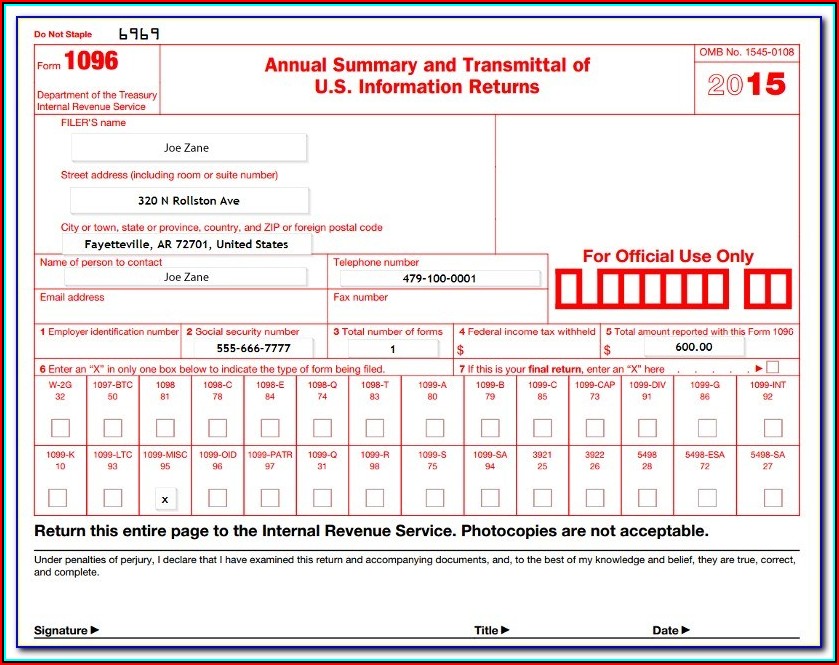

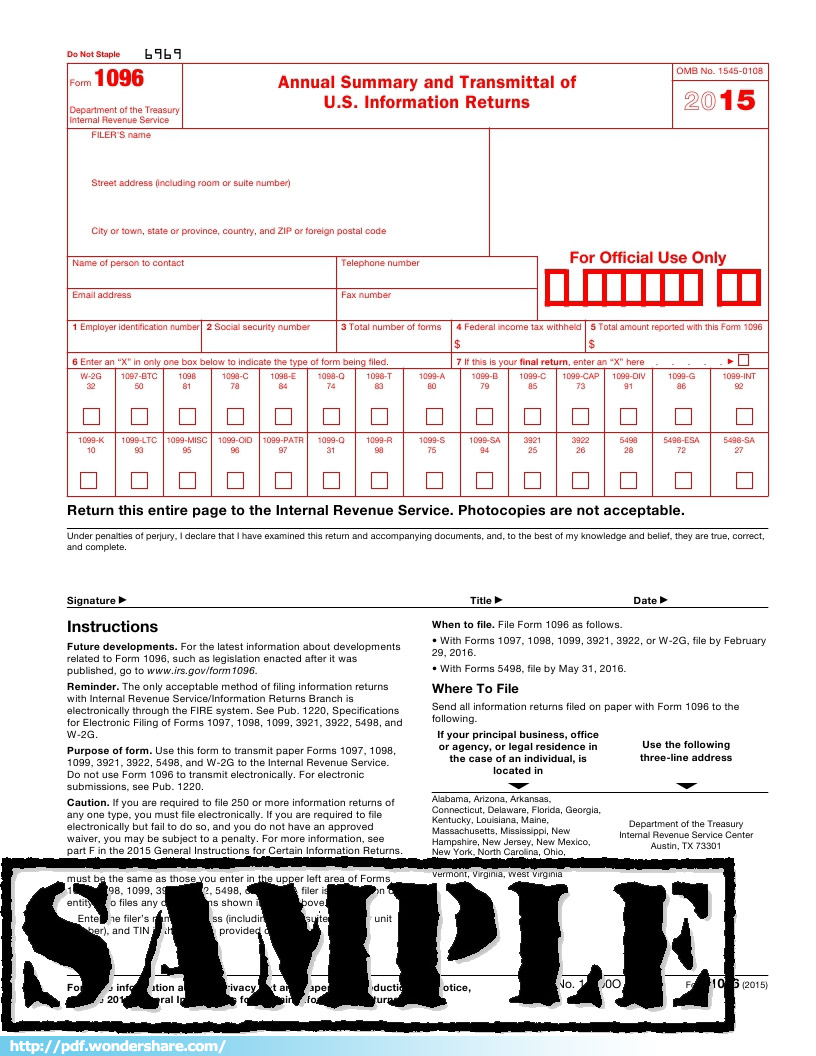

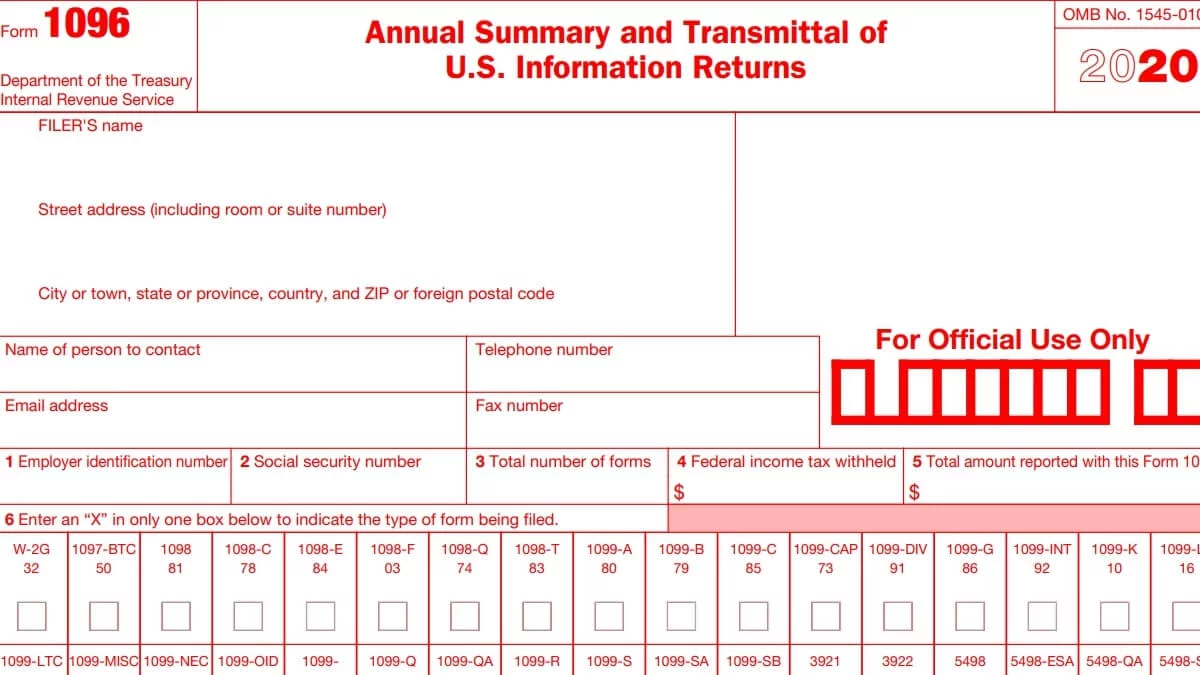

Form 1096 Template

Form 1096 Template - Information returns, is used to summarize and transmit information returns filed with the irs. Form 1096 is a summary tax report used by businesses to submit information returns to the irs. Information about form 1096, annual summary and transmittal of u.s. These errors might include incorrect totals or mismatched information between the 1096 and the. Form 1096 is the annual summary and transmittal of us information returns issued by the internal revenue service (irs). File form 1096 as follows. Form 1096, annual summary and transmittal of u.s. Does anyone have a template they have created. I am looking for either a word or excel template to complete irs form 1096. File form 1096 in the calendar year following the year for which the information is being reported, as follows. File form 1096 as follows. Information returns, including recent updates, related forms and instructions on how to file. File form 1096 in the calendar year following the year for which the information is being reported, as follows. Information returns) (2024) and other income tax forms from the federal internal revenue service. A new 1096 form is required when errors are found in the original submission. Form 1096 is used when you're submitting paper 1099 forms to the irs. Business owners use this form to submit information returns. Click on employer and information returns, and we’ll mail. Irs form 1096, titled annual summary and transmittal of u.s. I am looking for either a word or excel template to complete irs form 1096. Does anyone have a template they have created. 14, 2025 — business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system. I would be most appreciative. A new 1096 form is required when errors are found in the original submission. File form 1096 in the calendar year following the year. Business owners use this form to submit information returns. Form 1096 is a summary tax report used by businesses to submit information returns to the irs. I would be most appreciative. It can only be used to file paper forms and is not required for. Click on employer and information returns, and we’ll mail. Business owners use this form to submit information returns. Form 1096 is used by. Information returns, including recent updates, related forms and instructions on how to file. Irs form 1096, titled annual summary and transmittal of u.s. Form 1096 is a summary tax report used by businesses to submit information returns to the irs. File form 1096 in the calendar year following the year for which the information is being reported, as follows. I am looking for either a word or excel template to complete irs form 1096. Information returns) (2024) and other income tax forms from the federal internal revenue service. Business owners use this form to submit information returns. Form 1096 is. It can only be used to file paper forms and is not required for. Irs form 1096, titled annual summary and transmittal of u.s. I am looking for either a word or excel template to complete irs form 1096. Form 1096 is used when you're submitting paper 1099 forms to the irs. Form 1096 is used by. File form 1096 as follows. I would be most appreciative. Information returns, including recent updates, related forms and instructions on how to file. File form 1096 in the calendar year following the year for which the information is being reported, as follows. Information returns, is used to summarize and transmit information returns filed with the irs. These errors might include incorrect totals or mismatched information between the 1096 and the. I would be most appreciative. 14, 2025 — business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system. Information returns) (2024) and other income tax forms from the federal internal revenue service. Does anyone have a. It can only be used to file paper forms and is not required for. These errors might include incorrect totals or mismatched information between the 1096 and the. Click on employer and information returns, and we’ll mail. A new 1096 form is required when errors are found in the original submission. Irs form 1096, titled annual summary and transmittal of. Information returns, is used to summarize and transmit information returns filed with the irs. These errors might include incorrect totals or mismatched information between the 1096 and the. It can only be used to file paper forms and is not required for. Form 1096 is used by. Form 1096 is used when you're submitting paper 1099 forms to the irs. Form 1096 is the annual summary and transmittal of us information returns issued by the internal revenue service (irs). I would be most appreciative. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included. File form 1096 in the calendar year following the year for which the information is being reported, as. Form 1096 is a summary tax report used by businesses to submit information returns to the irs. Form 1096 is the annual summary and transmittal of us information returns issued by the internal revenue service (irs). File form 1096 in the calendar year following the year for which the information is being reported, as follows. Information returns, is a document that summarizes information returns you file with the irs, such as forms 1099. To order official irs information returns, which include a scannable form 1096 for filing with the irs, visit www.irs.gov/orderforms. Information about form 1096, annual summary and transmittal of u.s. File form 1096 in the calendar year following the year for which the information is being reported, as follows. Does anyone have a template they have created. Information returns, is used to summarize and transmit information returns filed with the irs. Information returns) (2024) and other income tax forms from the federal internal revenue service. Form 1096 is used when you're submitting paper 1099 forms to the irs. Business owners use this form to submit information returns. 14, 2025 — business taxpayers can file electronically any form 1099 series information returns for free with the irs information returns intake system. I am looking for either a word or excel template to complete irs form 1096. Click on employer and information returns, and we’ll mail. A new 1096 form is required when errors are found in the original submission.Free irs form 1096 template rewabags

Fillable Form 1096 Edit, Sign & Download in PDF PDFRun

1096 IRS PDF Fillable Template 2022 With Print and Clear Buttons

1096 IRS PDF Fillable Template 2022 With Print and Clear Buttons

1096 IRS PDF Fillable Template 2023/2024 With Print and Clear Buttons

Downloadable Irs Form 1096 Form Resume Examples N8VZj7DVwe

IRS 1096 Form Download, Create, Edit, Fill and Print

Free irs form 1096 template nelocoin

Irs 1096 Form Printable Printable Forms Free Online

Irs Form 1096 Fillable Universal Network

Download Or Print The 2024 Federal (Annual Summary And Transmittal Of U.s.

I Would Be Most Appreciative.

Form 1096 Is Used By.

File Form 1096 As Follows.

Related Post: