Schedule C Excel Template

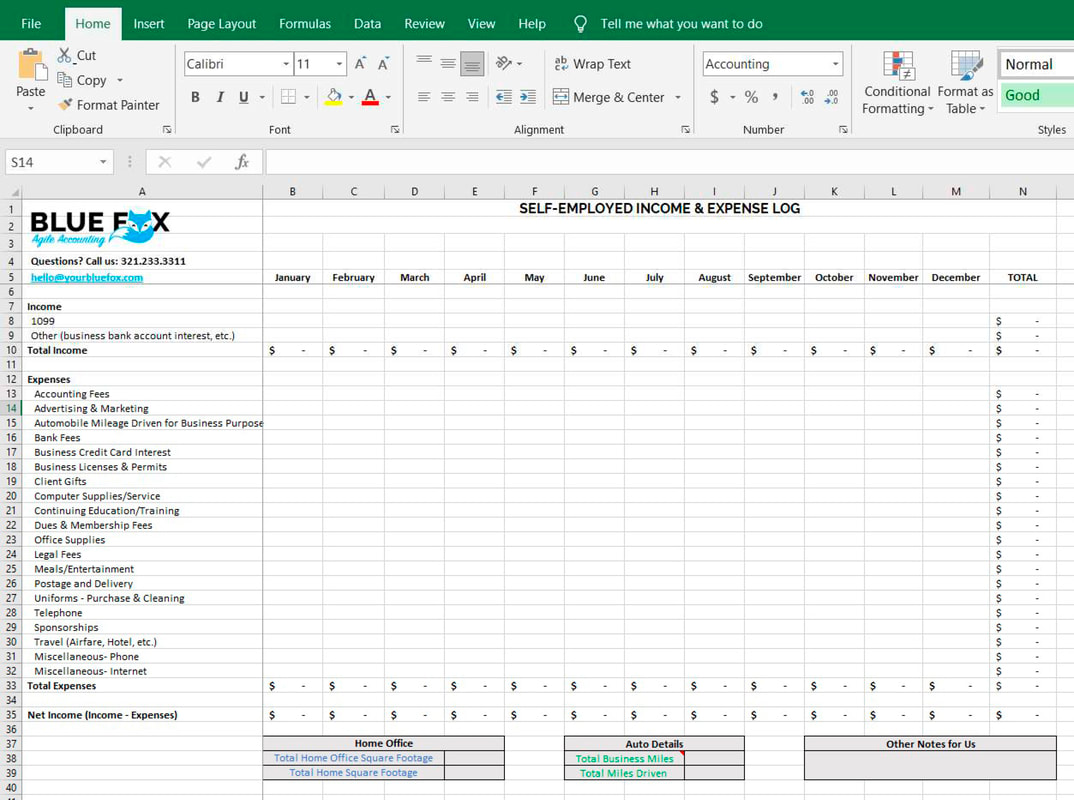

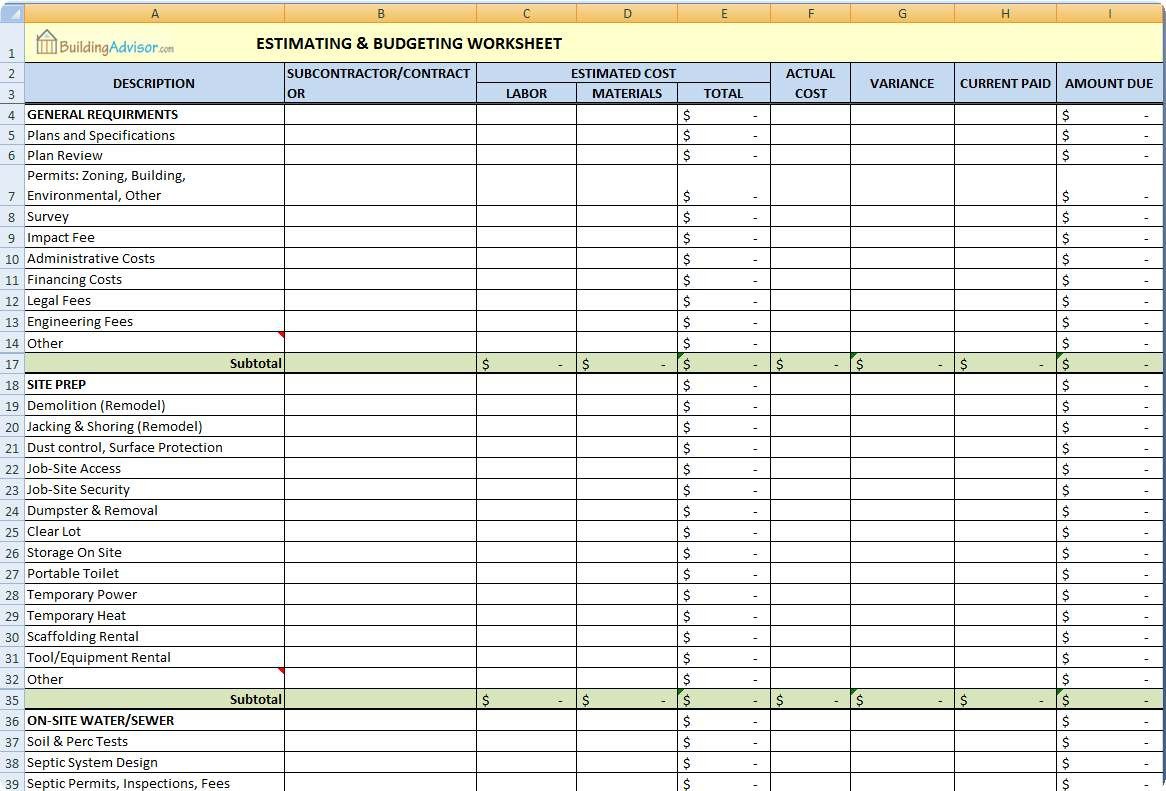

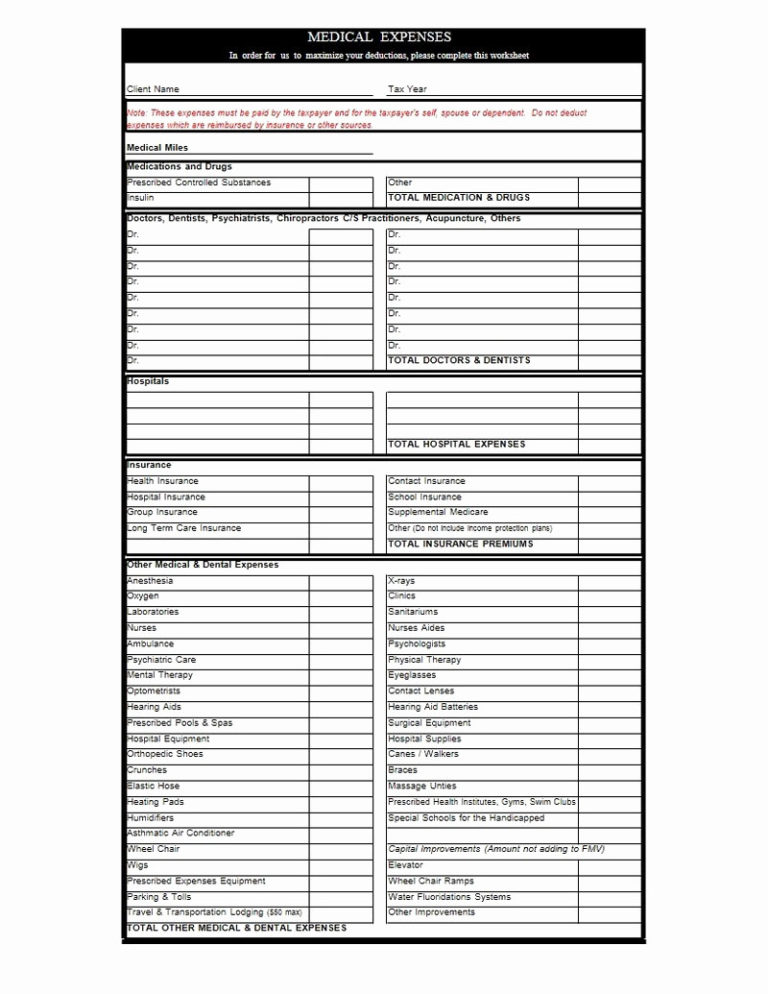

Schedule C Excel Template - Easy to use excel workbook for tracking your business income and expenses. The schedule c report template pulls together information you need to complete part i, part ii, and part v of schedule c. Set up this report template in your client organization to help you to. Up to 10% cash back schedule c (form 1040) business profit or loss (p&l) with excel download. Use a separate worksheet for each. Create a customized schedule c excel template with ai to track business income and expenses. Use separate sheet for each type of business. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if. Use separate sheet for each business. Also, use schedule c to report (a) wages and expenses you had as a statutory employee, (b) income and deductions of certain qualified joint. Sole proprietors in the united states use schedule c (form 1040) to report business income and expenses. If you're not keen on creating a schedule from scratch, excel offers a variety of templates that can serve as a great starting. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if. Up to 10% cash back schedule c (form 1040) business profit or loss (p&l) with excel download. Also, use schedule c to report (a) wages and expenses you had as a statutory employee, (b) income and deductions of certain qualified joint. Use separate sheet for each business. Use separate sheet for each type of business. Easy to use excel workbook for tracking your business income and expenses. I also put together a guide to help her know which. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; Use separate sheet for each business. The schedule c report template pulls together information you need to complete part i, part ii, and part v of schedule c. The schedule c (form 1040) bookkeeping template for excel and google sheets is made to help you keep your sole proprietorship's income and expenses organized and make. Using excel templates for cleaning. This free template helps you track business expenses using schedule c tax. The schedule c (form 1040) bookkeeping template for excel and google sheets is made to help you keep your sole proprietorship's income and expenses organized and make. It provides comprehensive guidelines to help. Also, use schedule c to report (a) wages and expenses you had as a statutory. The schedule c report template pulls together information you need to complete part i, part ii, and part v of schedule c. Use a separate worksheet for each. Easy to use excel workbook for tracking your business income and expenses. Set up this report template in your client organization to help you to. I also put together a guide to. Easy to use excel workbook for tracking your business income and expenses. Using excel templates for cleaning schedules. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; The schedule c (form 1040) bookkeeping template for excel and google sheets is made. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor; It provides comprehensive guidelines to help. This free template helps you track business expenses using schedule c tax. Create a customized schedule c excel template with ai to track business income and. Up to 10% cash back schedule c (form 1040) business profit or loss (p&l) with excel download. Sole proprietors in the united states use schedule c (form 1040) to report business income and expenses. I put together an excel spreadsheet with columns for all the information you need to track business expenses for schedule c. Use separate sheet for each. Up to 10% cash back schedule c (form 1040) business profit or loss (p&l) with excel download. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if. If you're not keen on creating a schedule from scratch, excel offers a variety of templates. Use separate sheet for each business. Up to 10% cash back schedule c (form 1040) business profit or loss (p&l) with excel download. Use separate sheet for each type of business. I also put together a guide to help her know which. Use a separate worksheet for each. It provides comprehensive guidelines to help. Using excel templates for cleaning schedules. Create a customized schedule c excel template with ai to track business income and expenses. The schedule c (form 1040) bookkeeping template for excel and google sheets is made to help you keep your sole proprietorship's income and expenses organized and make. I put together an excel spreadsheet. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if. It provides comprehensive guidelines to help. Use separate sheet for each type of business. Set up this report template in your client organization to help you to. Use a separate worksheet for each. Also, use schedule c to report (a) wages and expenses you had as a statutory employee, (b) income and deductions of certain qualified joint. If you're not keen on creating a schedule from scratch, excel offers a variety of templates that can serve as a great starting. Use separate sheet for each type of business. This free template helps you track business expenses using schedule c tax. Use separate sheet for each business. I put together an excel spreadsheet with columns for all the information you need to track business expenses for schedule c. Using excel templates for cleaning schedules. Use a separate worksheet for each. Up to 10% cash back schedule c (form 1040) business profit or loss (p&l) with excel download. I also put together a guide to help her know which. It provides comprehensive guidelines to help. The schedule c (form 1040) bookkeeping template for excel and google sheets is made to help you keep your sole proprietorship's income and expenses organized and make. The schedule c report template pulls together information you need to complete part i, part ii, and part v of schedule c. Schedule c worksheet for self employed businesses and/or independent contractors irs requires we have on file your own information to support all schedule c’s business name (if. Easy to use excel workbook for tracking your business income and expenses. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;Schedule C Worksheet Excel

Schedule C Excel Template

Schedule C And Expense Worksheet

Schedule C Excel Template

Schedule C IRS Form 1040 Spreadsheet Excel Google Sheets Etsy

Taxready & Expense Tracker Schedule C Excel Template Small

Schedule C Spreadsheet

Schedule C In Excel Format

30 Schedule C Excel Template Simple Template Design

Schedule C Excel Spreadsheet

Square, Paypal, Etc.) Business Name:.

Set Up This Report Template In Your Client Organization To Help You To.

Create A Customized Schedule C Excel Template With Ai To Track Business Income And Expenses.

Sole Proprietors In The United States Use Schedule C (Form 1040) To Report Business Income And Expenses.

Related Post: