Kentucky Tobacco Tax Excel Template

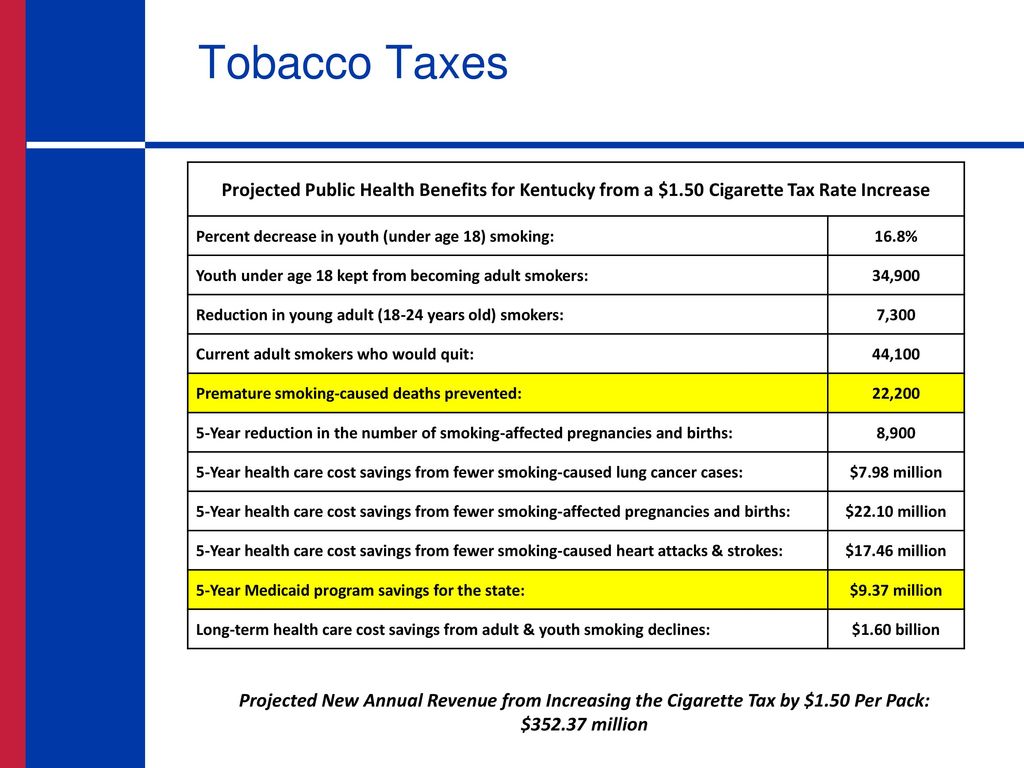

Kentucky Tobacco Tax Excel Template - Discover 15 kentucky tobacco tax templates in excel, featuring cigarette and smokeless tobacco calculations, tax rates, and revenue tracking, perfect for tobacco. A catalog of the various cigarette tax return forms and reports for all the states along with their filing and. A catalog of the tobacco excise tax forms and reports for all the states along with a link to the form. The kentucky tobacco tax excel template is equipped with features designed to make your tax management process seamless. An excel template helps you: Dor has also provided an excel template and xml conversion tool to assist the filers in creating an xml file. Generate customized templates for form 73a421, kentucky's monthly tobacco tax return. Kentucky tobacco tax excel template helps calculate cigarette and smokeless tobacco taxes, featuring formulas for wholesale and retail pricing, tax rates, and revenue. Calculate kentucky tobacco tax with ease using our excel template, featuring cigarette and vaping product tax rates, revenue tracking, and smoking cessation resources,. The department of revenue administers tobacco taxes on cigarettes, other tobacco products, snuff, and vapor products. Generate customized templates for form 73a421, kentucky's monthly tobacco tax return. Here is an example of how to create a kentucky tobacco tax excel template: Create a kentucky tobacco tax template now with 7 ultimate ways, featuring cigarette tax calculation, tobacco tax forms, and tax exemption guidelines for a seamless. Cigarettes are also subject to kentucky sales tax of approximately $0.32. The department of revenue administers tobacco taxes on cigarettes, other tobacco products, snuff, and vapor products. Discover 15 kentucky tobacco tax templates in excel, featuring cigarette and smokeless tobacco calculations, tax rates, and revenue tracking, perfect for tobacco. Kentucky tobacco tax excel template helps calculate cigarette and smokeless tobacco taxes, featuring formulas for wholesale and retail pricing, tax rates, and revenue. Tax compliance is critical in the tobacco industry. Create a table with the following columns: A catalog of the various cigarette tax return forms and reports for all the states along with their filing and. Tobacco products retailers must submit a kentucky tax. These templates automatically calculate tax liabilities for cigarettes ($1.10 per pack), snuff ($0.19 per. Cigarettes are also subject to kentucky sales tax of approximately $0.32. Tobacco returns are filed, and cigarette stamp orders are made online through tap. Create a table with the following columns: An excel template helps you: Tobacco returns are filed, and cigarette stamp orders are made online through tap. To create a functional excel template for calculating kentucky tobacco taxes, follow these steps: Kentucky cigarette tax template helps calculate tobacco taxes, including sales and use taxes, with related forms and instructions for smokers and retailers, streamlining state tax. These templates automatically. Create a table with the following columns: A catalog of the various cigarette tax return forms and reports for all the states along with their filing and. Here is an example of how to create a kentucky tobacco tax excel template: Tobacco products retailers must submit a kentucky tax. Discover 15 kentucky tobacco tax templates in excel, featuring cigarette and. To create a functional excel template for calculating kentucky tobacco taxes, follow these steps: Create a kentucky tobacco tax template now with 7 ultimate ways, featuring cigarette tax calculation, tobacco tax forms, and tax exemption guidelines for a seamless. Tobacco products retailers must submit a kentucky tax. The department of revenue administers tobacco taxes on cigarettes, other tobacco products, snuff,. This article provides an excel template for calculating tobacco tax in kentucky, useful for businesses and individuals to manage tax obligations effectively. Keep abreast of current tax rates and regulations specific to kentucky. A catalog of the various cigarette tax return forms and reports for all the states along with their filing and. The department of revenue administers tobacco taxes. Product type, quantity, wholesale price, and tax. The department of revenue administers tobacco taxes on cigarettes, other tobacco products, snuff, and vapor products. Kentucky tobacco tax excel template helps calculate cigarette and smokeless tobacco taxes, featuring formulas for wholesale and retail pricing, tax rates, and revenue. Cigarette and tobacco licenses are obtained online through the. Tobacco products retailers must submit. Dor has also provided an excel template and xml conversion tool to assist the filers in creating an xml file. Product type, quantity, wholesale price, and tax. Generate customized templates for form 73a421, kentucky's monthly tobacco tax return. Cigarette and tobacco licenses are obtained online through the. A catalog of the tobacco excise tax forms and reports for all the. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Kentucky tobacco tax excel template helps calculate cigarette and vaping taxes, including sales tax, use tax, and wholesale tax, with formulas for easy computation and. Tobacco returns are filed, and cigarette stamp orders are made online through tap. Here is an example of how. The kentucky department of revenue conducts work under the authority of the finance and administration cabinet. Discover 15 kentucky tobacco tax templates in excel, featuring cigarette and smokeless tobacco calculations, tax rates, and revenue tracking, perfect for tobacco. An excel template helps you: This article provides an excel template for calculating tobacco tax in kentucky, useful for businesses and individuals. Create a kentucky tobacco tax template now with 7 ultimate ways, featuring cigarette tax calculation, tobacco tax forms, and tax exemption guidelines for a seamless. Tobacco returns are filed, and cigarette stamp orders are made online through tap. Discover 15 kentucky tobacco tax templates in excel, featuring cigarette and smokeless tobacco calculations, tax rates, and revenue tracking, perfect for tobacco.. Generate customized templates for form 73a421, kentucky's monthly tobacco tax return. This article provides an excel template for calculating tobacco tax in kentucky, useful for businesses and individuals to manage tax obligations effectively. Create a kentucky tobacco tax template now with 7 easy ways, including calculation tools, tax forms, and revenue reporting, to simplify cigarette and vaping product. Here is an example of how to create a kentucky tobacco tax excel template: A catalog of the various cigarette tax return forms and reports for all the states along with their filing and. These templates automatically calculate tax liabilities for cigarettes ($1.10 per pack), snuff ($0.19 per. Create a kentucky tobacco tax template now with 7 ultimate ways, featuring cigarette tax calculation, tobacco tax forms, and tax exemption guidelines for a seamless. Kentucky cigarette tax template helps calculate tobacco taxes, including sales and use taxes, with related forms and instructions for smokers and retailers, streamlining state tax. Dor has also provided an excel template and xml conversion tool to assist the filers in creating an xml file. Tobacco returns are filed, and cigarette stamp orders are made online through tap. Kentucky tobacco tax excel template helps calculate cigarette and smokeless tobacco taxes, featuring formulas for wholesale and retail pricing, tax rates, and revenue. Discover 15 kentucky tobacco tax templates in excel, featuring cigarette and smokeless tobacco calculations, tax rates, and revenue tracking, perfect for tobacco. Tobacco products retailers must submit a kentucky tax. Cigarette and tobacco licenses are obtained online through the. Kentucky tobacco tax excel template helps calculate cigarette and vaping taxes, including sales tax, use tax, and wholesale tax, with formulas for easy computation and. Tax compliance is critical in the tobacco industry.Increasing Tobacco Excise Tax ppt download

15 Kentucky Tobacco Tax Templates Ultimate Excel Guide Excel Web

Kentucky Tobacco Tax Excel Template Excel Web

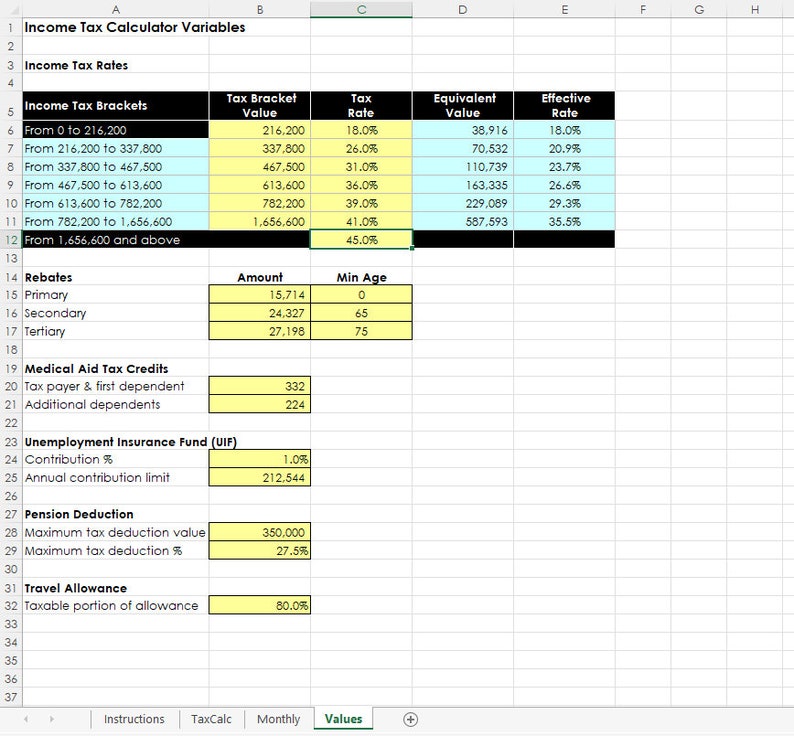

Excel Tax Template

Tax Excel Template/calculator Accounting Template Etsy

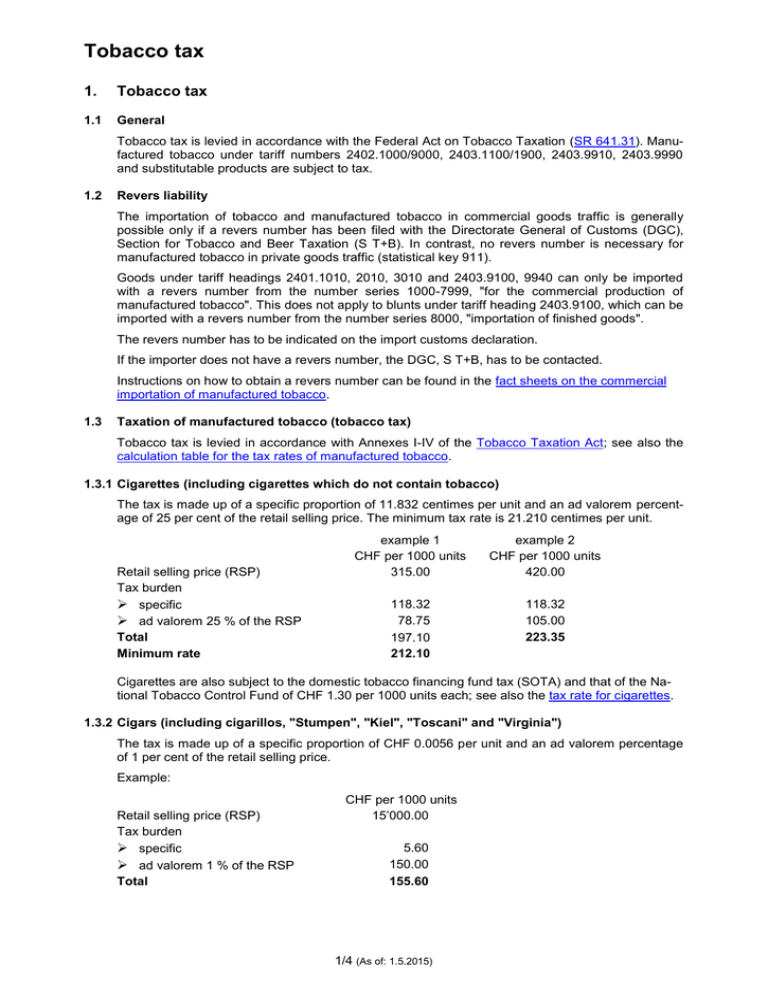

Tobacco tax

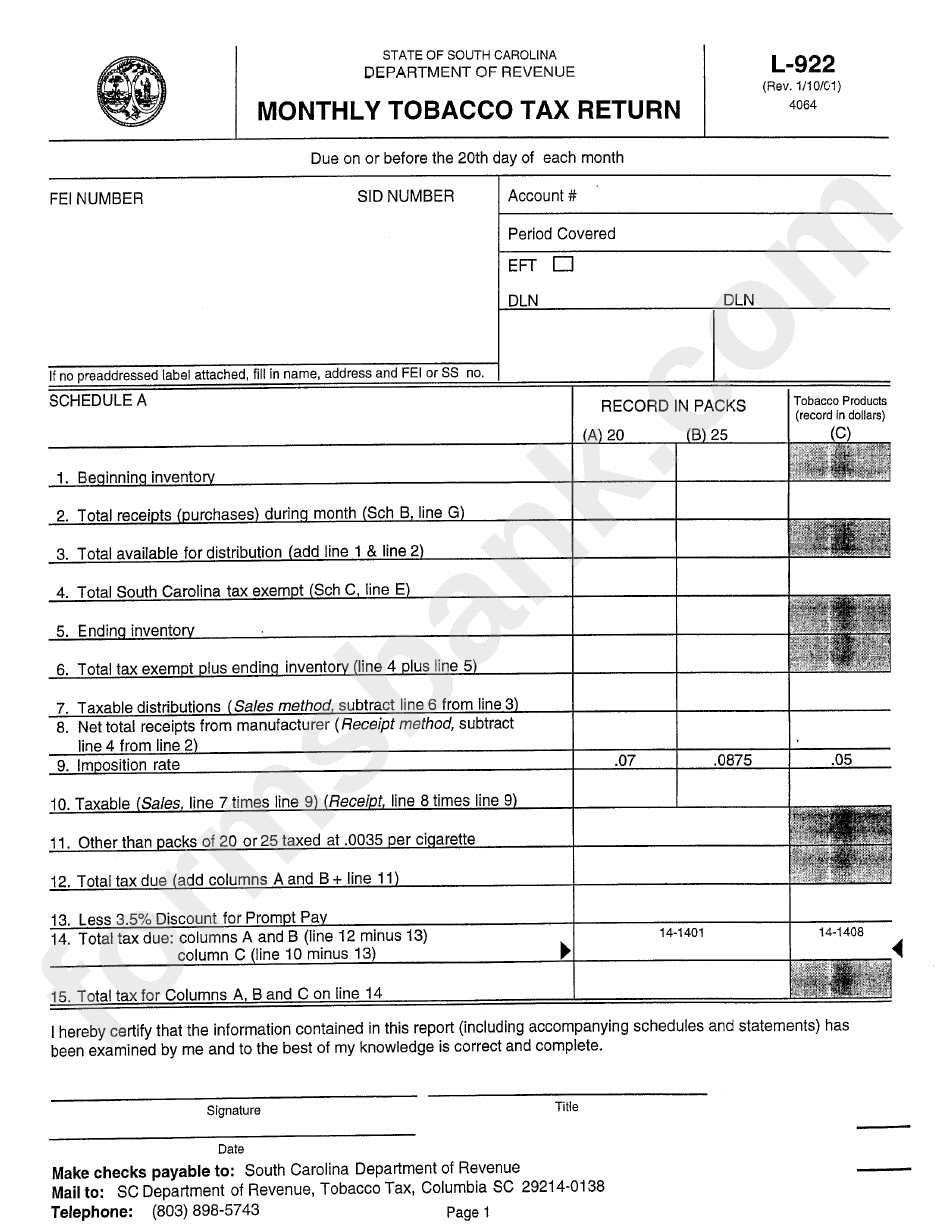

Form L022 Monthly Tobacco Tax Return Form printable pdf download

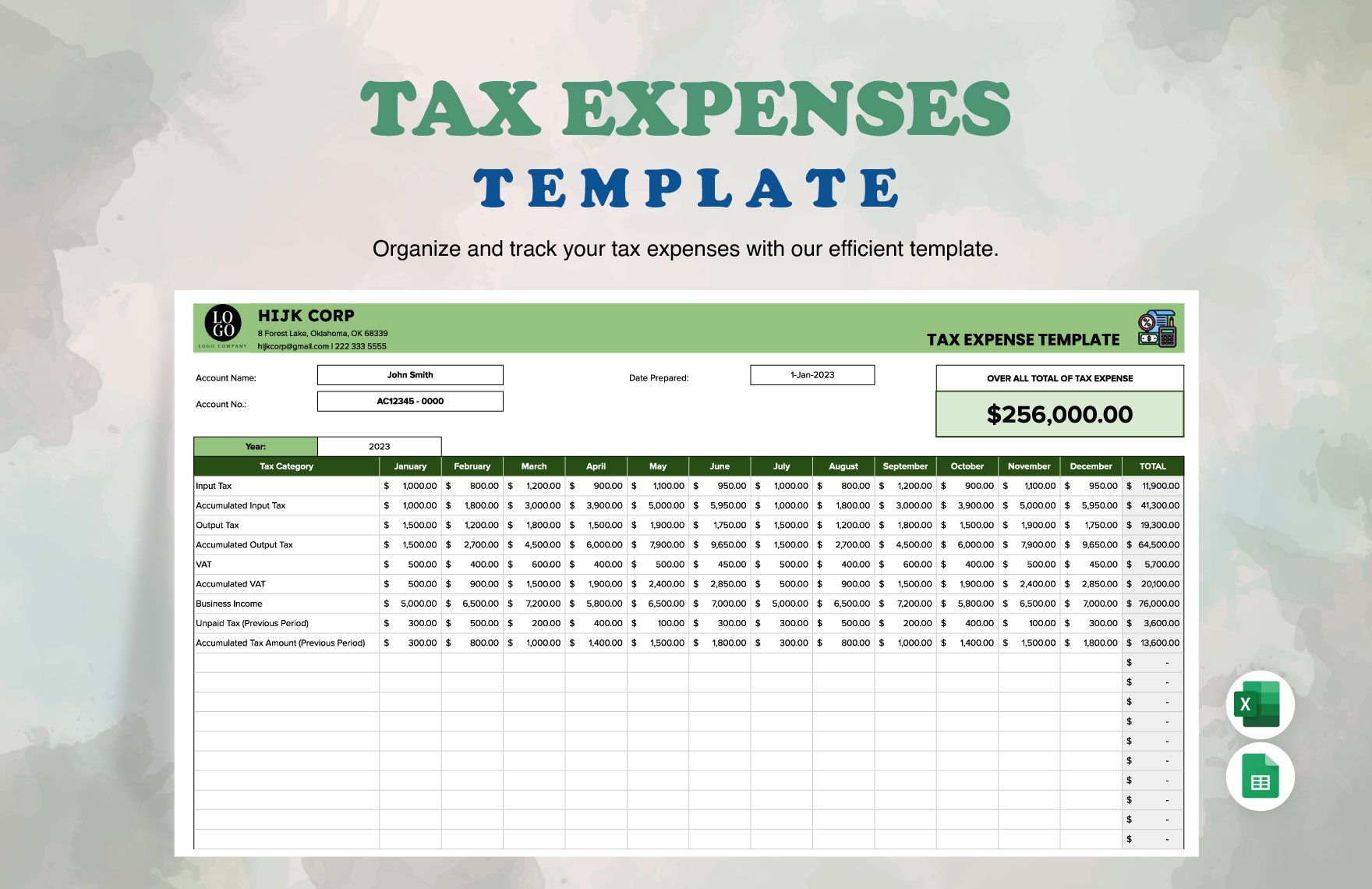

Tax Expenses Template in Excel, Google Sheets Download

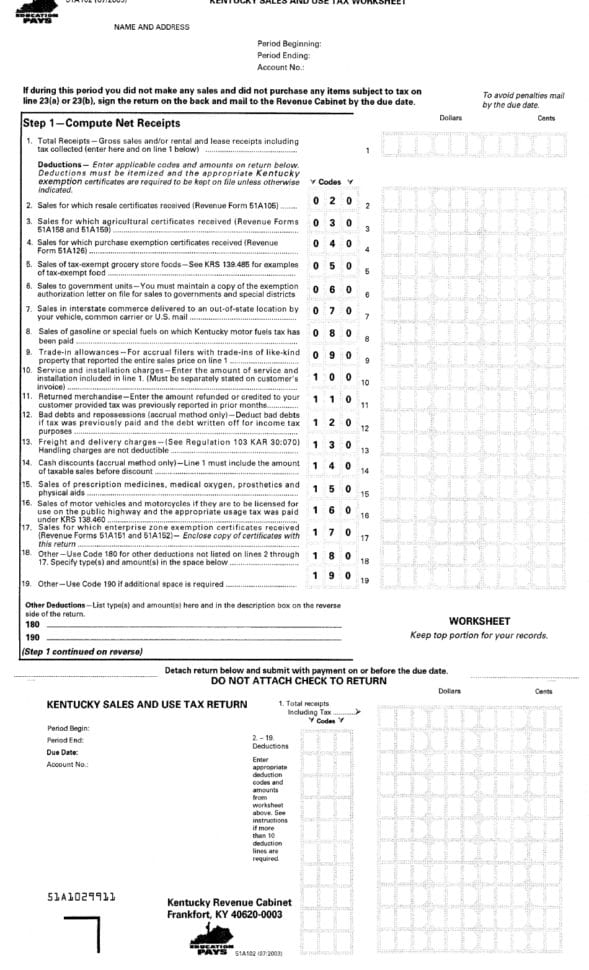

Kentucky Sales Use Tax Worksheet Printable Pdf Download —

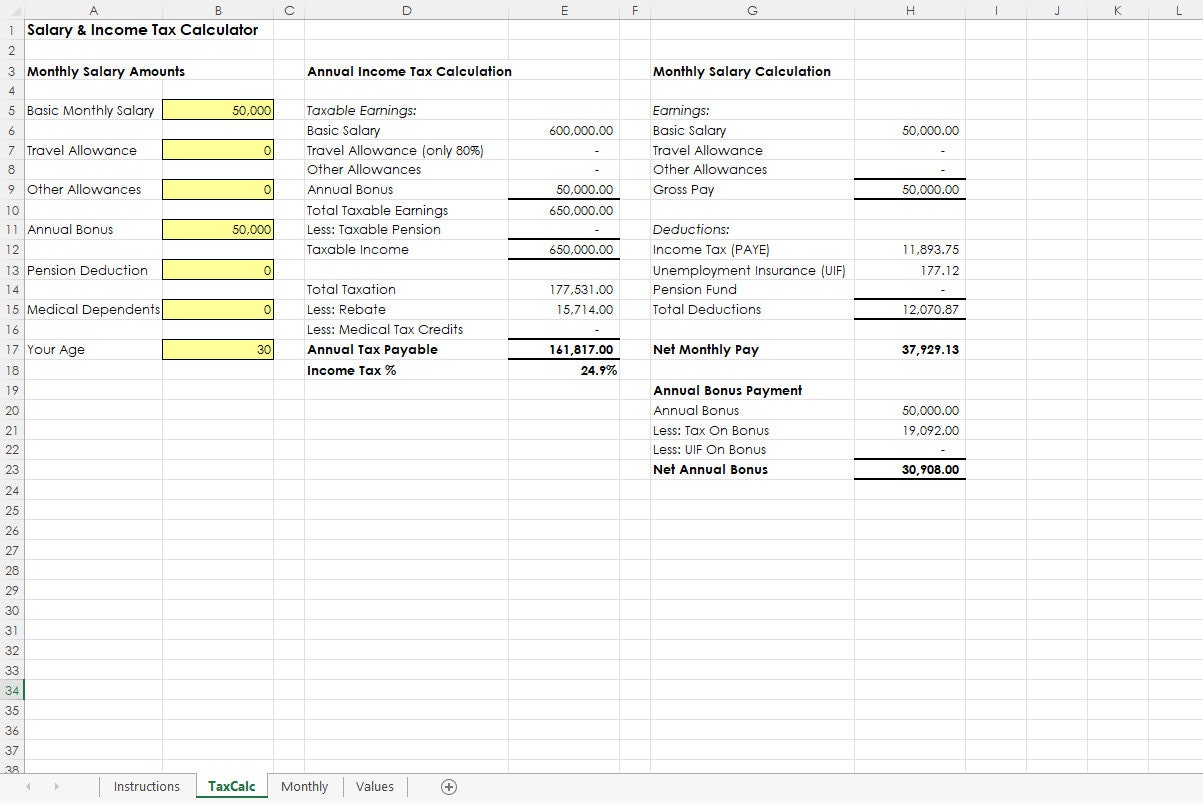

Tax Excel Template/calculator Accounting Template Etsy

The Kentucky Department Of Revenue Conducts Work Under The Authority Of The Finance And Administration Cabinet.

The Department Of Revenue Administers Tobacco Taxes On Cigarettes, Other Tobacco Products, Snuff, And Vapor Products.

A Catalog Of The Tobacco Excise Tax Forms And Reports For All The States Along With A Link To The Form.

Cigarettes Are Also Subject To Kentucky Sales Tax Of Approximately $0.32.

Related Post: