Paid In Full Letter Template

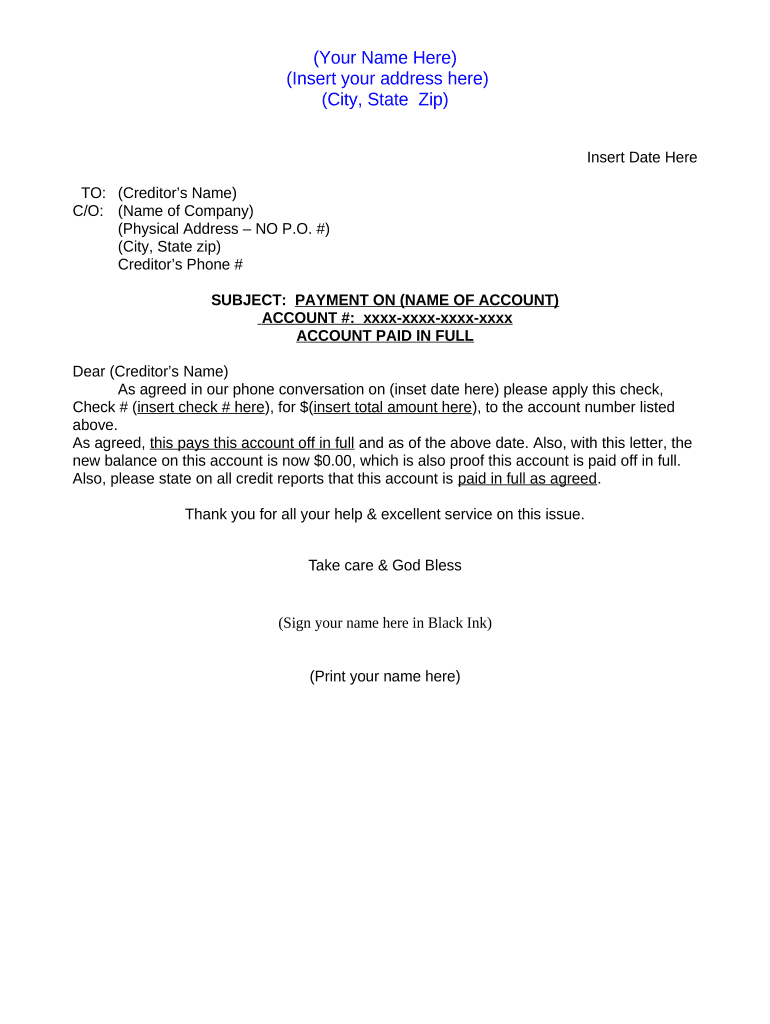

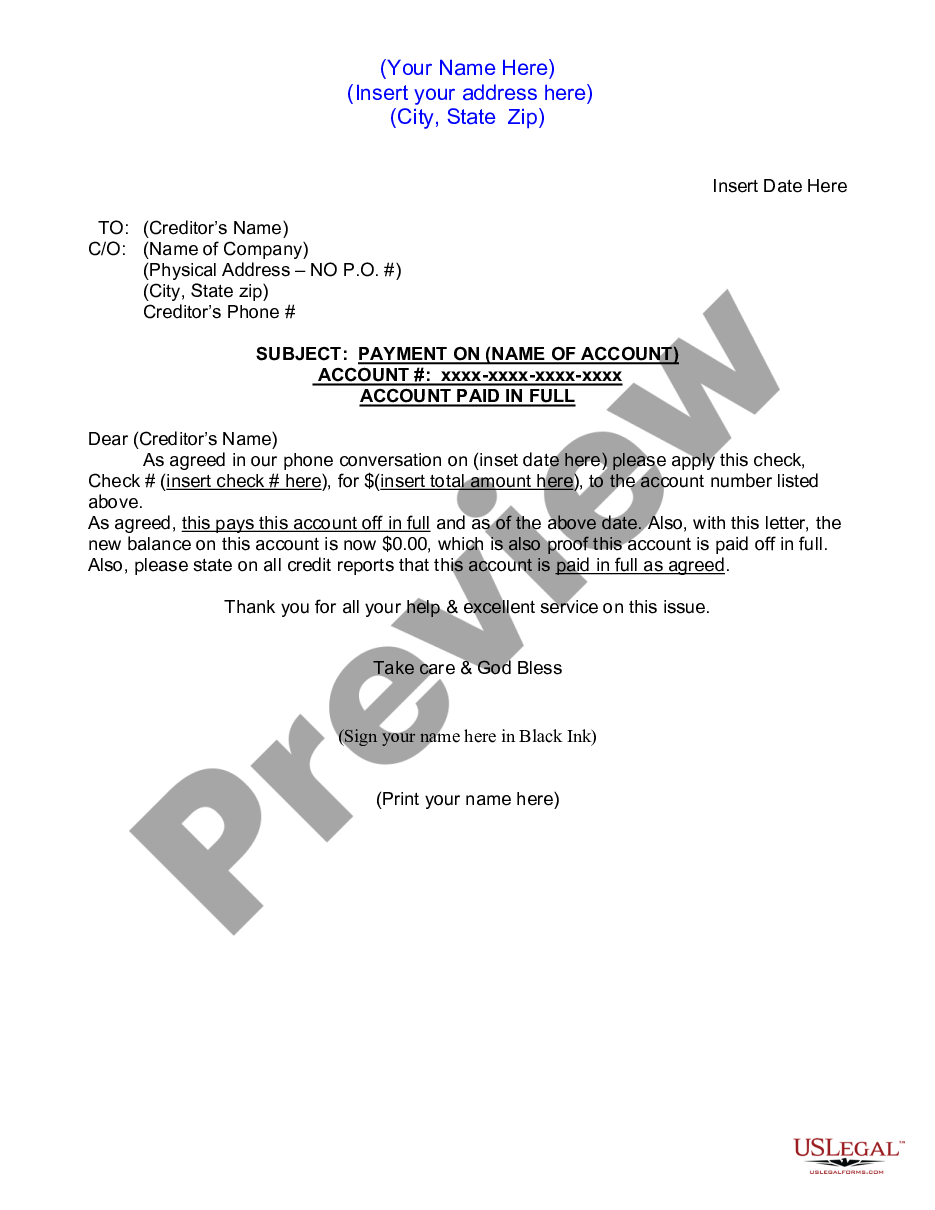

Paid In Full Letter Template - Writing a paid in full statement lets a creditor know that you have paid your debt. Up to $40 cash back letter for account paid in full a sample paid in full letter from a creditor is a document provided by a creditor to confirm that a debtor has successfully cleared off all. Overdue payment reminder email template. Effective full and final payment letters are essential in resolving financial disputes and ensuring clear communication. Below is a template that you can use to get started on your own paid in full letter. When you fully pay off a debt, you may send or receive a paid in full letter. These letters formally acknowledge settlements, helping to. Up to 40% cash back send sample paid in full letter from creditor via email, link, or fax. You can also download it, export it or print it out. Acceptance of this final payment as proof that you agree the account is {paid in full or settled}. Effective full and final payment letters are essential in resolving financial disputes and ensuring clear communication. When you fully pay off a debt, you may send or receive a paid in full letter. You should send a paid in full letter to your creditor or collection agency once you have paid the agreed amount in full. Craft your email in a polite yet firm tone, possibly. Acceptance of this final payment as proof that you agree the account is {paid in full or settled}. Make sure each piece of information has its own line and you are clear in what you are. Up to 40% cash back a paid in full letter is a formal document confirming that a debt or loan has been completely repaid. Now that this debt is paid, i do not expect to hear from you except to confirm the account is. Below is a template that you can use to get started on your own paid in full letter. In this article, i will share my unique experiences, provide you with three proven templates, and offer valuable tips to ensure your letter is both professional and persuasive. When you fully pay off a debt, you may send or receive a paid in full letter. Overdue payment reminder email template. Writing a paid in full statement lets a creditor know that you have paid your debt. Effective full and final payment letters are essential in resolving financial disputes and ensuring clear communication. You should send a paid in. Up to $40 cash back letter for account paid in full a sample paid in full letter from a creditor is a document provided by a creditor to confirm that a debtor has successfully cleared off all. You should send a paid in full letter to your creditor or collection agency once you have paid the agreed amount in full.. In this article, i will share my unique experiences, provide you with three proven templates, and offer valuable tips to ensure your letter is both professional and persuasive. You should send a paid in full letter to your creditor or collection agency once you have paid the agreed amount in full. Acceptance of this final payment as proof that you. You can also download it, export it or print it out. Up to 40% cash back a paid in full letter is a formal document confirming that a debt or loan has been completely repaid. Acceptance of this final payment as proof that you agree the account is {paid in full or settled}. A paid in full letter notifies your. Up to 40% cash back send sample paid in full letter from creditor via email, link, or fax. Effective full and final payment letters are essential in resolving financial disputes and ensuring clear communication. Up to 40% cash back a paid in full letter is a formal document confirming that a debt or loan has been completely repaid. These letters. If you send a paid in full letter to your creditor or debt collection agency, it informs them that you’re. It includes account details, payment confirmation, and the date of. You should send a paid in full letter to your creditor or collection agency once you have paid the agreed amount in full. A paid in full statement is a. When you fully pay off a debt, you may send or receive a paid in full letter. These letters formally acknowledge settlements, helping to. If you send a paid in full letter to your creditor or debt collection agency, it informs them that you’re. Acceptance of this final payment as proof that you agree the account is {paid in full. You should send a paid in full letter to your creditor or collection agency once you have paid the agreed amount in full. Up to 40% cash back a paid in full letter is a formal document confirming that a debt or loan has been completely repaid. Up to 40% cash back send sample paid in full letter from creditor. You should send a paid in full letter to your creditor or collection agency once you have paid the agreed amount in full. A paid in full statement is a letter to your creditor that explains the details of the debt owed and how and. Overdue payment reminder email template. It includes account details, payment confirmation, and the date of.. Edit your paid in full letter online. Up to 40% cash back send sample paid in full letter from creditor via email, link, or fax. It includes account details, payment confirmation, and the date of. Overdue payment reminder email template. A paid in full letter notifies your creditor or collection. Up to $40 cash back letter for account paid in full a sample paid in full letter from a creditor is a document provided by a creditor to confirm that a debtor has successfully cleared off all. If you send a paid in full letter to your creditor or debt collection agency, it informs them that you’re. Acceptance of this final payment as proof that you agree the account is {paid in full or settled}. Up to 40% cash back send sample paid in full letter from creditor via email, link, or fax. Up to 40% cash back a paid in full letter is a formal document confirming that a debt or loan has been completely repaid. Craft your email in a polite yet firm tone, possibly. Effective full and final payment letters are essential in resolving financial disputes and ensuring clear communication. A paid in full statement is a letter to your creditor that explains the details of the debt owed and how and. Edit your paid in full letter online. Overdue payment reminder email template. These letters formally acknowledge settlements, helping to. Below is a template that you can use to get started on your own paid in full letter. It includes account details, payment confirmation, and the date of. A paid in full letter notifies your creditor or collection. When you fully pay off a debt, you may send or receive a paid in full letter. Writing a paid in full statement lets a creditor know that you have paid your debt.Paid (infull) Receipt Template Invoice Maker

Personal Loan Paid in Full Letter Draft Destiny

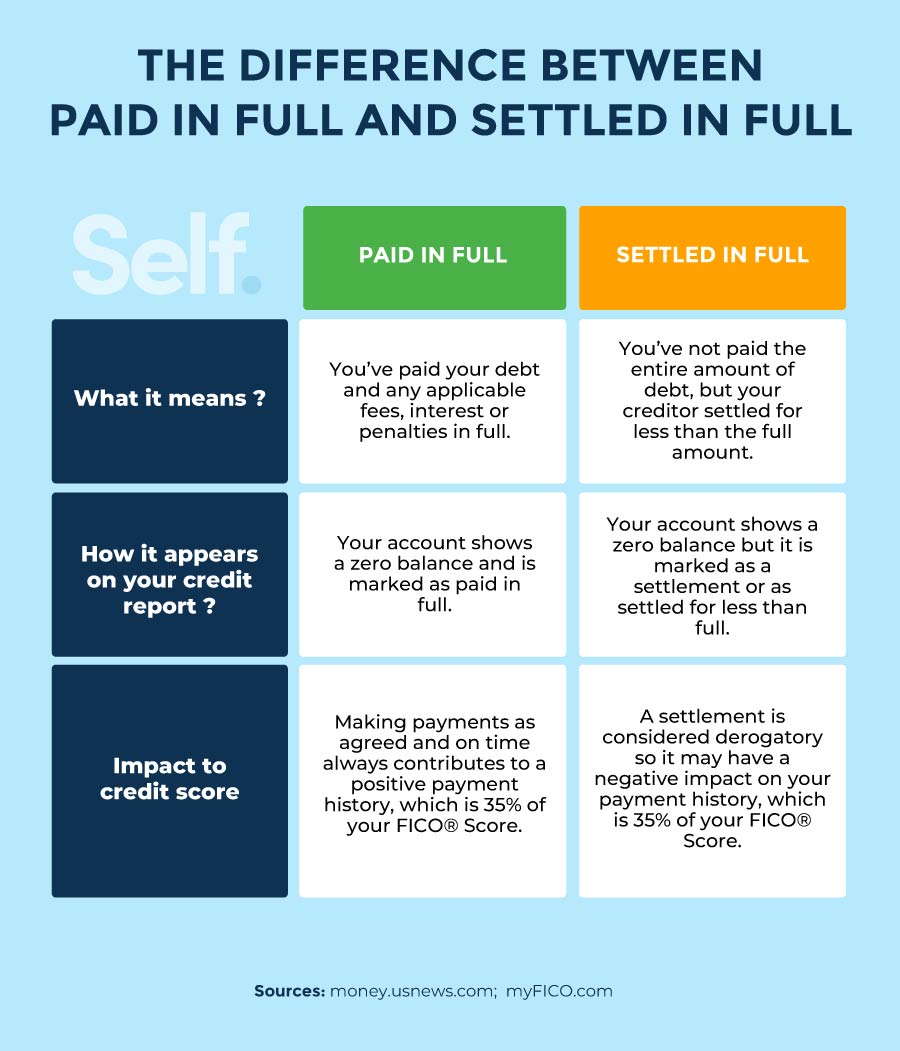

How to Use a PaidinFull Letter (+ Template) Self. Credit Builder.

paid in full receipt template Doc Template pdfFiller

Paid In Full Letter Sample

Paid In Full Letter Fill Online, Printable, Fillable, Blank pdfFiller

Letter for Account Paid in Full DocHub

35 Paid In Full Template Hamiltonplastering

Sample Paid In Full Letter

Paid (infull) Receipt Template Invoice Maker

Make Sure Each Piece Of Information Has Its Own Line And You Are Clear In What You Are.

You Should Send A Paid In Full Letter To Your Creditor Or Collection Agency Once You Have Paid The Agreed Amount In Full.

You Can Also Download It, Export It Or Print It Out.

In This Article, I Will Share My Unique Experiences, Provide You With Three Proven Templates, And Offer Valuable Tips To Ensure Your Letter Is Both Professional And Persuasive.

Related Post: