Florida Court Summons Credit Card Debt Template

Florida Court Summons Credit Card Debt Template - Solosuit walks you through these steps. Respond to a credit card debt summons by drafting a concise answer, denying claims, and listing defenses. To respond to the debt collector’s lawsuit in florida, you simply need to file an answer with the county court. When you receive a summons for debt collection, it’s important to take action. First off, getting a summons for unpaid credit card. In a nutshell, you will have to file an answer by responding to each and every allegation contained in the complaint as either admitted or denied and you may state your. Here are the initial steps you should take in order to submit a summons response. How to answer a florida court summons for debt collection. Take a florida debt relief options calculator that helps you understand your options. Of the summons and complaint, you can assert this defense. A court summons is a legal document issued by a florida court, notifying you of a lawsuit filed against you by a creditor or debt collector. How to answer a florida court summons for debt collection. Respond to every paragraph in the complaint. If you receive a summons and complaint from a debt collector or creditor, it means you’re being sued for unpaid debt. Of the summons and complaint, you can assert this defense. Set up the pleading (your answer) in the same manner that the plaintiff set up the complaint. File it with the court and attorney by the deadline. Here are the initial steps you should take in order to submit a summons response. When you receive a summons for debt collection, it’s important to take action. This has to be in writing and generally, you have to answer within 20 to 30 days of receiving the summons. Take a florida debt relief options calculator that helps you understand your options. What does it mean to respond to a debt collection lawsuit in florida? Let's discuss how to handle this and walk you through a sample answer to a summons for credit card debt, so you know exactly what to do. Set up the pleading (your answer) in. To respond to a debt lawsuit, you need to take three steps. Take a florida debt relief options calculator that helps you understand your options. First off, getting a summons for unpaid credit card. When writing the answer, you only need to admit or deny each allegation. Respond to a credit card debt summons by drafting a concise answer, denying. Here are the initial steps you should take in order to submit a summons response. When you receive a summons for debt collection, it’s important to take action. Debt.com provides expert guidance on how to answer a civil summons for credit card debt, including advice on how to reach a settlement outside of court to avoid legal action. Of the. Of the summons and complaint, you can assert this defense. Take a florida debt relief options calculator that helps you understand your options. If you receive a summons and complaint from a debt collector or creditor, it means you’re being sued for unpaid debt. What does it mean to respond to a debt collection lawsuit in florida? To respond to. If you receive a summons and complaint from a debt collector or creditor, it means you’re being sued for unpaid debt. This has to be in writing and generally, you have to answer within 20 to 30 days of receiving the summons. Here are the initial steps you should take in order to submit a summons response. First off, getting. File it with the court and attorney by the deadline. Here are the initial steps you should take in order to submit a summons response. Let's discuss how to handle this and walk you through a sample answer to a summons for credit card debt, so you know exactly what to do. When you receive a summons for debt collection,. Respond to every paragraph in the complaint. Here are the initial steps you should take in order to submit a summons response. Let's discuss how to handle this and walk you through a sample answer to a summons for credit card debt, so you know exactly what to do. To respond to a debt lawsuit, you need to take three. Respond to a credit card debt summons by drafting a concise answer, denying claims, and listing defenses. When you've been sued over a credit card debt, the plaintiff usually hopes that you'll ignore the lawsuit. How to answer a florida court summons for debt collection. If you receive a summons and complaint from a debt collector or creditor, it means. First off, getting a summons for unpaid credit card. In a nutshell, you will have to file an answer by responding to each and every allegation contained in the complaint as either admitted or denied and you may state your. Take a florida debt relief options calculator that helps you understand your options. Let's discuss how to handle this and. If you receive a summons and complaint from a debt collector or creditor, it means you’re being sued for unpaid debt. Here are the initial steps you should take in order to submit a summons response. When you've been sued over a credit card debt, the plaintiff usually hopes that you'll ignore the lawsuit. In a nutshell, you will have. How to answer a florida court summons for debt collection. Debt.com provides expert guidance on how to answer a civil summons for credit card debt, including advice on how to reach a settlement outside of court to avoid legal action. File it with the court and attorney by the deadline. Here's a sample answer to a summons for a credit card debt lawsuit. Respond to a credit card debt summons by drafting a concise answer, denying claims, and listing defenses. Here are the initial steps you should take in order to submit a summons response. Of the summons and complaint, you can assert this defense. Respond to every paragraph in the complaint. In a nutshell, you will have to file an answer by responding to each and every allegation contained in the complaint as either admitted or denied and you may state your. To respond to a debt lawsuit, you need to take three steps. Set up the pleading (your answer) in the same manner that the plaintiff set up the complaint. When you've been sued over a credit card debt, the plaintiff usually hopes that you'll ignore the lawsuit. It’s important to respond to (or answer) the lawsuit. What does it mean to respond to a debt collection lawsuit in florida? If you receive a summons and complaint from a debt collector or creditor, it means you’re being sued for unpaid debt. Solosuit walks you through these steps.Debt Collection Summons Answer Letter

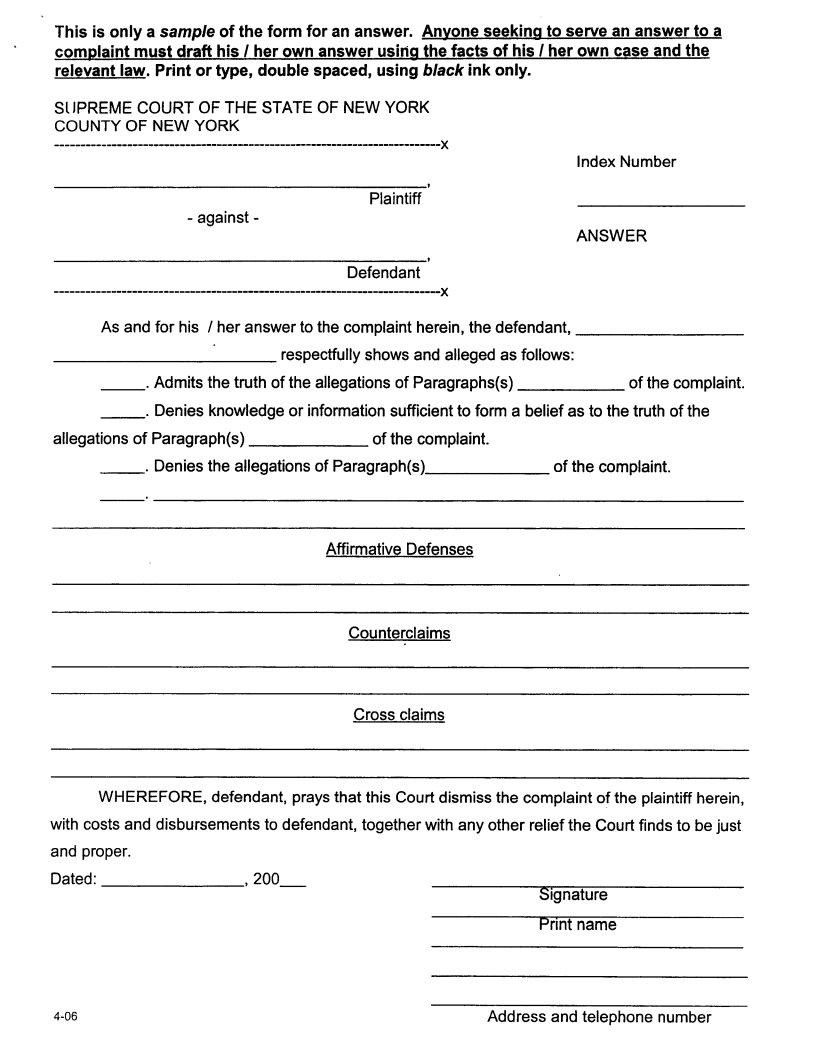

Template Sample Answer To Summons For Credit Card Debt

Template Sample Answer To Summons For Credit Card Debt

Debt Summons Answer Template

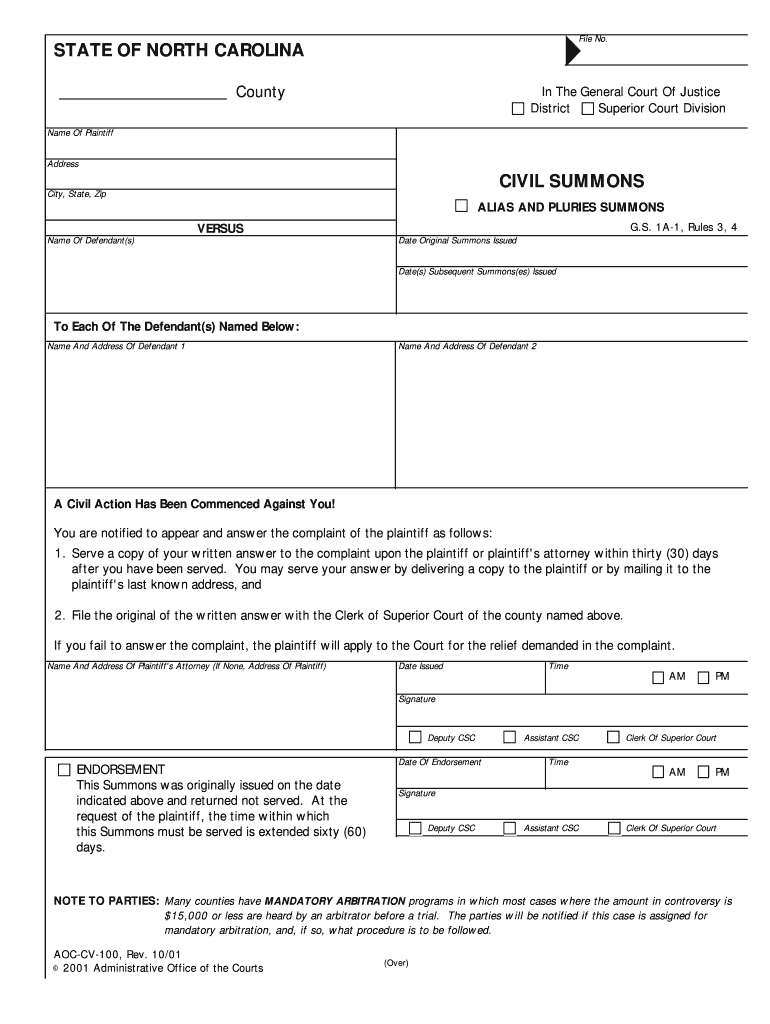

summons and complaint Doc Template pdfFiller

How to Answer a Civil Summons for Credit Card Debt The Free Financial

Example Of Summons Response Letter

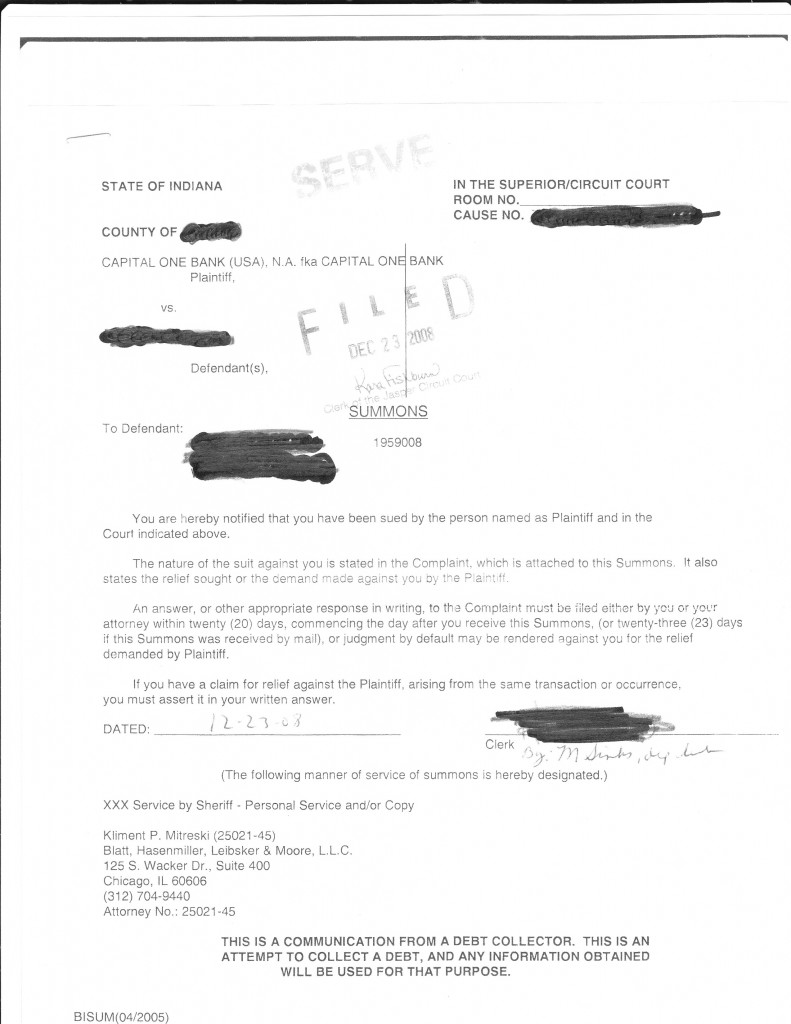

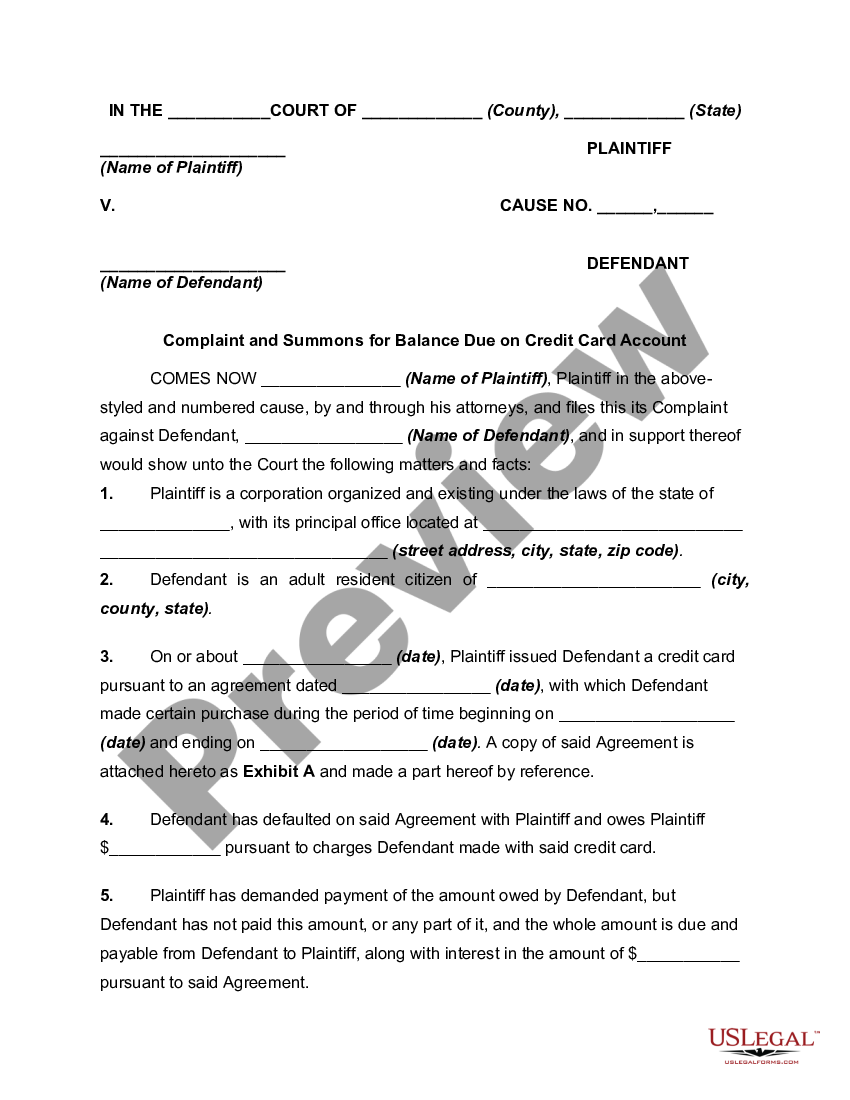

Complaint and Summons for Balance Due on Credit Card Account Summons

Answer To Debt Collection Lawsuit Template Card Template

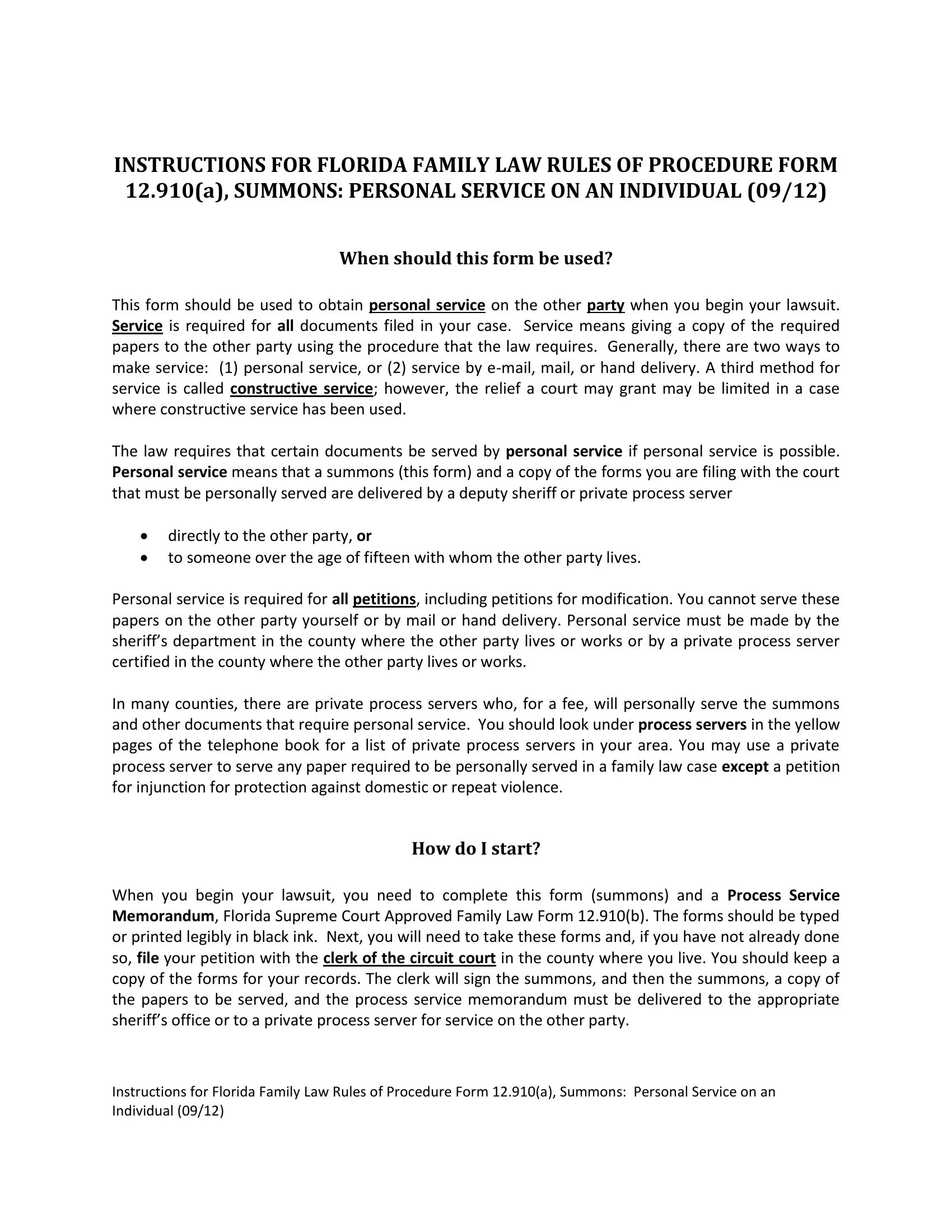

Form Fl Summons ≡ Fill Out Printable PDF Forms Online

To Respond To The Debt Collector’s Lawsuit In Florida, You Simply Need To File An Answer With The County Court.

This Has To Be In Writing And Generally, You Have To Answer Within 20 To 30 Days Of Receiving The Summons.

A Court Summons Is A Legal Document Issued By A Florida Court, Notifying You Of A Lawsuit Filed Against You By A Creditor Or Debt Collector.

Take A Florida Debt Relief Options Calculator That Helps You Understand Your Options.

Related Post: