Triple Net Lease Template

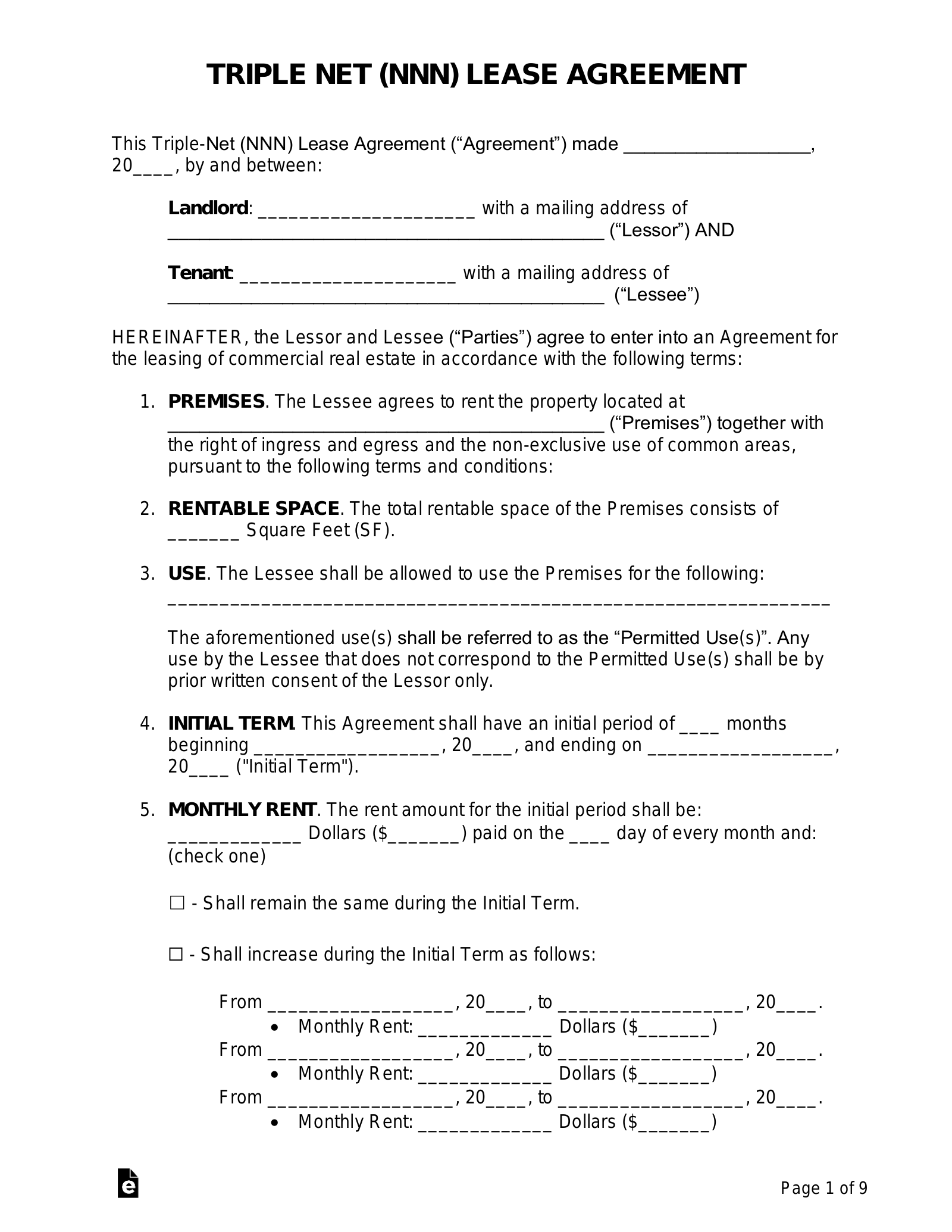

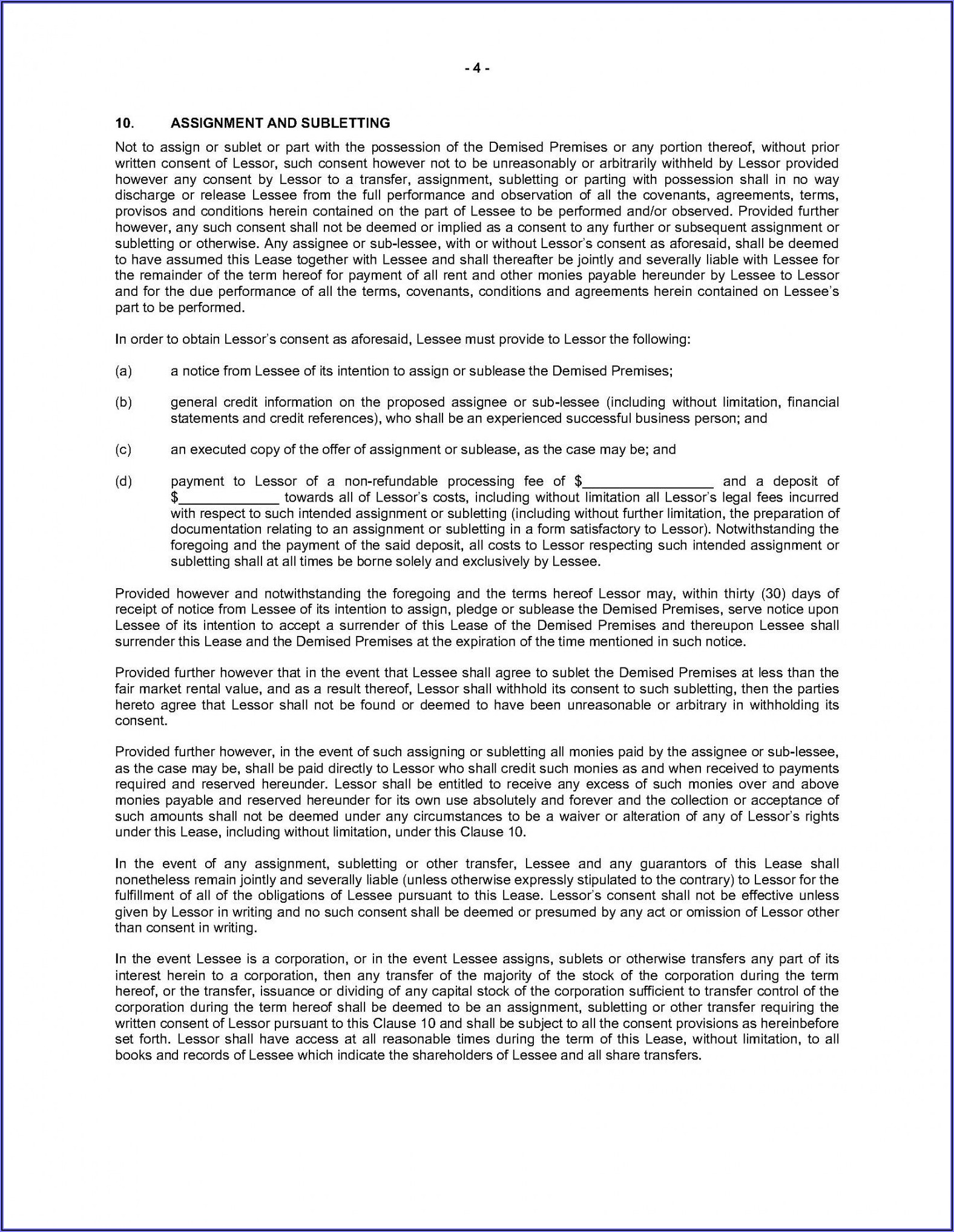

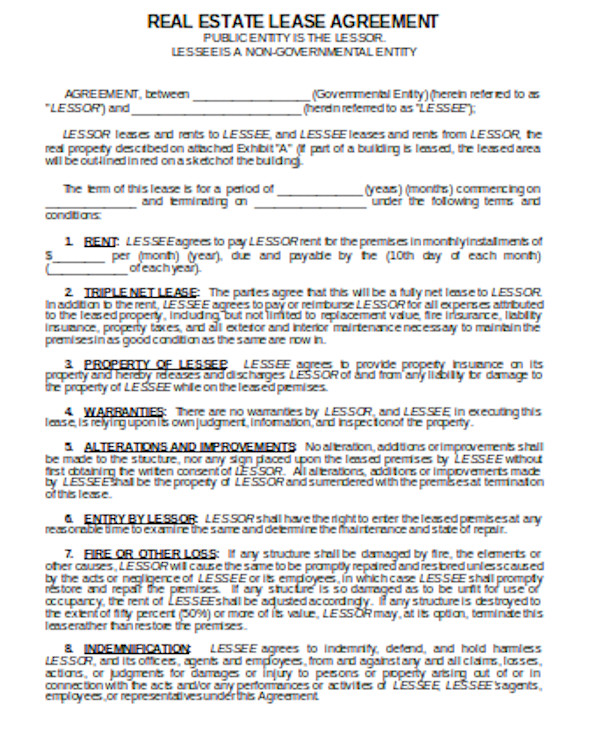

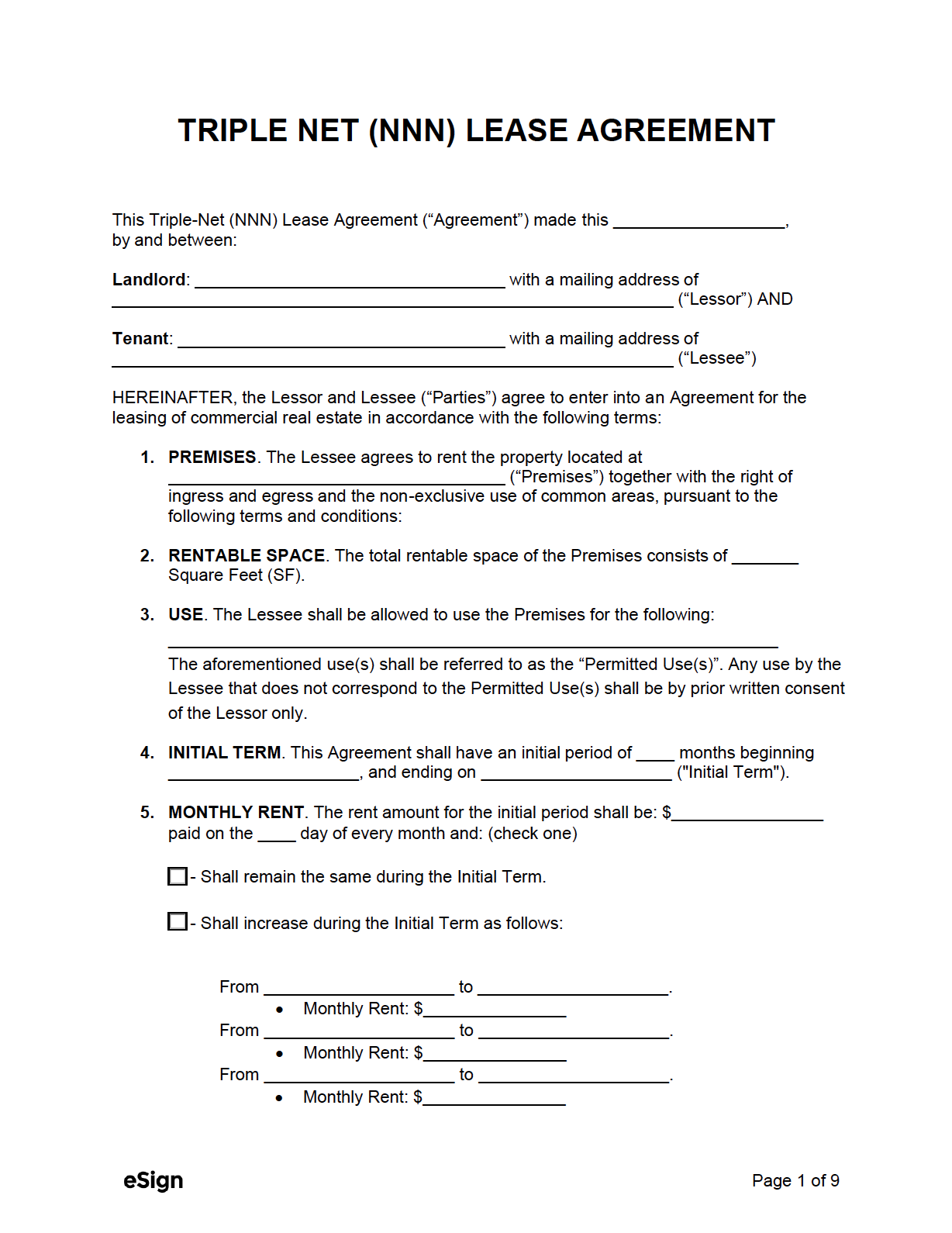

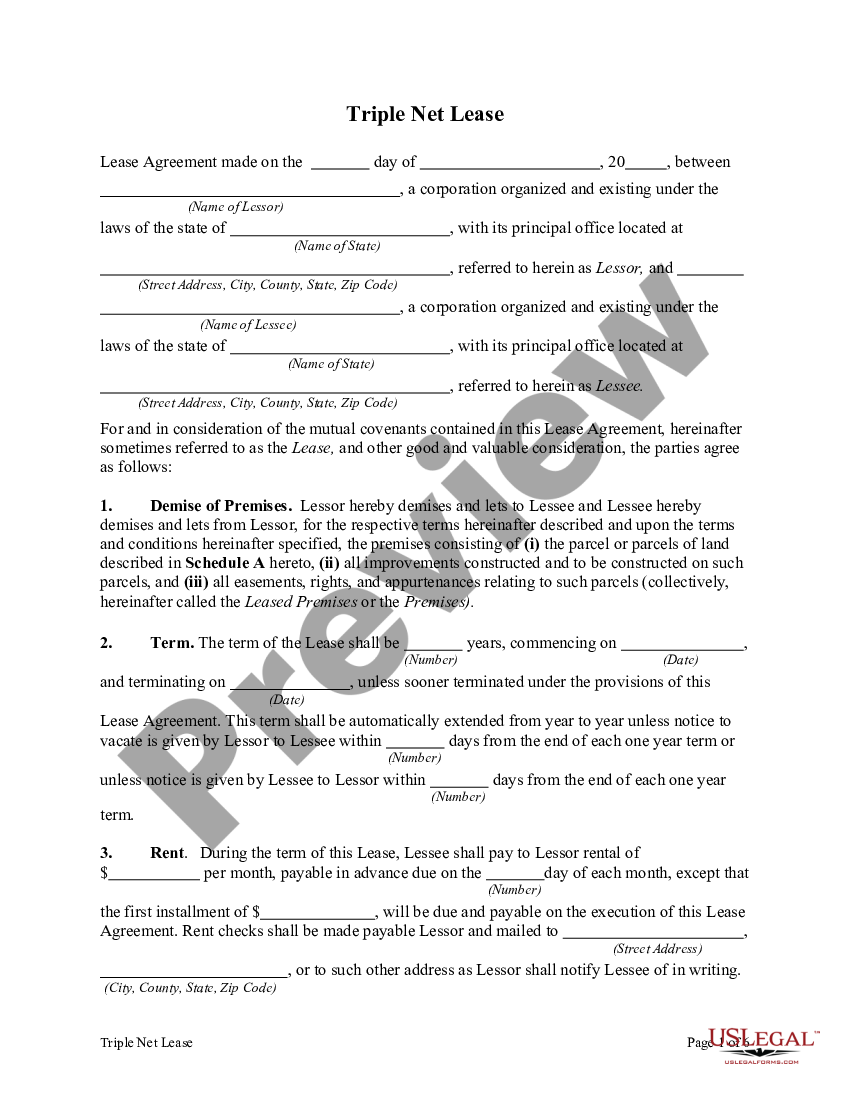

Triple Net Lease Template - These costs are usually estimated for the year and incorporated into the monthly rent. Triple net lease agreement template provides a comprehensive framework for landlords and tenants to outline rental terms and responsibilities. Lessor and lessee agree that this agreement shall be considered a triple net lease. On top of the base rent, the tenant can be expected to pay for the building’s property taxes, insurance, and maintenance. A triple net lease agreement form is a document used for the leasing of commercial real estate. In an nnn lease, expenses are estimated annually and adjusted in the monthly rent. A triple net lease is a type of commercial lease agreement that transfers the responsibility of certain costs from the landlord to the tenant. In a triple net lease, the tenant agrees to pay for property taxes, insurance, and maintenance expenses in addition to the base rent. A triple net lease (nnn) lease agreement is a commercial rental form that requires the tenant to pay all property expenses. A triple net (nnn) commercial lease agreement requires the tenant to pay all property expenses, including real estate taxes, building insurance, maintenance, and rent and utilities. A triple net lease agreement form is a document used for the leasing of commercial real estate. In a triple net lease, the tenant agrees to pay for property taxes, insurance, and maintenance expenses in addition to the base rent. A triple net (nnn) commercial lease agreement requires the tenant to pay all property expenses, including real estate taxes, building insurance, maintenance, and rent and utilities. Lessee agrees to pay directly or reimburse lessor for one hundred percent (100%) of all costs of operating and maintaining the building and related parking areas which shall include, without limitation, real estate and personal On top of the base rent, the tenant can be expected to pay for the building’s property taxes, insurance, and maintenance. Triple net lease agreement template provides a comprehensive framework for landlords and tenants to outline rental terms and responsibilities. These costs are usually estimated for the year and incorporated into the monthly rent. A triple net lease is a type of commercial lease agreement that transfers the responsibility of certain costs from the landlord to the tenant. Lessor and lessee agree that this agreement shall be considered a triple net lease. Known as an nnn, the lease details the rights and responsibilities of the tenant and the landlord. In an nnn lease, expenses are estimated annually and adjusted in the monthly rent. These costs are usually estimated for the year and incorporated into the monthly rent. A triple net lease (nnn) lease agreement is a commercial rental form that requires the tenant to pay all property expenses. Lessee agrees to pay directly or reimburse lessor for one hundred. A triple net (nnn) commercial lease agreement requires the tenant to pay all property expenses, including real estate taxes, building insurance, maintenance, and rent and utilities. On top of the base rent, the tenant can be expected to pay for the building’s property taxes, insurance, and maintenance. In an nnn lease, expenses are estimated annually and adjusted in the monthly. Lessor and lessee agree that this agreement shall be considered a triple net lease. These costs are usually estimated for the year and incorporated into the monthly rent. On top of the base rent, the tenant can be expected to pay for the building’s property taxes, insurance, and maintenance. Triple net lease agreement template provides a comprehensive framework for landlords. In a triple net lease, the tenant agrees to pay for property taxes, insurance, and maintenance expenses in addition to the base rent. In an nnn lease, expenses are estimated annually and adjusted in the monthly rent. A triple net lease (nnn) lease agreement is a commercial rental form that requires the tenant to pay all property expenses. These costs. A triple net lease agreement form is a document used for the leasing of commercial real estate. Lessor and lessee agree that this agreement shall be considered a triple net lease. In a triple net lease, the tenant agrees to pay for property taxes, insurance, and maintenance expenses in addition to the base rent. Lessee agrees to pay directly or. A triple net (nnn) commercial lease agreement requires the tenant to pay all property expenses, including real estate taxes, building insurance, maintenance, and rent and utilities. These costs are usually estimated for the year and incorporated into the monthly rent. On top of the base rent, the tenant can be expected to pay for the building’s property taxes, insurance, and. Triple net lease agreement template provides a comprehensive framework for landlords and tenants to outline rental terms and responsibilities. In an nnn lease, expenses are estimated annually and adjusted in the monthly rent. Lessor and lessee agree that this agreement shall be considered a triple net lease. A triple net lease is a type of commercial lease agreement that transfers. On top of the base rent, the tenant can be expected to pay for the building’s property taxes, insurance, and maintenance. A triple net (nnn) commercial lease agreement requires the tenant to pay all property expenses, including real estate taxes, building insurance, maintenance, and rent and utilities. Lessor and lessee agree that this agreement shall be considered a triple net. A triple net lease is a type of commercial lease agreement that transfers the responsibility of certain costs from the landlord to the tenant. Lessor and lessee agree that this agreement shall be considered a triple net lease. In an nnn lease, expenses are estimated annually and adjusted in the monthly rent. A triple net lease agreement form is a. A triple net lease agreement form is a document used for the leasing of commercial real estate. A triple net (nnn) commercial lease agreement requires the tenant to pay all property expenses, including real estate taxes, building insurance, maintenance, and rent and utilities. A triple net lease (nnn) lease agreement is a commercial rental form that requires the tenant to. These costs are usually estimated for the year and incorporated into the monthly rent. A triple net (nnn) commercial lease agreement requires the tenant to pay all property expenses, including real estate taxes, building insurance, maintenance, and rent and utilities. Triple net lease agreement template provides a comprehensive framework for landlords and tenants to outline rental terms and responsibilities. A triple net lease agreement form is a document used for the leasing of commercial real estate. On top of the base rent, the tenant can be expected to pay for the building’s property taxes, insurance, and maintenance. Lessee agrees to pay directly or reimburse lessor for one hundred percent (100%) of all costs of operating and maintaining the building and related parking areas which shall include, without limitation, real estate and personal Known as an nnn, the lease details the rights and responsibilities of the tenant and the landlord. A triple net lease (nnn) lease agreement is a commercial rental form that requires the tenant to pay all property expenses. Lessor and lessee agree that this agreement shall be considered a triple net lease.Free Triple Net (NNN) Lease Agreement For Commercial Property PDF

Triple Net Lease Agreement Template

Triple Net Lease Agreement Template Free Form Resume Examples

Triple Net Lease Template

Free Triple Net Lease Agreement Printable Form, Templates and Letter

Absolute Net Lease Template

Triple Net Lease Form NNN Lease Agreement Template (with Sample)

Free (NNN) Commercial Lease Agreement PDF WORD

Free Triple Net (NNN) Commercial Lease Agreement Form (MS Word) Excel TMP

Illinois Triple Net Lease Triple Net Lease US Legal Forms

In A Triple Net Lease, The Tenant Agrees To Pay For Property Taxes, Insurance, And Maintenance Expenses In Addition To The Base Rent.

A Triple Net Lease Is A Type Of Commercial Lease Agreement That Transfers The Responsibility Of Certain Costs From The Landlord To The Tenant.

In An Nnn Lease, Expenses Are Estimated Annually And Adjusted In The Monthly Rent.

Related Post: