Validation Letter To Debt Collector Template

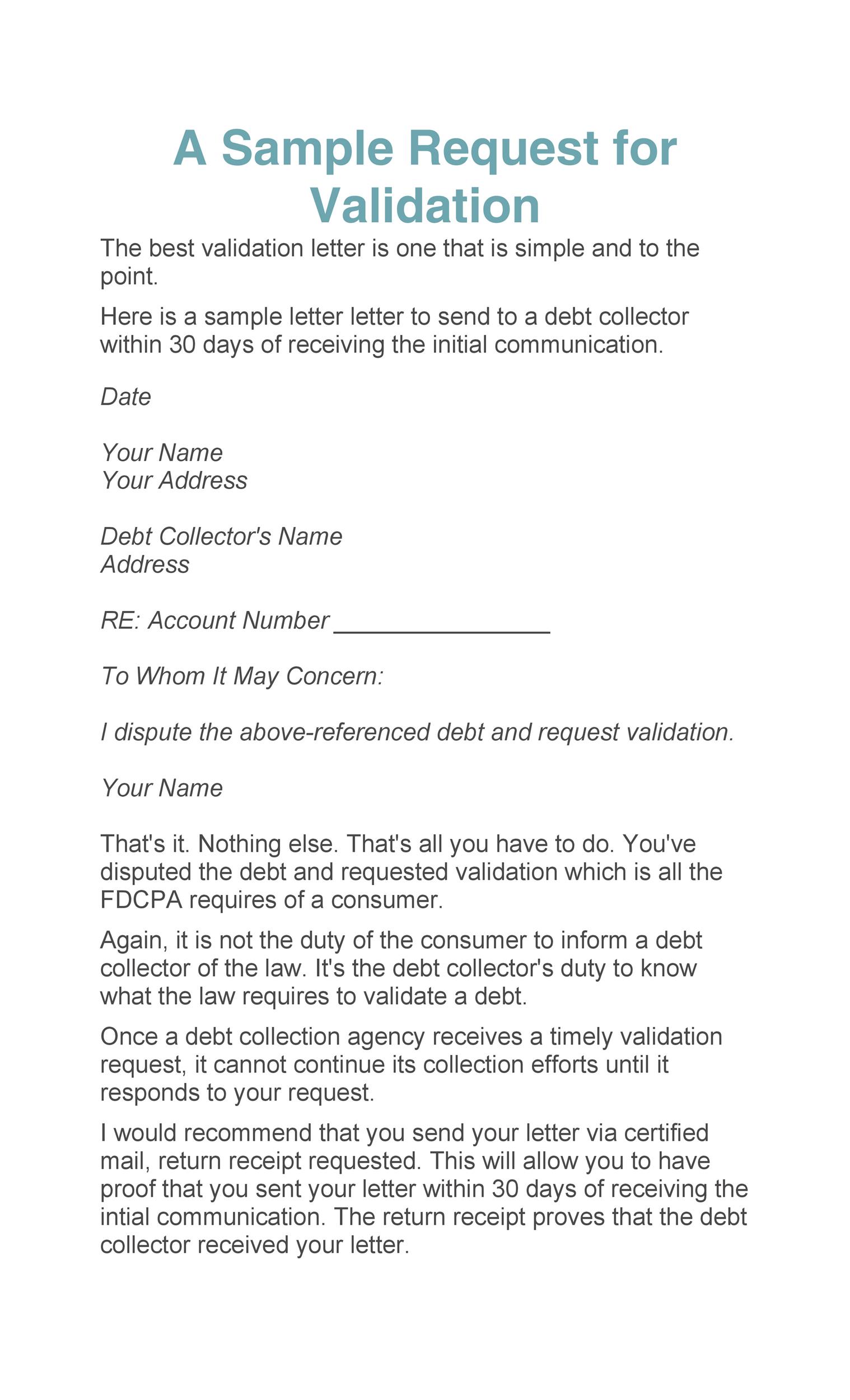

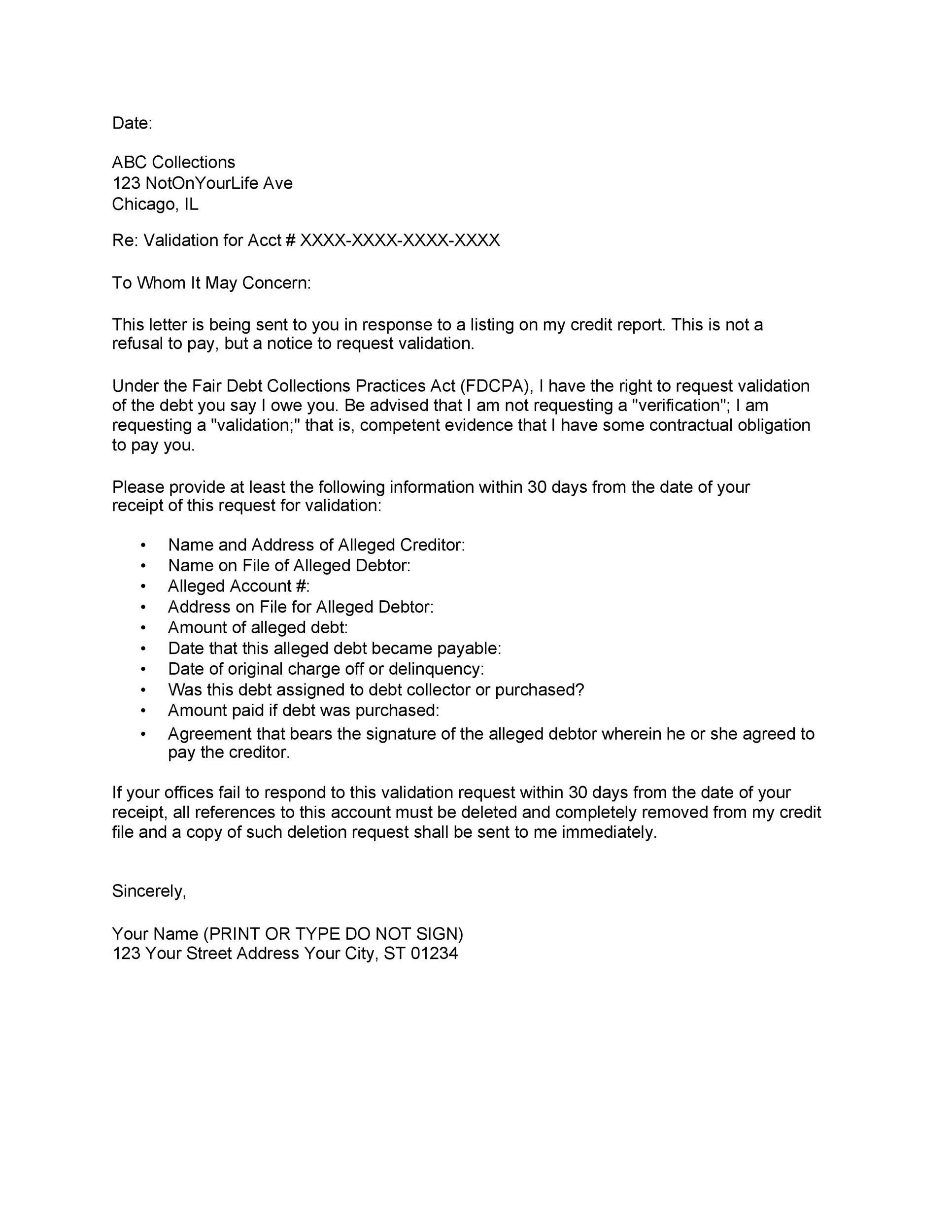

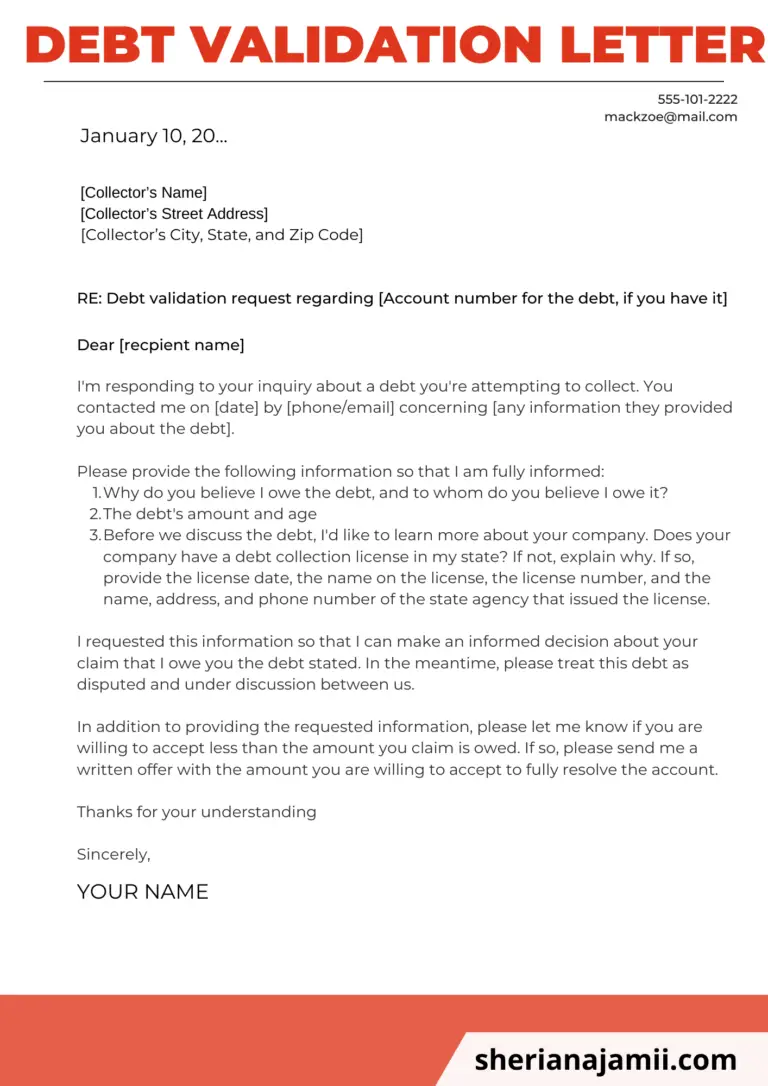

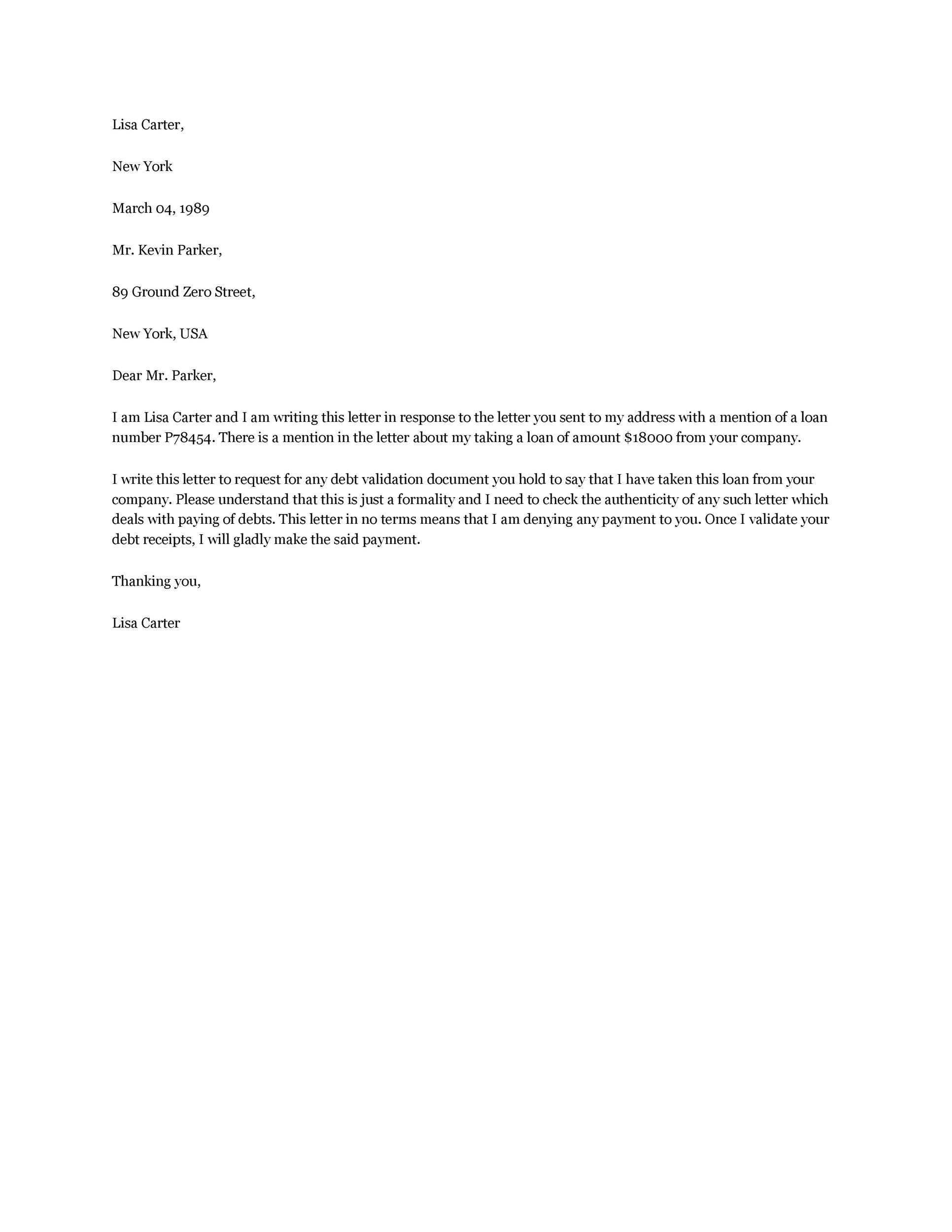

Validation Letter To Debt Collector Template - The purpose of the validation letter is to inform the collector that the debtor is 1) aware of their rights under the fair debt collection practices act (fdcpa) and 2) is requesting additional information to prove the debt is accurate. Perfect for individuals facing undue pressure from debt collectors. Collectors must provide a debt validation notice within five days of initial contact. • complete accounting of alleged debt. Regardless of what a debt collector may say by phone, sending a debt validation letter can help to ensure that you do not pay a debt that you do not owe, fall victim to a debt collection scam, or revive an old debt that could potentially be past the statute of limitations. When a debt collector is asking you to pay money, you’re entitled to ask for details. The sample letter below will help you to get details on the following: The role of a demand letter in debt collection. A debt validation letter is correspondence you send to debt collectors and creditors to request proof of the debts. Access our free debt validation letter template, downloadable in ms word and google docs formats. Begin writing the letter by adding the contact information for you and for the debt collector. Simplify debt dispute resolution with this template designed to request debt validation from creditors or collection agencies. A copy of the last billing statement sent to me by the original creditor. The right to know how the debt was incurred is guaranteed to all consumers through the fair debt collection practices act. Specify the nature of the debt, including its origin and any accompanying documentation. Use this free debt validation letter template. Under federal law, you have a right to get information about any debt you supposedly owe. Personal information, debt details, request for validation, and legal references. Sending a debt validation letter can be a simple and straightforward process. A debt validation letter is sent by a consumer to verify a debt by requesting evidence of the claim. Clarify the original debt amount and payment schedule. • complete accounting of alleged debt. Specify the nature of the debt, including its origin and any accompanying documentation. State the amount of the debt when you obtained it, and when that was. • the amount of the debt and how old it is. How do i fill this out? Debt validation letters are created to protect customers from unfair debt collection practices. This file provides a sample debt validation letter that consumers can use to dispute unnecessary debt claims. The purpose of the validation letter is to inform the collector that the debtor is 1) aware of their rights under the fair debt. The fdcpa offers additional protections against abusive or harassing behavior by debt collectors. Easily dispute and validate your debts with our free debt validation letter template. The purpose of the validation letter is to inform the collector that the debtor is 1) aware of their rights under the fair debt collection practices act (fdcpa) and 2) is requesting additional information. Simplify debt dispute resolution with this template designed to request debt validation from creditors or collection agencies. • verification that this debt was assigned or sold to collector. Under this law, debt collectors cannot contact you at inconvenient times, use threatening language, or misrepresent the amount owed. It outlines the necessary components and legal rights under the fair debt collection. Finish by clearly stating your dispute and the requests you have for the collector. Get debt validation letter form Under the fair debt collection practices act (fdcpa), a debt collector must provide a written debt validation letter within five days. • complete accounting of alleged debt. Easily dispute and validate your debts with our free debt validation letter template. State the amount of the debt when you obtained it, and when that was. Specify the nature of the debt, including its origin and any accompanying documentation. Use our debt validation letter to request the validity of a debt. Under this law, debt collectors cannot contact you at inconvenient times, use threatening language, or misrepresent the amount owed. It outlines. • complete accounting of alleged debt. Perfect for individuals facing undue pressure from debt collectors. Clarify the original debt amount and payment schedule. Get debt validation letter form How do i fill this out? A copy of the last billing statement sent to me by the original creditor. Failing to do so is a direct violation. Writing a letter requesting debt validation is fairly straightforward. Easily dispute and validate your debts with our free debt validation letter template. • details about the debt collector’s authority to collect this money. A debt validation letter is correspondence you send to debt collectors and creditors to request proof of the debts. Essentially you are asking the creditor to tell you why they feel you are responsible for the indebtedness, provide their information, and any facts supporting their claim that this is your debt. Provide detailed information on all parties involved, including your. To fill out this form, start by entering today's date and the collector's information. Sending a debt validation letter can be a simple and straightforward process. Easily dispute and validate your debts with our free debt validation letter template. The sample letter below will help you to get details on the following: Clarify the original debt amount and payment schedule. Regardless of what a debt collector may say by phone, sending a debt validation letter can help to ensure that you do not pay a debt that you do not owe, fall victim to a debt collection scam, or revive an old debt that could potentially be past the statute of limitations. Collectors must provide a debt validation notice within five days of initial contact. You need to ask any debt collection company that claims that you owe a debt to provide this letter to prove that you do. Essentially you are asking the creditor to tell you why they feel you are responsible for the indebtedness, provide their information, and any facts supporting their claim that this is your debt. Under this law, debt collectors cannot contact you at inconvenient times, use threatening language, or misrepresent the amount owed. If you have been contacted regarding outstanding debts, collectors are legally required to provide proof of those debts. Simplify debt dispute resolution with this template designed to request debt validation from creditors or collection agencies. A demand letter is a formal written notice sent by a creditor or a collection agency to a debtor, requesting payment of an outstanding debt. The role of a demand letter in debt collection. Writing a debt validation letter can keep you from paying a bogus debt collection. Ensures the debt is legitimate and verifies the collector’s authority to collect. Easily dispute and validate your debts with our free debt validation letter template. If you notify a debt collector in writing that you are judgment proof and request they cease communication, they. The fdcpa offers additional protections against abusive or harassing behavior by debt collectors. Provide verification and documentation about why this is a debt that i am required to pay. Clarify the original debt amount and payment schedule.Debt Validation Letter for Debt Collectors (Template and Sample)

50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

5 Compliant Debt Validation Letter Templates and Samples — Etactics

50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

Second Debt Validation Letter Sample

50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab

50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

Debt Validation Letter 2025 (guide & Free Samples) Sheria Na Jamii

50 Free Debt Validation Letter Samples & Templates ᐅ TemplateLab

Free Printable Debt Validation Letter Templates [PDF, Word] Medical

• Complete Accounting Of Alleged Debt.

A Copy Of The Last Billing Statement Sent To Me By The Original Creditor.

The Purpose Of The Validation Letter Is To Inform The Collector That The Debtor Is 1) Aware Of Their Rights Under The Fair Debt Collection Practices Act (Fdcpa) And 2) Is Requesting Additional Information To Prove The Debt Is Accurate.

Provide Detailed Information On All Parties Involved, Including Your Legal Name And Contact Information.

Related Post:

![50 Free Debt Validation Letter Templates [& Samples] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2019/06/debt-validation-letter-05-790x1022.jpg)

![Free Printable Debt Validation Letter Templates [PDF, Word] Medical](https://www.typecalendar.com/wp-content/uploads/2023/05/debt-validation-letter-template-2024.jpg)