Safe Note Template With Valuation Cap And No Discount

Safe Note Template With Valuation Cap And No Discount - As you've learned, there are two key terms to a safe from which you can build four different types of safe: The company negotiates with investors to sell $1,000,000 worth of series a preferred stock at a. Offer higher discount rates to investors;. Some investors find valuation caps inconvenient, and selling a. Sets a maximum valuation but does not offer a. Safe with no valuation cap and no discount: Review multiple versions with different use cases depending on your needs. Here are some of the most common types of safe notes: Upon raising funds above a certain threshold, it allows the safe investor to convert at the cap share price. Plus, download a sample safe. You can read more about post. Here are some of the most common types of safe notes: Review multiple versions with different use cases depending on your needs. It's an agreement that provides investors the right to purchase equity in the company at a future. The safe note template includes. The valuation cap and the discount rate. There are two key components of a safe note: Some investors find valuation caps inconvenient, and selling a. Investor has purchased a safe for $100,000. Safe holders) receive the same. Generally, safe notes have no maturity date and no interest rate. You can read more about post. There are two key components of a safe note: This is the one you can pull from y combinator’s website. Here are some of the most common types of safe notes: It's an agreement that provides investors the right to purchase equity in the company at a future. Safe with no valuation cap and no discount: Offer higher discount rates to investors;. There are two key components of a safe note: This is the one you can pull from y combinator’s website. Click each link to learn more. When a safe does not have a valuation cap or a discount rate, it is said to have a “ most favored nation ” clause. Review multiple versions with different use cases depending on your needs. Review multiple versions with different use cases depending on your needs. Upon raising funds above a certain threshold,. Safe with no valuation cap and no discount: When a safe does not have a valuation cap or a discount rate, it is said to have a “ most favored nation ” clause. Here are some of the most common types of safe notes: As you've learned, there are two key terms to a safe from which you can build. Find safe note templates created and drafted by lawyers to buy. Ycombinator has open sourced all their standard agreements on safe notes here. Here are some of the most common types of safe notes: Investor has purchased a safe for $100,000. This means the investors (e.g. The valuation cap is $5,000,000. Generally, safe notes have no maturity date and no interest rate. Here are some of the most common types of safe notes: You can read more about post. Plus, download a sample safe. Investor has purchased a safe for $100,000. The valuation cap sets the maximum valuation at which the investor's investment will convert into. Generally, safe notes have no maturity date and no interest rate. Offer higher discount rates to investors;. The valuation cap and the discount rate. Sets a maximum valuation but does not offer a. Safe holders) receive the same. Offer higher discount rates to investors;. Some investors find valuation caps inconvenient, and selling a. It's an agreement that provides investors the right to purchase equity in the company at a future. There are two key components of a safe note: Review multiple versions with different use cases depending on your needs. Safe holders) receive the same. Generally, safe notes have no maturity date and no interest rate. Click each link to learn more. Safe with no valuation cap and no discount: It's an agreement that provides investors the right to purchase equity in the company at a future. Plus, download a sample safe. The safe note template includes the following components: Review multiple versions with different use cases depending on your needs. The safe note template includes. Plus, download a sample safe. Safe with no valuation cap and no discount: Sets a maximum valuation but does not offer a. Review multiple versions with different use cases depending on your needs. Here are some of the most common types of safe notes: This is the one you can pull from y combinator’s website. When a safe does not have a valuation cap or a discount rate, it is said to have a “ most favored nation ” clause. Investor has purchased a safe for $100,000. Generally, safe notes have no maturity date and no interest rate. Some investors find valuation caps inconvenient, and selling a. As you've learned, there are two key terms to a safe from which you can build four different types of safe: Review multiple versions with different use cases depending on your needs. Safe holders) receive the same. There are two key components of a safe note: The safe note template includes the following components:Safe Cap Table Template

SAFE Notes A Quick Guide

SAFE Convertible Note Template Eqvista

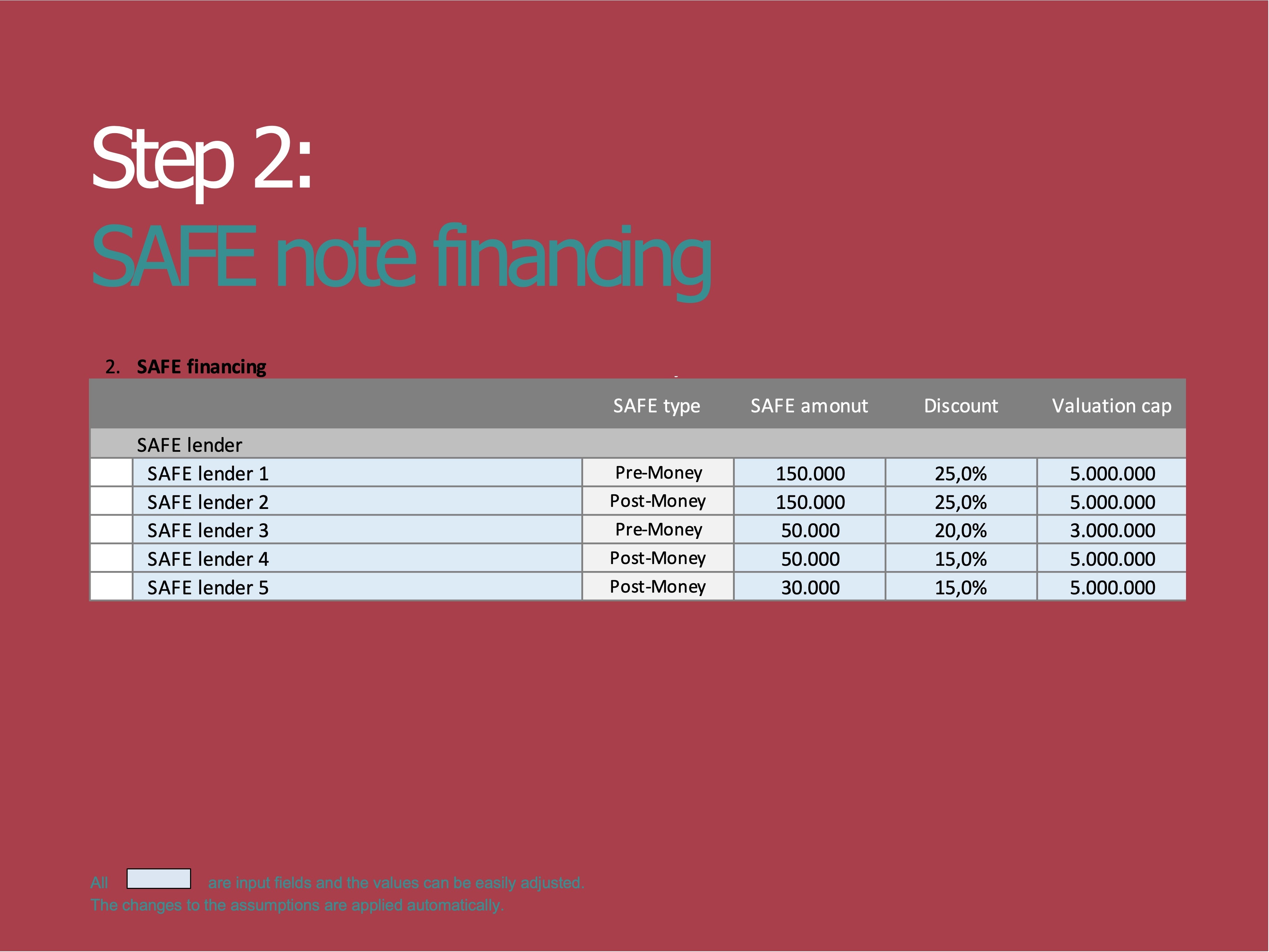

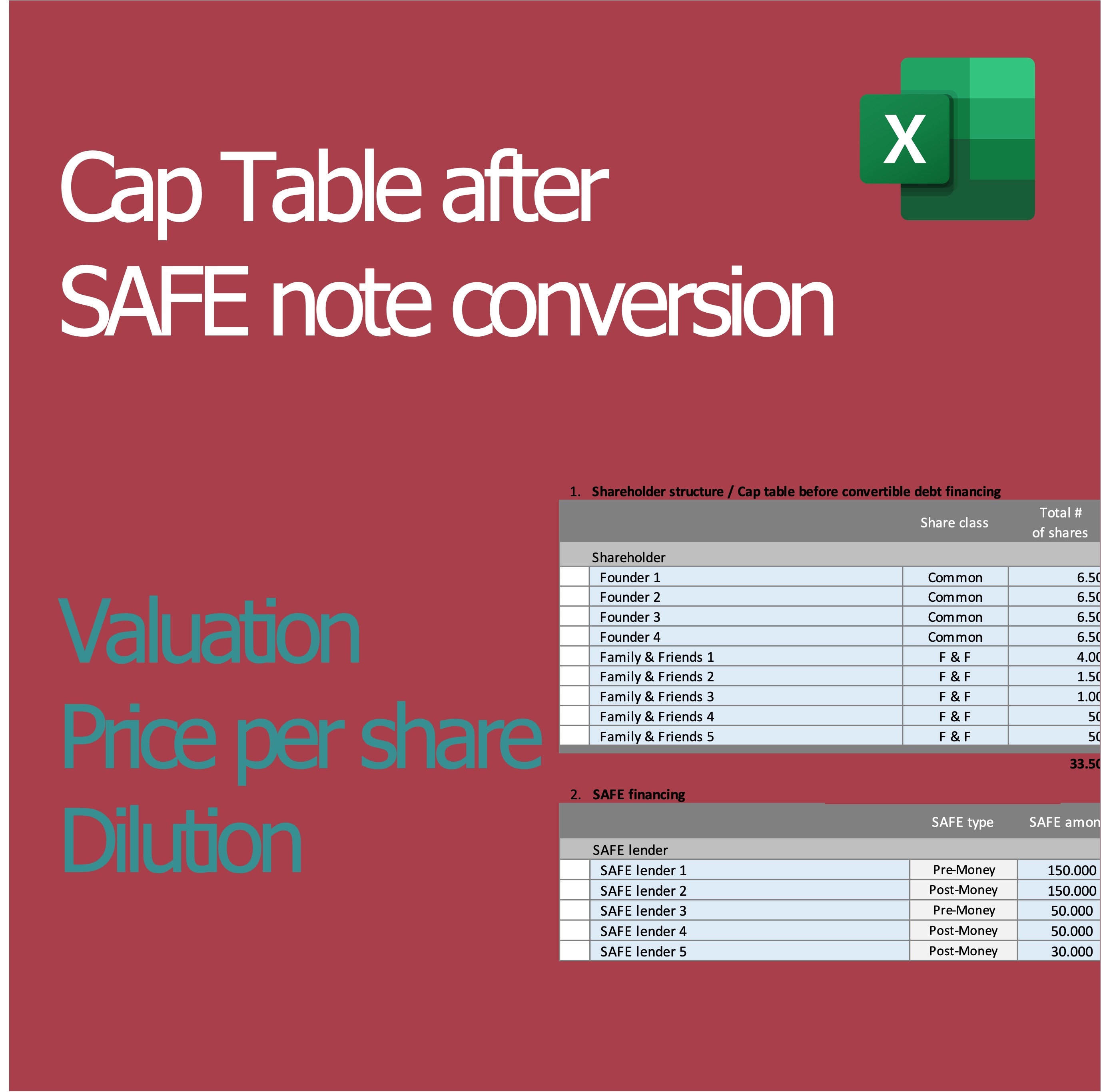

Cap Table Calculation model for the conversion of a SAFE note Excel

SAFE Note or SAFE Agreement Template Customizable Legal Document

SAFE Notes Explained Video, Guide, and Excel File

SAFE Convertible Note Template Eqvista

Post Money Safe Agreement Valuation Cap and Discount Doc Template

SAFE Notes Explained Video, Guide, and Excel File

Cap Table Calculation model for the conversion of a SAFE note Excel

Click Each Link To Learn More.

You Can Read More About Post.

It's An Agreement That Provides Investors The Right To Purchase Equity In The Company At A Future.

There Are Two Key Components Of A Safe Note:

Related Post: