Lbo Model Template

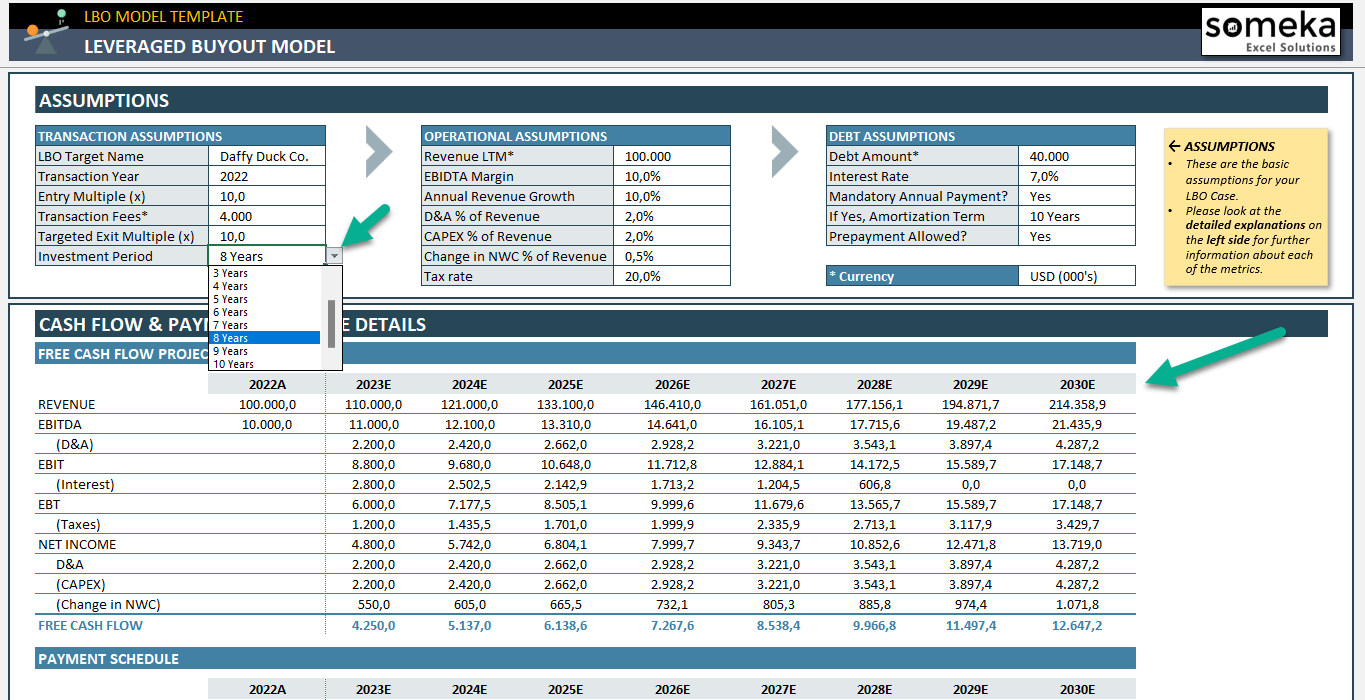

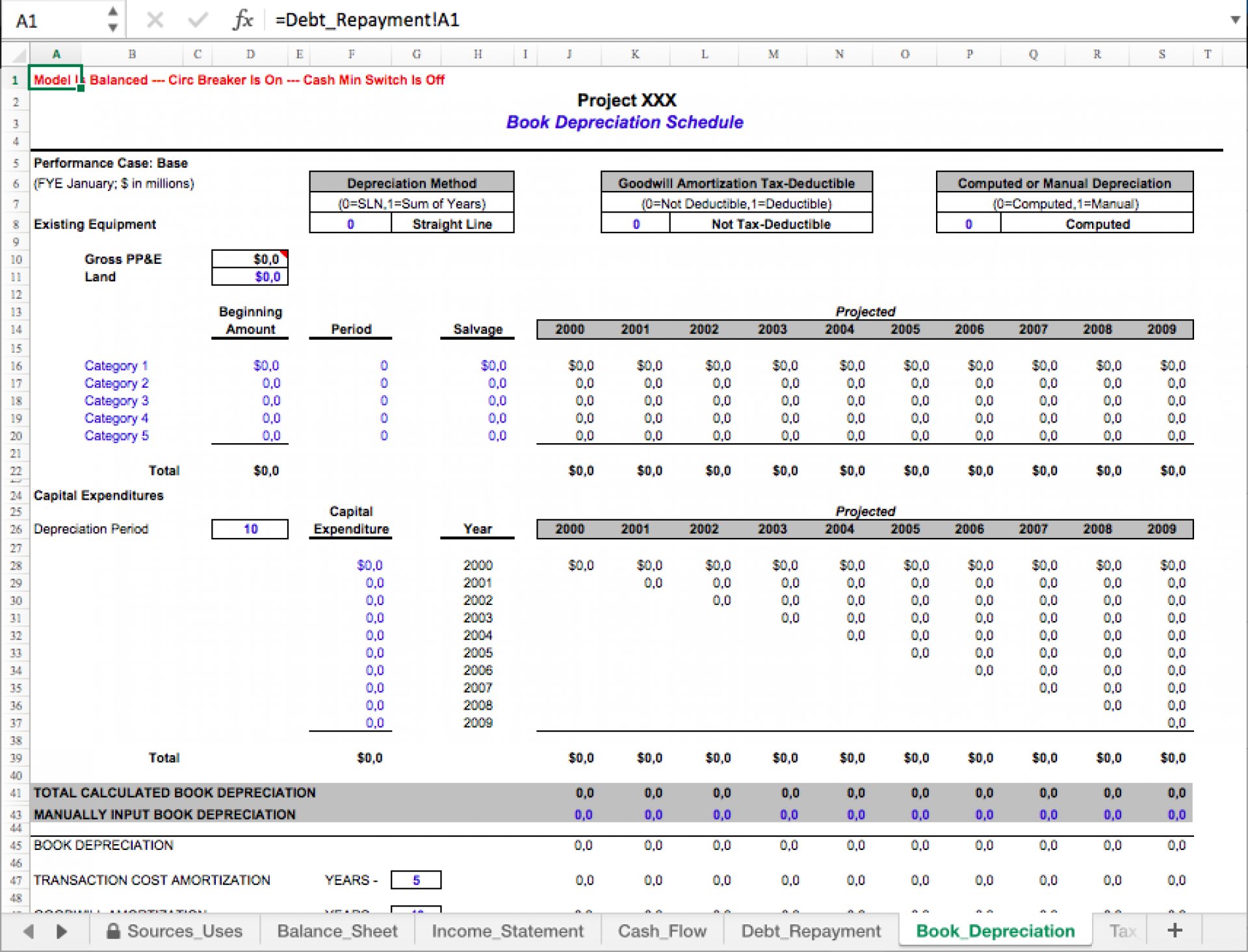

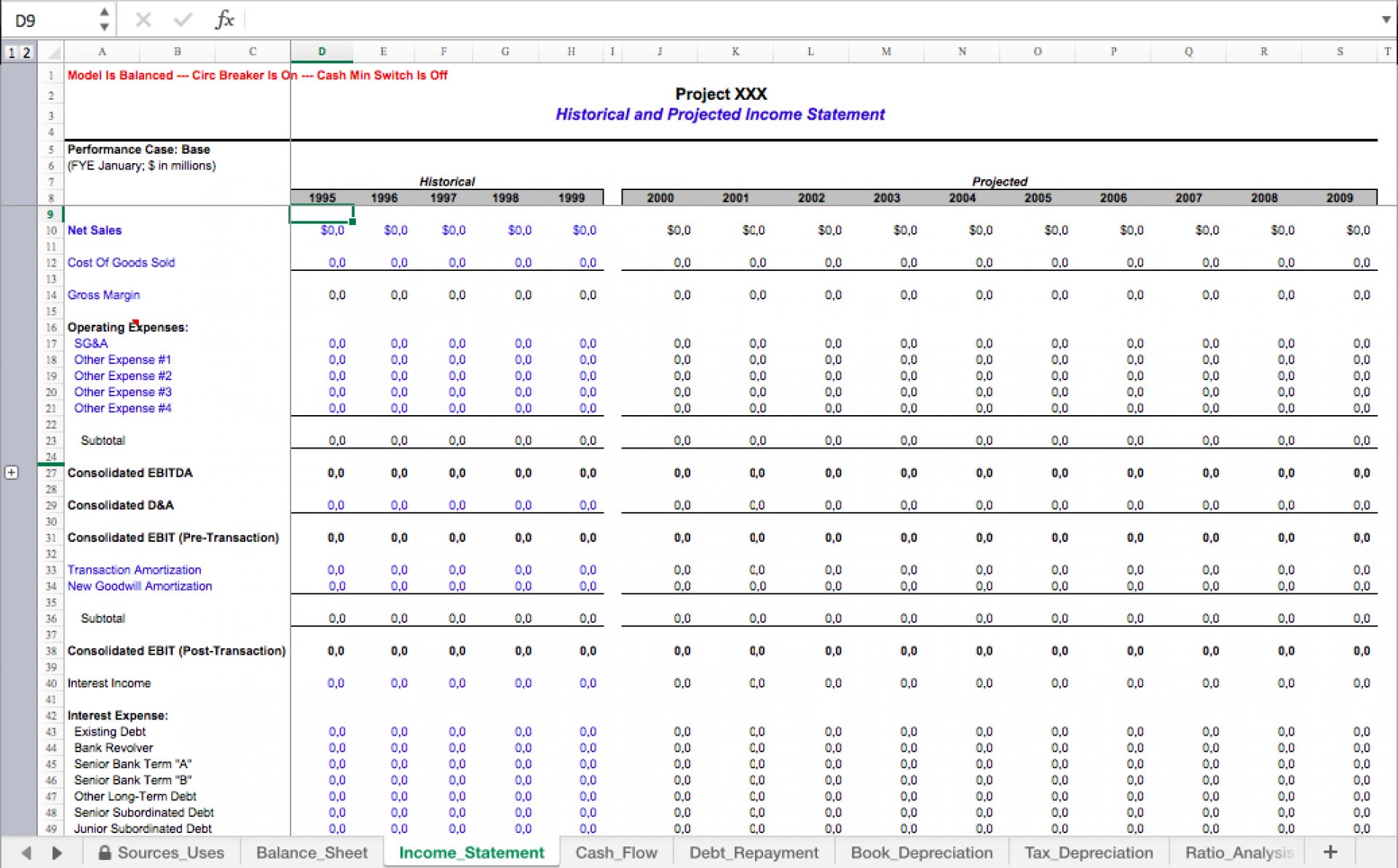

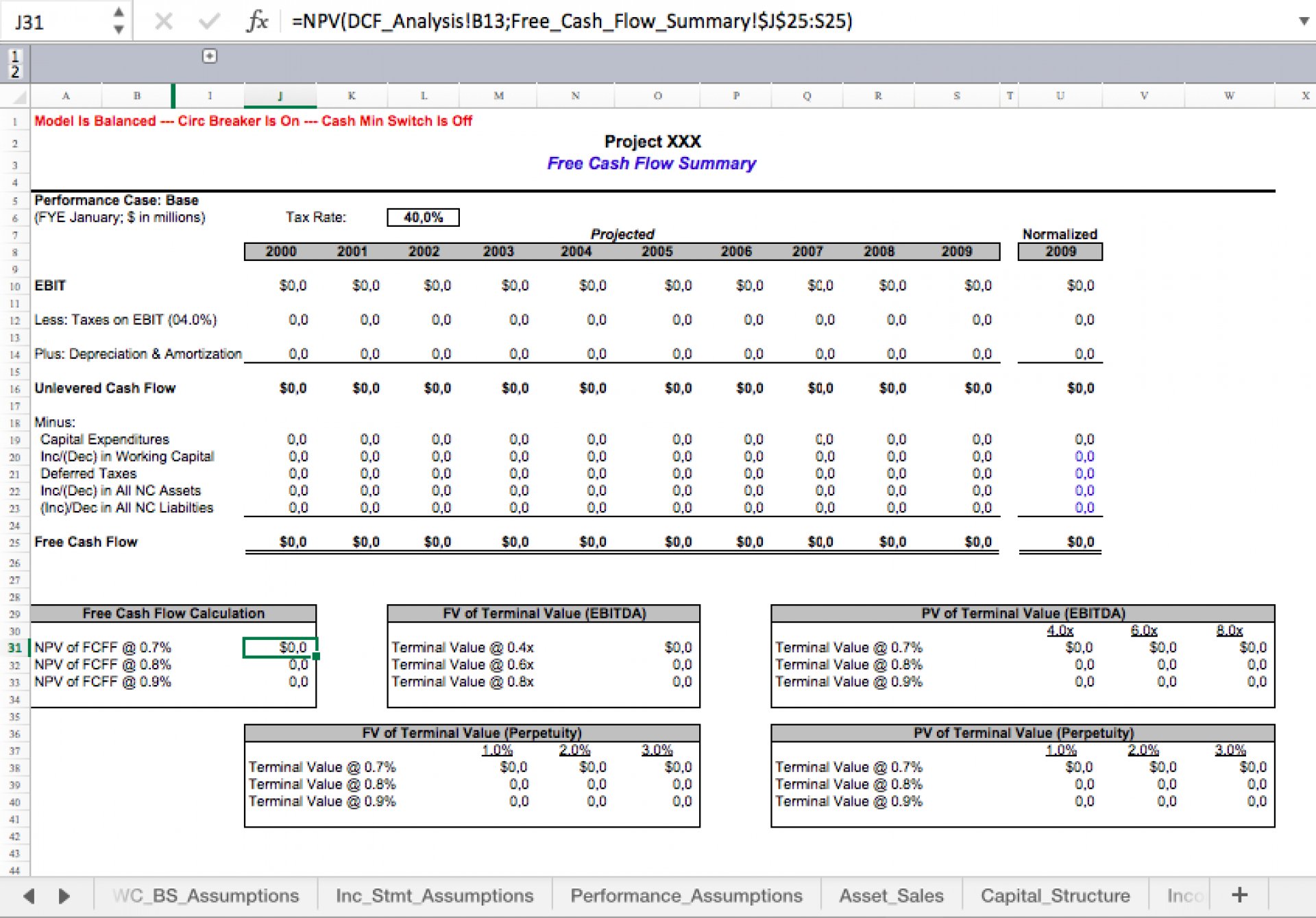

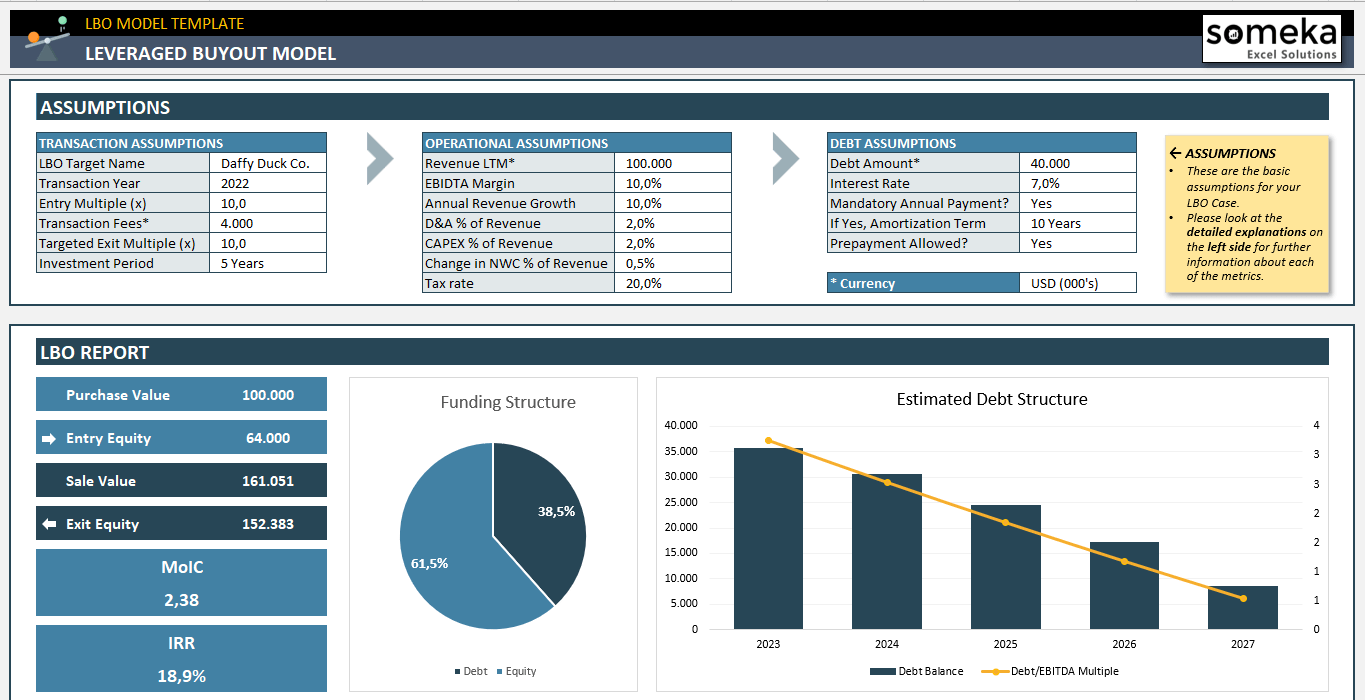

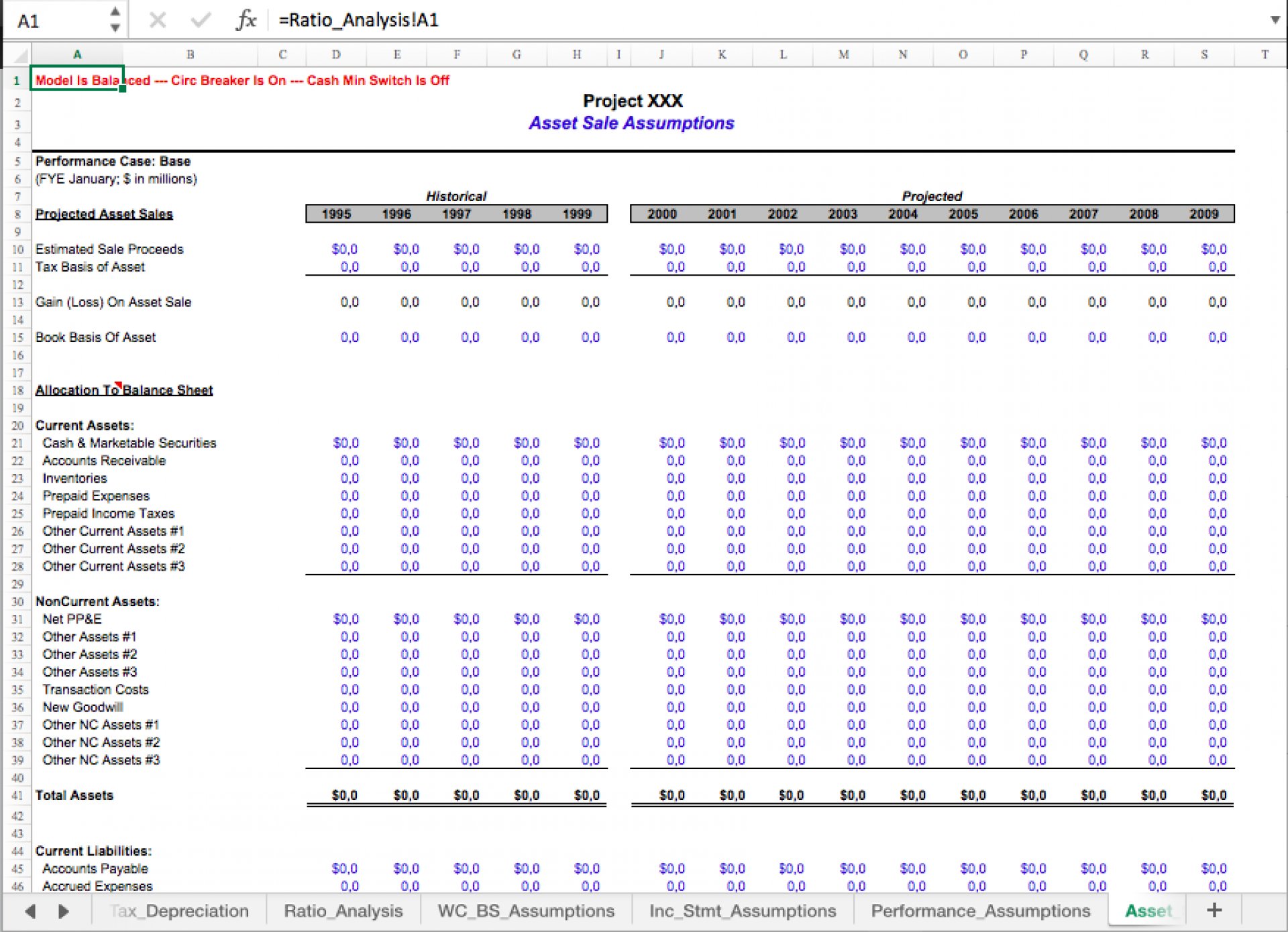

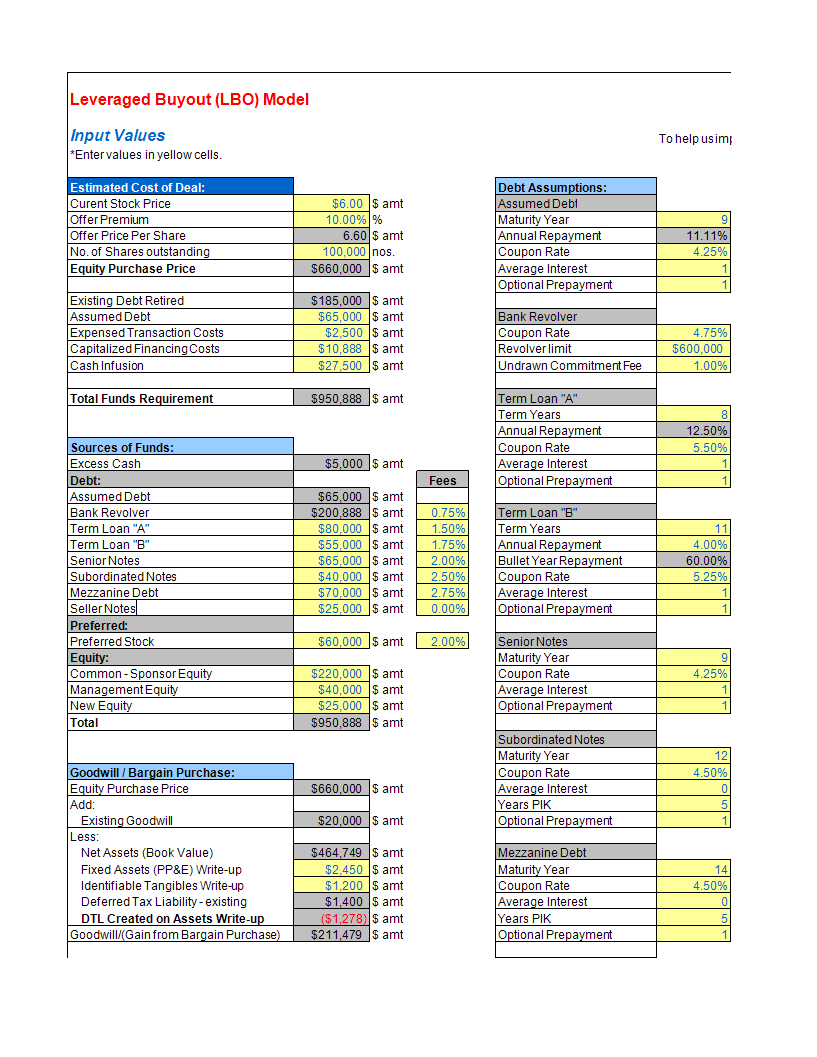

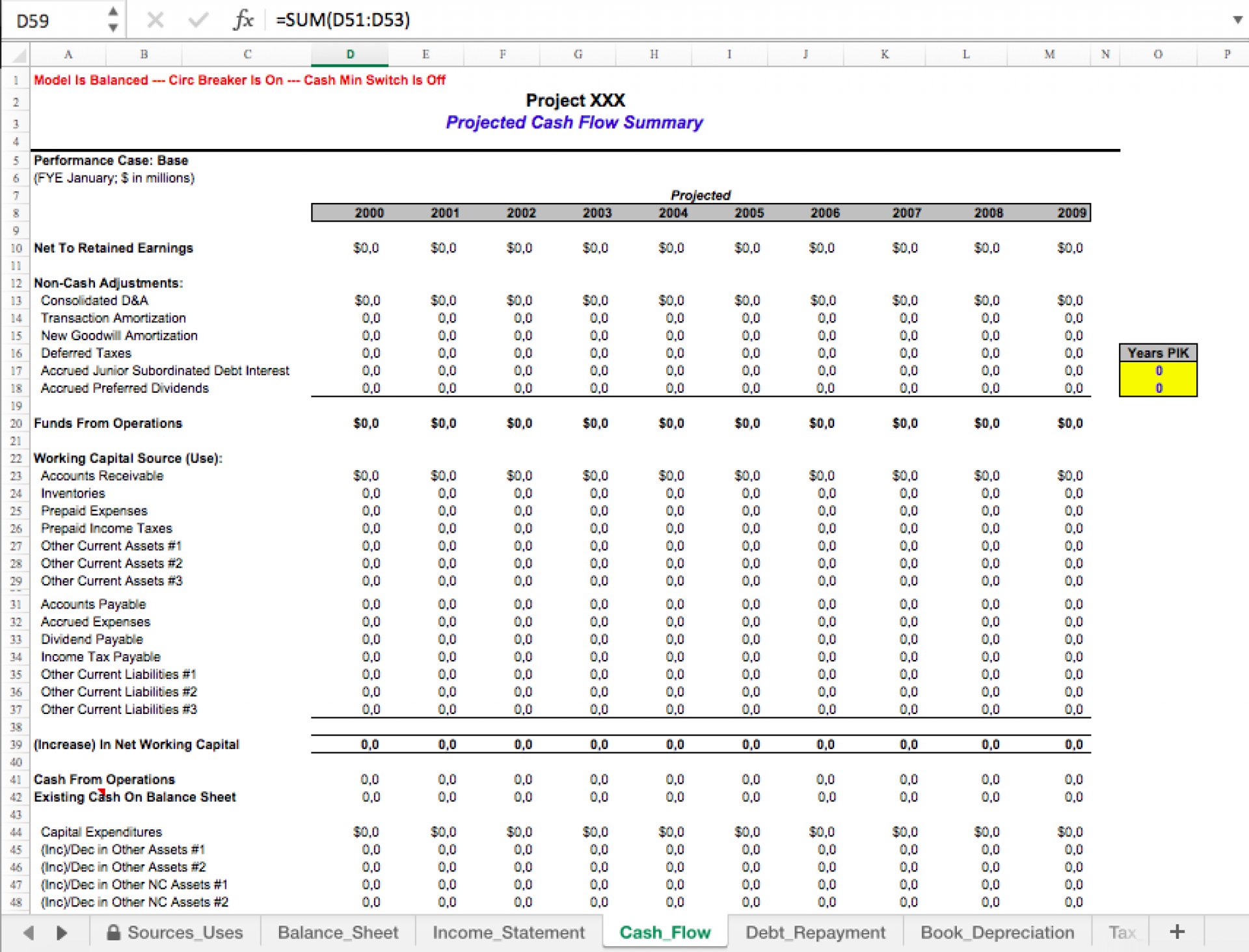

Lbo Model Template - Download the lbo template from the free resources section to enable modelling lbo scenarios and perform sensitivity analysis. Unlock the potential of your small business and entrepreneurship through acquisition (eta) deals with smb center's free simple leveraged buyout (lbo) model template. Designed for precision and ease of use, our models provide a robust. This excel model template and accompanying videos will help you to improve your financial modeling skills and give you the capability to create and build your own lbo analysis. From valuation of the target company and loan viability to scenario simulation and investment. A full leveraged buyout (lbo) model template in excel for a project to understand its different components (valuation, dcf, wacc etc.) and work with your own. The model is used to derive cfadr,. Download our lbo model template to evaluate if a purchase is worth it. Get an introduction to a simple leveraged buyout model. Going over some of the cash sources in my lbo model. Download our lbo model template to evaluate if a purchase is worth it. From valuation of the target company and loan viability to scenario simulation and investment. The model is used to derive cfadr,. The model includes three financial statements, exit analysis, metrics,. This excel model template and accompanying videos will help you to improve your financial modeling skills and give you the capability to create and build your own lbo analysis. Designed for precision and ease of use, our models provide a robust. Use this model to complete the calculations. Download a free excel template to build your own private equity lbo model with various financing and debt inputs and schedules. Unlock the potential of your small business and entrepreneurship through acquisition (eta) deals with smb center's free simple leveraged buyout (lbo) model template. Start with an integrated financial statement model & add components needed for analysis. From valuation of the target company and loan viability to scenario simulation and investment. The model includes key inputs, assumptions, calculations, and outputs for valuation,. Download a free excel template to build your own private equity lbo model with various financing and debt inputs and schedules. Going over some of the cash sources in my lbo model. Start with an. Going over some of the cash sources in my lbo model. Get an introduction to a simple leveraged buyout model. From valuation of the target company and loan viability to scenario simulation and investment. This excel model template and accompanying videos will help you to improve your financial modeling skills and give you the capability to create and build your. The model includes key inputs, assumptions, calculations, and outputs for valuation,. Use this model to complete the calculations. The model is used to derive cfadr,. Going over some of the cash sources in my lbo model. Download a free excel template to build your own private equity lbo model with various financing and debt inputs and schedules. Start with an integrated financial statement model & add components needed for analysis. Download our lbo model template to evaluate if a purchase is worth it. Learn more about lbos, their history and. Get an introduction to a simple leveraged buyout model. The model is used to derive cfadr,. Start with an integrated financial statement model & add components needed for analysis. A full leveraged buyout (lbo) model template in excel for a project to understand its different components (valuation, dcf, wacc etc.) and work with your own. Unlock the potential of your small business and entrepreneurship through acquisition (eta) deals with smb center's free simple leveraged buyout (lbo). Use this model to complete the calculations. Get an introduction to a simple leveraged buyout model. A full leveraged buyout (lbo) model template in excel for a project to understand its different components (valuation, dcf, wacc etc.) and work with your own. Going over some of the cash sources in my lbo model. Learn more about lbos, their history and. The model is used to derive cfadr,. A full leveraged buyout (lbo) model template in excel for a project to understand its different components (valuation, dcf, wacc etc.) and work with your own. Going over some of the cash sources in my lbo model. This excel model template and accompanying videos will help you to improve your financial modeling skills. Download our lbo model template to evaluate if a purchase is worth it. Learn more about lbos, their history and. Download an excel model to evaluate the business case of buying a company with high debt financing. The model includes key inputs, assumptions, calculations, and outputs for valuation,. This excel model template and accompanying videos will help you to improve. Download the lbo template from the free resources section to enable modelling lbo scenarios and perform sensitivity analysis. Designed for precision and ease of use, our models provide a robust. Download our lbo model template to evaluate if a purchase is worth it. Delegates will build an lbo model for a real company based on historical data and a little. Delegates will build an lbo model for a real company based on historical data and a little guidance about forecast drivers and operating estimates. Download a free excel template to build your own private equity lbo model with various financing and debt inputs and schedules. The model includes three financial statements, exit analysis, metrics,. Download an excel model to evaluate. This excel model template and accompanying videos will help you to improve your financial modeling skills and give you the capability to create and build your own lbo analysis. Going over some of the cash sources in my lbo model. A full leveraged buyout (lbo) model template in excel for a project to understand its different components (valuation, dcf, wacc etc.) and work with your own. Download the lbo template from the free resources section to enable modelling lbo scenarios and perform sensitivity analysis. Download our lbo model template to evaluate if a purchase is worth it. Get an introduction to a simple leveraged buyout model. From valuation of the target company and loan viability to scenario simulation and investment. Unlock the potential of your small business and entrepreneurship through acquisition (eta) deals with smb center's free simple leveraged buyout (lbo) model template. Download a free excel template to build your own private equity lbo model with various financing and debt inputs and schedules. Designed for precision and ease of use, our models provide a robust. Start with an integrated financial statement model & add components needed for analysis. Learn more about lbos, their history and. Use this model to complete the calculations. Delegates will build an lbo model for a real company based on historical data and a little guidance about forecast drivers and operating estimates.LBO Model Excel Template Leveraged Buyout Model Valuation

Leveraged Buyout (LBO) Model Template Excel Eloquens

LBO Model Template Excel Template Investment Evaluation Leveraged

Leveraged Buyout (LBO) Model Template Excel Eloquens

Leveraged Buyout (LBO) Model Template Excel Eloquens

LBO Model Excel Template Leveraged Buyout Model Valuation

Leveraged Buyout (LBO) Model Template Excel Eloquens

Leveraged Buyout (LBO) Model Templates at

Leveraged Buyout (LBO) Model Template Excel Eloquens

Leveraged Buyout (LBO) Model Template Excel Eloquens

The Model Is Used To Derive Cfadr,.

Download An Excel Model To Evaluate The Business Case Of Buying A Company With High Debt Financing.

The Model Includes Key Inputs, Assumptions, Calculations, And Outputs For Valuation,.

The Model Includes Three Financial Statements, Exit Analysis, Metrics,.

Related Post: