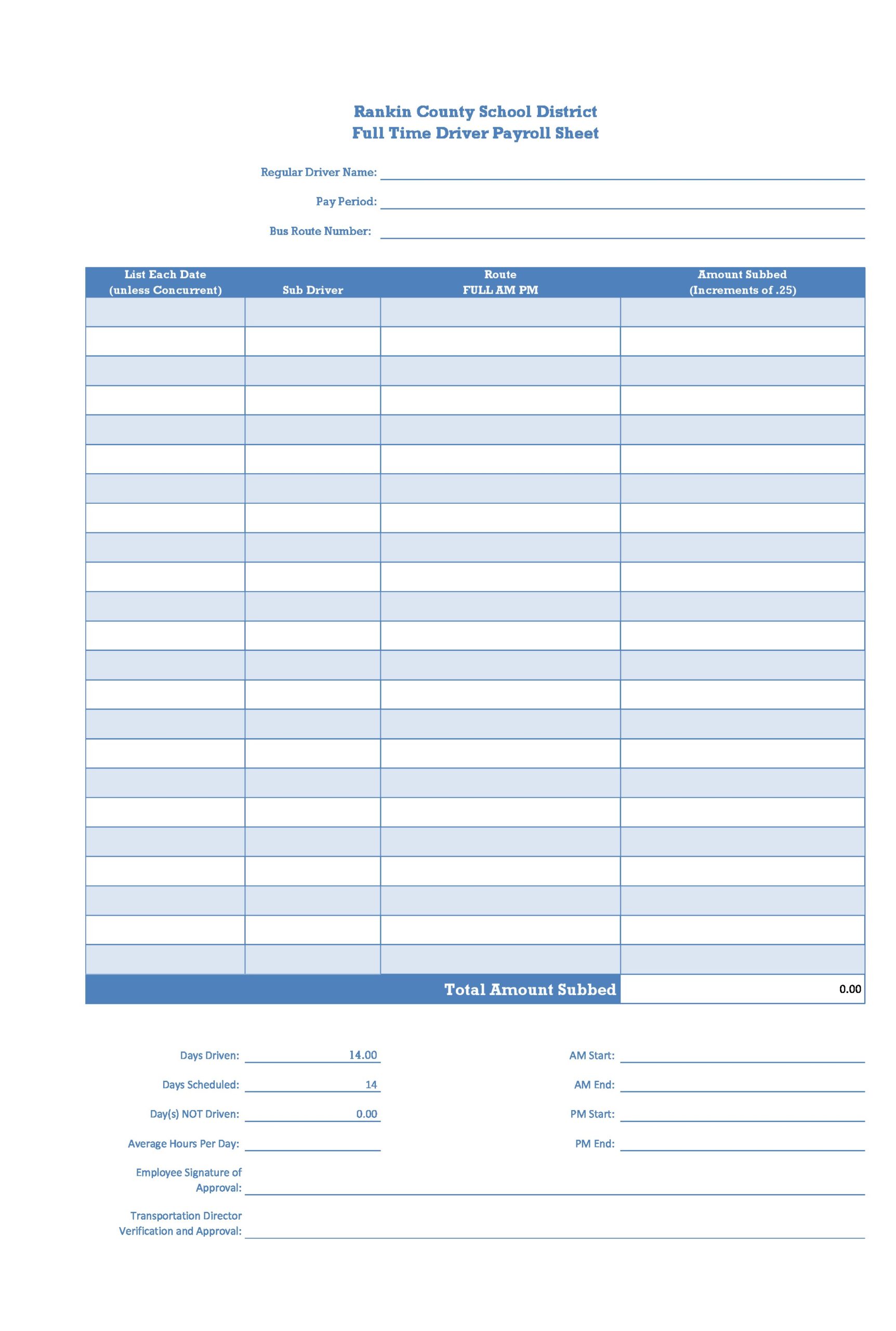

Payroll Summary Report Template

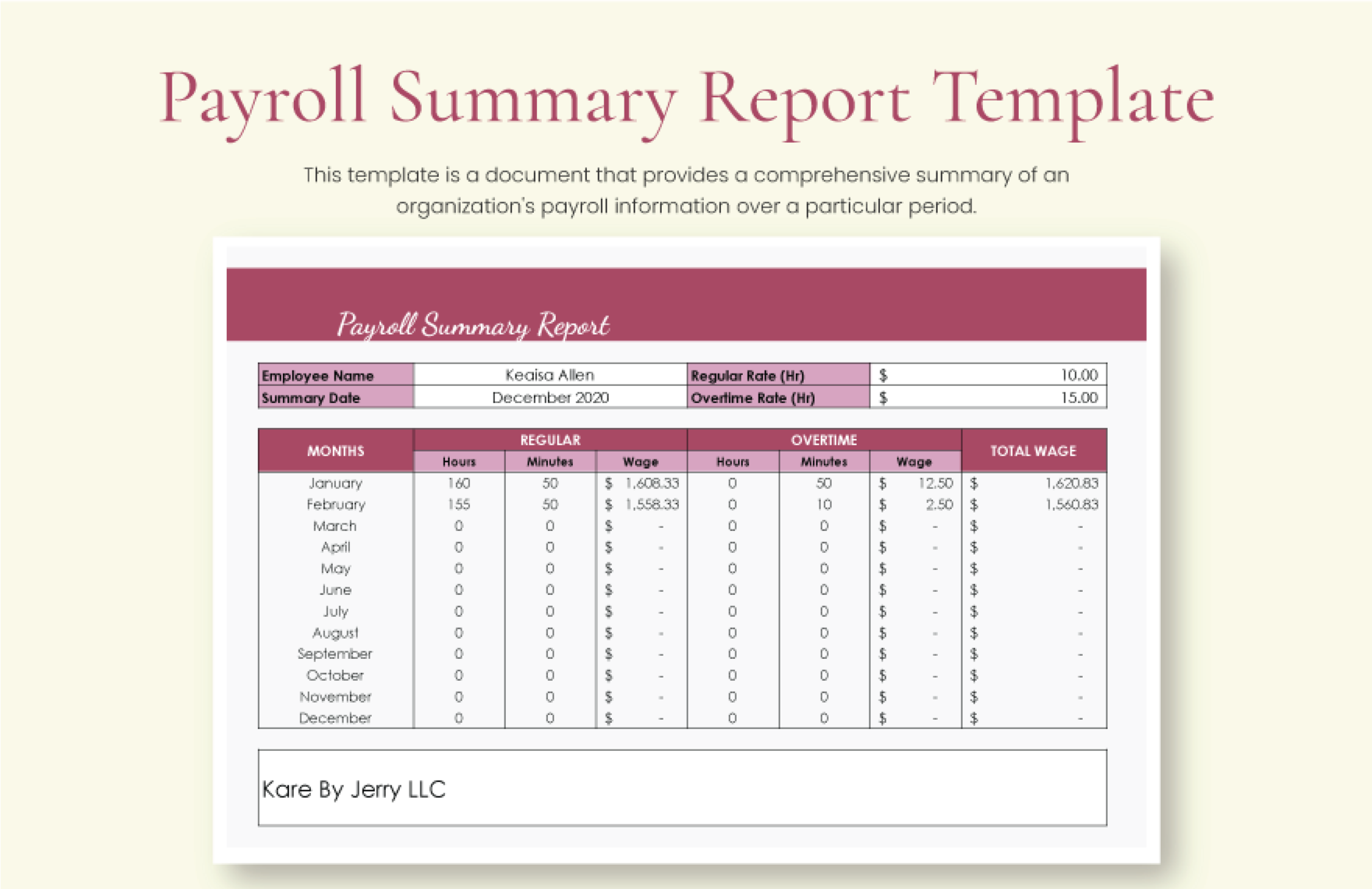

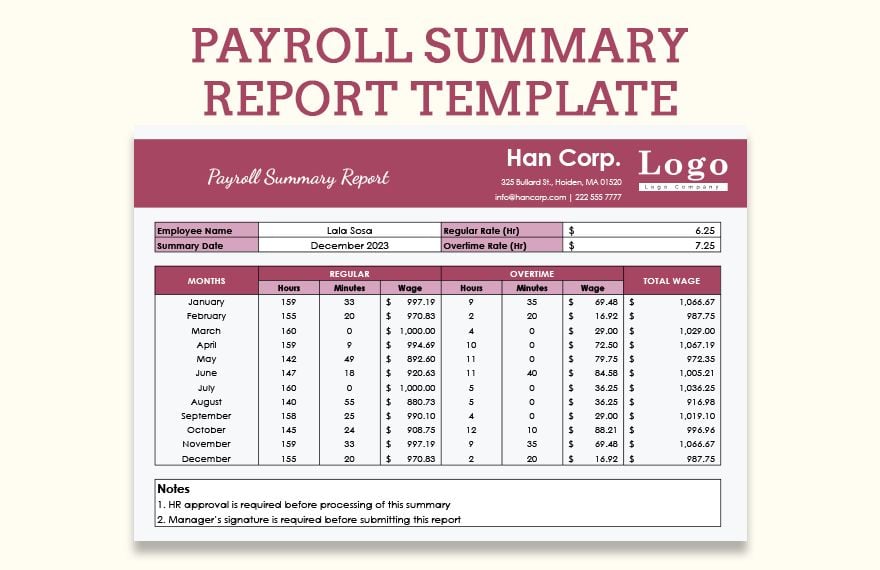

Payroll Summary Report Template - Simplify payroll management with template.net’s professional payroll report templates. Or you can check out our free report templates that you would get without spending a single penny. Payroll reports are documents that summarize payroll data, like wages, employee hours, and payroll taxes. It contains details such as overtime payments, withheld taxes, hourly rates, total hours worked, vacation payments, etc. We also have kept our summary report ready that can give you several ideas on the process of designing the payroll report. Includes pay stubs, timesheets, a payroll register template, and more. Easily customize and print or save as a pdf. Customize salary summaries, deduction reports, and overtime sheets in our ai editor tool for efficient payroll processing. Download free payroll templates for excel, word, and pdf. You can also print or export payroll templates as pdfs. Download a free payroll summary template to track and calculate employee wages and deductions. It contains details such as overtime payments, withheld taxes, hourly rates, total hours worked, vacation payments, etc. Or you can check out our free report templates that you would get without spending a single penny. You can also use smartsheet to find professional payroll summary report templates and payroll ledger templates. Download free payroll templates for excel, word, and pdf. You can use them for many reasons, like calculating employer taxes, verifying profit calculations, and budgeting to pay your employees. Includes pay stubs, timesheets, a payroll register template, and more. We also have kept our summary report ready that can give you several ideas on the process of designing the payroll report. Simplify payroll management with template.net’s professional payroll report templates. Say goodbye to complex spreadsheets and hello to template.net's payroll summary report template. It contains details such as overtime payments, withheld taxes, hourly rates, total hours worked, vacation payments, etc. You can also print or export payroll templates as pdfs. Download free payroll templates for excel, word, and pdf. Say goodbye to complex spreadsheets and hello to template.net's payroll summary report template. Easily customize and print or save as a pdf. A payroll summary report template is a template that contains detailed information about employees’ payments and deductions. You can also print or export payroll templates as pdfs. Payroll reports are documents that summarize payroll data, like wages, employee hours, and payroll taxes. Customize salary summaries, deduction reports, and overtime sheets in our ai editor tool for efficient payroll processing. Easily. Say goodbye to complex spreadsheets and hello to template.net's payroll summary report template. You can use them for many reasons, like calculating employer taxes, verifying profit calculations, and budgeting to pay your employees. It contains details such as overtime payments, withheld taxes, hourly rates, total hours worked, vacation payments, etc. Easily customize and print or save as a pdf. A. Customize salary summaries, deduction reports, and overtime sheets in our ai editor tool for efficient payroll processing. Designed for busy hr professionals, this template provides detailed insights into employee pay data, enabling you to identify trends, reduce errors,. Easily customize and print or save as a pdf. Say goodbye to complex spreadsheets and hello to template.net's payroll summary report template.. Simplify payroll management with template.net’s professional payroll report templates. You can also use smartsheet to find professional payroll summary report templates and payroll ledger templates. Designed for busy hr professionals, this template provides detailed insights into employee pay data, enabling you to identify trends, reduce errors,. Easily customize and print or save as a pdf. Includes pay stubs, timesheets, a. You can also print or export payroll templates as pdfs. What is a payroll summary report? Download a free payroll summary template to track and calculate employee wages and deductions. Customize salary summaries, deduction reports, and overtime sheets in our ai editor tool for efficient payroll processing. Simplify payroll management with template.net’s professional payroll report templates. What is a payroll summary report? Download free payroll templates for excel, word, and pdf. Say goodbye to complex spreadsheets and hello to template.net's payroll summary report template. You can also print or export payroll templates as pdfs. Easily customize and print or save as a pdf. Includes pay stubs, timesheets, a payroll register template, and more. We also have kept our summary report ready that can give you several ideas on the process of designing the payroll report. You can also print or export payroll templates as pdfs. Customize salary summaries, deduction reports, and overtime sheets in our ai editor tool for efficient payroll processing. Download. Simplify payroll management with template.net’s professional payroll report templates. We also have kept our summary report ready that can give you several ideas on the process of designing the payroll report. Say goodbye to complex spreadsheets and hello to template.net's payroll summary report template. Easily customize and print or save as a pdf. Or you can check out our free. Simplify payroll management with template.net’s professional payroll report templates. Designed for busy hr professionals, this template provides detailed insights into employee pay data, enabling you to identify trends, reduce errors,. You can also print or export payroll templates as pdfs. What is a payroll summary report? Download free payroll templates for excel, word, and pdf. Designed for busy hr professionals, this template provides detailed insights into employee pay data, enabling you to identify trends, reduce errors,. Customize salary summaries, deduction reports, and overtime sheets in our ai editor tool for efficient payroll processing. You can also use smartsheet to find professional payroll summary report templates and payroll ledger templates. It contains details such as overtime payments, withheld taxes, hourly rates, total hours worked, vacation payments, etc. Download a free payroll summary template to track and calculate employee wages and deductions. Download free payroll templates for excel, word, and pdf. We also have kept our summary report ready that can give you several ideas on the process of designing the payroll report. You can also print or export payroll templates as pdfs. A payroll summary report template is a template that contains detailed information about employees’ payments and deductions. Say goodbye to complex spreadsheets and hello to template.net's payroll summary report template. Easily customize and print or save as a pdf. Includes pay stubs, timesheets, a payroll register template, and more. You can use them for many reasons, like calculating employer taxes, verifying profit calculations, and budgeting to pay your employees.40 Free Payroll Report Templates (Excel / Word) ᐅ TemplateLab

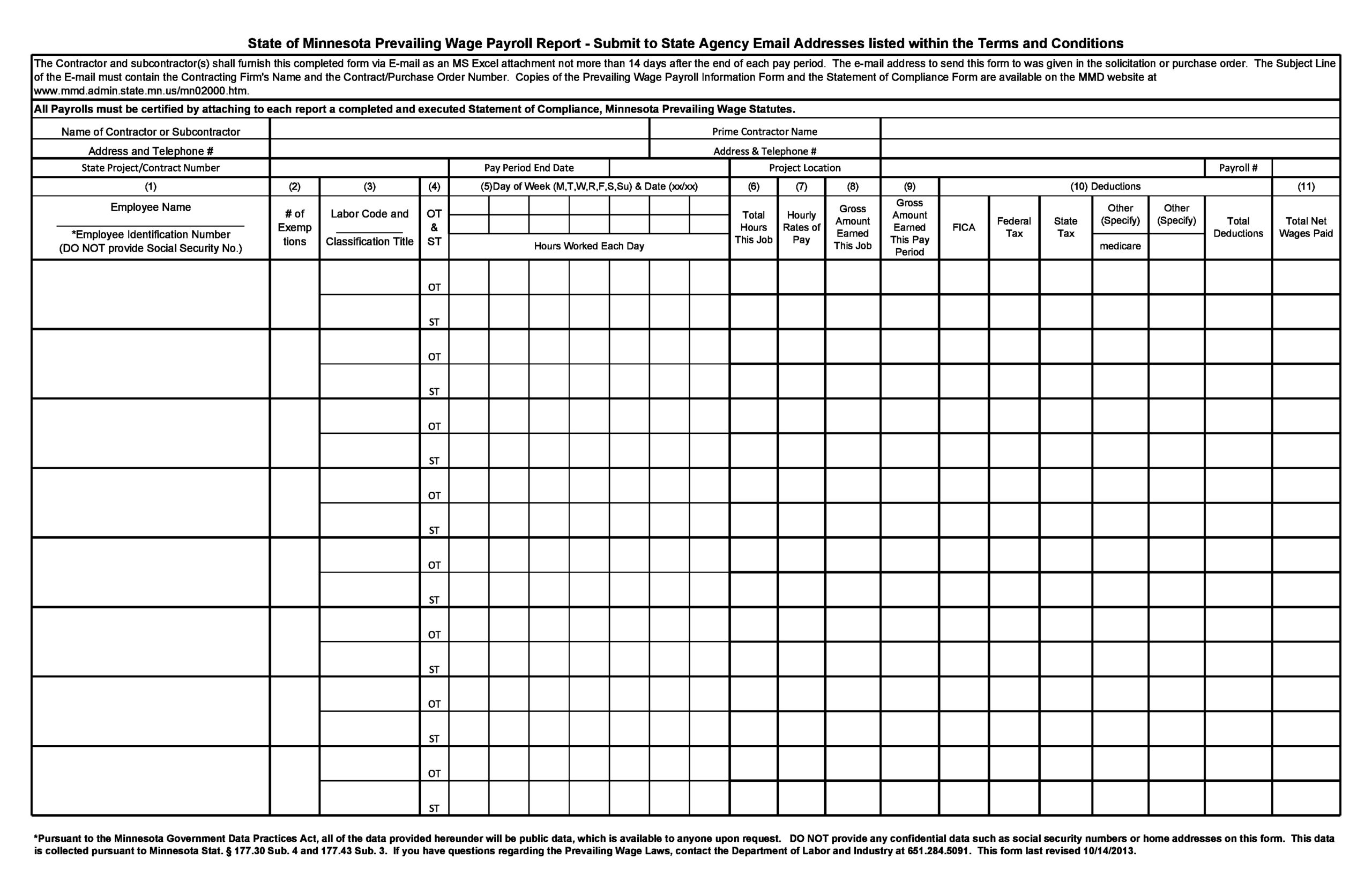

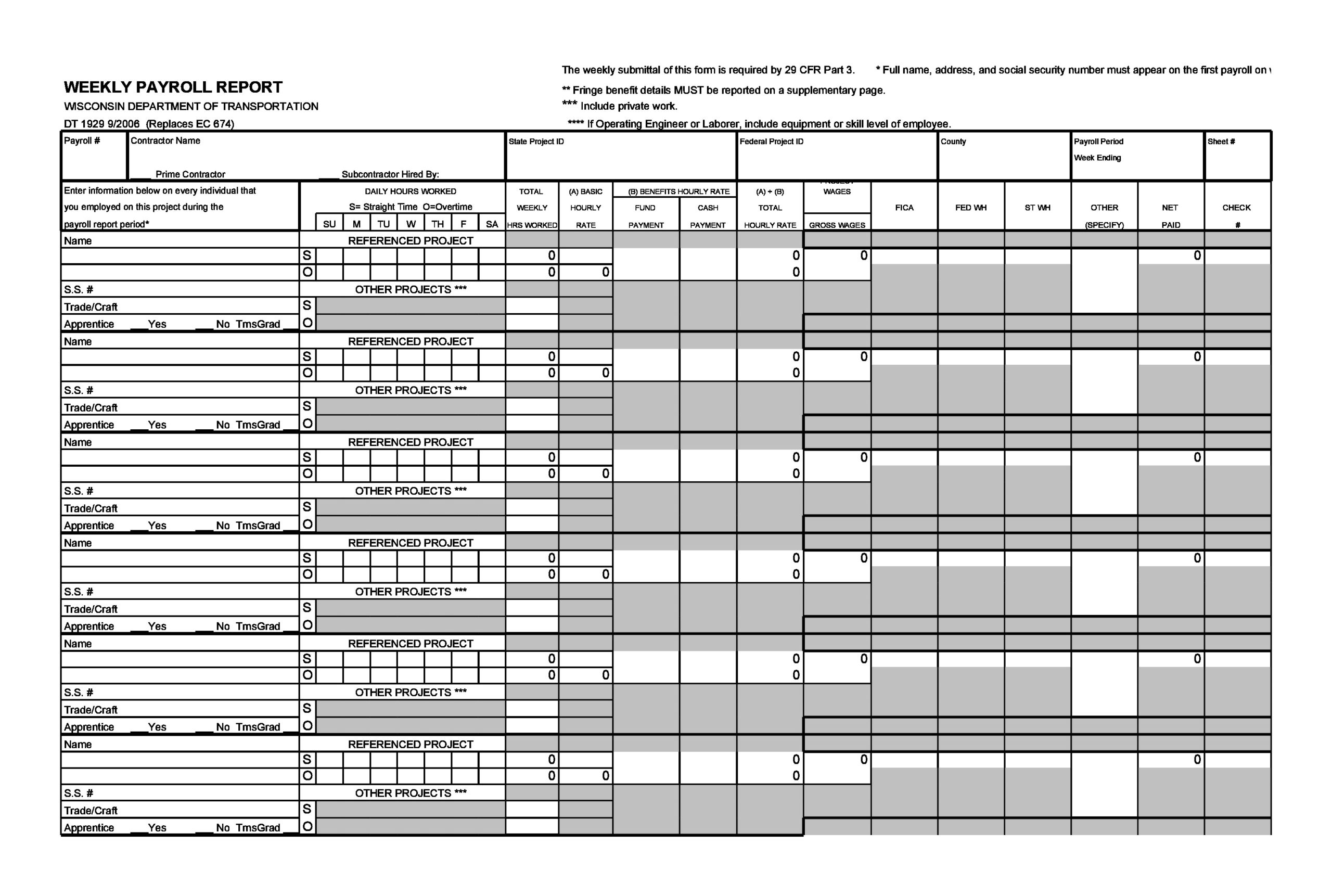

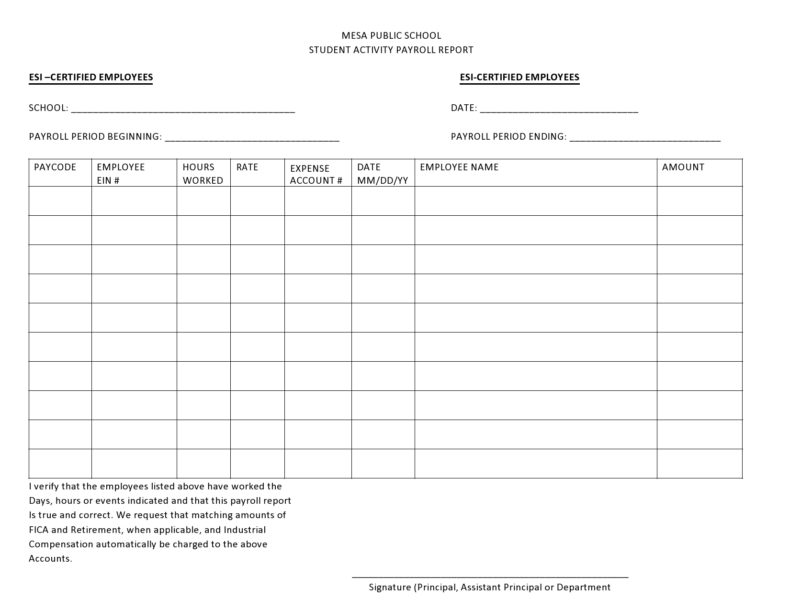

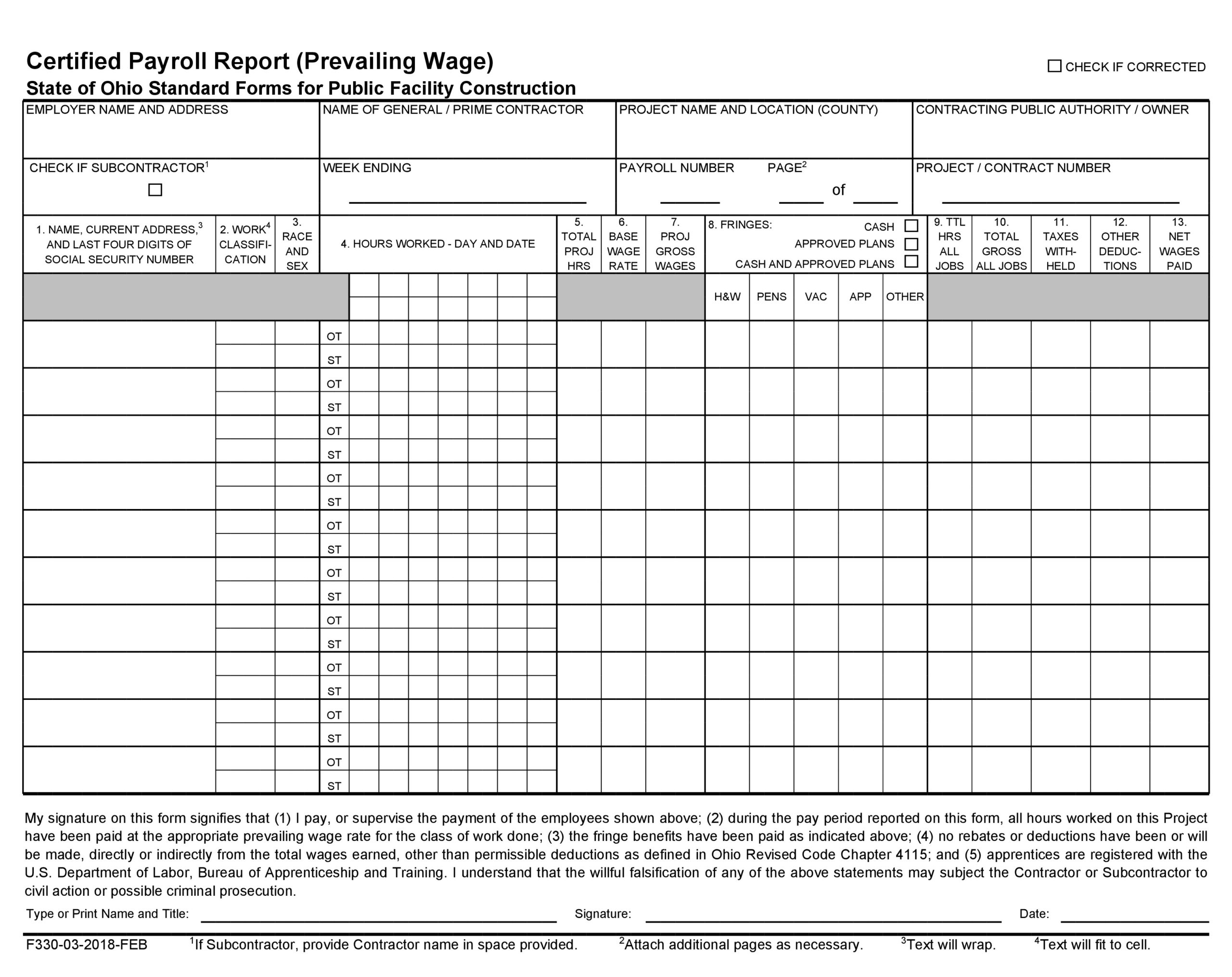

40 Free Payroll Report Templates (Excel / Word) ᐅ TemplateLab

Payroll Summary Report Template

40 Free Payroll Report Templates (Excel / Word) ᐅ TemplateLab

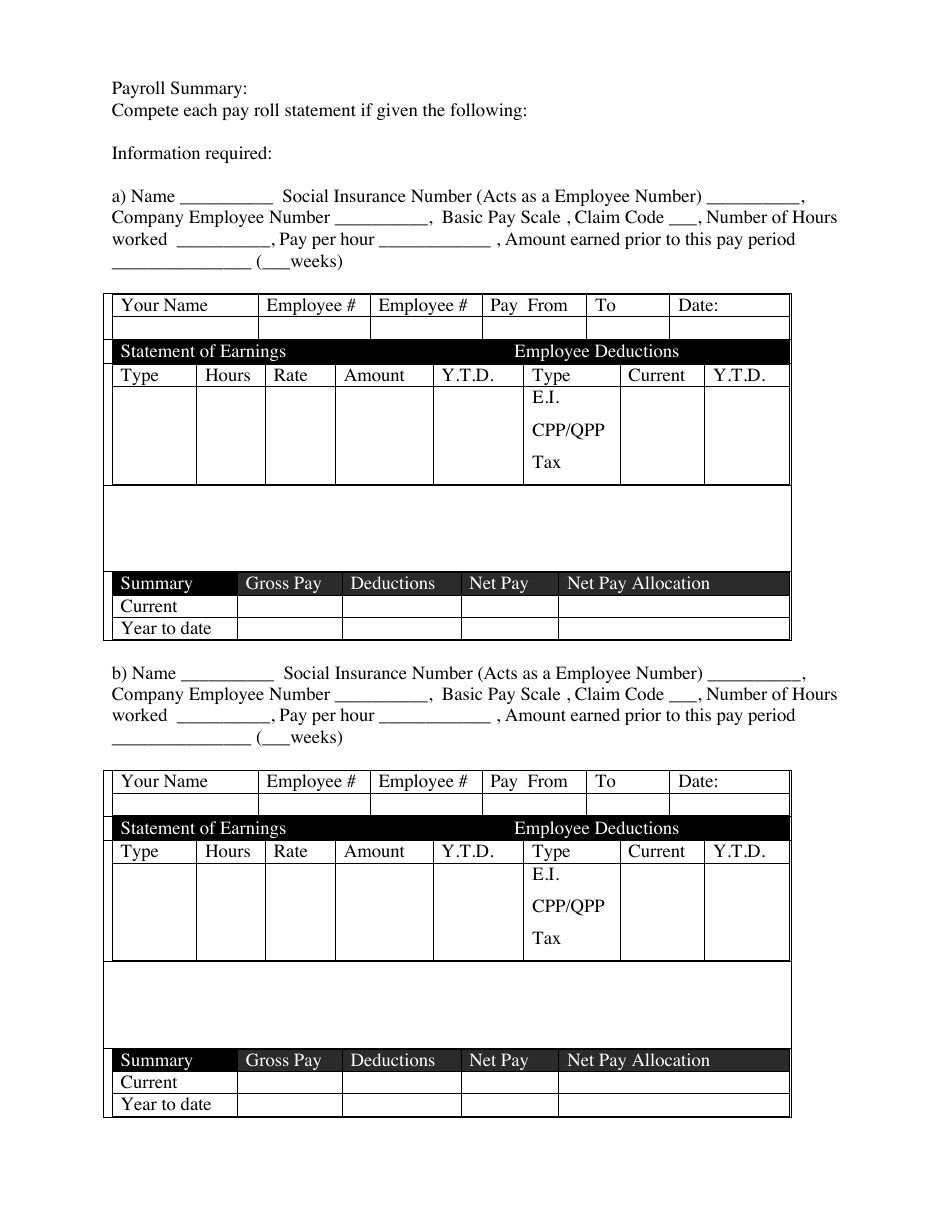

Payroll Summary Report Template Templates2 Resume Examples

40 Free Payroll Report Templates (Excel / Word) ᐅ TemplateLab

Payroll Summary Template Fill Out, Sign Online and Download PDF

40 Free Payroll Report Templates (Excel / Word) ᐅ TemplateLab

FREE 8+ Sample Payroll Report Templates in MS Word PDF

Free Payroll Report Template Google Docs, Word

Payroll Reports Are Documents That Summarize Payroll Data, Like Wages, Employee Hours, And Payroll Taxes.

Simplify Payroll Management With Template.net’s Professional Payroll Report Templates.

What Is A Payroll Summary Report?

Or You Can Check Out Our Free Report Templates That You Would Get Without Spending A Single Penny.

Related Post: