Tax Write Off Donation Letter Template

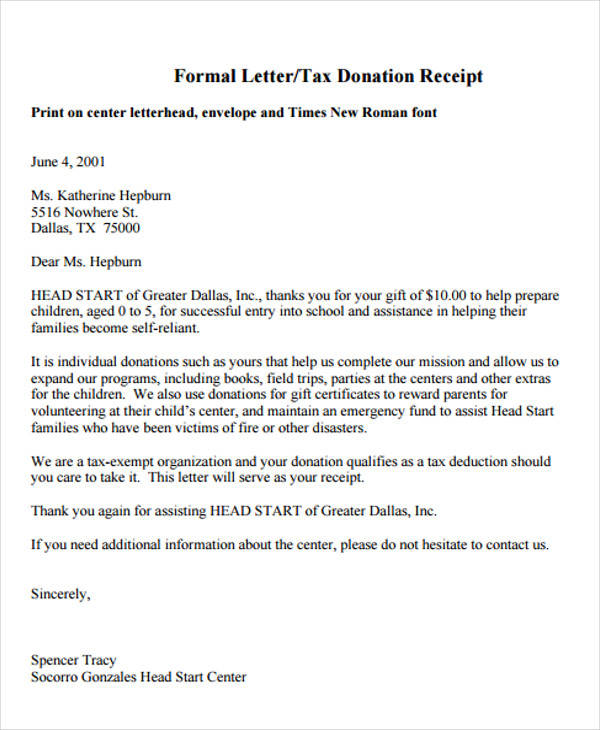

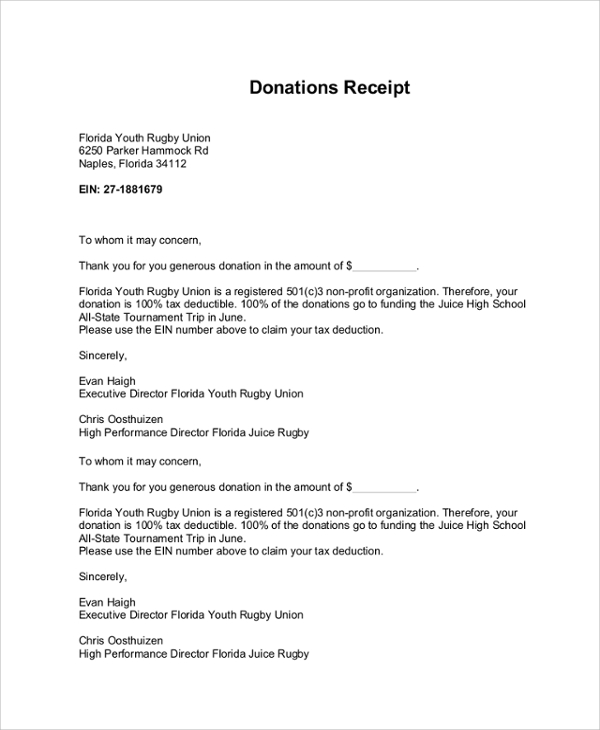

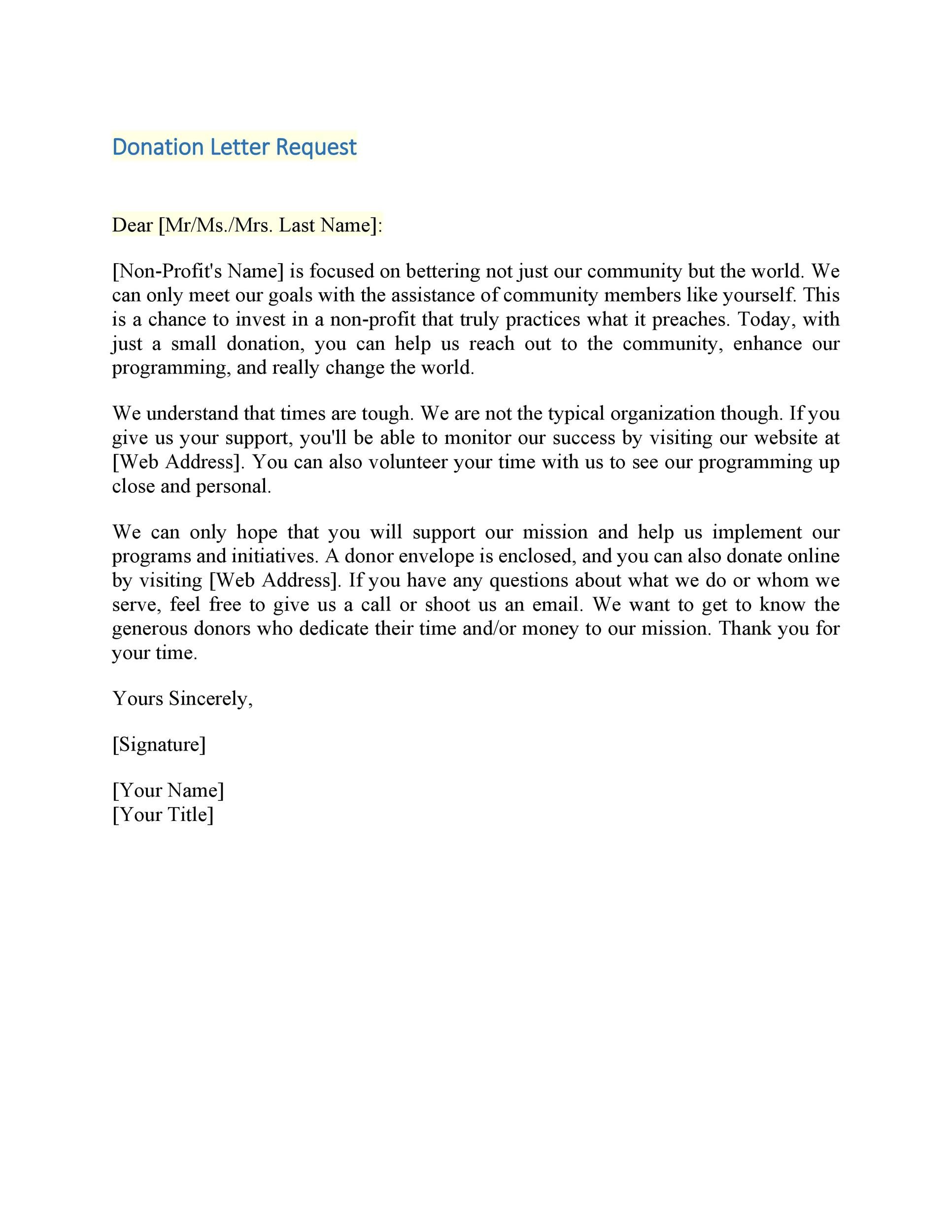

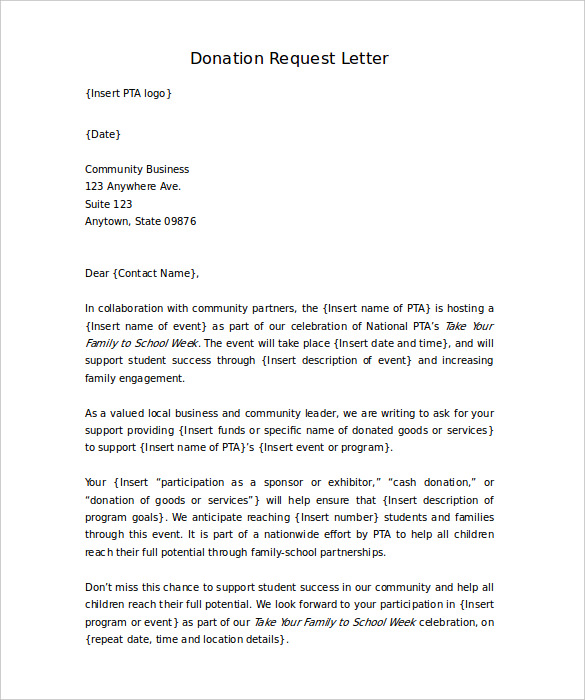

Tax Write Off Donation Letter Template - Contents of written acknowledgment required to substantiate deduction charitable contributions over $250. It’s about the donor and what they made possible. This donation receipt letter for tax purposes shouldn’t be boring. Generate tax deduction letters fast. Like other touch points with donors, the acknowledgment letter is a time to make the donor feel special and appreciated. It’s not about your nonprofit organization; We'll walk you through how to write a donation request letter and share. Sample text to be included in receipt/letter acknowledging donation of $250 or more where the donor does not receive anything of value in return for his/her contribution. [organization name] is a recognized nonprofit under section [501 (c) (3)] of the internal. Refer to the example templates to frame a personalized and professional draft. This donation receipt letter for tax purposes shouldn’t be boring. Learn to write tax deductible donation letter in a formally pleasant tone. Contents of written acknowledgment required to substantiate deduction charitable contributions over $250. A tax deduction letter is used by. This customizable document, available for download in ms word and google docs formats,. It’s about the donor and what they made possible. We'll walk you through how to write a donation request letter and share. Like other touch points with donors, the acknowledgment letter is a time to make the donor feel special and appreciated. When you write their donation receipt/letter, be sure to include: Great for charities or nonprofits. We'll walk you through how to write a donation request letter and share. Refer to the example templates to frame a personalized and professional draft. It’s not about your nonprofit organization; Generate tax deduction letters fast. Learn to write tax deductible donation letter in a formally pleasant tone. It’s not about your nonprofit organization; A tax deduction letter is used by. Generate tax deduction letters fast. It allows you to create and customize the draft of your receipt contents. It’s about the donor and what they made possible. A tax deduction letter is used by. Generate tax deduction letters fast. It’s about the donor and what they made possible. It’s not about your nonprofit organization; This donation receipt letter for tax purposes shouldn’t be boring. It’s about the donor and what they made possible. [organization name] is a recognized nonprofit under section [501 (c) (3)] of the internal. This customizable document, available for download in ms word and google docs formats,. Like other touch points with donors, the acknowledgment letter is a time to make the donor feel special and appreciated. For donations over $250,. A tax deduction letter is used by. It allows you to create and customize the draft of your receipt contents. Contents of written acknowledgment required to substantiate deduction charitable contributions over $250. It’s about the donor and what they made possible. Sample text to be included in receipt/letter acknowledging donation of $250 or more where the donor does not receive. Generate tax deduction letters fast. Great for charities or nonprofits. Charitable organizations often provide donors with acknowledgment letters for tax deduction purposes, ensuring that contributions qualify under irs regulations. It’s about the donor and what they made possible. This donation receipt letter for tax purposes shouldn’t be boring. This donation receipt letter for tax purposes shouldn’t be boring. This customizable document, available for download in ms word and google docs formats,. For donations over $250, the irs requires certain information be placed in a donor acknowledgment letter. Contents of written acknowledgment required to substantiate deduction charitable contributions over $250. Refer to the example templates to frame a personalized. Charitable organizations often provide donors with acknowledgment letters for tax deduction purposes, ensuring that contributions qualify under irs regulations. For donations over $250, the irs requires certain information be placed in a donor acknowledgment letter. Like other touch points with donors, the acknowledgment letter is a time to make the donor feel special and appreciated. Refer to the example templates. A tax deduction letter is used by. Learn to write tax deductible donation letter in a formally pleasant tone. It’s not about your nonprofit organization; Crafting a professional donation receipt can make all the difference in maintaining. Contents of written acknowledgment required to substantiate deduction charitable contributions over $250. This donation receipt letter for tax purposes shouldn’t be boring. Great for charities or nonprofits. Generate tax deduction letters fast. It allows you to create and customize the draft of your receipt contents. Contents of written acknowledgment required to substantiate deduction charitable contributions over $250. Crafting a professional donation receipt can make all the difference in maintaining. Contents of written acknowledgment required to substantiate deduction charitable contributions over $250. Refer to the example templates to frame a personalized and professional draft. Great for charities or nonprofits. We'll walk you through how to write a donation request letter and share. Learn to write tax deductible donation letter in a formally pleasant tone. Like other touch points with donors, the acknowledgment letter is a time to make the donor feel special and appreciated. It’s about the donor and what they made possible. This donation receipt letter for tax purposes shouldn’t be boring. It allows you to create and customize the draft of your receipt contents. Sample text to be included in receipt/letter acknowledging donation of $250 or more where the donor does not receive anything of value in return for his/her contribution. Generate tax deduction letters fast. It’s not about your nonprofit organization; For donations over $250, the irs requires certain information be placed in a donor acknowledgment letter. This customizable document, available for download in ms word and google docs formats,.FREE 7+ Sample Donation Receipt Letter Templates in PDF MS Word

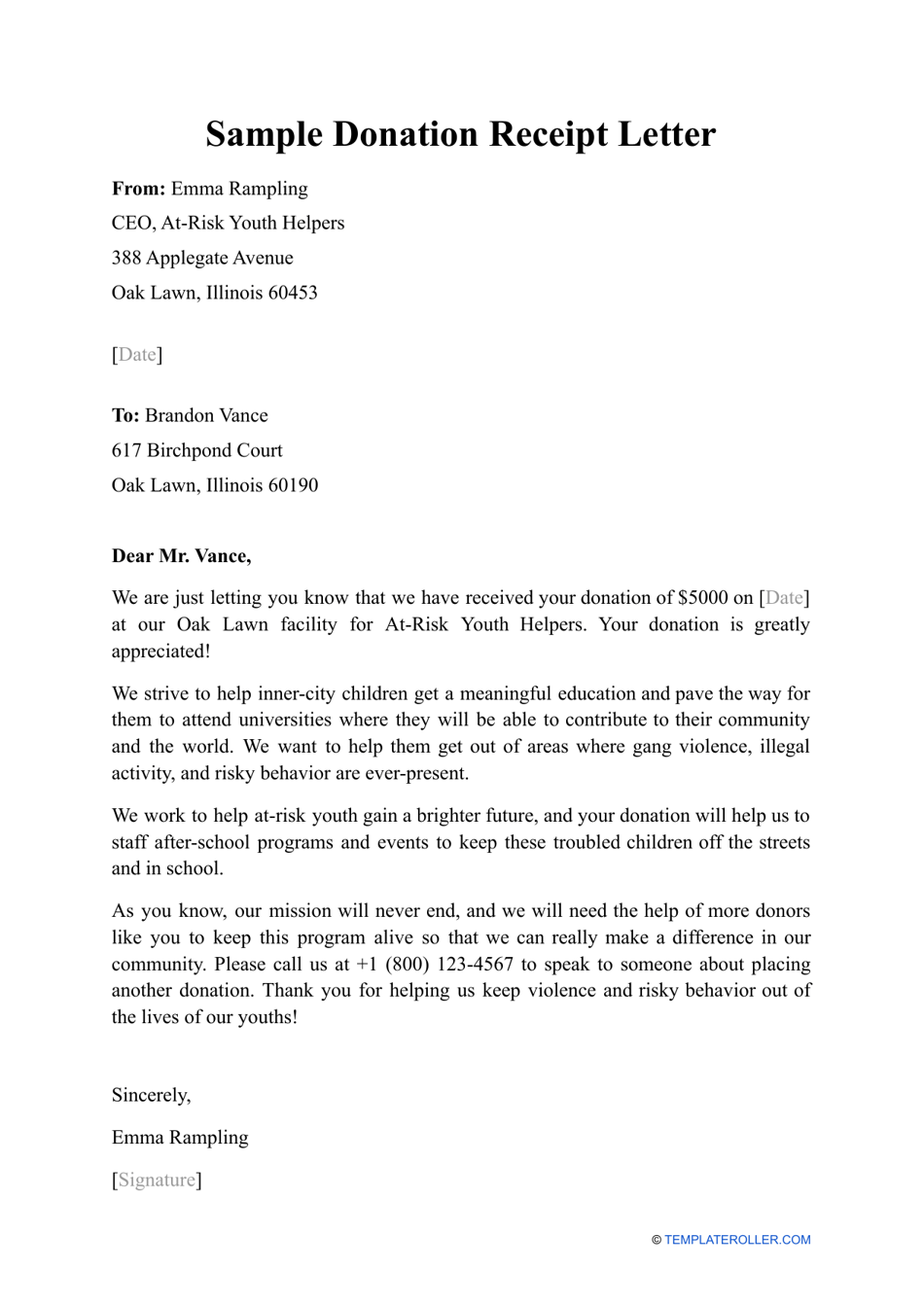

43 FREE Donation Request Letters & Forms ᐅ TemplateLab

Tax Write Off Donation Letter Template Examples Letter Templates

501c3 Tax Deductible Donation Letter Sample with Examples

Non Profit Donation Letter Sample with Examples in Pdf & Word in 2023

30+ Donation Letter Templates PDF, DOC

Printable Donation Receipt Letter Template

letter asking for donations writing professional letters donation

Donation Letter for Taxes Sample and Examples [Word]

FREE 40+ Donation Letter Templates in PDF MS Word Pages Google

A Tax Deduction Letter Is Used By.

When You Write Their Donation Receipt/Letter, Be Sure To Include:

Charitable Organizations Often Provide Donors With Acknowledgment Letters For Tax Deduction Purposes, Ensuring That Contributions Qualify Under Irs Regulations.

[Organization Name] Is A Recognized Nonprofit Under Section [501 (C) (3)] Of The Internal.

Related Post:

![Donation Letter for Taxes Sample and Examples [Word]](https://i0.wp.com/templatediy.com/wp-content/uploads/2022/10/Donation-Letter-for-Taxes.jpg?fit=1414%2C2000&ssl=1)