Time And Effort Reporting Federal Grants Template

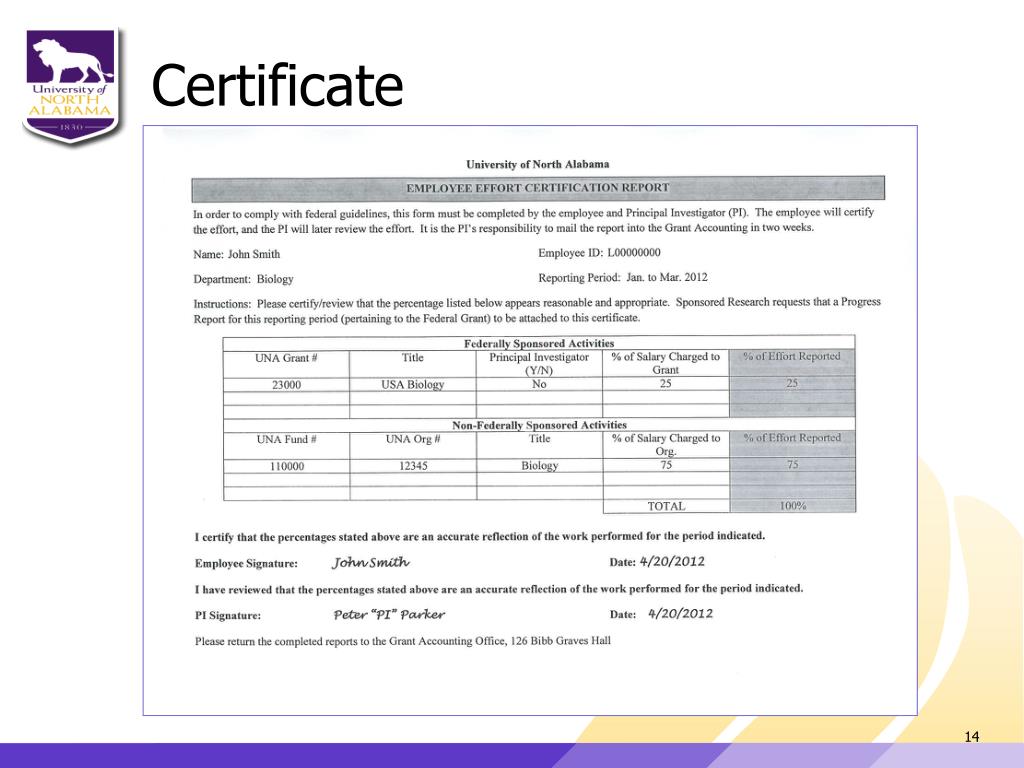

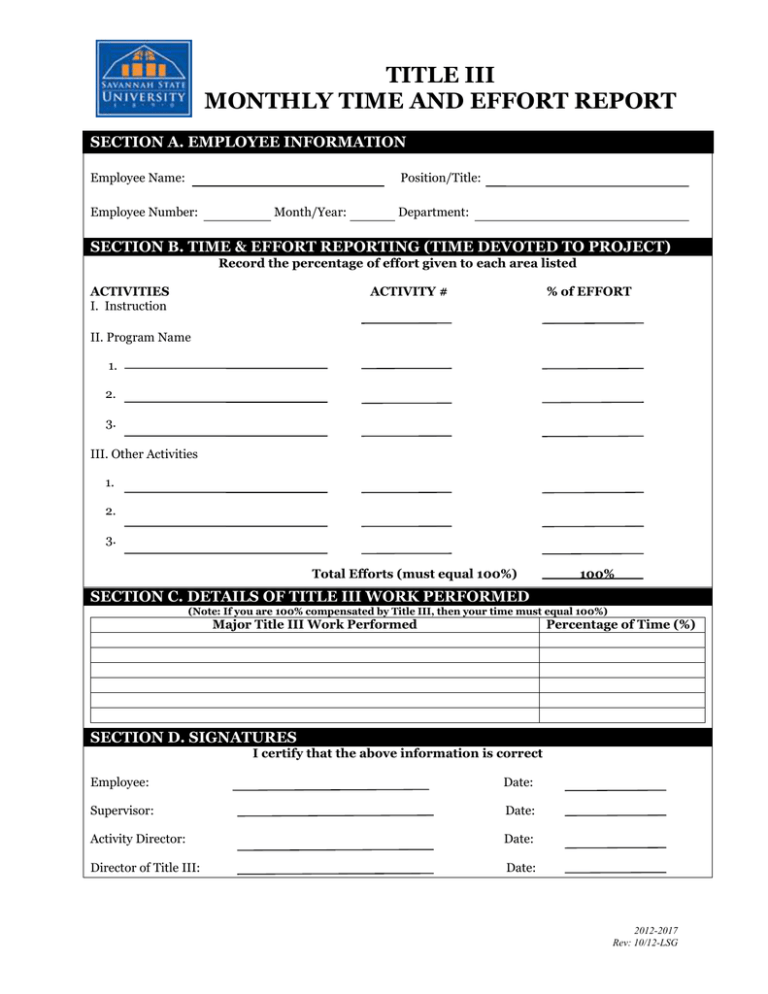

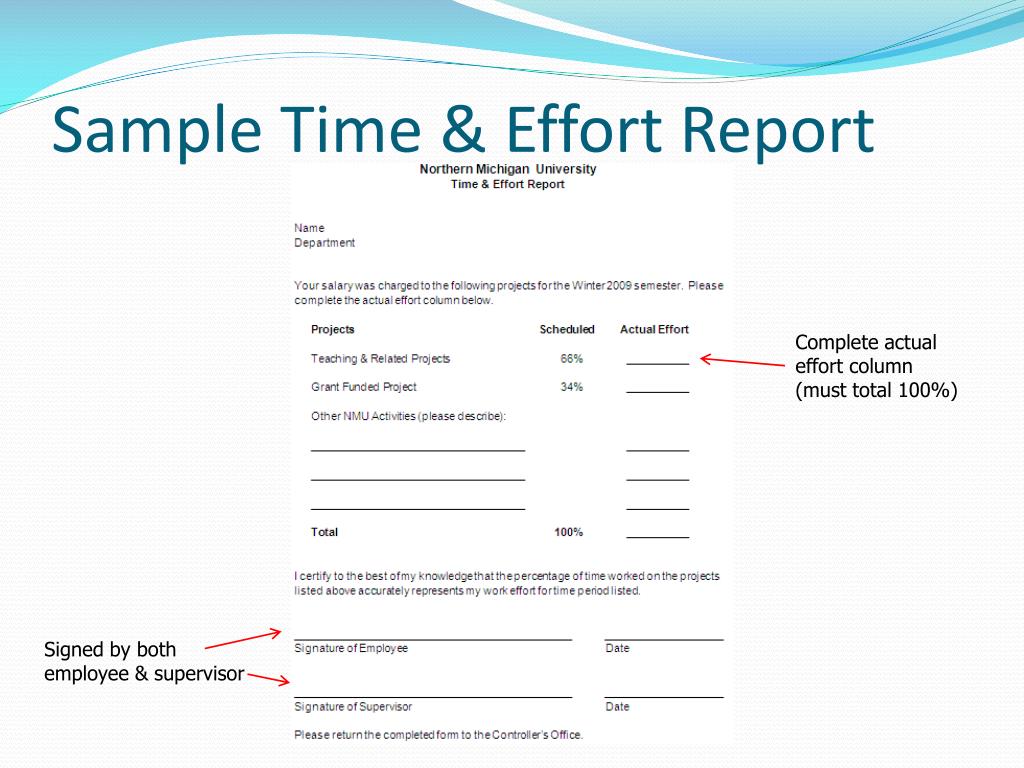

Time And Effort Reporting Federal Grants Template - Time and effort records verify that salaries and wages. Part with federal grant funds to document his/her time spent working on federal programs in order to ensure that charges to each federal program reflect an accurate account of the. Up to $50 cash back under federal requirements, all employees charged to federal grants must maintain time and effort reporting. This limit includes salary compensation. This fact sheet focuses on ways. In order to be in compliance with federal grant regulations regarding effort expended on federal grants, this form must be completed and filed in the tvr program office within 30 days of the. This template must be saved. As recipients of federal funds, nifa grantees must follow uniform guidance (ug) standards related to personnel service compensation (2 cfr 200.430). Report by specific federal grant. Time and effort reports must be a single, certified document that reflect 100% of an employee’s time worked in a given period. Accurate time allocation is a cornerstone for nonprofit organizations, especially those with grant funding. The way you upload your completed information will depend on whether you are submitting your proposal via research.gov or grants.gov. Time and effort records verify that salaries and wages. • any employee funded by federal grants must maintain documentation showing that their time is allocable to a federal program. Time and effort reporting is a federally mandated process that confirms that the salaries and benefits charged to, or pledged as a cost share to, grant funded projects are reasonable and. Time and effort reports must be a single, certified document that reflect 100% of an employee’s time worked in a given period. As recipients of federal funds, nifa grantees must follow uniform guidance (ug) standards related to personnel service compensation (2 cfr 200.430). It is the organization’s responsibility to define and consistently apply the term “year”, and to specify this definition in the budget justification. The purpose of this guidance is to assist subgrantees to understand what documentation they are required to maintain for time distribution records (“time & effort”). Federal employment practices, including federal employee performance reviews, shall reward individual initiative, skills, performance, and hard work and shall not under any. This template must be saved. This fact sheet focuses on ways. The purpose of this guidance is to assist subgrantees to understand what documentation they are required to maintain for time distribution records (“time & effort”). Also known as time distribution record. Time & effort reporting for federal grants sdccd grants & contracts the uniform guidance states that allowable personnel. The way you upload your completed information will depend on whether you are submitting your proposal via research.gov or grants.gov. In order to be in compliance with federal grant regulations regarding effort expended on federal grants, this form must be completed and filed in the tvr program office within 30 days of the. This limit includes salary compensation. Time and. Time and effort reporting is a federally mandated process that confirms that the salaries and benefits charged to, or pledged as a cost share to, grant funded projects are reasonable and. Time and effort reports must be a single, certified document that reflect 100% of an employee’s time worked in a given period. This fact sheet focuses on ways. This. This template must be saved. The way you upload your completed information will depend on whether you are submitting your proposal via research.gov or grants.gov. Time and effort reporting is required to document that: Time and effort records verify that salaries and wages. Federal employment practices, including federal employee performance reviews, shall reward individual initiative, skills, performance, and hard work. Part with federal grant funds to document his/her time spent working on federal programs in order to ensure that charges to each federal program reflect an accurate account of the. Federal employment practices, including federal employee performance reviews, shall reward individual initiative, skills, performance, and hard work and shall not under any. Time and effort reporting is a process where. Time and effort reports must be a single, certified document that reflect 100% of an employee’s time worked in a given period. Time and effort reporting is a federally mandated process that confirms that the salaries and benefits charged to, or pledged as a cost share to, grant funded projects are reasonable and. • documentation must be based on records. Also known as time distribution record. Dear faculty and staff, as news outlets and other sources report information about changing federal and state policies, we want to be sure you know that leaders from across. Federal employment practices, including federal employee performance reviews, shall reward individual initiative, skills, performance, and hard work and shall not under any. Up to $50. This template must be saved. • any employee funded by federal grants must maintain documentation showing that their time is allocable to a federal program. The way you upload your completed information will depend on whether you are submitting your proposal via research.gov or grants.gov. Time & effort reporting for federal grants sdccd grants & contracts the uniform guidance states. Policy template time & effort reporting purpose per omb uniform guidance 2 cfr 200.430 (i), staff paid with a portion of federal funding must maintain records that accurately reflect the. Federal employment practices, including federal employee performance reviews, shall reward individual initiative, skills, performance, and hard work and shall not under any. Also known as time distribution record. As recipients. This fact sheet focuses on ways. Time and effort reporting is a federally mandated process that confirms that the salaries and benefits charged to, or pledged as a cost share to, grant funded projects are reasonable and. Federal employment practices, including federal employee performance reviews, shall reward individual initiative, skills, performance, and hard work and shall not under any. In. Policy template time & effort reporting purpose per omb uniform guidance 2 cfr 200.430 (i), staff paid with a portion of federal funding must maintain records that accurately reflect the. Accurate time allocation is a cornerstone for nonprofit organizations, especially those with grant funding. Time & effort reporting for federal grants sdccd grants & contracts the uniform guidance states that allowable personnel costs charged to federal programs may include reasonable. This template must be saved. The way you upload your completed information will depend on whether you are submitting your proposal via research.gov or grants.gov. Time and effort reporting is a process where employees working on federally funded projects document the time they dedicate to those activities. This fact sheet focuses on ways. The purpose of this guidance is to assist subgrantees to understand what documentation they are required to maintain for time distribution records (“time & effort”). Up to $50 cash back under federal requirements, all employees charged to federal grants must maintain time and effort reporting. Part with federal grant funds to document his/her time spent working on federal programs in order to ensure that charges to each federal program reflect an accurate account of the. Sometimes employees mistakenly think that it doesn’t matter which grant they charge their time to, since “it’s all federal money!” • federal funds were charged only for time actually worked • personnel costs are for allowable activities It is the organization’s responsibility to define and consistently apply the term “year”, and to specify this definition in the budget justification. Time and effort reports must be a single, certified document that reflect 100% of an employee’s time worked in a given period. • documentation must be based on records that accurately. Here are some of the reasons why streamlined payroll and time allocation.PPT Time and Effort Reporting for Federal Grants PowerPoint

Time And Effort Reporting Templates

Fillable Online Sample Time and Effort Reporting Form Fax Email Print

Time And Effort Reporting Templates Fill Online, Printable, Fillable

Time And Effort Reporting Federal Grants Template

PPT Time and Effort Reporting for Federal Grants PowerPoint

Federal Grant Time and Effort Reporting . Doc Template pdfFiller

Time And Effort Reporting Templates

Time And Effort Reporting Templates

Time And Effort Reporting Templates

This Limit Includes Salary Compensation.

Federal Employment Practices, Including Federal Employee Performance Reviews, Shall Reward Individual Initiative, Skills, Performance, And Hard Work And Shall Not Under Any.

Report By Specific Federal Grant.

• Any Employee Funded By Federal Grants Must Maintain Documentation Showing That Their Time Is Allocable To A Federal Program.

Related Post: