Irr Template

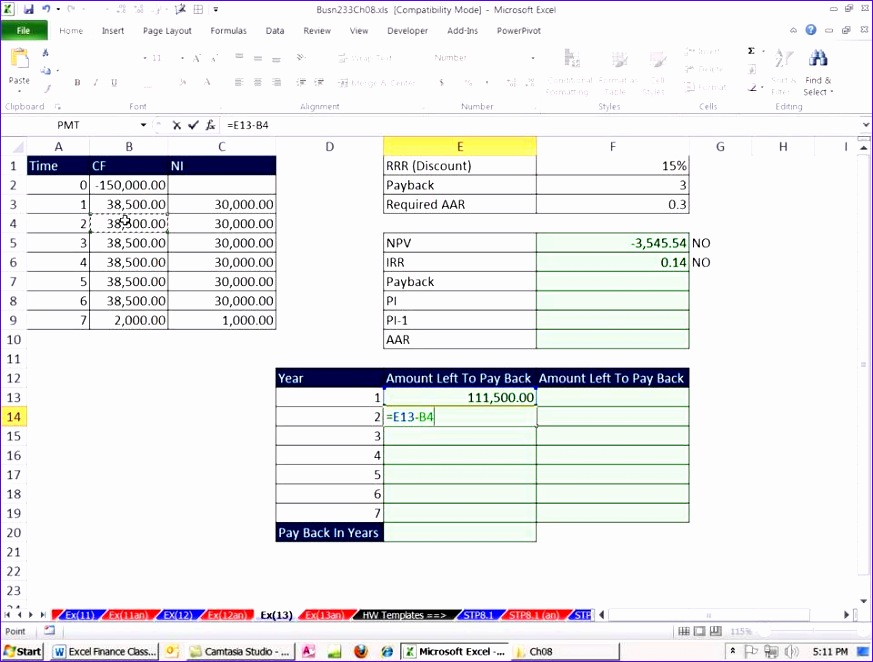

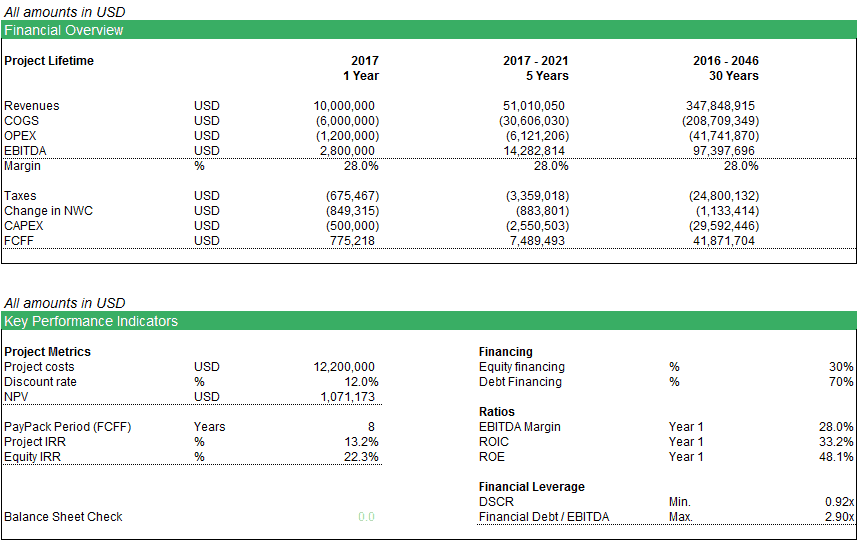

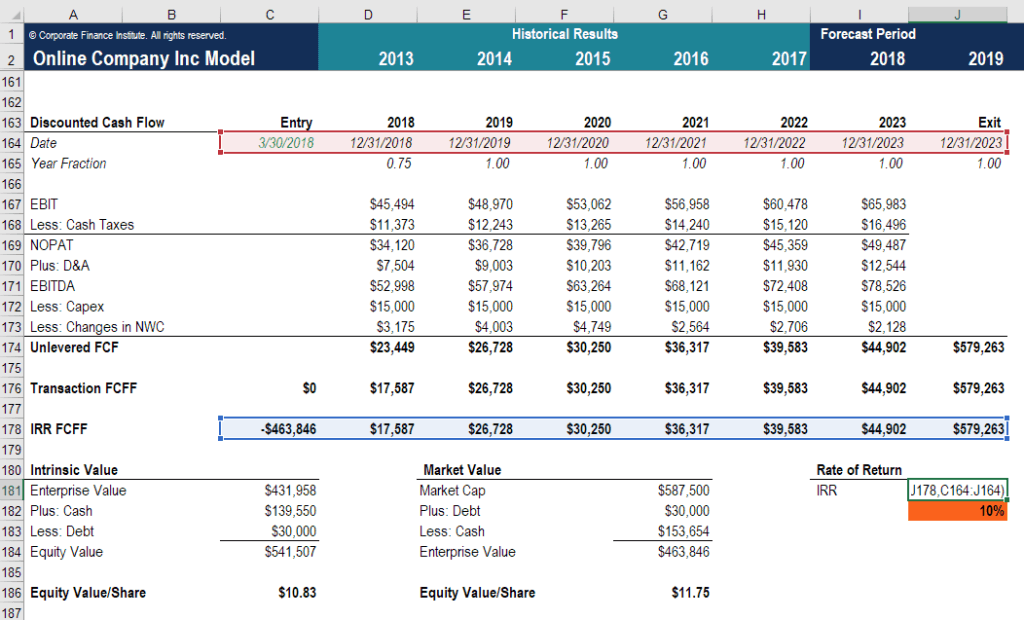

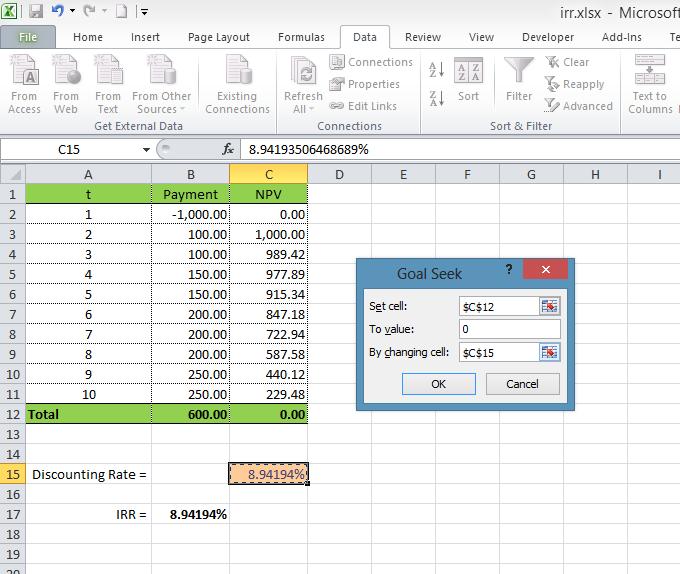

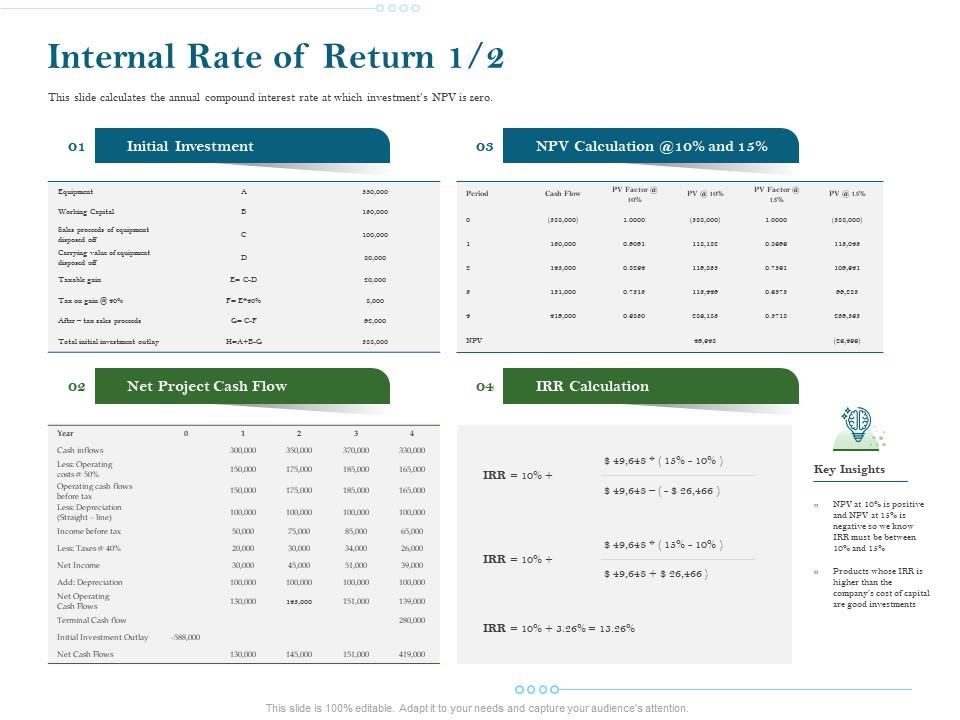

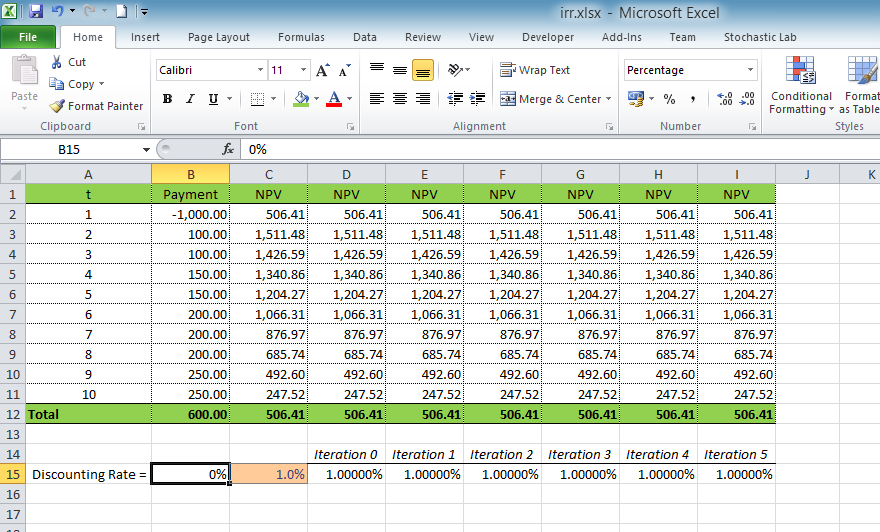

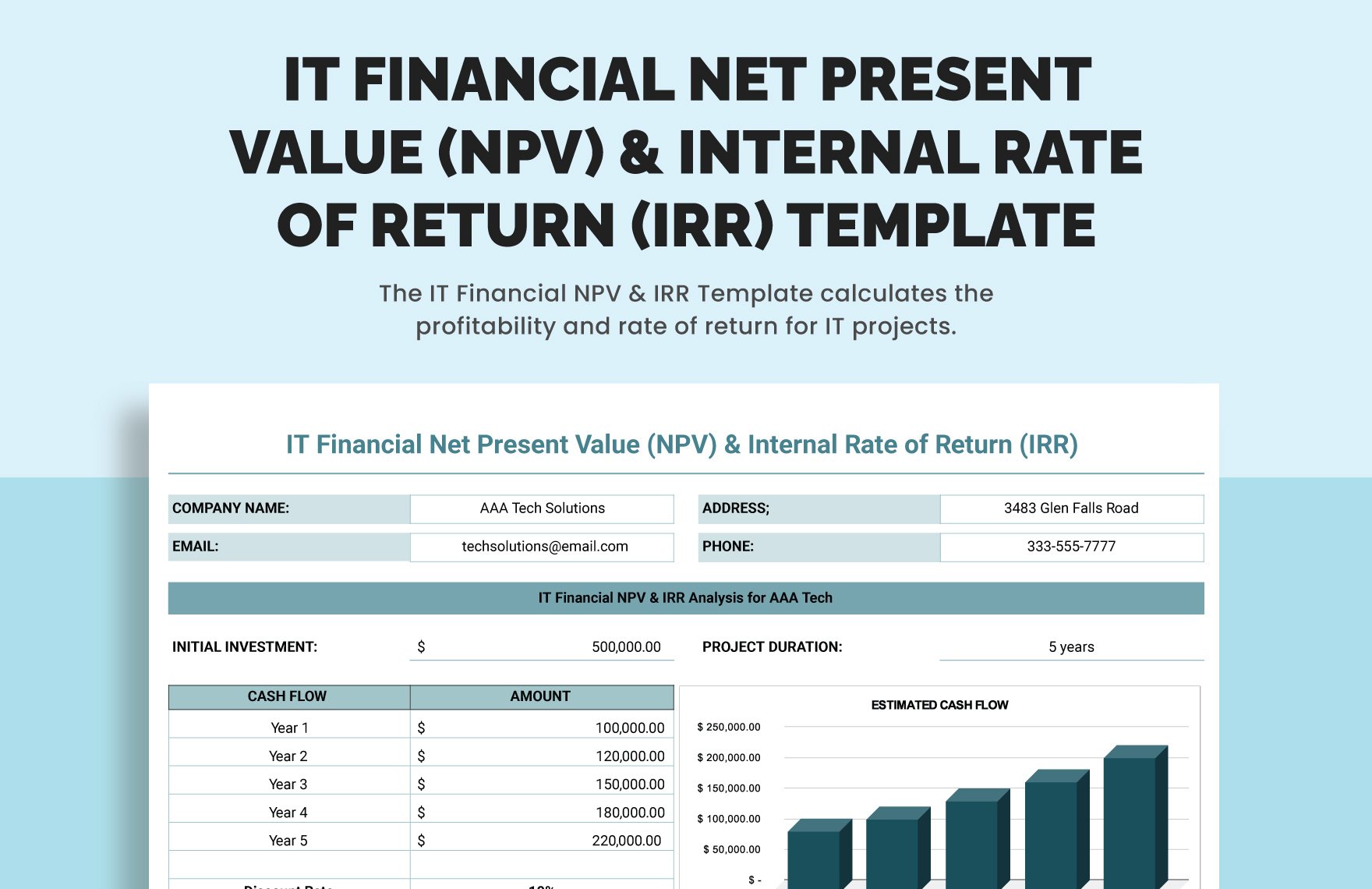

Irr Template - It also explains how irr is different from the net present value. We discuss the irr formula and function's use in excel, calculation, examples, and downloadable templates. In this post, i’ll build off that worksheet and show you how you can calculate the internal rate of return (irr) in excel. The internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable. =irr(b1:b6) the irr comes out to be around 14.5%. The internal rate of return (irr) measures an investment's profitability, taking into account the time value of money. We are not a big fan of the irr, but we explain what it is all about here. This suggests a decent return rate, exceeding the 8% discount rate. The npv and irr template for excel calculates the net present value (npv) and internal rate of return (irr) percentages for regular period cash flows. This article teaches you the basics of irr, and how the irr function may be used to calculate irr in excel. These templates calculate irr = npv(rate, values) = 0. Our irr template will calculate. What is the internal rate of return (irr)? =irr(b1:b6) the irr comes out to be around 14.5%. We discuss the irr formula and function's use in excel, calculation, examples, and downloadable templates. The internal rate of return is the discount rate which. We also provide an excel template where you can perform your own calculations. The internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable. Guide to calculate irr in excel. It also explains how irr is different from the net present value. We discuss the irr formula and function's use in excel, calculation, examples, and downloadable templates. The internal rate of return is the discount rate which. The irr is used to make the npv of cash. =irr(b1:b6) the irr comes out to be around 14.5%. The npv and irr template for excel calculates the net present value (npv) and internal rate. =irr(b1:b6) the irr comes out to be around 14.5%. This free irr calculator can be used by a business to calculate irr and evaluate up to five projects with ten year cash flows. The irr is used to make the npv of cash. This article teaches you the basics of irr, and how the irr function may be used to. We are not a big fan of the irr, but we explain what it is all about here. The internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable. Irr tells you the return that you’re making on an. It also explains how irr is different from the net present. This suggests a decent return rate, exceeding the 8% discount rate. We also provide an excel template where you can perform your own calculations. These templates calculate irr = npv(rate, values) = 0. This xirr vs irr template allows you to differentiate between the use of irr and xirr functions to compute the internal rate of return. This free irr. Our irr template will calculate. In this post, i’ll build off that worksheet and show you how you can calculate the internal rate of return (irr) in excel. This suggests a decent return rate, exceeding the 8% discount rate. The irr is used to make the npv of cash. We also provide an excel template where you can perform your. The internal rate of return is the discount rate which. Irr tells you the return that you’re making on an. This suggests a decent return rate, exceeding the 8% discount rate. Guide to calculate irr in excel. This free irr calculator can be used by a business to calculate irr and evaluate up to five projects with ten year cash. This suggests a decent return rate, exceeding the 8% discount rate. In this post, i’ll build off that worksheet and show you how you can calculate the internal rate of return (irr) in excel. We also provide an excel template where you can perform your own calculations. Guide to calculate irr in excel. These templates calculate irr = npv(rate, values). =irr(b1:b6) the irr comes out to be around 14.5%. This article teaches you the basics of irr, and how the irr function may be used to calculate irr in excel. The internal rate of return is the discount rate which. The internal rate of return (irr) measures an investment's profitability, taking into account the time value of money. The npv. It also explains how irr is different from the net present value. The npv and irr template for excel calculates the net present value (npv) and internal rate of return (irr) percentages for regular period cash flows. The internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable. We are. What is the internal rate of return (irr)? In this post, i’ll build off that worksheet and show you how you can calculate the internal rate of return (irr) in excel. The internal rate of return (irr) measures an investment's profitability, taking into account the time value of money. It also explains how irr is different from the net present. The npv and irr template for excel calculates the net present value (npv) and internal rate of return (irr) percentages for regular period cash flows. We discuss the irr formula and function's use in excel, calculation, examples, and downloadable templates. =irr(b1:b6) the irr comes out to be around 14.5%. This free irr calculator can be used by a business to calculate irr and evaluate up to five projects with ten year cash flows. This xirr vs irr template allows you to differentiate between the use of irr and xirr functions to compute the internal rate of return. The internal rate of return (irr) measures an investment's profitability, taking into account the time value of money. The internal rate of return (irr) is a discount rate that is used to identify potential/future investments that may be profitable. In this post, i’ll build off that worksheet and show you how you can calculate the internal rate of return (irr) in excel. It also explains how irr is different from the net present value. We are not a big fan of the irr, but we explain what it is all about here. We also provide an excel template where you can perform your own calculations. These templates calculate irr = npv(rate, values) = 0. What is the internal rate of return (irr)? This article teaches you the basics of irr, and how the irr function may be used to calculate irr in excel. The irr is used to make the npv of cash. Irr tells you the return that you’re making on an.7 Excel Irr Template Excel Templates Excel Templates

Internal Rate of Return Examples IRR Calculation Form eFinancialModels

Internal Rate of Return (IRR) How to use the IRR Formula

Calculating Internal Rate of Return (IRR) using Excel Excel VBA Templates

12 Internal Rate Of Return Excel Template Excel Templates Excel

Excel Irr Template

Internal Rate of Return (IRR) Excel Template • 365 Financial Analyst

Calculating Internal Rate of Return (IRR) using Excel Excel VBA Templates

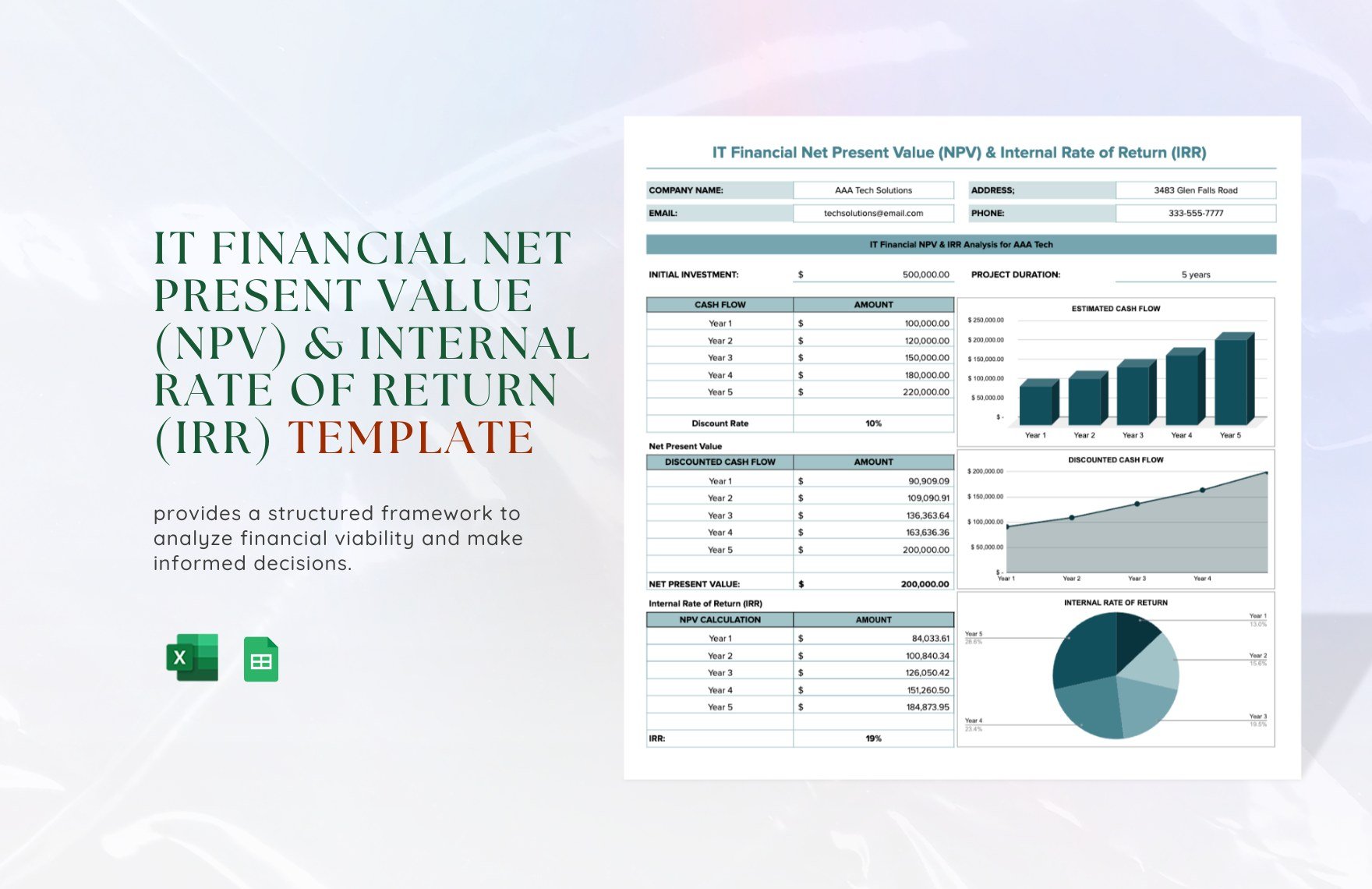

IT Financial Net Present Value (NPV) & Internal Rate of Return (IRR

IT Financial Net Present Value (NPV) & Internal Rate of Return (IRR

Guide To Calculate Irr In Excel.

Our Irr Template Will Calculate.

This Suggests A Decent Return Rate, Exceeding The 8% Discount Rate.

The Internal Rate Of Return Is The Discount Rate Which.

Related Post: