Payroll Deduction Authorization Form Template

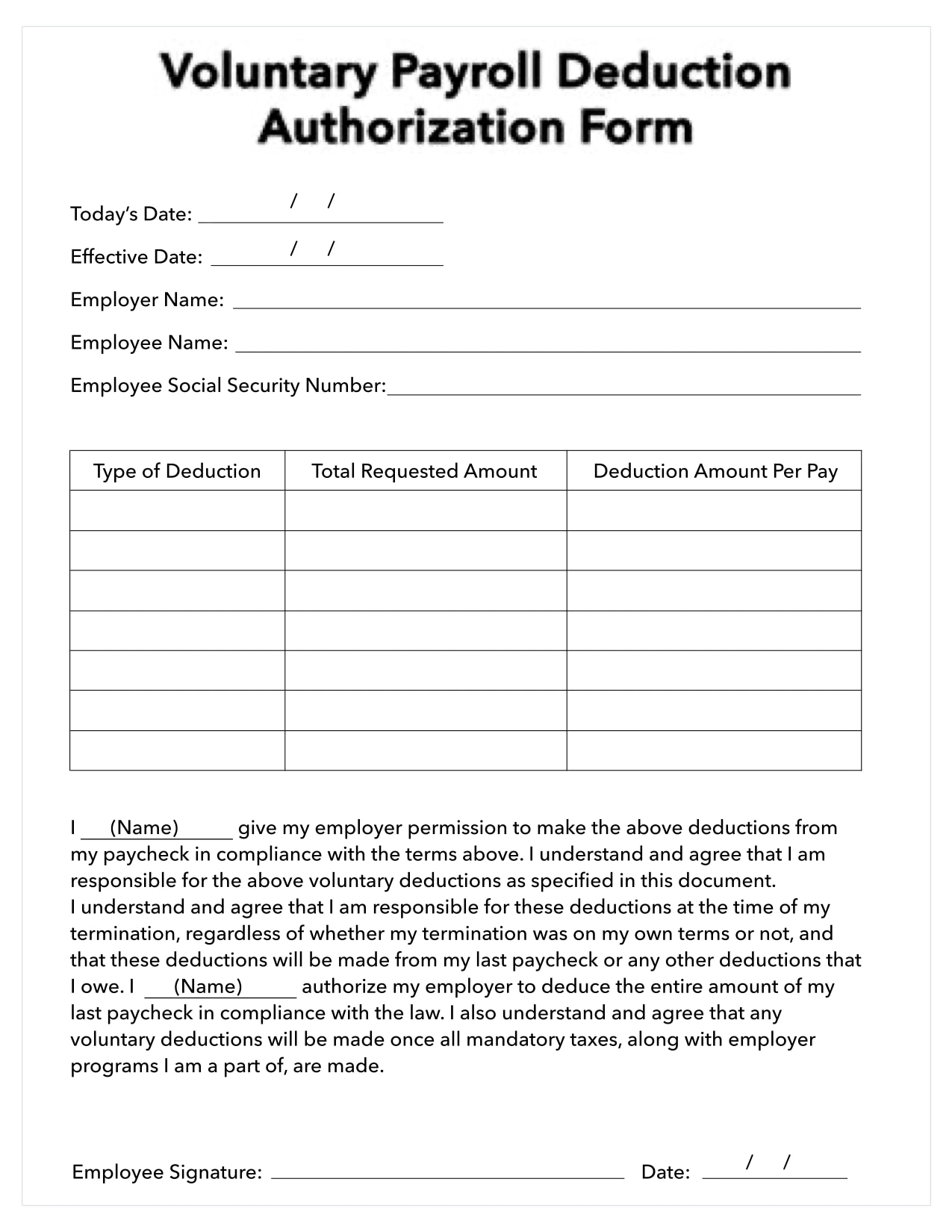

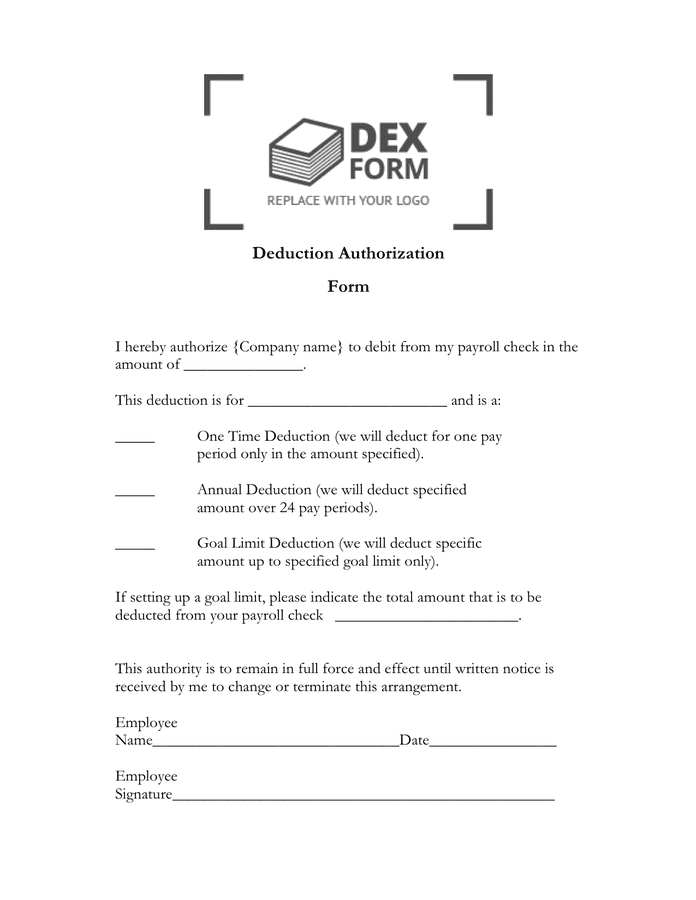

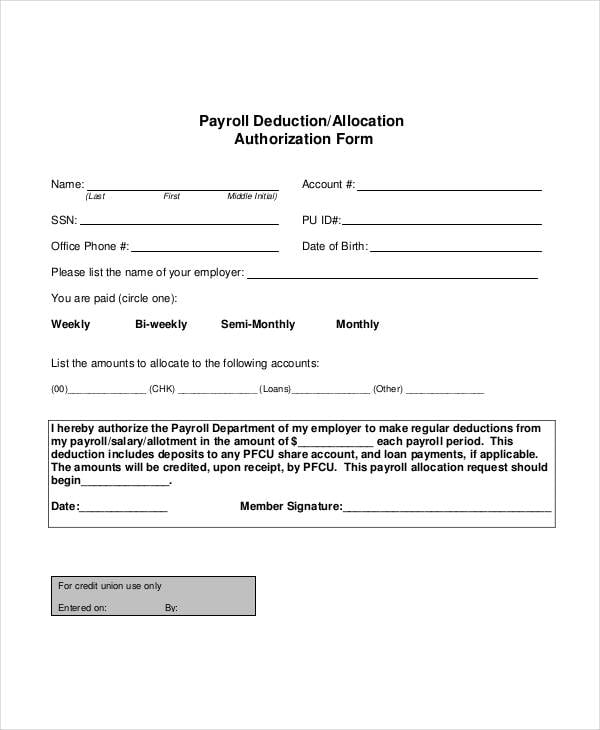

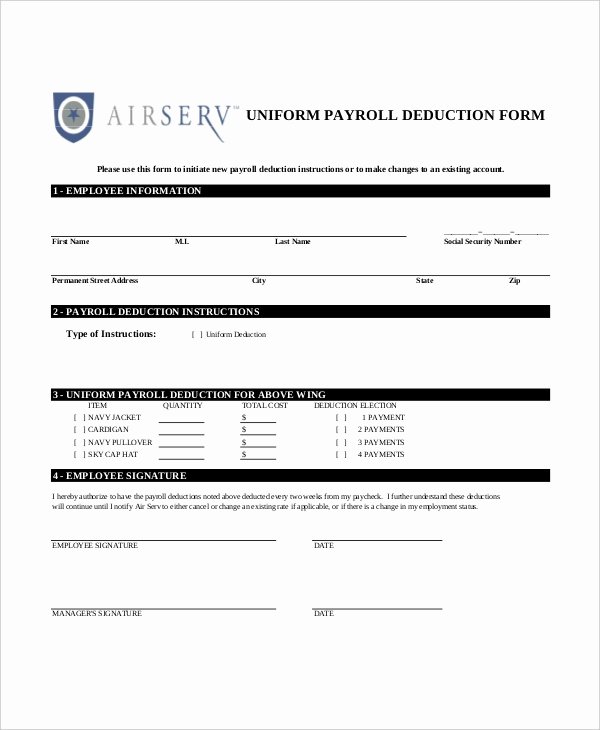

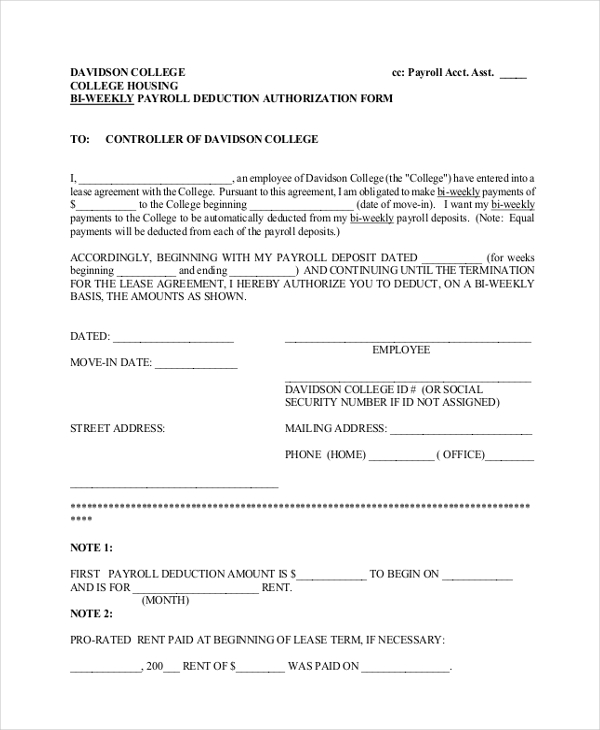

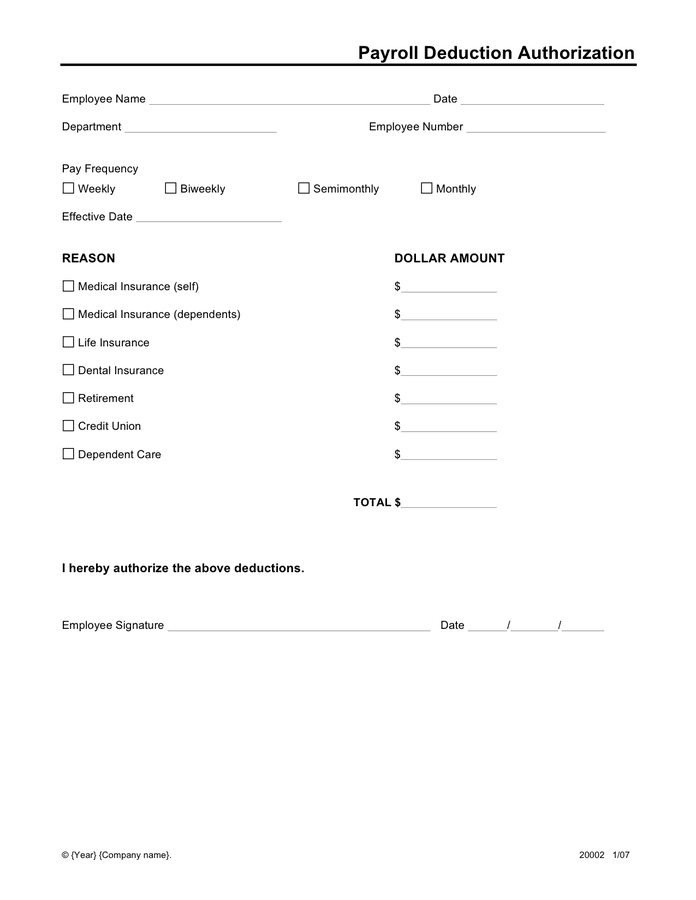

Payroll Deduction Authorization Form Template - [your name] [your address] [city, state, zip code] [date] to whom it may concern, i, [your name], hereby authorize [company/organization name] to make payroll deductions from my. They can fill out their relevant financial details, reason for deduction, and so on. Download or preview 1 pages of pdf version of payroll deduction authorization form (doc: While not always required, it's a good idea to give staff the ability to authorize new kinds of deductions from their paychecks. This payroll deduction authorization form template allows employees to authorize payroll deductions. This authorizes my employer to retain the entire amount of my last paycheck in compliance with the law. 📄 payroll deduction authorization form template. This form is used by taxpayers and employers to agree on a payroll deduction plan to pay off a tax liability. Improve your payroll deduction process with our fully customizable payroll deduction authorization form. Employers can also use this form to. Downloading our sample template will help you to collect the authorization and documentation from your employees to process payroll deductions. A sample form to document authorization of payroll deductions. Improve your payroll deduction process with our fully customizable payroll deduction authorization form. Download or preview 1 pages of pdf version of payroll deduction authorization form (doc: Employees can use authorize deduction from their payroll with this form. I further understand and agree that deductions will be made after any mandatory. While not always required, it's a good idea to give staff the ability to authorize new kinds of deductions from their paychecks. I have been advanced $ amount deducted from my next paycheck. I further understand and agree that deductions will be made after any mandatory. 37.6 kb ) for free. Employers can also use this form to. Use this free deduction authorization form to properly. This payroll deduction authorization form template allows employees to authorize payroll deductions. $ revoked in writing or until my employment is terminated. I further understand and agree that deductions will be made after any mandatory. This payroll deduction authorization form template allows employees to authorize payroll deductions. Instantly download payroll deduction authorization template, sample & example in microsoft word (doc), google docs, apple pages format. While not always required, it's a good idea to give staff the ability to authorize new kinds of deductions from their paychecks. We support you and your company by providing. A sample form to document authorization of payroll deductions. This authorizes my employer to retain the entire amount of my last paycheck in compliance with the law. Instantly download payroll deduction authorization template, sample & example in microsoft word (doc), google docs, apple pages format. $ revoked in writing or until my employment is terminated. How to draft a voluntary. Downloading our sample template will help you to collect the authorization and documentation from your employees to process payroll deductions. I further understand and agree that deductions will be made after any mandatory. They can fill out their relevant financial details, reason for deduction, and so on. 37.6 kb ) for free. I, _________________________, hereby authorize (company name) to withhold. This payroll deduction authorization form template allows employees to authorize payroll deductions. This form can be used to authorize new benefit deductions, request changes to current deductions and/or cancel benefit deductions. It includes sections on deduction. How to draft a voluntary payroll deduction form? It includes instructions on how to complete, sign, and return the form, as well as. This form is used by taxpayers and employers to agree on a payroll deduction plan to pay off a tax liability. I further understand and agree that deductions will be made after any mandatory. I further understand and agree that deductions will be made after any mandatory. A sample form to document authorization of payroll deductions. This authorizes my employer. This form is used by taxpayers and employers to agree on a payroll deduction plan to pay off a tax liability. How to draft a voluntary payroll deduction form? Employees can use authorize deduction from their payroll with this form. This payroll deduction authorization form template allows employees to authorize payroll deductions. Employers can also use this form to. Download this voluntary payroll deduction form template now! The payroll deduction form template provided by wpforms offers a simple and efficient way for businesses to facilitate payroll deductions while ensuring accuracy and. I, _________________________, hereby authorize (company name) to withhold from my wages the total amount of $_______________ which shall be withheld at a rate of $__________ per. A sample. Download this voluntary payroll deduction form template now! I have been advanced $ amount deducted from my next paycheck. It includes instructions on how to complete, sign, and return the form, as well as. Improve your payroll deduction process with our fully customizable payroll deduction authorization form. Available in a4 & us letter sizes. I further understand and agree that deductions will be made after any mandatory. How to draft a voluntary payroll deduction form? This payroll deduction authorization form template allows employees to authorize payroll deductions. We support you and your company by providing this voluntary payroll. Download this voluntary payroll deduction form template now! They can fill out their relevant financial details, reason for deduction, and so on. This payroll deduction authorization form template allows employees to authorize payroll deductions. While not always required, it's a good idea to give staff the ability to authorize new kinds of deductions from their paychecks. Use this free deduction authorization form to properly. We support you and your company by providing this voluntary payroll. 37.6 kb ) for free. Instantly download payroll deduction authorization template, sample & example in microsoft word (doc), google docs, apple pages format. A sample form to document authorization of payroll deductions. I have been advanced $ amount deducted from my next paycheck. How to draft a voluntary payroll deduction form? It includes instructions on how to complete, sign, and return the form, as well as. Available in a4 & us letter sizes. Downloading our sample template will help you to collect the authorization and documentation from your employees to process payroll deductions. $ revoked in writing or until my employment is terminated. It can also be used as a reference for. This form is used by taxpayers and employers to agree on a payroll deduction plan to pay off a tax liability.Payroll Deduction Authorization Form Prebuilt template airSlate SignNow

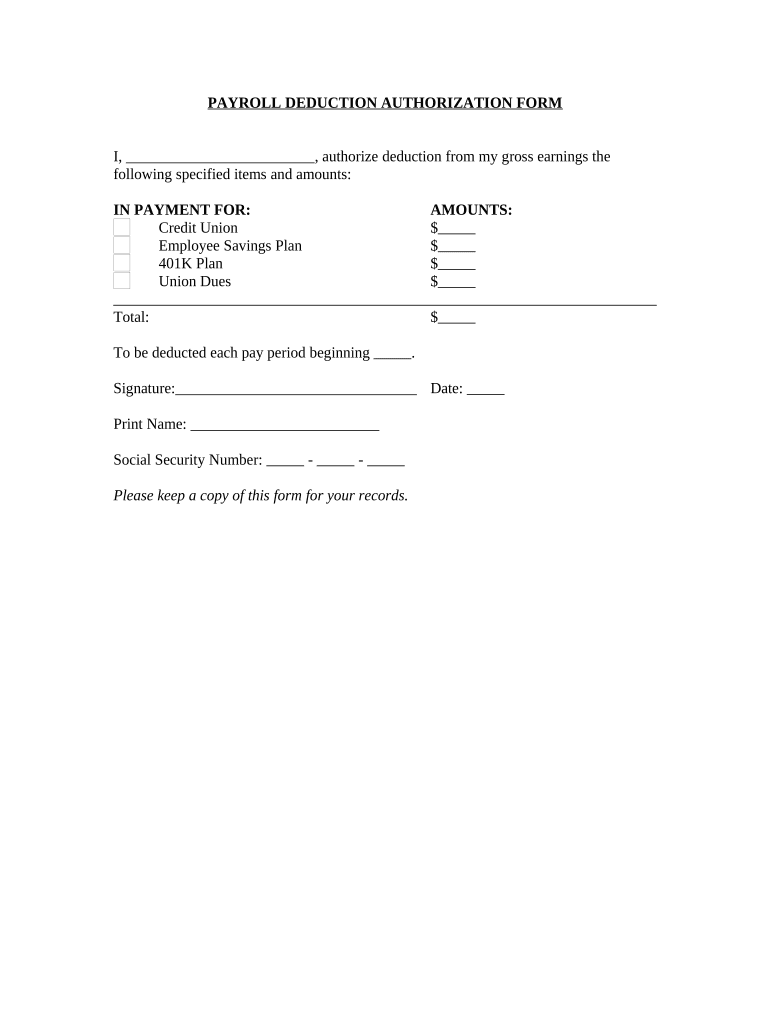

Payroll Deduction Authorization Form Template Free

Payroll Deduction Form Template PDF Template

Payroll Deduction Form download free documents for PDF, Word and Excel

Payroll Deduction Authorization Form Template Free

Printable Payroll Deduction Form Template Printable Templates

Payroll Deduction Form Template 14+ Sample, Example, Format

Payroll Deduction Authorization Form Template

Payroll Deduction Form Template

Payroll Deduction Form download free documents for PDF, Word and Excel

The Payroll Deduction Form Template Provided By Wpforms Offers A Simple And Efficient Way For Businesses To Facilitate Payroll Deductions While Ensuring Accuracy And.

It Includes Sections On Deduction.

This Form Can Be Used To Authorize New Benefit Deductions, Request Changes To Current Deductions And/Or Cancel Benefit Deductions.

This Authorizes My Employer To Retain The Entire Amount Of My Last Paycheck In Compliance With The Law.

Related Post: