Form 5102 Annual Records Service Template

Form 5102 Annual Records Service Template - Department of state to assess and evaluate the medical. Existing companies have one year to file; Some forms cannot be viewed in a web browser and must be opened in adobe acrobat reader on your desktop system. Fraudsters are exploiting the recent corporate transparency act (cta) requirements by sending out fake “form 5102” requests. Form 5102 is often used in. Therefore, this document should be used as the. Are required to report their beneficial. New companies must file within 90 days of creation or registration. If a pdf file won't open, try downloading the file to your device and opening it using adobe acrobat. Fincen’s website includes guidance about the beneficial ownership information reporting requirements on its beneficial ownership information webpage. Click here for instructions on opening this form. Therefore, this document should be used as the. Are required to report their beneficial. Certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the united states must report information about their beneficial. Existing companies have one year to file; Under the act, small businesses across the united states need to file beneficial ownership information reports, also known as corporate transparency reports. Some forms cannot be viewed in a web browser and must be opened in adobe acrobat reader on your desktop system. New companies must file within 90 days of creation or registration. Pursuant to the united us businesses states corporate transparency act, enacted by congress. Form 5102 is often used in. New companies must file within 90 days of creation or registration. Fraudsters are exploiting the recent corporate transparency act (cta) requirements by sending out fake “form 5102” requests. Department of state to assess and evaluate the medical. Click here for instructions on opening this form. Are required to report their beneficial. The latest versions of irs forms, instructions, and publications. Pursuant to the united us businesses states corporate transparency act, enacted by congress. Up to $50 cash back the dss 5102 form, also known as the request for medical examination, is used by the u.s. Are required to report their beneficial. Fraudsters are exploiting the recent corporate transparency act (cta) requirements. Form 5102 is often used in. Existing companies have one year to file; Are required to report their beneficial. Fincen’s website includes guidance about the beneficial ownership information reporting requirements on its beneficial ownership information webpage. Here’s what you need to know:. Beginning january 1, 2024, certain types of limited liability companies, corporations, and other similar entities must report information about their beneficial owners—the persons who. Fraudsters are exploiting the recent corporate transparency act (cta) requirements by sending out fake “form 5102” requests. Department of state to assess and evaluate the medical. The latest versions of irs forms, instructions, and publications. Under. Recently, scammers have been capitalizing on the corporate transparency act by sending fraudulent emails and letters to business owners, falsely claiming that they must fill. Department of state to assess and evaluate the medical. Certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the united states must report information about. Recently, scammers have been capitalizing on the corporate transparency act by sending fraudulent emails and letters to business owners, falsely claiming that they must fill. Beginning january 1, 2024, certain types of limited liability companies, corporations, and other similar entities must report information about their beneficial owners—the persons who. Existing companies have one year to file; Fraudsters are exploiting the. If a pdf file won't open, try downloading the file to your device and opening it using adobe acrobat. The latest versions of irs forms, instructions, and publications. Click here for instructions on opening this form. Under the act, small businesses across the united states need to file beneficial ownership information reports, also known as corporate transparency reports. Are required. Click here for instructions on opening this form. Existing companies have one year to file; Are required to report their beneficial. Under the act, small businesses across the united states need to file beneficial ownership information reports, also known as corporate transparency reports. If a pdf file won't open, try downloading the file to your device and opening it using. Therefore, this document should be used as the. Here’s what you need to know:. Are required to report their beneficial. Click here for instructions on opening this form. Form 5102 is often used in. Here’s what you need to know:. Department of state to assess and evaluate the medical. Certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the united states must report information about their beneficial. Under the act, small businesses across the united states need to file beneficial ownership information reports, also. New companies must file within 90 days of creation or registration. The latest versions of irs forms, instructions, and publications. Pursuant to the united us businesses states corporate transparency act, enacted by congress. If a pdf file won't open, try downloading the file to your device and opening it using adobe acrobat. Form 5102 is often used in. Click here for instructions on opening this form. Recently, scammers have been capitalizing on the corporate transparency act by sending fraudulent emails and letters to business owners, falsely claiming that they must fill. Certain types of corporations, limited liability companies, and other similar entities created in or registered to do business in the united states must report information about their beneficial. Fincen’s website includes guidance about the beneficial ownership information reporting requirements on its beneficial ownership information webpage. Existing companies have one year to file; Here’s what you need to know:. Therefore, this document should be used as the. Fraudsters are exploiting the recent corporate transparency act (cta) requirements by sending out fake “form 5102” requests. Beginning january 1, 2024, certain types of limited liability companies, corporations, and other similar entities must report information about their beneficial owners—the persons who. Are required to report their beneficial.Fillable Online Fort Knox Form 5102, Telework Request and Approval Fax

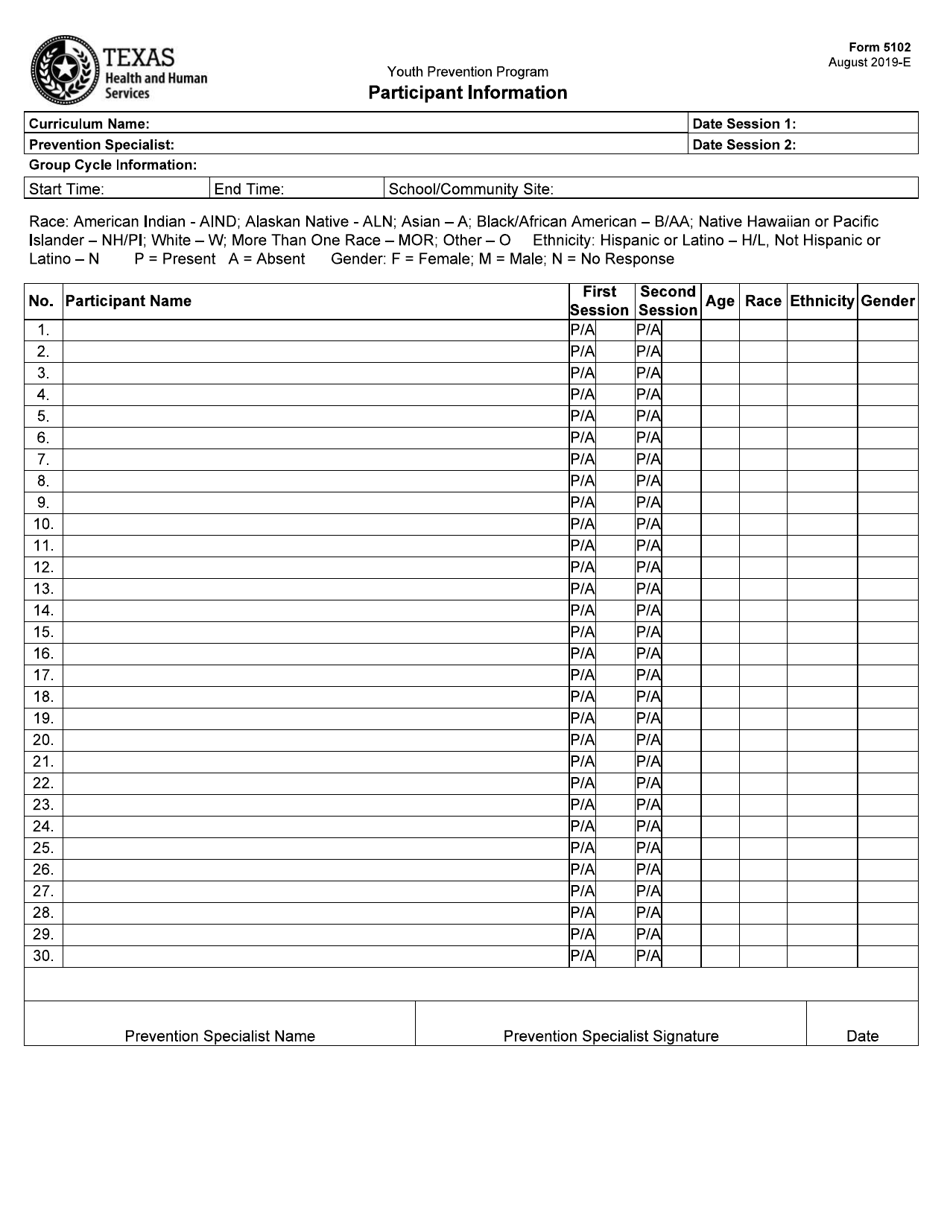

Form 5102 Fill Out, Sign Online and Download Fillable PDF, Texas

Form Dss 5102 ≡ Fill Out Printable PDF Forms Online

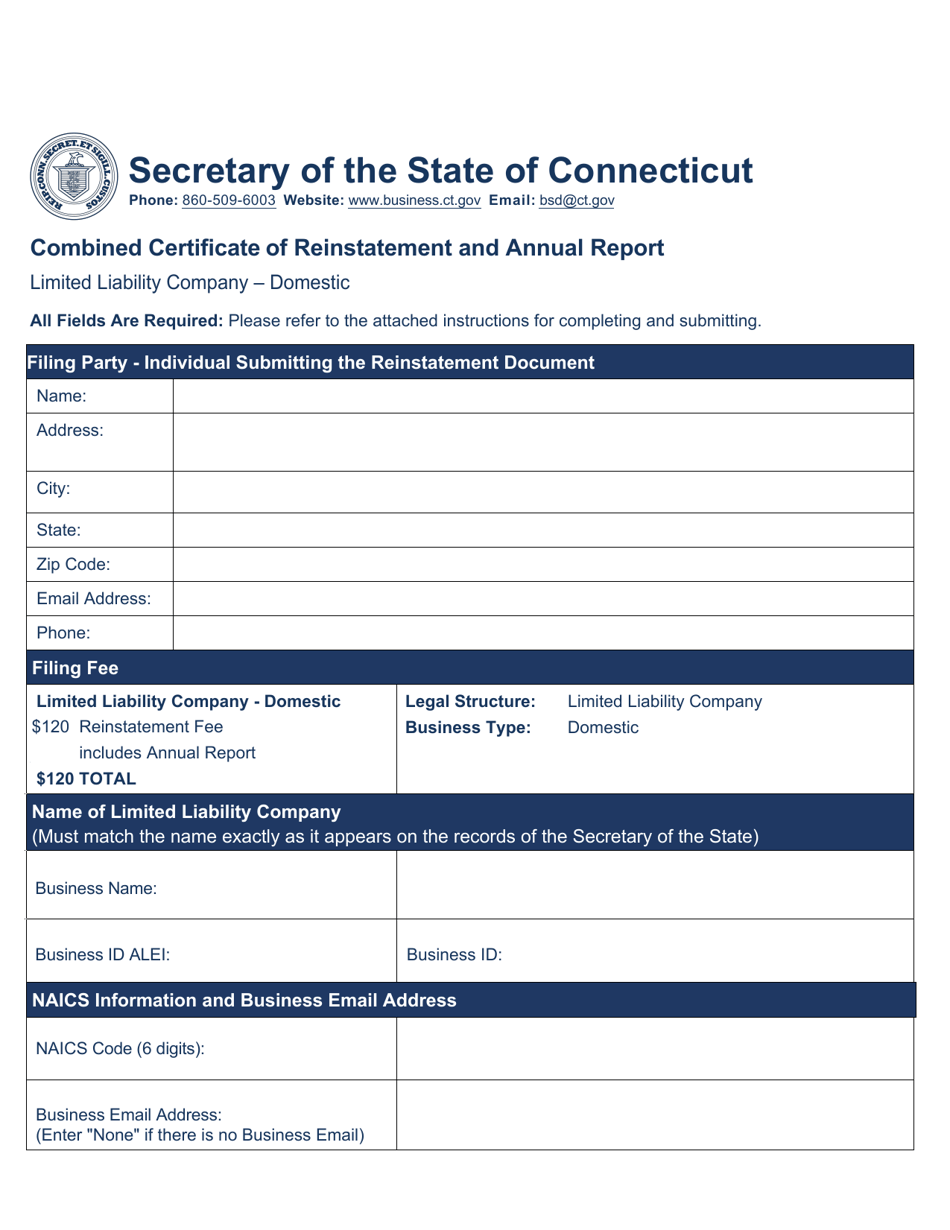

Connecticut Combined Certificate of Reinstatement and Annual Report

20232025 Form TX Comptroller 05102 Fill Online, Printable, Fillable

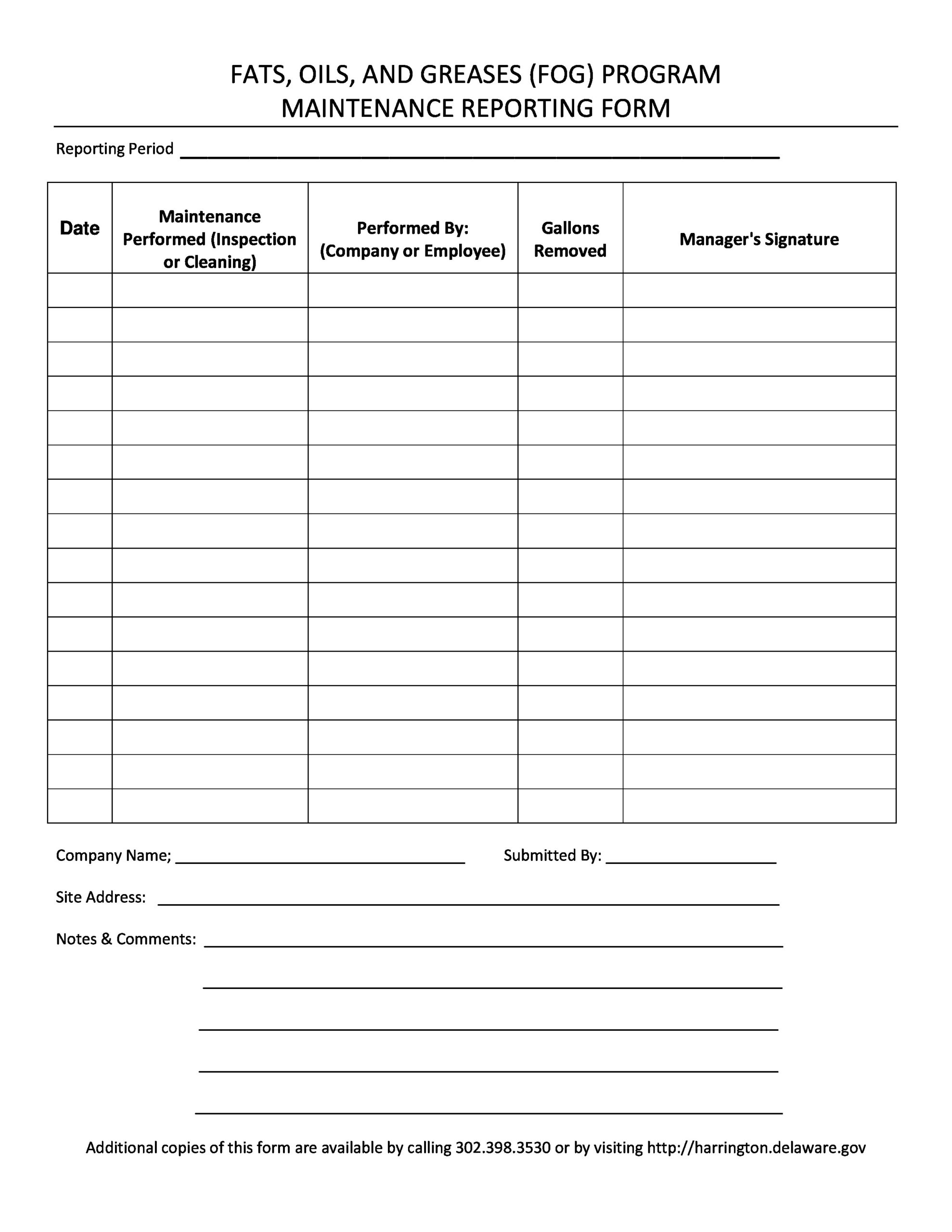

Maintenance Report Template Excel

Fillable Online SPAWARSYSCENLANT 5102/1, 05/11 SUPERVISOR'S REPORT

Annual Report Template For Non Profit Organization

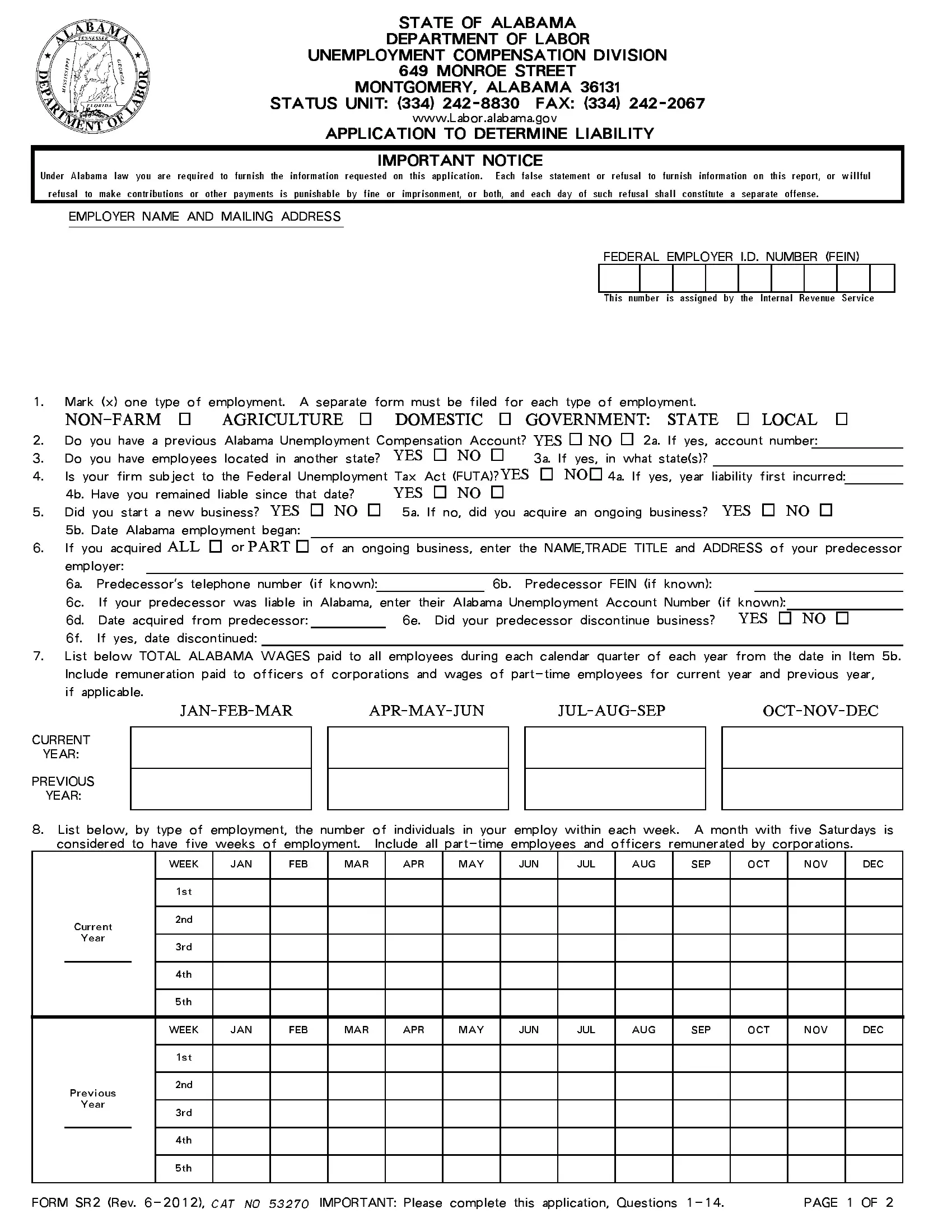

Alabama Form Sr 2 ≡ Fill Out Printable PDF Forms Online

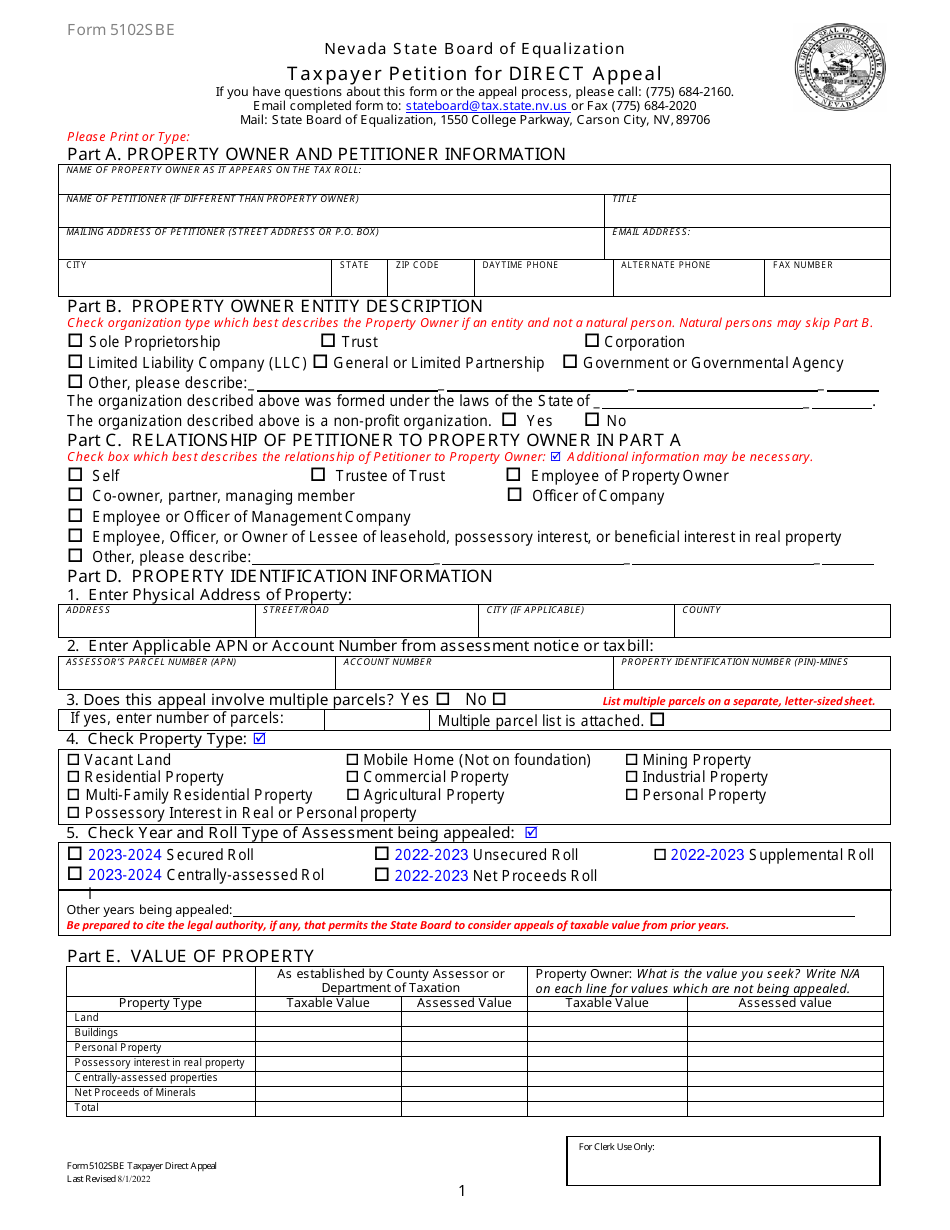

Form 5102SBE 2023 Fill Out, Sign Online and Download Printable PDF

Some Forms Cannot Be Viewed In A Web Browser And Must Be Opened In Adobe Acrobat Reader On Your Desktop System.

Department Of State To Assess And Evaluate The Medical.

Up To $50 Cash Back The Dss 5102 Form, Also Known As The Request For Medical Examination, Is Used By The U.s.

Under The Act, Small Businesses Across The United States Need To File Beneficial Ownership Information Reports, Also Known As Corporate Transparency Reports.

Related Post: