Tax Donation Letter Template

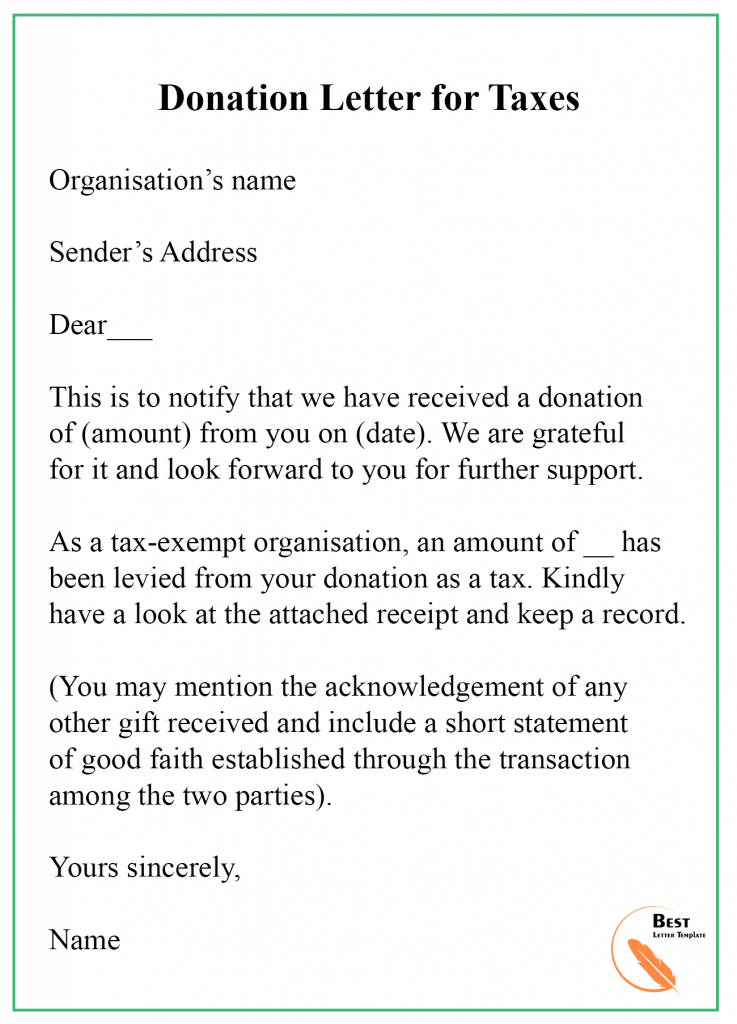

Tax Donation Letter Template - When putting together an engagement letter for tax services, following some best practices can make the process. Not only is it important to gain new donors for your cause, but it’s also key to keep the support of the donors you already. Using a (501)(c)(3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. When you make a charitable. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. This form provides details about the donated items,. This customizable document, available for download in ms word and google docs formats,. In order for a donor to take a tax deduction for a contribution of $250 or more, the donor must receive a contemporaneous written acknowledgement of the donation from the organization. This designation allows donors to claim charitable donation tax deductions, providing financial incentives for contributions. Crafting a professional donation receipt can make all the difference in maintaining. We will populate it automatically with all the necessary donation details and organization info. Best practices for creating an engagement letter for tax services. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization, such as a charity or foundation. Charitable organizations often provide donors with acknowledgment letters for tax deduction purposes, ensuring that contributions qualify under irs regulations. When you make a charitable. Crafting a professional donation receipt can make all the difference in maintaining. Contents of written acknowledgment required to substantiate deduction charitable contributions over $250. It allows you to create and customize the draft of your receipt contents. Not only is it important to gain new donors for your cause, but it’s also key to keep the support of the donors you already. We'll walk you through how to write a donation request letter and share. We will populate it automatically with all the necessary donation details and organization info. Best practices for creating an engagement letter for tax services. Using a (501)(c)(3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. Nonprofit organizations must send letters for charitable contributions of $250 or more per the irs website. As. Best practices for creating an engagement letter for tax services. This designation allows donors to claim charitable donation tax deductions, providing financial incentives for contributions. We will populate it automatically with all the necessary donation details and organization info. When you make a charitable. Nonprofit organizations must send letters for charitable contributions of $250 or more per the irs website. We will populate it automatically with all the necessary donation details and organization info. Crafting a professional donation receipt can make all the difference in maintaining. It allows you to create and customize the draft of your receipt contents. Donation receipts are quite simply the act of providing a donor with a receipt for their monetary contribution to an organization,. Contents of written acknowledgment required to substantiate deduction charitable contributions over $250. This designation allows donors to claim charitable donation tax deductions, providing financial incentives for contributions. Charity organizations, such as 501(c)(3) nonprofit entities in the united states, must provide donors with official donation receipts following irs guidelines to ensure tax. Nonprofit organizations must send letters for charitable contributions of. As nonprofits are faced with higher. When you make a charitable. The donation receipt can be sent via email or postal mail. This designation allows donors to claim charitable donation tax deductions, providing financial incentives for contributions. Donations to crs are tax deductible to the full extent allowable under the law. It allows you to create and customize the draft of your receipt contents. Contents of written acknowledgment required to substantiate deduction charitable contributions over $250. Not only is it important to gain new donors for your cause, but it’s also key to keep the support of the donors you already. Donation receipts are quite simply the act of providing a. Using a (501)(c)(3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. The donation receipt can be sent via email or postal mail. Best practices for creating an engagement letter for tax services. Charitable organizations often provide donors with acknowledgment letters for tax deduction purposes, ensuring that contributions qualify under irs regulations. In. We will populate it automatically with all the necessary donation details and organization info. When putting together an engagement letter for tax services, following some best practices can make the process. When you make a charitable. This customizable document, available for download in ms word and google docs formats,. Nonprofit organizations must send letters for charitable contributions of $250 or. As nonprofits are faced with higher. When putting together an engagement letter for tax services, following some best practices can make the process. Charitable organizations often provide donors with acknowledgment letters for tax deduction purposes, ensuring that contributions qualify under irs regulations. Donations to crs are tax deductible to the full extent allowable under the law. We'll walk you through. In order for a donor to take a tax deduction for a contribution of $250 or more, the donor must receive a contemporaneous written acknowledgement of the donation from the organization. Nonprofit organizations must send letters for charitable contributions of $250 or more per the irs website. The donation receipt can be sent via email or postal mail. It allows. We will populate it automatically with all the necessary donation details and organization info. When you make a charitable. Donations to crs are tax deductible to the full extent allowable under the law. Using a (501)(c)(3) donation receipt template helps the donor captures all the relevant information for the donor’s tax returns. This customizable document, available for download in ms word and google docs formats,. Contents of written acknowledgment required to substantiate deduction charitable contributions over $250. It allows you to create and customize the draft of your receipt contents. In order for a donor to take a tax deduction for a contribution of $250 or more, the donor must receive a contemporaneous written acknowledgement of the donation from the organization. The donation receipt can be sent via email or postal mail. Crafting a professional donation receipt can make all the difference in maintaining. This form provides details about the donated items,. Tips to write the perfect appeal letter and keep them donating. When putting together an engagement letter for tax services, following some best practices can make the process. This designation allows donors to claim charitable donation tax deductions, providing financial incentives for contributions. Charity organizations, such as 501(c)(3) nonprofit entities in the united states, must provide donors with official donation receipts following irs guidelines to ensure tax. Charitable organizations often provide donors with acknowledgment letters for tax deduction purposes, ensuring that contributions qualify under irs regulations.Donation Letter for Taxes Sample and Examples [Word]

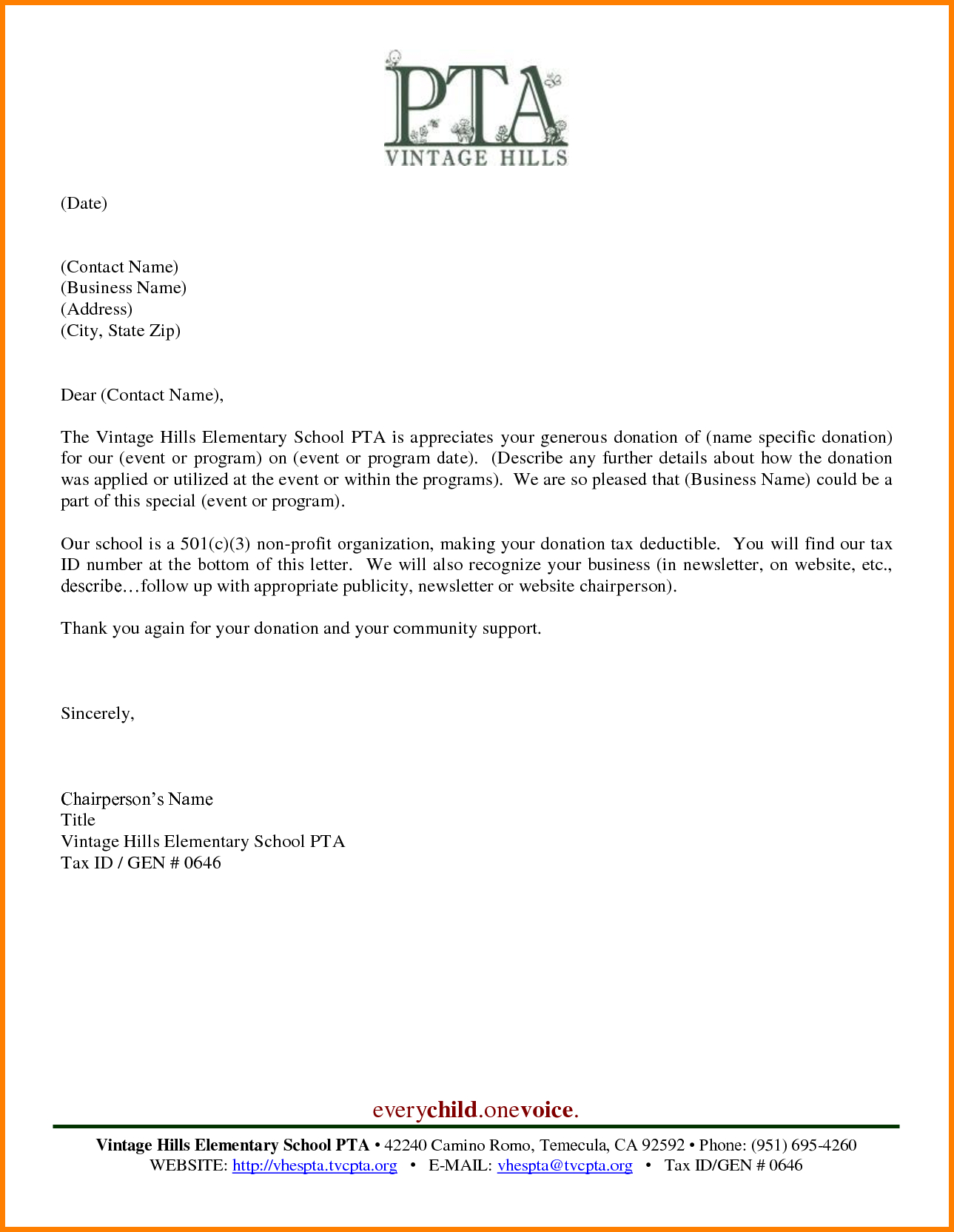

501c3 Tax Deductible Donation Letter Sample with Examples

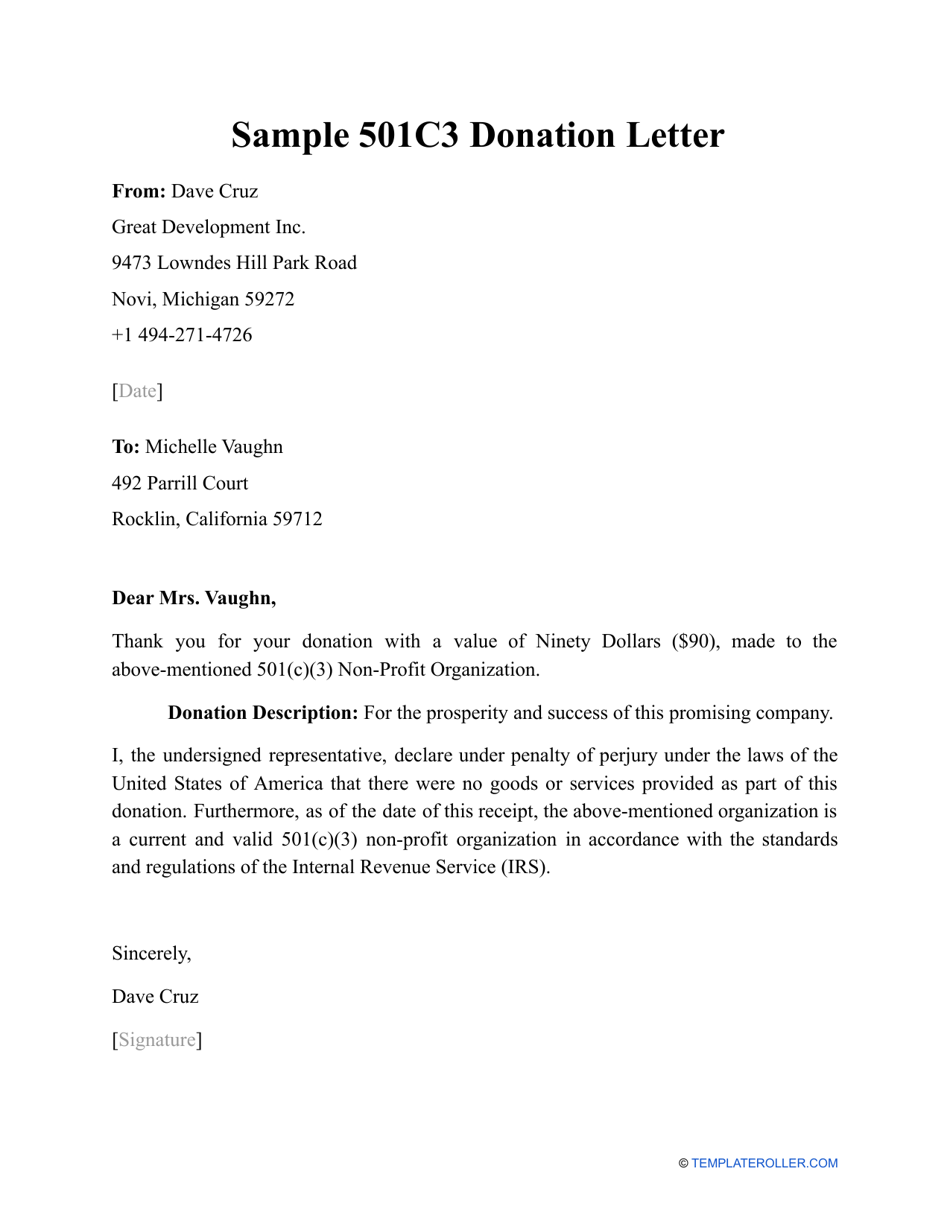

Sample 501c3 Donation Letter Fill Out, Sign Online and Download PDF

FREE 7+ Sample Donation Receipt Letter Templates in PDF MS Word

Donation Letter for Taxes Sample and Examples [Word]

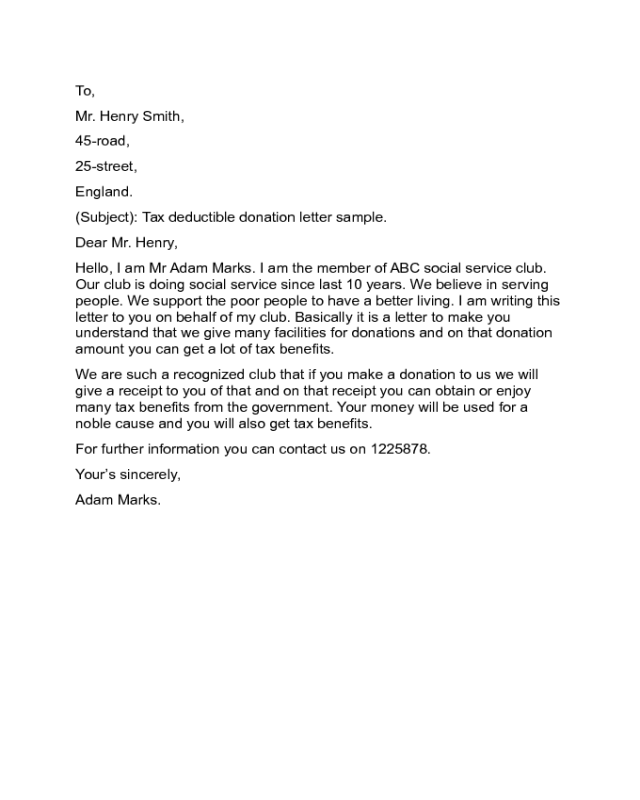

13+ Free Donation Letter Template Format, Sample & Example

Sample Acknowledgement Receipt For Donation

Tax Deductible Donation Thank You Letter Template Examples Letter

2025 Donation Letter Templates Fillable, Printable PDF & Forms Handypdf

FREE 40+ Donation Letter Templates in PDF MS Word Pages Google

Best Practices For Creating An Engagement Letter For Tax Services.

We'll Walk You Through How To Write A Donation Request Letter And Share.

Nonprofit Organizations Must Send Letters For Charitable Contributions Of $250 Or More Per The Irs Website.

Not Only Is It Important To Gain New Donors For Your Cause, But It’s Also Key To Keep The Support Of The Donors You Already.

Related Post:

![Donation Letter for Taxes Sample and Examples [Word]](https://i0.wp.com/templatediy.com/wp-content/uploads/2022/10/donation-letter-for-tax-purpose-pdf.jpg?fit=1414%2C1999&ssl=1)

![Donation Letter for Taxes Sample and Examples [Word]](https://i0.wp.com/templatediy.com/wp-content/uploads/2022/10/Donation-Letter-for-Taxes.jpg?fit=1414%2C2000&ssl=1)