Tos Oco Order Template

Tos Oco Order Template - For example, first buy 300 shares of stock. You can click “similar order” on an already filled order, then post it in your other account. How do you make an order template in thinkorswim that will automatically create a stop loss and take profit order when you buy or sell.*****. I have several templates made out that include various stops and some with oco for profit targets. In this tutorial video series, coach gino poore shows a convenient way to use a “customized” oco bracket order he built in thinkorswim (tos) to buy options on a stock. Other users reply with suggestions and links to. One for a profit target (a sell limit order) and another for a stop loss (a. Like was mentioned already, create an order with your triggers and save it, you can make one for each “price range” of stocks you typically buy. Open a chart for the security you want to trade. If and when you edit these guys a save button will open and you can then build as. We’ll go through several methods to create stops/oco orders as well as. One for a profit target (a sell limit order) and another for a stop loss (a. In today’s video we’ll be discussing on the many advanced orders types available within thinkorswim. In today’s video we’ll be discussing how to create advanced orders, specifically oco bracket orders, on the thinkorswim mobile app. I have several templates made out that include various stops and some with oco for profit targets. In the template drop down there are five standard order types. A user asks how to create an oco order template that can be used on any ticker with a buy stoplimit, sell limit and stoploss. In this tutorial video series, coach gino poore shows a convenient way to use a “customized” oco bracket order he built in thinkorswim (tos) to buy options on a stock. This option will automatically create an oco order template in your order entry tool that you can customize before sending it off as a working order. Like was mentioned already, create an order with your triggers and save it, you can make one for each “price range” of stocks you typically buy. In this tutorial video series, coach gino poore shows a convenient way to use a “customized” oco bracket order he built in thinkorswim (tos) to buy options on a stock. This video also covers the other advanced order options and the method of saving an order template for future use. This bracket order is useful for placing trades after hours. If it’s a $10 spot select the $10 order type and. Other users reply with suggestions and links to. This bracket order is useful for placing trades after hours and for protecting the trade when you aren’t around to put a stop in. A user asks how to create an oco order template that can be used on any ticker. Click on the trade tab in the bottom right corner of the. How do you make an order template in thinkorswim that will automatically create a stop loss and take profit order when you buy or sell.*****. This bracket order is useful for placing trades after hours and for protecting the trade when you aren’t around to put a stop. I have several templates made out that include various stops and some with oco for profit targets. This video also covers the other advanced order options and the method of saving an order template for future use. This bracket order is useful for placing trades after hours and for protecting the trade when you aren’t around to put a stop. If and when you edit these guys a save button will open and you can then build as. Like was mentioned already, create an order with your triggers and save it, you can make one for each “price range” of stocks you typically buy. What i don't know how to do is to set tos so that each time i. One for a profit target (a sell limit order) and another for a stop loss (a. For example, first buy 300 shares of stock. The first order in the order entry screen triggers three oco orders. Open a chart for the security you want to trade. If and when you edit these guys a save button will open and you. Like was mentioned already, create an order with your triggers and save it, you can make one for each “price range” of stocks you typically buy. You can click “similar order” on an already filled order, then post it in your other account. Click on the trade tab in the bottom right corner of the. Learn how to create a. We’ll go through several methods to create stops/oco orders as well as. Other users reply with suggestions and links to. You can click “similar order” on an already filled order, then post it in your other account. This option will automatically create an oco order template in your order entry tool that you can customize before sending it off as. To add oco brackets on thinkorswim, you can follow these steps: In the template drop down there are five standard order types. I have several templates made out that include various stops and some with oco for profit targets. You can click “similar order” on an already filled order, then post it in your other account. This bracket order is. In the template drop down there are five standard order types. Click on the trade tab in the bottom right corner of the. Other users reply with suggestions and links to. To add oco brackets on thinkorswim, you can follow these steps: It is an order type used in stock market trading where you can simultaneously set up two different. Switch over to the monitor tab to build. It is an order type used in stock market trading where you can simultaneously set up two different orders for a position: Learn how to create a oco bracket order in thinkorswim. This bracket order is useful for placing trades after hours and for protecting the trade when you aren’t around to put a stop in. One for a profit target (a sell limit order) and another for a stop loss (a. How do you make an order template in thinkorswim that will automatically create a stop loss and take profit order when you buy or sell.*****. In this tutorial video series, coach gino poore shows a convenient way to use a “customized” oco bracket order he built in thinkorswim (tos) to buy options on a stock. Open a chart for the security you want to trade. Other users reply with suggestions and links to. Click on the trade tab in the bottom right corner of the. I have several templates made out that include various stops and some with oco for profit targets. In today’s video we’ll be discussing how to create advanced orders, specifically oco bracket orders, on the thinkorswim mobile app. This option will automatically create an oco order template in your order entry tool that you can customize before sending it off as a working order. The first order in the order entry screen triggers three oco orders. In the template drop down there are five standard order types. Like was mentioned already, create an order with your triggers and save it, you can make one for each “price range” of stocks you typically buy.How to Create a Thinkorswim OCO Order Thinkorswim Tutorial YouTube

ToS Tutorial P/L + OCO Orders YouTube

Think or Swim TOS OCO Bracket Orders How to setup Automation

How to Make an Order Template in ThinkorSwim (TOS) YouTube

Thinkorswim Custom Order Template

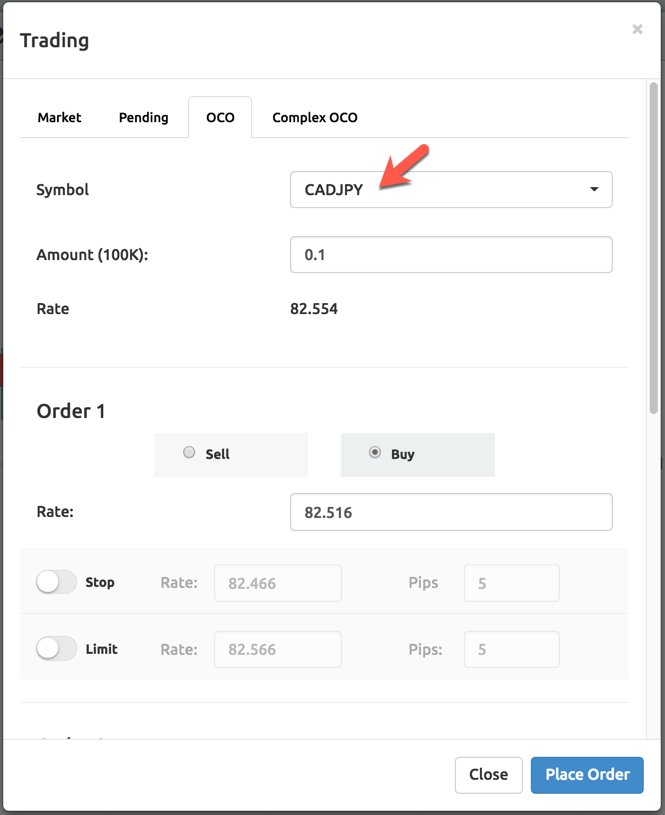

SmartTrader OCO orders

HOW TO SET OCO ORDER ON BINANCE (EXPLAINED WITH EXAMPLES) YouTube

Thinkorswim (TOS) Tutorial How to set up a Customized Contingent

How To Place A Conditional Order By Creating An Order Template On

How To Create Advanced Orders OCO Bracket ThinkorSwim YouTube

For Example, First Buy 300 Shares Of Stock.

Focusing Mainly On The 1St Triggers Oco, 1St Triggers 2 Oco, And 1St Triggers 3.

If It’s A $10 Spot Select The $10 Order Type And.

To Add Oco Brackets On Thinkorswim, You Can Follow These Steps:

Related Post: