Trust Accounting Template

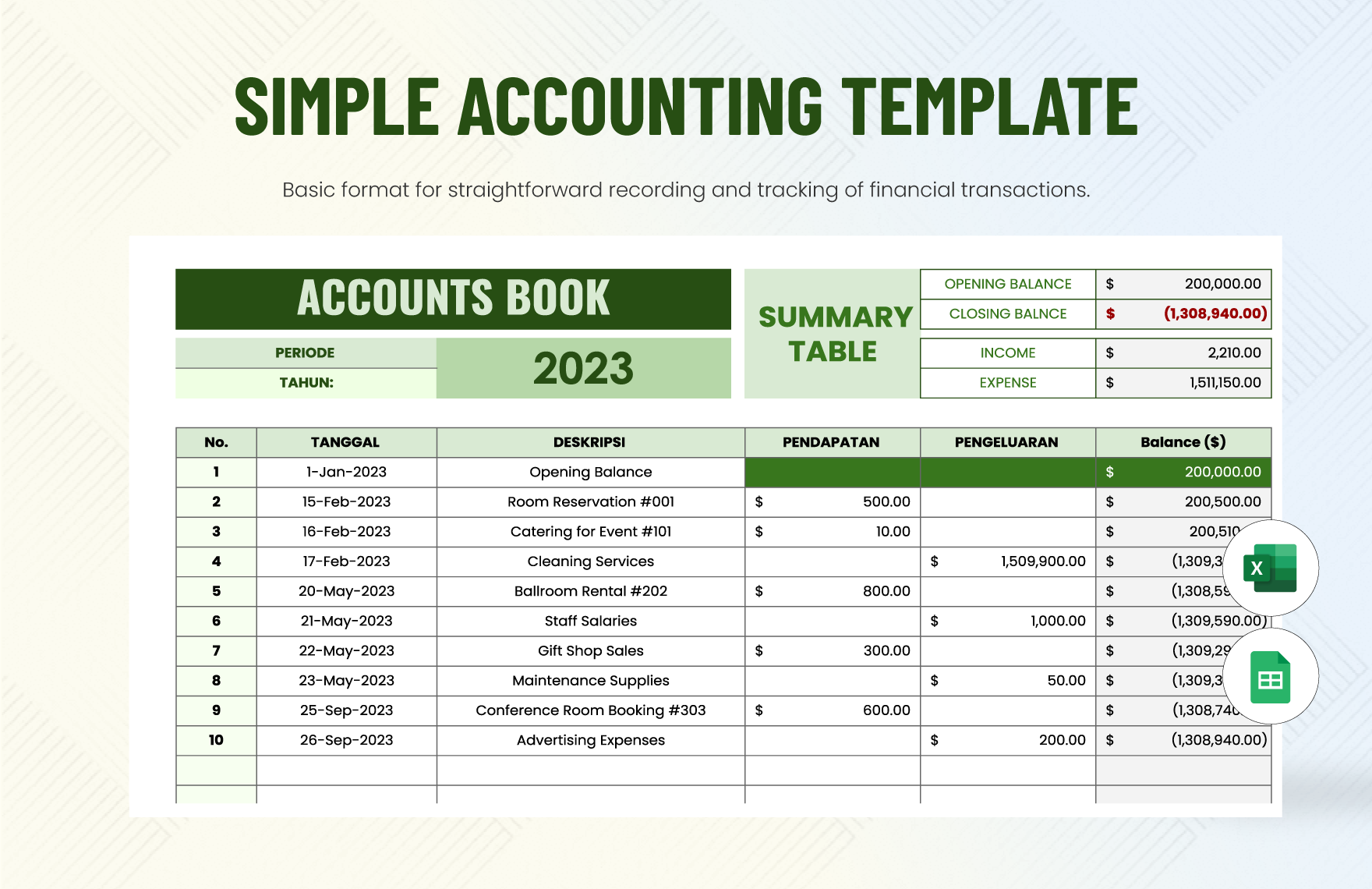

Trust Accounting Template - Use this template to prepare comprehensive trust financial statements in excel based on ifrs for sme's. Download blank, excel or word forms for manual or electronic trust account record keeping. Quicken accounting templates by actec for estates and trusts has been tested and is compatible with quicken deluxe 2013 through 2018. Pace & associates cpas can assist fiduciaries in preparing detailed and accurate trust accounting reports that adhere to legal requirements and follow best practices. Provides a list of trust accounts with their respective balances and grand totals in detail or summary format. A trust account is a segregated bank account in which money of this type is received, which keeps it separated from the professional’s operating funds. The purpose of this example is to show the different types of. This customizable and editable tool streamlines trust fund management,. Tax reporting is a critical aspect of trust accounting. These templates are intended for trust accounting use by lawyers with fewer than 25 trust transactions per month. Flexible subtotaling options allow subtotaling by bank account or attorney or. This customizable and editable tool streamlines trust fund management,. Customer support (10% of total score) to assess each software provider’s customer support services, i considered the following: Check out our trust accounting guide for law firms to learn how it works, rules to follow, and best practices to streamline your. Pace & associates cpas can assist fiduciaries in preparing detailed and accurate trust accounting reports that adhere to legal requirements and follow best practices. Provides a list of trust accounts with their respective balances and grand totals in detail or summary format. These ledger pages are not intended to represent the only ethically correct way to keep trust accounting records. Trustees must file an annual fiduciary income tax return, typically irs form 1041, which reports the trust’s income,. Our unique trust financial statement format consists of automated reports including an. The purpose of this example is to show the different types of. Trustees must file an annual fiduciary income tax return, typically irs form 1041, which reports the trust’s income,. Don't hesitate to explore the available options and. Download blank, excel or word forms for manual or electronic trust account record keeping. Pace & associates cpas can assist fiduciaries in preparing detailed and accurate trust accounting reports that adhere to legal requirements. Provides a list of trust accounts with their respective balances and grand totals in detail or summary format. Quicken accounting templates by actec for estates and trusts has been tested and is compatible with quicken deluxe 2013 through 2018. Trust accounts are essential in financial management,. See sample data, guidelines and tips for lawyers in wisconsin. Pace & associates cpas. Quicken accounting templates by actec for estates and trusts has been tested and is compatible with quicken deluxe 2013 through 2018. Flexible subtotaling options allow subtotaling by bank account or attorney or. Trust accounting sample report author: Check out our trust accounting guide for law firms to learn how it works, rules to follow, and best practices to streamline your.. Provides a list of trust accounts with their respective balances and grand totals in detail or summary format. These ledger pages are not intended to represent the only ethically correct way to keep trust accounting records. Trustees must file an annual fiduciary income tax return, typically irs form 1041, which reports the trust’s income,. A trust account is a segregated. Users with higher volumes of trust activity should consider. Experience unparalleled trust accounting management with the trust accounting template from template.net! Provides a list of trust accounts with their respective balances and grand totals in detail or summary format. The purpose of this example is to show the different types of. Flexible subtotaling options allow subtotaling by bank account or. Provides a list of trust accounts with their respective balances and grand totals in detail or summary format. See sample data, guidelines and tips for lawyers in wisconsin. The purpose of this example is to show the different types of. Pace & associates cpas can assist fiduciaries in preparing detailed and accurate trust accounting reports that adhere to legal requirements. Trust accounts provide a mechanism for safeguarding assets, ensuring compliance with legal regulations, and giving you peace of mind. Customer support (10% of total score) to assess each software provider’s customer support services, i considered the following: Experience unparalleled trust accounting management with the trust accounting template from template.net! The purpose of this example is to show the different types. Provides a list of trust accounts with their respective balances and grand totals in detail or summary format. See sample data, guidelines and tips for lawyers in wisconsin. Trustees must file an annual fiduciary income tax return, typically irs form 1041, which reports the trust’s income,. These templates are intended for trust accounting use by lawyers with fewer than 25. This customizable and editable tool streamlines trust fund management,. Customer support (10% of total score) to assess each software provider’s customer support services, i considered the following: See sample data, guidelines and tips for lawyers in wisconsin. Accounting for receipt of income and disbursement of expense on rental properties. Pace & associates cpas can assist fiduciaries in preparing detailed and. Customer support (10% of total score) to assess each software provider’s customer support services, i considered the following: Provides a list of trust accounts with their respective balances and grand totals in detail or summary format. Trustees must file an annual fiduciary income tax return, typically irs form 1041, which reports the trust’s income,. Pace & associates cpas can assist. Trust accounts are essential in financial management,. Tax reporting is a critical aspect of trust accounting. Provides a list of trust accounts with their respective balances and grand totals in detail or summary format. A trust account is a segregated bank account in which money of this type is received, which keeps it separated from the professional’s operating funds. Our unique trust financial statement format consists of automated reports including an. These templates are intended for trust accounting use by lawyers with fewer than 25 trust transactions per month. These ledger pages are not intended to represent the only ethically correct way to keep trust accounting records. Users with higher volumes of trust activity should consider. The purpose of this example is to show the different types of. Don't hesitate to explore the available options and. Trust accounting involves closely managing and tracking client funds under requirements from the american bar association (aba) and local jurisdictions. Customer support (10% of total score) to assess each software provider’s customer support services, i considered the following: Trust accounts provide a mechanism for safeguarding assets, ensuring compliance with legal regulations, and giving you peace of mind. Trustees must file an annual fiduciary income tax return, typically irs form 1041, which reports the trust’s income,. Trust accounting sample report author: Pace & associates cpas can assist fiduciaries in preparing detailed and accurate trust accounting reports that adhere to legal requirements and follow best practices.Trust Accounting Template

Trust Accounting Software (IOLTA) for Law Firms CosmoLex

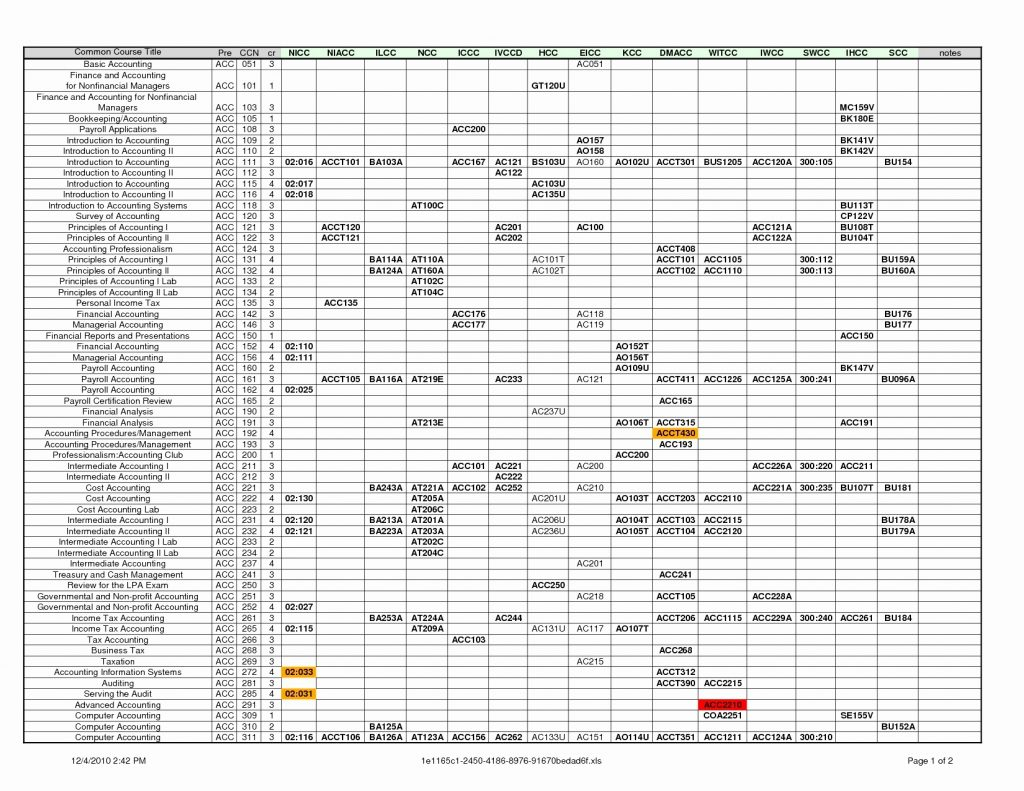

Trust Accounting Spreadsheet Template

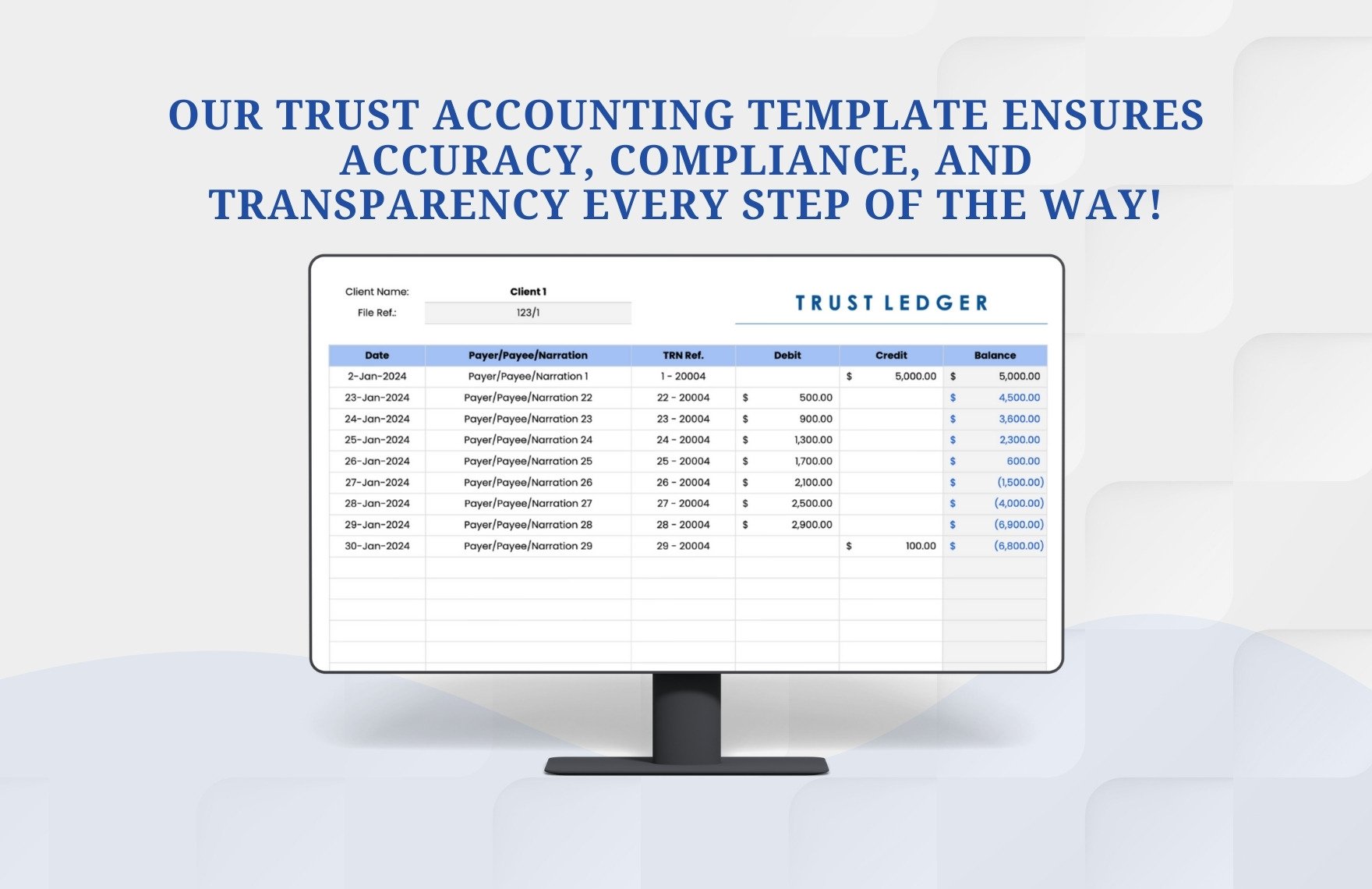

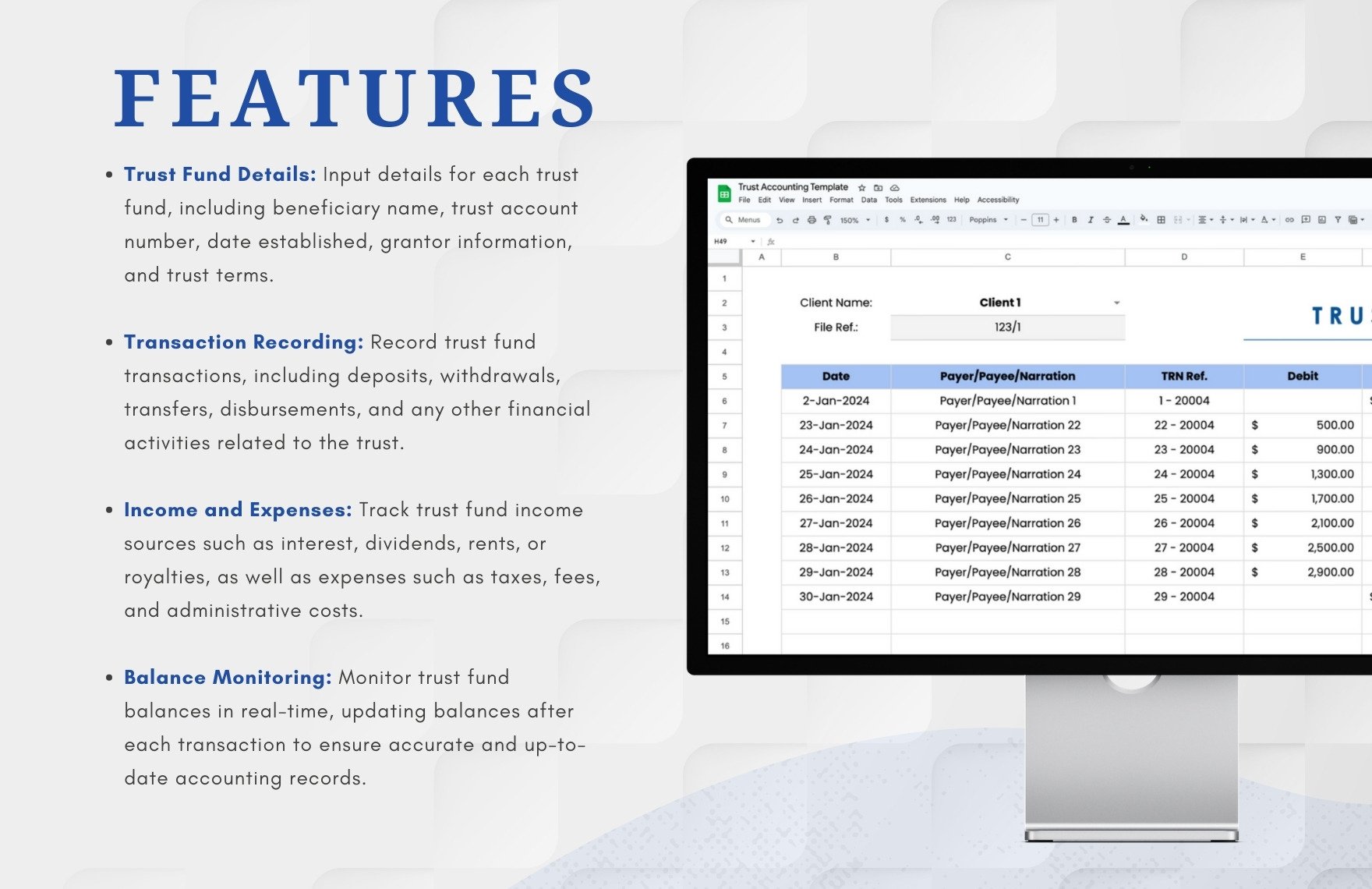

Trust Accounting Template in Excel, Google Sheets Download

Trust Accounting Template in Excel, Google Sheets Download

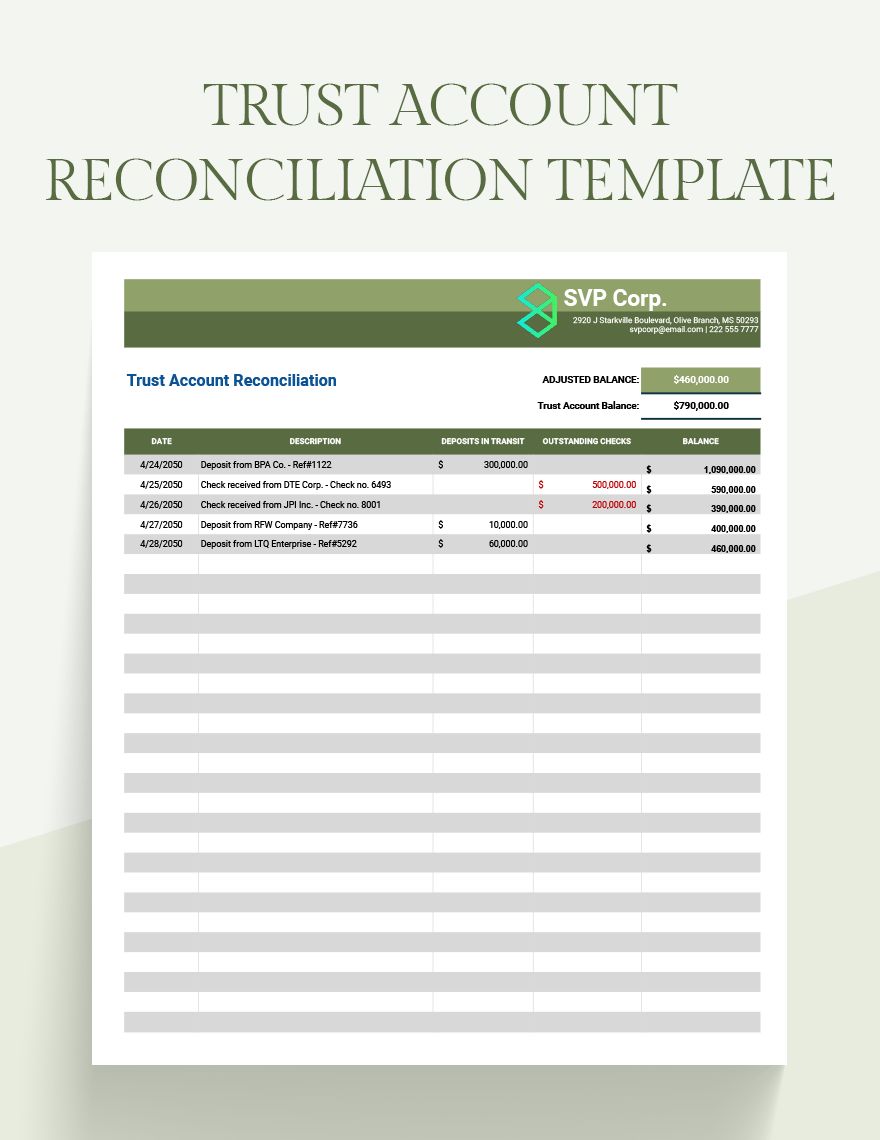

Trust Account Reconciliation Template Google Sheets, Excel

Trust Accounting Spreadsheet Template

Trust Accounting Template in Excel, Google Sheets Download

Trust Accounting Spreadsheet Template

Trust Accounting Template in Excel, Google Sheets Download

This Customizable And Editable Tool Streamlines Trust Fund Management,.

Quicken Accounting Templates By Actec For Estates And Trusts Has Been Tested And Is Compatible With Quicken Deluxe 2013 Through 2018.

Streamline Financial Management With Effective Trust Account Templates Designed For Accurate Tracking And Reconciliation.

Flexible Subtotaling Options Allow Subtotaling By Bank Account Or Attorney Or.

Related Post: