Reconciliation Template

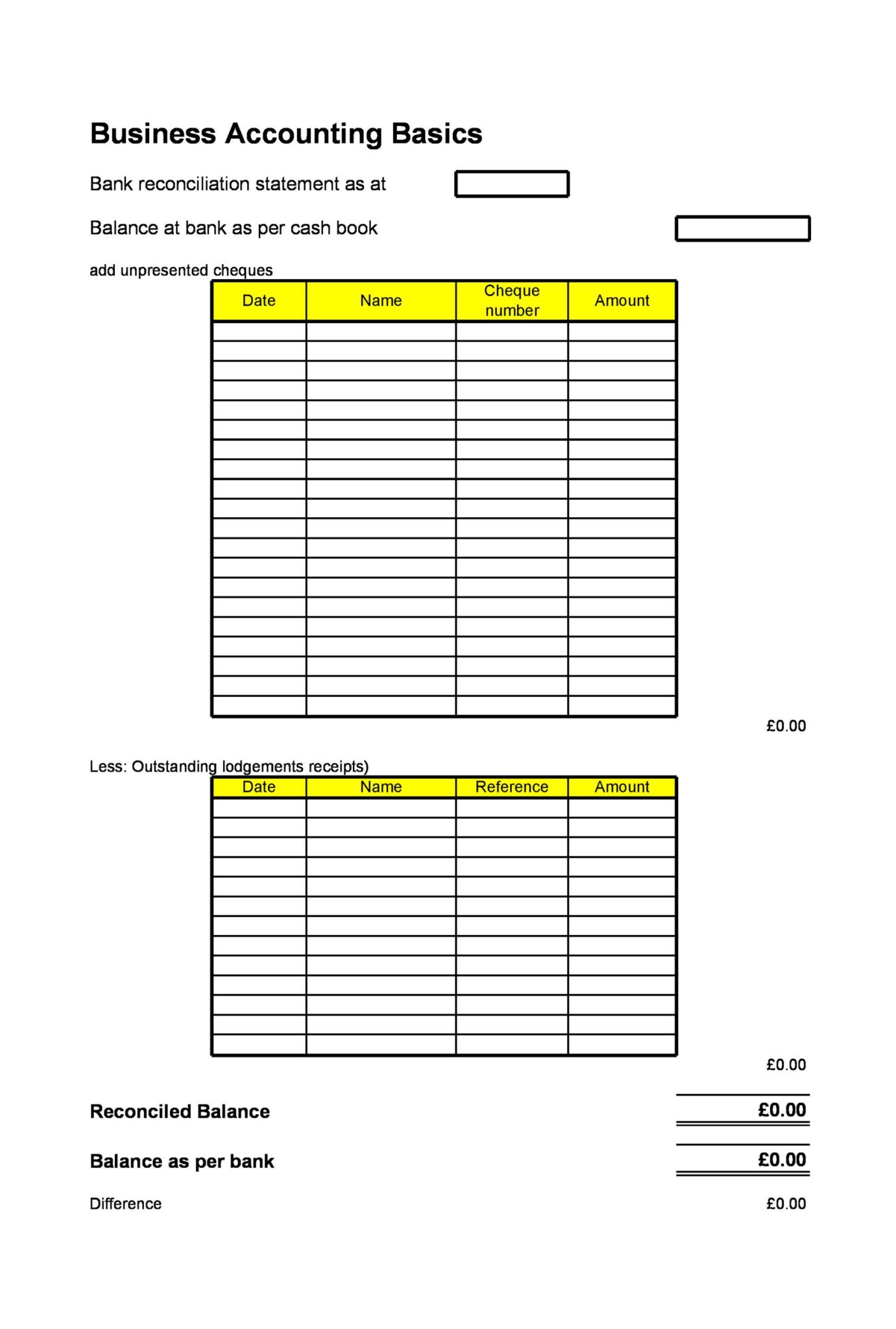

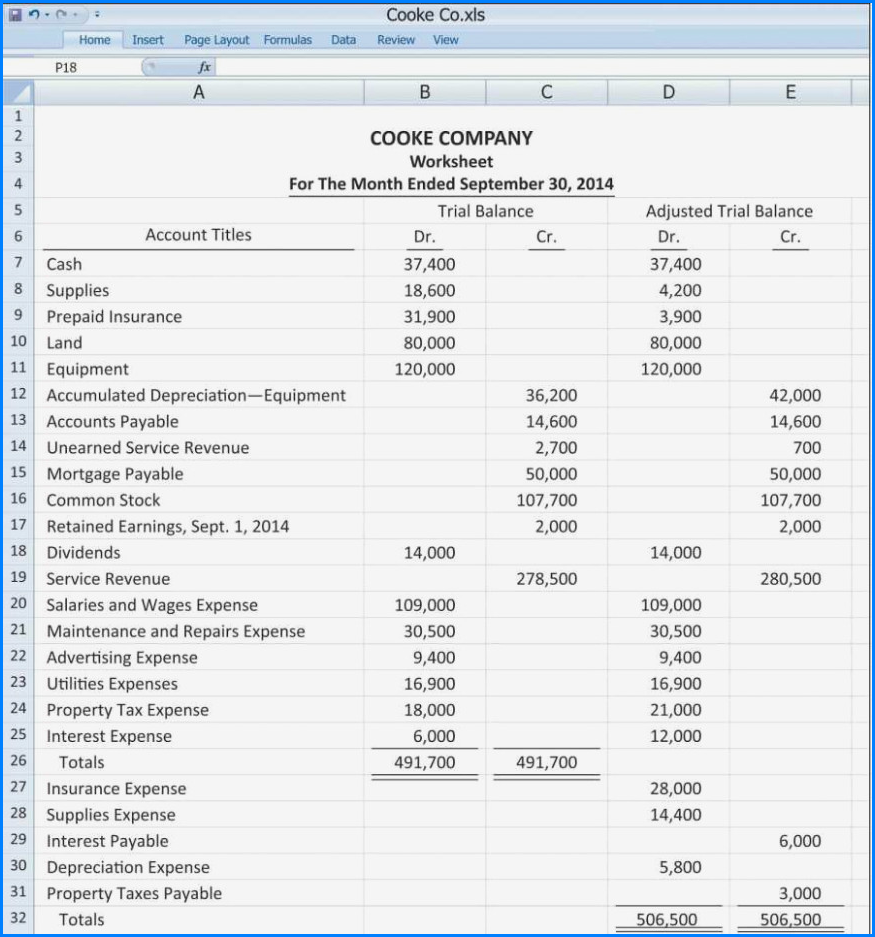

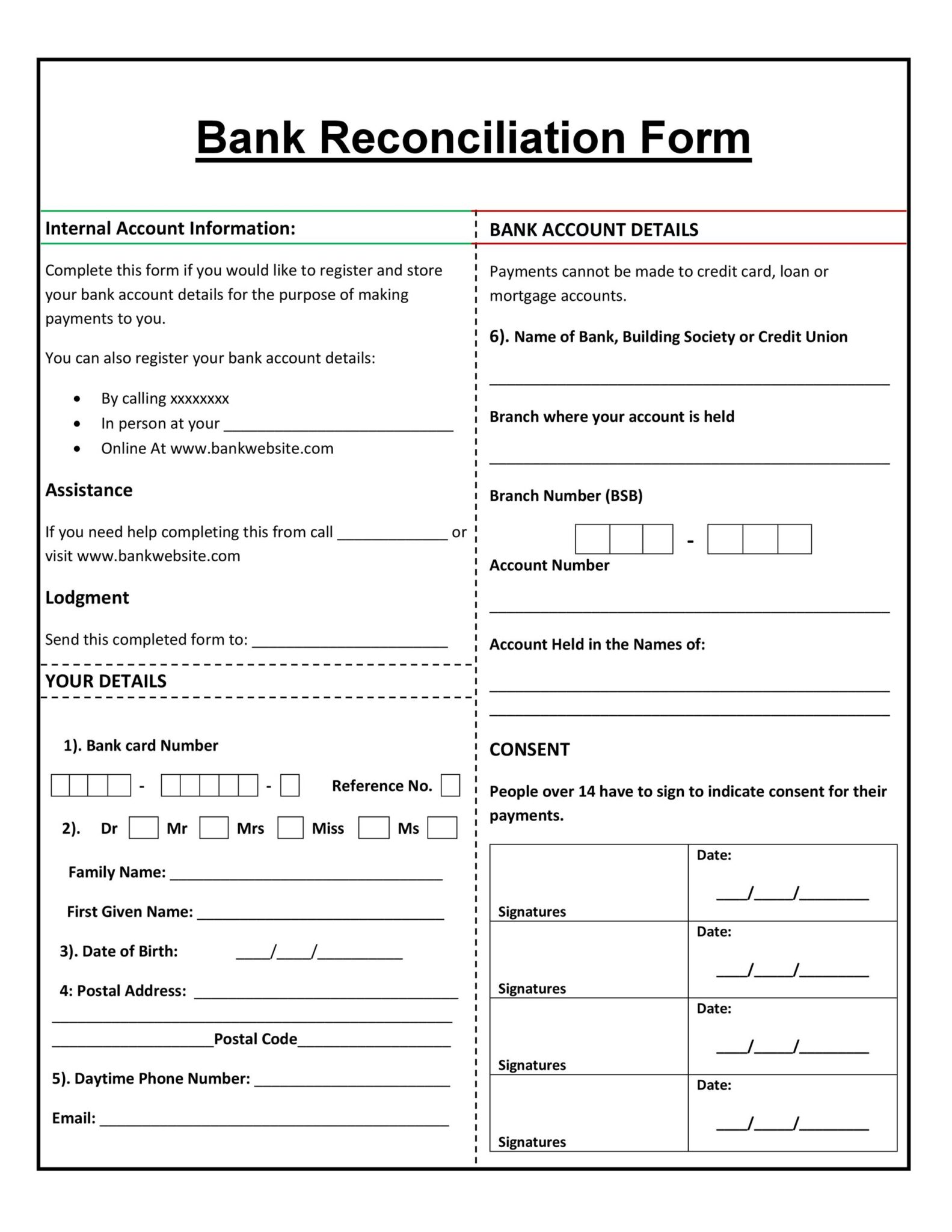

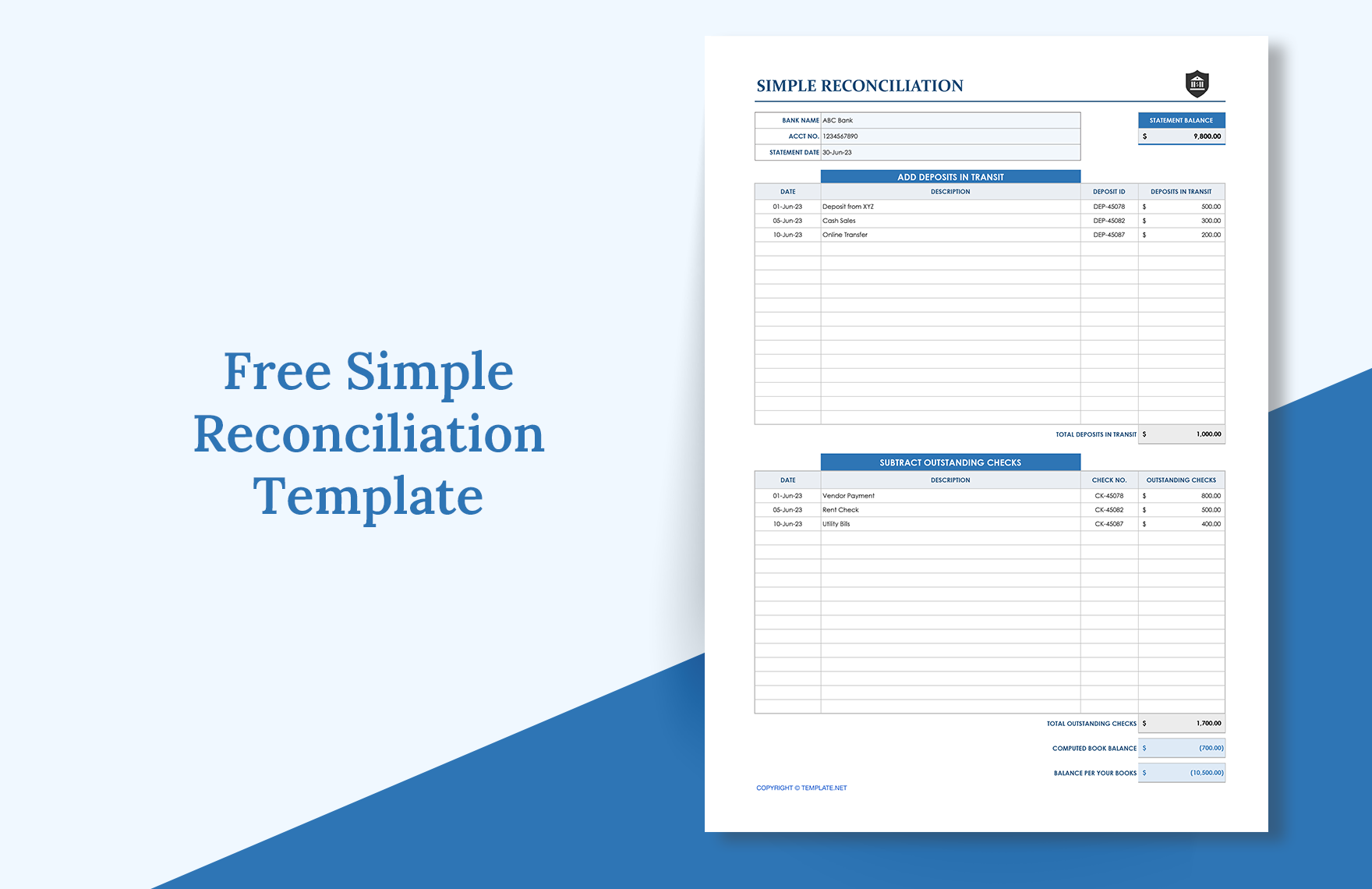

Reconciliation Template - Streamline your financial reconciliation process with our reconciliation excel template generator. Reconciliation is a key process in accounting and treasury management that involves comparing two sets of records to make sure they match. Coefficient’s account reconciliation ledger template transforms this essential task. Once you’ve downloaded your template, simply input your business name and information in the header. Make reconciliation documents with template.net's free reconciliation templates excel. Reconciliation highlights redundancies or weaknesses in how you handle finances. Download our free bank reconciliation template to reconcile your financial records. Its google sheets format simplifies tracking and reconciling financial data, making it accessible for both. Clearly, companies that master it gain a competitive edge—ensuring compliance, improving. For example, you might compare. For example, you might compare. Clearly, companies that master it gain a competitive edge—ensuring compliance, improving. Use on any account, petty cash, ledger, or other purposes. Make reconciliation documents with template.net's free reconciliation templates excel. Download your bank reconciliation template from freshbooks to get started. This powerful tool combines the functionality of excel with advanced ai capabilities to create. Download our free bank reconciliation template to reconcile your financial records. Dealing with accounts receivable reconciliation can often feel like juggling flaming torches while riding a unicycle. Reconciliation is a key process in accounting and treasury management that involves comparing two sets of records to make sure they match. Intercompany reconciliation can reduce financial statement errors by up to 30%. Once you’ve downloaded your template, simply input your business name and information in the header. This powerful tool combines the functionality of excel with advanced ai capabilities to create. We have free, printable templates like that editable on ms word like reconciliation specialists, reconciliation clerks, reconciliation analysts, and more. Online editing is available for template.net's free reconciliation templates google sheets.. Use on any account, petty cash, ledger, or other purposes. For example, you might compare. Account reconciliation is an accounting process performed at the end of an accounting period to ensure that the account balances in the business general ledger are completed and accurate. Once you’ve downloaded your template, simply input your business name and information in the header. Coefficient’s. For example, you might compare. Account reconciliation is an accounting process performed at the end of an accounting period to ensure that the account balances in the business general ledger are completed and accurate. Download your bank reconciliation template from freshbooks to get started. We have free, printable templates like that editable on ms word like reconciliation specialists, reconciliation clerks,. Use on any account, petty cash, ledger, or other purposes. Unlock the benefits of accurate financial management with a free bank reconciliation template designed to streamline the process of aligning your bank statement. Easily track deposits, checks, fees, and errors to ensure accurate balances. Dealing with accounts receivable reconciliation can often feel like juggling flaming torches while riding a unicycle.. Its google sheets format simplifies tracking and reconciling financial data, making it accessible for both. Reconciliation is a key process in accounting and treasury management that involves comparing two sets of records to make sure they match. For example, you might compare. Unlock the benefits of accurate financial management with a free bank reconciliation template designed to streamline the process. Account reconciliation is an accounting process performed at the end of an accounting period to ensure that the account balances in the business general ledger are completed and accurate. Okay, maybe not that dramatic, but it can definitely seem. Clearly, companies that master it gain a competitive edge—ensuring compliance, improving. Edit pivot table, payroll reconciliation content, accounts payables, and accounts. Streamline your financial reconciliation process with our reconciliation excel template generator. Intercompany reconciliation can reduce financial statement errors by up to 30%. Download your bank reconciliation template from freshbooks to get started. Clearly, companies that master it gain a competitive edge—ensuring compliance, improving. Download our free bank reconciliation template to reconcile your financial records. Reconciliation highlights redundancies or weaknesses in how you handle finances. Intercompany reconciliation can reduce financial statement errors by up to 30%. Clearly, companies that master it gain a competitive edge—ensuring compliance, improving. Coefficient’s account reconciliation ledger template transforms this essential task. For example, you might compare. Use on any account, petty cash, ledger, or other purposes. For example, you might compare. Streamline your financial reconciliation process with our reconciliation excel template generator. Reconciliation is a key process in accounting and treasury management that involves comparing two sets of records to make sure they match. Account reconciliation is an accounting process performed at the end of an. Once you’ve downloaded your template, simply input your business name and information in the header. Coefficient’s account reconciliation ledger template transforms this essential task. For example, you might compare. Download accounting reconciliation templates for free. We have free, printable templates like that editable on ms word like reconciliation specialists, reconciliation clerks, reconciliation analysts, and more. Easily track deposits, checks, fees, and errors to ensure accurate balances. Reconciliation highlights redundancies or weaknesses in how you handle finances. Its google sheets format simplifies tracking and reconciling financial data, making it accessible for both. Download our free bank reconciliation template to reconcile your financial records. Online editing is available for template.net's free reconciliation templates google sheets. Unlock the benefits of accurate financial management with a free bank reconciliation template designed to streamline the process of aligning your bank statement. Download accounting reconciliation templates for free. Edit pivot table, payroll reconciliation content, accounts payables, and accounts receivable. Use on any account, petty cash, ledger, or other purposes. Dealing with accounts receivable reconciliation can often feel like juggling flaming torches while riding a unicycle. Okay, maybe not that dramatic, but it can definitely seem. This powerful tool combines the functionality of excel with advanced ai capabilities to create. Reconciliation is a key process in accounting and treasury management that involves comparing two sets of records to make sure they match. Coefficient’s account reconciliation ledger template transforms this essential task. For example, you might compare. Account reconciliation is an accounting process performed at the end of an accounting period to ensure that the account balances in the business general ledger are completed and accurate.50+ Bank Reconciliation Examples & Templates [100 Free]

Free Printable Bank Reconciliation Templates

55 Useful Bank Reconciliation Template RedlineSP

50+ Bank Reconciliation Examples & Templates [100 Free]

50+ Bank Reconciliation Examples & Templates [100 Free]

50+ Bank Reconciliation Examples & Templates [100 Free]

Free Simple Reconciliation Template Excel, Google Sheets

50+ Bank Reconciliation Examples & Templates [100 Free]

55 Useful Bank Reconciliation Template RedlineSP

√ Free Printable Bank Reconciliation Template

Clearly, Companies That Master It Gain A Competitive Edge—Ensuring Compliance, Improving.

Intercompany Reconciliation Can Reduce Financial Statement Errors By Up To 30%.

Download Your Bank Reconciliation Template From Freshbooks To Get Started.

Make Reconciliation Documents With Template.net's Free Reconciliation Templates Excel.

Related Post:

![50+ Bank Reconciliation Examples & Templates [100 Free]](http://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-07.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](http://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-21.jpg?w=320)

![50+ Bank Reconciliation Examples & Templates [100 Free]](https://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-02.jpg)

![50+ Bank Reconciliation Examples & Templates [100 Free]](http://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-32.jpg?w=320)

![50+ Bank Reconciliation Examples & Templates [100 Free]](http://templatelab.com/wp-content/uploads/2017/04/Bank-Reconciliation-Template-38.jpg)