Irs Abatement Letter Template

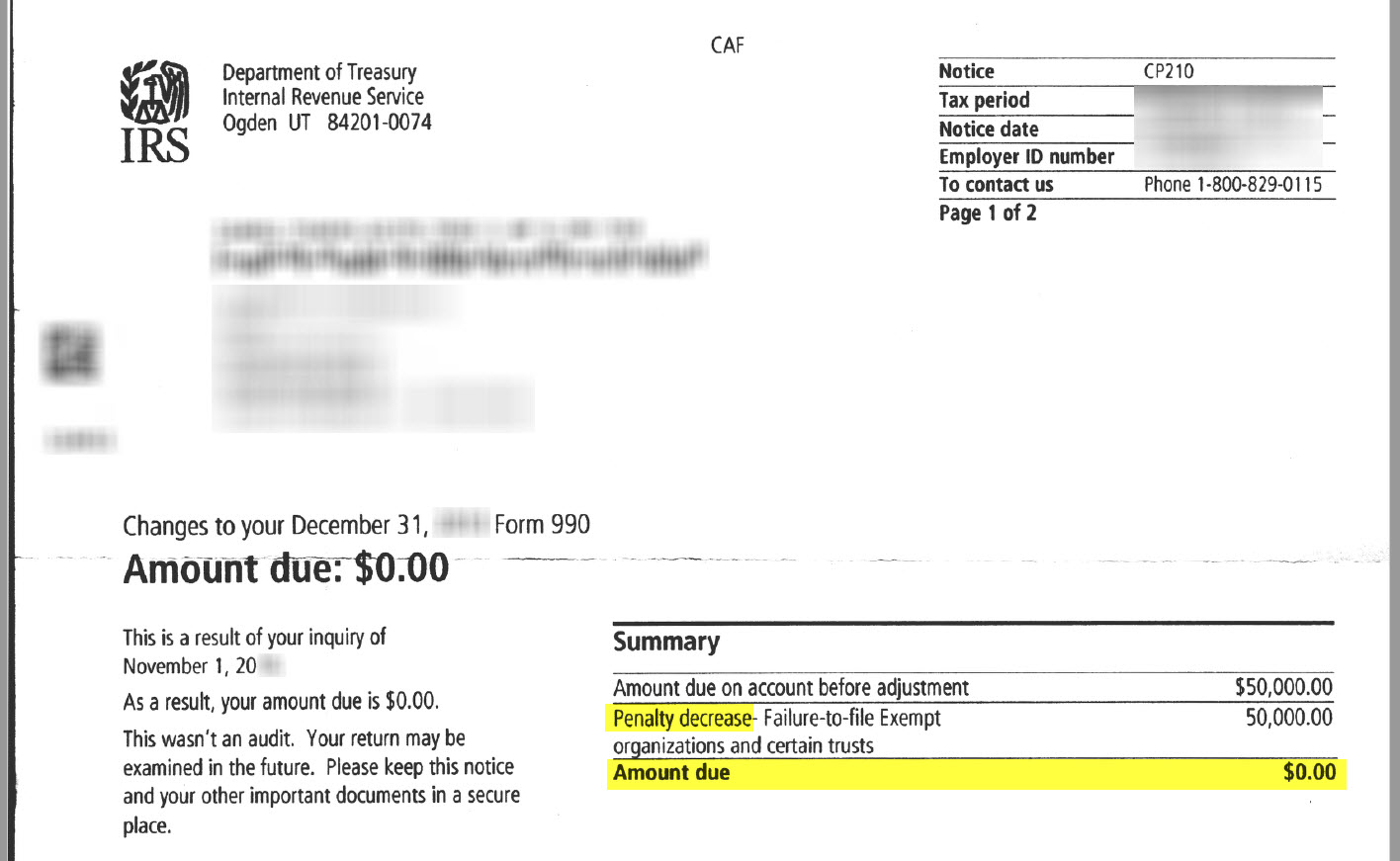

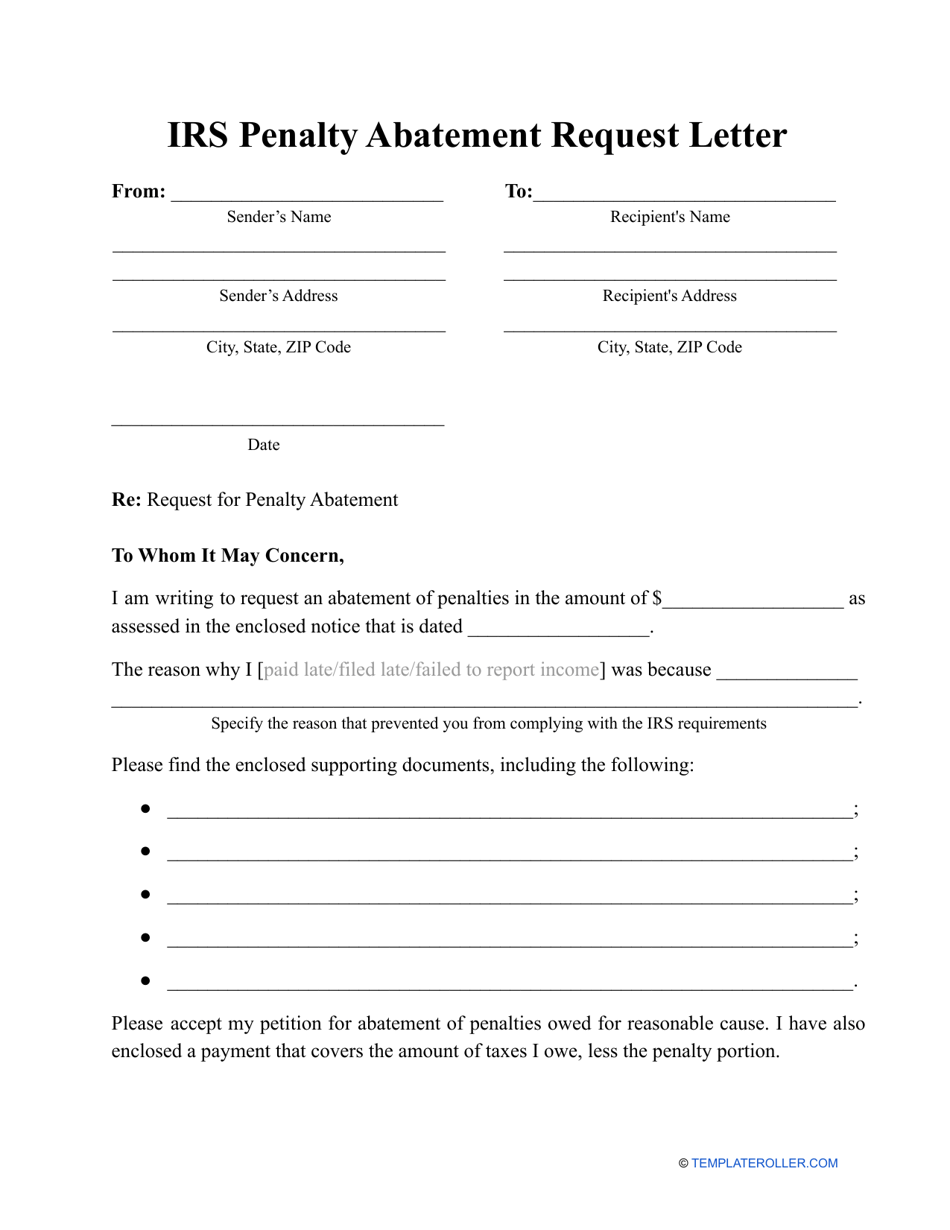

Irs Abatement Letter Template - Regardless of the method you choose, you need to explain what you failed to pay the taxes owed. Access 3 effective irs penalty abatement request letter templates. You can request penalty abatement by writing a letter to the irs. We’ll also explain the criteria for penalty abatement, how to write a successful fta. The letter should explain why. In this article, we will provide you with templates, examples, and samples of letters to the irs for penalty waivers. As soon as a penalty is proposed or assessed by the irs you should take steps to write a persuasive penalty abatement letter, as there may be legal time limits for requesting relief. Here’s a comprehensive guide to writing an irs penalty abatement request letter. Simplify your process and avoid hefty fines with ease! This document provides sample letters that can be used to request an abatement of irs penalties for failure to file, failure to pay, or failure to deposit. You’ll need skill, savvy, and a great first time penalty abatement letter to secure approval for your next tax resolution client. This document provides sample letters that can be used to request an abatement of irs penalties for failure to file, failure to pay, or failure to deposit. These letters will help you get started on your own letter and. Here’s a comprehensive guide to writing an irs penalty abatement request letter. Simplify your process and avoid hefty fines with ease! In this article, we will provide you with templates, examples, and samples of letters to the irs for penalty waivers. Regardless of the method you choose, you need to explain what you failed to pay the taxes owed. You can request penalty abatement by writing a letter to the irs. This irs letter requests the irs to remove or reduce penalties due to specific circumstances that. We have everything you need and a downloadable template to. The letter should explain why. You’ll need skill, savvy, and a great first time penalty abatement letter to secure approval for your next tax resolution client. In this article, we will provide you with templates, examples, and samples of letters to the irs for penalty waivers. Why write a penalty abatement request. You can save time by using a first. We have everything you need and a downloadable template to. Access 3 effective irs penalty abatement request letter templates. Here’s a comprehensive guide to writing an irs penalty abatement request letter. You can save time by using a first. As soon as a penalty is proposed or assessed by the irs you should take steps to write a persuasive penalty. An annotated irs penalty abatement request that provides explanations as to how to write to the irs and request penalty relief. We have everything you need and a downloadable template to. Anders johansson is requesting an abatement of. The letter should explain why. This document provides sample letters that can be used to request an abatement of irs penalties for. An annotated irs penalty abatement request that provides explanations as to how to write to the irs and request penalty relief. Why write a penalty abatement request. The letter should explain why. We’ll also explain the criteria for penalty abatement, how to write a successful fta. This irs letter requests the irs to remove or reduce penalties due to specific. Here’s a comprehensive guide to writing an irs penalty abatement request letter. This irs letter requests the irs to remove or reduce penalties due to specific circumstances that. You’ll need skill, savvy, and a great first time penalty abatement letter to secure approval for your next tax resolution client. Anders johansson is requesting an abatement of. You can save time. You can request penalty abatement by writing a letter to the irs. We have everything you need and a downloadable template to. Why write a penalty abatement request. Regardless of the method you choose, you need to explain what you failed to pay the taxes owed. We’ll also explain the criteria for penalty abatement, how to write a successful fta. Here’s a comprehensive guide to writing an irs penalty abatement request letter. We have everything you need and a downloadable template to. We’ll also explain the criteria for penalty abatement, how to write a successful fta. Anders johansson is requesting an abatement of. An annotated irs penalty abatement request that provides explanations as to how to write to the irs. You can save time by using a first. An annotated irs penalty abatement request that provides explanations as to how to write to the irs and request penalty relief. Here’s a comprehensive guide to writing an irs penalty abatement request letter. As soon as a penalty is proposed or assessed by the irs you should take steps to write a. Regardless of the method you choose, you need to explain what you failed to pay the taxes owed. This document provides sample letters that can be used to request an abatement of irs penalties for failure to file, failure to pay, or failure to deposit. In this guide, i’ll share my insights and provide three unique templates to help you. In this guide, i’ll share my insights and provide three unique templates to help you write an effective irs penalty abatement request letter. We’ll also explain the criteria for penalty abatement, how to write a successful fta. The letter should explain why. Here’s a comprehensive guide to writing an irs penalty abatement request letter. We have everything you need and. We’ll also explain the criteria for penalty abatement, how to write a successful fta. Simplify your process and avoid hefty fines with ease! The letter should explain why. As soon as a penalty is proposed or assessed by the irs you should take steps to write a persuasive penalty abatement letter, as there may be legal time limits for requesting relief. You can request penalty abatement by writing a letter to the irs. You’ll need skill, savvy, and a great first time penalty abatement letter to secure approval for your next tax resolution client. An annotated irs penalty abatement request that provides explanations as to how to write to the irs and request penalty relief. You can save time by using a first. Why write a penalty abatement request. Here’s a comprehensive guide to writing an irs penalty abatement request letter. Access 3 effective irs penalty abatement request letter templates. In this guide, i’ll share my insights and provide three unique templates to help you write an effective irs penalty abatement request letter. We have everything you need and a downloadable template to. These letters will help you get started on your own letter and. This document provides sample letters that can be used to request an abatement of irs penalties for failure to file, failure to pay, or failure to deposit.Penalty Relief Due To Reasonable Cause Sample Letter

Letter Of Abatement Sample

How to write a tax abatement letter

Sample Irs Penalty Abatement Request Letter

Letter Of Abatement Sample

Abatement Meaning, Example, Taxes, How it Works?

Irs Abatement Letter Template

IRS Penalty Abatement Request Letter Template Download Printable PDF

Letter Of Abatement Sample

Sample Letters To Irs For Abatement Of Penalties

Regardless Of The Method You Choose, You Need To Explain What You Failed To Pay The Taxes Owed.

This Irs Letter Requests The Irs To Remove Or Reduce Penalties Due To Specific Circumstances That.

Anders Johansson Is Requesting An Abatement Of.

In This Article, We Will Provide You With Templates, Examples, And Samples Of Letters To The Irs For Penalty Waivers.

Related Post: