Leveraged Buyout Model Template

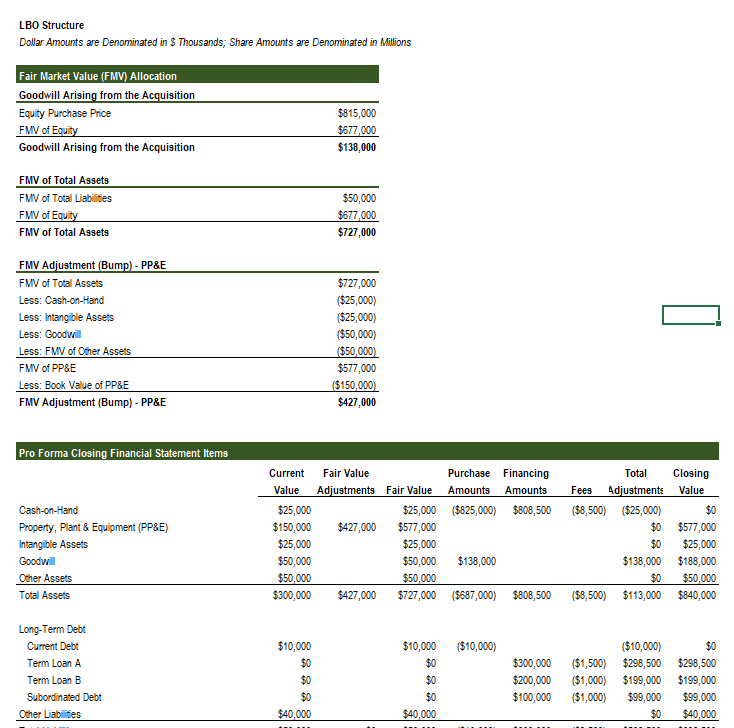

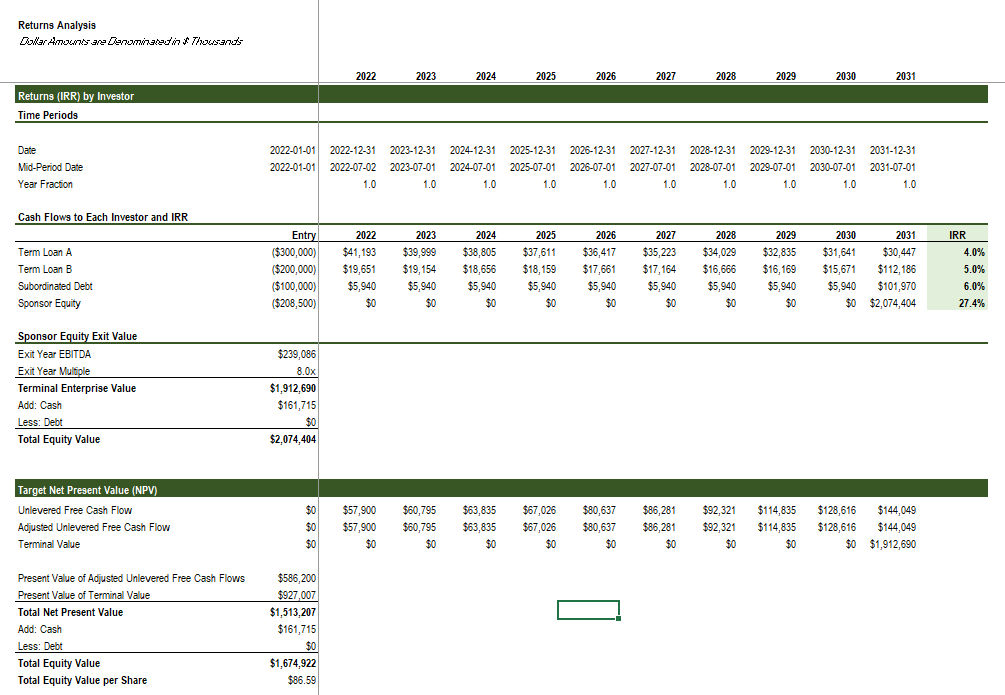

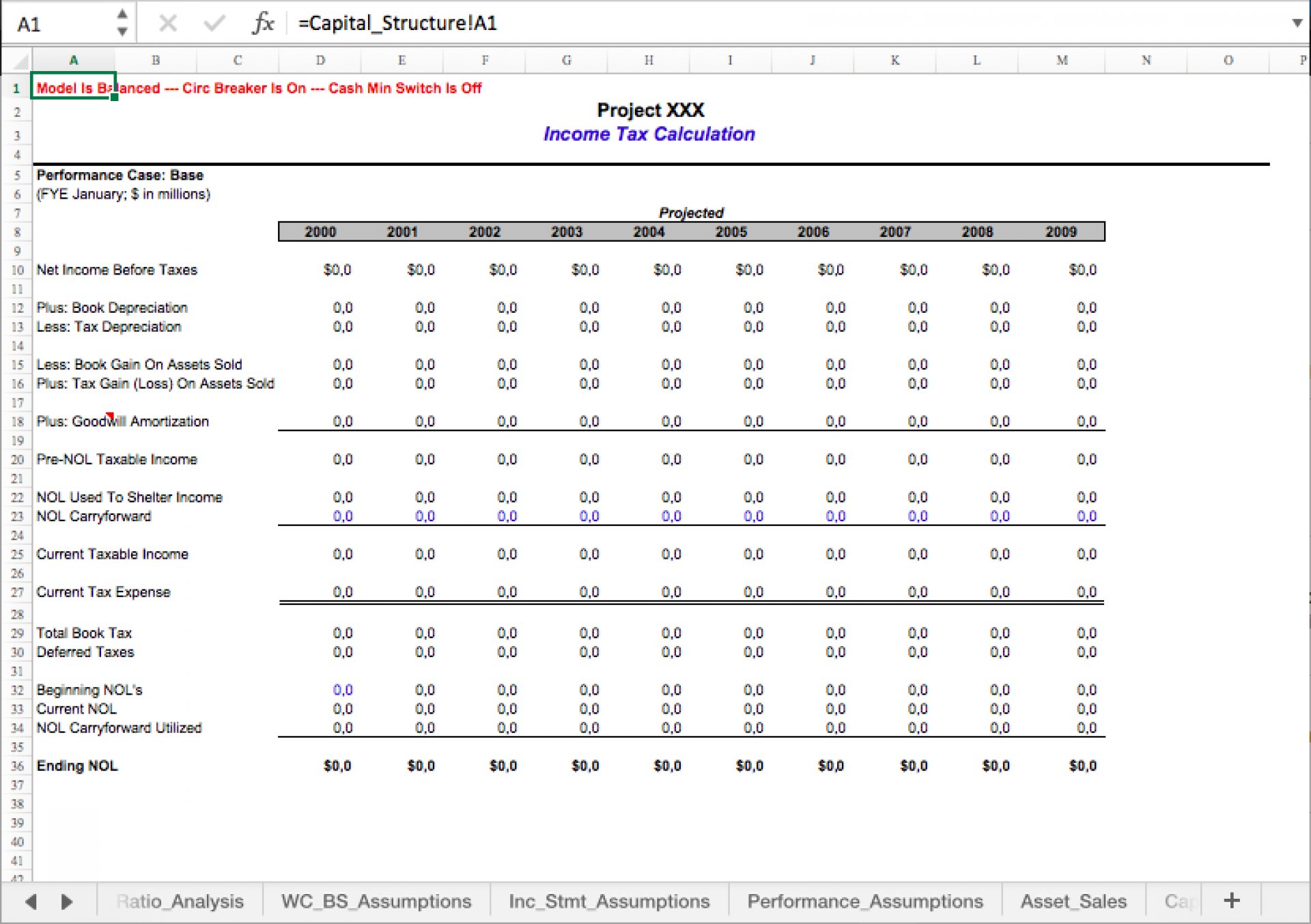

Leveraged Buyout Model Template - Delegates will build an lbo model for a real company based on historical data and a little guidance about forecast drivers and operating estimates. The objective is to maximize. Start with an integrated financial statement model & add components needed for analysis. Leveraged buyout (lbo) model presents the business case of the purchase of a company by using a high level of debt financing. Lbo (leveraged buyout) financial model for private companies (clean, simple, functional, and reusable template). This template allows you to build your own private equity lbo model using various financing/debt. Download wso's free leveraged buyout (lbo) model template below! Simple leveraged buyout (lbo) model excel template + instructions. The model is used to derive cfadr,. A leveraged buyout (lbo) is when a sponsor, typically a private equity (pe) firm, uses a relatively high amount of debt combined with some equity capital to purchase a. Get an introduction to a simple leveraged buyout model. Simple leveraged buyout (lbo) model excel template + instructions. A leveraged buyout (lbo) model is a financial analysis used to assess the acquisition of a company using a significant amount of debt. Download wso's free leveraged buyout (lbo) model template below! The objective is to maximize. Leveraged buyout (lbo) model presents the business case of the purchase of a company by using a high level of debt financing. The model is used to derive cfadr,. The document appears to be an outline for a leveraged buyout model, listing various financial terms and metrics involved in a leveraged buyout transaction. This template allows you to build your own private equity lbo model using various financing/debt. This is a modular financial model meaning that relevant calculations are separated into separate tabs that can. Designed for precision and ease of use, our models provide a robust. It includes sections on the. Download wso's free leveraged buyout (lbo) model template below! Delegates will build an lbo model for a real company based on historical data and a little guidance about forecast drivers and operating estimates. Leveraged buyout (lbo) model presents the business case of the. A leveraged buyout (lbo) is when a sponsor, typically a private equity (pe) firm, uses a relatively high amount of debt combined with some equity capital to purchase a. Unlock the potential of your small business and entrepreneurship through acquisition (eta) deals with smb center's free simple leveraged buyout (lbo) model template. Simple leveraged buyout (lbo) model excel template +. Excel model tutorial for building a detailed leveraged buyout analysis. Lbo (leveraged buyout) financial model for private companies (clean, simple, functional, and reusable template). Download wso's free leveraged buyout (lbo) model template below! This template allows you to build your own private equity lbo model using various financing/debt. The objective is to maximize. This is a modular financial model meaning that relevant calculations are separated into separate tabs that can. Leveraged buyout (lbo) model presents the business case of the purchase of a company by using a high level of debt financing. Get an introduction to a simple leveraged buyout model. Excel model tutorial for building a detailed leveraged buyout analysis. Delegates will. The objective is to maximize. This is a modular financial model meaning that relevant calculations are separated into separate tabs that can. It includes sections on the. A leveraged buyout (lbo) model is a financial analysis used to assess the acquisition of a company using a significant amount of debt. Delegates will build an lbo model for a real company. Lbo (leveraged buyout) financial model for private companies (clean, simple, functional, and reusable template). It includes sections on the. The model generates the three financial. Excel model tutorial for building a detailed leveraged buyout analysis. Unlock the potential of your small business and entrepreneurship through acquisition (eta) deals with smb center's free simple leveraged buyout (lbo) model template. The model generates the three financial. This template allows you to build your own private equity lbo model using various financing/debt. This is a modular financial model meaning that relevant calculations are separated into separate tabs that can. Start with an integrated financial statement model & add components needed for analysis. The document appears to be an outline for a. Get an introduction to a simple leveraged buyout model. This is a modular financial model meaning that relevant calculations are separated into separate tabs that can. The objective is to maximize. Lbo (leveraged buyout) financial model for private companies (clean, simple, functional, and reusable template). A leveraged buyout (lbo) model is a financial analysis used to assess the acquisition of. The document appears to be an outline for a leveraged buyout model, listing various financial terms and metrics involved in a leveraged buyout transaction. A leveraged buyout (lbo) model is a financial analysis used to assess the acquisition of a company using a significant amount of debt. This template allows you to build your own private equity lbo model using. Unlock the potential of your small business and entrepreneurship through acquisition (eta) deals with smb center's free simple leveraged buyout (lbo) model template. This template allows you to build your own private equity lbo model using various financing/debt. Leveraged buyout (lbo) model presents the business case of the purchase of a company by using a high level of debt financing.. The objective is to maximize. Download wso's free leveraged buyout (lbo) model template below! This template allows you to build your own private equity lbo model using various financing/debt. The model is used to derive cfadr,. This is a modular financial model meaning that relevant calculations are separated into separate tabs that can. The model generates the three financial. Simple leveraged buyout (lbo) model excel template + instructions. Lbo (leveraged buyout) financial model for private companies (clean, simple, functional, and reusable template). Unlock the potential of your small business and entrepreneurship through acquisition (eta) deals with smb center's free simple leveraged buyout (lbo) model template. A leveraged buyout (lbo) model is a financial analysis used to assess the acquisition of a company using a significant amount of debt. Get an introduction to a simple leveraged buyout model. Excel model tutorial for building a detailed leveraged buyout analysis. A leveraged buyout (lbo) is when a sponsor, typically a private equity (pe) firm, uses a relatively high amount of debt combined with some equity capital to purchase a. Leveraged buyout (lbo) model presents the business case of the purchase of a company by using a high level of debt financing. The document appears to be an outline for a leveraged buyout model, listing various financial terms and metrics involved in a leveraged buyout transaction.Lbo Model Excel Template

Leveraged Buyout (LBO) Model Template

Excel Template Leveraged Buyout (LBO) Model (Excel template XLSX) Flevy

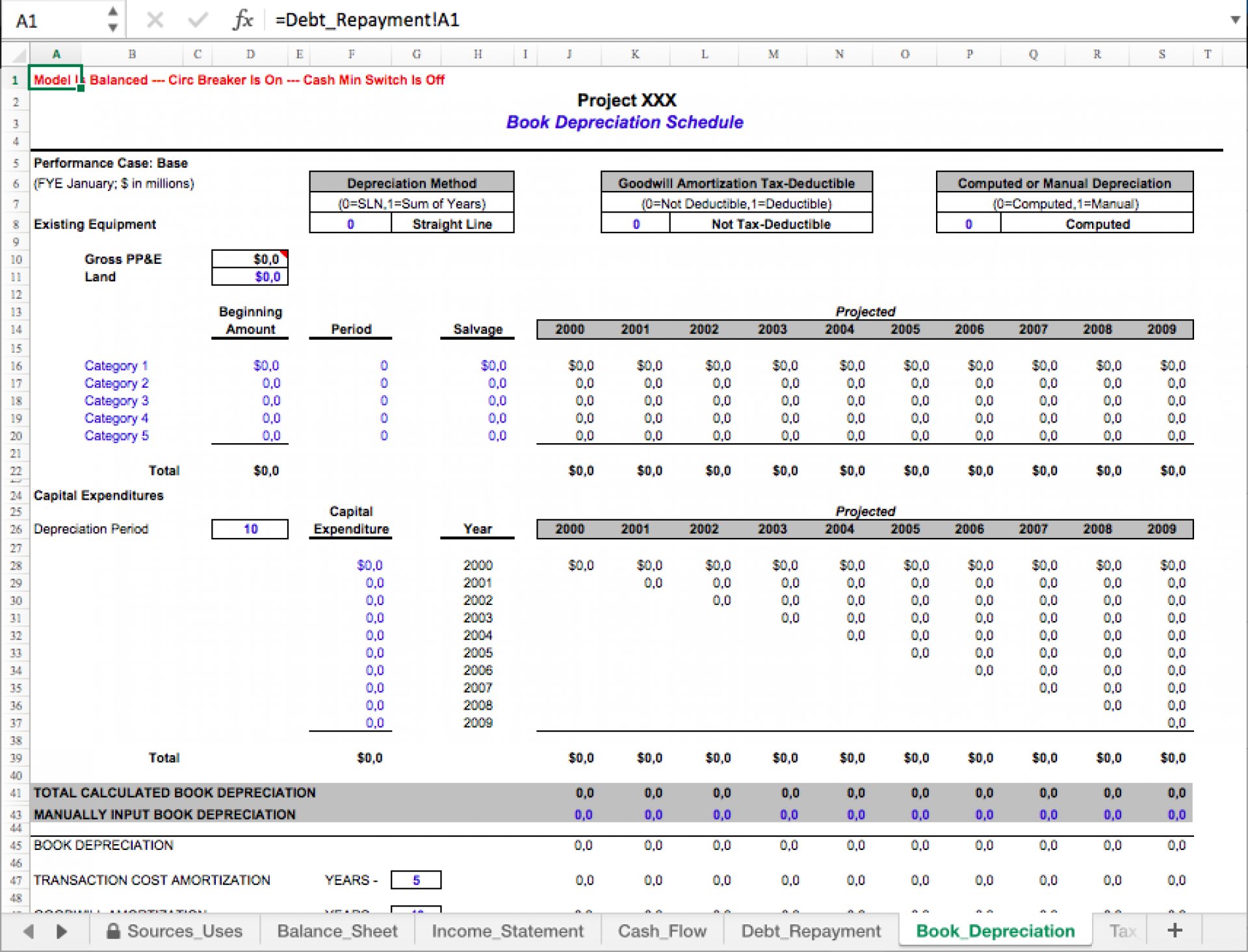

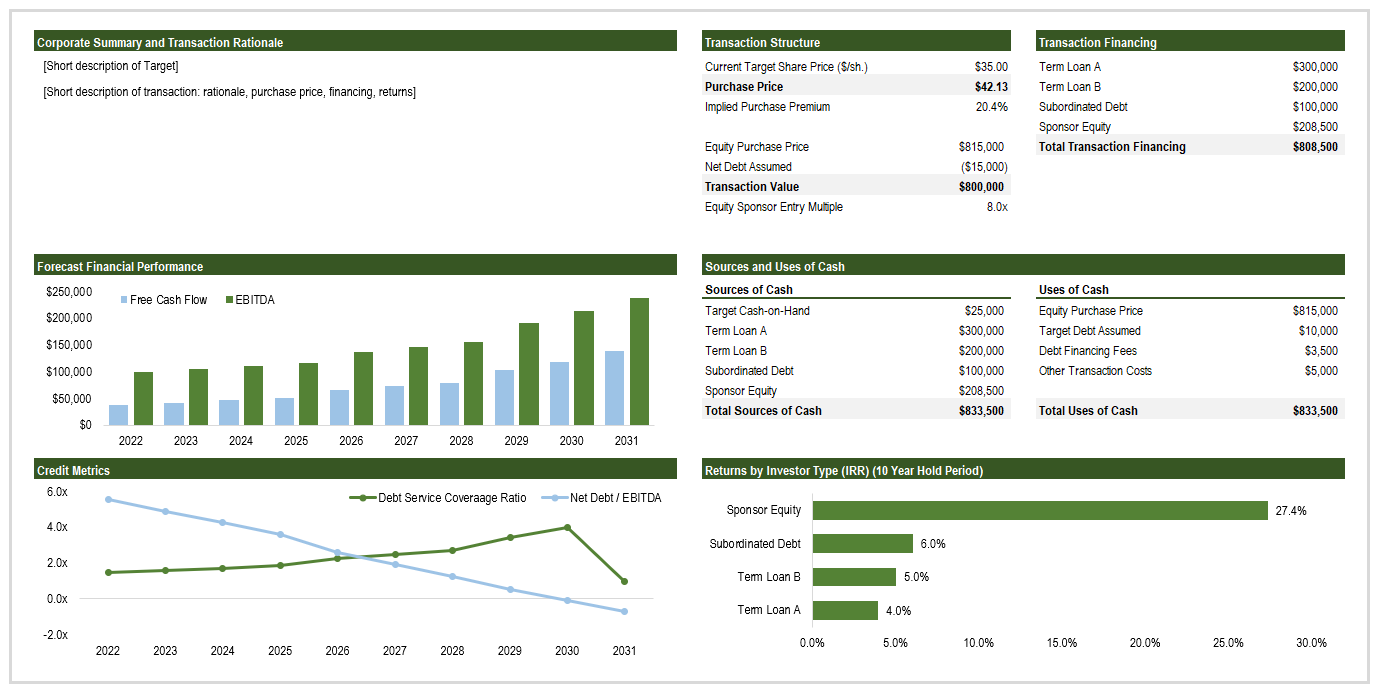

Detailed Leveraged Buyout (LBO) Financial Model Template and Overview

Detailed Leveraged Buyout (LBO) Financial Model Template and Overview

Detailed Leveraged Buyout (LBO) Financial Model Template and Overview

Detailed Leveraged Buyout (LBO) Financial Model Template and Overview

Lbo Model Template

Excel Template Leveraged Buyout (LBO) Model (Excel template XLSX) Flevy

Leveraged Buyout (LBO) Model Template

Delegates Will Build An Lbo Model For A Real Company Based On Historical Data And A Little Guidance About Forecast Drivers And Operating Estimates.

Start With An Integrated Financial Statement Model & Add Components Needed For Analysis.

Designed For Precision And Ease Of Use, Our Models Provide A Robust.

It Includes Sections On The.

Related Post: