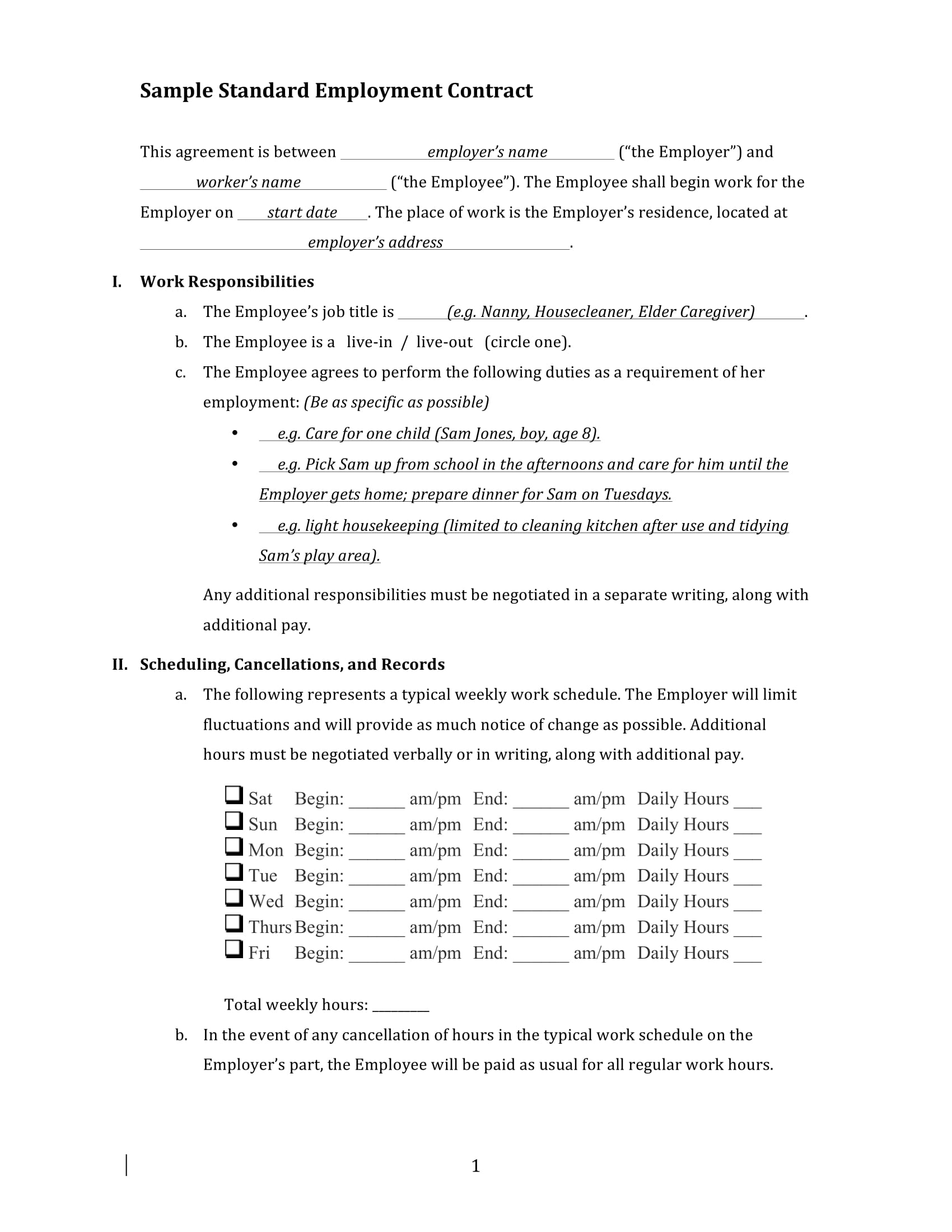

Super Salary Sacrifice Agreement Template

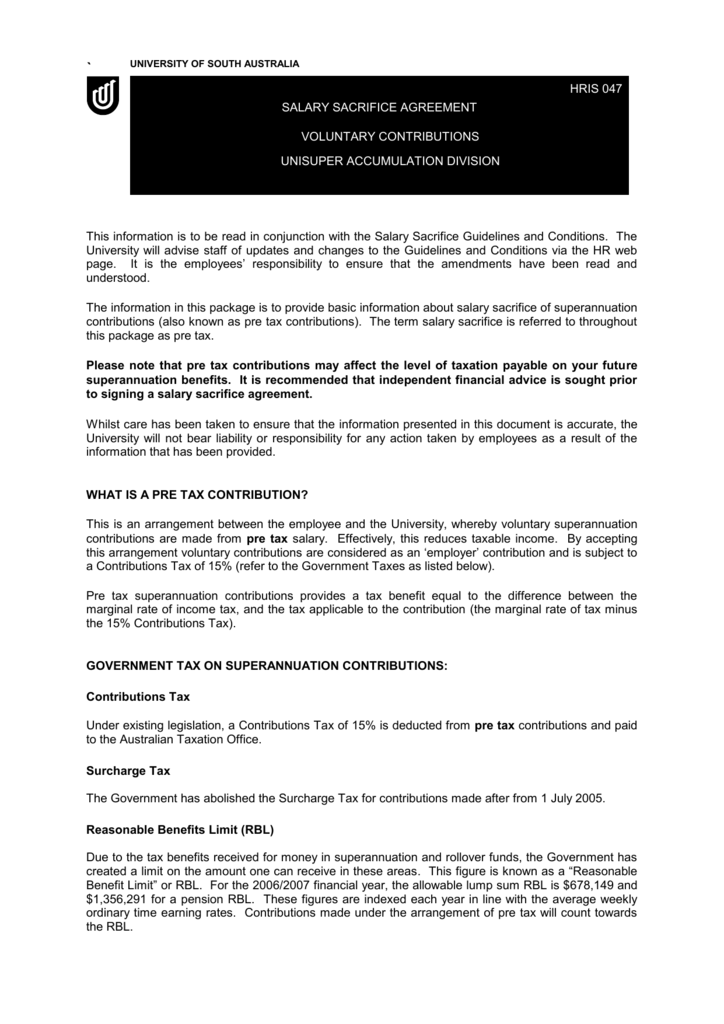

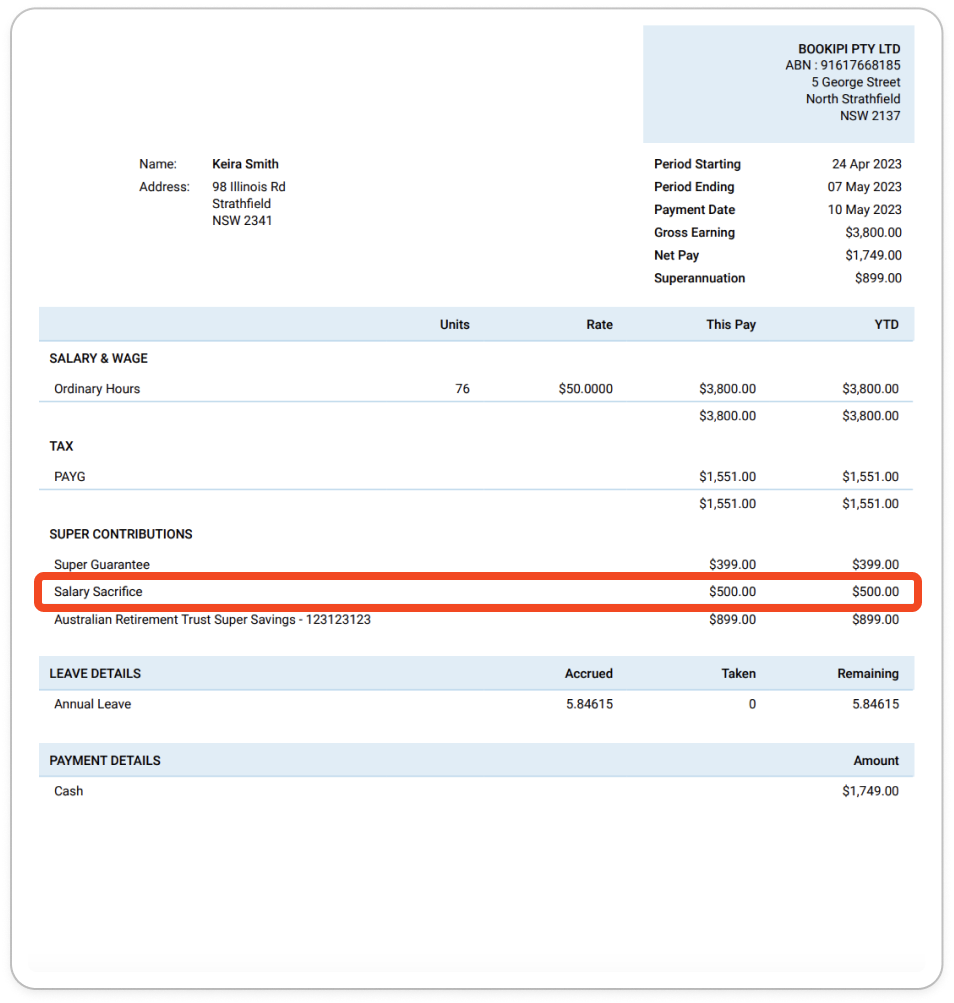

Super Salary Sacrifice Agreement Template - Up to $40 cash back complete salary sacrifice agreement template online with us legal forms. Save or instantly send your ready. No need to install software, just go to dochub, and sign up instantly and for free. Employers can set up a salary sacrifice for super arrangement with their employee to get the benefits of a salary sacrifice. Talk to your employer first to make sure they’re happy to contribute to super from your pay. Have read the current product disclosure statement and understand that i’m eligible to contribute to my mlc super account. Save or instantly send your ready. 2.1 the employee may specify a proportion of the salary that is to be sacrificed in advance (the “sacrificed amount”) prior to earning the same during the period covered by this salary. For each employee, you’ll need to agree with them on the amount of. Salary sacrificing to super is when. Complete all parts of this form and provide it to your employer/payroll. From 1 january 2020, you are required to pay super. This salary sacrifice agreement is an agreement for an arrangement between an employer and an employee, whereby the employee agrees to forego part of their future entitlement to salary. For each employee, you’ll need to agree with them on the amount of. This top up is in addition to your. Up to $40 cash back complete salary sacrifice agreement template online with us legal forms. I would like to make the following salary sacrifice. Save or instantly send your ready. Talk to your employer first to make sure they’re happy to contribute to super from your pay. Salary sacrifice for employer superannuation under this agreement an employee may choose to sacrifice salary for employer superannuation contributions into a complying superannuation. Learn how it works and use our calculator to see if it's right for you. Salary sacrificing to super is when. Save or instantly send your. This top up is in addition to your. Super salary sacrifice agreement employees may request to salary sacrifice a portion of their salary/wage before tax is deducted to their superannuation. Super salary sacrifice agreement employees may request to salary sacrifice a portion of their salary/wage before tax is deducted to their superannuation. Talk to your employer first to make sure they’re happy to contribute to super from your pay. Up to $40 cash back complete salary sacrifice agreement template online with us legal forms. From 1 january 2020, you are. Up to $40 cash back complete salary sacrifice agreement template online with us legal forms. You should consider your contributions caps and seek further. For each employee, you’ll need to agree with them on the amount of. Employers can set up a salary sacrifice for super arrangement with their employee to get the benefits of a salary sacrifice. Employers can. Save or instantly send your. Easily fill out pdf blank, edit, and sign them. This salary sacrifice agreement is an agreement for an arrangement between an employer and an employee, whereby the employee agrees to forego part of their future entitlement to salary. This top up is in addition to your. What would you like to do? Save or instantly send your ready. Employers can set up a salary sacrifice for super arrangement with their employee to get the benefits of a salary sacrifice. Could you save on tax and grow your super by salary sacrificing? 2.1 the employee may specify a proportion of the salary that is to be sacrificed in advance (the “sacrificed amount”) prior. Talk to your employer first to make sure they’re happy to contribute to super from your pay. Employers can set up a salary sacrifice for super arrangement with their employee to get the benefits of a salary sacrifice. This salary sacrifice agreement is an agreement for an arrangement between an employer and an employee, whereby the employee agrees to forego. I have read the current product disclosure statement and understand that i’m eligible to contribute into my nominated super account. Talk to your employer first to make sure they’re happy to contribute to super from your pay. From 1 january 2020, you are required to pay super guarantee. Salary sacrifice for employer superannuation under this agreement an employee may choose. No salary sacrifice scheme can get off the ground without an agreement first in place. If so, simply complete this form and give it to your employer or follow the process your employer has. This top up is in addition to your. Easily fill out pdf blank, edit, and sign them. Salary sacrificing to super is when. Up to $40 cash back complete salary sacrifice agreement template online with us legal forms. You should consider your contributions caps and seek further. I have read the current product disclosure statement and understand that i’m eligible to contribute into my nominated super account. This salary sacrifice agreement is an agreement for an arrangement between an employer and an employee,. You should consider your contributions caps and seek further. Complete all parts of this form and provide it to your employer/payroll. I have read the current product disclosure statement and understand that i’m eligible to contribute into my nominated super account. Save or instantly send your. Have read the current product disclosure statement and understand that i’m eligible to contribute. Up to 40% cash back edit, sign, and share salary sacrifice super form template online. Up to $40 cash back complete salary sacrifice agreement template online with us legal forms. Could you save on tax and grow your super by salary sacrificing? From 1 january 2020, you are required to pay super guarantee. This salary sacrifice agreement is an agreement for an arrangement between an employer and an employee, whereby the employee agrees to forego part of their future entitlement to salary. Easily fill out pdf blank, edit, and sign them. This top up is in addition to your. For each employee, you’ll need to agree with them on the amount of. What would you like to do? You should consider your contributions caps and seek further. Save or instantly send your ready. Employers can set up a salary sacrifice for super arrangement with their employee to get the benefits of a salary sacrifice. Salary sacrifice for employer superannuation under this agreement an employee may choose to sacrifice salary for employer superannuation contributions into a complying superannuation. Learn how it works and use our calculator to see if it's right for you. Have read the current product disclosure statement and understand that i’m eligible to contribute to my mlc super account. Super salary sacrifice agreement employees may request to salary sacrifice a portion of their salary/wage before tax is deducted to their superannuation.Salary Sacrifice Agreement Template Edit Online & Download Example

Fillable Online Pension Salary Sacrifice Opt In Form Fax Email Print

STANDARD SALARY SACRIFICE AGREEMENT Club Super

Salary Sacrifice Form 7

Salary Sacrifice To Your Super Super Salary Sacrifice Agreement

Salary Sacrifice Super Form Template

Effective Salary Sacrifice Agreement Template Master Template

Super Salary Sacrifice Agreement Template

Salary Sacrifice Agreement Template Classles Democracy

How To Add Salary Sacrifices To STP Pay Runs Payroller

I Would Like To Make The Following Salary Sacrifice.

2.1 The Employee May Specify A Proportion Of The Salary That Is To Be Sacrificed In Advance (The “Sacrificed Amount”) Prior To Earning The Same During The Period Covered By This Salary.

Up To $40 Cash Back Complete Salary Sacrifice Agreement Template Online With Us Legal Forms.

To Be Able To Do This, There Are.

Related Post: