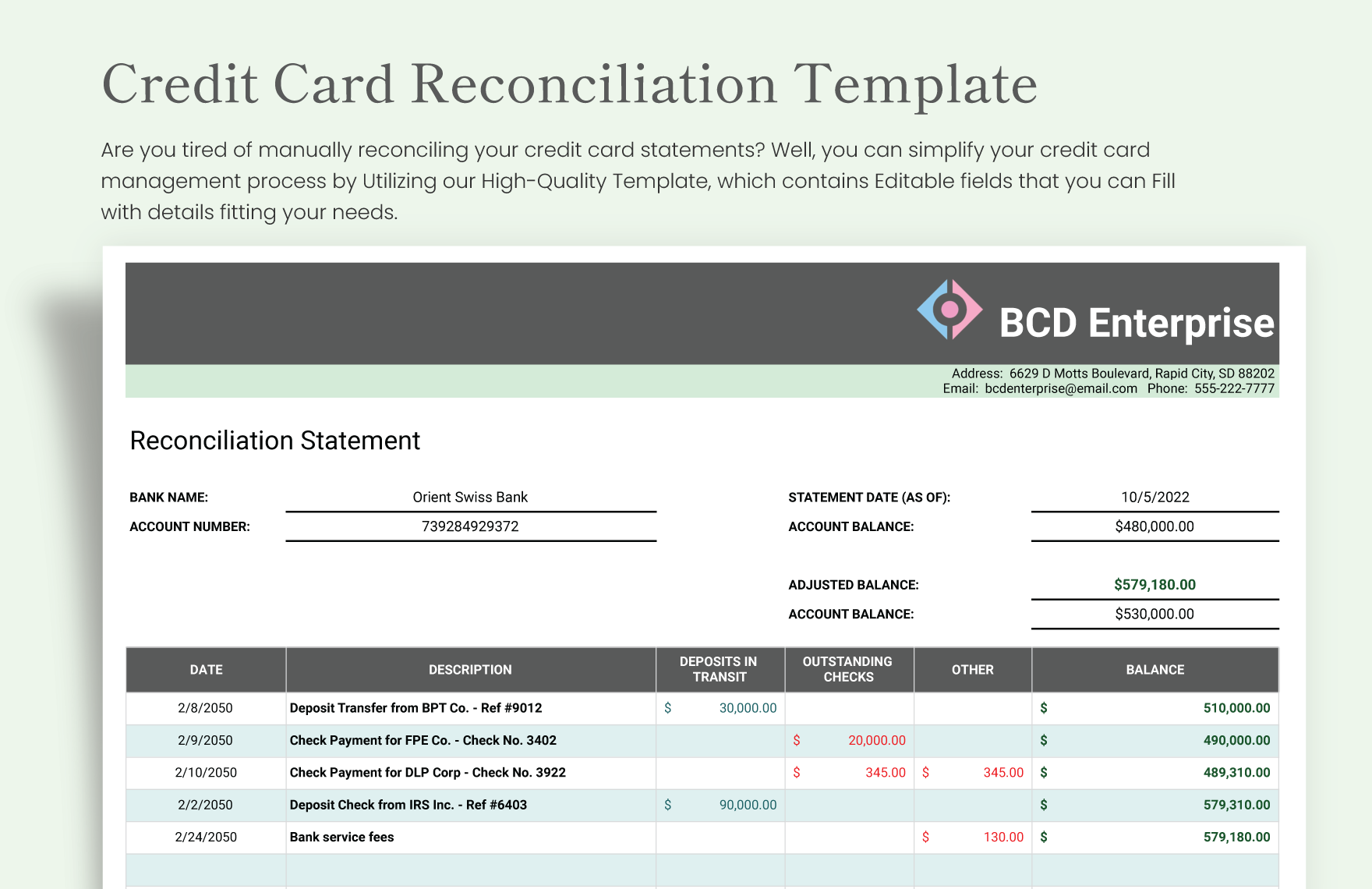

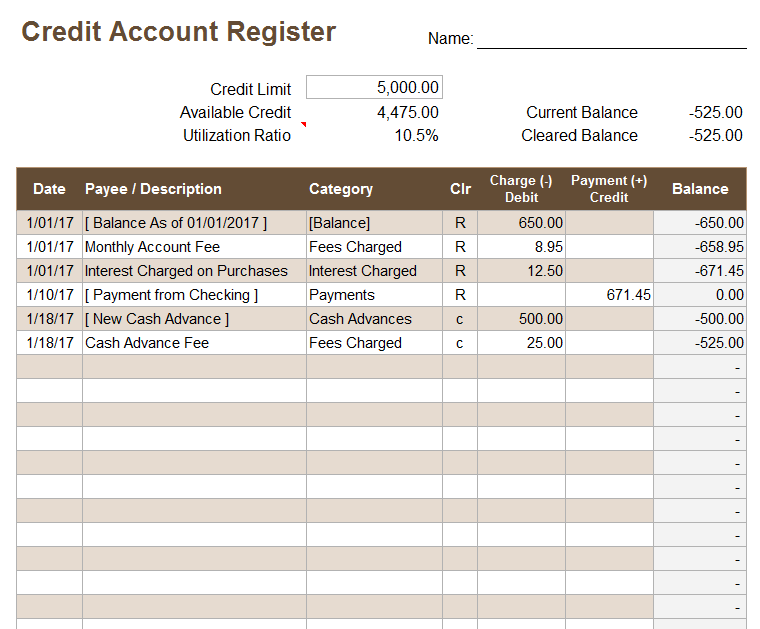

Credit Card Reconciliation Template In Excel

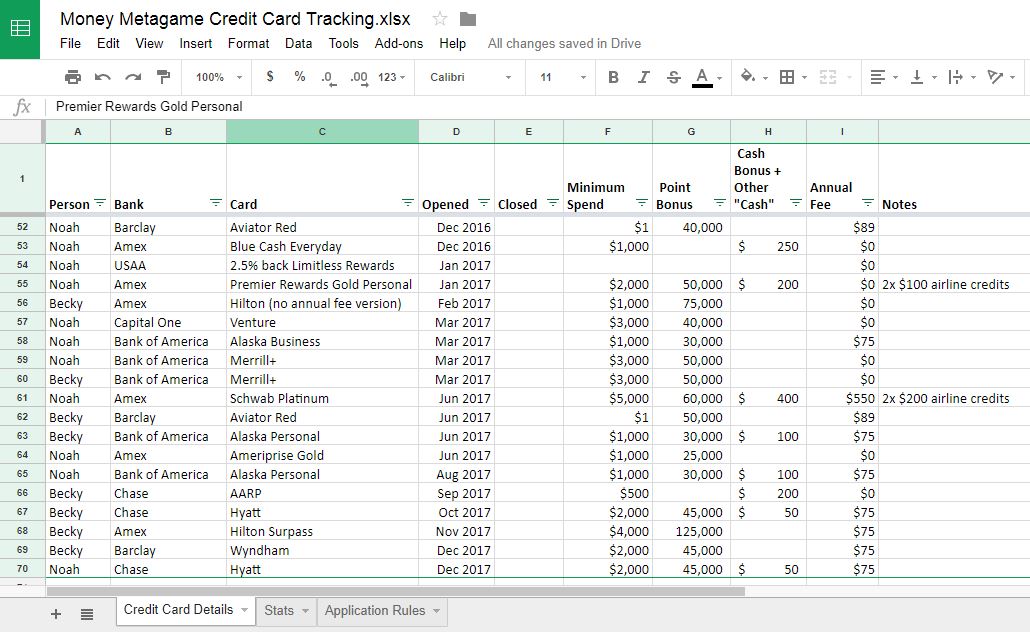

Credit Card Tracker Template In Excel (Download.xlsx)

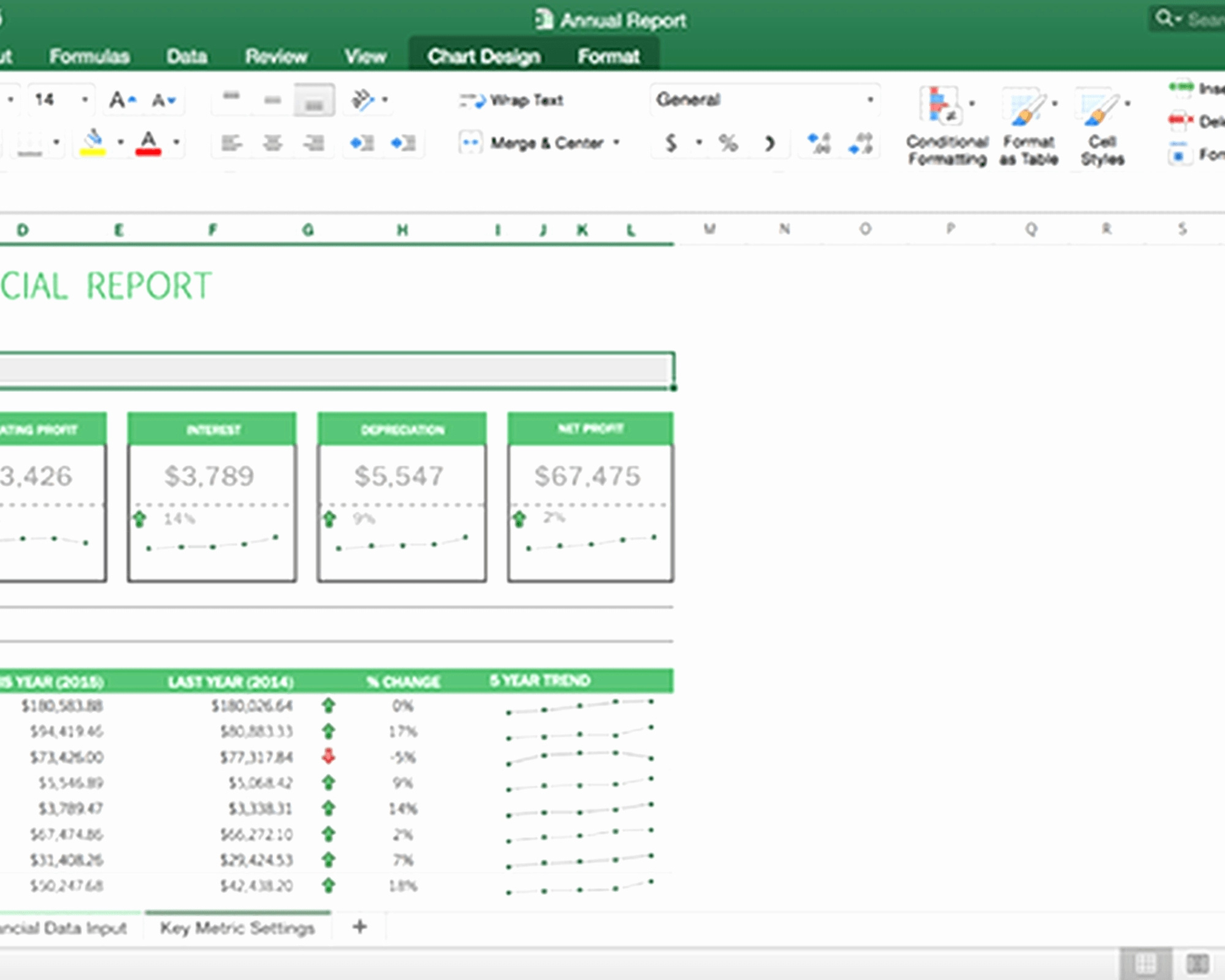

Credit Card Excel Template

Credit Card Excel Template

Credit Card Information Excel Spreadsheet, Credit Card Log, 46 OFF

Credit Card Spreadsheet Template —

Credit Card Excel Template

Credit Card Payoff Excel Spreadsheet Template

Credit Card Reconciliation Excel Template Excel Templates

Wps Has Many Fully Customizable Credit Cards Excel Templates That Many.

View Our Free And Editable Credit Card Templates For Excel Or Google Sheets.

This Credit Card Payoff Spreadsheet Template Helps You Easily Plan And Track Payments For All Your Credit Cards In One Place.

Mathematically Speaking, The Avalanche Method Is The Most Efficient Way To Get Rid Of Your Credit Card Debt.

Related Post: