Template Sample Answer To Summons For Credit Card Debt

Template Sample Answer To Summons For Credit Card Debt - Solosuit can help you draft and file your answer and settle your debt before going to court. Respond to a credit card debt summons by drafting a concise answer, denying claims, and listing defenses. 3) what state is the. If you have ever been served a summons, it can be a very unsettling experience. Written answer consumer credit transaction. Learn how to prepare an 'answer' document as a response to a summons for credit card debt and deny allegations where applicable. I deny the allegations in the complaint. Your answer is your chance. And if you've received a summons for. _____ i did not receive a copy of the summons and complaint. File it with the court and attorney by the deadline. When drafting your answer to a summons for a credit card, it's important to cover essential components: Here's a sample answer to a summons for a credit card debt lawsuit. Up to $50 cash back use the provided summons answer template or create your own document with the required sections, including a caption, background information, and your. 1) what is the name of the creditor suing you? Take control and learn how to file an answer by reading this guide. A credit card company or bill collector can start a lawsuit with a summons and a complaint. Up to $9 cash back to best help you, i need to know the following: You do not need an attorney to answer a debt collection lawsuit successfully. When you've been sued over a credit card debt, the plaintiff usually hopes that you'll ignore the lawsuit. Keep reading to get the sample answer to a summons for credit card debt. When drafting your answer to a summons for a credit card, it's important to cover essential components: 2) what is the amount you are being sued for? You do not need an attorney to answer a debt collection lawsuit successfully. A lawsuit summons for credit card. Now on to examples of how you can answer this summons and complaint. Take control and learn how to file an answer by reading this guide. What is a summons for credit card debt? Solosuit can help you draft and file your answer and settle your debt before going to court. 2) what is the amount you are being sued. The plaintiff is the assignee of _____________ bank. Your answer is your chance. Take control and learn how to file an answer by reading this guide. Up to $9 cash back to best help you, i need to know the following: Up to $40 cash back in this article, we will delve into the details of what an answer to. 2) what is the amount you are being sued for? Respond to a credit card debt summons by drafting a concise answer, denying claims, and listing defenses. A credit card company or bill collector can start a lawsuit with a summons and a complaint. 3) what state is the. There should be numbers such as: It tells you that you have the opportunity to appear in court, provides information. When you receive a court summons for credit card debt, it's important to respond promptly. Up to $40 cash back basic elements of a sample answer: Written answer consumer credit transaction. A lawsuit summons for credit card debt notifies you that you're being sued for an. Learn how to prepare an 'answer' document as a response to a summons for credit card debt and deny allegations where applicable. Up to $40 cash back in this article, we will delve into the details of what an answer to summons template with credit card debt entails, its key components, and different types. I deny the allegations in the. 1) what is the name of the creditor suing you? When you receive a court summons for credit card debt, it's important to respond promptly. Now on to examples of how you can answer this summons and complaint. A credit card company or bill collector can start a lawsuit with a summons and a complaint. Take control and learn how. There should be numbers such as: And if you've received a summons for. Your answer is your chance. When you receive a court summons for credit card debt, it's important to respond promptly. 1) what is the name of the creditor suing you? Take control and learn how to file an answer by reading this guide. Learn how to prepare an 'answer' document as a response to a summons for credit card debt and deny allegations where applicable. When you've been sued over a credit card debt, the plaintiff usually hopes that you'll ignore the lawsuit. A credit card company or bill collector. I deny the allegations in the complaint. The summons tells you that you’re being sued, and the complaint (sometimes called a “petition”) tells you why. Your answer is your chance. Up to $40 cash back in this article, we will delve into the details of what an answer to summons template with credit card debt entails, its key components, and. The plaintiff is the assignee of _____________ bank. Up to $9 cash back to best help you, i need to know the following: Here's a sample answer to a summons for a credit card debt lawsuit. Sample answer to summons for credit card debt. Take control and learn how to file an answer by reading this guide. What is a summons for credit card debt? Up to $40 cash back in this article, we will delve into the details of what an answer to summons template with credit card debt entails, its key components, and different types. Written answer consumer credit transaction. It tells you that you have the opportunity to appear in court, provides information. There should be numbers such as: When you receive a court summons for credit card debt, it's important to respond promptly. Your answer is your chance. Up to $50 cash back use the provided summons answer template or create your own document with the required sections, including a caption, background information, and your. Respond to a credit card debt summons by drafting a concise answer, denying claims, and listing defenses. _____ i did not receive a copy of the summons and complaint. Dealing with debt is never an easy experience.Sample Response Letter To The Court For A Debt Summons

Credit card summons

Free Response Letter to Summons Template Edit Online & Download

Sample Answer To Debt Summons

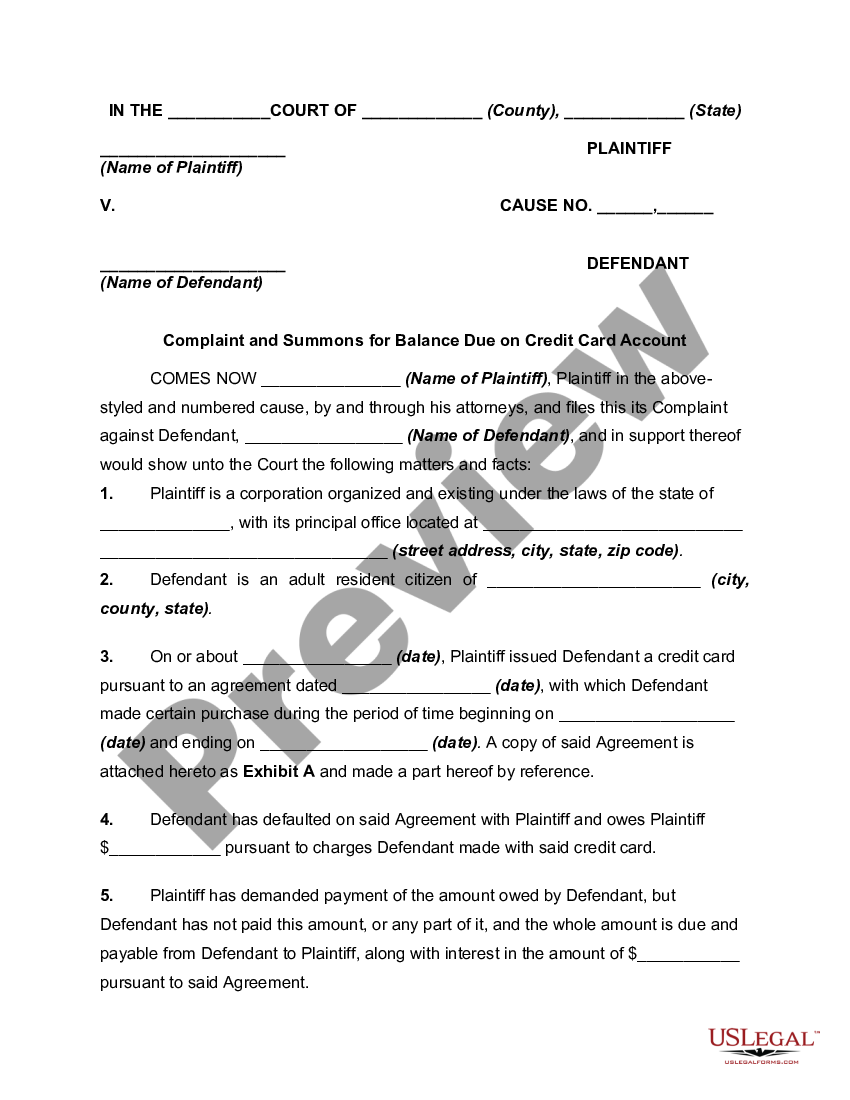

Complaint and Summons for Balance Due on Credit Card Account Summons

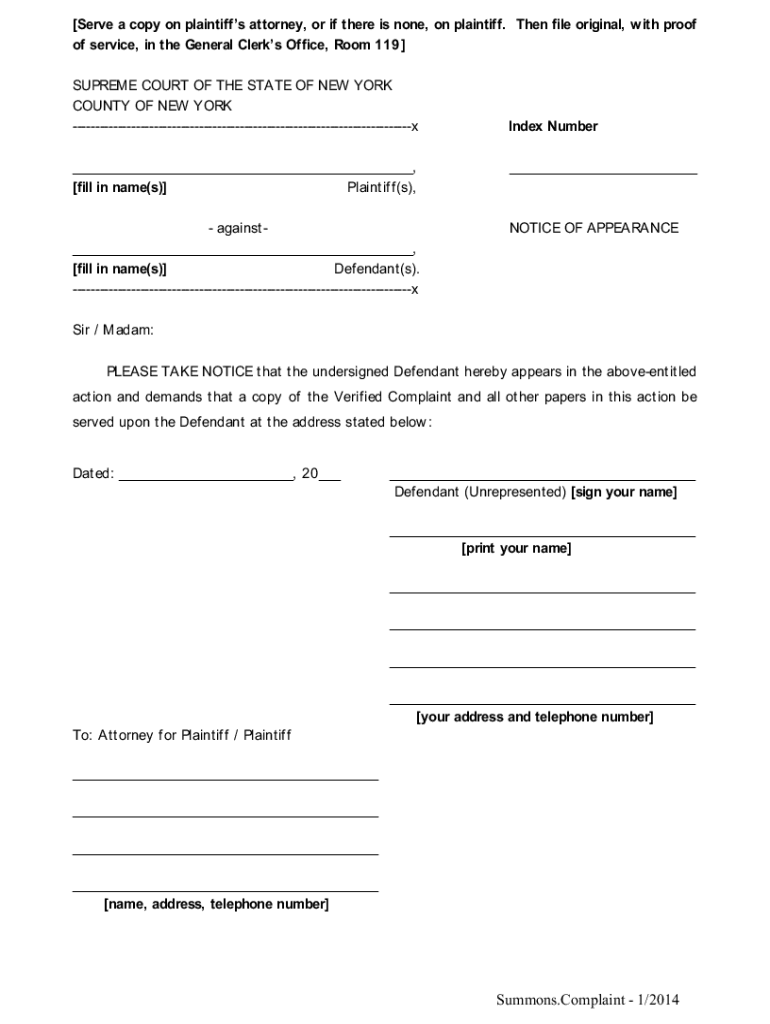

Example Of A Written Answer To A Summons Fill Online, Printable

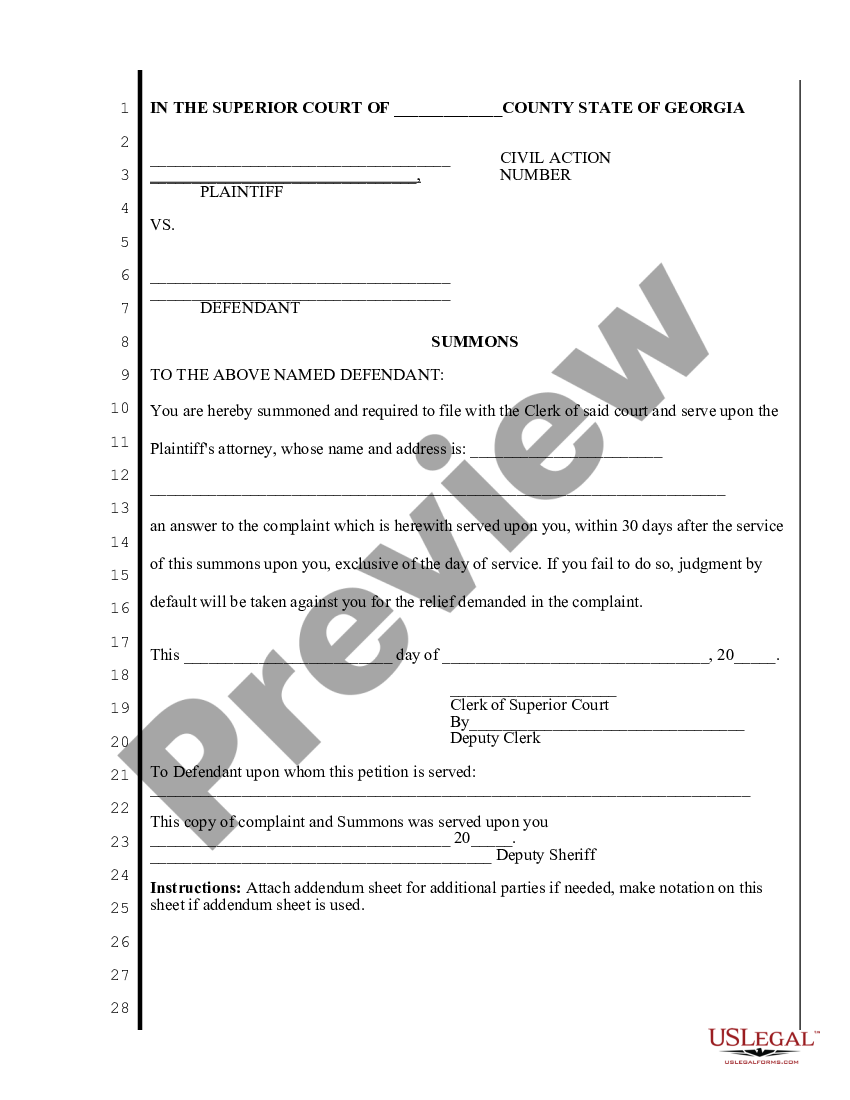

Response To Civil Action Summons For Credit Card Debt US Legal Forms

Template Sample Answer To Summons For Credit Card Debt

Summons answer template Fill out & sign online DocHub

Template Sample Answer To Summons For Credit Card Debt

The Summons Tells You That You’re Being Sued, And The Complaint (Sometimes Called A “Petition”) Tells You Why.

When Drafting Your Answer To A Summons For A Credit Card, It's Important To Cover Essential Components:

Solosuit Can Help You Draft And File Your Answer And Settle Your Debt Before Going To Court.

Now On To Examples Of How You Can Answer This Summons And Complaint.

Related Post: