Printable Free 609 Credit Dispute Letter Templates

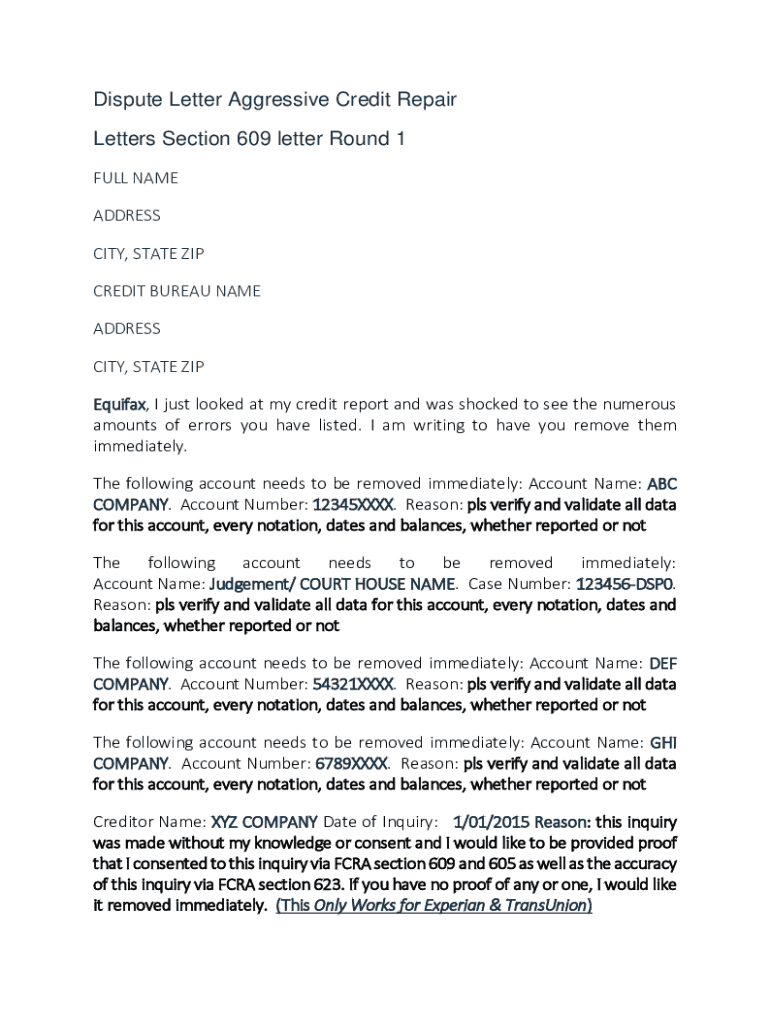

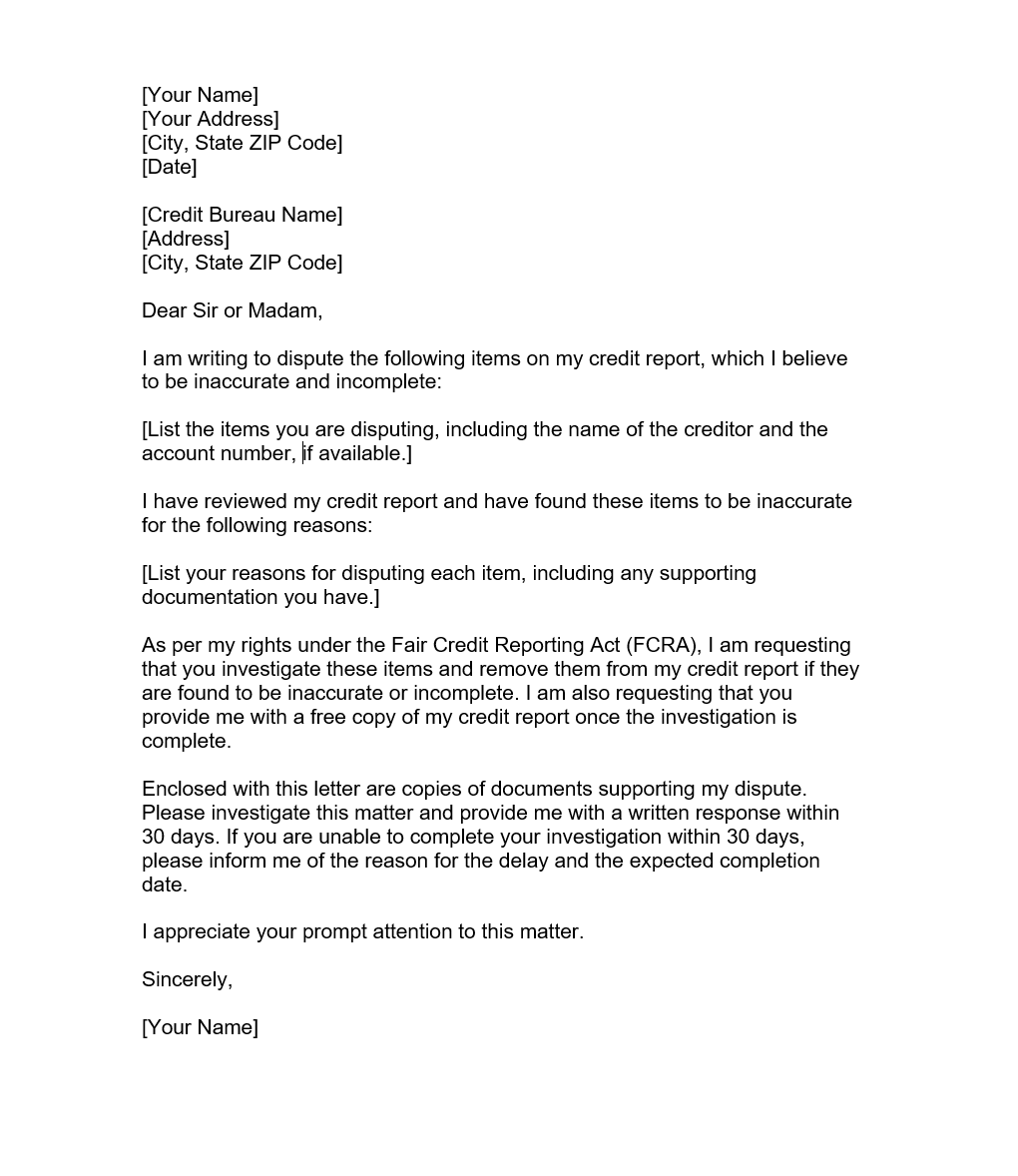

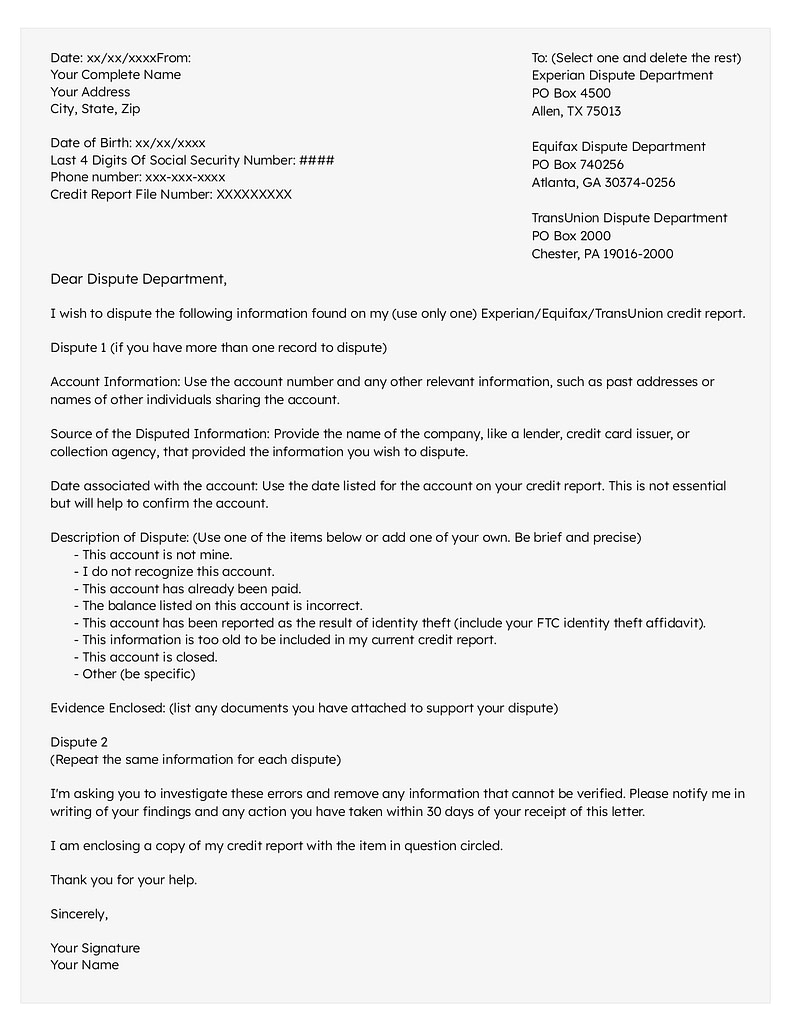

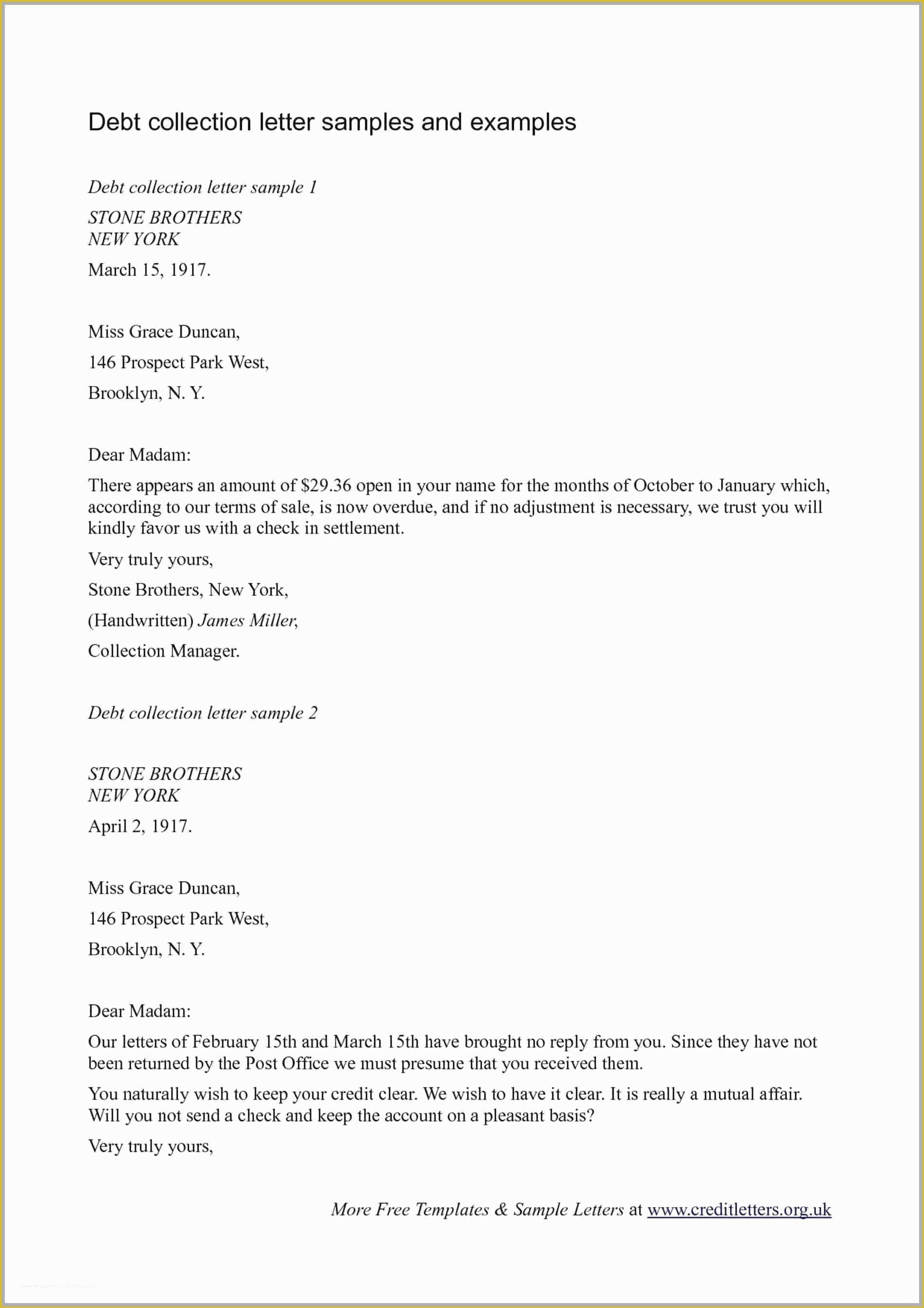

Printable Free 609 Credit Dispute Letter Templates - These templates provide you with a framework to draft a formal dispute letter that adheres to the legal requirements of the fair credit reporting act. A 609 letter is a method of requesting the removal of negative information (even if it’s accurate) from your credit report, thanks to the legal specifications of section 609 of the fair credit reporting act. Learn how to write a 609 letter to fix credit report errors. If you’ve identified inaccurate credit information, or if you want to know more about your current credit info, you need to know how to draft and send a 609 dispute letter. Below is a sample template for a 609 dispute letter. By law, the credit bureau must give a response within 30 days upon receiving notice. Sending a 609 dispute letter may help you remove errors from your credit report. Fortunately, you can challenge inaccurate items with a 609 dispute letter. If the entries are negative, they are removed from the credit report, which increases your credit score. A credit report dispute letter allows consumers to challenge inaccurate, incomplete, or outdated information on their credit reports. Dispute 1 (if you have more than one record to dispute) account information: Sending a 609 dispute letter may help you remove errors from your credit report. Moreover, section 609 of the fair credit reporting act. You can download each company’s dispute form or use the letter included in this guide, which provides the credit reporting company with enough information to identify you and the specific accounts or tradelines that you are disputing. Writing this letter is an effective way of requesting that the negative information even if it’s accurate gets removed from your credit report. Section 609 of the fair credit reporting act has legal specifications that can save you a lot of trouble from getting tagged as a credit risk. A 609 letter is a method of requesting the removal of negative information (even if it’s accurate) from your credit report, thanks to the legal specifications of section 609 of the fair credit reporting act. These templates offer a convenient and organized way to communicate with credit bureaus and creditors to request the correction or removal of disputed items. Download our winning 609 dispute letter, plus free tips to help you boost your credit. By law, the credit bureau must give a response within 30 days upon receiving notice. Per section 609, i am entitled to see the source of the information, which is the original contract that contains my signature. A credit report dispute letter is used to remove an invalid collection from a person's credit history that was either paid, falsely listed, or if the debt is more than seven years old. If the entries are negative,. Download our winning 609 dispute letter, plus free tips to help you boost your credit. A credit report dispute letter is used to remove an invalid collection from a person's credit history that was either paid, falsely listed, or if the debt is more than seven years old. If the entries are negative, they are removed from the credit report,. If disputing erroneous data with the credit reporting agencies hasn’t generated the desired results, your next step may be to write what’s known as a “609 letter” to the credit reporting agencies. You can download each company’s dispute form or use the letter included in this guide, which provides the credit reporting company with enough information to identify you and. If the entries are negative, they are removed from the credit report, which increases your credit score. This guide explains the process and includes a free template to help you get started! Learn how to use credit report disputes, improve your personal finance and raise your score to 100+. You can download each company’s dispute form or use the letter. Writing this letter is an effective way of requesting that the negative information even if it’s accurate gets removed from your credit report. Use our credit report dispute letter template to contest inaccurate items on your credit report. Download a printable credit dispute letter via the link below. You can download each company’s dispute form or use the letter included. I wish to dispute the following information found on my (use only one) experian/equifax/transunion credit report. Section 609 of the fair credit reporting act has legal specifications that can save you a lot of trouble from getting tagged as a credit risk. These templates provide you with a framework to draft a formal dispute letter that adheres to the legal. A “609 dispute letter” is often used to dispute inaccuracies on your credit report under the u.s. The ultimate guide to repair your credit score. Writing this letter is an effective way of requesting that the negative information even if it’s accurate gets removed from your credit report. Sending a 609 dispute letter may help you remove errors from your. However, they do not always promise that your dispute will be successful. Section 609 outlines your right to receive copies of your credit report and any information appearing on it. Download a printable credit dispute letter via the link below. If the entries are negative, they are removed from the credit report, which increases your credit score. We’ve tested over. This guide explains the process and includes a free template to help you get started! Fortunately, you can challenge inaccurate items with a 609 dispute letter. Dispute 1 (if you have more than one record to dispute) account information: Below is a sample template for a 609 dispute letter. I am exercising my right under the fair credit reporting act,. These templates provide you with a framework to draft a formal dispute letter that adheres to the legal requirements of the fair credit reporting act. Use our credit report dispute letter template to contest inaccurate items on your credit report. A credit report dispute letter allows consumers to challenge inaccurate, incomplete, or outdated information on their credit reports. I wish. Let’s take a closer look at what a 609 dispute letter is, how it works, and why you may need to write one. You'll find countless 609 letter templates online; Fair credit reporting act (fcra), specifically section 609. The ultimate guide to repair your credit score. A 609 dispute letter points out some inaccurate, negative, or erroneous information on your credit report, forcing the credit company to change them. These templates offer a convenient and organized way to communicate with credit bureaus and creditors to request the correction or removal of disputed items. Fortunately, you can challenge inaccurate items with a 609 dispute letter. A 609 dispute letter is a formal way to request more information about the accounts on your credit report. Sending a 609 dispute letter may help you remove errors from your credit report. If disputing erroneous data with the credit reporting agencies hasn’t generated the desired results, your next step may be to write what’s known as a “609 letter” to the credit reporting agencies. A 609 letter is a method of requesting the removal of negative information (even if it’s accurate) from your credit report, thanks to the legal specifications of section 609 of the fair credit reporting act. This guide explains the process and includes a free template to help you get started! Moreover, section 609 of the fair credit reporting act. Below is a sample template for a 609 dispute letter. A 609 letter, also known as a 609 dispute letter, can help you remove “unverifiable” bad marks, boost your credit score, and help you qualify for loans that you otherwise wouldn’t meet the requirements for. Dispute 1 (if you have more than one record to dispute) account information:609 Credit Dispute Letter Forms Docs 2023

Printable 609 Letter Template Fillable Form 2023

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]

Free 609 Credit Dispute Letter Templates Of Free Section 609 Credit

Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]

Pdf Printable Free 609 Credit Dispute Letter Templates

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

Pdf Printable Free 609 Credit Dispute Letter Templates

Free 609 Credit Dispute Letter Templates Pdf Printable Templates

We’ve Tested Over 15 Dispute Letters.

Use The Account Number And Any Other Relevant Information, Such As Past Addresses Or

Section 609 Of The Fair Credit Reporting Act Has Legal Specifications That Can Save You A Lot Of Trouble From Getting Tagged As A Credit Risk.

Learn How To Use Credit Report Disputes, Improve Your Personal Finance And Raise Your Score To 100+.

Related Post:

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-10.jpg)

![Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/05/609-credit-dispute-letter.jpg)

![Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/05/letter-disputing-credit-report.jpg)

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-17-790x1022.jpg)