Revocable Living Trust Template Free

Revocable Living Trust Template Free - A revocable living trust is a legal document that allows you to control how your assets will be managed and distributed in the event that you become incapacitated or pass away. A living trust, also known as a revocable trust, is an agreement created by a person, known as the grantor, to hold some portion of their assets during their lifetime. When you die, your revocable trust becomes irrevocable. Create a revocable living trust template with ease with legalsimpli. What makes it “revocable” is that the settlor (the person who. A revocable living trust form is a legal document used in estate planning that enables you to retain control over your assets during your lifetime and determine how they'll be distributed upon your death. Legally, the trust holds the title. Not only do these documents allow you to dictate who will receive your estate at your death, but it gives your family peace of mind knowing that they are carrying out your final wishes. It also may be able to make funds and assets available more quickly than a will. The trustee is responsible for safeguarding the trust's assets during the grantor's lifetime. Given below are the steps to set up a revocable living trust: A living trust (or inter vivos trust) is a legal document allowing an individual (grantor) to place assets under the management of a trustee, who can be the grantor or another party. A revocable living trust (sometimes referred to simply as a “living trust”) is a legal arrangement wherein assets are placed under the control of a trustee during the settlor’s (trustor’s) lifetime, with instructions regarding their management and distribution. Legally, the trust holds the title. The trust provides for payment of income to the grantor and the distribution of the remaining trust assets once the grantor dies. Use our revocable living trust form to transfer your estate and other assets to your heirs easily and quickly, avoiding court processes. Not only do these documents allow you to dictate who will receive your estate at your death, but it gives your family peace of mind knowing that they are carrying out your final wishes. You can name a trustee to handle your affairs and specify how you want your assets to be distributed. Your successor trustee takes control and starts distributing assets according to your trust instructions. Create your document with ease and avoid going to court. Trust and distribute trust property to the persons entitled to it. A living trust (or inter vivos trust) is a legal document allowing an individual (grantor) to place assets under the management of a trustee, who can be the grantor or another party. When you die, your revocable trust becomes irrevocable. A revocable living trust (sometimes referred to simply as. A revocable living trust can be changed, revoked or canceled as per the grantor’s wishes and is fairly easy to draft. What happens to revocable living trust at death? An advantage of a living trust, also known as revocable living trust, is that it does not have to go through the standard probate process, so funds can be distributed to. In addition to basic fees, several extra costs may arise when establishing a living trust. Delegate duties and powers, including hiring and/or employing accounts, lawyers, and other experts. What makes it “revocable” is that the settlor (the person who. It restricts the grantor from adjusting or making changes to it once they have set it in motion. Establish your revocable. It is an effective tool for privacy concerns and avoiding the damages incurred during probation. A revocable living trust is an essential legal document that allows individuals to place their assets in a trust while still alive for their beneficiaries to inherit after their death. Practically, you maintain full control. Delegate duties and powers, including hiring and/or employing accounts, lawyers,. The grantor can also be the trustee as they retain control of the assets. A living trust, also known as a revocable trust, is an agreement created by a person, known as the grantor, to hold some portion of their assets during their lifetime. A revocable living trust is an essential legal document that allows individuals to place their assets. Many jurisdictions impose fees for filing legal documents, typically ranging from $50 to $300.; This trust can include monetary assets, property assets, and also valuables. A revocable living trust form is a legal document used in estate planning that enables you to retain control over your assets during your lifetime and determine how they'll be distributed upon your death. A. The moment property enters a revocable trust, its legal title transfers. You can name a trustee to handle your affairs and specify how you want your assets to be distributed. It should include all the assets and the heirs and state that the trustee will be responsible for the maintenance of the assets. A revocable living trust can be changed,. Many jurisdictions impose fees for filing legal documents, typically ranging from $50 to $300.; Practically, you maintain full control. It should include all the assets and the heirs and state that the trustee will be responsible for the maintenance of the assets. A revocable and/or irrevocable trust avoids this “because the trust does not need to go through the court. Practically, you maintain full control. Many jurisdictions impose fees for filing legal documents, typically ranging from $50 to $300.; Establish your revocable living trust seamlessly. Not only do these documents allow you to dictate who will receive your estate at your death, but it gives your family peace of mind knowing that they are carrying out your final wishes. You. Introduction to revocable living trusts. A revocable living trust is a legal document that allows you to control how your assets will be managed and distributed in the event that you become incapacitated or pass away. A revocable living trust is a legal arrangement where an individual (the grantor) transfers ownership of their assets into a trust during their lifetime.. Enjoy peace of mind because legalsimpli ensures all customer data is 100% secure. For those unfamiliar with how this works, here’s the reality: Introduction to revocable living trusts. Document notarization can add $10 to $25 per signature, depending on local rates.; Protect assets, expedite distribution to beneficiaries, and safeguard your interests. The word file will quickly download so examine the folder where documents are store on your home computer or smart phone. Use our free living revocable trust template to ensure your assets are always managed correctly. A revocable living trust form is a document that creates a legal entity (called a trust) to hold assets like real estate, money, and valuables. It also may be able to make funds and assets available more quickly than a will. The trust provides for payment of income to the grantor and the distribution of the remaining trust assets once the grantor dies. A living trust, also known as a revocable trust, is an agreement created by a person, known as the grantor, to hold some portion of their assets during their lifetime. The agreement should state that the grantor is making a trust for the sake of the beneficiaries. Living trust forms can help you execute a will or revocable living trust. The grantor can modify or revoke the living trust document at any time and retains control over the assets. The trustee is responsible for safeguarding the trust's assets during the grantor's lifetime. The pdf will open in an all new browser window so you can print or download it.Revocable Trust Template Free

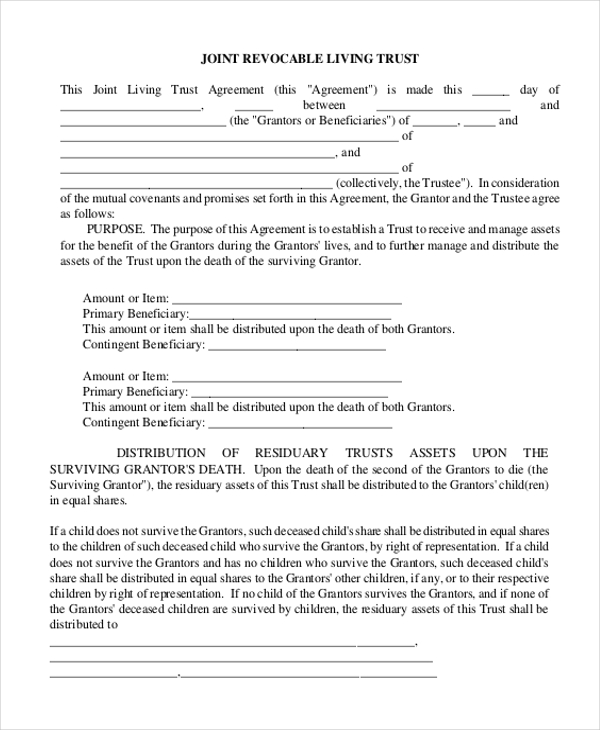

FREE 10+ Sample Living Trust Form Templates in PDF Word

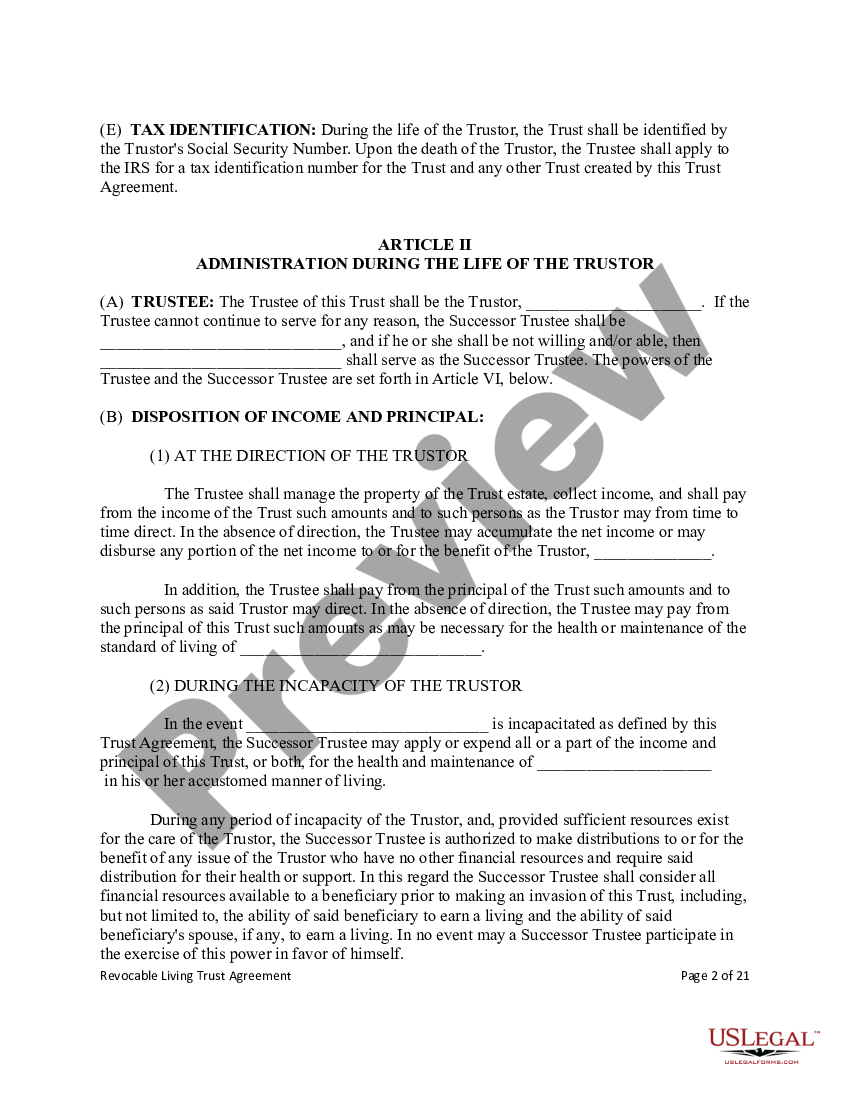

Living Trust Revocable Living Trust US Legal Forms

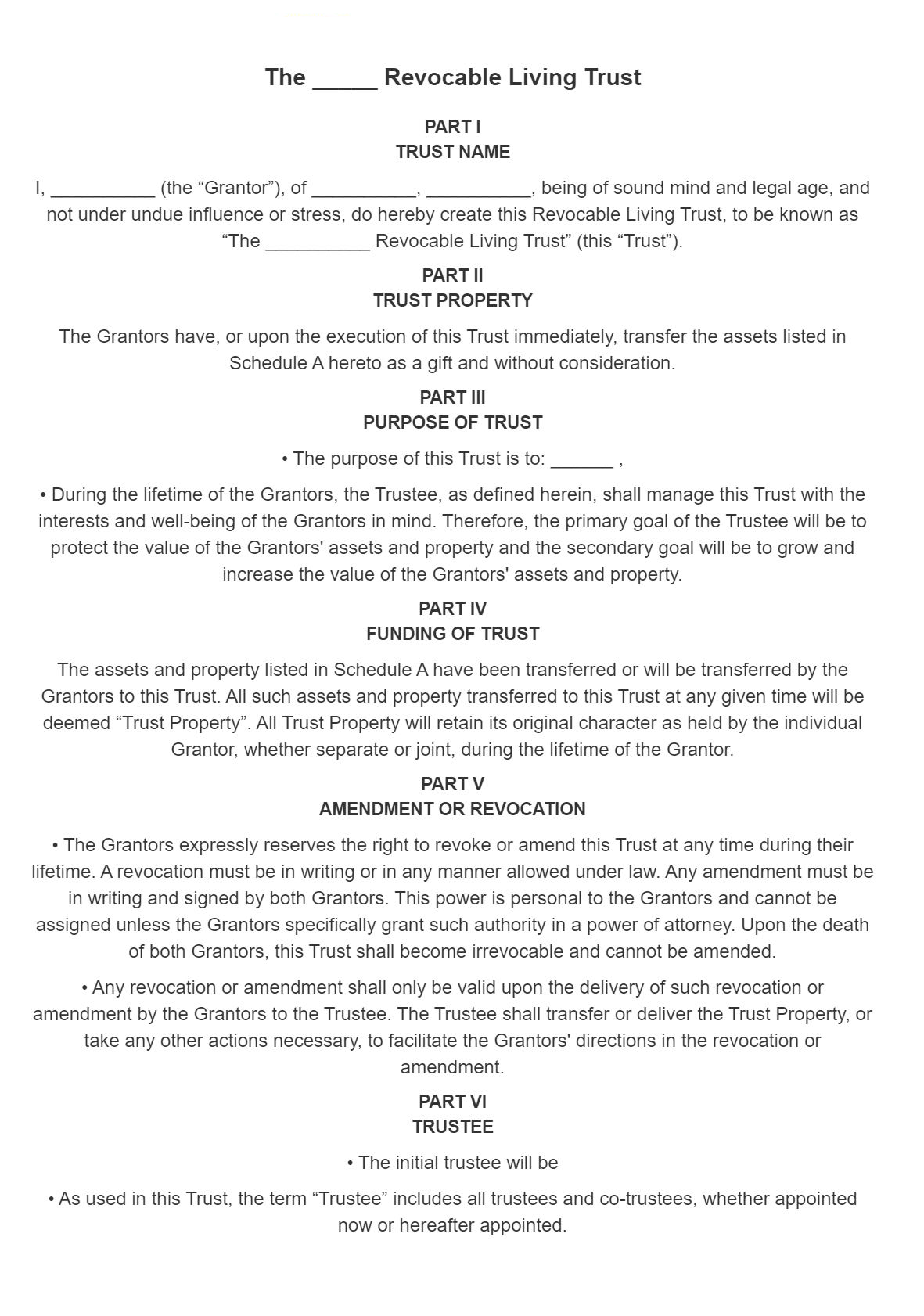

FREE 11+ Living Trust Form Samples, PDF, MS Word, Google Docs

living trust revocable Doc Template pdfFiller

FREE 10+ Sample Living Trust Form Templates in PDF Word

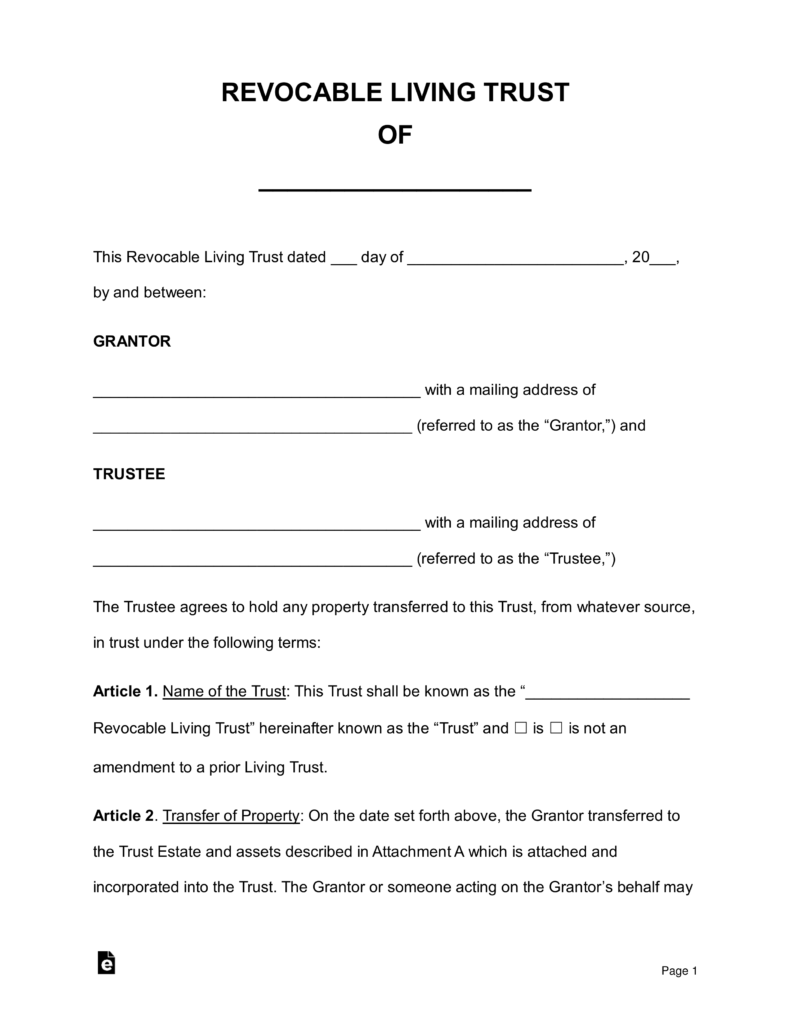

Free Revocable Living Trust Form PDF & Word Template LawDistrict

FREE 10+ Sample Living Trust Form Templates in PDF Word

Free Revocable Living Trust Legal Template for 2023 PDF & Word

Living Trust Revocable Living Trust US Legal Forms

You Can Name A Trustee To Handle Your Affairs And Specify How You Want Your Assets To Be Distributed.

A Revocable Living Trust (Sometimes Referred To Simply As A “Living Trust”) Is A Legal Arrangement Wherein Assets Are Placed Under The Control Of A Trustee During The Settlor’s (Trustor’s) Lifetime, With Instructions Regarding Their Management And Distribution.

A Revocable And/Or Irrevocable Trust Avoids This “Because The Trust Does Not Need To Go Through The Court System, And The Trust Assets Simply Pass Via The Terms Of The Trust,” Says Bernard.

A Revocable Living Trust Can Be Changed, Revoked Or Canceled As Per The Grantor’s Wishes And Is Fairly Easy To Draft.

Related Post: