Irs Letter 12C Response Template

Irs Letter 12C Response Template - You may have received this notice because you need. Up to 8% cash back the irs was unable to process your tax return because required information was incomplete or missing. You may be eligible for free tas help if your irs problem is causing financial difficulty, if you’ve tried and been unable to resolve your issue with the irs, or if you believe an. If we don’t receive a response from you, we may have to increase the tax you owe or reduce your refund. If you need to sign a return, the irs sends you this letter. It includes the reasons your return cannot be processed and. The irs will not say what generates a 12c letter but unusually large refund could do it. 31, 2019, form 1040 federal individual income tax return, but we need more information to process the return accurately. Read and respond to the letter in a timely fashion. Here's a guide to understanding it: Irs letter 12c, titled “individual return incomplete for processing,” is issued when the irs finds that a tax return, such as form 1040, form 1040a, or form 1040ez, is. 31, 2019, form 1040 federal individual income tax return, but we need more information to process the return accurately. You may be eligible for free tas help if your irs problem is causing financial difficulty, if you’ve tried and been unable to resolve your issue with the irs, or if you believe an. Read and respond to the letter in a timely fashion. This sample irs tax audit notice was sent to one our members in bentonville, arkansas (ar). If you need to sign a return, the irs sends you this letter. Here's a guide to understanding it: Up to 8% cash back the irs was unable to process your tax return because required information was incomplete or missing. To obtain the forms, schedules, or publications to respond. Form 8962 is incomplete or. If you believe there is an error send the irs a letter detailing the error. Irs letter 12c requests additional information in regards to form 8586 and form 3800 on our. The irs will not say what generates a 12c letter but unusually large refund could do it. Letter 12c is an irs notice sent to inform a taxpayer that. In this blog post, we’ll explain how to respond to a letter 12c request for more information and how to file form 8962. This sample irs tax audit notice was sent to one our members in bentonville, arkansas (ar). We are sending you letter 12c because we need more information to process your individual income tax return. You may be. If you believe there is an error send the irs a letter detailing the error. A 12c letter means the irs needs more information to process your return. The irs will not say what generates a 12c letter but unusually large refund could do it. Where can i see all the supporting documents that turbotax already submitted to the irs,. According to the irs, letter 12c is a submission processing notice. We are sending you letter 12c because we need more information to process your individual income tax return. Letter 12c is an irs notice sent to inform a taxpayer that additional information is needed to process a tax return. The letter has check boxes to indicate information needed to.. Where can i see all the supporting documents that turbotax already submitted to the irs, so i can figure out which ones might be missing? In this blog post, we’ll explain how to respond to a letter 12c request for more information and how to file form 8962. Don’t panic and read the letter carefully. I got a letter 12c. This sample irs tax audit notice was sent to one our members in bentonville, arkansas (ar). Irs letter 12c, titled “individual return incomplete for processing,” is issued when the irs finds that a tax return, such as form 1040, form 1040a, or form 1040ez, is. 12c is an identify verification letter. Where can i see all the supporting documents that. If we don’t receive a response from you, we may have to increase the tax you owe or reduce your refund. Irs letter 12c requests additional information in regards to form 8586 and form 3800 on our. Read and respond to the letter in a timely fashion. This form is required when someone on your tax. According to the irs,. Where can i see all the supporting documents that turbotax already submitted to the irs, so i can figure out which ones might be missing? If you need to sign a return, the irs sends you this letter. This sample irs tax audit notice was sent to one our members in bentonville, arkansas (ar). Form 8962 is incomplete or. Follow. 12c is an identify verification letter. This sample irs tax audit notice was sent to one our members in bentonville, arkansas (ar). This form is required when someone on your tax. How to respond to a 12c letter. 31, 2019, form 1040 federal individual income tax return, but we need more information to process the return accurately. I got a letter 12c from the irs. You may have received this notice because you need. Don’t panic and read the letter carefully. Read and respond to the letter in a timely fashion. Letter 12c is an irs notice sent to inform a taxpayer that additional information is needed to process a tax return. If we don’t receive a response from you, we may have to increase the tax you owe or reduce your refund. How to respond to a 12c letter. Where can i see all the supporting documents that turbotax already submitted to the irs, so i can figure out which ones might be missing? If you need to sign a return, the irs sends you this letter. The letter has check boxes to indicate information needed to. The irs will not say what generates a 12c letter but unusually large refund could do it. To obtain the forms, schedules, or publications to respond. In this blog post, we’ll explain how to respond to a letter 12c request for more information and how to file form 8962. 12c is an identify verification letter. Up to 8% cash back the irs was unable to process your tax return because required information was incomplete or missing. Follow these steps & get a legal action plan if you need help. Letter 12c is an irs notice sent to inform a taxpayer that additional information is needed to process a tax return. We are sending you letter 12c because we need more information to process your individual income tax return. 31, 2019, form 1040 federal individual income tax return, but we need more information to process the return accurately. Read and respond to the letter in a timely fashion. It includes the reasons your return cannot be processed and.Irs Letter Response Template

Irs Response Letter Template Samples Letter Template Collection

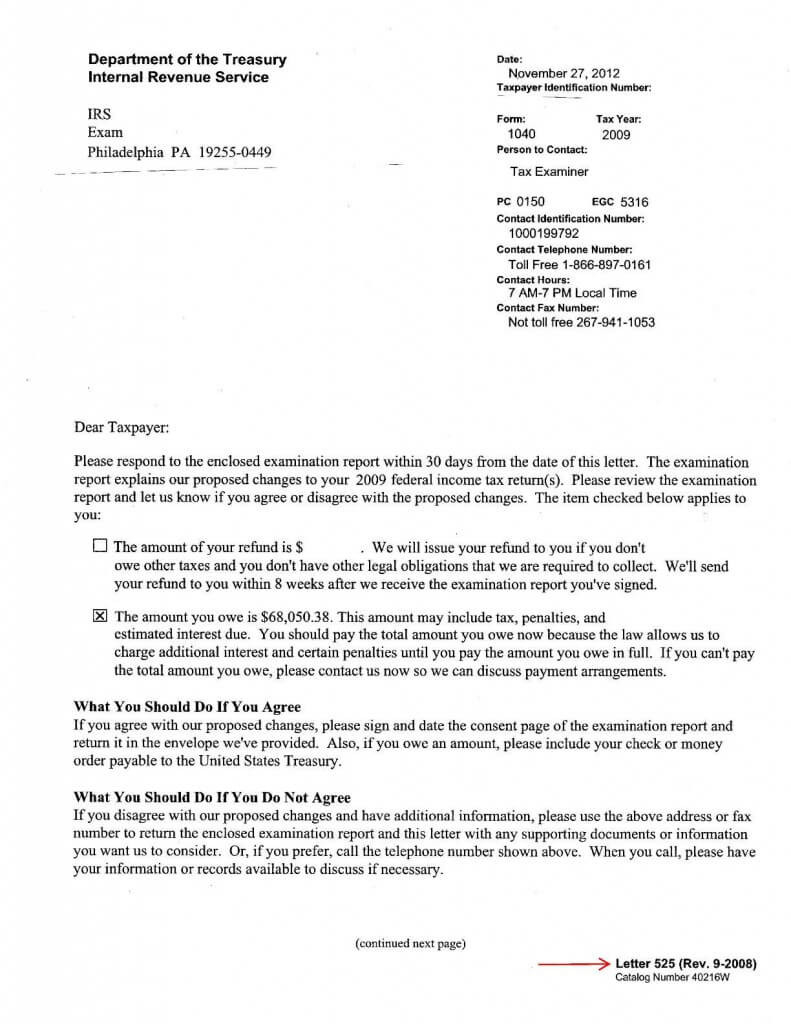

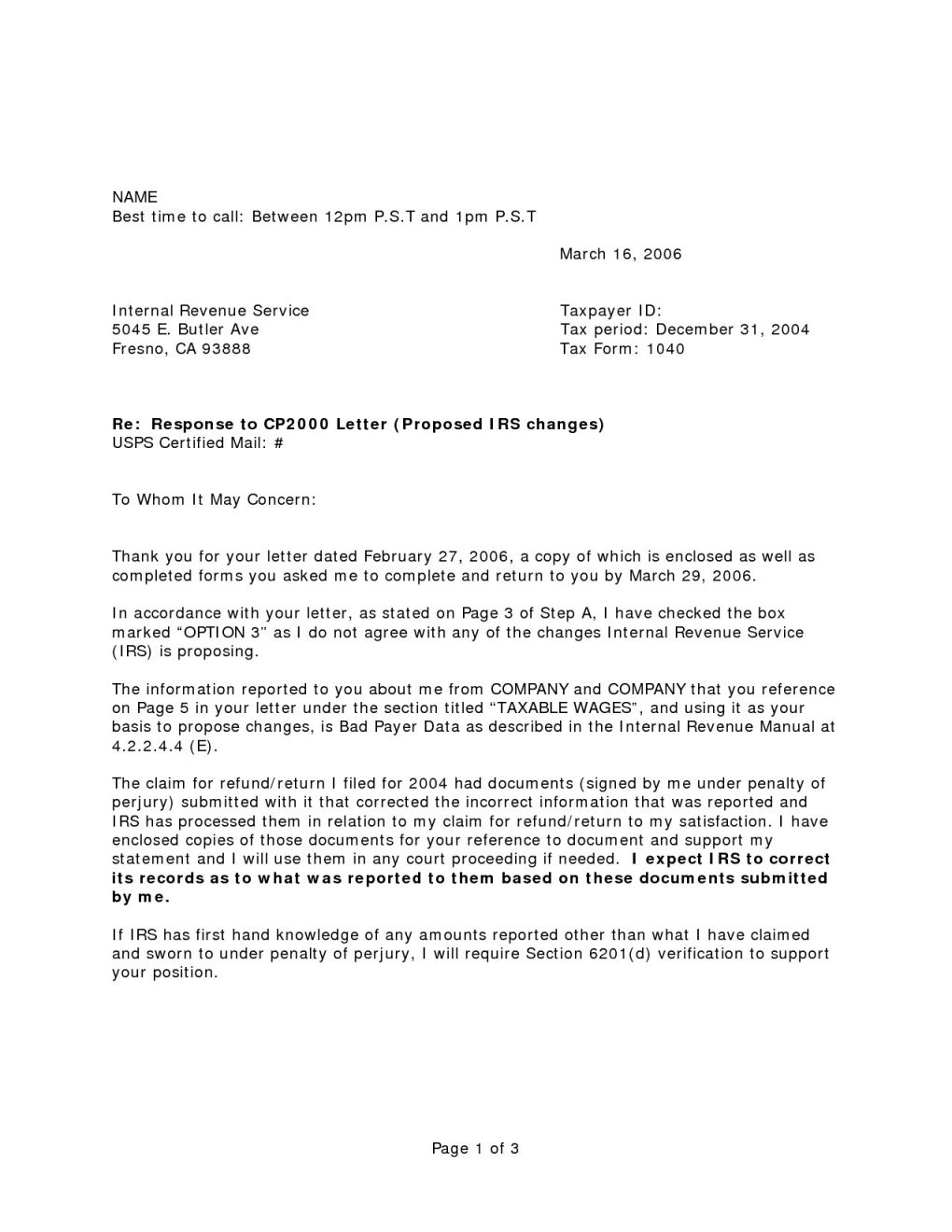

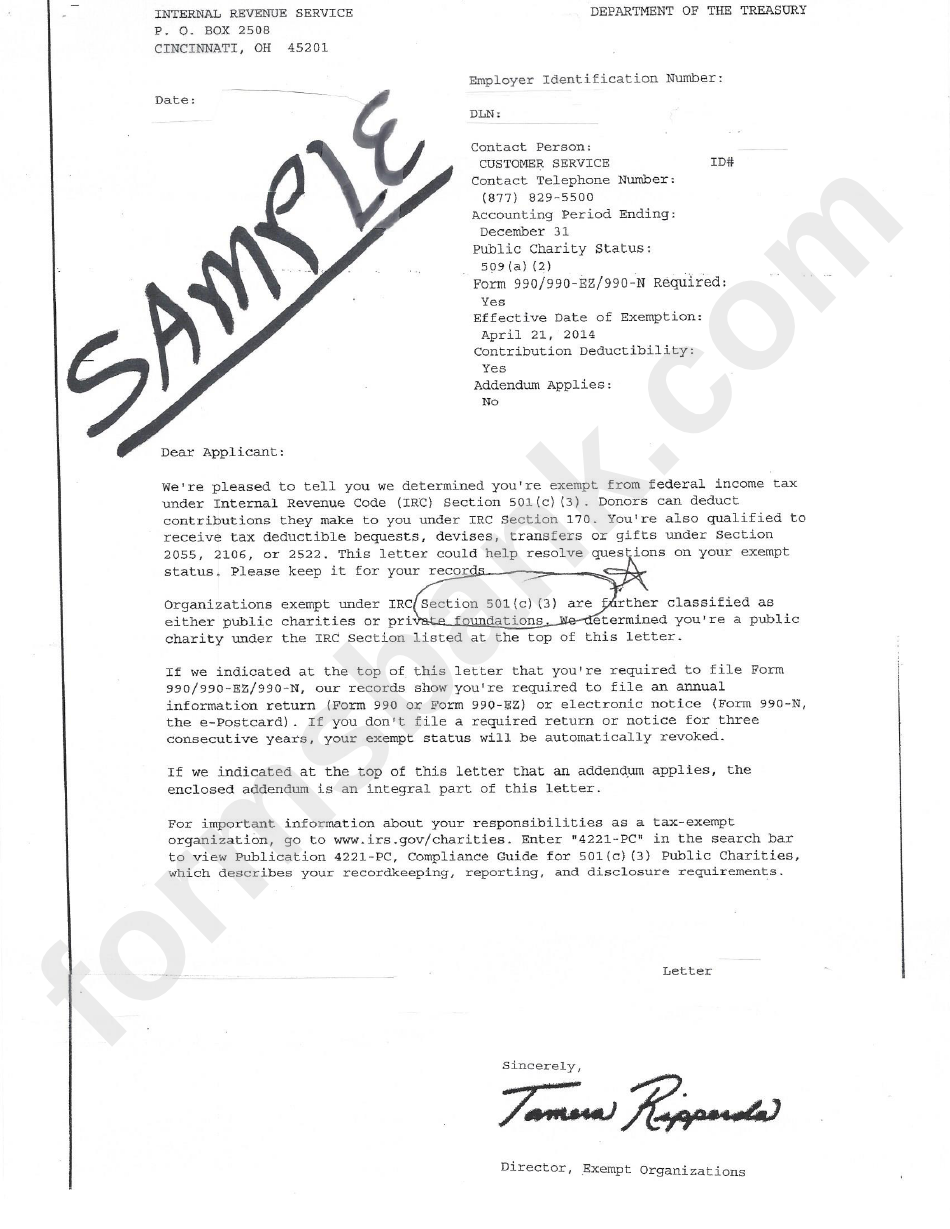

Letter to the IRS IRS Response Letter Form (with Sample)

Irs letter 12c response template Fill out & sign online DocHub

IRS Audit Letter 12C Sample 1

Irs Audit Letter Sample Free Printable Documents

Sample Filled Form 12c Tax Fill Online, Printable, Fillable

Irs Letter 12c Response Template prntbl.concejomunicipaldechinu.gov.co

Irs Letter Response Template

Fillable Online IRS Letter 12C Reconciliation of Premium Tax Credit

Irs Letter 12C, Titled “Individual Return Incomplete For Processing,” Is Issued When The Irs Finds That A Tax Return, Such As Form 1040, Form 1040A, Or Form 1040Ez, Is.

If You Believe There Is An Error Send The Irs A Letter Detailing The Error.

Irs Letter 12C Requests Additional Information In Regards To Form 8586 And Form 3800 On Our.

I Got A Letter 12C From The Irs.

Related Post: